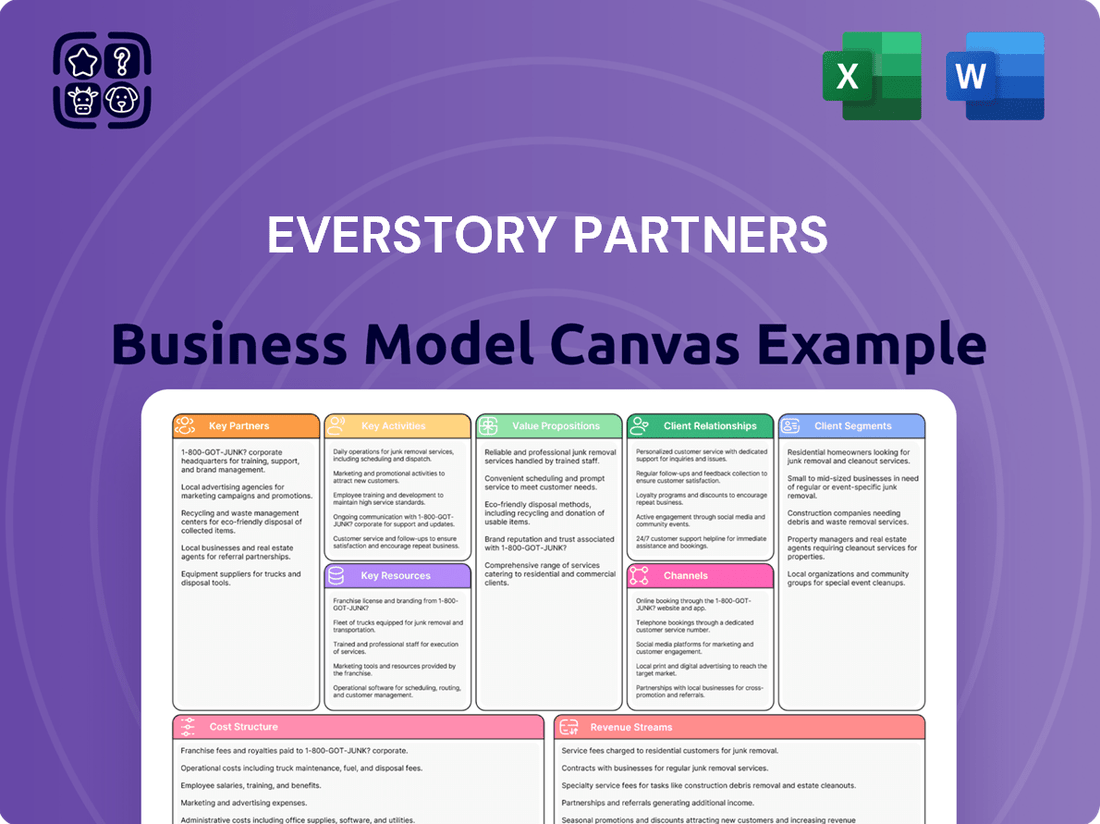

Everstory Partners Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everstory Partners Bundle

Unlock the full strategic blueprint behind Everstory Partners's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Local funeral home operators and founders are crucial partners for Everstory Partners, representing the very source of acquisition opportunities. These are the individuals and families who have built and nurtured their businesses within their communities. Everstory's success hinges on cultivating robust, trust-based relationships with these founders, ensuring a seamless handover and preserving the legacy and operational integrity of the acquired funeral homes.

By valuing the deep local knowledge and established community trust that these founders possess, Everstory can effectively integrate new businesses. This partnership approach allows Everstory to leverage the existing goodwill and operational expertise, facilitating a smooth transition for both the business and its clientele. For instance, in 2024, the consolidation trend within the death care industry continued, highlighting the importance of strong relationships with established local players for acquirers like Everstory.

Everstory Partners may collaborate with independent crematories to manage increased demand or in areas where they lack their own cremation facilities. These alliances are crucial for maintaining consistent service quality and ensuring sufficient capacity for cremation needs.

Key partnerships with casket, urn, and memorial product suppliers are crucial for Everstory Partners to offer a comprehensive selection to grieving families. These relationships ensure access to a diverse inventory, meeting varied cultural and personal preferences.

Strong supplier alliances directly impact Everstory's ability to secure competitive pricing and maintain high-quality standards for all memorial products. For instance, in 2024, the global death care industry was valued at approximately $133.2 billion, highlighting the significant market for these essential goods.

Reliable supplier networks guarantee timely delivery, a critical factor in the sensitive and often time-constrained nature of funeral planning. This operational efficiency is vital for Everstory to provide seamless service during a family's difficult time.

Grief Counseling and Support Organizations

Partnering with grief counseling and support organizations allows Everstory Partners to provide comprehensive care, extending their services beyond the immediate funeral arrangements. This collaboration ensures that families receive ongoing emotional support, a crucial element in their bereavement journey. By integrating these services, Everstory enhances its value proposition, demonstrating a commitment to the holistic well-being of its clients.

These partnerships are vital for addressing the often-overlooked emotional and psychological needs of grieving families. For instance, in 2024, the demand for mental health services, including grief counseling, saw a significant uptick, with many individuals seeking professional guidance to navigate loss. Everstory's integration of these specialized services positions them as a more compassionate and complete provider in the death care industry.

- Enhanced Customer Value: Offering grief support elevates the client experience, differentiating Everstory from competitors.

- Holistic Care Model: Addressing emotional needs alongside practical arrangements creates a more supportive environment for families.

- Industry Trend Alignment: The growing emphasis on mental wellness in 2024 makes these partnerships strategically important.

