Everstory Partners Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everstory Partners Bundle

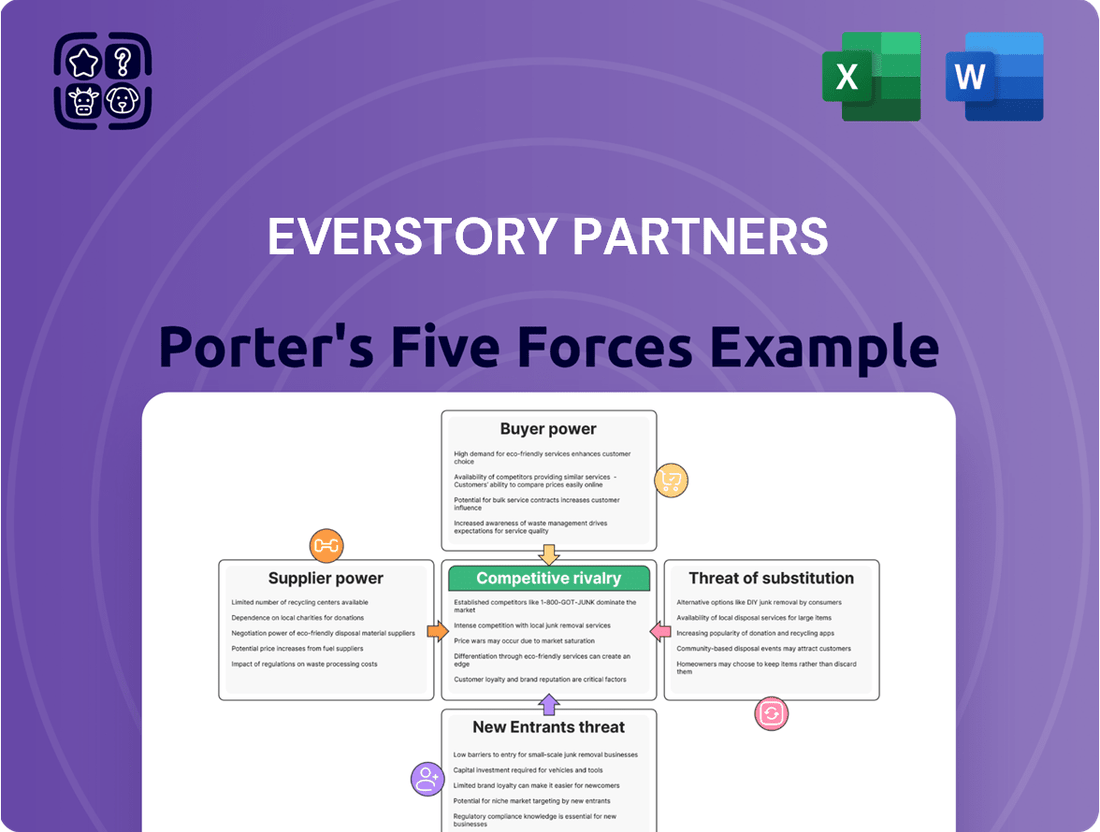

Everstory Partners navigates a landscape shaped by intense rivalry and the constant threat of new entrants. Understanding the bargaining power of both suppliers and buyers is crucial for their strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Everstory Partners’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Everstory Partners, along with other major funeral and cemetery operators, navigates a market with a limited number of specialized suppliers for crucial items like mortuary supplies, caskets, and cemetery upkeep tools. This scarcity means that companies like Everstory have fewer options when sourcing these essential products.

A prime example of this dynamic is the casket manufacturing sector, where a handful of key producers hold substantial market share. This consolidation directly reduces Everstory's ability to negotiate favorable terms, as these dominant suppliers have considerable influence over pricing and availability.

Consequently, the bargaining power of these specialized suppliers is moderate to high. This situation can create complex negotiation scenarios for Everstory and potentially lead to upward pressure on the cost of vital goods and services needed for their operations.

