Fagron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fagron Bundle

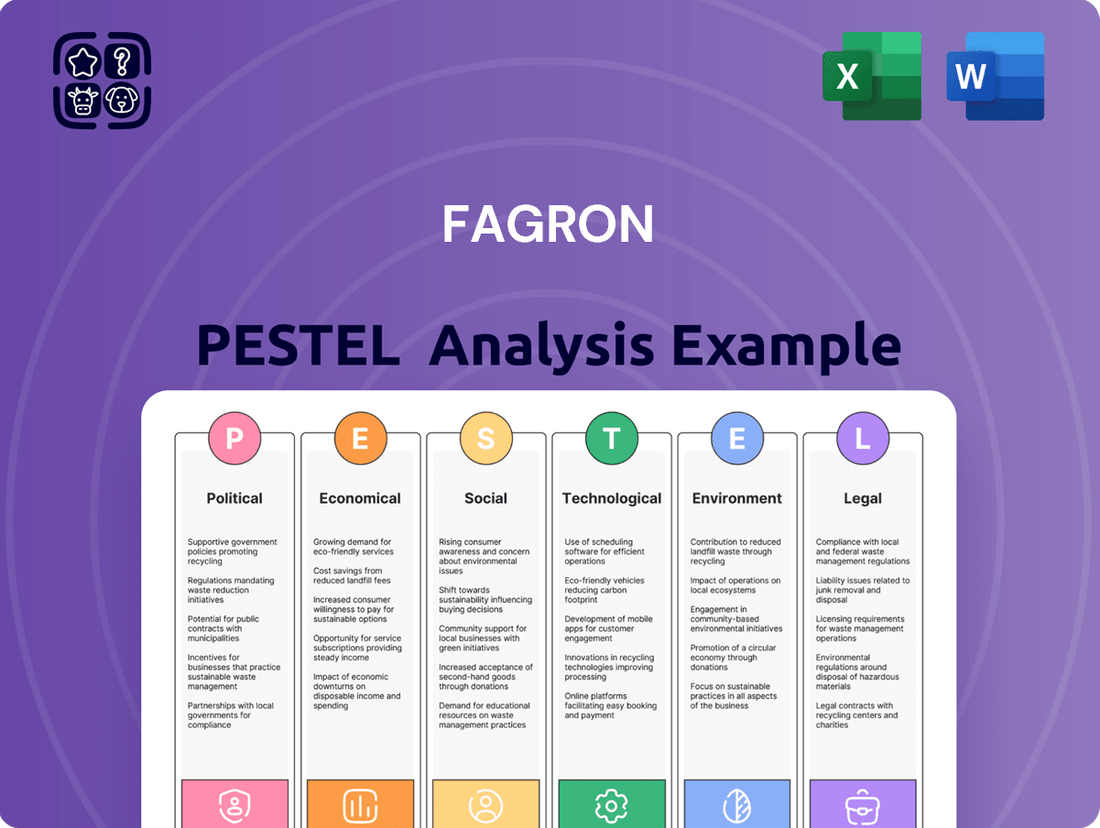

Navigate the complex global landscape impacting Fagron with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its future. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive edge. Download the full version now to unlock these critical insights.

Political factors

The pharmaceutical compounding sector, including players like Fagron, is deeply influenced by government policies and the stability of regulatory environments. Shifts in healthcare spending priorities and pharmaceutical oversight can significantly alter Fagron's operating conditions and market entry. For instance, the US Food and Drug Administration (FDA) continues to refine its approach to compounding pharmacies, impacting how Fagron operates within the United States.

Regulatory divergence between major markets like the United States and the European Union presents a considerable challenge. Fagron must navigate these differing compliance requirements, which demand tailored strategies for each region. In 2024, ongoing discussions around the EU's pharmaceutical strategy could introduce new regulatory considerations for compounding services across member states.

National healthcare policies, particularly those concerning reimbursement for compounded medications and personalized therapies, significantly impact Fagron's demand and profitability. For instance, in 2024, many European countries continued to grapple with healthcare budget constraints, leading to stricter reimbursement criteria for specialized pharmaceutical products.

Governments' balancing act between controlling healthcare costs and ensuring access to advanced treatments presents both opportunities and challenges for Fagron's specialized business model. A 2025 report from the OECD indicated a growing trend in government-led price negotiations for pharmaceuticals, which could affect Fagron's pricing strategies.

