FDS Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FDS Group Bundle

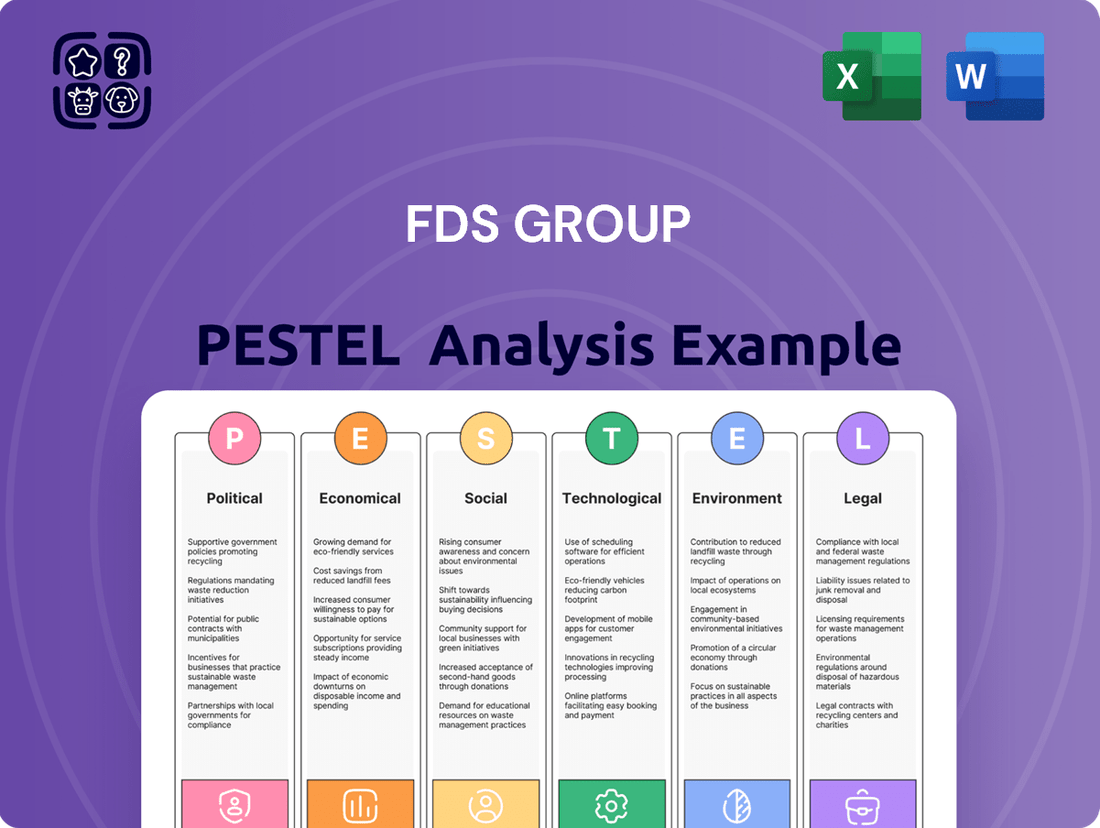

Navigate the complex external forces shaping FDS Group's future with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and threats. This comprehensive report provides actionable intelligence to inform your strategic decisions. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Government infrastructure spending is a significant driver for FDS Group. Increased investment in public works, such as transportation networks and public buildings, directly translates into higher demand for FDS Group's specialized architectural and structural engineering services. For instance, the 2024 Infrastructure Investment and Jobs Act in the United States allocates substantial funds towards upgrading roads, bridges, and public transit, creating a robust pipeline of potential projects for firms like FDS Group.

Policies focused on urban regeneration and the development of new public facilities, like hospitals or educational institutions, are particularly beneficial. These initiatives often require complex and bespoke structural solutions, aligning perfectly with FDS Group's expertise. The ongoing push for sustainable development and smart city initiatives in many developed nations, including significant government backing in the UK and Germany for green infrastructure from 2024 onwards, further amplifies these opportunities.

However, FDS Group must remain agile to shifts in government spending priorities and budget allocations. A sudden reduction in public infrastructure budgets, perhaps due to economic downturns or a change in political administration, could lead to a noticeable decrease in available projects. For example, a projected slowdown in some European national infrastructure budgets for 2025, as indicated by early fiscal planning reports, warrants close monitoring by FDS Group.

Building and planning regulations are a critical consideration for FDS Group. Strict building codes, such as those mandated by the International Building Code (IBC) or local equivalents, dictate everything from fire resistance ratings of facade materials to structural integrity requirements. For instance, in 2024, many regions are updating their energy efficiency codes, requiring higher insulation values and more sophisticated ventilation systems, which directly impacts the design and material selection for architectural structures.

FDS Group needs to remain agile in adapting to these evolving planning regulations. For example, the increasing focus on sustainability and embodied carbon in construction, as seen in the UK's Building Regulations 2025 proposals, could necessitate a shift towards more recycled or low-carbon materials in facade systems. Failure to comply can lead to project delays, fines, and reputational damage, while proactive adaptation can unlock opportunities for innovative, compliant solutions.