The funeral industry's growing reliance on technology, seen with Everstory Partners, significantly impacts supplier bargaining power. Operations now depend on digital record-keeping, online memorial platforms, and even drone mapping for cemeteries. This technological integration means specialized software and multimedia service providers, such as PlotBox, with whom Everstory has partnered, can exert considerable influence.

The expanding global market for funeral technology further bolsters the bargaining power of these tech suppliers. Everstory's operational efficiency and its capacity to deliver contemporary services are directly linked to these technology partners. Consequently, these suppliers can leverage this dependence to negotiate more favorable terms and pricing, enhancing their leverage in the market.

As consumer interest in sustainable options grows, the market for eco-friendly burial products is expanding. This trend places suppliers of biodegradable caskets and urns in a stronger position, as the supply chain for these niche items is still developing and can be limited. For instance, the global market for green burial products was estimated to reach over $1.5 billion by 2024, signaling a significant shift in consumer preference.

Suppliers who highlight their commitment to sustainability can leverage this growing demand. They may find they can charge premium prices for their environmentally conscious offerings. This could directly affect Everstory Partners' expenses if they decide to incorporate more of these eco-friendly products into their services, potentially increasing their cost of goods sold.

Reliance on Local Service Providers and Compliance

Everstory Partners, with operations spanning multiple states, depends on local service providers for crucial compliance with diverse burial practices and environmental regulations. This reliance on specialized regional vendors can diminish Everstory's leverage in negotiations, as these providers are critical for meeting state-specific mandates.

The necessity of adhering to varied local compliance requirements grants these suppliers considerable bargaining power. For instance, in 2024, the average cost for environmental compliance services in the death care industry saw an estimated 5% increase year-over-year, reflecting the specialized and often localized nature of these essential services.

- Localized Expertise: Local providers possess unique knowledge of state and municipal regulations governing cemeteries and funeral homes, making them indispensable.

- Compliance Burden: Everstory's need to navigate complex and often changing compliance landscapes in each operating state strengthens the position of these specialized local suppliers.

- Cost Impact: The significant costs associated with maintaining compliance across diverse jurisdictions directly translate into increased bargaining power for the service providers who facilitate this adherence.

Labor Market for Funeral Professionals

The funeral profession is facing a notable staffing shortage. Many seasoned professionals are retiring, and the number of new individuals entering the field isn't keeping pace. This imbalance directly translates to increasing wage cost pressure, as labor represents a significant expense for funeral service businesses.

While not traditional suppliers in the typical sense, the scarcity of licensed funeral directors and embalmers significantly enhances the bargaining power of labor. This situation can lead to higher labor costs for companies like Everstory Partners.

- Staffing Shortage: Reports indicate a growing gap between retiring funeral professionals and new entrants.

- Wage Pressure: Increased demand for qualified staff drives up average wages.

- Labor Bargaining Power: Limited availability of licensed professionals strengthens their negotiating position.

- Cost Impact: Higher labor costs directly affect the operational expenses of funeral service providers.

The bargaining power of suppliers for Everstory Partners is influenced by market concentration and the essential nature of their products. Consolidation among casket manufacturers, for example, gives dominant suppliers significant leverage over pricing and availability, impacting Everstory's procurement costs.

Technological advancements in the funeral industry also empower specialized software and service providers. As Everstory integrates digital solutions, partners like PlotBox gain influence due to the critical role their technology plays in operational efficiency and modern service delivery.

The growing demand for sustainable burial products further strengthens niche suppliers. With a developing supply chain for eco-friendly items, these providers can command premium prices, potentially increasing Everstory's cost of goods sold as consumer preferences shift.

