China Evergrande Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Evergrande Group Bundle

China Evergrande Group's marketing mix is a complex interplay of ambitious product diversification, aggressive pricing tactics, expansive distribution networks, and high-impact promotional campaigns. Understanding these elements is crucial for grasping their market dominance and the strategies that fueled their growth.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for China Evergrande Group. Ideal for business professionals, students, and consultants looking for strategic insights into one of the world's largest property developers.

Product

China Evergrande Group's Residential Communities segment is central to its identity, with a strong emphasis on developing large-scale, integrated living environments across China. These projects go beyond mere housing, incorporating a wide array of amenities and services to foster complete communities.

The company's portfolio showcases a commitment to innovative design and robust construction quality, aiming to offer residents a high standard of living. For instance, by the end of 2023, Evergrande had a substantial pipeline of residential projects, though specific completion numbers for the year were impacted by the company's ongoing financial challenges.

Evergrande's property management segment, Evergrande Property Services Group, offers comprehensive community living, asset management, and community operations primarily within China. This division plays a crucial role in the company's diversified business model.

In 2024, Evergrande Property Services Group reported operating revenue of approximately RMB12,756.7 million. This figure highlights the substantial contribution of its property management services to the group's overall financial performance.

China Evergrande Group's property investment segment focuses on acquiring and managing a vast portfolio of residential and commercial real estate. This strategic approach aims to generate long-term value through asset appreciation and consistent rental income. As of late 2023, Evergrande's property development pipeline, a key component of its investment strategy, encompassed projects across numerous Chinese cities, though the exact current valuation of its investment property holdings is subject to ongoing market fluctuations and restructuring efforts.

New Energy Vehicles (NEVs)

Evergrande's foray into New Energy Vehicles (NEVs) through its subsidiary, China Evergrande New Energy Vehicle Group, represents a strategic diversification into the burgeoning sustainable transportation sector. This initiative is designed to capitalize on China's significant demand for electric vehicles, aligning with national environmental goals. The company's ambition is to establish a strong presence in the EV market, contributing to the broader shift towards greener mobility solutions.

Despite facing significant headwinds, including demands for subsidy repayments and prolonged delays in financial disclosures as of early 2024, the NEV segment remains an integral component of Evergrande's multifaceted product diversification strategy. This segment, while facing operational and financial scrutiny, continues to be positioned as a future growth driver.

- Product: Electric vehicles (EVs) designed to meet growing consumer demand for sustainable transportation.

- Price: Pricing strategies are likely influenced by competitive EV market dynamics and government incentives, though specific pricing for Evergrande's NEVs has faced uncertainty.

- Place: Distribution aims to leverage China's extensive automotive market, with potential for both online and offline sales channels.

- Promotion: Marketing efforts would focus on the environmental benefits and technological advancements of their NEV offerings, though promotional activities have been overshadowed by financial challenges.

Tourism and Leisure Projects

Evergrande's product strategy in tourism and leisure encompasses ambitious, large-scale developments like Ocean Flower Island in Hainan. This project, intended as a major international tourist destination, showcases the company's diversification beyond real estate.

The group also operates entertainment venues, including theme park brands such as Hengda Children of the World and Hengda Water World. These ventures are designed to capture a share of the growing domestic and international tourism market, offering families and individuals entertainment options.

These tourism and leisure projects serve to diversify Evergrande's revenue streams, reducing reliance on its core property development business. By catering to the leisure and entertainment needs of consumers, the company aimed to create additional avenues for growth and profitability.

While specific financial performance data for these segments in late 2024 or early 2025 is not readily available due to the company's ongoing restructuring, Ocean Flower Island faced significant challenges, including regulatory scrutiny and project delays, impacting its operational viability.

Evergrande's product strategy extends beyond residential properties to include electric vehicles (EVs) and tourism/leisure ventures. The NEV segment aims to tap into China's growing demand for sustainable transport, while tourism projects like Ocean Flower Island target the leisure market. These diversified products represent an effort to broaden revenue streams and explore new growth avenues.

| Product Segment | Key Offerings | Status/Notes (as of early 2025) |

|---|---|---|

| Residential Communities | Large-scale, integrated living environments with amenities. | Significant pipeline, but completion impacted by financial challenges. |

| New Energy Vehicles (NEVs) | Electric vehicles for sustainable transportation. | Ambition to establish presence; facing operational and financial scrutiny. |

| Tourism & Leisure | Large-scale developments (e.g., Ocean Flower Island), theme parks. | Aimed to diversify revenue; Ocean Flower Island faced regulatory scrutiny and delays. |

What is included in the product

This analysis explores China Evergrande Group's marketing mix, detailing its diverse product portfolio, competitive pricing strategies, extensive distribution network, and aggressive promotional activities to understand its market positioning and strategic implications.

