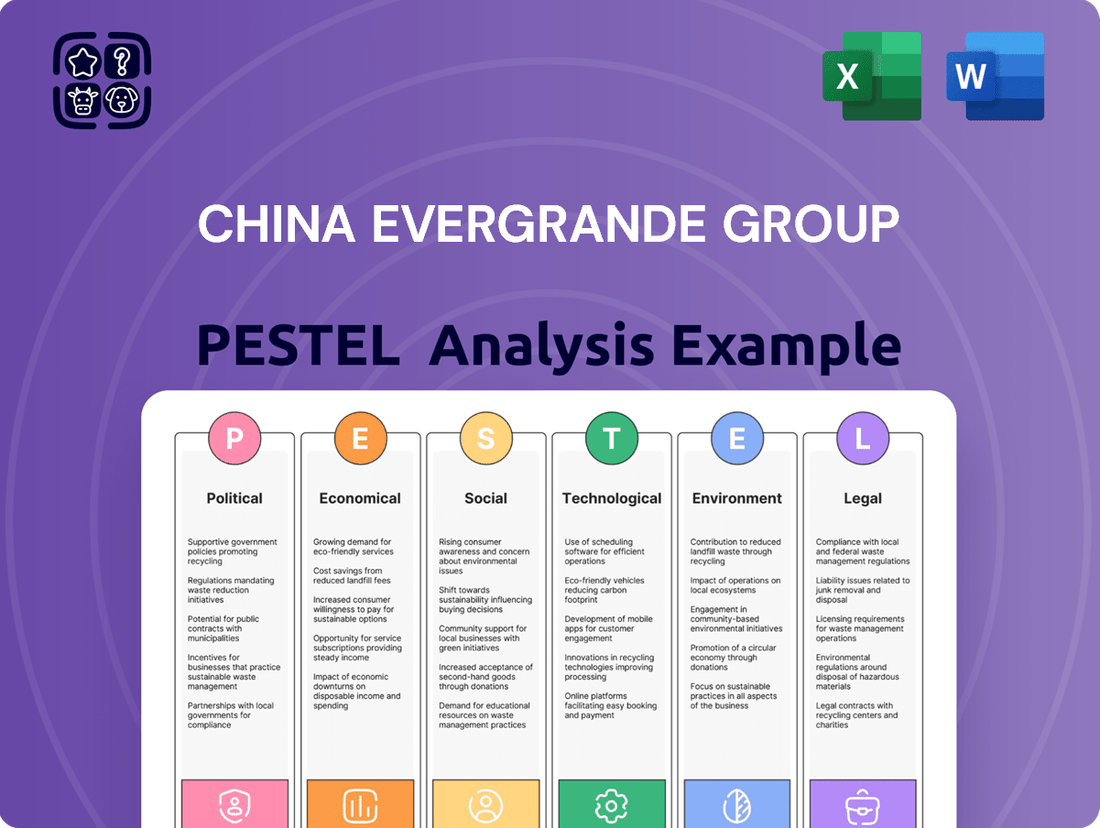

China Evergrande Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Evergrande Group Bundle

China Evergrande Group faces a complex web of external forces, from shifting government policies and economic downturns to evolving social expectations and technological advancements. Understanding these PESTLE factors is crucial for anyone looking to navigate the company's volatile landscape.

Political factors

Government intervention in China's real estate market, particularly the 'Three Red Lines' policy enacted in August 2020, has profoundly impacted developers like Evergrande. This policy imposed strict leverage limits, directly restricting developers' access to new financing and exacerbating existing liquidity issues.

The 'Three Red Lines' policy aimed to de-risk the property sector by capping liabilities relative to assets, equity, and cash. For Evergrande, this meant a significant reduction in its borrowing capacity, a crucial element for its growth model, contributing directly to its 2021 liquidity crisis.

Beijing's policy direction for 2024-2025 centers on stabilizing the property market, a crucial move for Evergrande. The emphasis is shifting from aggressive expansion to ensuring existing housing projects are completed and delivered to buyers, a critical factor for buyer confidence and market stability.

A key strategy involves encouraging local governments to acquire unsold properties, repurposing them for social housing initiatives. This could potentially absorb some of the excess inventory and alleviate pressure on developers like Evergrande, though the scale and funding mechanisms for these purchases remain a significant variable.

This policy shift signals a move towards a more balanced, dual-track housing system, integrating social housing alongside the traditional commodity housing market. The success of this approach will hinge on effective implementation and the financial capacity of local governments to undertake these acquisitions.