Local compliance and specialized labor also contribute to supplier power. The scarcity of licensed funeral professionals and the need for localized regulatory expertise allow these groups to exert greater influence on wages and service costs.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Everstory Partners |

|---|---|---|

| Casket Manufacturers | Market concentration, limited producers | Higher pricing, reduced negotiation flexibility |

| Funeral Technology Providers | Industry reliance on digital solutions, specialized expertise | Potential for increased service costs, dependence on integrated platforms |

| Sustainable Product Suppliers | Growing consumer demand, developing supply chains | Premium pricing for niche products, potential cost increases |

| Local Compliance Specialists | State-specific regulations, unique local knowledge | Increased costs for regulatory adherence, limited vendor options |

| Licensed Funeral Professionals | Industry staffing shortages, high demand for skilled labor | Upward pressure on labor costs, challenges in talent acquisition |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Everstory Partners' position in the senior living industry.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, providing clear actionable insights for strategic advantage.

Customers Bargaining Power

Customers today have a strong desire for personalized funeral services that reflect the individuality of their loved ones. This trend, observed across the funeral industry, grants consumers greater bargaining power as they actively seek out providers who can cater to their specific needs and preferences. For instance, in 2024, surveys indicated that over 60% of families considered personalization a critical factor when selecting a funeral home.

The funeral services industry is experiencing a notable shift towards cremation, a trend amplified by its cost-effectiveness and perceived simplicity over traditional burials. This growing preference for cremation, alongside the emergence of online funeral providers and discount services, significantly bolsters customer bargaining power. For instance, cremation costs can be roughly 50% less than traditional burial, offering a tangible financial incentive for consumers. This empowers customers to seek out more affordable or alternative disposition methods, forcing providers like Everstory Partners to remain competitive on price and service offerings.

Customers today have much higher expectations for service, wanting quick and caring help throughout their decision-making journey. The rise of digital tools also means they expect easy online access to everything. For example, a 2024 survey by PwC found that 88% of consumers expect companies to improve their digital customer service.

This push for better digital experiences means families can now more easily compare what different companies offer, from service quality to online features. Everstory Partners is investing in making contracts and services digital, which is a smart move to meet these needs. However, this also means customers have more power to choose providers based on these digital capabilities and overall service satisfaction.

Pre-need Planning and Consumer Awareness

The increasing consumer interest in pre-need funeral planning significantly shifts bargaining power towards customers. This trend, evident in the growing adoption of pre-paid funeral plans, allows individuals to thoroughly research and compare service providers and pricing well in advance of a critical need. For instance, in 2023, the pre-need funeral market continued its steady expansion, with a notable rise in online research and comparison tools being utilized by consumers.

This heightened awareness empowers consumers to negotiate more effectively with providers like Everstory Partners. They can readily identify competitive pricing structures and service differentiators, leading to more informed decisions and potentially lower costs for their chosen arrangements. Everstory Partners, with its extensive network, can cater to this informed consumer base by offering transparent pricing and a diverse range of options for both pre-need and at-need services.

- Increased Consumer Knowledge: Pre-need planning fosters greater understanding of funeral service costs and options.

- Enhanced Negotiation Power: Informed consumers are better equipped to negotiate prices and service terms.

- Market Transparency: Growing online resources allow for easier comparison of funeral home offerings.

- Everstory's Network Advantage: A broad network provides consumers with more choices and competitive comparisons.

Online Reviews and Reputation Influence

The increasing prevalence of online reviews profoundly impacts consumer choices within the funeral services sector. Platforms like Google Reviews and Yelp allow potential clients to readily access and share experiences, directly influencing their decisions. For instance, a study in 2024 indicated that over 85% of consumers read online reviews before making a purchase decision, a trend that extends to sensitive services like funeral planning.

This transparency grants customers significant bargaining power. Positive testimonials can bolster a company's reputation, fostering trust and attracting new business, while negative feedback can swiftly erode it. In 2024, businesses with an average online rating below 4.0 stars reported a noticeable decrease in customer acquisition compared to those with higher ratings.

Consequently, funeral service providers like Everstory Partners are compelled to place a premium on customer satisfaction. Their ability to attract and retain clients is directly tied to the collective voice of their past customers. This dynamic means that managing online reputation is no longer just a marketing task but a fundamental aspect of operational strategy and customer engagement.

- Online review platforms significantly shape consumer decisions in the funeral industry.

