FDS Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FDS Group Bundle

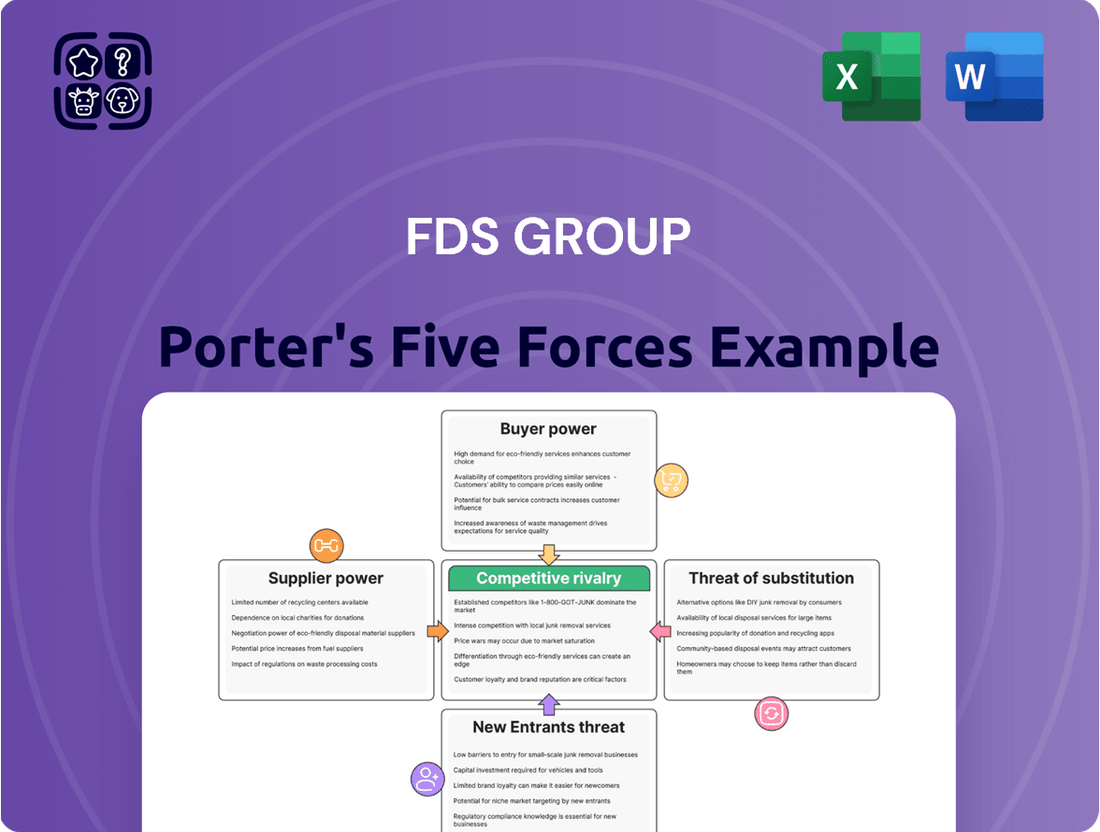

Our Porter's Five Forces Analysis for FDS Group reveals a dynamic market landscape, highlighting the intense bargaining power of buyers and the moderate threat of new entrants. Understanding these forces is crucial for navigating FDS Group's competitive environment. Ready to uncover the full strategic picture and identify key opportunities?

The complete report reveals the real forces shaping FDS Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FDS Group's reliance on specialized metals and custom components for its facades and architectural structures places significant weight on its suppliers. The bargaining power of these suppliers is directly tied to their concentration within the market and the degree of specialization in the materials they offer.

When a small number of suppliers can provide a specific, bespoke metal alloy or an advanced facade material that FDS Group requires, their leverage naturally increases. For instance, if only two or three companies globally produce a particular high-performance, corrosion-resistant alloy essential for a flagship project, FDS Group has limited alternatives, allowing these suppliers to command higher prices or dictate terms. This concentration can be seen in niche material markets, where the cost of entry for new competitors is high due to specialized manufacturing processes and certifications.