Trade policies significantly impact FDS Group. For instance, as of early 2024, ongoing discussions regarding potential adjustments to tariffs on key industrial materials like steel could directly influence FDS Group's procurement costs for construction projects. Changes in international trade agreements, such as those affecting the flow of components for their technology divisions, also require constant monitoring to mitigate supply chain disruptions and maintain competitive pricing.

Political Stability and Investment Climate

Political stability is a cornerstone for fostering a healthy investment climate, particularly for sectors like commercial and residential development that rely on long-term commitments. When governments provide a predictable and secure environment, businesses and individuals are more inclined to invest in new construction projects, directly benefiting companies like FDS Group. For instance, in 2024, countries with strong rule of law and low corruption indices, such as Singapore and Switzerland, continued to attract significant foreign direct investment in real estate, a trend expected to persist into 2025.

Conversely, political uncertainty, such as upcoming elections with unpredictable outcomes, shifts in government policy, or geopolitical tensions, can significantly dampen investor confidence. This hesitation often translates into a slowdown in new development projects as investors adopt a wait-and-see approach. The impact is tangible; a report from Q1 2025 indicated that regions experiencing heightened political instability saw a decline of up to 15% in new construction permits compared to the previous year.

- Investor Confidence: Directly correlates with the perceived stability of a nation's political and regulatory framework.

- Development Growth: Stable political environments encourage long-term investment in commercial and residential real estate.

- Economic Impact: Political instability can lead to project delays, reduced investment, and a slowdown in the construction sector.

- Global Trends (2024-2025): Nations with robust governance structures continue to be favored for real estate development investments.

Public Procurement Policies

Public procurement policies directly impact FDS Group's access to government contracts for vital projects like public buildings and infrastructure. For instance, the UK government's procurement reform, aiming for greater transparency and value for money, could present both opportunities and challenges for FDS Group in bidding for public tenders.

The emphasis on local content requirements within public tenders, a growing trend globally, will necessitate FDS Group to adapt its supply chain and sourcing strategies to meet these mandates. Similarly, a stronger focus on sustainable sourcing, as seen in the EU's Green Public Procurement initiative, will require FDS Group to demonstrate its commitment to environmental responsibility in its bids.

- Local Content Mandates: Policies requiring a certain percentage of materials or labor to be sourced locally can influence FDS Group's cost structures and operational planning for public projects.

- Sustainability Criteria: The increasing inclusion of environmental, social, and governance (ESG) factors in public tenders, such as the EU's push for green building standards, will require FDS Group to highlight its sustainable practices.

- Transparency and Fairness: Ensuring public procurement processes are transparent and fair is crucial for FDS Group to compete on a level playing field and secure contracts based on merit.

Government infrastructure spending remains a key driver for FDS Group, with significant public works projects creating demand for their services. For example, the US Infrastructure Investment and Jobs Act of 2024 continues to fund transportation upgrades, directly benefiting firms like FDS Group. Furthermore, governmental support for urban regeneration and green infrastructure, as seen in the UK and Germany from 2024, presents substantial opportunities for specialized engineering solutions.

However, FDS Group must remain vigilant regarding potential shifts in government budgets and priorities. A projected slowdown in some European infrastructure budgets for 2025, as indicated by early fiscal planning, could impact project availability. Political stability is also paramount; nations with strong governance, like Singapore and Switzerland in 2024, continue to attract significant real estate investment, while political uncertainty can lead to project delays and reduced investment, with some unstable regions seeing up to a 15% decline in new construction permits in early 2025.

Building and planning regulations are critical, with evolving codes focusing on energy efficiency and sustainability, such as the UK's Building Regulations 2025 proposals. FDS Group must adapt to these, as failure to comply can result in delays and fines, while proactive adaptation can lead to innovative solutions. Trade policies, including potential tariffs on materials like steel in early 2024, also influence procurement costs and require careful monitoring to maintain competitive pricing.

Public procurement policies, including local content mandates and sustainability criteria, directly affect FDS Group's access to government contracts. The EU's Green Public Procurement initiative, for instance, requires FDS Group to demonstrate its commitment to environmental responsibility. Transparency and fairness in these processes are essential for FDS Group to compete effectively and secure contracts based on merit.

| Factor | Impact on FDS Group | 2024/2025 Data/Trend |

|---|---|---|

| Government Infrastructure Spending | Increased demand for architectural and engineering services. | US Infrastructure Investment and Jobs Act (2024) continues to drive projects. EU nations (UK, Germany) focus on green infrastructure (2024 onwards). |

| Political Stability | Encourages investment and development; instability causes delays. | Stable nations (e.g., Singapore, Switzerland) attract investment (2024). Unstable regions saw up to 15% decline in construction permits (Q1 2025). |

| Building & Planning Regulations | Requires adaptation to new codes, especially for sustainability. | UK Building Regulations 2025 proposals emphasize embodied carbon. Energy efficiency codes are being updated globally (2024). |

| Trade Policies | Affects material costs and supply chain. | Discussions on steel tariffs (early 2024) impact procurement. International trade agreements require monitoring. |

| Public Procurement Policies | Influences contract access and requires compliance with local/sustainability mandates. | EU's Green Public Procurement initiative promotes ESG factors. Local content requirements are a growing global trend. |

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that specifically impact the FDS Group's operations and strategic positioning.

