China Evergrande Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Evergrande Group Bundle

China Evergrande Group faces intense competition, with significant threats from new entrants and powerful buyers in the real estate sector. Understanding the bargaining power of suppliers and the constant threat of substitutes is crucial for navigating its complex market landscape.

The complete report reveals the real forces shaping China Evergrande Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Evergrande Group's inability to secure new financing, a direct consequence of its colossal debt and ongoing liquidation, significantly amplifies the bargaining power of its remaining creditors. Lenders, facing substantial risk, can dictate highly unfavorable terms or outright refuse further capital, leaving Evergrande with minimal leverage.

The Chinese government's 'three red lines' policy, designed to curb excessive developer borrowing, further constrains companies like Evergrande, empowering financially sound lenders who can now demand premium rates or simply avoid involvement with distressed entities.

Many contractors and material suppliers to Evergrande have been left unpaid, transforming them into creditors within a protracted and intricate liquidation process. This history of non-payment grants these suppliers considerable influence over any future ventures, prompting them to demand upfront payments or significantly higher prices from other developers to offset perceived risks.

For Evergrande, their leverage stems from the claims these suppliers hold, though the recovery of these debts is anticipated to be minimal and protracted. As of early 2024, reports indicated that hundreds of billions of yuan in payments were owed to various contractors and suppliers, highlighting the scale of the unpaid debts.

Local governments in China act as significant suppliers of land for real estate development. Historically, their ability to control land supply gave them considerable bargaining power. However, with the ongoing property market downturn and a sharp decline in land sale revenues, local governments may be more willing to negotiate favorable terms to attract developers who can still transact.

For China Evergrande Group, this specific aspect of supplier bargaining power is largely moot. Given Evergrande's liquidation status, it is effectively removed from the land acquisition market. Therefore, its ability to negotiate terms with land-supplying local governments is nonexistent, neutralizing this potential force in its current operational context.

Specialized Labor and Expertise

While general construction workers might have limited individual leverage, specialized talent such as experienced project managers and engineers in complex, large-scale real estate developments can exert significant bargaining power. These skilled professionals can negotiate for higher salaries or better contract terms, especially when demand for their expertise is high.

The financial distress and ongoing liquidation of China Evergrande Group have a pronounced impact on its ability to attract and retain this specialized labor. A talent drain is likely, as skilled workers will gravitate towards developers perceived as more financially stable and offering greater job security.

- Specialized Talent Leverage: Experts in large-scale real estate development can command higher wages and more favorable terms due to their unique skills.

- Impact of Financial Distress: Developers in liquidation, like Evergrande, face significant challenges in attracting top talent.

- Talent Migration: Skilled professionals are likely to move to more stable companies, reducing the pool of available expertise for struggling firms.

Commodity Price Fluctuations

Commodity price fluctuations significantly impact the bargaining power of suppliers for developers like China Evergrande Group. Suppliers of essential construction materials, such as steel and cement, are sensitive to global market trends. For active developers, sharp increases in these material costs can amplify supplier leverage within the industry, directly pressuring profitability if those costs cannot be passed on to consumers.

- Steel prices saw considerable volatility in 2023, with futures trading on exchanges like the London Metal Exchange (LME) experiencing price swings influenced by global demand and supply chain disruptions.

- Cement prices in China also faced upward pressure in early 2024 due to increased energy costs and environmental regulations impacting production.

- For developers that are actively constructing projects, a 10% increase in raw material costs could directly reduce profit margins by a similar percentage if sales prices remain static.

