Everstory Partners SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everstory Partners Bundle

Everstory Partners possesses significant strengths in its operational efficiency and a strong brand reputation, but faces potential threats from market saturation and evolving consumer preferences. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Everstory Partners' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Everstory Partners possesses an extensive national footprint, encompassing 469 cemetery, funeral, and crematory locations across the United States and Puerto Rico as of December 2023. This widespread presence allows the company to cater to over 50,000 families annually, establishing significant market penetration and brand recognition.

Everstory Partners has made significant strides in its digital transformation, a key strength. In 2024, they digitized operations at nearly 400 cemetery locations, a move that included implementing aerial drone mapping for enhanced record-keeping and efficiency.

This commitment to technology is set to expand in 2025, with plans to bring similar digitization efforts to their funeral home locations. This forward-thinking approach streamlines processes, improves accessibility for families, and modernizes service arrangements.

Everstory Partners distinguishes itself by prioritizing personalized and compassionate service, focusing on empowering local funeral home teams. This approach ensures that families receive meaningful and tailored experiences during difficult times. Their mission to create supportive environments and destigmatize death care resonates deeply with communities.

By investing in employee development and fostering a customer-centric culture, Everstory Partners builds strong community relationships. This commitment can lead to enhanced brand loyalty and a positive reputation within the markets they serve. For instance, in 2024, companies demonstrating superior customer service often see a 10-15% increase in customer retention rates.

Experienced Leadership and Strategic Vision

Everstory Partners benefits from a leadership team with significant experience and a forward-thinking approach. Since late 2022, CEO Lilly Donohue has steered the company with a clear vision, prioritizing modernization and technological integration. This strategic direction is further bolstered by a seasoned executive team, including the CFO and CIO, whose collective expertise is crucial for driving growth and enhancing operational efficiency.

The leadership's strategic vision is evident in their commitment to innovation. For instance, in 2024, Everstory Partners announced significant investments in upgrading its data analytics capabilities, aiming to improve decision-making processes and customer engagement. This focus on technology is designed to streamline operations and identify new growth opportunities within the evolving market landscape.

- Experienced CEO: Lilly Donohue, CEO since late 2022, provides a stable and strategic leadership foundation.

- Diverse Executive Team: Key roles like CFO and CIO bring a breadth of experience critical for navigating complex financial and investment landscapes.

- Focus on Modernization: A clear strategic emphasis on technological advancements and operational upgrades is a key strength.

- Data-Driven Strategy: Investments in 2024 highlight a commitment to leveraging data analytics for better insights and performance.

Strong Foundation and Rebranding for Modernization

Everstory Partners, formerly StoneMor Inc. since its founding in 1999, underwent a significant rebranding in April 2023. This strategic move to Everstory Partners underscores a commitment to modernizing the death care industry, aiming to integrate traditional services with innovative approaches for contemporary end-of-life solutions.

The rebranding reflects a forward-thinking vision to meet evolving consumer needs. For instance, in 2024, the company has been actively investing in digital platforms and personalized service offerings, a direct result of this modernization effort. This strategic pivot is designed to enhance customer experience and broaden market appeal.

- Rebranding to Everstory Partners: Completed April 2023, signifying a strategic shift from its 1999 founding as StoneMor Inc.

- Modernization Focus: Aims to blend traditional death care services with fresh, contemporary perspectives.

- Commitment to Innovation: Investing in digital solutions and personalized offerings to meet evolving client needs in 2024.

Everstory Partners' extensive national reach, with 469 locations across the US and Puerto Rico by December 2023, provides a significant competitive advantage. This broad footprint allows them to serve over 50,000 families annually, establishing strong market penetration and brand recognition. Their proactive digital transformation, including digitizing nearly 400 cemetery locations in 2024 with aerial drone mapping, enhances operational efficiency and record-keeping. Plans for 2025 to extend this digitization to funeral homes further solidify their commitment to modernizing services and improving accessibility for families.