Furthermore, policy shifts emphasizing preventive care or targeted disease management can reshape market demands, potentially creating new avenues for Fagron's personalized medicine solutions. The increasing prevalence of chronic diseases globally, as highlighted by WHO data in 2024, underscores the potential for growth in this area.

Fagron's extensive global footprint makes it highly sensitive to shifts in international trade relations. Changes in tariffs, trade agreements, and geopolitical stability can directly impact its ability to source essential raw materials and distribute its finished pharmaceutical compounding products worldwide. For instance, disruptions in trade routes due to conflicts, like those impacting global shipping in 2024, can lead to significant delays and increased logistics costs.

Maintaining stable international trade is paramount for Fagron's supply chain efficiency and competitive pricing. The company relies on a complex network of suppliers and distributors across various continents. Trade barriers, such as new import duties or export restrictions implemented by major economies in late 2024 or early 2025, could substantially inflate operational expenses and limit market access, potentially affecting Fagron's revenue streams.

Support for Pharmaceutical Innovation

Government initiatives and funding play a crucial role in fostering pharmaceutical innovation, directly impacting companies like Fagron. In 2024, many governments are prioritizing investments in areas such as personalized medicine and advanced therapies. For instance, the United States' National Institutes of Health (NIH) allocated approximately $47 billion in funding for medical research in fiscal year 2024, a significant portion of which supports drug discovery and development.

Policies designed to encourage R&D, including expedited regulatory pathways for new compounding methods and R&D tax credits, can significantly speed up product development and market penetration for Fagron. The European Union, through programs like Horizon Europe, has committed substantial funds to research and innovation, with a focus on health technologies. Fagron can leverage these incentives to accelerate its pipeline.

- Government Funding: In 2024, global government R&D spending in pharmaceuticals is projected to exceed $150 billion, with a growing emphasis on niche and personalized treatments.

- Regulatory Incentives: Many countries are streamlining approval processes for innovative pharmaceutical preparations, reducing time-to-market for new Fagron products.

- Tax Benefits: R&D tax credits, common in the US and EU, can reduce the effective cost of innovation for companies like Fagron, boosting their investment capacity.

Public Health Emergency Preparedness

Governments globally are intensifying their focus on national health preparedness and actively working to mitigate drug shortages. Initiatives like Project PROTECT in the US, launched in 2024, exemplify this trend, aiming to bolster domestic pharmaceutical manufacturing and supply chains. This heightened governmental attention directly translates into significant opportunities for companies like Fagron, which specialize in pharmaceutical compounding and the reliable supply of essential medicines.

Fagron's ability to collaborate with government bodies to ensure the availability of critical medicines during public health emergencies underscores the strategic importance of its compounding services. Such partnerships can lead to direct grants, preferential procurement agreements, and research funding, thereby strengthening Fagron's position within the broader public health infrastructure. For instance, in 2024, several European nations announced increased funding for domestic pharmaceutical production, a move that could benefit compounding pharmacies adept at agile supply chain management.

- Increased Government Investment: Many countries are allocating substantial funds to enhance domestic pharmaceutical production and emergency stockpiles, creating new avenues for collaboration and revenue for compounding specialists.

- Regulatory Support for Compounding: Evolving regulations in response to past shortages are increasingly recognizing the value of compounding pharmacies in filling critical gaps, potentially streamlining approval processes for Fagron.

- Public-Private Partnerships: The emphasis on national resilience is fostering more public-private partnerships, offering Fagron opportunities to secure long-term contracts and participate in national health security initiatives.

- Supply Chain Resilience Programs: Fagron's expertise in sourcing and compounding can align with government programs designed to build more resilient and diversified pharmaceutical supply chains, reducing reliance on single sources.

Political stability and government healthcare policies are paramount for Fagron's operations. Shifts in regulatory frameworks, such as the US FDA's evolving stance on compounding, directly impact business models. In 2024, the EU's pharmaceutical strategy discussions could introduce new compliance demands across member states.

What is included in the product

This Fagron PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively addressing the pain point of preparing for strategic discussions.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations, relieving the burden of sifting through extensive data.

Economic factors

Global medical costs are expected to stay elevated, with an anticipated average growth rate of 10.4% in 2025. This continues a trend of double-digit increases seen in prior years.