The Hong Kong court's liquidation order for China Evergrande Group in January 2024, following persistent failures to propose a workable restructuring, clearly demonstrates the Chinese government's firm stance on heavily indebted property developers. This decisive action, though primarily impacting offshore creditors, sends a strong message about market discipline and has a ripple effect on investor confidence in the broader Chinese real estate sector.

Local Government Fiscal Health

The significant downturn in China's real estate sector, particularly impacting developers like Evergrande, has directly strained local government finances. Historically, revenue from land sales constituted a major portion of local government budgets, often exceeding 40% in many regions. For instance, in 2023, land sale revenue for many provincial-level governments saw declines of over 20% compared to the previous year, a trend that continued into early 2024.

This fiscal pressure means local governments may have less capacity or willingness to offer financial support or favorable policies to struggling property developers. The reduced fiscal health could lead to a more cautious approach regarding new project approvals and infrastructure spending, potentially impacting any remaining or restructured operations of companies like Evergrande.

- Reduced Land Sales Revenue: Local government income from land auctions and sales has plummeted, with some regions experiencing drops exceeding 30% in 2023-2024.

- Fiscal Strain Impact: This financial pressure limits the ability of local governments to provide subsidies or financial assistance to property developers.

- Policy Repercussions: Expect a more conservative stance on new development approvals and infrastructure investment, affecting the broader real estate ecosystem.

- Evergrande's Operational Context: The fiscal health of local governments directly influences the environment in which Evergrande's restructuring and any future projects must operate.

'Deliver Unfinished Homes' Initiative

A significant political focus in China centers on ensuring the completion and handover of pre-sold properties. This initiative is crucial for maintaining social stability and bolstering consumer trust in the real estate market, especially in light of developer defaults.

To address this, the government has implemented measures such as the 'whitelist' lending program. This program specifically directs funds to qualifying construction projects, aiming to prevent homebuyers from being left with unfinished homes.

- Government Priority: Completion of pre-sold homes to ensure social stability and consumer confidence.

- Key Mechanism: The 'whitelist' lending program to channel funds to eligible projects.

- Objective: Prevent homebuyers from facing undelivered properties.

The Chinese government's firm stance on property market regulation, exemplified by the January 2024 liquidation order for Evergrande, underscores a commitment to market discipline. This action, while impacting offshore creditors, signals a stricter approach to indebted developers, influencing investor sentiment across the sector.

Local government finances, heavily reliant on land sales which saw declines of over 20% in 2023-2024, are strained. This fiscal pressure limits their capacity to support struggling developers, potentially leading to more conservative policies on new project approvals.

A key political priority for 2024-2025 is ensuring the completion of pre-sold housing projects to maintain social stability and consumer trust. The 'whitelist' lending program is a critical tool designed to direct funds to qualifying projects, aiming to prevent unfinished homes for buyers.

| Policy/Event | Date | Impact on Developers | Government Objective |

|---|---|---|---|

| 'Three Red Lines' Policy | August 2020 | Restricted financing, exacerbated liquidity issues | De-risk property sector |

| Evergrande Liquidation Order | January 2024 | Reinforced market discipline, impacted investor confidence | Enforce market accountability |

| 'Whitelist' Lending Program | Ongoing (2024-2025 focus) | Channels funds to eligible projects | Ensure completion of pre-sold homes |

What is included in the product

This PESTLE analysis examines the multifaceted external environment impacting China Evergrande Group, detailing how political shifts, economic volatility, social trends, technological advancements, environmental concerns, and legal frameworks create both significant risks and potential avenues for strategic adaptation.

A concise PESTLE analysis of China Evergrande Group, highlighting political instability and economic downturns, offers a clear roadmap for mitigating external risks during strategic planning.

Economic factors

China's real estate sector is grappling with a notable downturn, characterized by falling housing prices and sluggish sales throughout 2024. This persistent weakness puts immense pressure on developers, including Evergrande, hindering their ability to generate revenue and manage debt.

A key factor exacerbating this situation is the considerable oversupply of housing. Estimates suggest inventory levels are more than two years' worth of demand, a surplus that makes a swift market recovery exceptionally difficult and prolongs the challenges faced by companies like Evergrande.

The real estate crisis, significantly amplified by Evergrande's default, has cast a long shadow over China's economic trajectory and shaken consumer confidence. This sector, historically a powerhouse for economic expansion, is now experiencing a noticeable downturn in both investment and sales, directly contributing to a deceleration in overall economic growth.