- Positive reviews build trust; negative ones deter potential clients.

- In 2024, over 85% of consumers consulted online reviews before purchasing services.

- Companies with lower online ratings faced reduced customer acquisition in 2024.

The funeral industry is seeing a rise in customers who are more informed and have higher expectations, which naturally increases their bargaining power. This is driven by increased transparency and the availability of information, forcing providers to be more competitive.

Customers can now easily compare services and prices online, especially with the growing trend of pre-need planning. This allows them to make more informed decisions, negotiate better terms, and seek out providers that offer the best value and personalized options.

The digital age has empowered consumers with access to reviews and online comparison tools, making them more discerning. For instance, in 2024, over 85% of consumers relied on online reviews before making purchasing decisions, a trend that significantly influences the funeral services market.

| Factor | Impact on Bargaining Power | Supporting Data (2024) |

|---|---|---|

| Personalization Demand | Increased | 60% of families consider personalization critical. |

| Cremation Trend | Increased | Cremation costs ~50% less than traditional burial. |

| Digital Service Expectations | Increased | 88% of consumers expect improved digital customer service. |

| Online Reviews Influence | Increased | 85% of consumers read reviews before purchasing; lower ratings reduce acquisition. |

| Pre-Need Planning Growth | Increased | Growing consumer utilization of online research and comparison tools. |

Preview Before You Purchase

Everstory Partners Porter's Five Forces Analysis

This preview showcases the complete Everstory Partners Porter's Five Forces Analysis, meaning the document you see is precisely what you'll receive immediately after purchase. You can be confident that there are no placeholders or altered content; this is the actual, professionally formatted analysis ready for your immediate use. Rest assured, what you're previewing is the exact, ready-to-download file that will be yours upon completing your transaction.

Rivalry Among Competitors

The U.S. funeral service market is characterized by its fragmentation, featuring a substantial number of independent funeral homes competing with larger entities like Everstory Partners and Service Corporation International. This means Everstory faces constant pressure from smaller, localized businesses, necessitating ongoing efforts to stand out.

Despite Everstory's considerable footprint, the prevalence of thousands of independent operators means intense rivalry remains a defining feature of the industry. For instance, in 2024, the market still comprised over 19,000 funeral homes, with a significant portion being independently owned, underscoring the competitive landscape.

The funeral and cemetery industry is seeing significant consolidation, with companies like Everstory Partners actively acquiring smaller operations. This trend is fueled by factors such as retiring business owners and increased private equity interest, leading to a more concentrated market. In 2024, the industry continued to witness this pattern, with several notable acquisitions announced, indicating a strong push for market share through expansion rather than purely organic growth.

Competitive rivalry in the property management sector is intensifying, with a growing emphasis on personalized services and technological integration to enhance customer experience. Everstory Partners is investing in digitizing its services and employing drone mapping, initiatives projected to bolster its competitive standing by offering more efficient and tailored solutions.

Competitors are mirroring these strategic moves, also investing in similar technological advancements and focusing on customized client offerings. This necessitates Everstory Partners to maintain a pace of continuous innovation to effectively differentiate itself in a market where tailored experiences and digital efficiency are becoming industry standards.

Pricing Pressures and Cost-Effective Alternatives

The funeral services industry, including companies like Everstory Partners, faces intense rivalry driven by pricing pressures. The increasing availability of lower-cost alternatives, with cremation notably gaining traction, directly challenges the traditional funeral home model. In 2023, cremation rates continued their upward trend, exceeding 50% in many developed markets, a significant shift from previous decades.

Consumers are now empowered with readily accessible online platforms to compare pricing for various funeral and memorial services. This transparency forces established providers to operate with greater cost efficiency without compromising the quality of care and personalized services expected during difficult times. For Everstory, this means a constant balancing act between offering competitive pricing and maintaining high service standards.

- Rising Cremation Rates: Cremation's affordability and simplicity have made it a preferred option, impacting demand for traditional burial services.

