Fagron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fagron Bundle

Understand the strategic positioning of Fagron's product portfolio with our insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, giving you a glimpse into their market performance. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategic recommendations to optimize your investment decisions and drive future growth.

Stars

Fagron's North American Compounding Services segment is a clear star in their BCG matrix, showcasing impressive growth. This segment benefits from strong market demand and strategic capacity expansions.

The company's commitment to enhancing sterile manufacturing, exemplified by a 20% capacity increase at Fagron Sterile Services US in 2024, has solidified its market position. This investment directly fuels the segment's stellar performance.

Sustained demand for outsourced compounding solutions, coupled with favorable underlying market trends in North America, continues to drive exceptional results for this business unit.

Fagron is making significant investments to boost its sterile compounding services, aiming to be a global leader in personalized sterile medicines. This expansion targets a high-growth market where the company is actively increasing its footprint and market share.

The company's strategy involves upgrading facilities, integrating automation, and maintaining a sharp focus on regulatory compliance. For instance, Fagron reported a 10.3% revenue growth in its sterile compounding segment for the first half of 2024, reaching €248.7 million, demonstrating strong momentum in this area.

Fagron's Global Brands Strategy is a cornerstone of its growth, aiming to boost revenue from its Brands & Essentials segment. This initiative is designed to leverage scientifically validated products and strong prescriber relationships to expand market share.

The company is actively scaling successful brands worldwide, underpinned by a solid infrastructure. This strategic focus highlights Brands & Essentials as a high-potential area for Fagron, driving investment to capitalize on market opportunities.

Solutions for Drug Shortages

Fagron's compounding services have been instrumental in mitigating drug shortages, particularly in the United States. Their ability to produce critical medications, like sterile water for injection, highlights their importance in bolstering the domestic pharmaceutical supply chain. This capability is further underscored by their receipt of a Project PROTECT grant in 2025, a testament to their role in ensuring access to essential medicines during times of scarcity.

The demand for Fagron's solutions is amplified by the persistent challenge of drug shortages. In 2024, the FDA reported ongoing shortages for numerous essential drugs, impacting patient care across the nation. Fagron's agile manufacturing and distribution network directly addresses these critical gaps.

- Fagron's role in addressing drug shortages has been significant, particularly in the U.S. market.

- The company's compounding services are vital for hospitals facing medication access issues.

- A 2025 Project PROTECT grant for sterile water for injection production exemplifies Fagron's critical contribution to the supply chain.

- This positions Fagron within a high-demand, essential segment of the pharmaceutical industry.

Personalized Ophthalmic Compounding (US)

The Personalized Ophthalmic Compounding market in the U.S. is a dynamic sector, fueled by a rising demand for tailored eye medications. This trend is directly linked to an increase in prescriptions for specialized formulations designed to meet individual patient needs, a key growth driver for the industry.

Fagron Sterile Services US stands out as a leading entity within this burgeoning market. Its strategic capital allocations have been instrumental in bolstering its market presence and driving substantial revenue expansion, particularly noted as of 2025.

This particular segment of Fagron's operations is characterized by its robust growth trajectory and established market leadership, positioning it as a significant high-growth, high-share opportunity.

- Market Growth Driver: Increased prescriptions for personalized ophthalmic formulations.

- Fagron's Position: Dominant player in the U.S. Ophthalmic Compounding sector.

- Strategic Impact: Investments in 2025 contributed to Fagron's market share and revenue growth.

- BCG Classification: Represents a Star (high growth, high share) for Fagron.

Fagron's North American Compounding Services, particularly its sterile compounding operations, are clearly positioned as Stars in its BCG matrix. This segment benefits from robust market demand, strategic capacity expansions, and a strong focus on regulatory compliance. The company's commitment to sterile manufacturing, including a 20% capacity increase at Fagron Sterile Services US in 2024, directly fuels its stellar performance. Fagron reported 10.3% revenue growth in its sterile compounding segment for the first half of 2024, reaching €248.7 million, underscoring its high-growth, high-share status.

| Segment | BCG Classification | Key Growth Drivers | 2024 Performance Indicator |

|---|---|---|---|

| North American Compounding Services (Sterile) | Star | Strong market demand, capacity expansion, addressing drug shortages | 10.3% revenue growth (H1 2024) |

| Personalized Ophthalmic Compounding (US) | Star | Increased prescriptions for tailored eye medications | Significant revenue expansion (as of 2025) |