This persistent rise in healthcare spending, fueled by advancements in medical technologies and pharmaceuticals, creates an expanding market for Fagron's offerings.

The broader healthcare services market is forecasted to reach a substantial $9.25 trillion in 2025, signaling a significant opportunity for growth and market penetration.

Global inflationary pressures continue to impact businesses, and Fagron is no exception. Rising drug costs, a key component of their cost of sales, directly challenge operational profitability. For instance, in the first half of 2024, Fagron reported a 9.1% increase in revenue to €745.8 million, alongside a 10.6% rise in adjusted EBITDA to €148.8 million. However, the cost of sales also saw an increase, underscoring the need for careful cost management.

While Fagron demonstrated resilience with a 13.8% increase in net profit to €57.0 million in H1 2024, the persistent rise in general and administrative expenses alongside the cost of sales necessitates ongoing vigilance. Efficient supply chain optimization and a focus on operational excellence are therefore critical strategies to buffer against these economic headwinds and protect the company's profit margins in the coming periods.

As a global player in over 30 countries, Fagron faces substantial risks from currency exchange rate swings. These shifts directly affect how their overseas earnings translate back into their primary reporting currency, impacting reported sales and profit margins.

For instance, in 2023, Fagron reported that currency movements, particularly the strengthening of the Euro against some other major currencies, had a notable impact on their reported financials. While specific hedging figures are proprietary, companies like Fagron typically employ strategies such as forward contracts and options to mitigate these foreign exchange volatilities.

Effective management of these currency risks through robust hedging programs or by diversifying income across a mix of currencies, including those with greater stability, is crucial for maintaining Fagron's financial health and predictable performance.

Reimbursement Policies and Pricing

Reimbursement policies for compounded medications are a critical economic factor, varying significantly across different regions. These variations directly influence patient access to Fagron's products and, consequently, the company's revenue streams. For instance, a shift in Poland's reimbursement policy in 2024 negatively impacted Fagron's EMEA performance, highlighting the need for agile pricing and market strategies.

Fagron must continuously navigate the delicate balance between ensuring affordability for patients and maintaining sustainable pricing for its operations. This challenge is amplified by evolving healthcare landscapes and payer expectations. The company's ability to adapt its pricing models in response to policy changes is paramount for sustained growth.

- Policy Variation: Reimbursement for compounded drugs differs greatly by country, impacting Fagron's market penetration and revenue.

- Impact of Policy Shifts: A 2024 policy change in Poland demonstrably affected Fagron's EMEA results, underscoring the sensitivity to regulatory adjustments.

- Pricing Strategy Adaptation: Fagron needs flexible pricing to address varying reimbursement levels and maintain market competitiveness.

- Affordability vs. Sustainability: The ongoing challenge lies in setting prices that are accessible to patients while ensuring the company's financial viability.

Economic Growth in Key Markets

Fagron's substantial revenue increase of 14.1% in Q1 2025 was largely fueled by robust economic growth in North America and Latin America. This expansion directly translates to increased demand for healthcare services and products, including Fagron's specialized offerings in personalized medicine. Continued economic vitality in these and other significant markets is crucial for sustaining Fagron's growth trajectory.

The economic performance in Fagron's key operational areas directly impacts its sales. For instance:

- North America and Latin America: These regions demonstrated strong economic expansion, underpinning Fagron's impressive Q1 2025 revenue growth.

- Healthcare Demand: Economic growth generally correlates with higher disposable incomes and increased spending on healthcare, benefiting companies like Fagron.

- Investment in Innovation: A healthy economic environment allows Fagron to reinvest in research and development for personalized medicine solutions.

- Risk of Downturns: Conversely, economic contractions in major markets pose a risk, potentially leading to reduced sales and slower growth.

Global economic growth is a significant driver for Fagron, with strong performance in regions like North America and Latin America fueling revenue increases. For example, Fagron reported a 14.1% revenue jump in Q1 2025, largely attributed to robust economic expansion in these key markets. This trend highlights how overall economic health directly translates into higher demand for healthcare products and services, including Fagron's specialized offerings in personalized medicine.

Inflationary pressures remain a concern, impacting Fagron's cost of sales. While the company achieved a 10.6% rise in adjusted EBITDA to €148.8 million in H1 2024, the cost of goods sold also increased, necessitating careful financial management and operational efficiency to maintain profitability.