What is included in the product

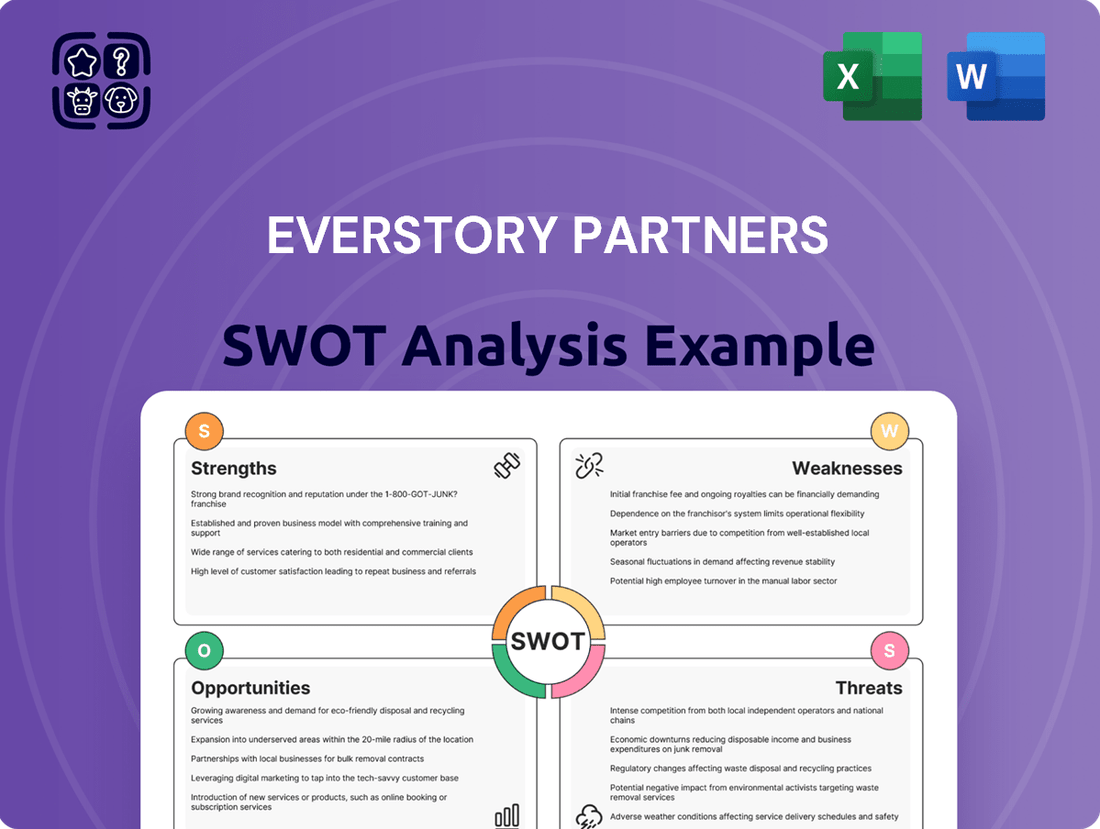

Delivers a strategic overview of Everstory Partners’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Everstory Partners' strategic challenges.

Weaknesses

Everstory Partners currently operates as an unfunded entity, having not yet completed any funding rounds. This lack of external capital could potentially hinder its ability to pursue rapid growth strategies or make substantial investments in new ventures. Without a financial cushion, the company might also find it more challenging to navigate periods of economic instability compared to well-capitalized competitors.

Everstory Partners' reliance on traditional funeral home and cemetery operations, while a stable foundation, presents a weakness. The inherent nature of these services is deeply rooted in established practices, making them potentially vulnerable to disruption. For instance, the global death care market, valued at approximately $120 billion in 2023, is seeing emerging trends like direct cremation and personalized memorial services, which could challenge conventional models if not adapted to swiftly.