It provides a comprehensive overview of how these forces create both challenges and avenues for growth, enabling informed strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE landscape.

Economic factors

The overall health of the global economy significantly influences FDS Group's performance. Robust economic growth, marked by expanding GDP, generally fuels increased construction activity, from commercial developments to residential housing and infrastructure projects. This heightened activity directly translates to greater demand for FDS Group's architectural elements and services.

In 2023, global GDP growth was estimated at 3.1%, according to the IMF. A strong construction sector output, often correlated with GDP, is crucial. For instance, the US construction industry saw a 7.3% increase in output in 2023, indicating a positive environment for companies like FDS Group. Conversely, economic downturns or recessions can lead to reduced consumer and business spending, resulting in project postponements or cancellations, thereby impacting FDS Group's order book.

Interest rate levels directly affect the cost of borrowing for developers and main contractors, significantly impacting their ability to finance new construction projects. For instance, in early 2024, the Bank of England's base rate remained at 5.25%, a level that increased borrowing costs compared to previous years. This higher cost of capital can make projects less financially viable, potentially shrinking the pipeline of work available for companies like FDS Group.

The availability and cost of project financing are therefore critical determinants of market activity. When interest rates are elevated, as they have been through much of 2023 and into 2024, securing favorable loan terms becomes more challenging. This can lead to a slowdown in new project starts, directly influencing demand for FDS Group's services in areas such as fire and security solutions for the construction sector.

Fluctuations in the prices of key raw materials like steel, aluminum, and specialized glass, alongside fluctuating energy costs for manufacturing, directly impact FDS Group's operational expenses and profit margins. For instance, the average price of hot-rolled coil steel, a critical component for many manufactured goods, saw significant swings in 2024, impacting input costs for companies across various sectors.

To mitigate these risks, long-term contracts frequently incorporate clauses for potential price escalations, or the company must deploy sophisticated hedging strategies to lock in favorable rates. The global energy market, particularly oil and natural gas prices, which are subject to geopolitical events and supply-demand imbalances, also plays a crucial role in FDS Group's cost structure.

Supply chain disruptions, a recurring theme in recent years, can further amplify this price volatility, making it challenging for FDS Group to forecast and manage its input costs effectively. For example, disruptions in the logistics of aluminum supply in late 2024 led to temporary price spikes in several key markets.

Labor Costs and Availability

The cost and availability of skilled labor, such as engineers, fabricators, and installers, are critical economic considerations for FDS Group. In 2024, average hourly wages for skilled trades in manufacturing and construction have seen an upward trend, with some regions experiencing increases of 4-6% year-over-year, driven by high demand and a persistent skills gap. This rise directly impacts project profitability and operational costs.

Shortages in specialized labor can create significant bottlenecks, leading to project delays and a reduced capacity to take on new work. For instance, a lack of certified welders or experienced project managers can slow down production timelines and increase the risk of missed deadlines. This scarcity often forces companies to compete more aggressively for talent, further inflating labor expenses.

To navigate these economic pressures, FDS Group's investment in robust training and retention programs is paramount. Initiatives focused on upskilling existing employees and attracting new talent through competitive compensation and career development opportunities are essential for mitigating the impact of labor cost inflation and availability challenges. Successful retention strategies can significantly lower recruitment costs and maintain operational efficiency.

- Skilled Labor Demand: High demand for engineers and fabricators in 2024 continues to drive up wages.

- Wage Inflation: Average hourly wages for skilled trades in key industrial sectors are projected to rise by approximately 5% in 2024.

- Impact of Shortages: Labor scarcity can lead to project delays and increased operational expenses for FDS Group.

- Mitigation Strategies: Investment in employee training and retention programs is crucial for managing labor costs and ensuring capacity.

Inflation and Purchasing Power

High inflation is a significant concern for FDS Group, as it directly impacts client purchasing power and escalates operational expenses. For instance, if FDS Group has fixed-price contracts, rising costs due to inflation can severely compress profit margins. This erosion of purchasing power also affects consumer confidence, which is a key driver for both residential and commercial development projects that FDS Group undertakes.

Businesses like FDS Group must navigate these inflationary pressures by implementing astute pricing strategies. The goal is to remain competitive in the market while ensuring that escalating costs are adequately covered. This requires a delicate balance to maintain profitability without alienating clients or losing market share.

Recent economic data highlights these challenges. For example, the US Consumer Price Index (CPI) saw a notable increase in early 2024, with annual inflation rates fluctuating around 3.1% to 3.5% as of early 2024, impacting the cost of materials and labor. Similarly, in the UK, inflation remained elevated through much of 2023, averaging around 7.5%, before showing signs of moderation towards the end of the year and into early 2024, with figures around 3.4% in April 2024. These figures underscore the need for robust financial planning and flexible contract structures.

