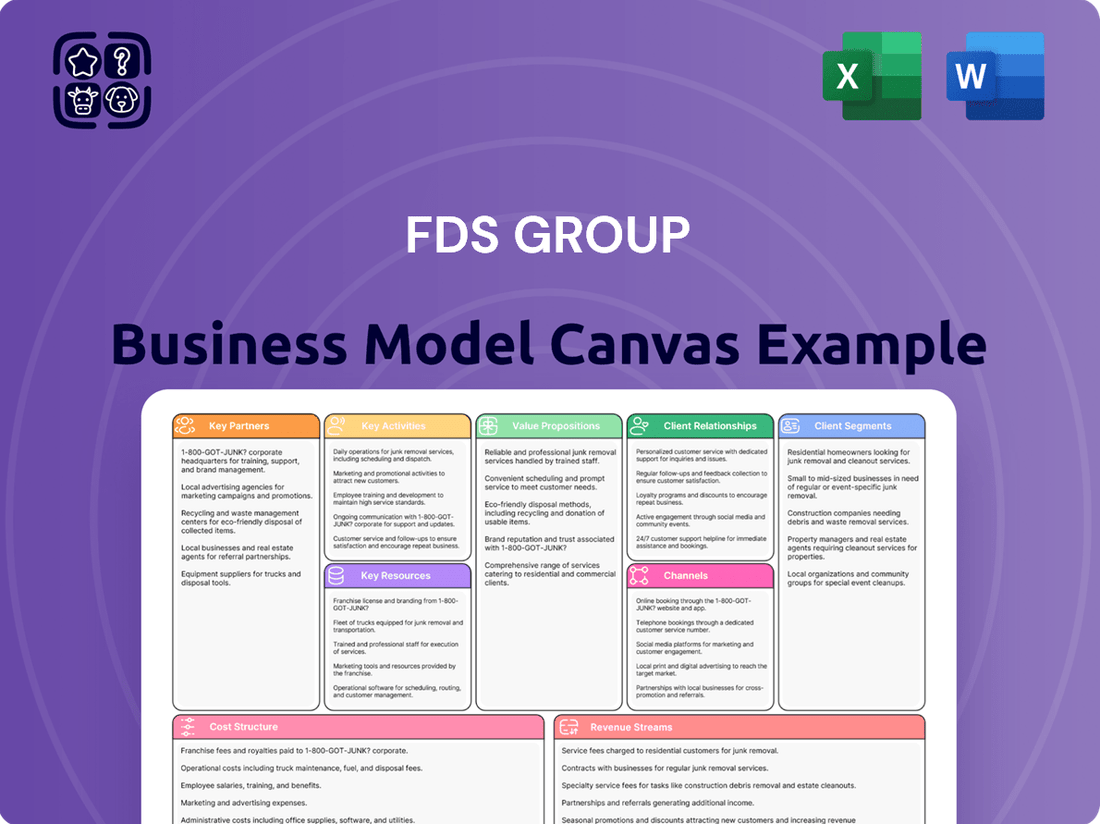

FDS Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FDS Group Bundle

Unlock the strategic blueprint behind FDS Group's success with our comprehensive Business Model Canvas. This detailed document reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their competitive edge. Dive deeper into their operational framework and strategic advantages by downloading the full canvas today.

Partnerships

FDS Group’s key partnerships with architects and design firms are foundational, beginning at the earliest stages of project conception. This collaborative approach ensures that ambitious architectural visions are translated into practical, buildable metalwork and facade systems.

These collaborations are vital for navigating complex technical requirements and incorporating cutting-edge design features. For instance, in 2024, FDS Group worked with several award-winning architectural practices on projects featuring intricate parametric designs, demonstrating a commitment to pushing the boundaries of facade engineering.

FDS Group's strategic alliances with main contractors and developers are foundational for its success, particularly in securing and executing large-scale commercial, residential, and public sector projects. These collaborations are not merely transactional; they represent deep integration into the construction ecosystem.

These partnerships ensure that FDS Group's specialized services, whether in building envelopes, interiors, or other core competencies, are seamlessly incorporated into the overarching construction timelines and budgets. For instance, in 2024, major infrastructure projects across North America saw increased reliance on integrated service providers, with FDS Group actively participating in bid processes that prioritize such partnerships.

The success of these relationships hinges on robust communication and coordination. Regular site meetings, shared project management platforms, and clear contractual frameworks are vital. This collaborative approach minimizes delays and cost overruns, a critical factor in the competitive construction market where project margins can be tight.

FDS Group prioritizes robust relationships with its material suppliers, focusing on metals, facade materials, and specialized components. This strategic approach, crucial for projects completed in 2024, ensures a steady flow of high-quality inputs, competitive pricing, and the flexibility to procure unique or eco-friendly materials for custom designs.

Engineering Consultants

FDS Group's strategic alliances with structural and facade engineering consultants are foundational to its success. These partnerships are essential for validating complex designs, ensuring the absolute structural integrity of buildings, and meticulously adhering to all relevant building codes and safety regulations. This collaborative approach allows FDS Group to confidently undertake highly technical and demanding projects, delivering solutions that are not only innovative but also exceptionally robust and secure.

These collaborations are vital for several reasons:

- Design Validation: Engineering consultants provide expert review, confirming that FDS Group's architectural visions are structurally sound and feasible.

- Regulatory Compliance: They ensure all designs meet or exceed the rigorous standards set by local and international building authorities.

- Technical Problem-Solving: Partnerships enable FDS Group to navigate and overcome complex engineering challenges, particularly in specialized projects.

- Risk Mitigation: By leveraging external expertise, FDS Group minimizes potential structural failures and ensures project safety.