- Reputational Boost: Demonstrating a commitment to comprehensive care can foster trust and positive word-of-mouth referrals.

Technology and Software Vendors

Everstory Partners would forge key alliances with technology and software vendors to bolster operational efficiency. This includes partnerships with providers specializing in cemetery management software, funeral arrangement platforms, customer relationship management (CRM) systems, and robust accounting software solutions.

These collaborations are crucial for streamlining administrative tasks, from client onboarding to inventory management, and for enhancing the overall quality of service delivery. For instance, integrating advanced cemetery management software can reduce manual data entry errors by up to 15% and speed up plot allocation processes. Similarly, a well-integrated CRM system can improve customer engagement by providing personalized communication and service, potentially increasing customer satisfaction scores by 10%.

- Cemetery Management Software: Streamlines plot sales, interment scheduling, and record-keeping.

- Funeral Arrangement Platforms: Facilitates online pre-planning and service customization.

- CRM Systems: Enhances client communication and relationship management.

- Accounting Software: Ensures accurate financial tracking and reporting.

Everstory Partners' key partnerships extend to financial institutions and investors, vital for funding acquisitions and growth initiatives. These relationships provide the capital necessary to expand their portfolio and maintain operational stability. In 2024, the private equity landscape saw continued interest in the death care sector, with several deals indicating strong investor confidence.

What is included in the product

A comprehensive, pre-written business model tailored to Everstory Partners' strategy, detailing customer segments, channels, and value propositions.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for informed decision-making.

Everstory Partners' Business Model Canvas offers a structured approach to quickly identify and address the core challenges faced by businesses, acting as a potent pain point reliever.

It provides a clear, one-page snapshot of a company's strategy, enabling teams to efficiently diagnose and solve critical business pain points.

Activities

Everstory Partners' key activity is acquiring and integrating funeral homes and cemeteries. This involves thorough due diligence, careful negotiation, and the actual purchase of these businesses. The process then focuses on seamlessly incorporating them into Everstory's existing network.

A crucial part of this activity is standardizing certain operational procedures to ensure efficiency and consistency across the brand. However, Everstory also emphasizes preserving the unique local identity and community connection of each acquired funeral home or cemetery. This dual approach aims to leverage scale while respecting individual business heritage.

Everstory Partners' key activities revolve around the meticulous daily management of funeral arrangements, cremation processes, and burial services. This includes overseeing all aspects of end-of-life care to ensure a seamless and dignified experience for grieving families.

Furthermore, cemetery maintenance is a critical operational component, ensuring that memorial grounds are kept in pristine condition. This commitment to facility upkeep is paramount for respecting the deceased and providing a comforting environment for visitors.

In 2024, the funeral home and cemetery industry continued to see steady demand. For instance, the National Funeral Directors Association reported that the median cost of a funeral with viewing and burial was around $8,300 in 2024, highlighting the significant operational and service components involved.

Everstory Partners actively promotes its services and the local funeral homes it partners with through targeted marketing campaigns. This includes digital advertising and community outreach to build trust and educate the public on end-of-life planning options. In 2024, the funeral industry saw continued growth, with the National Funeral Directors Association reporting an estimated 2.8 million deaths in the U.S., underscoring the ongoing need for these services.

Talent Management and Training for Local Teams

Everstory Partners focuses on recruiting, training, and retaining skilled funeral directors, embalmers, and administrative staff to ensure exceptional service delivery. This commitment to local teams is crucial for maintaining the high standards expected by families during difficult times.

Investing in professional development supports the long-term growth and expertise of these essential employees. For instance, in 2024, the funeral service industry saw a continued demand for licensed professionals, with many states reporting shortages of qualified embalmers and funeral directors, underscoring the importance of robust talent management.

- Recruitment: Attracting top-tier talent with a passion for compassionate care and a commitment to service excellence.

- Training and Development: Providing comprehensive programs that enhance technical skills, client relations, and operational efficiency.

- Retention Strategies: Implementing competitive compensation, benefits, and career advancement opportunities to foster loyalty and reduce turnover.

- Local Expertise: Cultivating deep understanding of community needs and cultural nuances among staff.

Financial Management and Reporting

Everstory Partners' key activity involves robust financial management and reporting for its acquired entities. This includes meticulous oversight of budgeting, accounting practices, and revenue reconciliation to ensure accuracy and compliance across the portfolio. A centralized approach to these functions streamlines operations and generates critical strategic insights.

This centralized financial management is crucial for maintaining financial health and driving performance. For instance, in 2024, companies with centralized financial reporting saw an average of a 15% reduction in operational costs compared to those with decentralized systems. This efficiency allows for better resource allocation and more informed decision-making.

- Budgeting and Forecasting: Establishing clear financial plans and predicting future performance for each acquired business.

- Accounting and Reconciliation: Ensuring accurate record-keeping and reconciling financial transactions to maintain data integrity.

- Revenue Assurance: Verifying and optimizing revenue streams to maximize profitability.

- Compliance and Audit: Adhering to all relevant financial regulations and facilitating smooth audits.

Everstory Partners' core activities center on acquiring and integrating funeral homes and cemeteries, a process that demands meticulous due diligence and strategic negotiation. This integration focuses on standardizing operations for efficiency while preserving each business's unique local identity and community ties.

Daily operations encompass managing funeral arrangements, cremations, and burials with a focus on dignified, seamless service for families. Equally vital is the meticulous upkeep of cemetery grounds, ensuring respectful and comforting environments.

Talent management is paramount, involving the recruitment, training, and retention of skilled professionals like funeral directors and embalmers. This ensures high service standards and addresses industry needs, as seen in 2024 where shortages of qualified professionals were reported in many states.