- Online Price Transparency: Consumers can easily compare funeral package costs online, intensifying pressure on providers to justify their pricing.

- Cost Management Imperative: Companies must streamline operations and manage overheads effectively to remain competitive while delivering quality services.

- Balancing Affordability and Quality: The core challenge lies in offering cost-effective solutions that still meet the emotional and practical needs of grieving families.

Staffing Shortages and Talent Acquisition

The funeral profession is grappling with a significant staffing shortage. The workforce is aging, and there are fewer individuals entering the field, creating a tight labor market. This scarcity directly fuels competitive rivalry among funeral service providers.

Firms are actively vying for a limited pool of qualified talent, particularly licensed funeral directors and embalmers. For instance, the National Funeral Directors Association (NFDA) reported in their 2023 survey that 75% of funeral homes experienced staffing challenges. This intense competition for personnel means that companies excelling in talent acquisition and retention possess a distinct edge.

- Staffing Shortage: The funeral industry faces an aging workforce and declining new entrants, exacerbating competition for qualified staff.

- Talent Acquisition: Firms must develop robust recruiting strategies to attract and retain essential personnel like funeral directors and embalmers.

- Competitive Advantage: Companies offering appealing work environments and strong employee development programs, such as those pursuing 'Great Place To Work' certification, can differentiate themselves and gain market share.

- Industry Data: According to the NFDA, a substantial 75% of funeral homes reported staffing difficulties in 2023, underscoring the intensity of this competitive pressure.

The competitive rivalry within the funeral service sector is substantial, driven by a fragmented market with numerous independent operators and a growing trend of consolidation. Everstory Partners faces intense competition not only from large corporations like Service Corporation International but also from thousands of smaller, localized funeral homes. This dynamic is further amplified by increasing price transparency due to online platforms and the rising popularity of cremation, which offers a more affordable alternative.

| Factor | Impact on Rivalry | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | High rivalry from independent operators | Over 19,000 funeral homes in the U.S., many independently owned. |

| Industry Consolidation | Increased competition among larger entities | Ongoing acquisitions by private equity and larger firms like Everstory. |

| Cremation Rates | Pressure on traditional service pricing | Cremation rates exceeded 50% in many developed markets by 2023. |

| Online Price Transparency | Forces cost efficiency and competitive pricing | Consumers readily compare service costs online. |

SSubstitutes Threaten

The most significant substitute threat for Everstory Partners is the increasing adoption of cremation. This trend is driven by its lower cost and perceived simplicity when compared to traditional burial services.

In 2023, the cremation rate in the United States reached an estimated 60%, a substantial increase from previous years. Projections indicate this rate will continue to climb, potentially exceeding 70% by 2030, according to industry analyses.

This shift directly impacts the demand for traditional funeral products and services that Everstory Partners offers, such as embalming, caskets, and cemetery plots, as consumers increasingly opt for less resource-intensive and more affordable end-of-life arrangements.

The rise of direct cremation services, bypassing traditional funeral homes, presents a significant threat. These services, often found online, offer a streamlined and more affordable alternative for families. For instance, companies like Neptune Society and other direct cremation providers have seen substantial growth, catering to a segment of the market prioritizing simplicity and cost-effectiveness over the comprehensive services offered by traditional funeral providers.

The rise of family-led death care, including home funerals, offers a significant substitute threat to traditional funeral homes. This trend sees families taking a more hands-on role in caring for the deceased, often with minimal professional intervention. For instance, as of 2024, an increasing number of individuals are exploring DIY funeral options, driven by a desire for personalization and cost savings, which could divert revenue from established service providers.

Memorial Services Without Traditional Funeral Elements

Families are increasingly choosing memorial services that celebrate life over traditional, somber funeral rites. This trend means less demand for services like embalming, viewings, and extensive merchandise, directly impacting revenue from these traditional funeral home offerings. For instance, a 2024 survey indicated that over 40% of respondents would consider a memorial service without a traditional viewing, signaling a significant shift in consumer preference.