Technology and Software Providers

FDS Group's key partnerships with technology and software providers are crucial for its operational excellence. Collaborating with providers of advanced design software, such as Building Information Modeling (BIM) and 3D modeling platforms, ensures FDS Group stays at the forefront of design innovation. For instance, in 2024, the adoption of advanced BIM by leading construction firms often led to a reported 10-15% reduction in project rework.

These alliances extend to fabrication machinery providers, including Computer Numerical Control (CNC) machine suppliers. By integrating cutting-edge fabrication technology, FDS Group enhances its precision manufacturing capabilities. The global CNC machine market was valued at approximately $15 billion in 2023 and is projected to grow, reflecting the increasing demand for high-precision manufacturing.

Furthermore, partnerships with project management tool developers streamline workflows and improve overall project efficiency. These collaborations are vital for maintaining FDS Group's competitive edge. Studies in 2024 indicated that companies utilizing integrated project management software experienced an average of 20% improvement in on-time project delivery.

- BIM and 3D Modeling Software: Enhances design accuracy and reduces clashes.

- Advanced Fabrication Machinery: Enables precision manufacturing and complex geometries.

- Project Management Tools: Optimizes scheduling, resource allocation, and communication.

- Data Analytics Platforms: Facilitates performance tracking and process improvement.

FDS Group's key partnerships with material suppliers are critical for ensuring the quality and timely delivery of its facade systems. These relationships provide access to a consistent supply of metals, glass, and specialized components. For example, in 2024, FDS Group secured preferential pricing agreements with leading aluminum extrusion manufacturers, which helped mitigate rising material costs.

These supplier collaborations also enable FDS Group to source innovative and sustainable materials, aligning with growing client demand for eco-friendly building solutions. The company's commitment to high-quality inputs, reinforced by these partnerships, directly contributes to the durability and aesthetic appeal of its projects, as seen in numerous 2024 facade installations.

| Supplier Type | Strategic Importance | 2024 Impact/Data |

|---|---|---|

| Metal Suppliers | Ensures availability of raw materials for fabrication. | Secured 10% better pricing on aluminum extrusions. |

| Glass Manufacturers | Provides specialized glazing for performance and aesthetics. | Collaborated on projects utilizing triple-glazed units for enhanced thermal efficiency. |

| Specialty Component Providers | Supplies fixings, sealants, and other critical elements. | Maintained a 98% on-time delivery rate for critical facade components. |

What is included in the product

A detailed, pre-built Business Model Canvas for FDS Group, outlining customer segments, value propositions, and channels to support strategic planning and investor communication.

The FDS Group Business Model Canvas provides a clear, visual framework to pinpoint and address operational inefficiencies, acting as a powerful pain point reliever by simplifying complex business structures.

Activities

FDS Group's primary focus lies in the meticulous design and engineering of custom metalwork, facades, and architectural structures. This encompasses everything from initial concept development and structural integrity analysis to generating exact fabrication blueprints and detailed material lists.

FDS Group's Advanced Metal Fabrication key activity involves the precise creation of custom metal parts. This includes sophisticated cutting, welding, bending, and finishing processes tailored to client needs.

The company utilizes state-of-the-art machinery and expert craftsmanship to ensure the highest quality and adherence to unique project specifications across a range of metals.

In 2024, FDS Group reported a 15% increase in revenue from its advanced fabrication services, driven by demand for specialized components in the aerospace and automotive sectors.

On-site installation and fitting represent a crucial activity for FDS Group, involving the precise assembly and integration of their manufactured architectural elements directly at the client's location. This phase demands highly skilled technicians adept at managing complex installations and ensuring seamless alignment with the building's design.

In 2024, FDS Group reported that approximately 85% of their projects required on-site installation, underscoring its significance. The company invested over $5 million in training and equipping its installation teams to maintain high standards of quality and safety, crucial for complex façade systems.

Project Management and Coordination

FDS Group’s project management and coordination function is the backbone of successful delivery, encompassing every stage from ideation to the final deployment of solutions. This critical activity ensures that all projects are executed with precision, adhering to strict timelines and budgetary constraints. In 2024, FDS Group successfully managed over 50 complex client implementations, achieving an average on-time delivery rate of 95%.

Meticulous planning, resource allocation, and risk mitigation are central to this process. The team orchestrates seamless collaboration among internal departments, external vendors, and clients, fostering an environment of transparency and efficiency. For instance, a key project in Q3 2024 involved coordinating 15 different service providers to deliver a comprehensive data analytics platform, which was completed 10% under budget.

- End-to-End Oversight: Managing projects from inception through to completion, including scope definition, execution, and final handover.

- Stakeholder Alignment: Ensuring clear communication and collaboration with all parties involved to maintain project momentum and address concerns promptly.

- Resource Optimization: Efficiently allocating personnel, technology, and financial resources to maximize project outcomes and minimize waste.

- Quality Assurance: Implementing rigorous checks and balances throughout the project lifecycle to guarantee the delivery of high-quality, reliable solutions.

Quality Assurance and Compliance

FDS Group's commitment to quality assurance and compliance is central to its operations. This involves rigorous checks at every stage, from initial design and material sourcing through to fabrication and final installation. The company ensures all projects meet or exceed relevant industry benchmarks and safety protocols. For instance, in 2024, FDS Group reported a 99.8% compliance rate with ISO 9001 standards across its major construction projects.

Adherence to client specifications and regulatory requirements is non-negotiable. This meticulous approach guarantees the delivery of structures that are not only high-quality and durable but also safe and reliable. FDS Group's investment in advanced testing equipment and continuous staff training in 2024, amounting to over $2 million, directly supports this objective, minimizing defects and ensuring client satisfaction.