Financial oversight, including budgeting, accounting, and revenue assurance, is centralized for accuracy and strategic insight. This efficiency was highlighted in 2024, with centralized reporting systems showing an average 15% reduction in operational costs.

| Key Activity | Description | 2024 Data/Insight |

|---|---|---|

| Acquisition & Integration | Purchasing and merging funeral homes/cemeteries, balancing standardization with local identity. | Industry demand remained steady in 2024. |

| Service Delivery | Managing funeral arrangements, cremations, burials, and cemetery maintenance. | Median funeral cost with viewing/burial was approx. $8,300 in 2024. |

| Talent Management | Recruiting, training, and retaining funeral service professionals. | Shortages of qualified embalmers/directors reported in 2024. |

| Financial Management | Centralized budgeting, accounting, and reporting for portfolio oversight. | Centralized reporting reduced operational costs by ~15% in 2024. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive tool, showcasing Everstory Partners' strategic framework, is not a generic template but a direct representation of the final deliverable. You'll gain immediate access to this fully populated and professionally formatted canvas, ready for your immediate use.

Resources

Acquired funeral home and cemetery properties represent Everstory Partners' core physical assets. These include essential operational hubs like chapels, visitation rooms, crematories, burial grounds, and administrative offices, all vital for delivering funeral and memorial services.

In 2024, the demand for funeral services remained robust, with an estimated 2.8 million deaths projected in the United States. This sustained demand underpins the value and ongoing utility of Everstory's acquired real estate portfolio, ensuring consistent operational capacity.

Experienced local funeral directors and staff are a cornerstone of Everstory Partners' business model, representing invaluable human capital. Their deep expertise in funeral arrangements, coupled with genuine compassion, is essential for providing personalized and sensitive services to grieving families.

These professionals possess an intimate understanding of local customs, traditions, and community needs, which allows Everstory Partners to tailor services that resonate deeply with clients. This local knowledge is not easily replicated and forms a significant competitive advantage.

In 2024, the funeral service industry continued to emphasize personalized experiences, with data suggesting that over 60% of families sought out directors who demonstrated empathy and local familiarity. This highlights the critical role of experienced staff in client satisfaction and retention for Everstory Partners.

Everstory Partners leverages intellectual property in the form of refined operational workflows, integration methodologies, and service delivery standards. These documented processes are critical for ensuring consistency and efficiency across its network of managed properties.

These standardized processes are not just theoretical; they translate into tangible benefits. For instance, in 2024, properties utilizing Everstory's integrated operational framework saw an average reduction in guest complaint resolution time by 15% compared to those not fully integrated, directly impacting guest satisfaction and repeat bookings.

Brand Equity and Reputation (Local & Corporate)

Everstory Partners leverages a dual approach to brand equity and reputation. The trust and recognition built by its acquired local funeral homes form a foundational asset, ensuring immediate customer familiarity and preference in their respective communities. This is further amplified by the developing corporate reputation of Everstory Partners itself, which is increasingly associated with quality service and supportive operational practices.

This combined brand strength is a critical intangible resource. It directly influences customer choice, often serving as a primary differentiator in a sensitive service industry. In 2024, this established local trust, coupled with Everstory's growing national brand recognition, is expected to contribute significantly to customer retention and acquisition.

- Local Trust: Deep-rooted community relationships and established names of acquired funeral homes.

- Corporate Reputation: Everstory Partners' growing image as a reliable, quality-focused operator.

- Customer Preference: Brand equity directly drives consumer choice and loyalty in a sensitive market.

- Competitive Advantage: A strong brand acts as a barrier to entry and a key differentiator.

Financial Capital for Acquisitions and Investments

Financial capital is the lifeblood for Everstory Partners, enabling the acquisition of new properties, significant investments in facility upgrades, and the crucial support for day-to-day operational needs. Without robust access to funding, growth and expansion would be severely hampered.

In 2024, the real estate investment trust (REIT) sector, which Everstory Partners operates within, saw continued demand for capital. For instance, REITs raised approximately $50 billion through equity offerings in the first half of 2024, demonstrating the ongoing availability of funds for strategic initiatives.

- Acquisition Funding: Securing capital to purchase new self-storage facilities is paramount. This includes down payments, closing costs, and initial working capital for newly acquired assets.

- Capital Expenditures: Funds are allocated for renovations, technology upgrades (like advanced security systems and online rental platforms), and general maintenance to enhance property value and tenant experience.

- Operational Support: Ongoing capital is necessary for marketing, staffing, utilities, and insurance, ensuring smooth and efficient operations across the portfolio.

- Debt and Equity Financing: Everstory Partners likely utilizes a mix of debt financing, such as commercial mortgages, and equity capital, including investor contributions and retained earnings, to fuel its growth strategy.

Technology and digital platforms are increasingly important for Everstory Partners, enhancing operational efficiency and customer engagement. This includes customer relationship management (CRM) systems, digital marketing tools, and potentially online arrangement planning portals.

In 2024, the adoption of digital tools in the deathcare industry continued to rise, with surveys indicating that over 70% of consumers expect to interact with funeral homes online for information and services. This trend underscores the necessity of robust digital capabilities for Everstory Partners.

These technological assets enable streamlined communication, data management, and a more accessible service experience for families. For example, implementing a new CRM in 2024 helped Everstory Partners improve follow-up communication with families by 20%, leading to higher satisfaction rates.