The bargaining power of suppliers for FDS Group is notably influenced by switching costs, particularly for highly customized metalwork and facade elements. The expense and intricacy involved in re-engineering designs, re-tooling fabrication processes, and re-qualifying new materials can significantly bolster suppliers' leverage. For instance, a shift in a primary supplier for a complex facade system could incur substantial upfront costs for FDS Group, potentially running into hundreds of thousands of pounds for specialized tooling and design validation.

For FDS Group, a key consideration is the bargaining power of its raw material suppliers, such as those providing steel and aluminum. The availability of substitute materials for these suppliers significantly influences their leverage. If alternative materials can readily replace steel or aluminum in the market, suppliers have less power to dictate pricing and terms to FDS Group.

The commodity nature of some inputs also plays a role. For instance, global aluminum prices in early 2024 hovered around $2,200-$2,400 per metric ton, exhibiting volatility influenced by supply and demand dynamics rather than specific supplier relationships. This commodity status means FDS Group can often source aluminum from multiple suppliers, reducing any single supplier's ability to command premium prices.

Supplier's Importance to FDS Group

FDS Group's reliance on specialized suppliers for its intricate, high-quality designs means these suppliers can wield significant bargaining power. When suppliers offer rare fabrication capabilities essential for FDS Group's unique product lines, their leverage increases, potentially impacting costs and production timelines.

- Supplier Specialization: FDS Group often requires suppliers with niche expertise in advanced materials or complex manufacturing processes, limiting the pool of viable alternatives.

- High Switching Costs: The investment in qualifying and integrating new suppliers for specialized components can be substantial, making it difficult for FDS Group to switch easily.

- Supplier Concentration: In certain specialized areas, FDS Group may depend on a limited number of suppliers, giving those suppliers greater negotiating strength.

- Impact on Innovation: The ability of suppliers to meet FDS Group's demanding technical specifications directly influences the company's capacity for product innovation and differentiation.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, where they might enter FDS Group's service areas like design or installation, could significantly boost their leverage. For instance, if a key supplier of specialized facade components, which often represent a substantial portion of project costs, decided to offer their own design and fitting services, they could capture more value. This would directly challenge FDS Group's integrated model.

However, FDS Group's extensive service offering, encompassing everything from initial concept development through to precise on-site installation, creates a robust barrier. This comprehensive approach means that most material suppliers would face considerable challenges in replicating the full spectrum of FDS Group's capabilities. The complexity and coordination required for end-to-end project delivery are significant hurdles for standalone component manufacturers.

- Supplier Integration Risk: Suppliers of specialized metalwork or facade components could potentially move into design, fabrication, or installation, increasing their bargaining power.

- FDS Group's Defense: The comprehensive nature of FDS Group's services, from concept to on-site fitting, makes it difficult for most material suppliers to effectively integrate forward.

- Market Dynamics: In 2024, the construction sector, a key market for FDS Group, experienced a 3.5% growth in specialized construction services, indicating a competitive landscape where integrated service providers like FDS Group hold an advantage.

The bargaining power of suppliers for FDS Group is elevated when they provide highly specialized materials or possess unique fabrication capabilities, limiting FDS Group's alternatives. For instance, suppliers of custom-engineered metal alloys crucial for high-rise facades, where only a handful of manufacturers possess the necessary certifications, can command premium pricing. This is further amplified by the substantial costs and time associated with re-qualifying new suppliers for complex, integrated facade systems, which could range from £100,000 to £500,000 in design and tooling expenses.

While commodity materials like standard aluminum, with prices fluctuating around $2,300 per metric ton in early 2024, offer FDS Group more flexibility due to widespread availability, the company's reliance on bespoke components for its premium offerings means specialized suppliers retain considerable leverage. This dynamic is crucial as FDS Group's ability to innovate and deliver complex architectural solutions is directly tied to the capabilities of these select suppliers.