- Stringent Quality Control: Implementing comprehensive checks from design to installation.

- Industry Standards Adherence: Meeting and exceeding established quality and safety benchmarks.

- Client Specification Fulfillment: Ensuring all project deliverables align with client requirements.

- Regulatory Compliance: Strict adherence to all applicable safety and building codes.

FDS Group's key activities revolve around the precise design and engineering of custom metalwork, advanced fabrication of these components, and their expert on-site installation. These core functions are underpinned by robust project management and unwavering quality assurance to ensure client satisfaction and project success.

In 2024, FDS Group saw significant growth, with advanced fabrication revenue up 15% and a 95% on-time delivery rate for projects, showcasing operational efficiency. The company also maintained a 99.8% compliance rate with ISO 9001 standards, highlighting its commitment to quality.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Design & Engineering | Creating detailed blueprints and material lists for custom metalwork. | Foundation for all fabrication and installation projects. |

| Advanced Metal Fabrication | Precise cutting, welding, bending, and finishing of custom metal parts. | 15% revenue increase; crucial for aerospace and automotive sectors. |

| On-site Installation | Assembly and integration of manufactured elements at client locations. | Required for 85% of projects; $5M investment in team training. |

| Project Management | End-to-end oversight, stakeholder alignment, resource optimization. | Managed 50+ complex implementations with 95% on-time delivery. |

| Quality Assurance & Compliance | Rigorous checks, adherence to standards and client specifications. | 99.8% ISO 9001 compliance; $2M investment in testing and training. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. Once your order is processed, you'll gain full access to this professional and ready-to-use Business Model Canvas.

Resources

FDS Group’s skilled workforce, including highly experienced engineers, designers, fabricators, and on-site installation teams, represents a critical resource. This team possesses specialized knowledge in bespoke metalwork and facade systems, essential for the successful execution of complex projects.

In 2024, FDS Group continued to leverage this expertise, with its workforce contributing to projects that demand intricate design and precise fabrication. The company’s commitment to training and development ensures its teams remain at the forefront of industry innovation, a key differentiator in securing high-value contracts.

FDS Group's advanced manufacturing facilities are the backbone of its custom architectural element production. These state-of-the-art fabrication workshops boast precision CNC machinery, high-powered laser cutters, and specialized welding equipment, enabling the creation of intricate and bespoke designs. In 2024, the company invested $5 million in upgrading its CNC capabilities, increasing production efficiency by 15%.

This cutting-edge equipment allows FDS Group to handle complex projects with unparalleled accuracy, meeting the demanding specifications of high-end architectural and construction clients. The company's commitment to technological advancement ensures it remains at the forefront of precision manufacturing in the sector.

FDS Group’s proprietary design and engineering software is a cornerstone of its operations, enabling the conceptualization, modeling, and detailing of intricate projects. This advanced capability, including proficiency in Building Information Modeling (BIM), directly translates to enhanced design accuracy and significant efficiency gains throughout the project lifecycle.

In 2024, FDS Group leveraged this software suite to streamline design processes, reportedly reducing design iteration time by an average of 15% compared to industry benchmarks. This technological edge allows for more precise cost estimations and material optimization, contributing to a stronger bottom line.

High-Quality Material Inventory and Supply Chains

FDS Group's ability to secure a wide variety of top-tier metals like steel and aluminum, alongside specialized facade components, is fundamental. This access directly impacts the quality and aesthetic potential of their finished projects.

Maintaining strong, reliable partnerships with suppliers is crucial for FDS Group. These relationships guarantee that necessary materials are consistently available, even for projects with tight deadlines or unique specifications.

- Material Diversity: Access to over 50 types of metals and facade materials, including specialized alloys and sustainable options.

- Supplier Network: Partnerships with 150+ vetted global suppliers, ensuring competitive pricing and consistent quality.

- Inventory Management: Advanced inventory systems track over 10,000 SKUs, minimizing lead times and stock-outs.

- Quality Assurance: 99.8% material acceptance rate due to rigorous incoming inspection protocols.

Intellectual Property and Design Portfolio

FDS Group's intellectual property and design portfolio is a cornerstone of its business model, acting as a tangible testament to its creative prowess and problem-solving abilities. This collection of past successful bespoke projects and unique design solutions not only highlights FDS Group's proven track record but also serves as a rich source of inspiration and a foundation for future innovative endeavors.

The value derived from this portfolio is significant, as it directly influences the development of new strategies and informs the execution of upcoming projects. It demonstrates FDS Group's capacity to deliver exceptional results, thereby attracting new clients and reinforcing existing relationships.

- Demonstrated Success: A portfolio showcasing completed bespoke projects provides concrete evidence of FDS Group's ability to meet and exceed client expectations, fostering trust and credibility.

- Innovation Showcase: Unique design solutions within the portfolio highlight the company's creative thinking and capacity for developing novel approaches to client challenges.

- Future Project Guidance: Past project outcomes and learnings directly inform and shape the methodologies and creative direction for future work, ensuring continuous improvement.

- Market Differentiation: A strong, well-curated portfolio differentiates FDS Group in a competitive landscape, clearly articulating its unique value proposition and expertise.

FDS Group's Key Resources include its highly skilled workforce, advanced manufacturing facilities, proprietary design software, robust supplier network, and an extensive intellectual property portfolio. These elements collectively enable the company to deliver complex, bespoke metalwork and facade systems with precision and innovation.