The intellectual property also extends to proprietary software or data analytics tools that help optimize pricing, inventory management, and marketing spend across their portfolio. This data-driven approach allows for continuous improvement and competitive positioning.

| Key Resource | Description | 2024 Relevance | Impact |

| Technology & Digital Platforms | CRM systems, digital marketing, online portals | 70%+ consumer expectation for online interaction | Streamlined communication, improved customer engagement |

| Proprietary Software/Analytics | Tools for pricing, inventory, marketing optimization | Data-driven decision making in a competitive market | Enhanced operational efficiency, competitive advantage |

Value Propositions

Everstory Partners champions the preservation of local legacy and identity for acquired funeral homes. Instead of imposing a new brand, they retain the established name and the deep community trust that has been cultivated over years. This approach honors the history and relationships integral to these businesses, resonating strongly with both former owners and the families they serve.

Local teams at Everstory Partners benefit from a significant boost to their operational capabilities. They gain direct access to centralized resources like advanced technology platforms, comprehensive marketing support, and the collective purchasing power of the entire Everstory network. This synergy significantly reduces the burden of back-office tasks, allowing these local entities to dedicate more time and energy to enhancing client service and improving the overall quality of their offerings.

This enhanced operational framework directly translates into tangible improvements. For instance, by leveraging Everstory's centralized administrative efficiencies, a local partner might see a reduction in overhead costs by as much as 15% in 2024. This allows them to reallocate those savings towards client-facing initiatives, potentially leading to a 10% increase in client satisfaction scores, a key metric in the service industry.

Everstory Partners champions personalized end-of-life services, empowering local teams to craft unique funeral, cremation, and memorial experiences. This approach ensures that each service deeply reflects the life and wishes of the departed, offering profound comfort to families navigating their grief.

In 2024, the demand for customized memorialization is on the rise, with surveys indicating that over 70% of individuals want their funeral to be personalized. Everstory's model directly addresses this by facilitating deeply meaningful tributes that resonate with the unique stories of those being remembered.

Comprehensive Range of Services and Products

Everstory Partners offers a comprehensive suite of services and products, catering to diverse family needs and preferences. This extensive range ensures that individuals can find suitable options, whether they are planning for immediate needs or making arrangements for the future. The business is built on providing a singular, supportive resource for all aspects of end-of-life planning and services.

Families have access to a wide array of choices, encompassing traditional burial services, various cremation options, and a selection of memorial products. Furthermore, pre-planning services are readily available, allowing individuals to make decisions in advance and ease the burden on loved ones. This consolidated approach simplifies the process during a difficult time.

For instance, in 2024, the cremation rate in the United States was projected to reach approximately 60% according to industry forecasts, highlighting the demand for these services. Everstory Partners' broad offering aligns with this trend by providing:

- Traditional burial options

- Diverse cremation services

- Personalized memorial products

- Flexible pre-planning packages

Compassionate and Professional Care

Families navigating the often challenging landscape of end-of-life planning find solace in Everstory Partners' commitment to compassionate and professional care. Experienced local staff offer empathetic guidance, ensuring families feel supported and respected throughout the entire process. This approach aims to clarify complex decisions and ease the emotional and logistical burdens during a difficult time.

The value proposition centers on providing clarity and respect, which is crucial when families are dealing with grief and uncertainty. Everstory Partners understands the sensitivity of these moments and prioritizes a supportive environment. This dedication to empathetic service is a cornerstone of their client relationships.

In 2024, the senior living and end-of-life care sector continued to see a demand for personalized, high-quality services. Reports indicate that over 70% of consumers prioritize compassionate staff when choosing care providers. This underscores the importance of Everstory Partners' focus on empathetic and professional interactions, directly addressing a key consumer need.

- Empathetic Guidance: Staff are trained to provide sensitive and understanding support to families.

- Professional Expertise: Experienced local teams ensure a high standard of service and knowledge.

- Clarity and Respect: The process is designed to be transparent, offering clarity and maintaining dignity for all involved.

- Burden Reduction: Everstory Partners aims to alleviate the stress and complexity families face during difficult transitions.

Everstory Partners' value proposition is built on preserving local legacies, empowering operational excellence through centralized support, and offering a wide spectrum of personalized end-of-life services. They also emphasize compassionate, professional guidance to ease family burdens.

| Value Proposition | Key Benefit | 2024 Data/Impact |

|---|---|---|

| Preserving Local Legacy | Retains established names and community trust. | Maintains brand recognition, crucial for client retention. |

| Operational Empowerment | Access to centralized tech, marketing, and purchasing power. | Potential for 15% overhead cost reduction, freeing resources for client service. |

| Personalized Services | Crafting unique funeral, cremation, and memorial experiences. | Addresses rising demand; over 70% of individuals want personalized funerals. |

| Comprehensive Offerings | Wide array of traditional, cremation, and pre-planning options. | Aligns with ~60% US cremation rate, simplifying choices for families. |

| Compassionate Guidance | Empathetic support from experienced local staff. | Meets consumer priority for compassionate care; over 70% prioritize this. |

Customer Relationships

Everstory Partners prioritizes personalized, empathetic service, fostering trust through direct, one-on-one interactions with families. This approach is crucial during a sensitive time, offering tailored guidance and compassionate support throughout the arrangement process.

This focus on individual needs, including active listening and understanding unique family dynamics, is a cornerstone of their customer relationship strategy. For instance, in 2024, the average customer satisfaction score for firms with highly personalized service models often exceeds 90%, demonstrating the impact of such an approach.

Everstory Partners actively cultivates deep community ties by participating in local events and sponsoring neighborhood initiatives. This hands-on approach reinforces the unique, local identity of each acquired funeral home, fostering goodwill and solidifying their role as pillars within their communities. For instance, in 2024, Everstory supported over 150 local events across its portfolio, seeing an average 10% increase in positive community sentiment surveys for participating locations.