The bargaining power of suppliers to China Evergrande Group is significantly diminished due to its liquidation status. Unpaid contractors and material suppliers, now essentially creditors, have limited leverage for future dealings, often demanding upfront payments from other developers to offset past losses. This situation means that for Evergrande, the traditional supplier power dynamics are largely irrelevant as it cannot engage in new procurement.

| Supplier Type | Historical Leverage | Current Leverage (Evergrande) |

|---|---|---|

| Material Suppliers (Steel, Cement) | Moderate, influenced by commodity prices. | Negligible; focus on recovering past debts. |

| Construction Contractors | Moderate, dependent on project scale and payment terms. | Very Low; many are creditors seeking partial recovery. |

| Land Suppliers (Local Governments) | High, controlling land availability. | Non-existent; Evergrande is out of the land acquisition market. |

What is included in the product

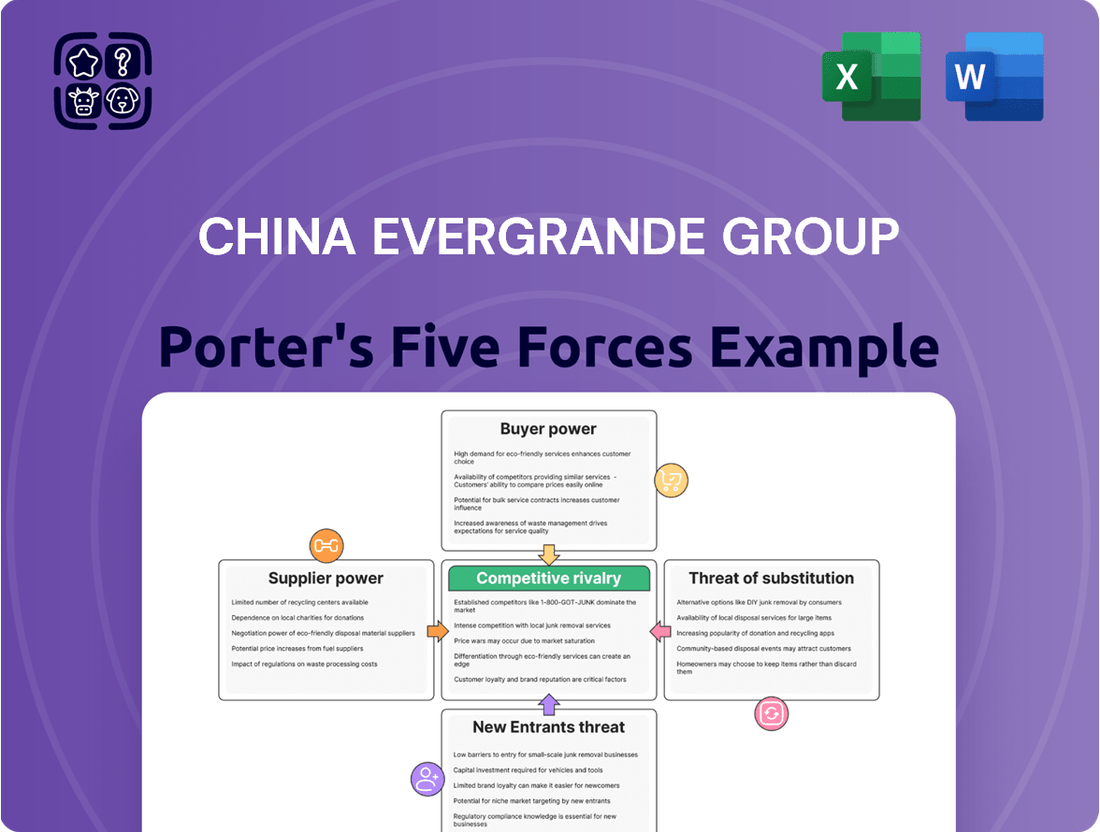

This analysis delves into the competitive forces shaping China Evergrande Group's operating environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector.

A clear, one-sheet summary of Porter's Five Forces for China Evergrande Group, highlighting intense competition and buyer power, perfect for quick decision-making on navigating its financial distress.

Customers Bargaining Power

The Chinese real estate market is grappling with a severe downturn, characterized by declining property values and a substantial surplus of unsold homes. This oversupply, coupled with economic uncertainties and worries about project completion, has made homebuyers extremely hesitant.

In 2024, this cautious sentiment translates directly into increased bargaining power for potential buyers. They are now in a position to negotiate for significantly lower prices, demand higher quality construction, and secure more advantageous payment terms, directly impacting developers like Evergrande.