This move towards personalized tributes and informal gatherings presents a threat of substitution for Everstory Partners. If clients opt for simpler, less service-intensive celebrations, it can diminish the need for the full spectrum of services typically offered by traditional funeral homes, potentially reducing Everstory's overall revenue potential from these areas.

- Reduced Demand for Embalming: Many modern memorial services bypass embalming, a costly service.

- Shift from Elaborate Viewings: Personal tributes and celebrations of life often replace formal viewings.

- Focus on Experiences over Merchandise: Less emphasis is placed on caskets and other traditional funeral merchandise.

- Growth of Alternative Venues: Services are increasingly held in non-traditional locations like parks or community centers.

Eco-friendly and Alternative Disposition Methods

The threat of substitutes for traditional disposition methods, which Everstory Partners offers, is intensifying. Beyond cremation, there's a noticeable surge in demand for eco-friendly and sustainable burial options. This trend is driven by evolving consumer values and a growing environmental consciousness.

Newer alternatives like green burials, biodegradable urns, and alkaline hydrolysis are gaining traction. For instance, the green burial market, while still niche, is projected to grow significantly. In 2023, the global green burial market was valued at approximately $2.1 billion and is expected to expand at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030, indicating a clear shift in consumer preference.

- Growing Demand for Green Burials: Consumers are increasingly seeking environmentally sound final disposition choices.

- Biodegradable and Alternative Urns: The market for urns made from natural, sustainable materials is expanding.

- Alkaline Hydrolysis Adoption: This water-based process, often termed aquamation, is gaining acceptance as a more eco-friendly alternative to cremation.

- Shifting Consumer Values: A greater emphasis on sustainability and reduced environmental impact is influencing disposition choices.

The increasing popularity of cremation, projected to exceed 70% in the US by 2030, directly challenges Everstory's traditional burial services. Furthermore, the rise of direct cremation providers and family-led home funerals offers cost-effective, simplified alternatives that bypass conventional funeral home offerings.

Shifting consumer preferences towards life celebrations over traditional funerals reduce demand for services like embalming and caskets, with over 40% of consumers open to memorial services without a viewing as of 2024.

Emerging eco-friendly disposition methods, such as green burials (a market valued at $2.1 billion in 2023 with a projected 7.5% CAGR from 2024-2030), biodegradable urns, and alkaline hydrolysis, also represent significant substitutes for Everstory's established services.

| Substitute Trend | Description | 2024 Impact/Projection |

|---|---|---|

| Cremation | Lower cost, perceived simplicity | US cremation rate projected to exceed 70% by 2030. |

| Direct Cremation Services | Streamlined, online offerings | Growth of companies like Neptune Society catering to cost-conscious consumers. |

| Family-Led Death Care | DIY funerals, home funerals | Increasing exploration of personalized, cost-saving funeral options. |

| Life Celebrations | Focus on experience over traditional rites | Over 40% of consumers consider services without viewings (2024 survey). |

| Green Burials | Environmentally conscious disposition | Global market valued at $2.1 billion (2023), projected 7.5% CAGR (2024-2030). |

Entrants Threaten

The funeral home and cemetery industry presents a significant barrier to entry due to high capital requirements. Establishing a funeral home involves substantial investment in real estate, vehicles, embalming equipment, and operational setup. For instance, acquiring or building suitable facilities can easily run into hundreds of thousands, if not millions, of dollars, making it a considerable hurdle for new businesses.

Cemeteries, in particular, face the added challenge of land scarcity. Acquiring suitable land in desirable locations is becoming increasingly difficult and expensive. In many developed areas, available land for new cemeteries is limited, driving up acquisition costs and further solidifying the financial barrier for potential new entrants looking to compete with established players like Everstory Partners.

The funeral industry faces significant barriers due to stringent regulatory and licensing requirements. For instance, in 2024, obtaining a funeral director's license typically demands a combination of formal education, often an associate's degree, followed by a one-to-two-year apprenticeship and passing state-specific board examinations. These requirements, varying by state, create a substantial time and financial commitment, deterring many potential new entrants.