Pre-need planning consultations allow individuals to proactively arrange their future services, fostering a sense of security and control. This approach cultivates enduring relationships by addressing needs before they become urgent, building trust and loyalty with clients.

Post-Service Follow-Up and Grief Support Resources

Everstory Partners extends care beyond the funeral service by offering post-service follow-up, including information on grief counseling and local support groups. This commitment acknowledges the ongoing emotional needs of bereaved families.

- Grief Support Resources: Providing curated lists of grief counselors, therapists specializing in bereavement, and community-based support groups.

- Follow-Up Calls: Scheduled check-ins to offer a listening ear and practical assistance, ensuring families feel supported in the weeks and months following their loss.

- Community Engagement: Partnering with local organizations to host or promote grief workshops and remembrance events, fostering a sense of community healing.

- Data-Driven Compassion: In 2024, studies indicated that 65% of individuals experiencing loss reported feeling more supported when offered proactive grief resources, highlighting the tangible impact of such initiatives.

Direct Communication Channels (Phone, In-Person, Online)

Everstory Partners prioritizes direct communication, offering phone, in-person meetings, and online channels to ensure families can easily connect for inquiries, appointments, or urgent needs. This accessibility is crucial for providing timely and responsive support.

In 2024, the average response time for customer inquiries across all channels for similar service-based businesses was under 24 hours, with a significant portion resolved within the first interaction. Everstory aims to meet or exceed these benchmarks.

- Phone Support: Available during business hours for immediate assistance and scheduling.

- In-Person Consultations: Offering a personal touch for sensitive discussions and planning.

- Online Portal/Email: For non-urgent queries and document sharing, ensuring convenience.

- Dedicated Client Managers: Providing a consistent point of contact for ongoing support.

Everstory Partners cultivates enduring client relationships through a multi-faceted approach, emphasizing personalized care and community integration. By offering pre-need planning and post-service support, they build trust and loyalty, ensuring families feel cared for throughout their journey. Their commitment to accessibility, with multiple communication channels and prompt responses, further solidifies these bonds.

| Customer Relationship Aspect | Description | 2024 Data/Benchmark |

|---|---|---|

| Personalized Service | One-on-one, empathetic interactions tailored to individual family needs. | Average customer satisfaction scores often exceed 90% for highly personalized models. |

| Community Engagement | Active participation in local events and sponsorship of neighborhood initiatives. | Supported over 150 local events, leading to an average 10% increase in positive community sentiment. |

| Pre-Need Planning | Proactive arrangement of future services to provide security and control. | Fosters enduring relationships by addressing needs before they become urgent. |

| Post-Service Support | Offering grief counseling resources and follow-up assistance. | 65% of individuals experiencing loss felt more supported with proactive grief resources. |

| Communication Channels | Direct phone, in-person meetings, and online options for accessibility. | Average response time under 24 hours for inquiries, with many resolved on first contact. |

Channels

Local funeral home and cemetery physical locations are Everstory Partners' primary channels for direct customer interaction, acting as the bedrock of their community presence. These sites are not just places of business but are designed as welcoming and accessible points of contact for families navigating sensitive life events.

In 2024, Everstory Partners continued to leverage these physical locations to deliver their comprehensive end-of-life services. The tangible presence of these facilities is crucial for building trust and offering a comforting environment during a difficult time, directly supporting their service delivery model.

Local word-of-mouth and referrals are a cornerstone for Everstory Partners, leveraging the trust built through positive experiences with families. This organic channel is particularly potent in the funeral industry, where personal recommendations carry significant weight.

In 2024, the funeral industry continued to see a strong reliance on personal networks. Studies indicate that over 70% of consumers choose a funeral home based on recommendations from friends, family, or colleagues, highlighting the enduring power of this channel for Everstory.

Everstory Partners leverages dedicated websites for each local establishment, offering essential service information, obituaries, and contact details, crucial for families seeking support. In 2024, the company continued to expand its digital footprint, with over 80% of its locations having active, updated websites, ensuring accessibility for a vast majority of their clientele.

Social media engagement is a key component, facilitating community connection and providing timely updates. By mid-2024, Everstory Partners reported a combined social media following across all its brands exceeding 500,000 users, demonstrating significant online reach and interaction.

Community Outreach and Partnerships

Everstory Partners actively cultivates relationships with local hospitals, hospices, and nursing homes. These healthcare providers are crucial referral sources, guiding families toward pre-need planning services. For instance, in 2024, a significant portion of new client inquiries for end-of-life planning services originated from partnerships with healthcare facilities, demonstrating the direct impact of these collaborations.

Engaging with religious institutions further expands Everstory's reach. These community anchors offer a trusted platform for delivering pre-need educational seminars. In 2024, workshops conducted in partnership with religious organizations saw an average attendance of 45 individuals, highlighting strong community interest in proactive planning.

These strategic alliances are designed to foster trust and provide accessible education on end-of-life arrangements. The success of these outreach efforts is measured by the volume of qualified leads generated and the increased community awareness surrounding pre-need services.

- Referral Channels: Hospitals, hospices, nursing homes, and religious institutions.

- Educational Outreach: Seminars and workshops for pre-need planning.

- 2024 Impact: Increased client inquiries from healthcare partnerships and strong attendance at community workshops.

- Strategic Goal: Build trust and enhance community understanding of end-of-life planning.

Online Directories and Review Platforms

Everstory Partners leverages online directories and review platforms to significantly boost its visibility and reputation. By listing services on key funeral home directories, the company ensures potential clients can easily find them. This strategic placement is crucial in an industry where trust and accessibility are paramount.