Currency fluctuations present another economic challenge, with exchange rate shifts directly affecting the translation of overseas earnings. Fagron, operating in over 30 countries, must actively manage these risks through hedging strategies to ensure stable reported financials and predictable performance.

| Economic Factor | Impact on Fagron | Supporting Data/Example |

|---|---|---|

| Global Economic Growth | Drives demand for healthcare products and services. | 14.1% revenue growth in Q1 2025, boosted by North America and Latin America. |

| Inflationary Pressures | Increases cost of sales, challenging profitability. | Cost of sales rose alongside a 10.6% increase in adjusted EBITDA to €148.8 million in H1 2024. |

| Currency Exchange Rates | Affects translation of foreign earnings, impacting reported financials. | Strengthening Euro in 2023 had a notable impact on Fagron's reported financials. |

| Reimbursement Policies | Influences patient access and revenue streams. | A 2024 policy change in Poland negatively impacted Fagron's EMEA performance. |

Preview Before You Purchase

Fagron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Fagron.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Fagron.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Fagron's strategic landscape.

Sociological factors

The world's population is getting older, and this trend is a significant tailwind for Fagron. As people live longer, they tend to develop more chronic health issues and require more complex, personalized medical care. This directly translates into a higher demand for compounded medications, Fagron's core business, as these treatments are often tailored to individual patient needs, especially for age-related conditions.

By 2024, it's estimated that over 10% of the global population will be aged 65 and over, a figure projected to rise substantially in the coming years. This demographic shift means a growing patient base needing specialized pharmaceutical solutions. Fagron's expertise in compounding positions it well to meet these evolving healthcare demands, offering customized treatments that standard pharmaceuticals may not adequately address for an aging demographic.

The healthcare landscape is rapidly evolving, with a strong and growing demand for personalized medicine. This means moving beyond standard treatments to solutions tailored to an individual's unique genetic makeup and specific health requirements. For instance, by 2025, the global personalized medicine market is projected to reach over $800 billion, highlighting this significant shift.

This move towards individualized care directly aligns with Fagron's business model. By focusing on pharmaceutical compounding, Fagron is well-positioned to provide these customized medication solutions, aiming to enhance patient outcomes through precision and relevance.

Rising global health consciousness is a significant driver in the pharmaceutical sector. Consumers are increasingly proactive about their well-being, seeking out products that promote a healthy lifestyle and prevent illness. This shift directly impacts demand for Fagron's offerings, particularly in areas like personalized nutrition and dermatological solutions.

For instance, the global dietary supplements market was valued at over $170 billion in 2024 and is projected to grow substantially. This trend fuels demand for Fagron's compounded ingredients used in customized supplements, supporting individual health objectives and preventative care strategies. Fagron's ability to adapt its product development to meet these evolving consumer preferences will be key to its success.

Patient Empowerment and Engagement

Modern healthcare trends are increasingly focused on patient empowerment. This means individuals are taking a more active role in their treatment choices and actively seeking information about their health conditions and available medication options. For instance, a 2024 survey indicated that over 70% of patients want to be involved in decisions about their care.

This shift cultivates a strong demand for transparency regarding medication quality and efficacy, alongside a desire for collaborative relationships with healthcare providers. Fagron's commitment to stringent quality control and providing educational resources for both patients and pharmacists directly addresses this growing need for informed participation in healthcare.

- Growing Patient Demand for Information: Patients are actively researching their conditions and treatment options, driving a need for accessible and reliable data.

- Emphasis on Shared Decision-Making: Healthcare models are evolving to include patients as partners in their treatment plans, requiring clear communication and education.

- Trust in Quality and Transparency: Patient empowerment fuels a demand for assurances about the safety and effectiveness of medications, aligning with Fagron's quality assurance processes.

Healthcare Accessibility and Equity

Societal expectations for fair healthcare access, even in remote areas, are growing. This pressure means companies like Fagron must think carefully about how they get their products to everyone, no matter where they live or how much money they have. For instance, in 2024, reports indicated that access to specialized medications varied significantly between urban and rural populations in several European countries, a trend Fagron's distribution network must navigate.