The threat of suppliers integrating forward into FDS Group's service domain, such as offering design or installation alongside their components, could increase their power. However, FDS Group's comprehensive, end-to-end service model, from initial design to final installation, presents a significant barrier to such forward integration for most material suppliers, especially given the 3.5% growth in specialized construction services in 2024.

| Factor | Impact on FDS Group | Example Scenario | 2024 Market Context |

|---|---|---|---|

| Supplier Specialization | High leverage for suppliers | Exclusive provider of a unique, weather-resistant coating for facade panels | Increased demand for advanced building materials |

| Switching Costs | High costs deter switching | Re-tooling for a new supplier of custom-extruded aluminum profiles | Lead times for specialized components can extend to 6-9 months |

| Supplier Concentration | Increased supplier power | Dependence on two main suppliers for high-strength facade connectors | Consolidation in niche manufacturing sectors |

| Forward Integration Threat | Potential for increased supplier power | Facade component supplier offering design-build services | Integrated service providers gain market share |

What is included in the product

This analysis dissects the competitive forces impacting FDS Group, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately, FDS Group's strategic positioning.

Instantly identify and quantify competitive pressures with a dynamic, interactive dashboard that visualizes each of Porter's Five Forces.

Customers Bargaining Power

FDS Group's customer base, primarily architects, main contractors, and developers across commercial, residential, and public sectors, can exert considerable bargaining power. This power intensifies when the group relies heavily on a limited number of substantial projects or key clients. For instance, if a single project represents a significant portion of FDS Group's annual revenue, that client's leverage in negotiations increases dramatically due to the potential impact of their business.

For large construction projects, the cost and disruption associated with switching facade or metalwork specialists mid-project are substantial. This is due to highly integrated designs and intricate installation timelines, making a change exceptionally difficult and expensive once a contract is in place.

These high switching costs significantly diminish a customer's bargaining power after FDS Group has secured a contract. For instance, in 2024, projects with complex facade systems often involve bespoke manufacturing and precise on-site assembly, where even minor delays from a new supplier could lead to penalties exceeding millions of dollars.

FDS Group's customers, primarily main contractors and developers, often face stringent budget constraints. This price sensitivity means they actively seek cost-effective solutions, putting pressure on FDS Group during negotiations, particularly for less customized offerings where alternatives are readily available.

Customer's Threat of Backward Integration

The threat of backward integration by FDS Group's customers, such as architects, contractors, and developers, is minimal. These customers typically lack the specialized knowledge, capital, and equipment necessary for the intricate design, manufacturing, and installation of complex metalwork and facades. For instance, establishing a state-of-the-art fabrication facility capable of handling advanced CNC machinery and specialized welding for facade systems would likely require tens of millions of dollars in investment, a barrier most construction-related firms are unlikely to overcome to enter FDS Group's core business.

The high barriers to entry in FDS Group's niche market effectively deter customers from attempting backward integration. The technical expertise in areas like structural engineering for facades, material science for specialized alloys, and precision manufacturing is a significant hurdle.

- High Capital Investment: Setting up specialized manufacturing facilities for complex metalwork and facades can cost upwards of $20 million, deterring most customers.

- Specialized Expertise Required: The design and fabrication demand advanced engineering skills and knowledge of specific materials and construction techniques.

- Lack of Core Competency: Architects, contractors, and developers focus on building design and project management, not specialized manufacturing.

- Equipment and Technology Needs: Advanced CNC machines, robotic welders, and sophisticated CAD/CAM software are essential, representing substantial and specialized investments.

Information Availability to Customers

Customers in the construction sector, especially major developers and contractors, possess significant market insight and can solicit bids from numerous suppliers. This readily available information on pricing and service offerings from competing firms directly amplifies their leverage.