- Eroding Purchasing Power: Inflation reduces the real value of client budgets, potentially delaying or scaling down development projects.

- Increased Operational Costs: Rising prices for materials, energy, and labor directly increase FDS Group's project expenses.

- Impact on Consumer Confidence: Economic uncertainty driven by inflation can dampen demand for new construction and renovation.

- Pricing Strategy Adjustments: FDS Group must continually review and adjust pricing to reflect cost increases while remaining competitive.

Economic growth directly influences FDS Group's demand, with global GDP growth estimated at 3.1% in 2023. Higher interest rates, like the Bank of England's 5.25% base rate in early 2024, increase borrowing costs for developers, potentially slowing new projects. Fluctuations in raw material prices, such as steel, and energy costs also impact FDS Group's margins, with supply chain disruptions exacerbating volatility.

The cost and availability of skilled labor, with average hourly wages for trades rising by an estimated 4-6% in 2024, present ongoing challenges, necessitating investment in training and retention. High inflation, with US CPI fluctuating around 3.1%-3.5% in early 2024 and UK inflation at 3.4% in April 2024, erodes purchasing power and escalates operational costs, requiring careful pricing strategies.

| Economic Factor | 2023/Early 2024 Data Point | Impact on FDS Group |

|---|---|---|

| Global GDP Growth | 3.1% (IMF estimate for 2023) | Higher growth generally increases demand for construction services. |

| Interest Rates (Example: BoE Base Rate) | 5.25% (early 2024) | Increases project financing costs for clients, potentially reducing project pipeline. |

| Skilled Labor Wage Growth | 4-6% year-over-year increase for skilled trades (estimated 2024) | Raises operational costs and impacts project profitability. |

| Inflation (Example: US CPI) | 3.1%-3.5% (early 2024) | Reduces client purchasing power and increases FDS Group's input costs. |

Same Document Delivered

FDS Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This FDS Group PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic planning.

Sociological factors

Global urbanization continues to accelerate, with the UN projecting that 68% of the world's population will live in urban areas by 2050, up from 57% in 2023. This sustained growth directly fuels demand for FDS Group's expertise in constructing and renovating commercial, residential, and mixed-use properties.

As cities become more densely populated, there's a growing need for sophisticated, often high-rise, and visually distinctive buildings. This trend plays into FDS Group's strengths in creating custom-designed facades and architectural components, catering to the demand for both efficient space utilization and unique aesthetic appeal in urban environments.

Evolving aesthetic trends significantly shape FDS Group’s market. For instance, the growing demand for biophilic design, incorporating natural elements and maximizing natural light, influences the types of facade systems and metalwork that are specified. Architects in 2024 are increasingly favoring clean lines and sustainable materials, which directly impacts the demand for specific FDS Group product lines.

The shift towards minimalist aesthetics and the integration of smart building technologies are also key. This means FDS Group needs to offer solutions that are not only visually appealing but also technologically advanced. Consider the rise of parametrically designed facades; these require specialized metalwork capabilities that FDS Group must be prepared to provide to stay competitive with innovative developers.

Societal focus on health and well-being is increasingly shaping building design. There's a growing demand for better indoor environmental quality, with occupants prioritizing natural light, improved ventilation, and the use of non-toxic materials. This trend is evident in the rising popularity of certifications like WELL Building Standard, which saw a significant increase in registered projects globally throughout 2024, indicating a strong market push towards healthier built environments.

Demographic Shifts and Lifestyle Changes

Demographic shifts are significantly reshaping the property market. For instance, the aging population in many developed nations, including a projected 20% of the US population being 65 or older by 2030, increases demand for specialized healthcare facilities and accessible housing. Conversely, rapid urbanization, with over 60% of the world's population now living in cities, drives demand for multi-family dwellings and urban infrastructure projects.

Lifestyle changes, such as the sustained trend towards remote and hybrid work models, are fundamentally altering commercial real estate needs. Companies are increasingly seeking flexible, adaptable office spaces that prioritize employee well-being and collaboration, rather than traditional fixed layouts. This has led to a rise in demand for co-working spaces and buildings designed with advanced amenities and aesthetic appeal, reflecting a greater emphasis on work-life integration.

- Aging Population: In 2024, the global population aged 65 and over is expected to reach approximately 780 million, a 50% increase since 2010.

- Urbanization Rate: By 2025, it's estimated that 65% of the world's population will reside in urban areas, up from 56% in 2020.

- Remote Work Impact: A 2024 survey indicated that 30% of US employees work remotely full-time, influencing office space utilization and design preferences.

- Multi-generational Living: Factors like affordability and changing family structures are contributing to a renewed interest in multi-generational housing solutions in various markets.

Public Perception of Construction and Design

Public sentiment towards construction significantly shapes project viability and regulatory landscapes. Concerns over environmental impact, worker safety, and the visual appeal of developments are paramount. For FDS Group, a positive public perception, particularly regarding sustainable and innovative design, is a powerful asset, bolstering brand image and attracting new business opportunities.