As of early 2024, property sales in China continued to show weakness, with many major cities reporting year-on-year declines. This slowdown directly impacts related industries like construction and materials, further dampening economic activity.

Consumer confidence has been particularly affected, as property ownership is a significant component of household wealth in China. Uncertainty surrounding the real estate market and the financial stability of developers like Evergrande has led to more cautious spending habits among households.

Evergrande's colossal debt, reportedly over $300 billion, and its eventual liquidation have exposed significant weaknesses within China's financial infrastructure. This situation has triggered a ripple effect, with numerous other property developers facing defaults and a tightening of credit across the market, impacting the wider economic landscape.

The contagion effect is evident as the crisis has spread, leading to a credit crunch that restricts lending and investment for a broad range of businesses. By early 2024, analysts estimated that the total debt held by China's property developers had reached trillions of yuan, underscoring the systemic nature of the problem.

Decline in Land Sale Revenues

Local governments in China, particularly those dependent on land sales for revenue, have seen a substantial decrease in income due to the prolonged property market slump. For instance, in 2023, land sale revenues for China's 300 major cities dropped by 19.7% year-on-year, reaching approximately 3.7 trillion yuan. This fiscal shortfall directly impacts their ability to finance essential public services and infrastructure projects.

This reduced fiscal capacity can create a less favorable environment for future real estate development. The decline in land sales, a critical income stream for many local authorities, forces them to seek alternative revenue sources or cut spending. This situation directly affects developers like Evergrande, as it can lead to tighter local government budgets for infrastructure upgrades or incentives that would typically support the property sector.

- Fiscal Pressure on Local Governments: Land sales historically accounted for a significant portion of local government revenue, often exceeding 30% in some regions.

- Impact on Public Services: Reduced land sale income can lead to cuts in funding for education, healthcare, and urban development projects.

- Real Estate Market Environment: A strained fiscal position for local governments may result in less supportive policies for the property sector, potentially hindering recovery.

- Evergrande's Exposure: Evergrande's business model, heavily reliant on acquiring land for development, is directly exposed to these shifts in local government finances and policies.

Shift in Investment Landscape

The ongoing property crisis in China is fundamentally reshaping the nation's economic structure. Projections indicate that real estate, a long-standing pillar, will occupy a reduced share of the overall economy in the coming years. This shift necessitates a strategic pivot for large, diversified entities like China Evergrande Group.

Investment is increasingly flowing into sectors beyond traditional real estate. Technology, consumer goods, and services are emerging as key growth areas, attracting significant capital. This trend is evident in the 2024 market outlook, where technology stocks have shown robust performance, and consumer spending is projected to rebound, driven by supportive government policies aimed at stimulating domestic demand.

- Reduced Real Estate Dependence: Analysts predict the property sector's contribution to China's GDP could fall by 5-10% by 2025.

- Sectoral Investment Diversification: Venture capital funding in China's tech sector reached an estimated $30 billion in the first half of 2024.

- Consumer Spending Growth: Retail sales in China are forecast to grow by 6-8% in 2024, signaling a strong consumer market.

- Strategic Reorientation: Companies like Evergrande must adapt by reallocating resources and focusing on high-growth, non-property related ventures to remain competitive.

The economic landscape in China, particularly the real estate sector, faced significant headwinds in 2024. Falling housing prices and subdued sales created immense pressure on developers like Evergrande, impacting their revenue streams and debt management capabilities.

A substantial housing oversupply, estimated at more than two years of demand, prolonged the market's challenges. This downturn, amplified by Evergrande's default, decelerated China's economic growth and eroded consumer confidence, as property is a major component of household wealth.

The crisis exposed financial infrastructure weaknesses, leading to a credit crunch and defaults among other developers. Local governments also felt the pinch, with land sale revenues dropping by 19.7% in 2023, impacting public services and the real estate market environment.