The Chinese property market, particularly in lower-tier cities, is heavily saturated with numerous developers offering a vast inventory of properties. This abundance of choice significantly strengthens the bargaining power of customers, allowing them to meticulously compare options and demand better terms or prices. In 2024, this trend continues as buyers are less compelled to make immediate decisions, instead opting to explore various projects and developers.

Evergrande's ongoing liquidation and its past inability to deliver projects have further amplified customer leverage. Potential buyers are now actively seeking developers with a proven track record of stability and timely project completion, effectively steering clear of companies perceived as high-risk. This shift in buyer sentiment directly benefits more financially sound competitors, as customers prioritize reliability over potentially cheaper, but riskier, options.

Government policies in China have significantly shifted to favor property buyers, directly impacting developers like China Evergrande. For instance, in 2024, authorities continued to implement measures such as lowering down payment requirements and reducing mortgage interest rates to boost the real estate market. These actions effectively decrease the financial burden on potential homebuyers, making property acquisition more accessible and affordable.

This increased affordability translates into greater purchasing power for consumers. When buyers have more options and face lower entry barriers, they become less dependent on any single developer. Consequently, they can negotiate more aggressively on price, terms, and conditions, thereby amplifying their bargaining power against developers who are eager to secure sales in a competitive environment.

Switching Costs are Low for Property Management

For Evergrande Property Services, residents generally face minimal barriers when considering a switch to a different property management provider. This low switching cost empowers them to seek better service or more competitive pricing.

The ease with which residents can change management companies, especially in a market with numerous competitors, significantly enhances their bargaining power. They can collectively or individually voice dissatisfaction and seek alternatives.

- Low Switching Costs: Residents can easily move to another property management company, impacting Evergrande Property Services' ability to retain clients.

- Competitive Landscape: The presence of many property management firms means residents have ample choices, further strengthening their bargaining position.

- Demand for Quality: This ease of switching compels service providers like Evergrande Property Services to maintain high service standards and competitive fee structures to retain customer loyalty.

Intense Price Competition in New Energy Vehicles (NEVs)

Evergrande's foray into the New Energy Vehicle (NEV) market is met with a landscape defined by aggressive price competition. This intense rivalry means customers wield considerable bargaining power, able to readily compare offerings from a multitude of strong domestic and international players.

The NEV sector, particularly in China, has seen a significant 'race to the bottom' in pricing. For instance, by late 2023 and into 2024, many NEV manufacturers, including established brands and newer entrants, have engaged in substantial price cuts to capture market share. This dynamic directly amplifies customer leverage.

- Intense Competition: The NEV market features numerous manufacturers vying for dominance, leading to a buyer's market.

- Price Sensitivity: Customers can easily switch between brands based on price reductions and promotional offers.

- Market Saturation: A growing number of NEV models available means consumers have more choices than ever before.

- Technological Advancements: Rapid innovation often leads to older models being discounted, further benefiting price-conscious buyers.

The bargaining power of customers in China's real estate sector has significantly increased, especially in 2024. This is driven by a substantial oversupply of properties, economic uncertainties, and a widespread concern about project completion, forcing developers like Evergrande to offer more attractive terms.

With numerous developers competing in a saturated market, buyers in 2024 have the luxury of choice, enabling them to negotiate lower prices and better conditions. This leverage is further amplified by government policies aimed at making homeownership more accessible, such as reduced down payments and interest rates.

The financial distress of companies like Evergrande, including its liquidation proceedings, makes buyers even more discerning, prioritizing stability and reliability. This sentiment pushes customers towards developers with a proven track record, leaving those with financial challenges with less pricing power.