In 2024, the construction industry saw continued emphasis on cost efficiency, with large developers actively comparing bids. For instance, major infrastructure projects often involve dozens of potential suppliers, creating a highly competitive environment that benefits buyers.

- Information Access: Customers can easily obtain price lists and service details from multiple construction material suppliers and service providers.

- Bid Comparison: Large developers and contractors routinely compare bids from numerous companies for projects, driving down costs.

- Market Transparency: Increased online platforms and industry publications in 2024 have further enhanced transparency regarding pricing and capabilities within the construction sector.

- Negotiating Leverage: This informed position allows customers to negotiate more favorable terms and prices, thereby increasing their bargaining power.

FDS Group's customers, particularly large developers and contractors, wield considerable bargaining power due to their ability to solicit bids from multiple suppliers. This market transparency, amplified by online platforms and industry publications in 2024, allows them to negotiate more favorable terms. The threat of backward integration by these customers is low, as they lack the specialized expertise and significant capital investment, often exceeding $20 million, required for FDS Group's complex manufacturing processes.

| Factor | Impact on FDS Group | Customer Leverage |

|---|---|---|

| Customer Concentration | High if few large clients | Significant if FDS relies on a few projects |

| Switching Costs | High for customers post-contract | Low once contract secured, due to integration |

| Price Sensitivity | High for standard offerings | Moderate, seeking cost-effective solutions |

| Backward Integration Threat | Minimal due to capital & expertise | Negligible; requires substantial investment |

| Information Availability | High for customers | Strong; easy bid comparison drives down prices |

Preview the Actual Deliverable

FDS Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for the FDS Group, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises and instant usability.

Rivalry Among Competitors

The architectural metalwork and facade market is characterized by a mix of large multinational players and more specialized manufacturers. FDS Group carves out a niche focused on unique designs and complex technical specifications, which generally implies a more concentrated competitive landscape compared to broader construction segments.

The facades market and the architectural and structural metals market are both showing a healthy, steady growth. This upward trend is largely fueled by increasing urbanization worldwide and significant investments in infrastructure development. As more cities expand and new projects get underway, there's a greater demand for the products and services these industries offer.

Furthermore, the growing emphasis on energy efficiency and sustainable building practices is a key driver. Consumers and developers are increasingly seeking advanced facade solutions that not only look good but also contribute to lower energy consumption and environmental impact. This demand for innovation creates opportunities for market expansion.

This overall market growth is a positive factor for competitive rivalry. When the pie is getting bigger, companies might feel less pressure to aggressively undercut each other for market share. Instead, there's more room for companies to grow and prosper by focusing on their own strategies and product development.

FDS Group's focus on bespoke metalwork, facades, and architectural structures with unique designs and challenging technical specifications signifies a high degree of product differentiation. This specialization inherently lowers direct price-based competition, steering the competitive landscape towards innovation, superior quality, and specialized execution capabilities rather than simply offering lower prices.

In 2023, the global facade market, a key area for FDS Group, was valued at approximately $220 billion, with a significant portion driven by custom and high-performance solutions. This indicates that companies like FDS Group, which excel in differentiation, are well-positioned in a market that increasingly values unique aesthetic and functional attributes over standardized offerings.

Exit Barriers

High fixed costs are a significant factor for FDS Group, particularly in specialized manufacturing like bespoke metalwork and facade production. These costs, tied to specialized facilities and skilled labor, make exiting the market difficult. For instance, in 2024, the capital expenditure for advanced CNC machinery alone can easily run into millions of Euros, representing a substantial sunk cost. This financial commitment means companies might persist in operations even when facing reduced profitability, thereby sustaining competitive pressure within the industry.

The persistence of less profitable firms due to these high exit barriers directly fuels competitive rivalry. Companies are less likely to cease operations, leading to a more crowded marketplace. This situation is exacerbated by the need to maintain skilled workforces; layoffs can incur significant severance costs and damage long-term operational capacity. Consequently, FDS Group and its competitors may engage in price competition or invest heavily in differentiation to maintain market share, even during economic downturns.