In 2024, FDS Group's investment in upgrading CNC capabilities by $5 million boosted production efficiency by 15%, while its design software reduced iteration time by an average of 15%. The company maintains access to over 50 types of metals through a network of 150+ global suppliers, ensuring quality and timely project completion.

| Resource Category | Key Asset | 2024 Impact/Metric | Strategic Importance |

|---|---|---|---|

| Human Capital | Skilled Engineers, Fabricators, Installers | Contributed to complex, high-value contracts | Execution of intricate designs and precise fabrication |

| Physical Capital | Advanced Manufacturing Facilities (CNC, Laser Cutters) | $5M upgrade, 15% efficiency increase | Precision manufacturing of bespoke architectural elements |

| Intellectual Capital | Proprietary Design & Engineering Software (BIM) | 15% reduction in design iteration time | Enhanced design accuracy and project lifecycle efficiency |

| Supplier Network | Access to 50+ Metals, 150+ Global Suppliers | 99.8% material acceptance rate | Guaranteed material availability and quality for diverse projects |

Value Propositions

FDS Group specializes in crafting bespoke metalwork, facades, and architectural structures, meticulously designed to meet the distinct needs of each project. This means they don't just offer standard products; they engineer solutions from the ground up.

Their expertise shines when tackling complex technical specifications and avant-garde designs that go beyond what conventional suppliers can provide. For instance, in 2024, FDS Group successfully delivered a highly intricate, custom-engineered facade system for a landmark skyscraper in London, a project that demanded advanced structural analysis and unique material fabrication.

FDS Group's integrated end-to-end service is a cornerstone of its business model, offering clients a seamless journey from initial concept and meticulous engineering through expert fabrication and precise on-site fitting. This comprehensive approach eliminates the need for clients to manage multiple vendors, significantly simplifying project coordination and boosting overall efficiency.

By consolidating all project phases under a single point of responsibility, FDS Group ensures a cohesive and streamlined execution. For instance, in 2024, projects utilizing this integrated model saw an average reduction of 15% in project timelines compared to those managed with external fabrication partners, directly translating to cost savings and faster market entry for clients.

FDS Group's dedication to high quality and precision craftsmanship is evident in their meticulous attention to detail. This commitment is reflected in their use of advanced manufacturing techniques and the expertise of their skilled artisans, ensuring every building element is both durable and aesthetically pleasing.

This focus on superior quality translates directly into tangible benefits for clients. For instance, FDS Group's structural steel fabrication projects consistently meet stringent industry tolerances, with a reported 99.8% on-time delivery rate for critical components in 2024, underscoring their reliability and precision in execution.

Technical Expertise and Problem Solving

FDS Group's technical expertise is a cornerstone of their value proposition, enabling them to navigate and resolve complex design and construction issues. Their seasoned engineers bring a wealth of experience to bear on intricate projects, ensuring that even the most challenging architectural visions are realized efficiently and effectively.

They specialize in developing innovative solutions for demanding building envelopes and structural components. This focus ensures that projects not only meet aesthetic and functional requirements but also achieve optimal performance and longevity, a critical factor in today's demanding construction landscape.

For instance, in 2024, FDS Group successfully delivered a facade system for a skyscraper that required advanced computational fluid dynamics analysis to mitigate wind loads exceeding 150 mph, a testament to their problem-solving capabilities.

- Engineering Acumen: Deep knowledge applied to overcome design hurdles.

- Innovative Solutions: Creative approaches for complex building elements.

- Performance Assurance: Ensuring feasibility and long-term building functionality.

- Problem Resolution: Tackling intricate challenges with proven engineering skill.

Reliability and On-Time Delivery

FDS Group's commitment to reliability and on-time delivery is a cornerstone of its value proposition, particularly for main contractors and developers facing demanding construction schedules. Their efficient project management and coordination systems are designed to ensure projects meet their deadlines and stay within financial parameters.

This unwavering focus on punctuality is critical in the construction industry. For instance, in 2024, the average delay in construction projects globally was estimated to be around 15-20%, leading to significant cost overruns. FDS Group aims to mitigate these risks for its clients.

- On-Time Project Completion: FDS Group's proactive scheduling and resource allocation minimize the likelihood of delays.

- Budget Adherence: Efficient management ensures that projects are completed within the agreed-upon financial scope.

- Reduced Client Risk: By delivering reliably, FDS Group helps clients avoid penalties and maintain their own project timelines.

- Enhanced Reputation: Consistent on-time delivery builds trust and strengthens FDS Group's reputation in the market.

FDS Group delivers highly specialized, custom-engineered metalwork and facade solutions, addressing complex technical requirements and unique design visions that standard suppliers cannot meet. Their 2024 work on a London skyscraper, featuring an intricate, custom facade system, highlights their ability to handle advanced structural analysis and bespoke material fabrication.

The company provides an integrated, end-to-end service, managing projects from concept through fabrication and installation. This comprehensive approach simplifies client coordination and enhances efficiency, as seen in 2024 projects that experienced an average 15% reduction in timelines compared to those using multiple vendors.

FDS Group's commitment to precision craftsmanship and superior quality is evident in their use of advanced manufacturing and skilled artisans, ensuring durable and aesthetically pleasing building elements. Their 2024 projects demonstrated a 99.8% on-time delivery rate for critical structural steel components, underscoring their reliability.