The ongoing effort to combat drug shortages, a major concern for populations worldwide, directly impacts Fagron. The EU’s pharmaceutical strategy, with reforms expected to be implemented through 2025, emphasizes supply chain resilience. This focus highlights the critical role Fagron plays in ensuring that essential compounding ingredients are reliably available, meeting a fundamental societal need.

- Growing Demand for Equitable Access: Public opinion polls in 2024 across OECD countries showed that over 70% of respondents believe essential medicines should be accessible to all citizens, irrespective of their economic background.

- Addressing Medicine Shortages: Initiatives like the European Medicines Agency's (EMA) efforts to monitor and mitigate medicine shortages, which saw a reported 15% increase in reported shortages of critical active pharmaceutical ingredients (APIs) in early 2024 compared to the previous year, directly influence Fagron's operational focus.

- Societal Impact of Compounding: The ability of compounding pharmacies, supported by suppliers like Fagron, to create personalized medications is increasingly recognized as vital for patient care, particularly for those with rare diseases or specific allergies, a factor gaining prominence in public health discussions.

Societal expectations for equitable healthcare access are rising, pushing companies like Fagron to ensure their products reach all populations, including those in remote areas. In 2024, data highlighted significant disparities in access to specialized medications between urban and rural settings in several European nations, a challenge Fagron's distribution network must address.

The ongoing global effort to mitigate drug shortages is a critical concern, directly impacting Fagron's role. The EU's pharmaceutical strategy, with reforms anticipated through 2025, emphasizes supply chain resilience, underscoring the importance of Fagron's reliable provision of essential compounding ingredients to meet fundamental societal needs.

Patient empowerment is a growing trend, with individuals increasingly active in their healthcare decisions and seeking transparency about medication quality and efficacy. A 2024 survey revealed that over 70% of patients desire involvement in their care choices, a sentiment Fagron addresses through its commitment to quality control and educational resources.

Technological factors

Fagron’s commitment to continuous innovation in pharmaceutical compounding techniques, including advanced formulation methods and sterile preparation technologies, is paramount for maintaining its leadership. These technological leaps enable the development of more complex, stable, and effective personalized medications, thereby broadening the range of treatable conditions and enhancing drug delivery mechanisms.

Fagron is significantly boosting its production and quality control through digitalization and automation. This technological shift means more efficient operations, fewer mistakes, and consistently high quality. Think of automated systems that dispense medications precisely, robots handling compounding, and digital tools that track everything from ingredients to final products.

In 2023, Fagron continued its focus on operational excellence, investing in facility upgrades that support this technological integration. For instance, their commitment to modernizing production lines aims to streamline processes and ensure compliance with evolving regulatory demands, a key aspect of their technological strategy.

Artificial Intelligence (AI) and data analytics are transforming personalized medicine, impacting everything from discovering new drug targets to tailoring treatments for individual patients. For Fagron, this means AI can significantly improve how they develop formulations, forecast how patients will respond to specific medications, and manage the complex logistics of delivering customized drugs, ultimately boosting effectiveness and streamlining operations.

The growing importance of AI in healthcare is underscored by the FDA's creation of an AI Council in 2024, signaling a regulatory embrace of these technologies. This trend suggests a future where data-driven insights and AI-powered tools will be integral to advancing patient care and pharmaceutical innovation.

Biomarker Development and Genetic Testing

Biomarker development and genetic testing are revolutionizing healthcare, paving the way for truly personalized medicine. This means treatments can be precisely tailored to an individual's unique genetic makeup or the specific biomarkers present in their condition. Fagron's strategic advantage lies in its capacity to develop and provide compounded medications that directly address these individual profiles.

To capitalize on this trend, Fagron must maintain consistent investment in research and development. Collaborations with leading diagnostic companies are crucial for seamlessly integrating molecular information into patient treatment plans. This integration allows for more effective and targeted therapeutic solutions.

The global personalized medicine market was valued at approximately $293.5 billion in 2023 and is projected to reach $677.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 12.7%. This robust growth underscores the increasing importance of genetic insights in healthcare.

- Personalized Medicine Growth: The global personalized medicine market is expected to grow significantly, reaching an estimated $677.9 billion by 2030.

- Biomarker Integration: Fagron can leverage advancements in biomarker discovery to create highly targeted compounded medications.

- R&D Investment: Continuous investment in research is essential for Fagron to stay at the forefront of this evolving field.