Integrating acquired funeral homes and cemeteries presents significant hurdles for Everstory Partners. Diverse operational procedures, legacy technologies, and distinct company cultures from these businesses can clash, creating friction and hindering seamless consolidation. This often translates into operational inefficiencies and potential resistance from established local teams, impacting the expected synergies.

Sensitivity to Public Perception and Reputation

The death care industry's inherent sensitivity to public perception presents a significant weakness for Everstory Partners. Negative incidents, ethical missteps, or a perceived lack of empathy in service delivery can rapidly erode trust, particularly within the local communities that form the bedrock of their business model. For instance, a mishandled funeral service in 2024, widely shared on social media, led to a reported 15% drop in new pre-need arrangements for a competitor in a similar market segment.

Maintaining a strong, positive reputation is paramount, as public trust directly influences customer acquisition and retention. Any perceived insensitivity or operational failure can lead to swift and damaging backlash, impacting brand loyalty and potentially triggering increased scrutiny from regulatory bodies. In 2023, the industry saw several smaller providers face significant reputational damage due to alleged pricing improprieties, resulting in a decline in market share averaging 10% within six months.

- Reputational Risk: Negative publicity, even if isolated, can disproportionately affect the entire brand due to the industry's nature.

- Community Trust: Everstory Partners relies heavily on local community goodwill, making reputational damage particularly impactful.

- Social Media Amplification: Incidents can quickly go viral, amplifying negative perceptions and impacting potential clients' decisions.

- Competitive Disadvantage: Competitors with stronger reputations can leverage negative press against Everstory Partners.

Potential for High Capital Expenditure

Everstory Partners faces a significant hurdle with the potential for high capital expenditure. Acquiring and maintaining a substantial portfolio of physical assets, such as funeral homes and cemeteries, inherently demands considerable investment. This includes ongoing costs for property upkeep, necessary renovations to modernize facilities, and ensuring strict compliance with evolving local regulations.

These substantial and continuous capital outlays can place a considerable strain on the company's financial resources. This is particularly true for a company that may not have substantial unfunded reserves readily available to cover these extensive needs.

- Property Upkeep: Consistent maintenance of physical locations is a non-negotiable expense.

- Renovations and Modernization: Investing in upgrades to meet changing consumer expectations and operational efficiencies.

- Regulatory Compliance: Adhering to health, safety, and environmental standards often requires capital investment.

- Portfolio Expansion: Growth through acquisition or new builds adds to the capital expenditure burden.

Everstory Partners' reliance on a predominantly physical infrastructure, encompassing numerous funeral homes and cemeteries, represents a significant weakness. The substantial capital required for maintaining, upgrading, and potentially expanding these physical assets can strain financial resources, especially without robust external funding. For instance, the national average cost for maintaining a cemetery property can range from $5,000 to $15,000 per acre annually, a considerable ongoing expense.

The integration of newly acquired businesses presents ongoing challenges. Diverse operational systems, varying technological infrastructures, and distinct corporate cultures can lead to inefficiencies and hinder the realization of expected synergies. This complexity can slow down the pace of consolidation and impact overall operational smoothness.

The death care industry is sensitive to public perception, and negative publicity or ethical missteps can severely damage Everstory Partners' reputation and community trust. A single mishandled service, amplified by social media, could lead to a significant decline in new business, as seen with industry competitors experiencing drops of up to 15% in pre-need arrangements following negative press in 2024.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Capital Intensive Operations | High expenditure for physical asset maintenance, upgrades, and regulatory compliance. | Financial strain, potential limitations on growth and investment. | Cemetery property maintenance can cost $5,000-$15,000 per acre annually. |

| Integration Complexity | Challenges in merging diverse operational procedures, technologies, and cultures of acquired entities. | Operational inefficiencies, delayed synergy realization, potential resistance from staff. | Acquisition integration can take 12-24 months to fully realize expected cost savings. |

| Reputational Sensitivity | Vulnerability to negative publicity and ethical concerns impacting community trust. | Erosion of brand loyalty, loss of clients, increased regulatory scrutiny. | Industry competitors saw up to 15% decline in pre-need arrangements after negative publicity in 2024. |

Preview Before You Purchase

Everstory Partners SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The death care market is a significant growth area, with projections indicating it will reach $142.2 billion by 2025 and expand to $164.6 billion by 2033. This upward trend is largely fueled by an aging global population, which naturally increases the need for end-of-life services.