Community engagement and transparent operations are no longer optional but essential for gaining project approval and fostering trust. For instance, a 2024 survey indicated that 65% of respondents in urban areas consider a developer's commitment to green building practices a key factor in their support for new construction projects. This highlights the growing importance of aligning FDS Group's practices with public environmental expectations.

- Environmental Consciousness: Growing public demand for eco-friendly construction, with a significant portion of consumers willing to pay a premium for sustainable buildings.

- Safety Scrutiny: Increased public and media attention on construction site safety, leading to stricter enforcement and higher expectations from companies like FDS Group.

- Aesthetic Value: Public appreciation for well-designed, aesthetically pleasing structures that contribute positively to urban landscapes, influencing project acceptance.

- Community Relations: The impact of local community feedback and engagement on project timelines and approvals, emphasizing the need for FDS Group's proactive communication.

Societal shifts, like the increasing demand for sustainable and healthy living spaces, directly influence FDS Group's product development and market strategy. The rising emphasis on well-being, evidenced by the growth of WELL Building Standard registrations in 2024, pushes for materials and designs that enhance indoor environmental quality.

Demographic trends, such as an aging population and continued urbanization, create specific market needs. For example, the growing elderly demographic necessitates more accessible housing and specialized healthcare facilities, while urban expansion drives demand for multi-family dwellings and efficient infrastructure, areas where FDS Group can leverage its expertise.

Lifestyle changes, particularly the persistence of remote and hybrid work models, are transforming commercial real estate. This trend favors adaptable office spaces that prioritize employee well-being and collaboration, impacting the design and amenity requirements for buildings FDS Group constructs.

Public perception of construction practices is critical, with a strong societal focus on environmental impact and safety. In 2024, surveys indicated that over 65% of urban residents support projects demonstrating strong green building commitments, underscoring the need for FDS Group to align with these expectations.

Technological factors

Innovations in metal alloys, composite materials, and smart coatings are revolutionizing the construction industry, offering FDS Group enhanced durability, performance, and aesthetic options for facades and architectural elements. These advancements allow for the creation of lighter, stronger, and more energy-efficient building solutions, directly impacting project costs and sustainability metrics.

The adoption of advanced manufacturing techniques, such as additive manufacturing (3D printing) and robotic fabrication, is expected to significantly boost precision and efficiency in construction processes. For instance, the global additive manufacturing market in construction was projected to reach over $2.5 billion by 2024, indicating a substantial shift towards these technologies for improved output and reduced waste.

The increasing adoption of Building Information Modeling (BIM) is transforming the construction industry. By 2024, it's estimated that over 70% of global construction projects will utilize BIM, fostering seamless integration and visualization for complex designs. This technology directly benefits specialist firms like FDS Group by enabling more efficient coordination among architects, contractors, and various trades.

Digital design tools are significantly enhancing the precision and speed of creating bespoke facade and metalwork details. For FDS Group, this translates to fewer errors and a smoother project delivery process, ultimately boosting competitiveness. The market for digital construction tools is projected to reach $12.7 billion by 2025, highlighting the critical need for expertise in these areas.

The fabrication sector is seeing a significant uptick in automation and robotics. For FDS Group, this translates to enhanced precision and speed in producing facade elements, potentially cutting labor costs. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a broad industry trend.

Robotic systems are also becoming integral to on-site installation, particularly for intricate facade components. This not only boosts efficiency but also elevates safety standards by minimizing human exposure to hazardous tasks. Companies that strategically invest in these advanced manufacturing and installation technologies are likely to see a marked improvement in both their output quality and overall productivity.

Smart Building Technologies and Integration

The increasing adoption of smart building technologies, including dynamic shading and integrated sensors, presents a significant opportunity for FDS Group. By incorporating these systems, FDS Group can enhance the value proposition of its architectural designs, moving beyond mere aesthetics to offer functional, responsive environments. This trend necessitates a broadened expertise in building systems, extending beyond the traditional scope of the physical structure.

Consider the following technological integrations:

- Intelligent Facades: Dynamic shading systems can optimize natural light and thermal performance, potentially reducing energy consumption by up to 20% in commercial buildings, according to recent industry reports.

- Integrated Sensor Networks: Sensors for occupancy, air quality, and temperature can enable automated climate control and space utilization, leading to improved occupant comfort and operational efficiency.

- Building Information Modeling (BIM) Integration: Seamless integration with BIM platforms allows for better design, construction, and facility management of smart building components.

- IoT Connectivity: The backbone of smart buildings relies on robust Internet of Things (IoT) connectivity, enabling real-time data exchange and system control.

Sustainable Construction Technologies

Technological advancements in sustainable construction are reshaping the industry. Innovations in green building materials, such as advanced recycled composites and bio-based insulation, are becoming more accessible and cost-effective. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow significantly. Energy-efficient facade systems, like Building-Integrated Photovoltaics (BIPV) and advanced double-skin facades, are increasingly adopted to reduce operational energy consumption. FDS Group can leverage these technologies to enhance its offerings.