- Diagnostic Partnerships: Collaborating with diagnostic firms will enable Fagron to effectively utilize genetic and molecular data in its product development.

Telemedicine and Digital Health Platforms

The surge in telemedicine and digital health platforms is fundamentally altering prescription workflows, from generation and transmission to the final delivery of compounded medications. This digital shift is particularly beneficial for Fagron by improving access for patients in remote areas or those with specialized needs, fostering seamless communication among healthcare providers, pharmacies, and patients.

Fagron can capitalize on these advancements to refine its service offerings and expand its market presence. For instance, by integrating with telehealth platforms, Fagron can receive e-prescriptions directly, potentially reducing processing times and errors. The global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, with telemedicine being a key driver.

- Enhanced Patient Access: Telemedicine facilitates consultations for patients who might otherwise struggle to reach specialized compounding pharmacies.

- Streamlined Prescription Management: Digital platforms enable secure and efficient electronic transmission of prescriptions, minimizing manual data entry.

- Improved Communication Channels: Integrated systems can foster better dialogue between prescribers, Fagron’s pharmacies, and patients regarding medication needs and fulfillment.

- Market Expansion Opportunities: Leveraging digital health tools allows Fagron to reach a broader patient base, including those in underserved geographic regions.

Fagron's technological advancements are driving efficiency and quality through automation and digitalization, evident in their 2023 facility upgrades to modernize production lines. AI and data analytics are increasingly vital, with the FDA establishing an AI Council in 2024 to guide its integration into healthcare, which Fagron can leverage for formulation development and patient response forecasting.

The personalized medicine market, valued at $293.5 billion in 2023 and projected to reach $677.9 billion by 2030, highlights the impact of biomarker development and genetic testing. Fagron’s strategic advantage lies in developing compounded medications tailored to individual genetic profiles, supported by ongoing R&D and partnerships with diagnostic firms.

The growth of telemedicine and digital health platforms, with the digital health market valued at approximately $200 billion in 2023, is transforming prescription workflows. These platforms enhance patient access, streamline prescription management through e-prescriptions, and improve communication, allowing Fagron to expand its market reach to underserved areas.

| Technology Area | 2023/2024 Impact | Future Outlook |

|---|---|---|

| Automation & Digitalization | Facility upgrades for efficient operations; reduced errors. | Further integration for precise medication dispensing and supply chain tracking. |

| AI & Data Analytics | FDA AI Council formation (2024); potential for improved formulation and patient response prediction. | Transforming drug discovery, personalized treatment plans, and logistical optimization. |

| Biomarker & Genetic Testing | Personalized medicine market valued at $293.5B (2023); projected to reach $677.9B by 2030. | Enabling highly targeted compounded medications based on individual genetic makeup. |

| Telemedicine & Digital Health | Digital health market valued at ~$200B (2023); improved prescription workflows. | Expanding patient access, streamlining e-prescriptions, and enhancing provider-patient communication. |

Legal factors

The U.S. Food and Drug Administration (FDA) continues to significantly influence pharmaceutical compounding, impacting Fagron's business. New policies, such as the interim policy on using bulk drug substances starting January 2025, and proposed rules for Demonstrable Difficulties for Compounding Lists (DDC lists), signal a more stringent regulatory landscape for both 503A and 503B compounders. Staying compliant with these evolving FDA directives is paramount for Fagron's operational continuity and market access.

The European Union's significant overhaul of pharmaceutical legislation, initiated with a proposed medicines strategy in October 2024 and further shaped by the European Parliament's April 2024 position, directly impacts Fagron. These reforms prioritize patient access, innovation, and supply chain robustness, necessitating strategic adjustments for companies operating within the EU market.

Key elements of this legislative reform include the introduction of mandatory data protection schemes and the requirement for environmental risk assessments. Fagron's business model, which relies on efficient and compliant pharmaceutical operations, will need to adapt to these new regulatory frameworks, potentially influencing product development timelines and market entry strategies.

The increasing focus on personalized medicine means data privacy, particularly for genetic information, is a major legal consideration. Regulations like the EU's GDPR, which has specific provisions for genetic data, are setting a global standard. Fagron must implement strong data protection measures to comply.

Ensuring patients give informed consent for the use of their sensitive genetic data is paramount. Failure to do so not only risks legal penalties but also erodes the trust essential for Fagron's operations in this sensitive field.