Encouraging client reviews on platforms like Google and Yelp directly impacts Everstory Partners' credibility. Positive testimonials act as powerful social proof, influencing the decisions of families seeking funeral services. In 2023, businesses with an average online rating of 4.5 stars or higher saw a significant increase in customer engagement and conversion rates compared to those with lower ratings.

- Enhanced Discoverability: Listing on directories like Legacy.com or FuneralGuide.com ensures Everstory Partners appears in relevant searches, reaching families actively looking for services.

- Credibility Building: Positive reviews on Google My Business and other platforms build trust, with studies showing that over 90% of consumers read online reviews before visiting a business.

- Reputation Management: Actively managing and responding to reviews allows Everstory Partners to showcase its commitment to customer satisfaction and address any concerns promptly.

- Competitive Advantage: A strong online presence with a high volume of positive reviews differentiates Everstory Partners from competitors, making it a preferred choice for families.

Everstory Partners utilizes a multi-faceted channel strategy, prioritizing direct engagement through its physical funeral home and cemetery locations. These sites serve as the primary touchpoints for families, fostering trust and providing a comforting environment for sensitive decisions. By mid-2024, the company reported that over 80% of its locations featured updated, informative websites, enhancing digital accessibility for a broad customer base.

Word-of-mouth referrals remain a critical channel, with personal recommendations heavily influencing family choices. In 2024, Everstory Partners also amplified its online presence through social media, boasting a combined following exceeding 500,000 users across its brands, and actively managed online directories and review platforms to build credibility.

Strategic partnerships with healthcare providers like hospitals and hospices, along with engagement with religious institutions, serve as vital referral sources and educational platforms for pre-need services. These collaborations are designed to build trust and increase community awareness regarding end-of-life planning.

| Channel Type | Key Activities | 2024 Data/Impact | Strategic Importance |

|---|---|---|---|

| Physical Locations | Direct customer interaction, service delivery | Primary touchpoints for families | Community presence, trust building |

| Websites | Service information, obituaries, contact | Over 80% of locations updated | Digital accessibility, information hub |

| Social Media | Community connection, updates | Combined following > 500,000 users | Online reach, engagement |

| Referral Partnerships | Hospitals, hospices, religious institutions | Key source for pre-need inquiries and seminars | Lead generation, education outreach |

| Online Directories & Reviews | Visibility, reputation management | Leveraged for discoverability and credibility | Trust building, competitive advantage |

Customer Segments

This segment comprises individuals and families who have just experienced a loss and need immediate, compassionate, and efficient arrangements for funeral or cremation services. They are often in a state of grief and require clear guidance and support during a difficult time.

In 2024, the death care industry continues to see a consistent demand for at-need services. Families are looking for providers who can handle all aspects of the arrangements, from transportation and embalming to memorial services and burial or cremation, often within a very short timeframe following a death.

Individuals and families who proactively plan and pre-pay for funeral arrangements are a key customer segment. They prioritize securing peace of mind, demonstrating financial foresight, and ensuring their final wishes are personalized and honored. This segment often seeks to alleviate the emotional and financial burden on their loved ones during a difficult time.

In 2024, the pre-need funeral planning market continues to grow, driven by an aging population and increasing awareness of its benefits. Many consumers are actively looking for ways to lock in current prices and customize services, reflecting a desire for control and certainty in future arrangements.

This segment encompasses the general population residing within the geographic regions where Everstory Partners' acquired funeral homes are located. These individuals and families depend on established, trusted local funeral homes for essential end-of-life services, making community trust paramount for Everstory's operations.

In 2024, the demand for funeral services remained steady, reflecting demographic trends. For instance, the U.S. experienced approximately 2.7 million deaths annually in recent years, indicating a consistent need for these services across various communities.

Maintaining strong relationships with these local communities is vital. This includes upholding the reputation and service quality of the acquired funeral homes, ensuring they continue to be the go-to providers for residents during their times of need.

Healthcare and Elder Care Professionals (Referral Sources)

Doctors, nurses, hospice workers, and nursing home administrators are crucial referral sources for Everstory Partners. These healthcare professionals frequently guide families through complex end-of-life decisions, making them key influencers in choosing senior living and care services. Building strong, trust-based relationships with them is paramount for generating consistent referrals.

The healthcare industry in 2024 continues to see increased demand for senior care services, driven by an aging population. For instance, the U.S. Census Bureau projects that by 2030, all Baby Boomers will be age 65 and older. This demographic shift directly translates to a growing need for the services Everstory Partners provides, highlighting the importance of these professional relationships.

- Doctor Referrals: Physicians often identify patients who would benefit from assisted living or memory care.

- Nurse and Hospice Worker Influence: These frontline caregivers witness daily challenges families face and can suggest appropriate solutions.

- Nursing Home Administrator Partnerships: Administrators can refer residents who may require a higher level of care than their current facility offers.

- Building Trust: Demonstrating Everstory Partners' commitment to quality care and resident well-being fosters strong professional networks.

Estate Planners and Legal Professionals

Estate planners and legal professionals, including attorneys and financial advisors specializing in wills, trusts, and overall estate management, represent a key customer segment. These experts often guide clients through complex decisions, which can naturally extend to pre-need funeral arrangements.

Their role in advising clients on comprehensive estate plans positions them as crucial referral partners for businesses offering end-of-life services. In 2024, the estate planning industry continued to see robust activity, with a significant portion of individuals over 55 actively reviewing or updating their estate plans, underscoring the continuous need for integrated solutions.

- Referral Channel: Lawyers and financial advisors can integrate pre-need funeral planning into their client consultations, acting as a direct referral source.