In the New Energy Vehicle (NEV) market, intense price competition in 2024, fueled by numerous domestic and international manufacturers, grants consumers significant bargaining power. Buyers can readily compare models and leverage price cuts and promotions, as the market experiences a trend of significant discounts.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Property Oversupply | High | Continued from previous years, exacerbating buyer leverage. |

| Economic Uncertainty | High | Buyers adopt a cautious approach, demanding better value. |

| Developer Financial Health | High | Buyers favor stable developers, increasing pressure on financially weak ones. |

| NEV Price Competition | Very High | Aggressive price cuts by manufacturers create a strong buyer's market. |

Full Version Awaits

China Evergrande Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The China Evergrande Group Porter's Five Forces analysis you see here details the intense competitive rivalry within China's property market, highlighting the significant threat of new entrants due to high capital requirements and regulatory hurdles. It also thoroughly examines the bargaining power of buyers, influenced by market saturation and price sensitivity, and the formidable bargaining power of suppliers, particularly in the construction materials sector. Furthermore, the analysis scrutinizes the threat of substitute products, though limited in the core real estate sector, and the overall industry attractiveness shaped by these forces.

Rivalry Among Competitors

The Chinese real estate market is experiencing a severe downturn, characterized by plummeting sales, declining property values, and a substantial surplus of unsold housing inventory. This challenging environment intensifies competition among the remaining developers who are aggressively pursuing a dwindling customer base.

In 2024, the pressure on developers like China Evergrande Group is immense as they strive to finish ongoing projects and service significant debt obligations. This situation forces them into aggressive pricing strategies and promotional offers, creating a cutthroat competitive landscape where market share is fiercely contested.

Evergrande's liquidation, a significant event in 2024, removes a dominant force from China's real estate sector. This once top-selling developer's exit, however, does not eliminate competitive intensity entirely, as the underlying demand and supply dynamics persist, with many other developers still vying for market share.

The market distress that led to Evergrande's downfall continues to affect the competitive landscape, creating an environment of caution and potential consolidation among remaining players. This situation means that while one competitor is gone, the overall rivalry remains fierce, albeit with altered strategies and heightened risk aversion.

In the current distressed market, State-Owned Enterprises (SOEs) are poised to become more dominant, bolstered by government backing and easier access to capital. This trend amplifies competition for private developers like Evergrande, as SOEs often possess superior financial stability and can pursue objectives beyond pure profit maximization, leading to an uneven competitive landscape.

Fragmented Property Management Market

The property management sector, a key area for Evergrande Property Services, is characterized by significant fragmentation. This means there are numerous companies competing for business, rather than a few dominant players. Competition here often hinges on factors like the quality of services offered, operational efficiency, and the price points companies can achieve.

This fragmented nature fuels intense rivalry. Companies are constantly working to keep their existing clients happy and to win new ones in a crowded marketplace. For example, by the end of 2023, the Chinese property management market saw numerous smaller firms actively seeking contracts, contributing to this competitive landscape.

- Fragmented Market: The property management industry is populated by a large number of diverse companies.

- Competition Basis: Rivalry centers on service quality, efficiency, and pricing strategies.

- Client Retention: Companies focus on maintaining existing client relationships and acquiring new ones.

- Industry Dynamics: Fragmentation ensures continuous competition as firms vie for market share.

Aggressive Competition in the NEV Sector

The New Energy Vehicle (NEV) sector in China is a battleground of fierce competition, marked by aggressive price wars. BYD and Geely are major players, but the market also sees numerous domestic and international brands vying for dominance. This intense rivalry, with over 100 NEV manufacturers operating in China as of early 2024, significantly pressures profit margins and necessitates constant technological advancement.

- Intense Rivalry: The Chinese NEV market is highly fragmented with numerous domestic and international players.

- Price Wars: Aggressive pricing strategies are common, squeezing profitability across the industry.

- Market Leaders: BYD and Geely are prominent, but many smaller firms struggle to gain substantial market share.

- Innovation Pressure: Continuous technological development is essential to remain competitive in this dynamic environment.