Product Liability and Quality Standards

Fagron operates in a highly regulated pharmaceutical sector, making product liability and adherence to quality standards paramount. Failure to meet these stringent global requirements can result in significant legal repercussions, including product recalls, substantial fines, and costly litigation.

The company's dedication to maintaining 'stringent quality standards' is not merely a matter of best practice but a critical legal imperative. For instance, in 2023, the pharmaceutical industry faced numerous product recalls, highlighting the intense scrutiny on quality control. Fagron's ongoing investments in operational excellence are directly aimed at mitigating these legal risks and safeguarding patient well-being.

- Product Liability: Fagron faces potential legal action if its compounded products cause harm due to defects or failure to meet safety standards.

- Quality Control: Strict adherence to Good Manufacturing Practices (GMP) and other regulatory guidelines is essential to prevent product contamination or efficacy issues.

- Regulatory Compliance: Non-compliance with pharmaceutical regulations in different operating regions can lead to severe penalties, impacting financial performance and market access.

Intellectual Property Rights

Protecting intellectual property rights is paramount for Fagron, especially concerning its innovative compounding concepts, specialized formulations, and proprietary equipment. These assets are the bedrock of its competitive edge in the pharmaceutical sector. Navigating the intricate landscape of patent laws, trade secret protections, and regulatory exclusivities across various global jurisdictions presents a significant legal hurdle.

Fagron's strategic management of its intellectual property is crucial for preventing unauthorized replication of its unique offerings. This proactive approach ensures that Fagron can maintain its market position and continue to invest in research and development. For instance, in 2024, the global pharmaceutical patent landscape saw continued activity, with companies filing thousands of new patents, underscoring the importance of robust IP protection strategies.

- Patent Protection: Fagron actively secures patents for novel drug delivery systems and compounding techniques to prevent competitors from copying its innovations.

- Trade Secrets: Confidentiality agreements and internal security measures are employed to safeguard proprietary manufacturing processes and formulation recipes.

- Regulatory Exclusivity: Fagron leverages regulatory exclusivities granted by health authorities, such as those in the EU and US, to extend market protection for its specialized products.

- Enforcement: The company monitors the market for potential infringements and takes legal action when necessary to defend its intellectual property rights, ensuring its innovations remain protected.

Fagron's operations are heavily influenced by evolving pharmaceutical regulations in key markets like the U.S. and EU. The FDA's proposed policies for bulk drug substances and Demonstrable Difficulties lists, effective from January 2025, signal increased compliance demands. Similarly, the EU's comprehensive medicine reforms, including mandatory data protection and environmental risk assessments, necessitate strategic adaptation for Fagron to maintain market access and operational efficiency.

Environmental factors

Fagron, operating in pharmaceutical manufacturing, faces increasing environmental regulations. These rules cover waste disposal, air and soil emissions, and the handling of hazardous materials. For example, the EU's pharmaceutical reform, implemented in 2024, places a strong emphasis on sustainability, mandating environmental risk assessments for all new drug approvals.

Compliance is critical for Fagron's global operations, as violations can lead to significant fines and even the suspension of operating licenses. The company must navigate these evolving standards to ensure continued market access and a positive corporate image.

Fagron places significant emphasis on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles, integrating them into its core business strategy to ensure ethical and responsible product development. This commitment translates into concrete actions aimed at reducing its environmental footprint, fostering employee well-being, and maintaining integrity throughout its supply chain.

A robust ESG performance is increasingly recognized as a key driver for Fagron's success. For instance, in 2023, Fagron reported a 14% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2022 baseline, demonstrating tangible progress in environmental stewardship. This focus not only strengthens its brand reputation but also attracts a growing pool of ESG-conscious investors and cultivates more positive relationships with all stakeholders.

Fagron's global supply chain, a complex network from raw material sourcing to final product delivery, faces increasing scrutiny regarding its environmental impact. This encompasses the carbon footprint generated by transportation and manufacturing, the water consumed in production processes, and the waste produced across the entire product lifecycle.

In 2023, the pharmaceutical industry, including companies like Fagron, continued to grapple with reducing its environmental footprint. While specific Fagron data for 2024/2025 is not yet publicly available, industry trends indicate a strong push towards sustainable logistics and greener manufacturing practices to mitigate these impacts.