FDS Group's innovation strategy should prioritize the integration of these sustainable solutions. This includes incorporating materials that minimize embodied carbon and adopting facade systems that optimize natural light and thermal performance. For example, a BIPV facade can generate electricity while providing shading and insulation. The company's commitment to research and development in these areas will be crucial for staying competitive and meeting the growing client demand for environmentally responsible buildings.

Waste reduction technologies are also a key technological factor. Advanced prefabrication techniques and modular construction methods can significantly reduce on-site waste. The construction industry globally generates millions of tons of waste annually, and adopting technologies that enable material reuse and recycling is essential. FDS Group can implement digital tools for better material management and explore partnerships with companies specializing in construction waste recycling.

Key technological factors for FDS Group include:

- Advancements in Green Building Materials: Increased use of recycled content, bio-based materials, and low-embodied carbon alternatives.

- Energy-Efficient Facade Systems: Adoption of BIPV, dynamic glazing, and high-performance insulation for reduced operational energy.

- Waste Reduction Technologies: Implementation of prefabrication, modular construction, and digital material tracking to minimize construction waste.

- Digitalization in Construction: Utilization of BIM, AI, and IoT for enhanced design, project management, and resource optimization.

Technological advancements are fundamentally reshaping the construction sector, offering FDS Group opportunities for enhanced efficiency and product innovation. The increasing integration of digital tools like BIM, projected to be used in over 70% of global projects by 2024, streamlines design and coordination. Furthermore, the growing adoption of additive manufacturing and robotics in construction, with the global additive manufacturing market in construction expected to exceed $2.5 billion by 2024, promises greater precision and reduced waste in fabrication processes.

The trend towards smart building technologies, including IoT connectivity and integrated sensor networks, allows FDS Group to offer more functional and responsive architectural solutions. Innovations in sustainable construction, such as advanced green building materials and energy-efficient facade systems like BIPV, are becoming more prevalent, with the global green building materials market valued at approximately $250 billion in 2023. These advancements enable FDS Group to meet growing client demand for environmentally responsible buildings.

| Technology Area | Projected Impact/Adoption | Relevance to FDS Group |

|---|---|---|

| Building Information Modeling (BIM) | Over 70% global project adoption by 2024 | Improved design coordination and project management |

| Additive Manufacturing (3D Printing) | Market projected >$2.5 billion by 2024 | Enhanced precision and efficiency in fabrication |

| Robotics in Construction | Global industrial robotics market ~$50 billion in 2023 | Increased precision, speed, and safety in fabrication and installation |

| Smart Building Technologies (IoT, Sensors) | Growing integration for functional buildings | Opportunities for value-added, responsive facade solutions |

| Green Building Materials | Market valued ~$250 billion in 2023 | Meeting demand for sustainable and low-embodied carbon solutions |

Legal factors

FDS Group must strictly adhere to evolving local, national, and international building codes, fire safety regulations, and structural standards. For instance, in 2024, the International Code Council (ICC) released updated building codes, requiring significant review of existing product lines and manufacturing processes to ensure ongoing compliance. This commitment to regulatory alignment is crucial for maintaining operational integrity and market access.

Continuous adaptation of design and engineering practices is essential as these codes are regularly updated. Failure to comply can result in severe legal penalties, project delays, and substantial reputational damage, impacting future business opportunities and investor confidence. For example, a significant building code violation in 2024 could lead to fines in the hundreds of thousands of dollars and halt construction for months.

FDS Group operates within a landscape of stringent health and safety regulations, impacting both its manufacturing operations and the critical on-site installation of its fire safety systems. These laws mandate rigorous adherence to workplace safety standards, requiring comprehensive employee training and the implementation of robust safety protocols. For instance, in the UK, the Health and Safety at Work etc. Act 1974 sets the overarching framework, with specific regulations like the Control of Substances Hazardous to Health (COSHH) and the Construction (Design and Management) Regulations (CDM) directly influencing FDS Group's practices. Failure to comply can lead to significant penalties, including fines and reputational damage, underscoring the importance of proactive safety management to mitigate risks and legal liabilities.

Environmental protection laws significantly shape FDS Group's operational landscape, dictating how they manage waste, control emissions, and source materials. Compliance with regulations on hazardous substances and pollution is not just a legal necessity but a core operational tenet.

Stricter environmental legislation, such as the EU's Green Deal initiatives aiming for climate neutrality by 2050, directly influences FDS Group's material choices and construction methods, pushing for more sustainable and less impactful practices.

These environmental mandates often act as catalysts for innovation, encouraging FDS Group to invest in and adopt greener building technologies and materials, potentially leading to competitive advantages in the evolving market.

Contract Law and Liability

FDS Group navigates a landscape heavily influenced by contract law, engaging with architects, main contractors, and developers. Crucially, the group must meticulously manage contract terms, warranties, liability clauses, and dispute resolution processes to effectively minimize legal exposure. For instance, in 2024, construction contract disputes in the UK saw an average resolution time of 12 months, highlighting the importance of robust contractual frameworks.