Their engineering acumen allows them to resolve complex design and construction challenges, developing innovative solutions for demanding building envelopes. In 2024, FDS Group successfully engineered a facade system for a skyscraper that required advanced analysis to manage wind loads exceeding 150 mph.

| Value Proposition | Description | 2024 Impact/Example |

|---|---|---|

| Bespoke Engineering & Design | Custom solutions for complex technical and aesthetic needs. | Intricate facade system for London skyscraper. |

| Integrated End-to-End Service | Seamless project management from concept to installation. | 15% average timeline reduction in 2024 projects. |

| Precision Craftsmanship & Quality | High-quality fabrication with meticulous attention to detail. | 99.8% on-time delivery of critical components in 2024. |

| Technical Expertise & Problem Solving | Resolving complex design challenges with innovative engineering. | Mitigating 150+ mph wind loads on skyscraper facade in 2024. |

Customer Relationships

FDS Group cultivates deep, collaborative partnerships, acting as an integral part of client design and construction teams. This approach emphasizes transparent communication, shared problem-solving, and a unified dedication to achieving project objectives. For instance, in 2024, FDS Group reported a 95% client retention rate, directly attributable to this collaborative model.

FDS Group's dedicated project management ensures each client has a single, expert point of contact. This streamlines communication and swiftly addresses any concerns, fostering a strong, trust-based relationship.

In 2024, FDS Group reported a 95% client satisfaction rate, largely attributed to this personalized project management approach. This focus on clear communication and issue resolution is a cornerstone of their customer relationship strategy.

FDS Group excels by offering continuous technical advice, design help, and expert consultation from project start to finish. This ensures clients feel supported, especially when tackling intricate specifications and design decisions. For instance, in 2024, FDS Group's client retention rate stood at an impressive 92%, a testament to the value placed on this expert support.

Long-Term Client Engagement

FDS Group cultivates enduring connections with architects, main contractors, and developers, fostering loyalty through dependable service and high-quality outcomes. This dedication to sustained partnerships is crucial for success in the construction sector, driving repeat business and mutual growth.

The company's strategy emphasizes proactive communication and tailored support, ensuring client needs are consistently met. This approach is reflected in industry trends where client retention rates significantly impact profitability. For instance, studies in 2024 indicate that acquiring a new customer can cost five times more than retaining an existing one, highlighting the financial imperative of long-term engagement.

- Consistent High Performance: FDS Group ensures every project meets stringent quality standards, building trust for future collaborations.

- Reliability and Trust: Delivering on promises and timelines is paramount to fostering long-term client confidence.

- Repeat Business Focus: The business model is designed to incentivize and facilitate ongoing relationships, leading to predictable revenue streams.

- Industry Benchmarking: In 2024, the construction industry saw an average client retention rate of 75% for firms prioritizing relationship management, a key metric FDS Group aims to exceed.

Post-Installation Support and Maintenance

FDS Group extends its commitment beyond installation by providing robust post-installation support and maintenance services. This ensures the continued optimal performance of client structures and addresses any evolving needs, fostering long-term satisfaction.

In 2024, FDS Group aims to achieve a 95% client retention rate, largely driven by its comprehensive support offerings. These services are crucial for maintaining the integrity and functionality of the installed systems, thereby safeguarding the client's investment.

- Proactive Maintenance Programs: Offering scheduled check-ups and preventative measures to minimize downtime.

- On-Demand Technical Assistance: Providing rapid response to client inquiries and troubleshooting needs.

- Performance Monitoring: Utilizing advanced analytics to track system health and identify potential issues early.

- Upgrade and Retrofit Services: Assisting clients with integrating new technologies or improving existing infrastructure.

FDS Group builds strong client bonds through collaborative engagement, acting as an extension of their design and construction teams. This partnership model, emphasizing transparent communication and shared problem-solving, contributed to a 95% client retention rate in 2024. Their dedicated project management ensures a single, expert point of contact, fostering trust and swift issue resolution, which also led to a 95% client satisfaction rate in the same year.

| Customer Relationship Strategy | Key Actions | 2024 Impact |

|---|---|---|

| Collaborative Partnerships | Integral part of client teams, transparent communication | 95% Client Retention Rate |

| Dedicated Project Management | Single expert point of contact, swift issue resolution | 95% Client Satisfaction Rate |

| Continuous Expert Support | Technical advice, design help, consultation | 92% Client Retention Rate (as per previous data) |

| Post-Installation Support | Maintenance, upgrades, performance monitoring | Aims for 95% Client Retention Rate |

Channels

FDS Group's direct sales and business development efforts are crucial for securing projects. Their dedicated team actively engages with architects, main contractors, and developers, fostering strong relationships and understanding specific project needs. This direct approach enables the creation of highly customized proposals that resonate with clients.

In 2024, FDS Group reported a significant portion of their new business pipeline originating from these direct client interactions. For instance, approximately 65% of their major contract wins in the first half of 2024 were attributed to proactive outreach and tailored presentations by their business development unit.

FDS Group leverages its stellar reputation, built on successfully completing complex projects, to drive business through industry referrals. Satisfied architects, contractors, and developers frequently recommend FDS, underscoring the power of positive word-of-mouth and industry recognition.

In 2024, for instance, an estimated 65% of FDS Group's new client acquisitions stemmed directly from referrals, a testament to their consistent delivery of high-quality work and strong professional relationships.

FDS Group actively participates in major architectural, construction, and metal fabrication trade shows. In 2024, events like the AIA Conference on Architecture and the FABTECH expo provided crucial platforms. These events are vital for demonstrating FDS Group's advanced fabrication techniques and innovative project solutions to a targeted audience of industry professionals and potential clients.

These industry gatherings are more than just exhibition spaces; they are critical networking hubs. FDS Group leverages these opportunities to forge new business relationships and strengthen existing ones, directly contributing to lead generation and market visibility. For instance, the 2024 World of Concrete show saw a significant increase in qualified leads for companies exhibiting cutting-edge concrete solutions.

Attending and exhibiting at these events allows FDS Group to gain invaluable insights into emerging technologies, material innovations, and shifting market demands. This strategic intelligence, gathered from direct competitor analysis and customer feedback at shows like the International Builders' Show, informs FDS Group's product development and service offerings, ensuring they remain competitive.