The competitive rivalry within China's real estate sector remains exceptionally high, even with Evergrande's liquidation in 2024. Developers are forced into aggressive pricing and promotions to attract buyers in a market with substantial unsold inventory and declining demand. State-owned enterprises, with their greater financial stability and government backing, are increasingly outmaneuvering private developers, creating an uneven playing field.

| Developer | Market Share (Est. 2024) | Key Competitive Strategy | Financial Health Indicator |

|---|---|---|---|

| China Vanke | 10-12% | Focus on stable, quality projects and operational efficiency | Relatively stable, but facing market pressures |

| Country Garden | 8-10% | Aggressive pricing and expansion into lower-tier cities | High debt, significant liquidity concerns |

| State-Owned Developers (e.g., Poly Developments) | Growing share (combined est. 20-25%) | Leveraging government support, access to capital, and strategic land acquisition | Generally strong financial backing and liquidity |

| Smaller Private Developers | Fragmented, <5% each | Niche markets, cost-cutting, and desperate pricing | High risk of default and consolidation |

SSubstitutes Threaten

The rental market presents a substantial threat of substitution for China Evergrande Group's core business of residential property sales. Government policies actively encouraging affordable rental housing, particularly in major urban centers, make renting a more accessible option for many. This is especially true for individuals experiencing economic uncertainty or grappling with high property purchase prices.

In 2024, the demand for rental properties in China's tier-one cities remained robust, driven by affordability concerns and increased migration to urban areas. For instance, rental yields in cities like Shanghai and Beijing, while varying, generally offered a more predictable cost of living compared to the substantial upfront investment and ongoing mortgage payments associated with homeownership, directly impacting the appeal of purchasing new Evergrande properties.

The market for existing or second-hand homes presents a significant threat of substitution for China Evergrande Group's new developments. As buyers face economic uncertainty and a cooling property market, the appeal of pre-owned properties increases. This trend was evident in 2024, with reports indicating a slowdown in new home sales across major Chinese cities, pushing developers to reconsider pricing strategies.

The declining prices in the second-hand market make these properties a more attractive alternative for many potential homeowners. For instance, in early 2024, average prices for resale homes in some Tier 1 cities saw a noticeable dip, offering buyers immediate occupancy and potentially lower overall acquisition costs compared to off-plan purchases. This directly pressures Evergrande and similar developers to enhance the value proposition of their new builds.

Customers of property management services have several alternatives, including managing properties themselves, hiring smaller local providers, or moving to different large property management firms. For instance, in 2024, the market for independent property managers continued to grow, with many small firms offering specialized services at competitive rates, potentially eroding market share for larger players like China Evergrande Group's property management arm.

The increasing prevalence of community-led initiatives and niche service providers also presents a threat. These alternatives cater to customers seeking more personalized or budget-friendly solutions, diverting demand. This trend highlights the need for established companies to differentiate themselves through superior service quality and innovative offerings to retain their client base.

Public Transportation and Ride-Sharing for Mobility

Consumers in China have readily available substitutes for personal car ownership, impacting demand for vehicles, including new energy vehicles (NEVs). The nation boasts an extensive public transportation system, with major cities like Shanghai and Beijing operating some of the world's busiest metro networks. For instance, Shanghai Metro carried over 3.8 billion passengers in 2023, illustrating the significant reach of public transit.

Ride-sharing services, such as Didi Chuxing, further provide convenient alternatives. These services are particularly appealing in densely populated urban centers where parking can be a challenge and the cost of ownership, including insurance and maintenance, is a consideration. This competition extends beyond traditional automakers, as these mobility solutions directly address a consumer's need for transportation without the commitment of owning a vehicle.

- Extensive Public Transit: China's urban areas are served by vast and efficient public transportation systems, reducing the necessity of private car ownership for many commuters.

- Growth of Ride-Sharing: Services like Didi Chuxing offer flexible and often cost-effective alternatives to personal vehicle use, especially in major metropolitan areas.

- Impact on NEV Demand: The availability of these substitutes can dampen the perceived need for new vehicles, including NEVs, thereby broadening the competitive landscape for automotive manufacturers.

Non-Real Estate Investments for Wealth Management

The threat of substitutes for China Evergrande Group's core business, real estate development, is significant. Historically, real estate in China has been a primary vehicle for wealth accumulation. However, the current property crisis has eroded investor confidence.