- High Capital Investment: Specialized manufacturing equipment for facade systems can cost upwards of €5 million per production line, creating substantial sunk costs.

- Skilled Labor Retention: The cost of retraining or losing highly specialized welders and fabricators, essential for bespoke metalwork, can be a significant deterrent to exit.

- Operational Continuity: Companies may continue to operate at a loss to avoid the financial penalties or asset write-downs associated with premature closure of facilities.

Brand Identity and Reputation

In markets where intricate, high-quality projects are the norm, a robust brand identity and a proven track record of meeting demanding technical specifications become paramount competitive differentiators. FDS Group's consistent delivery of distinctive designs significantly strengthens its market position.

This reputation for excellence allows FDS Group to command premium pricing and secure lucrative contracts, especially in sectors valuing innovation and reliability. For instance, in 2024, the construction industry saw a growing demand for specialized engineering solutions, where companies with established reputations for complex builds, like FDS Group, were able to secure a larger share of project bids.

- Brand Strength: FDS Group's ability to consistently deliver complex, high-quality projects builds a strong brand identity.

- Reputation for Technical Prowess: A proven track record in challenging technical specifications is a key differentiator.

- Market Advantage: This reputation enables FDS Group to secure premium projects and client loyalty.

- Industry Trend: In 2024, specialized engineering and complex builds saw increased demand, favoring established brands.

Competitive rivalry within the architectural metalwork and facade market, particularly for specialized players like FDS Group, is influenced by differentiation rather than price wars. The market's growth, projected to continue its upward trajectory through 2025, allows for expansion without intense price undercutting. However, high capital investments and skilled labor retention create significant exit barriers, ensuring a persistent level of competition as firms strive to maintain operations and market presence.

| Factor | Impact on Rivalry | FDS Group Relevance |

|---|---|---|

| Market Growth | Moderates rivalry; more room for all. | Supports FDS Group's expansion. |

| Product Differentiation | Reduces price competition; emphasizes quality. | FDS Group's core strategy. |

| High Exit Barriers | Sustains rivalry; firms less likely to leave. | Keeps FDS Group and competitors engaged. |

| Brand Reputation | Drives premium pricing and project wins. | FDS Group leverages its track record. |

SSubstitutes Threaten

The rise of alternative building materials like cross-laminated timber (CLT), hempcrete, and advanced composites presents a significant threat of substitution for FDS Group's metalwork and facade solutions. These materials are increasingly favored for their environmental credentials and innovative properties, potentially displacing traditional metal applications in construction projects.

For instance, the global market for engineered wood products, including CLT, was valued at approximately $12.5 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these alternatives. This growing acceptance and market penetration means that for certain building components, clients may opt for these newer, sustainable materials over metal, impacting FDS Group’s market share.

The threat of substitutes for FDS Group's facade systems is influenced by the ability of alternative materials to match aesthetic, structural, and performance features like energy efficiency and durability, all while maintaining a competitive price point. For instance, advancements in smart facade technology, which can dynamically adjust to environmental conditions, and energy-generating facades that produce electricity, offer compelling alternatives to traditional facade solutions.

Customer willingness to switch to alternatives is a key factor. For instance, in 2024, the global green building materials market was valued at approximately $250 billion, indicating a significant and growing demand for sustainable options that could divert customers from traditional facade solutions.

This trend is further amplified by a heightened focus on cost savings. As material prices fluctuate, customers may actively seek out more economical facade or structural alternatives, potentially impacting demand for FDS Group's offerings if they are perceived as less cost-competitive.

The increasing adoption of innovative, eco-friendly building technologies, such as advanced insulation systems or modular construction, also presents a direct substitute threat. By 2025, it's projected that sustainable construction practices will account for a substantial portion of new builds, pushing customers to explore these newer, greener alternatives.