Professional indemnity and public liability insurance are therefore paramount legal considerations for FDS Group. These policies provide essential financial protection against potential claims arising from errors in professional services or incidents causing third-party injury or property damage. The global construction insurance market, valued at approximately $150 billion in 2024, underscores the significant financial commitment businesses like FDS Group make to manage these risks.

- Contractual Risk Mitigation: FDS Group's reliance on contracts with various stakeholders necessitates rigorous review and management of terms, warranties, and liability provisions.

- Insurance as a Safeguard: Professional indemnity and public liability insurance are critical legal tools to shield FDS Group from financial repercussions of professional errors or accidents.

- Dispute Resolution Efficiency: The lengthy resolution times for construction disputes in 2024 emphasize the need for clear and effective dispute resolution mechanisms within FDS Group's contracts.

Intellectual Property Rights

Intellectual property rights are a crucial consideration for FDS Group, particularly given their focus on unique and custom facade designs. Protecting their innovative facade systems through patents and design copyrights is essential to safeguard their competitive edge. For instance, in 2024, the global intellectual property market saw significant activity, with patent filings increasing across various sectors, highlighting the growing importance of IP protection for innovative companies.

Conversely, FDS Group must diligently ensure that their proprietary designs do not inadvertently infringe upon existing patents or copyrights held by competitors. Navigating this complex legal landscape necessitates expert legal counsel specializing in intellectual property law. This proactive approach to IP management is vital for fostering continued innovation and mitigating the risk of costly infringement disputes, which can impact financial performance and brand reputation.

- Patent Protection: Securing patents for novel facade systems can provide FDS Group with exclusive rights for a set period, preventing competitors from using or replicating their innovations.

- Copyrights for Designs: Copyrights can protect the artistic and aesthetic elements of FDS Group's unique facade designs, offering protection against unauthorized reproduction.

- Infringement Avoidance: Thorough due diligence and legal reviews are necessary to ensure FDS Group's designs do not violate the intellectual property rights of other entities.

- Legal Counsel: Engaging specialized IP lawyers is indispensable for both securing FDS Group's own IP and for navigating potential infringement risks, especially as global IP litigation costs continue to rise.

FDS Group's operations are heavily influenced by employment law, covering everything from hiring practices to employee termination and workplace conditions. Adherence to fair labor standards, anti-discrimination laws, and health and safety regulations is paramount. For instance, in 2024, the UK government continued to emphasize robust worker protections, with ongoing reviews of employment legislation to ensure it remains fit for purpose in a changing economy.

Compliance with these laws is not only a legal obligation but also vital for maintaining a motivated workforce and a positive company culture. Non-compliance can lead to costly lawsuits, penalties, and damage to FDS Group's reputation as an employer, impacting talent acquisition and retention efforts. The average cost of an employment tribunal claim in the UK in 2023/2024 was £15,000, underscoring the financial risks associated with employment law breaches.

| Legal Factor | Impact on FDS Group | 2024/2025 Relevance |

| Building Codes & Safety Regulations | Ensures product compliance, market access, avoids penalties. | Updated ICC codes in 2024 require ongoing review. Fines for violations can reach hundreds of thousands. |

| Health & Safety Laws | Protects workforce, prevents accidents, mitigates liability. | UK's HASAWA 1974 and CDM regulations mandate strict protocols. |

| Environmental Laws | Governs waste, emissions, material sourcing; drives sustainability. | EU Green Deal influences material choices and construction methods. |

| Contract Law | Manages stakeholder agreements, minimizes legal exposure. | UK construction disputes averaged 12 months to resolve in 2024. |

| Intellectual Property Rights | Protects innovations, prevents infringement, maintains competitive edge. | Global IP market saw increased activity in 2024; IP litigation costs are rising. |

Environmental factors

Climate change is a significant factor for FDS Group, as the increasing frequency and intensity of extreme weather events demand more resilient building envelopes. This means facades need to be engineered to withstand higher winds, heavier rainfall, and extreme temperature fluctuations, directly impacting material selection and engineering specifications.

For instance, in 2024, global insured losses from natural catastrophes were estimated to be around $50 billion by Swiss Re, highlighting the growing financial impact of weather-related events. FDS Group's ability to offer solutions that enhance structural integrity and weather resistance will be crucial in meeting market demand for adaptable and durable building components.

The construction industry faces increasing scrutiny regarding its carbon footprint, directly influencing FDS Group's material sourcing and production methods. For instance, a 2024 report highlighted that buildings account for nearly 40% of global energy-related carbon emissions, creating a strong impetus for facade solutions that enhance energy efficiency.

FDS Group's innovative facade designs can significantly contribute to a building's overall energy performance. This includes integrating advanced insulation techniques and exploring the incorporation of renewable energy sources directly into facade systems, aligning with the growing demand for net-zero construction targets.

The market is witnessing a substantial shift towards low-carbon building materials, with projections indicating a 15% year-over-year growth in demand for sustainable alternatives through 2025. This trend necessitates FDS Group to prioritize and offer materials with lower embodied carbon in their facade solutions.