Economic shifts are underway, with projections indicating a reduced share for real estate in China's GDP by 2025. Investment is increasingly diversifying into technology and consumer goods, with venture capital in tech reaching an estimated $30 billion in H1 2024, and retail sales forecast to grow 6-8% in 2024.

| Economic Factor | 2023 Data/Estimate | 2024 Outlook/Estimate | Impact on Evergrande |

|---|---|---|---|

| Real Estate Market Performance | Falling housing prices, sluggish sales | Continued weakness, year-on-year declines in major cities | Reduced revenue, increased default risk |

| Housing Oversupply | >2 years of demand inventory | Persistent surplus | Hindered market recovery, prolonged challenges |

| Consumer Confidence | Affected by property market uncertainty | Cautious spending habits | Lower demand for new properties |

| Local Government Revenue (Land Sales) | -19.7% year-on-year drop (300 major cities) | Continued fiscal pressure | Potential for less supportive policies, tighter budgets |

| Sectoral Investment Shift | Growing investment in tech and services | Tech VC ~$30bn (H1 2024), Retail Sales +6-8% | Need for strategic reorientation away from traditional real estate |

Preview the Actual Deliverable

China Evergrande Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Evergrande Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the intricate dynamics shaping Evergrande's present and future challenges and opportunities.

Sociological factors

The widespread defaults and unfinished projects, exemplified by China Evergrande Group's struggles, have significantly damaged buyer confidence in China's property sector. This erosion of trust is a major sociological factor, as consumers are now wary of pre-paying for homes that may never be completed.

Reports indicate that millions of pre-sale homes remain unfinished, leaving many buyers facing substantial financial losses and uncertainty. This has created a deep-seated reluctance to invest in new real estate, impacting demand and sales volumes across the market.

Historically, owning a home in China was a deeply ingrained aspiration, viewed as a cornerstone of life and a secure investment. This cultural norm was reinforced by decades of rising property values, making real estate a primary wealth-building vehicle.

However, the ongoing crisis, exemplified by the struggles of companies like China Evergrande Group, has significantly altered this outlook, particularly for younger Chinese citizens. Many are now questioning the traditional path to homeownership, facing a market characterized by elevated prices and heightened financial uncertainty.

This shift is evident in changing attitudes. Surveys in 2024 indicated a growing preference among urban youth for renting, with a significant portion delaying or forgoing home purchases due to affordability concerns and a perceived lack of long-term stability in the property market.

China's demographic landscape is undergoing significant shifts. The country's population growth has plateaued, and there's a noticeable rise in single-person households. These trends are directly impacting the dynamics of housing demand, suggesting a move away from traditional family-sized units.

Urbanization remains a powerful force, continuing to draw populations towards major economic centers. However, the nature of housing demand within these urban areas is evolving. We are seeing a growing preference for more affordable rental options and a demand for smaller, more manageable living spaces, reflecting changing lifestyles and economic realities.

Impact on Social Stability

The cascading effects of Evergrande's financial distress have significantly impacted social stability in China. Widespread issues like unfinished housing projects, job losses within the construction and real estate sectors, and the erosion of household wealth through pre-sale deposits have fueled public discontent and anxieties about broader economic stability. This social pressure is a primary driver behind the government's strong directive to prioritize the 'delivery of unfinished homes,' aiming to mitigate social unrest.

The scale of the problem is substantial. By late 2023, estimates suggested that tens of millions of homebuyers were affected by delayed or halted construction on properties they had already paid for. This situation directly impacts the livelihoods of construction workers and related industries, contributing to unemployment figures. For instance, the real estate sector historically accounted for a significant portion of China's GDP, and its contraction has ripple effects across the economy, exacerbating social concerns.

- Millions of homebuyers affected by unfinished projects.

- Job losses concentrated in the construction and real estate industries.

- Erosion of household wealth due to pre-sale deposit risks.

- Government intervention focused on social stability through project completion.

Urbanization and Housing Needs

Despite recent property market challenges, China's urbanization continues unabated, driving a steady flow of people to its major cities in search of employment. This demographic shift fuels a persistent demand for housing, although the market is increasingly prioritizing more accessible, affordable, and rental-focused accommodations, a trend supported by government policy.

By the end of 2023, China's urbanization rate reached 66.16%, signifying a substantial portion of the population now residing in urban areas. This ongoing migration creates a fundamental need for residential units, but the preference is leaning towards rental properties and more budget-friendly options. For instance, the government's "housing is for living in, not for speculation" directive is shaping development towards meeting these evolving needs.

- Urbanization Rate: China's urbanization rate hit 66.16% by the close of 2023.

- Job-Driven Migration: People continue moving to large cities for better job prospects.

- Shifting Demand: Focus is moving towards affordable housing and rental units.

- Policy Influence: Government initiatives are steering development towards these new priorities.

The property crisis, highlighted by Evergrande's situation, has severely shaken consumer trust, especially among younger generations who are now reconsidering the traditional aspiration of homeownership. This shift is evidenced by surveys in 2024 showing a growing preference for renting and a delay in purchasing due to affordability and market instability.