Investors are increasingly looking towards alternative asset classes for wealth management. This includes a growing interest in equities, fixed-income securities, and other financial instruments. For instance, by the end of 2023, China's stock market capitalization stood at approximately $7.7 trillion, offering a substantial alternative to property investments.

- Shift in Investor Preference: A notable migration of capital away from real estate towards financial markets is observed.

- Reduced Speculative Demand: The allure of property as a speculative investment has diminished due to market volatility and developer defaults.

- Growth in Financial Products: The availability and attractiveness of substitute investments like stocks and bonds are increasing.

- Impact on Property Market: This diversification of investment strategies directly reduces the demand that previously supported the real estate sector's rapid expansion.

The threat of substitutes for China Evergrande Group's property developments is multifaceted, encompassing rental housing, the resale market, and alternative investment vehicles. These substitutes offer more accessible or predictable financial outcomes, particularly when economic uncertainty prevails.

In 2024, the appeal of rental housing as a substitute for homeownership remained strong, especially in major Chinese cities. Affordability concerns and increased urban migration continued to bolster demand for rental properties. For instance, while specific rental yield data varies by city, the consistent demand in tier-one cities like Shanghai and Beijing provided a stable alternative to the significant capital outlay required for purchasing new homes, directly impacting Evergrande's sales pipeline.

The resale property market also presented a considerable threat. As buyers became more cautious in 2024, the availability of pre-owned homes at potentially lower prices, or with immediate occupancy, became more attractive than new, off-plan developments. Reports from early 2024 indicated a slowdown in new home sales across key urban centers, with some resale markets showing price adjustments that made them a more compelling substitute for new builds.

Beyond direct housing alternatives, financial markets offered a significant substitute for real estate as an investment. By late 2023, China's stock market capitalization reached approximately $7.7 trillion. This substantial pool of alternative assets, including equities and bonds, attracted capital that might otherwise have been directed towards property, especially as investor confidence in real estate waned due to developer defaults and market volatility.

| Substitute Type | Key Drivers | Impact on Evergrande |

| Rental Housing | Affordability, Urban Migration, Economic Uncertainty | Reduced demand for new home purchases |

| Resale Property Market | Price Sensitivity, Immediate Occupancy, Market Caution | Competition with new developments, pressure on pricing |

| Financial Markets (Equities, Bonds) | Wealth Accumulation Diversification, Investor Confidence Shift | Capital diversion from real estate, reduced speculative demand |

Entrants Threaten

Entering China's real estate development sector demands vast capital for land acquisition, construction, and marketing, presenting a significant hurdle. For instance, in 2023, major cities continued to see substantial land sale prices, with some prime urban plots exceeding billions of yuan.

The introduction of the 'three red lines' policy in 2020 has further tightened developer financing, making it more difficult and selective for companies to secure loans. This policy aimed to reduce leverage, and its impact has continued through 2024, with banks exercising greater caution.

Consequently, these substantial financial barriers, coupled with a more risk-averse lending environment and reduced investor confidence in real estate, deter many potential new entrants from challenging established players like China Evergrande Group.

Strict government regulations and policy uncertainty pose a significant threat to new entrants in China's real estate sector. The Chinese government wields considerable influence through policies on land use, housing purchases, and developer debt, creating a challenging landscape. For instance, in 2023, authorities continued to implement measures aimed at deleveraging the property sector and ensuring housing affordability, which can directly impact the feasibility of new projects and the capital available for expansion.

Existing large-scale developers in China, like Evergrande before its troubles, have cultivated strong brand reputations and deep networks with suppliers and contractors over many years. This makes it incredibly difficult for new companies to enter the market and gain traction. For instance, in 2023, the total value of construction contracts awarded in China reached trillions of yuan, a market dominated by established players who benefit from these long-standing relationships.

New entrants face a significant hurdle in building consumer trust, especially given the widespread issues with unfinished projects that have plagued the industry. The sheer scale of investment and time required to establish a reputation for quality and reliability means that newcomers are at a distinct disadvantage against developers who have a proven track record, even if that track record is now under scrutiny.