What is included in the product

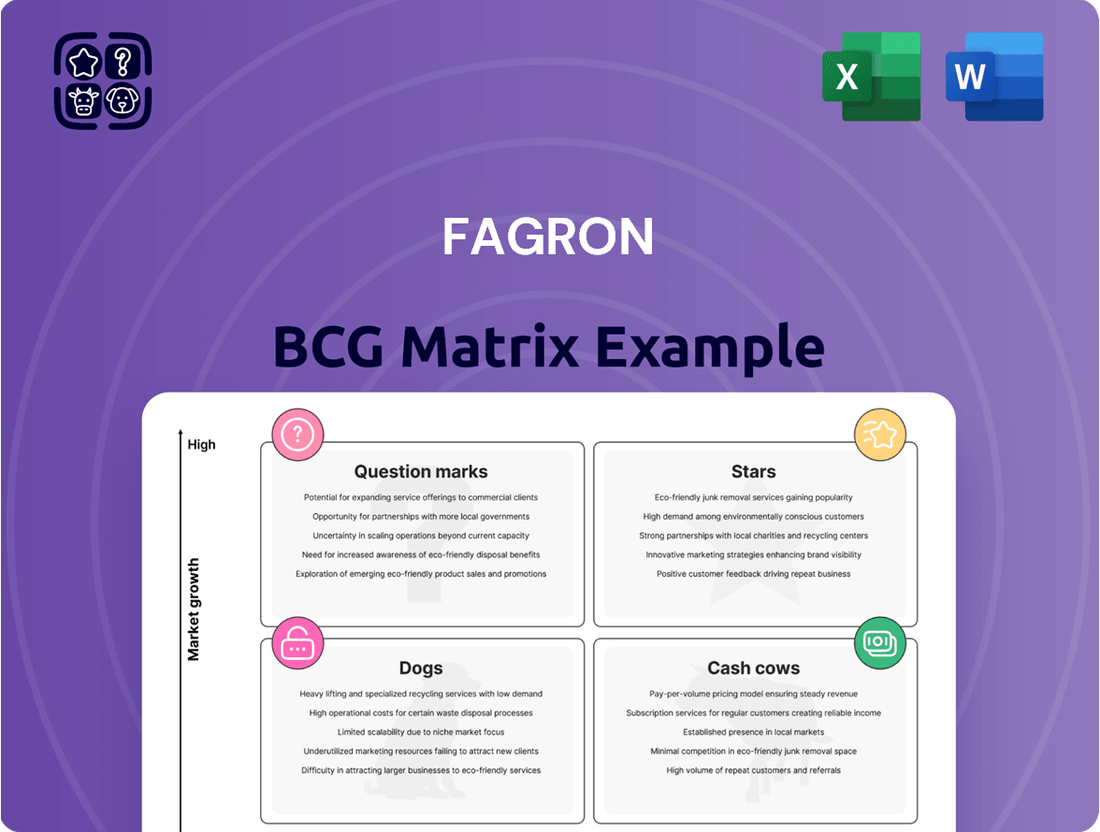

The Fagron BCG Matrix categorizes its products into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This framework guides strategic decisions on resource allocation, investment, and divestment for Fagron's portfolio.

Clear visual representation of Fagron's portfolio for strategic decision-making.

Cash Cows

Fagron's pharmaceutical raw materials segment is a dominant force, holding the number one spot in repackaging and distribution in its key markets. This mature business, characterized by high market share and operational efficiency through SKU harmonization and sourcing optimization, delivers robust and dependable cash flow. For instance, in 2023, Fagron reported revenue of €747.4 million from its Essentials segment, demonstrating its significant contribution to the company's financial stability.

Fagron's established non-sterile compounding business is a prime example of a Cash Cow within its portfolio. This mature segment benefits from the company's strong market position, allowing it to concentrate on boosting profitability. Key strategies include leveraging operational efficiencies, implementing automation, and refining quality control measures to maximize margins.

This segment consistently delivers substantial cash flow, requiring minimal reinvestment for growth. For instance, Fagron's focus on optimizing its non-sterile compounding operations is a direct reflection of its strategy to extract maximum value from mature, high-performing assets. The refinement of its registration business further supports high-value market segments within this core area.

The EMEA region represents a significant cash cow for Fagron, demonstrating consistent and steady growth across its diverse markets. This stability is underpinned by Fagron's extensive operational footprint and a favorable shift in competitive landscapes.

While EMEA's growth, often in the mid-single digits, doesn't match the high-teen expansion seen in North America, its reliable performance and diversified business model are crucial for generating consistent cash flow. For instance, in 2024, Fagron reported that its EMEA segment continued to be a strong contributor, with organic growth rates that, while moderate, provided a stable revenue stream.