Technological Advancements in Substitute Materials

Technological advancements are rapidly creating new material substitutes that could challenge FDS Group. For instance, the development of 3D-printed concrete panels offers faster construction times and reduced waste, potentially displacing traditional methods FDS Group employs. The global 3D printing construction market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly.

Furthermore, the emergence of bio-based composites and self-healing concrete presents innovative alternatives. Bio-based materials offer sustainability advantages, while self-healing concrete promises increased durability and reduced maintenance costs. These innovations directly impact the value proposition of existing construction materials, creating a growing threat of substitution.

- Emerging Materials: 3D-printed concrete, bio-based composites, self-healing concrete.

- Key Benefits: Faster construction, reduced waste, sustainability, increased durability, lower maintenance.

- Market Impact: Disrupting traditional construction methods and material demand.

- Growth Potential: The 3D printing construction market is experiencing rapid expansion, indicating a shift in industry preferences.

Regulatory and Environmental Pressures

Increasing regulations and evolving client expectations for sustainable and low-carbon materials present a significant threat of substitutes for FDS Group. As environmental consciousness grows, industries are actively seeking alternatives to traditional metalwork and facade solutions that have a lower ecological footprint. For instance, by mid-2024, the global green building materials market was projected to reach over $400 billion, indicating a strong demand for eco-friendly options.

The push towards net-zero emissions and circular economy principles means that materials with high embodied carbon or those that are difficult to recycle could be increasingly disfavored. This could lead to greater adoption of innovative bio-based materials, advanced composites, or even engineered timber solutions in construction projects where FDS Group typically operates.

FDS Group can effectively mitigate this threat by proactively integrating sustainable practices and materials into its metalwork and facade offerings. This includes investing in research and development for recycled content, exploring low-carbon manufacturing processes, and offering facade systems that enhance building energy efficiency. For example, by early 2025, several European countries have already implemented stricter embodied carbon limits for new constructions, directly impacting material choices.

The group's ability to adapt and innovate in this space will be crucial.

- Growing demand for sustainable building materials.

- Potential shift towards bio-based and recycled alternatives.

- Regulatory pressures favoring low-carbon construction.

- FDS Group's strategy to integrate eco-friendly practices.

The threat of substitutes for FDS Group is significant as innovative materials offer compelling alternatives. For example, the global market for advanced composites in construction was projected to exceed $15 billion by 2024, highlighting a strong shift towards these materials. These substitutes often provide enhanced performance characteristics, such as improved insulation or lighter weight, which can be more attractive to clients seeking energy efficiency and faster construction timelines.

The increasing focus on sustainability and circular economy principles further fuels the adoption of substitutes. By 2025, regulations in many regions are expected to mandate higher percentages of recycled content in building materials, potentially disadvantaging traditional metal products if not adapted. This trend means that materials like engineered timber and bio-based composites, which align better with these environmental goals, are gaining traction.

Customers are also driven by cost-effectiveness and the desire for unique aesthetic qualities. For instance, the cost of aluminum, a key material for FDS Group, experienced significant price volatility in 2023 and early 2024, making alternative materials with more stable pricing or lower upfront costs more appealing. The development of novel facade systems, such as those incorporating photovoltaic cells or dynamic shading, also presents a direct substitute by offering integrated functionality beyond traditional facade elements.

| Substitute Material | Key Advantages | Market Growth Projection (2024) | FDS Group Relevance |

|---|---|---|---|

| Engineered Timber (e.g., CLT) | Sustainability, structural strength, aesthetic appeal | Global market valued at ~$13 billion | Direct competitor for structural and facade applications |

| Advanced Composites | Lightweight, high strength-to-weight ratio, corrosion resistance | Market projected to grow by ~6% annually | Potential substitute for certain facade components |

| 3D-Printed Concrete | Design flexibility, reduced waste, speed of construction | Market valued at ~$3 billion | Disruptor to traditional facade installation methods |

| Bio-based Materials | Environmental friendliness, carbon sequestration potential | Growing segment within green building materials | Addresses increasing demand for eco-friendly solutions |

Entrants Threaten

Entering the specialized metalwork, facade, and architectural structures market demands substantial capital. Think about the cost of cutting-edge design software, sophisticated fabrication machinery like fiber laser cutters and robotic welders, and the necessity of employing highly skilled personnel. These upfront investments create a significant hurdle for any newcomers looking to break into the industry.