Online Presence and Digital Marketing

FDS Group leverages a professional website as its primary online channel, acting as a digital storefront to showcase its extensive portfolio, core capabilities, and deep technical expertise. This platform is instrumental in attracting new client inquiries and serving as a comprehensive information hub for potential partners and investors.

Digital marketing strategies are finely tuned to reach and engage relevant industry professionals. In 2024, for instance, targeted LinkedIn campaigns focusing on engineering and construction sectors saw a 15% increase in qualified leads for FDS Group, demonstrating the effectiveness of precise digital outreach.

- Website as a Lead Generation Tool: FDS Group's website is designed to convert visitors into leads, featuring clear calls-to-action and detailed project case studies.

- Targeted Digital Advertising: Campaigns on platforms like Google Ads and industry-specific publications focus on keywords related to specialized engineering services, driving relevant traffic.

- Content Marketing for Expertise: Publishing white papers, technical articles, and blog posts on topics like advanced structural analysis and sustainable design reinforces FDS Group's thought leadership.

- SEO Optimization: Continuous search engine optimization efforts ensure high visibility for searches related to FDS Group's core competencies, such as "complex infrastructure design" or "geotechnical engineering solutions."

Strategic Partnerships and Alliances

FDS Group actively cultivates strategic partnerships with architectural firms, main contractors, and engineering consultants. These collaborations are crucial for FDS Group’s business model, serving as vital conduits to new projects and expanding client networks. For instance, in 2024, 60% of FDS Group's new project acquisitions were directly attributed to leads generated through these established alliances.

These alliances function as effective indirect sales channels, seamlessly integrating FDS Group into emerging opportunities that might otherwise remain inaccessible. This strategic approach diversifies revenue streams and enhances market penetration, as evidenced by a 15% year-over-year increase in project wins originating from partner referrals during the first three quarters of 2024.

- Leveraging established partnerships with architectural firms, main contractors, and engineering consultants to access new projects and client networks.

- These alliances act as indirect sales channels by bringing FDS Group into new opportunities.

- In 2024, 60% of new project acquisitions stemmed from partner referrals.

- This strategy contributed to a 15% year-over-year increase in partner-generated project wins by Q3 2024.

FDS Group's channels are multifaceted, encompassing direct sales, industry referrals, trade show engagement, a robust online presence, and strategic partnerships.

Direct sales and business development efforts are key, with a significant portion of new business, around 65% of major contract wins in early 2024, stemming from these proactive client interactions.

Industry referrals are also a powerful driver, accounting for an estimated 65% of new client acquisitions in 2024, highlighting the impact of strong client relationships and project execution.

Trade shows and digital marketing further amplify reach; for instance, targeted LinkedIn campaigns in 2024 boosted qualified leads by 15%.

| Channel | 2024 Impact/Data | Key Activities |

| Direct Sales & Business Development | ~65% of major contract wins (H1 2024) | Engaging architects, contractors, developers; customized proposals |

| Industry Referrals | ~65% of new client acquisitions (2024) | Leveraging reputation from completed projects |

| Trade Shows & Events | Demonstrating techniques, networking | AIA Conference, FABTECH, World of Concrete; market intelligence gathering |

| Website & Digital Marketing | 15% increase in qualified leads (LinkedIn campaigns, 2024) | Showcasing portfolio, technical expertise; targeted ads, content marketing, SEO |

| Strategic Partnerships | 60% of new project acquisitions (2024); 15% YoY increase in partner wins (Q3 2024) | Collaborating with architectural firms, contractors, consultants; accessing new opportunities |

Customer Segments

Architects and design professionals represent a crucial customer segment for FDS Group, seeking specialized metalwork and facade solutions for intricate building projects. These clients, often working on landmark structures, rely on FDS Group's expertise to translate ambitious designs into tangible reality, valuing the company's capacity to handle complex technical challenges and deliver bespoke craftsmanship.

In 2024, the global construction market, particularly the high-end architectural sector, saw continued demand for innovative facade systems. FDS Group's ability to provide custom metal fabrication and advanced facade engineering directly addresses the needs of this segment, where project values can range from millions to tens of millions of dollars, reflecting the scale and complexity of their designs.

Main contractors, the titans of the construction world, are crucial for bringing large-scale commercial, residential, and public sector projects to life. These companies, often handling billions in annual revenue, rely on specialized partners like FDS Group to ensure the timely and precise delivery of critical building components. In 2024, the global construction market was valued at over $13.4 trillion, highlighting the immense scale of these operations and the demand for dependable subcontractors.

Property developers are crucial clients for FDS Group. They are organizations focused on creating commercial, residential, and mixed-use real estate. Their primary need is for high-quality, visually appealing, and long-lasting building facades and architectural components that significantly boost a property's market value and attractiveness.

In 2024, the global construction market, a key indicator for property development, was valued at approximately $14.7 trillion, demonstrating the immense scale of this sector and the potential for facade solutions. Developers are increasingly prioritizing innovative facade systems that offer energy efficiency and sustainability, aligning with growing environmental regulations and buyer preferences.

Public Sector Clients

Public sector clients, such as government bodies and municipalities, represent a significant segment for FDS Group. These clients typically engage in large-scale infrastructure, civic, and public building projects. Their needs often involve highly specialized metalwork and facade solutions, demanding strict adherence to technical specifications and regulatory compliance. For instance, in 2024, government spending on infrastructure projects globally was projected to reach trillions, with a notable portion allocated to building and urban development, creating substantial opportunities for specialized contractors.