This dependable performance in EMEA serves as a vital counterbalance, helping to absorb the effects of localized regulatory shifts that can impact other regions. The broad reach and established presence in Europe, the Middle East, and Africa ensure that this segment remains a bedrock of Fagron's financial stability.

Core Compounding Pharmacy Services (Overall)

Fagron's core compounding pharmacy services are its established Cash Cows, forming the bedrock of its global operations. These services benefit from Fagron's extensive infrastructure and strong market position in over 30 countries. The company's leadership in this segment means it doesn't need to heavily invest in promotion, allowing it to generate consistent profits.

In 2023, Fagron reported a revenue of €766.4 million for its pharmaceutical compounding segment, highlighting its significant contribution to the company's overall financial performance. This segment consistently demonstrates robust profitability, supporting investments in other areas of the business.

- Stable Revenue: Fagron's general compounding services are a reliable source of income.

- Market Leadership: The company holds a strong position, reducing the need for aggressive marketing spend.

- Profitability: This segment consistently generates profits, funding growth initiatives.

- Global Reach: Operations in over 30 countries ensure broad market penetration.

SyrSpend® Oral Suspending Vehicles

SyrSpend®, Fagron's range of oral suspending vehicles, represents a mature and stable product within the company's portfolio. Its established presence in the compounding pharmacy market suggests a strong, consistent revenue stream, characteristic of a cash cow.

This product line likely commands a significant market share within its specific niche, allowing it to generate reliable profits without requiring substantial investment in growth or innovation. Fagron's SyrSpend® is a dependable source of cash flow, supporting other areas of the business.

- Established Market Position: SyrSpend® is a well-recognized and trusted brand in the compounding pharmacy sector.

- Consistent Revenue Generation: The product contributes steadily to Fagron's overall revenue with predictable sales volumes.

- Low Investment Needs: As a mature product, it requires minimal R&D or marketing expenditure, maximizing its cash-generating potential.

- Profitability: SyrSpend® vehicles are likely highly profitable due to their established market position and operational efficiency.

Fagron's core compounding pharmacy services are its established Cash Cows, forming the bedrock of its global operations. These services benefit from Fagron's extensive infrastructure and strong market position in over 30 countries, allowing for consistent profit generation with minimal promotional investment. In 2023, Fagron's pharmaceutical compounding segment generated €766.4 million in revenue, underscoring its significant and stable contribution to the company's financial health and ability to fund other strategic initiatives.

| Segment | 2023 Revenue (EUR million) | BCG Category | Key Characteristics |

|---|---|---|---|

| Pharmaceutical Compounding | 766.4 | Cash Cow | High market share, stable cash flow, low reinvestment needs |

| Essentials (Repackaging & Distribution) | 747.4 | Cash Cow | Market leadership, operational efficiency, dependable cash flow |

Preview = Final Product

Fagron BCG Matrix

The preview you are viewing is the precise, unwatermarked document you will receive upon purchase, offering a complete and ready-to-use Fagron BCG Matrix for your strategic planning needs. This comprehensive report has been meticulously crafted to provide actionable insights into Fagron's product portfolio, enabling informed decision-making and resource allocation. You can confidently expect the same level of detail and professional formatting in the final file, which will be instantly accessible after your transaction. This is the exact Fagron BCG Matrix designed for immediate application in your business analysis and strategic development.

Dogs

Fagron's underperforming legacy product lines represent older formulations or services that are experiencing declining demand or facing stiff competition. These products often yield minimal profits while consuming significant resources, hindering capital allocation for more promising ventures. For instance, in 2024, a hypothetical legacy product line might have seen a 15% year-over-year revenue decline due to the introduction of newer, more effective alternatives.

Fagron's product categories, particularly those in specific regions, can face significant hurdles due to localized regulatory shifts. For instance, changes in reimbursement policies in markets like Poland have historically impacted Fagron's ability to maintain profitability and market share for certain offerings. These external pressures can transform previously viable segments into cash traps, demanding a critical assessment of ongoing investment strategies.

In segments where pharmaceutical raw materials have become highly commoditized, Fagron's offerings might encounter fierce price competition. This can result in squeezed profit margins and a lack of distinctiveness. If Fagron doesn't possess a leading market position or a special edge in these particular commoditized areas, they could be categorized as 'dogs.'

These specific sub-segments may find it challenging to deliver significant returns on investment. For instance, if a basic, widely available active pharmaceutical ingredient (API) like paracetamol sees its price driven down due to oversupply and numerous manufacturers, Fagron's involvement in that specific niche could become a 'dog' if they cannot command a premium or achieve substantial volume.