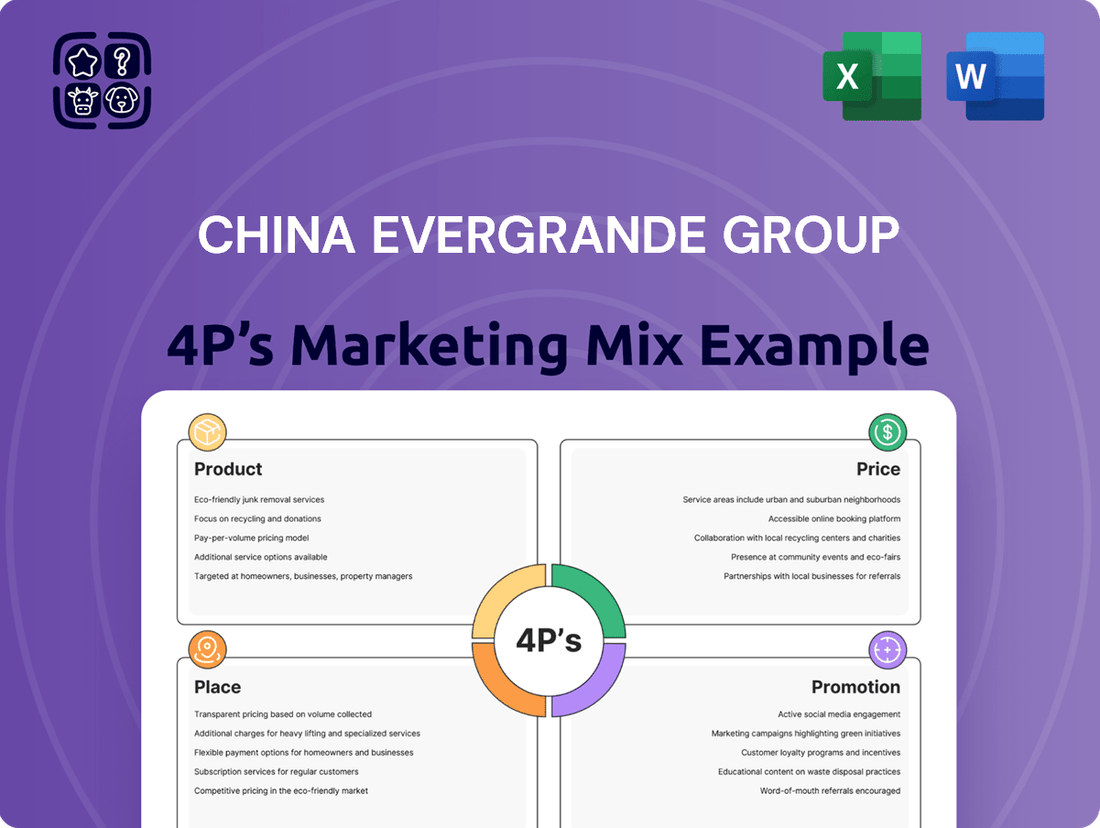

This analysis condenses China Evergrande Group's 4Ps marketing mix into a high-level view, highlighting how missteps in Product, Price, Place, and Promotion contributed to its financial distress, serving as a crucial pain point reliever for understanding the core issues.

Designed to be easily digestible for leadership, this 4Ps breakdown offers a rapid, at-a-glance understanding of Evergrande's strategic failures, acting as a pain point reliever by clearly identifying the marketing elements that exacerbated its crisis.

Place

Evergrande's extensive national presence is a cornerstone of its marketing strategy. By 2021, the company had a footprint in over 280 cities across mainland China, including all major metropolitan hubs like Beijing, Shanghai, Guangzhou, and Shenzhen. This vast network allowed them to tap into diverse customer segments across different city tiers, from first-tier metropolises to developing urban centers.