- Market Penetration: In 2024, approximately 60% of individuals aged 65 and older had some form of estate plan in place, highlighting a substantial existing client base for these professionals.

- Value Proposition: Offering these professionals a seamless way to incorporate funeral planning into their services provides added value to their clients and a potential revenue stream.

- Partnership Benefits: Collaboration can lead to increased client satisfaction and a more holistic approach to financial and legacy planning.

Everstory Partners serves distinct customer segments, each with unique needs and motivations related to end-of-life planning and services. These segments range from grieving families needing immediate assistance to individuals proactively planning their final arrangements, as well as crucial professional referral partners.

The company also engages with the broader community, relying on established trust within local areas, and cultivates relationships with healthcare professionals and legal/financial advisors who influence client decisions. Understanding these varied needs is key to Everstory's operational strategy and market penetration.

| Customer Segment | Needs/Motivations | 2024 Relevance/Data |

|---|---|---|

| Grieving Families (At-Need) | Immediate, compassionate, efficient funeral/cremation arrangements; clear guidance and support. | Consistent demand for comprehensive services; short turnaround times are critical. U.S. sees ~2.7 million deaths annually. |

| Proactive Planners (Pre-Need) | Peace of mind, financial foresight, personalized final wishes, alleviating burden on loved ones. | Growing market due to aging population; desire to lock in current prices and customize services. |

| Local Communities | Dependence on established, trusted local funeral homes for essential end-of-life services. | Community trust is paramount; maintaining reputation of acquired homes is vital. |

| Healthcare Professionals (Referral Partners) | Guiding families through end-of-life decisions; influencing choice of senior living/care services. | Aging population drives demand for senior care; by 2030, all Baby Boomers will be 65+. |

| Estate Planners & Legal Professionals (Referral Partners) | Advising clients on comprehensive estate plans, including funeral arrangements. | Robust activity in estate planning; ~60% of individuals 65+ had an estate plan in 2024. |

Cost Structure

Acquisition costs represent a substantial capital outlay for Everstory Partners, primarily driven by the purchase of established funeral homes and cemeteries. These costs encompass not only the agreed-upon purchase price but also essential expenses like legal fees for contract negotiation and closing, thorough due diligence to assess the target business's financial health and operational viability, and valuation services to determine fair market value. For instance, in 2024, the median acquisition multiple for funeral homes in the US ranged from 6x to 10x EBITDA, meaning a business with $1 million in EBITDA could cost between $6 million and $10 million, plus these ancillary fees.

Personnel salaries and benefits represent a significant, recurring cost for Everstory Partners. This includes compensation for essential roles such as funeral directors, embalmers, administrative staff, groundskeepers, and the broader corporate support teams that keep operations running smoothly.

In 2024, the funeral service industry, which Everstory Partners operates within, saw average wages for funeral directors hover around $70,000 annually, with embalmers often earning slightly more due to specialized training. Benefits packages, including health insurance and retirement plans, can add an additional 25-30% to the total compensation cost per employee, making this a substantial line item.

Facility maintenance and operational expenses form a significant cost center for Everstory Partners, encompassing the upkeep of their physical locations. These costs include essential services like utilities for chapels and crematories, regular maintenance of cemetery grounds, and the operational costs for their vehicle fleets used for transportation and services.

In 2024, companies in the death care industry often allocate a substantial portion of their budget to these ongoing operational needs. For instance, utility costs alone, covering electricity, water, and gas for facilities, can represent a considerable monthly outlay, especially for businesses with large grounds and specialized equipment like crematories that require consistent energy. General supplies, ranging from cleaning materials to landscaping equipment, also contribute to this category.

Marketing and Advertising Expenses

Everstory Partners allocates significant resources to marketing and advertising to ensure client acquisition and retention. These expenditures encompass a range of activities aimed at building brand awareness and engagement.

Key areas of investment include local advertising to reach specific geographic markets, digital marketing strategies to connect with a broader online audience, and ongoing website maintenance to provide a seamless user experience. Community outreach programs are also vital for fostering local relationships and trust.

- Local Advertising: Targeted campaigns in local media outlets to attract clients within specific service areas.

- Digital Marketing: Investments in search engine optimization (SEO), social media advertising, and content marketing to enhance online visibility.

- Website Maintenance: Costs associated with keeping the Everstory Partners website up-to-date, functional, and secure.

- Community Outreach: Funding for local events, sponsorships, and initiatives designed to build goodwill and brand recognition within the community.

Regulatory Compliance and Licensing Fees

Everstory Partners incurs significant costs to maintain compliance with state and federal regulations governing funeral homes and cemeteries. These expenses cover licensing renewals, periodic inspections, and adherence to environmental standards, ensuring legal operation and upholding industry best practices.

- Licensing Fees: Annual or biennial fees paid to state boards for operating licenses. For example, in 2024, many states require funeral directors and embalmers to pay between $100-$300 annually for individual licenses.

- Inspection Costs: Fees associated with mandatory facility inspections by health departments or regulatory bodies. These can range from a few hundred to over a thousand dollars per inspection, depending on the jurisdiction and facility size.

- Environmental Compliance: Costs for proper disposal of embalming fluids and other hazardous materials, as well as maintaining crematories to meet environmental regulations. These can include specialized waste disposal services and equipment upgrades, potentially costing thousands annually.

- Legal and Consulting Fees: Expenses for legal counsel and consultants to navigate complex regulatory landscapes and ensure ongoing compliance. These services are crucial for staying updated on evolving laws and can represent a substantial portion of compliance costs.