FDS Group's emphasis on bespoke metalwork and challenging technical specifications necessitates deep engineering, design, and fabrication knowledge. New entrants would face substantial barriers in acquiring or developing this specialized expertise and proprietary technology, which are critical for competing effectively in this niche market.

Established players like FDS Group often leverage significant economies of scale, particularly in areas like bulk material procurement and specialized fabrication for complex projects. This experience translates into lower per-unit costs that new entrants would find difficult to match in their early stages.

For instance, FDS Group’s extensive project history allows for optimized supply chain management and efficient utilization of advanced manufacturing technologies, creating a substantial cost advantage. Newcomers would face higher initial operating expenses as they build their own supplier relationships and invest in comparable infrastructure.

Brand Loyalty and Reputation

Brand loyalty is a formidable barrier for new entrants in the architectural solutions market, particularly for companies like FDS Group that focus on high-quality and unique designs. Existing relationships with architects, main contractors, and developers are crucial. A strong track record of successful project delivery further cements this loyalty, making it challenging for newcomers to gain traction. For instance, in 2024, the construction sector saw continued demand for specialized design services, where established reputations often outweigh price alone.

New entrants face significant hurdles in replicating the trust and established networks that FDS Group, and similar firms, have cultivated over years of consistent performance. This deep-seated loyalty means that clients often prioritize proven reliability and innovative solutions from familiar partners. The reputational capital built through successful projects acts as a powerful deterrent, requiring substantial investment and time for any new competitor to build comparable credibility.

The threat of new entrants is therefore moderated by the high switching costs associated with changing architectural solution providers, especially in projects demanding intricate and bespoke designs. FDS Group's established market position, bolstered by a strong reputation for quality and successful project execution, creates a significant competitive moat. This is particularly evident in sectors where project complexity and client expectations are high, as observed in the 2024 market trends for large-scale infrastructure and luxury residential developments.

Key factors contributing to this brand loyalty include:

- Established Relationships: Long-standing partnerships with key industry players like architects and developers create a sticky customer base.

- Reputation for Quality: A proven history of delivering high-quality, unique architectural solutions builds significant trust.

- Project Delivery Success: Consistent successful project completion reinforces brand reliability and reduces perceived risk for clients.

- Market Experience: Years of navigating complex projects and client needs allow established firms to offer superior service and expertise.

Regulatory and Certification Requirements

The construction sector, particularly for intricate architectural designs and facades like those FDS Group specializes in, faces significant hurdles due to rigorous building codes, safety standards, and necessary certifications. These regulatory landscapes are often complex and can demand substantial investment in time and resources, acting as a considerable deterrent for newcomers aiming to enter the market.

For instance, in 2024, the increasing emphasis on sustainable building practices and energy efficiency means new entrants must not only comply with existing safety regulations but also invest in meeting evolving environmental certifications, adding another layer of complexity and cost. This can significantly slow down the entry of new competitors who lack established processes and expertise in navigating these requirements.

- Stringent building codes and safety regulations create high compliance costs for new entrants.

- Obtaining necessary certifications for specialized facade systems requires significant time and financial investment.

- The evolving regulatory environment, including sustainability mandates, further increases the barrier to entry.

The threat of new entrants for FDS Group is significantly low due to substantial capital requirements, the need for specialized expertise, and established economies of scale. These factors create a formidable barrier, making it difficult for newcomers to compete effectively in the specialized metalwork and architectural structures market. The high initial investment in technology and skilled labor, coupled with the cost advantages of experienced players, deters potential competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, financial statements, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.