Optimizing Fagron's supply chain is not just about environmental responsibility; it's a strategic imperative for long-term viability and meeting the growing expectations of investors, regulators, and consumers for sustainable business operations.

Climate Change and Resource Scarcity

Climate change presents significant long-term environmental risks for companies like Fagron, potentially disrupting the sourcing of raw materials and impacting logistics through extreme weather events. For instance, in 2024, a significant portion of global pharmaceutical ingredient production remained concentrated in regions susceptible to climate-related disruptions, highlighting the vulnerability of supply chains.

Resource scarcity, particularly for specialized pharmaceutical ingredients, could directly affect Fagron's production costs and the consistent availability of essential products. The increasing demand for certain active pharmaceutical ingredients, coupled with potential climate-induced agricultural impacts on plant-based sources, could lead to price volatility. For example, reports in early 2025 indicated a 10-15% increase in the cost of certain botanical extracts due to adverse weather patterns in key growing regions.

- Increased frequency of extreme weather events (e.g., droughts, floods) impacting agricultural yields of botanical raw materials.

- Potential for supply chain disruptions due to climate-related natural disasters affecting transportation and manufacturing hubs.

- Rising costs of certain pharmaceutical ingredients due to scarcity and increased production challenges.

- Growing regulatory pressure and consumer demand for sustainable sourcing and reduced environmental footprint.

Fagron's proactive environmental management strategies and focus on supply chain resilience are crucial for mitigating these potential disruptions. By diversifying sourcing locations and investing in robust logistical networks, the company aims to ensure continuity of supply even amidst environmental challenges.

Demand for 'Greener' Pharmaceutical Products

Societal and regulatory pressure is mounting for pharmaceuticals to adopt greener practices. This translates into a demand for sustainable packaging, reduced manufacturing energy use, and minimizing pharmaceutical waste in ecosystems. For instance, a 2024 report highlighted that 70% of consumers are more likely to purchase from brands with strong environmental commitments.

Fagron's innovation in developing more environmentally sustainable products and processes will be crucial. This focus on eco-friendly solutions is not just a differentiator but a growing necessity for compliance. By 2025, it's projected that over 80% of pharmaceutical companies will have integrated sustainability metrics into their core business strategies, influencing supply chain decisions significantly.

- Growing Consumer Preference: Consumers increasingly favor brands with visible environmental responsibility, impacting purchasing decisions.

- Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations for manufacturing and product lifecycle management.

- Supply Chain Demands: Business partners and suppliers are also prioritizing environmentally conscious companies, influencing Fagron's operational choices.

- Innovation Driver: The push for greener products encourages R&D investment in sustainable materials and production methods.

Fagron's environmental performance is increasingly under scrutiny, with a focus on reducing its carbon footprint and waste generation. The company reported a 14% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022, demonstrating tangible progress. Industry trends for 2024/2025 indicate a continued push for sustainable logistics and greener manufacturing practices.

Climate change poses risks to Fagron's supply chain, particularly for botanical raw materials, with extreme weather events in 2024 impacting production regions. Reports in early 2025 showed a 10-15% cost increase for certain botanical extracts due to adverse weather, highlighting resource scarcity challenges.

Societal and regulatory pressure for greener practices is growing, with 70% of consumers in a 2024 report stating a preference for environmentally committed brands. By 2025, over 80% of pharmaceutical companies are projected to integrate sustainability metrics into their strategies, influencing supply chain decisions.

| Environmental Factor | Impact on Fagron | 2023 Data/2024-2025 Trend |

| Greenhouse Gas Emissions | Operational efficiency, regulatory compliance, brand reputation | 14% reduction in Scope 1 & 2 emissions (2023 vs 2022) |

| Climate Change Risks | Supply chain disruption, raw material availability, cost volatility | 10-15% cost increase for botanical extracts (early 2025) due to weather |

| Consumer & Regulatory Pressure | Market access, brand loyalty, innovation driver | 70% consumer preference for eco-brands (2024); 80%+ pharma companies integrating sustainability metrics (projected 2025) |

PESTLE Analysis Data Sources

Our Fagron PESTLE Analysis is informed by a comprehensive review of global economic databases, regulatory updates from health authorities, and industry-specific market research. We meticulously gather data from sources like the WHO, FDA, and leading pharmaceutical market intelligence firms to ensure accuracy and relevance.