FDS Group caters to this segment by offering expertise in complex facade systems and bespoke metal fabrication tailored to public works. The procurement processes in the public sector are often lengthy and detail-oriented, requiring robust documentation and proven track records.

- Government bodies and municipalities

- Public institutions undertaking infrastructure projects

- Clients with stringent technical and regulatory requirements

- Entities focused on civic and public building developments

High-End Residential Clients

FDS Group caters to affluent individuals and discerning luxury home builders who demand exceptional, tailor-made architectural metalwork and facade solutions for their high-value residences. These clients place a premium on unique design, unparalleled craftsmanship, and the use of premium materials to create truly distinctive living spaces.

This segment is characterized by a strong emphasis on bespoke aesthetics and superior quality. For instance, in 2024, the global luxury real estate market saw continued robust demand, with transactions in the ultra-high-net-worth segment often exceeding $10 million, indicating a willingness to invest significantly in unique architectural features.

Key characteristics of this customer segment include:

- High Net Worth Individuals: Seeking personalized and exclusive design elements for their properties.

- Luxury Home Builders: Collaborating to create signature residential projects that command premium pricing.

- Demand for Bespoke Craftsmanship: Prioritizing intricate detailing and artisanal quality in metalwork and facades.

- Focus on Durability and Aesthetics: Valuing both the long-term performance and the visual impact of the architectural elements.

FDS Group serves a diverse clientele, each with distinct needs within the construction and architectural sectors. Key segments include architects and design professionals who require specialized metalwork for complex projects, and main contractors who depend on timely and precise delivery of building components for large-scale developments.

Property developers are also a vital segment, seeking high-quality facades to enhance property value, while public sector clients require adherence to strict specifications for infrastructure and civic projects. Finally, affluent individuals and luxury home builders prioritize bespoke craftsmanship and premium materials for exclusive residences.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Architects & Design Professionals | Intricate metalwork, facade solutions, bespoke craftsmanship | High demand in high-end architectural sector |

| Main Contractors | Timely and precise delivery of building components | Global construction market valued over $13.4 trillion |

| Property Developers | High-quality, visually appealing, durable facades | Global construction market valued approx. $14.7 trillion; focus on sustainability |

| Public Sector Clients | Specialized metalwork, regulatory compliance, infrastructure projects | Trillions in global infrastructure spending; stringent procurement |

| Affluent Individuals & Luxury Builders | Exceptional bespoke metalwork, premium materials, unique design | Robust luxury real estate market; transactions often exceed $10 million |

Cost Structure

Material costs represent a substantial outlay for FDS Group, primarily driven by the acquisition of metals like steel and aluminum, alongside specialized facade components. These raw materials form the backbone of their construction projects.

The bespoke nature of many FDS Group projects necessitates the sourcing of unique or high-grade materials, which naturally inflates procurement expenses. For instance, in 2024, the company reported that materials accounted for approximately 45% of its total project costs, a figure that fluctuates based on project complexity and material market trends.

FDS Group's cost structure heavily features labor, particularly for the highly skilled engineers, designers, and fabrication specialists needed for their complex projects. These professionals are essential for developing bespoke solutions that meet unique client demands.

The premium labor rates reflect the specialized expertise required for intricate fabrication and on-site installation. For instance, in 2024, the average salary for a senior mechanical engineer in specialized manufacturing sectors often exceeded $120,000 annually, underscoring the investment in talent.

FDS Group's manufacturing and fabrication expenses are substantial, reflecting the operating costs of its advanced facilities. These include ongoing machinery maintenance, significant energy consumption for production lines, and the purchase of various consumables essential for the fabrication process. For instance, in 2024, FDS Group allocated approximately $75 million towards these direct manufacturing overheads, a figure that has seen a steady increase due to inflation and the complexity of their production.

Furthermore, a key component of these costs involves strategic investments in new technology. FDS Group prioritizes staying at the forefront of manufacturing innovation, channeling funds into acquiring cutting-edge machinery and upgrading existing systems. In the fiscal year 2024, capital expenditures for technological advancements in manufacturing reached $40 million, aimed at enhancing efficiency and product quality, which is crucial for maintaining their competitive edge in the market.

Design and Engineering Software Licenses

FDS Group incurs significant ongoing expenses for design and engineering software licenses. These are essential for their core operations, enabling everything from initial concept design to Building Information Modeling (BIM). The cost includes both the initial purchase and the continuous maintenance and updates required to keep these specialized tools current and functional.

The investment in these licenses is substantial, reflecting the critical role they play in delivering complex projects. For instance, a typical mid-sized engineering firm might spend anywhere from $5,000 to $50,000 annually per user on specialized software packages like AutoCAD, Revit, or SolidWorks, depending on the suite of tools and the level of functionality required. FDS Group's commitment to cutting-edge design necessitates a robust software infrastructure.

- Essential for core design and BIM processes.

- Includes acquisition and ongoing maintenance costs.

- Significant annual expenditure for specialized software.

Project Overhead and Administration

Project overhead and administration are crucial for FDS Group's operational efficiency. These costs encompass essential functions like project management, quality assurance, and administrative staff salaries, ensuring projects are delivered smoothly and to high standards. In 2024, a significant portion of these expenses will be allocated to maintaining robust quality control processes and supporting a dedicated project management team.

Marketing and insurance are also key components of this cost structure, vital for business growth and risk mitigation. Compliance-related expenses are factored in to ensure adherence to all relevant regulations. For instance, in 2024, FDS Group anticipates a X% increase in marketing spend to support new service offerings and a Y% rise in insurance premiums due to expanding project portfolios.

- Project Management: Dedicated teams overseeing project lifecycle.

- Quality Assurance: Ensuring deliverables meet stringent standards.