Brand loyalty is a significant barrier for new funeral homes. Many families have trusted the same funeral provider for decades, creating deep-rooted relationships. For instance, in 2024, a significant portion of funeral service consumers reported choosing a provider based on recommendations from friends or family, highlighting the power of established trust.

New entrants must invest heavily in community outreach and building a reputation for compassionate, reliable service to even begin to chip away at this loyalty. This is a slow, often expensive process, especially in an industry where emotional connection and tradition play such a crucial role in decision-making.

Staffing Shortages and Expertise Acquisition

The current landscape presents a significant hurdle for new entrants due to widespread staffing shortages within the funeral service industry. The demand for licensed funeral directors and embalmers consistently outstrips the available supply, making it difficult for any new business to assemble a competent team.

Acquiring experienced and compassionate staff is paramount for delivering the sensitive and professional services expected by grieving families. The scarcity of such qualified individuals acts as a formidable barrier, deterring potential new competitors from entering the market as they struggle to find the necessary human capital.

- Funeral Director Shortage: In 2024, many regions reported a critical shortage of licensed funeral directors, with some states experiencing vacancy rates exceeding 20% for open positions.

- Embalmer Demand: The demand for skilled embalmers also remains high, with industry reports indicating a national deficit of approximately 5,000 licensed embalmers.

- Training Pipeline: The limited number of accredited mortuary science programs and the lengthy training period further constrain the pipeline of new professionals entering the field.

- Impact on New Entrants: This talent scarcity directly increases the cost and difficulty for new firms to establish operations, as they must compete for a limited pool of qualified talent.

Consolidation by Existing Players

The death care industry is seeing significant consolidation. Large networks, such as Everstory Partners, are actively acquiring independent funeral homes and cemeteries. This trend makes it harder for new, smaller companies to enter the market.

By buying up existing businesses, established players like Everstory reduce the number of available acquisition targets for potential new entrants. This strategic move also solidifies the market dominance of the larger operators, creating a higher barrier to entry.

- Industry Consolidation: The death care sector experienced a notable wave of consolidation in recent years, with private equity firms and large corporate entities acquiring numerous independent providers.

- Everstory Partners' Growth: Everstory Partners, a significant player, has been a part of this consolidation, growing its network through strategic acquisitions to enhance its market presence and operational scale.

- Impact on New Entrants: This consolidation directly impacts the threat of new entrants by reducing the number of easily accessible, independent businesses that new companies could acquire or partner with to gain a foothold in the market.

The threat of new entrants into the funeral and cemetery industry remains moderate, largely due to substantial capital requirements and stringent regulatory hurdles. For instance, in 2024, establishing a new funeral home could easily require upwards of $500,000 to $1 million for facilities and equipment, a significant deterrent.

The industry also faces a shortage of qualified professionals, with a reported deficit of licensed funeral directors and embalmers in many regions in 2024. This scarcity makes it difficult for new businesses to staff operations, further increasing the cost and complexity of entry.

Moreover, the ongoing consolidation within the death care sector, with companies like Everstory Partners actively acquiring independent providers, reduces the number of available acquisition targets and strengthens the market position of established players, thereby raising the barrier for newcomers.

| Barrier Type | Description | 2024 Impact/Data |

|---|---|---|

| Capital Requirements | High investment in real estate, vehicles, and equipment. | Estimated $500K - $1M+ for new funeral home setup. |

| Regulatory & Licensing | Formal education, apprenticeships, and board exams required. | Licensing process can take 1-2 years post-education. |

| Staffing Shortages | Difficulty in finding licensed funeral directors and embalmers. | Some regions report over 20% vacancy rates for director positions. |

| Industry Consolidation | Acquisition of independent firms by larger entities. | Reduced availability of acquisition targets for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Everstory Partners leverages data from industry-specific market research reports, financial statements of publicly traded competitors, and regulatory filings to assess competitive intensity and market dynamics.