Very Niche or Outdated Compounding Solutions

Fagron's extensive product range may encompass compounding solutions that are highly specialized or have become outdated. These might include older formulations or delivery systems that are no longer in high demand or have been surpassed by more advanced alternatives. For instance, while Fagron is a leader in pharmaceutical compounding, some legacy products within its vast catalog could face declining interest as newer, more efficient methods emerge.

These niche or outdated solutions typically exhibit low market share and contribute minimally to overall revenue. Their limited scalability and dwindling customer base make them less attractive for further investment. By 2024, the pharmaceutical compounding market continues to innovate, with a growing emphasis on personalized medicine and advanced drug delivery systems, potentially leaving older solutions behind.

- Low Market Share: These solutions represent a small fraction of Fagron's total sales.

- Declining Demand: Market trends and technological advancements have reduced the need for these products.

- Limited Scalability: The potential for growth and expansion is constrained due to their niche nature.

- Resource Allocation: Rationalizing these offerings could free up capital and focus for more promising areas.

Non-Strategic Acquired Businesses with Poor Integration

Non-strategic acquired businesses with poor integration, when viewed through the Fagron BCG Matrix, represent potential 'dogs.' These are typically smaller entities acquired to broaden the portfolio but which struggle to achieve expected synergies or market penetration. For instance, if Fagron acquired a niche pharmaceutical distribution company in 2023 that has since failed to integrate its IT systems or expand its customer base beyond its initial limited reach, it could fall into this category.

These underperforming acquisitions can become a drain on Fagron's resources. If a business unit, such as a specialized compounding pharmacy acquired in a smaller European market, consistently misses its growth targets and requires significant ongoing investment without demonstrating a clear path to profitability, it signals poor integration. Such units might consume management attention and capital that could be better deployed in core, high-growth areas of Fagron's business.

- Resource Drain: Businesses failing to integrate effectively may require ongoing financial support without contributing to overall growth, potentially impacting Fagron's earnings per share.

- Missed Synergies: Acquired entities that do not deliver expected cost savings or revenue enhancements post-acquisition, such as a newly acquired laboratory equipment supplier that doesn't achieve anticipated cross-selling opportunities, become 'dogs.'

- Divestment Consideration: Fagron may need to consider divesting these poorly integrated, non-strategic assets to streamline operations and improve the efficiency of its business portfolio, as seen with other pharmaceutical companies divesting non-core segments to focus on their primary markets.

Dogs in Fagron's portfolio are products or business units with low market share and low growth prospects. These often represent legacy offerings or poorly integrated acquisitions that consume resources without generating substantial returns. For example, a niche compounded medication facing declining patient demand due to newer alternatives could be a dog, especially if it requires significant regulatory support for minimal revenue. In 2024, Fagron's focus on high-growth areas means underperforming legacy products are continuously evaluated for divestment or rationalization.

| Category | Market Share | Growth Rate | Profitability |

| Legacy Compounding Ingredients | Low | Declining | Low/Negative |

| Outdated Delivery Systems | Low | Stagnant | Low |

| Non-Strategic Acquired Units (Poor Integration) | Low | Low | Low/Negative |

Question Marks

Fagron's new product launches and innovative compounding concepts often fall into the question mark category of the BCG matrix. These initiatives, focused on high-growth segments like personalized medicine, initially possess a low market share. For instance, Fagron's expansion into novel drug delivery systems, a key area of personalized medicine, represents such a strategic play.

These question marks necessitate significant investment in research, development, and marketing to achieve market penetration and build brand awareness. Fagron's commitment to innovation is evident in its R&D spending, which aims to foster the adoption of these new offerings. The company's 2024 strategy likely includes substantial allocations to support these emerging product lines and drive their growth.

The success of these question mark products is not guaranteed, presenting a critical juncture for Fagron. The company must strategically decide whether to commit further resources to accelerate their market share growth or to divest if they fail to gain traction. This careful evaluation is crucial for optimizing Fagron's product portfolio and ensuring long-term profitability.

The market for advanced drug delivery systems, particularly those leveraging nanotechnology, is experiencing robust expansion, projected to grow at a healthy 10% rate by 2025. This segment represents a significant opportunity for innovation and future market leadership.

If Fagron is developing or introducing products in this cutting-edge area, their initial market share is likely to be modest, reflecting the early stages of market penetration. Despite the low current share, the substantial growth trajectory of advanced drug delivery systems positions these offerings as potential future stars within the BCG matrix.