Demographic changes, including plateauing population growth and an increase in single-person households, are reshaping housing demand, moving away from larger family units. Urbanization continues to drive migration to cities, but the demand within these areas favors more affordable rentals and smaller living spaces, reflecting evolving lifestyles and economic pressures.

| Sociological Factor | Impact on China Evergrande Group | 2024/2025 Data/Trend |

|---|---|---|

| Buyer Confidence | Eroded due to defaults and unfinished projects. | Surveys indicate continued buyer hesitancy and preference for completed properties. |

| Homeownership Aspiration | Weakened, particularly among youth, due to market uncertainty. | Growing trend of delaying or forgoing home purchases; increased interest in renting. |

| Demographic Shifts | Changing household structures and urbanization influence housing needs. | Rise in single-person households; continued urban migration favoring smaller, rental units. |

| Social Stability Concerns | Discontent from unfinished homes, job losses, and wealth erosion. | Government prioritizes project completion to mitigate social unrest; millions still affected by delays. |

Technological factors

China's ambitious smart city initiatives, a key technological factor, are reshaping urban landscapes. The government is heavily investing in integrating advanced technologies like IoT, AI, and 5G into city planning and infrastructure. For instance, by the end of 2024, China aimed to have over 50% of its major cities implementing smart city solutions, according to industry reports.

This technological push creates significant opportunities for real estate developers like Evergrande. By incorporating smart home technologies and connected community services, developers can differentiate their projects and attract a tech-savvy demographic. Evergrande's existing diversified business model could allow it to offer integrated solutions, from smart property management to energy-efficient building systems, enhancing resident experience and operational efficiency.

However, the rapid pace of technological change also presents challenges. Developers must continually adapt to evolving standards and invest in new infrastructure to remain competitive. The integration of diverse smart city systems also requires careful planning and execution to ensure seamless operation and data security, a complex undertaking for large-scale projects.

Evergrande's foray into new energy vehicle (NEV) manufacturing via Evergrande NEV signaled a strategic pivot towards high-growth, technology-driven sectors. This ambitious diversification aimed to tap into the burgeoning global demand for electric mobility.

China's NEV market is a powerhouse, projected to reach 18 million units by 2025, a significant jump from 5.7 million in 2022, buoyed by substantial government subsidies and rapid technological innovation. Despite this favorable landscape, Evergrande NEV has been grappling with severe liquidity issues, impacting its production and market entry plans.

China's push for green building is accelerating, with a target for all new urban buildings to meet green standards by 2025. This regulatory shift directly impacts developers like China Evergrande Group, requiring significant investment in sustainable materials and energy-efficient construction methods.

The adoption of these green technologies affects every stage of development, from initial design and material procurement to the construction process itself. Companies must adapt their supply chains and operational practices to comply with evolving environmental mandates.

Digitalization in Property Management

Technological advancements are significantly reshaping property management, with tools like Building Information Modeling (BIM) and smart systems for energy monitoring gaining traction. These innovations offer substantial benefits for efficiency and service quality. For Evergrande's property management arm, adopting these technologies presents a clear opportunity to streamline operations and enhance resident experiences, potentially leading to cost savings and improved customer satisfaction.

The integration of digital platforms allows for more sophisticated data analysis and predictive maintenance, reducing unexpected costs and downtime. For instance, smart building systems can optimize HVAC usage, leading to an estimated 10-20% reduction in energy consumption in commercial properties. Furthermore, digital platforms facilitate better communication with residents and faster response times to maintenance requests, directly impacting service delivery metrics.

- BIM adoption: Facilitates integrated design, construction, and operation, improving project lifecycle management.

- Smart systems: Enable real-time monitoring of energy, security, and tenant services, enhancing operational efficiency.

- Data analytics: Drives predictive maintenance and personalized service offerings, boosting resident satisfaction and reducing costs.

Research and Development in Core Technologies

China Evergrande Group's New Energy Vehicle (NEV) division is actively pursuing patents in key areas such as vehicle manufacturing processes, intelligent connectivity systems, and advanced power battery technology. This strategic focus on research and development is designed to build a strong foundation and secure a competitive advantage in the rapidly evolving automotive market.

Continued investment in these core technological areas is paramount for Evergrande's long-term success and sustainability as it ventures into new, technology-intensive sectors. For instance, the company's commitment to R&D in NEVs reflects a broader trend in China's automotive industry, which saw significant growth in patent applications related to electric vehicles and smart technologies in recent years.