Evergrande’s primary distribution for its residential properties is through direct sales, utilizing on-site sales centers located within its massive community developments. These centers serve as crucial touchpoints, offering prospective buyers a tangible experience of model homes and the project's overall amenities. This direct engagement strategy is designed to foster immediate connection and drive sales conversion.

Evergrande leverages its official website and popular Chinese social media platforms like WeChat and Weibo to broadcast marketing and sales information. These digital touchpoints are crucial for engaging potential buyers, offering detailed project specifications, development progress, and enabling initial customer inquiries. As of late 2023, Evergrande's digital engagement strategy aimed to reach millions of users across these platforms, reflecting the growing importance of online channels in China's real estate market.

Strategic Partnerships and Collaborations

Despite its severe financial distress, China Evergrande Group has a history of leveraging strategic partnerships to drive growth. In its current phase, liquidators are actively exploring potential buyers for various assets, notably including its electric vehicle (EV) division, known as Hengchi. This indicates a continued strategic focus on finding partners to salvage and potentially revive key business segments.

The property management segment, Evergrande Property Services, has been actively pursuing collaborations to broaden its reach. For instance, it engages in community group buying initiatives. These efforts aim to create new sales channels and expand the service offerings beyond traditional property management, fostering deeper engagement with residents and potentially generating new revenue streams.

- Asset Sales Discussions: Liquidators are in advanced discussions with potential buyers for Evergrande's assets, with a particular emphasis on the New Energy Vehicle (NEV) business.

- Property Services Expansion: Evergrande Property Services is utilizing community group buying and similar initiatives to diversify and expand its sales channels for related services.

- Historical Partnership Strategy: The company has a track record of forming strategic alliances, a strategy that continues to be explored by its administrators in the current restructuring efforts.

Property Management Network

Evergrande Property Services Group leverages its expansive network to manage a significant real estate footprint. As of December 31, 2024, the company oversaw a gross floor area of approximately 579 million square meters. This vast scale facilitates widespread accessibility of its property management services to a broad resident base.

The strategy for this extensive network centers on deep regional cultivation and a honeycomb-style expansion model. This approach allows for concentrated service delivery within specific geographic areas before broadening out, ensuring efficient operations and strong local presence.

- Gross Floor Area Under Management: 579 million square meters (as of December 31, 2024).

- Expansion Strategy: Regional deep cultivation and honeycomb-style expansion.

- Objective: To ensure broad accessibility and efficient delivery of property management services.

Evergrande's extensive national presence is a cornerstone of its marketing strategy, reaching over 280 cities by 2021. This widespread distribution network, primarily through direct sales at on-site centers, allows for tangible customer experiences. Digital platforms like WeChat and Weibo are crucial for engagement, reaching millions as of late 2023.

The company's property management arm, Evergrande Property Services, managed 579 million square meters as of December 31, 2024, utilizing a deep regional cultivation and honeycomb expansion model for efficient service delivery. Current efforts focus on asset sales, particularly the NEV division, and expanding property services through initiatives like community group buying.

Preview the Actual Deliverable

China Evergrande Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. It details China Evergrande Group's marketing mix, covering Product, Price, Place, and Promotion strategies. This comprehensive analysis is ready for your immediate use.

Promotion

China Evergrande Group historically relied on extensive marketing, notably for its new energy vehicle division, Hengchi. These efforts included frequent television ads designed to quickly establish brand recognition and generate consumer excitement. For instance, in 2021, Evergrande reportedly spent billions on advertising and promotional activities, a significant portion of which was directed towards building the Hengchi brand.

China Evergrande Group leveraged popular Chinese social media platforms like WeChat and Weibo to connect with its vast customer base, disseminating crucial company updates and engaging directly with potential buyers. This digital outreach was particularly vital in 2024, as the company navigated its restructuring efforts, aiming to maintain transparency and customer confidence amidst significant financial challenges.

Beyond domestic platforms, Evergrande maintained a corporate presence on LinkedIn, a key channel for sharing investor relations information and attracting talent, reflecting a dual strategy to engage both local and international stakeholders. This online presence was instrumental in communicating the company's ongoing restructuring progress and future outlook to a global audience.

Evergrande's promotional efforts, particularly in the face of its financial challenges, have heavily focused on project completion and delivery. This strategy is designed to rebuild trust and confidence among homebuyers and the broader market. The company's stated mission, "build the brand with quality and establish the enterprise with integrity," underscores this commitment.