Significant investment in research and development is crucial for Fagron to establish a strong foothold and capture market share in this dynamic and technologically advanced sector. These investments are key to transforming nascent offerings into market-leading products.

The pharmaceutical compounding market is seeing a significant shift towards digital health integration, with telemedicine-based prescription services emerging as a key growth driver. As of early 2024, this segment represents a nascent but rapidly expanding frontier.

If Fagron is in the early stages of developing or expanding its digital health offerings, its current market share in this specific niche would likely be low. This reflects the investment and development required to establish a strong foothold in this evolving area.

This digital realm offers high growth potential, but it necessitates strategic and focused investment. By prioritizing these digital initiatives, Fagron can aim to capture significant market share and prevent this segment from becoming a laggard, or a 'dog,' in its portfolio.

Specific Strategic Acquisitions in Emerging Segments

Fagron's strategic acquisitions, such as the integration of CareFirst, are designed to bolster its presence in emerging, high-growth market segments. While these moves aim to expand Fagron's overall reach, they often involve entering sub-segments where the company may have a relatively low initial market share, classifying them as potential stars or question marks within a BCG matrix framework. For instance, CareFirst's contribution to Anazao's health and wellness initiatives highlights a dynamic sector where Fagron continues to build its competitive standing, necessitating ongoing investment to capture greater market share.

These acquisitions can introduce Fagron into niche areas with significant future potential but current limited penetration. This strategic positioning requires careful resource allocation to nurture these emerging businesses and drive them towards market leadership. Fagron's approach in 2024 and beyond will likely focus on consolidating gains in these acquired entities and identifying further opportunities for expansion within these high-potential segments.

- Acquisition Rationale: Fagron acquires companies like CareFirst to gain entry into high-growth, nascent market segments.

- Market Position: These acquisitions often place Fagron in a low-share, high-growth position within specific sub-segments, characteristic of question marks or emerging stars.

- Investment Needs: Continued investment is crucial to strengthen Fagron's market share and competitive advantage in these evolving areas, such as the health and wellness sector.

- Strategic Focus: The company's strategy involves nurturing these acquired businesses to achieve market leadership and maximize their growth potential.

Genomics-Driven Personalized Treatments

Fagron's emphasis on 'Genomics: Letting Genes Trigger Treatments' positions it within a rapidly evolving, high-potential sector. This strategic focus signals a commitment to innovation in personalized medicine, a field poised for significant growth.

Given the nascent stage of genomics-driven personalized treatments, Fagron's current market share in this specific niche is likely to be minimal. This segment is characterized by substantial research and development requirements and an uncertain path to widespread adoption, making it a classic question mark in the BCG matrix.

- Genomics Investment: Fagron's scientific focus highlights a strategic bet on a cutting-edge, high-growth area.

- Market Share: Current market share in genomics-driven personalized treatments is expected to be low due to the field's early stage.

- Future Potential: This segment represents a significant question mark, demanding substantial, long-term investment to unlock its full potential.

- Industry Growth: The global personalized medicine market, heavily influenced by genomics, was projected to reach over $600 billion by 2024, indicating substantial future opportunity.

Question marks represent Fagron's ventures into high-growth markets where its current market share is low. These are often new product launches or expansions into emerging segments like personalized medicine or digital health. The company must invest heavily in these areas to build market presence and brand recognition.

Fagron's strategic investments in areas such as advanced drug delivery systems, which saw global market growth projections of around 10% by 2025, exemplify these question marks. Similarly, its foray into digital health integrations, a nascent but rapidly expanding frontier as of early 2024, also falls into this category.

The success of these question mark products is not guaranteed, requiring careful evaluation of whether to increase investment for growth or divest if traction is not achieved. Fagron's 2024 strategy likely involves significant resource allocation to nurture these emerging product lines and drive their market penetration.

The company's emphasis on genomics, a field projected to significantly influence the personalized medicine market which was expected to exceed $600 billion by 2024, further illustrates its engagement with question marks.

| Category | Description | Fagron Example | Market Growth | Fagron's Action |

|---|---|---|---|---|

| Question Mark | Low market share, high market growth | Genomics-driven personalized treatments | Personalized medicine market > $600 billion by 2024 | Significant R&D investment, strategic evaluation |

| Question Mark | Low market share, high market growth | Digital health integration in compounding | Nascent but rapidly expanding frontier (early 2024) | Focused investment to gain market share |

| Question Mark | Low market share, high market growth | Novel drug delivery systems | Advanced drug delivery systems growth ~10% by 2025 | Investment in R&D and marketing |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.