- Patent Focus: Evergrande's NEV unit is securing patents in vehicle manufacturing, intelligent connectivity, and power batteries.

- Competitive Edge: R&D investment aims to differentiate Evergrande in the competitive NEV market.

- Long-Term Viability: Continued innovation is essential for sustained success in new technology sectors.

- Industry Trend: This aligns with China's broader push for technological advancement in the automotive sector.

Technological advancements are central to China's smart city development, with significant government investment in IoT, AI, and 5G integration by 2024, aiming for over 50% of major cities to adopt these solutions. This creates opportunities for developers like Evergrande to integrate smart home features, enhancing project appeal and operational efficiency.

Evergrande's strategic move into New Energy Vehicles (NEVs) aligns with China's booming market, projected to reach 18 million units by 2025, driven by subsidies and innovation. However, Evergrande NEV has faced liquidity challenges impacting its production.

The push for green buildings, with a 2025 target for all new urban constructions to meet green standards, necessitates developer investment in sustainable materials and energy-efficient methods, impacting supply chains and operations.

Property management is being revolutionized by BIM and smart systems for energy monitoring, offering efficiency gains and improved resident experiences. Digital platforms enable data analytics for predictive maintenance, potentially cutting energy consumption by 10-20% in commercial properties.

| Technological Factor | Impact on Evergrande | Key Data/Projections (2024-2025) |

|---|---|---|

| Smart City Initiatives | Opportunity for differentiated property development, enhanced resident services. | Over 50% of major Chinese cities to implement smart city solutions by end of 2024. |

| New Energy Vehicles (NEVs) | Diversification into a high-growth sector, but facing liquidity challenges. | China's NEV market projected to reach 18 million units by 2025. |

| Green Building Standards | Requirement for investment in sustainable materials and energy-efficient construction. | All new urban buildings to meet green standards by 2025. |

| Property Management Tech (BIM, Smart Systems) | Potential for operational efficiency, cost savings, and improved resident satisfaction. | Smart systems can reduce energy consumption by 10-20% in commercial properties. |

Legal factors

The Hong Kong High Court's liquidation order for Evergrande in January 2024 is a pivotal legal event, shaping the recovery prospects for creditors, especially offshore bondholders. This ruling initiates a complex process for managing the company's vast asset base.

The liquidation proceedings are anticipated to be particularly challenging for mainland Chinese assets, given differing legal frameworks and the sheer scale of Evergrande's operations. Offshore creditors, who hold a significant portion of the company's debt, face an uphill battle in asserting their claims within this intricate legal landscape.

China's 'Three Red Lines' policy, introduced in August 2020, significantly tightened debt regulations for property developers. This policy set specific thresholds for developer liabilities, including a limit on liabilities to assets ratio (below 70%), net gearing ratio (below 100%), and cash to short-term debt ratio (above 1x). These stringent rules directly impacted Evergrande's ability to refinance its substantial debt, contributing heavily to its liquidity crunch.

The direct consequence of these regulations was a sharp reduction in available credit for developers like Evergrande. By August 2021, Evergrande had reportedly failed to meet at least two of the three red lines, specifically exceeding the net gearing ratio and the cash to short-term debt ratio. This regulatory pressure effectively choked off its access to new borrowing, exacerbating its financial difficulties and leading to its eventual default.

China's property laws are undergoing significant evolution, particularly concerning land use rights, urban renewal projects, and the conditions under which private property can be expropriated for public interest. These shifts directly impact how developers like Evergrande acquire land and secure development rights.

Recent legislative efforts, such as amendments to the Land Administration Law and ongoing discussions around urban planning laws, aim to clarify procedures for land acquisition and compensation. For instance, while expropriation for public interest is permitted, the process requires adherence to strict guidelines and fair compensation, a factor that can influence project viability and costs for developers.

Government Support and 'Whitelist' Mechanism

The Chinese government has implemented legal and policy measures, like the 'whitelist' lending program, to offer financial backing for qualified real estate developments amidst the ongoing property sector challenges. This initiative is designed to facilitate the completion of projects and foster market stability, all within a defined legal structure.

This 'whitelist' approach allows banks to extend credit to specific projects deemed viable, aiming to prevent defaults and ensure housing delivery. For instance, by mid-2024, reports indicated that a significant number of projects had been approved for this special lending, signaling a targeted effort to inject liquidity into the sector.