This demographic shift creates a sustained and growing demand for the services Everstory Partners provides, ensuring a stable customer base. The increasing life expectancy in many developed nations, coupled with the sheer volume of baby boomers entering their later years, solidifies this market's long-term viability.

The funeral industry is rapidly embracing digitalization, with consumers increasingly seeking online planning tools, virtual memorial services, and digital contract management. This shift presents a clear opportunity for Everstory Partners to leverage its recent technology investments. For instance, a 2024 survey indicated that over 60% of individuals planning funerals are comfortable using digital platforms for arrangements.

Concurrently, there's a growing demand for environmentally conscious disposition options, such as green burials and natural urns. This trend aligns perfectly with Everstory's capacity to integrate and promote eco-friendly services. The market for green funerals is projected to grow by nearly 15% annually through 2025, reflecting a significant consumer preference shift that Everstory can actively address.

The death care industry is ripe for consolidation, with larger entities absorbing smaller operations. Everstory Partners has strategically engaged in this trend, notably acquiring properties from Park Lawn Corporation in late 2023. This ongoing consolidation presents a significant opportunity for Everstory to expand its footprint and increase its market dominance through further targeted acquisitions.

Increased Adoption of Pre-Need Planning

The increasing consumer interest in pre-need funeral planning presents a significant growth avenue for Everstory Partners. This trend is driven by a desire for certainty and a way to alleviate future burdens on loved ones. In 2024, the pre-need market continues to expand, with many consumers actively seeking to lock in prices and personalize arrangements in advance.

Everstory Partners is well-positioned to capitalize on this shift. By enhancing its existing pre-planning programs and implementing targeted marketing campaigns, the company can attract more individuals looking to make these arrangements. This proactive approach not only secures future revenue streams but also strengthens Everstory's market presence.

- Growing Market Share: Pre-need arrangements are increasingly becoming the preferred method for funeral planning, indicating a substantial market opportunity.

- Revenue Stability: Expanding pre-need offerings can create more predictable and stable long-term revenue for Everstory Partners.

- Customer Loyalty: Robust pre-planning programs can foster greater customer loyalty and brand preference.

- Competitive Advantage: Differentiating through superior pre-need services can provide a distinct edge over competitors.

Diversification of Service Offerings

Everstory Partners has a significant opportunity to broaden its services beyond traditional funeral arrangements. The market is showing increased demand for personalized ceremonies, unique memorialization products, and even pet funeral services, reflecting evolving consumer preferences. By integrating these offerings, Everstory can tap into new revenue streams and cater to a wider client base.

For instance, the pet loss industry is experiencing substantial growth. In 2023, the global pet care market was valued at over $260 billion, with pet services, including end-of-life care, representing a significant portion. This indicates a strong market for specialized pet funeral services that Everstory could develop.

- Expand into personalized memorialization: Offer custom urns, memorial jewelry, and digital legacy services.

- Develop pet bereavement services: Create tailored funeral and cremation options for pets, including grief support resources.

- Introduce pre-need planning for niche services: Allow clients to plan for unique ceremonies or pet memorials in advance.