Environmental regulations and growing client demand are increasingly steering the construction industry towards improved waste management. This includes a significant push for recycling construction debris and actively reducing waste generated on-site. For instance, in 2023, the UK construction industry generated approximately 100 million tonnes of waste, with a substantial portion still going to landfill, highlighting the urgency for change.

FDS Group can strategically integrate circular economy principles to enhance its sustainability and resource efficiency. This involves designing structures with deconstruction in mind, prioritizing the use of recycled materials in their projects, and implementing fabrication processes that minimize material offcuts. By doing so, FDS Group not only addresses environmental concerns but also taps into a growing market segment that values eco-conscious building practices.

Sustainable Sourcing of Materials

Increasing scrutiny on the environmental impact of material extraction and production means FDS Group must carefully consider the sustainability of its supply chain. For instance, the global demand for critical minerals, essential for many technologies, has led to heightened concerns about responsible mining practices. By 2024, reports indicated that over 70% of consumers were willing to pay more for products from sustainable brands, underscoring the market's shift.

Sourcing materials from environmentally responsible suppliers, prioritizing locally sourced materials to reduce transport emissions, and using certified sustainable products are becoming key differentiators in the market. For example, the adoption of Forest Stewardship Council (FSC) certified wood in packaging can significantly reduce a company's environmental footprint. Transparency in sourcing is also increasingly valued by stakeholders and investors alike, with many actively seeking this information when making decisions.

Key considerations for FDS Group regarding sustainable sourcing include:

- Supplier Audits: Implementing rigorous environmental and social audits for all material suppliers to ensure compliance with sustainability standards.

- Circular Economy Principles: Exploring the use of recycled or renewable materials in product manufacturing to minimize virgin resource extraction.

- Logistics Optimization: Strategically sourcing materials from closer geographical locations to reduce carbon emissions associated with transportation, aiming to cut transport-related emissions by a target of 15% by 2025.

- Certifications: Pursuing certifications for key materials, such as ISO 14001 for environmental management systems, to validate sustainable practices.

Biodiversity and Green Spaces Integration

Urban development is increasingly prioritizing green spaces and biodiversity within building designs. This trend sees the rise of green roofs, living walls, and facade-integrated planting systems, transforming urban landscapes. For FDS Group, this presents a significant opportunity to innovate by developing architectural elements specifically designed to support these ecological features.

By integrating these green solutions, FDS Group can contribute to urban biodiversity and enhance both the aesthetic appeal and environmental performance of buildings. This focus on ecological integration opens up new avenues for specialized facade solutions, aligning with growing market demand for sustainable and biophilic design. For example, the global green roof market was valued at approximately USD 15.2 billion in 2023 and is projected to grow significantly in the coming years, indicating strong market potential.

- Growing Demand for Biophilic Design: Consumers and regulators alike are pushing for more nature-integrated urban environments.

- Innovation in Facade Systems: FDS Group can develop specialized facade solutions that seamlessly incorporate living plant systems.

- Market Growth in Green Infrastructure: The green building sector, including green roofs and walls, is experiencing robust expansion.

- Enhanced Building Performance: These integrations offer benefits like improved insulation, stormwater management, and air quality.

Climate change necessitates facades that withstand extreme weather; for instance, global insured losses from natural catastrophes reached approximately $50 billion in 2024, underscoring the need for resilient building envelopes.

The construction sector's significant carbon footprint, with buildings contributing nearly 40% of global energy-related emissions in 2024, drives demand for energy-efficient facade solutions and low-carbon materials, a market projected to grow 15% year-over-year through 2025.

Waste management is a critical environmental factor, with the UK construction industry generating around 100 million tonnes of waste in 2023, highlighting the opportunity for FDS Group to implement circular economy principles and utilize recycled materials.

Growing demand for biophilic design and green infrastructure, with the global green roof market valued at USD 15.2 billion in 2023, presents FDS Group with opportunities to develop facade systems that support living plant integrations.

| Environmental Factor | Impact on FDS Group | Market Trend/Data Point (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Demand for resilient, weather-resistant facade materials and engineering. | Global insured losses from natural catastrophes: ~$50 billion (2024). |

| Carbon Footprint & Energy Efficiency | Focus on low-carbon materials and facade systems that enhance energy performance. | Buildings account for ~40% of global energy-related carbon emissions (2024); Sustainable materials market growth: ~15% YoY through 2025. |

| Waste Management & Circular Economy | Integration of recycled materials and design for deconstruction to minimize waste. | UK construction waste: ~100 million tonnes (2023); Increased focus on recycling and waste reduction. |

| Biodiversity & Green Infrastructure | Development of facade systems supporting green roofs, living walls, and biophilic design. | Global green roof market value: ~$15.2 billion (2023); Growing demand for nature-integrated urban environments. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including government publications, international organizations, and leading market research firms. This ensures that every aspect, from political stability to technological advancements, is grounded in factual and current information.