Oversupply and Depressed Market Conditions

The current oversupply of housing units in China, coupled with depressed market conditions, significantly deters new entrants into the real estate sector. For instance, as of early 2024, the vacancy rate for residential properties remained a concern, making it challenging for new developments to secure buyers. This situation presents a high-risk, low-return environment for potential investors.

The sheer volume of unsold inventory, a legacy of previous development booms, acts as a formidable barrier. New projects struggle to gain traction when a substantial amount of existing housing remains vacant, forcing developers to compete on price or offer significant incentives, thereby eroding potential profits. This makes the prospect of entering the market unattractive for many.

- Housing Oversupply: Reports in late 2023 and early 2024 indicated millions of unsold housing units across major Chinese cities.

- Market Downturn: Property sales and investment saw a notable decline in 2023 compared to previous years, signaling weak demand.

- High Investment Risk: The capital-intensive nature of real estate development means new entrants face substantial upfront costs in a declining market.

- Low Profit Potential: With falling prices and intense competition for buyers, the immediate return on investment for new projects is severely limited.

Intense Competition in Diversified Segments

While China Evergrande Group's diversification into new energy vehicles (NEVs) and property management aims to broaden its revenue streams, these segments also face significant threats from new entrants. The NEV market, for instance, is highly competitive, with established global and domestic players already commanding substantial market share and engaging in aggressive price wars. This intense competition necessitates massive capital investment in research and development, manufacturing infrastructure, and battery technology, creating a formidable barrier for newcomers.

The property management sector, though seemingly less capital-intensive than NEVs, presents its own set of challenges for new entrants. Success in this area relies on building extensive operational networks, cultivating strong customer service capabilities, and achieving economies of scale. Small, new property management firms struggle to compete with larger, established players that possess established brand recognition, robust operational systems, and a significant existing client base, making it difficult to gain traction and scale effectively.

- NEV Market Dynamics: The global NEV market saw sales exceed 13.6 million units in 2023, a significant increase from previous years, indicating high demand but also intense competition. Established automakers and numerous startups are vying for market share, often leading to price reductions that pressure profit margins.

- Property Management Landscape: In China, the property management market is fragmented but consolidating. By the end of 2023, the top 100 property management companies managed over 15 billion square meters of contracted area, highlighting the advantage of scale for incumbents.

- Capital Requirements: Entering the NEV manufacturing space requires billions of dollars in investment for factories, R&D, and supply chain development. Property management, while less demanding upfront, still requires significant investment in technology and personnel to achieve competitive service levels and scale.

The threat of new entrants into China's real estate sector is significantly dampened by immense capital requirements for land acquisition and construction, with prime urban land sales in 2023 often reaching billions of yuan. The 'three red lines' policy, impacting developer financing through 2024, coupled with a general aversion to risk and diminished investor confidence, creates substantial financial barriers. These factors, alongside established players' brand reputations and extensive networks, make it exceedingly difficult for newcomers to gain market footing.

| Barrier Type | Description | Impact on New Entrants | 2023/2024 Data Point |

|---|---|---|---|

| Capital Requirements | High costs for land, construction, and marketing. | Deters entry due to substantial upfront investment needs. | Major Chinese city land sales often exceeded billions of yuan in 2023. |

| Financing Access | Tightened lending due to policies like 'three red lines'. | Makes securing loans more difficult and selective. | Banks showed increased caution in real estate lending throughout 2023-2024. |

| Brand Reputation & Networks | Established players have long-standing relationships. | New entrants struggle to build trust and secure supplier/contractor deals. | Trillions of yuan in construction contracts in 2023 were dominated by established firms. |

| Market Conditions | Oversupply and depressed demand. | Creates a high-risk, low-return environment. | Residential property vacancy rates remained a concern in early 2024. |

Porter's Five Forces Analysis Data Sources

Our analysis of China Evergrande Group's competitive landscape is built upon a foundation of publicly available financial statements, company disclosures, and reports from reputable real estate industry associations. We also incorporate insights from financial news outlets and market research databases to capture current industry trends and competitive pressures.