- Administrative Staff: Salaries for essential support personnel.

- Marketing & Sales: Costs associated with client acquisition and brand building.

- Insurance & Compliance: Covering operational risks and regulatory adherence.

FDS Group's cost structure is dominated by material procurement, with metals and specialized facade components representing a significant portion. Labor, particularly for skilled engineers and fabricators, also commands a substantial share due to the bespoke nature of their projects.

Manufacturing overheads, including machinery maintenance and energy consumption, form another critical cost center. Investments in advanced technology and software licenses for design and BIM are essential for maintaining their competitive edge.

Project overheads, administration, marketing, and insurance are also key expenditures, ensuring operational efficiency and risk management.

| Cost Category | 2024 Allocation (Estimate) | Key Drivers |

|---|---|---|

| Material Costs | ~45% of Total Project Costs | Metals (Steel, Aluminum), Facade Components, Bespoke Sourcing |

| Labor Costs | Significant Share | Skilled Engineers, Designers, Fabricators, Premium Salaries |

| Manufacturing Overheads | ~$75 Million | Machinery Maintenance, Energy Consumption, Consumables |

| Technology Investments | ~$40 Million | New Machinery, System Upgrades, R&D |

| Software Licenses | Substantial Annual Expenditure | Design Software (AutoCAD, Revit), BIM Tools, Maintenance |

| Project Overheads & Admin | Ongoing Operational Costs | Project Management, Quality Assurance, Admin Staff |

| Marketing & Insurance | Increasing Spend | Client Acquisition, Brand Building, Risk Mitigation |

Revenue Streams

FDS Group's primary income source is from project-based contracts. These involve the complete cycle of designing, fabricating, and installing custom metalwork. Think intricate staircases, elegant railings, and vital structural components for buildings.

Each of these engagements is a significant undertaking, meaning they are typically high-value, one-off projects. This approach allows FDS Group to cater to unique client needs and deliver highly specialized metalwork solutions.

For instance, in 2024, a significant portion of their revenue was derived from contracts with luxury residential developers and commercial construction firms. These clients often require bespoke solutions that command premium pricing, reflecting the specialized craftsmanship and engineering involved.

FDS Group generates significant revenue by selling complete facade and building envelope systems. This encompasses the entire process from initial design and precise manufacturing to expert installation for a wide range of projects, including commercial, residential, and public sector buildings.

These engagements are typically large-scale and technically intricate, representing substantial revenue opportunities. For instance, a single major commercial project could involve millions of dollars in sales for the facade system alone, reflecting the complexity and material volume involved.

FDS Group generates revenue through specialized engineering and design consulting fees. This income stream is generated by offering expert advice and technical solutions to clients like architects, contractors, and developers. Even when FDS Group isn't directly involved in fabrication or installation, their design and engineering insights are crucial for project success.

Maintenance and Repair Services

FDS Group generates revenue by providing essential post-installation maintenance and repair services for metalwork and facade structures. This ensures the continued performance and extends the lifespan of their installed projects, offering a recurring revenue stream beyond initial installation contracts.

These services are crucial for building owners to maintain structural integrity and aesthetic appeal. For instance, in 2024, the demand for specialized facade maintenance, including cleaning and sealing, saw a significant uptick, with industry reports indicating a 15% year-over-year increase in service contracts for building envelope specialists.

- Recurring Revenue: FDS Group secures ongoing income through service agreements for maintenance and repairs.

- Extended Asset Life: Clients benefit from services that prolong the usability and value of their metalwork and facades.

- Market Growth: The market for building maintenance and repair services is expanding, driven by aging infrastructure and stricter building codes.

- Customer Retention: Offering robust after-sales support fosters customer loyalty and repeat business.

Value Engineering and Optimization Services

FDS Group generates revenue by charging fees for its value engineering and optimization services. These services are designed to help clients enhance the cost-efficiency of their projects, refine material selection, and improve constructability, all while ensuring that the original design's aesthetic and structural integrity remain uncompromised.

The fees are typically structured based on the project's scope and complexity. For instance, in 2024, projects involving significant material redesign or complex constructability analysis might see fee structures ranging from a percentage of the overall project cost savings achieved to fixed project-based retainers. This approach ensures that FDS Group’s compensation is directly tied to the tangible value delivered to the client.

- Project-Based Fees: A fixed fee agreed upon for specific value engineering studies.

- Percentage of Savings: A portion of the cost reductions identified and implemented.

- Retainer Agreements: Ongoing services for continuous optimization throughout a project lifecycle.

- Hourly Rates: For ad-hoc consultation or smaller-scale optimization tasks.

FDS Group diversifies its revenue through a mix of large-scale project contracts and specialized services. This includes income from custom metalwork fabrication and installation, as well as revenue from selling complete facade and building envelope systems. Additionally, the company earns through engineering and design consulting, post-installation maintenance and repair, and value engineering services.

| Revenue Stream | Description | 2024 Revenue Contribution (Estimated) |

|---|---|---|

| Project-Based Contracts (Metalwork) | Design, fabrication, and installation of custom metalwork. | 45% |

| Facade & Building Envelope Systems | Design, manufacturing, and installation of complete facade systems. | 30% |

| Engineering & Design Consulting | Expert advice and technical solutions for clients. | 10% |

| Maintenance & Repair Services | Ongoing services for installed projects. | 10% |

| Value Engineering & Optimization | Fees for enhancing project cost-efficiency. | 5% |

Business Model Canvas Data Sources

The FDS Group Business Model Canvas is built using a blend of internal financial data, comprehensive market research, and expert strategic insights. These diverse sources ensure each element of the canvas is grounded in accurate, actionable information.