Everstory Partners can leverage the growing demand for personalized and eco-friendly death care options. The market is shifting towards unique memorialization products and environmentally conscious disposition methods, presenting a clear avenue for service expansion. Furthermore, the ongoing consolidation within the death care industry offers significant opportunities for strategic acquisitions, allowing Everstory to increase its market share and operational footprint.

| Opportunity Area | Market Trend | Everstory's Potential Action |

|---|---|---|

| Personalized Memorialization | Increasing demand for custom urns, memorial jewelry, and digital legacy services. | Develop and market a wider range of unique memorial products. |

| Eco-Friendly Dispositions | Growing consumer preference for green burials and natural urns, with the market projected to grow by 15% annually through 2025. | Expand offerings and marketing of sustainable funeral options. |

| Industry Consolidation | Larger entities acquiring smaller ones; Everstory acquired properties from Park Lawn Corporation in late 2023. | Pursue further targeted acquisitions to expand market presence. |

| Digitalization | Over 60% of individuals planning funerals in 2024 are comfortable using digital platforms for arrangements. | Enhance online planning tools and virtual services. |

Threats

The ongoing shift towards cremation, with over 60% of Americans opting for it in 2023 and projections indicating this figure could surpass 80% by 2040, directly impacts traditional funeral service providers. This trend, fueled by cost-effectiveness and growing environmental considerations, presents a significant challenge to businesses heavily reliant on cemetery plots and traditional burial services, such as Everstory Partners.

Everstory Partners faces a highly competitive landscape, populated by both large, established corporations and numerous smaller, often family-owned businesses. For instance, Service Corporation International (SCI) remains a dominant force in the industry. This market fragmentation intensifies pricing pressures and makes it challenging for any single player to capture significant market share.

The death care industry, including Everstory Partners, operates under a complex web of state and federal regulations. These cover everything from how facilities are run and land is used to how consumers are protected. For instance, shifts in zoning laws or new consumer rights legislation could directly impact Everstory's operational efficiency and necessitate increased spending on compliance measures.

In 2024, the ongoing evolution of consumer protection laws, particularly those related to pre-need arrangements and pricing transparency, presents a significant area of focus for companies like Everstory. Adapting to these evolving standards often involves updating sales processes, training staff, and potentially revising contract language, all of which contribute to increased operational costs and can affect profit margins.

Economic Downturns and Affordability Concerns

Economic downturns pose a significant threat to Everstory Partners by potentially reducing consumer spending on funeral services. This could steer demand away from premium offerings towards more budget-friendly choices, such as direct cremation, impacting revenue streams for higher-margin products.

Affordability gaps and cost constraints are already evident challenges within the death care market. For instance, a 2024 report indicated that nearly 40% of Americans found funeral costs to be a significant financial burden, suggesting a growing sensitivity to price among consumers.

This economic pressure could manifest in several ways:

- Decreased demand for customizable or elaborate funeral packages.

- Increased consumer interest in simpler, more economical service options.

- Potential for delayed or foregone services due to financial limitations.

- Heightened price competition among funeral service providers.

Reputational Risk from Data Breaches or Service Issues

Everstory Partners faces significant reputational risk as its reliance on digital platforms for contracts and record-keeping grows. A data breach could expose sensitive customer information, severely eroding trust. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, highlighting the financial and reputational fallout.

Widespread service disruptions or negative publicity stemming from any of Everstory Partners' numerous locations could also quickly tarnish its brand image. In 2024, companies experiencing significant service outages often saw a dip in customer satisfaction scores by as much as 30% within weeks of the incident.

- Increased Vulnerability: Growing digital dependency amplifies the risk of data breaches affecting sensitive client records.

- Erosion of Trust: A single breach or service failure can rapidly diminish consumer confidence built over years.

- Financial Repercussions: Data breaches can incur substantial costs, including regulatory fines and remediation expenses, impacting profitability.

- Brand Damage: Negative publicity from service issues across multiple locations can create a lasting stain on Everstory Partners' reputation.

The increasing preference for cremation, projected to exceed 80% by 2040, directly challenges Everstory Partners' traditional burial-focused business model. Intense competition from both large players like Service Corporation International and smaller, localized providers also exerts downward pressure on pricing and market share. Furthermore, evolving consumer protection laws and economic sensitivities necessitate costly adaptations and can shift demand towards more affordable options.

SWOT Analysis Data Sources

This Everstory Partners SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial statements, detailed market research reports, and insights from industry experts to ensure a robust and informed strategic overview.