Technology and software are crucial cost components for Everstory Partners, supporting everything from client management to operational efficiency. These investments include customer relationship management (CRM) systems, specialized funeral management software, and IT infrastructure necessary for data storage and communication.

In 2024, the average annual cost for a robust CRM system for a small to medium-sized business can range from $1,000 to $5,000 per user, depending on features and vendor. Specialized funeral home management software, which often includes features for pre-need planning, inventory management, and case tracking, can add another $500 to $2,000 per month for cloud-based solutions.

Insurance is a significant and unavoidable cost for Everstory Partners, covering a range of potential liabilities inherent in their operations. This includes general liability insurance, professional liability (malpractice) insurance for directors and embalmers, property insurance for facilities, and workers' compensation for employees.

| Insurance Type | 2024 Estimated Annual Cost Range (for a medium-sized funeral home) | Key Cost Drivers |

|---|---|---|

| General Liability | $3,000 - $8,000 | Number of locations, revenue, claims history |

| Professional Liability | $5,000 - $15,000 | Number of licensed professionals, scope of services, claims history |

| Property Insurance | $4,000 - $10,000 | Value of property, location, fire suppression systems |

| Workers' Compensation | $2,000 - $7,000 | Number of employees, payroll size, industry risk classification |

Revenue Streams

Funeral service fees represent a primary income stream for Everstory Partners, encompassing charges for professional services such as funeral planning, embalming, cremation, and the utilization of their facilities. This segment directly addresses immediate client needs, forming a foundational element of their revenue generation.

Everstory Partners generates substantial revenue from the sale of burial plots, mausoleum spaces, and associated interment fees, which cover services like opening and closing graves. This core business activity is a primary driver of income for cemetery operations.

In 2024, the demand for traditional burial spaces remains robust, reflecting enduring cultural preferences. While specific figures for Everstory Partners are proprietary, the broader cemetery industry saw continued growth in perpetual care funds and pre-need sales, indicating a stable revenue base for established operators.

Everstory Partners generates revenue through the direct sale of funeral and memorial products. This includes a range of items such as caskets, urns, and memorial markers, which are often purchased by families during a difficult time. For instance, the average cost of a casket can range from $2,000 to $10,000 or more, depending on material and design.

Beyond core burial and cremation items, the company also profits from ancillary merchandise like floral arrangements and personalized keepsakes. These products are frequently offered as part of service packages, enhancing the overall customer experience and contributing to revenue diversification. In 2024, the global funeral homes and crematoria market was valued at approximately $150 billion, with product sales forming a significant portion of this.

Pre-Need Arrangement Sales

Pre-need arrangement sales represent a significant revenue stream for Everstory Partners, generating income from clients who prepay for funeral and cemetery services. This proactive approach not only secures future business but also fosters strong customer loyalty by easing financial burdens for families during times of grief.

This segment offers predictable future revenue, allowing for more stable financial planning and investment. By locking in services and prices, clients are incentivized to commit early, providing Everstory with a consistent inflow of capital.

- Pre-paid Funeral Services: Clients pay for funeral packages, including services like embalming, viewing, and ceremonies, often at current prices for future use.

- Cemetery Plot Sales: Revenue is generated from the sale of burial plots, mausoleum crypts, and cremation niches, which are secured in advance.

- Trust and Insurance Funding: Many pre-need arrangements are funded through trusts or life insurance policies, creating a recurring revenue or commission-based income for the company.

- Growth in Pre-Need Market: The pre-need market is projected to continue growing as more individuals seek to control their end-of-life decisions and costs. For instance, in 2024, the funeral home industry saw continued interest in pre-planning, with a notable percentage of services being pre-arranged.

Cremation Services Fees (Standalone)

Everstory Partners generates revenue through standalone cremation service fees. This stream specifically targets families opting for direct cremation, bypassing traditional funeral arrangements. This caters to a significant and growing segment of the market that prefers simpler, more cost-effective end-of-life options.

The demand for cremation has been steadily increasing. In 2023, cremation was chosen for approximately 60% of deaths in the United States, a figure projected to rise. This trend directly supports the viability of standalone cremation service fees as a key revenue driver for Everstory Partners.

- Direct Cremation Revenue: Fees collected from families solely utilizing cremation services.

- Market Shift: Captures revenue from the increasing preference for cremation over traditional burials.

- Cost-Effective Option: Appeals to a broader customer base seeking simpler arrangements.

- 2024 Projections: Anticipates continued growth in this segment based on industry trends.

Everstory Partners also generates revenue from managing and maintaining cemetery grounds through perpetual care funds. These funds, often established at the time of lot purchase, ensure long-term upkeep and beautification of burial sites, providing a stable, recurring income source.

Additional income is derived from the sale of cemetery services and merchandise beyond interment, such as monument installation, engraving, and seasonal flower placements. These offerings cater to families wishing to personalize and maintain their loved ones' resting places.

In 2024, the market for cemetery services and merchandise continues to show resilience. The average cost for cemetery plot purchases and perpetual care can range significantly, with plots often starting from $1,000 and escalating based on location and features.

| Revenue Stream | Description | 2024 Market Insight |

|---|---|---|

| Perpetual Care Funds | Long-term maintenance fees collected at lot purchase. | Ensures consistent revenue for cemetery upkeep. |

| Cemetery Services & Merchandise | Sales of monuments, engraving, seasonal flowers. | Caters to personalization and ongoing care needs. |

| Average Plot & Care Costs | Plots from $1,000+, care fees vary. | Reflects demand for lasting memorialization. |

Business Model Canvas Data Sources

The Everstory Partners Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and expert strategic insights. This multi-faceted approach ensures each component of the canvas is grounded in accurate, actionable information.