- Government intervention: The 'whitelist' mechanism represents direct government support to address the property crisis.

- Project completion focus: The primary legal aim is to ensure that pre-sold housing projects are completed.

- Market stabilization: This policy is a legal framework to prevent a broader economic downturn stemming from the property sector.

Company Law and Corporate Governance

Recent amendments to China's Company Law, effective July 1, 2024, have introduced stricter corporate governance standards for limited liability companies. These updates mandate enhanced transparency in decision-making and greater accountability for directors and officers. For a company like Evergrande, navigating its liquidation process, these new regulations could significantly influence how its remaining assets are managed and how creditors are treated, potentially adding complexity to its restructuring or winding-up proceedings.

The revised law emphasizes improved risk management and internal controls, which are crucial for companies facing financial distress. Evergrande's situation, marked by its substantial debt and ongoing restructuring, will be scrutinized under these new legal frameworks. Compliance with these evolving corporate governance requirements is paramount, impacting any potential future business operations or asset disposals, especially as the company seeks to satisfy its creditors and comply with regulatory oversight.

- New Governance Requirements: China's Company Law amendments (effective July 2024) impose stricter rules on corporate governance for limited liability firms.

- Impact on Evergrande: These changes could affect Evergrande's compliance during liquidation and any future restructuring efforts.

- Focus on Transparency and Accountability: The revised law emphasizes enhanced transparency in decision-making and greater accountability for company leadership.

- Risk Management Emphasis: Updated regulations highlight the importance of robust risk management and internal control systems, critical for financially distressed entities.

The Hong Kong High Court's liquidation order in January 2024 underscores the critical role of legal frameworks in managing Evergrande's fallout. China's 'Three Red Lines' policy, introduced in 2020, directly constrained developer leverage, with Evergrande failing to meet key ratios by August 2021, severely limiting its refinancing options.

Evolving property laws, including land use and expropriation regulations, impact developer operations, while initiatives like the 'whitelist' lending program, which saw significant project approvals by mid-2024, aim to stabilize the sector through targeted legal support.

New corporate governance standards under China's Company Law amendments, effective July 2024, increase transparency and accountability, which will influence Evergrande's liquidation and any future asset management, demanding stricter adherence to risk management protocols.

| Legal Factor | Description | Impact on Evergrande | Relevant Period |

|---|---|---|---|

| Liquidation Order | Hong Kong High Court order for winding up. | Initiates complex asset management and creditor claims process. | January 2024 |

| 'Three Red Lines' Policy | Debt limits for property developers (e.g., net gearing <100%). | Restricted refinancing, contributing to liquidity crisis. | Introduced August 2020; Evergrande breached by August 2021 |

| 'Whitelist' Lending | Government-supported credit for qualified projects. | Aims to ensure project completion and market stability. | Active through mid-2024 |

| Company Law Amendments | Stricter corporate governance, transparency, and accountability. | Affects liquidation proceedings and future asset handling. | Effective July 1, 2024 |

Environmental factors

China's push for greener construction is intensifying, with a national goal for all new urban buildings to adhere to stringent green building standards by 2025. This directive necessitates the adoption of energy-efficient designs, the use of sustainable materials, and environmentally conscious construction methods. These evolving regulations directly influence the operational costs and project execution strategies for developers like China Evergrande Group.

China's ambitious goal of reaching peak carbon emissions by 2030 and achieving carbon neutrality by 2060 significantly impacts industries like construction. This national commitment translates into policies encouraging energy conservation and carbon reduction throughout the building sector. For a company like China Evergrande Group, heavily involved in large-scale residential developments, adapting its operations to meet these stringent environmental targets is becoming increasingly crucial. For instance, the Chinese government has implemented stricter standards for building energy efficiency, aiming to reduce the carbon footprint of new constructions.

China's increasing emphasis on sustainable urban development, highlighted by regulations like the Shanghai Green Building Regulations effective January 2025, directly impacts developers like Evergrande. These regulations push for greater resource conservation and pollution reduction in construction projects, influencing how Evergrande designs its residential communities.

This environmental shift encourages the adoption of green building materials and energy-efficient designs, potentially increasing initial construction costs but aiming for long-term operational savings and reduced environmental impact. For instance, the national target to have 60% of new urban buildings be green buildings by 2025 signifies a significant market push towards sustainability.

Waste Management and Resource Efficiency

China Evergrande Group, like all major developers, faces significant environmental pressures related to waste management and resource efficiency, especially given its extensive construction activities. The sheer scale of projects necessitates robust strategies to handle construction and demolition waste, which can be substantial. For instance, China generated an estimated 2.2 billion tonnes of construction waste in 2020, highlighting the national challenge.

Evergrande's environmental performance hinges on its ability to implement practices that minimize this waste. This includes adopting techniques for material reuse and recycling, such as crushing concrete for aggregate or salvaging timber. Furthermore, efficient resource utilization, from water and energy to raw materials like steel and cement, is crucial for both environmental sustainability and cost management. By prioritizing these aspects, Evergrande can mitigate its ecological footprint and potentially improve operational efficiency.

- Waste Minimization: Implementing strategies to reduce the volume of construction and demolition waste generated.

- Recycling and Reuse: Promoting the recycling of materials like concrete, steel, and wood, and encouraging the reuse of salvaged components.

- Resource Efficiency: Optimizing the use of water, energy, and raw materials throughout the development and construction phases.

- Regulatory Compliance: Adhering to China's increasingly stringent environmental regulations concerning waste disposal and resource management.

New Energy Vehicle Environmental Impact

China Evergrande Group's foray into new energy vehicles (NEVs) directly supports China's ambitious environmental goals, aiming to significantly cut down on transportation-related emissions. By 2023, China's NEV sales surpassed 9.5 million units, a testament to the market's rapid growth and government backing. This strategic alignment positions Evergrande to capitalize on a burgeoning sector driven by sustainability mandates.

However, the environmental footprint of NEVs isn't solely about tailpipe emissions. The production of EV batteries, a critical component, involves resource extraction and energy-intensive manufacturing processes. Furthermore, the end-of-life management of these batteries poses a significant challenge, with recycling infrastructure still developing. In 2024, the global lithium-ion battery recycling market was valued at approximately $2.5 billion, indicating a growing but still nascent industry.

The source of electricity used for charging NEVs also plays a crucial role in their overall environmental impact. If charging relies heavily on fossil fuel-based power generation, the net environmental benefit is diminished. China's energy mix is gradually shifting towards renewables, with solar and wind power capacity expanding, but the transition is ongoing. In 2023, renewable energy accounted for over 50% of China's total electricity generation capacity for the first time.

- NEV Market Growth: China's NEV sales exceeded 9.5 million units in 2023, reflecting strong market demand and policy support.

- Battery Production Concerns: The environmental impact of raw material sourcing and manufacturing for EV batteries remains a key consideration.

- Disposal Challenges: Effective and widespread battery recycling solutions are essential to mitigate the environmental burden of end-of-life EVs.

- Charging Infrastructure Impact: The carbon intensity of the electricity grid directly influences the true environmental advantage of NEVs.

China's environmental regulations are tightening, with a national goal for 60% of new urban buildings to be green buildings by 2025. This means developers like Evergrande must increasingly adopt sustainable materials and energy-efficient designs, impacting project costs and strategies. The nation's commitment to peak carbon emissions by 2030 and carbon neutrality by 2060 further pressures the construction sector to reduce its environmental footprint.

The sheer volume of construction waste in China, estimated at 2.2 billion tonnes in 2020, presents a significant challenge for large developers. Evergrande must implement robust waste management strategies, focusing on recycling and reuse of materials like concrete and steel to mitigate its ecological impact and improve efficiency.

Evergrande's venture into new energy vehicles (NEVs) aligns with China's environmental goals, as NEV sales surpassed 9.5 million units in 2023. However, the environmental impact of battery production and disposal, alongside the carbon intensity of the electricity grid used for charging, remain critical considerations for the sector's overall sustainability.

| Environmental Factor | China's Target/Status | Impact on Evergrande |

|---|---|---|

| Green Building Mandate | 60% of new urban buildings by 2025 | Increased compliance costs, adoption of sustainable practices |

| Carbon Neutrality Goal | By 2060 | Pressure to reduce operational emissions across all projects |

| Construction Waste | 2.2 billion tonnes generated in 2020 | Need for enhanced waste management and recycling initiatives |

| NEV Market Growth | 9.5 million+ units sold in 2023 | Opportunity in NEV sector, but with battery lifecycle considerations |

PESTLE Analysis Data Sources

Our China Evergrande Group PESTLE Analysis is grounded in a comprehensive review of official government publications, financial reports from regulatory bodies, and data from reputable economic and real estate industry associations. These sources provide critical insights into the political landscape, economic policies, and market dynamics impacting Evergrande.