This emphasis on delivering finished properties serves as a crucial promotional message, especially during times of market uncertainty. By prioritizing the completion of its projects, Evergrande aims to demonstrate its ongoing operational capacity and commitment to its customers, a vital aspect of its brand building.

Public Relations and Community Engagement

Evergrande Property Services actively cultivates a positive public image through robust public relations and community engagement. The company emphasizes its social contributions, notably its efforts to support rural households and create employment opportunities. These actions are designed to build goodwill and strengthen its connection with the wider community, even during periods of corporate difficulty.

These initiatives are more than just good deeds; they are strategic. By showcasing its commitment to societal well-being, Evergrande Property Services aims to mitigate negative perceptions and foster a sense of shared responsibility. This approach is crucial for maintaining stakeholder trust and navigating complex business environments.

- Community Investment: Evergrande Property Services has highlighted its role in assisting rural households, a key aspect of its corporate social responsibility.

- Job Creation: The company's efforts to provide job opportunities contribute to local economies and demonstrate its commitment to social upliftment.

- Reputation Management: These PR activities are vital for shaping a favorable public perception, especially in light of broader challenges faced by the parent group.

- Societal Connection: By engaging with the community, Evergrande Property Services seeks to maintain a relevant and positive presence beyond its core business operations.

Corporate Communication and Investor Relations

Even amidst its liquidation proceedings, China Evergrande Group's promotional efforts are now heavily focused on corporate communication and investor relations. This involves providing crucial updates to creditors and the broader market regarding its ongoing restructuring. The company is navigating a complex landscape, aiming to maintain stakeholder trust through transparent communication about its domestic business stability and operational safeguarding efforts.

Evergrande's investor relations strategy, though under immense pressure, centers on addressing legal proceedings and financial updates. This communication serves as a vital, albeit challenging, promotional tool. For instance, in late 2023 and early 2024, the company was still issuing statements regarding its restructuring progress and the status of various legal cases, attempting to manage perceptions and provide clarity to a distressed stakeholder base.

Key aspects of this promotional communication include:

- Regular Updates: Disseminating information on the progress of its liquidation and restructuring plans to creditors and investors.

- Domestic Operations: Communicating efforts to stabilize and safeguard ongoing domestic business operations to reassure stakeholders.

- Legal and Financial Transparency: Addressing ongoing legal proceedings and providing financial updates to maintain a degree of trust amidst uncertainty.

Evergrande's promotional strategy has evolved significantly, shifting from broad consumer advertising to focused communication during its restructuring. The emphasis is now on rebuilding trust through project delivery and transparent updates to stakeholders. This includes highlighting efforts to stabilize domestic operations and address ongoing legal and financial matters.

The company's communication efforts in late 2023 and early 2024 focused on providing crucial updates regarding its liquidation and restructuring plans. This transparency aims to manage perceptions and offer clarity to a distressed stakeholder base, particularly creditors and investors.

Key promotional messages revolve around safeguarding domestic business operations and addressing legal proceedings. For instance, statements were issued regarding restructuring progress and the status of various legal cases throughout this period.

Evergrande Property Services has also engaged in community investment and job creation initiatives to foster goodwill and manage its reputation. These actions are strategic, aiming to mitigate negative perceptions and maintain stakeholder trust during challenging times.

Price

Evergrande's property pricing strategy historically aimed to be competitive, adapting to market dynamics like local demand, competitor offerings, and government policies. This approach was designed to capture market share in various regions across China.

However, the current market reality presents significant challenges. Data from the National Bureau of Statistics of China indicates a downward trend in new home prices. For instance, in April 2024, 62 out of 70 major cities saw a month-on-month decrease in new home prices. Projections suggest this trend of falling or stagnant prices could persist through 2026, directly impacting Evergrande's pricing power.

China Evergrande Group's hefty debt burden, exceeding $300 billion as of late 2023, and the subsequent Hong Kong court-ordered liquidation in January 2024 have crippled its pricing power. This financial distress forces asset sales, likely at discounted prices, to meet obligations rather than optimize profit.

The liquidation primarily targets Evergrande's overseas operations, but it casts a long shadow over its mainland assets, creating significant uncertainty for any potential pricing strategies. This situation severely restricts any ability to set premium prices, as liquidity becomes the paramount concern.

The Chinese government has actively intervened to stabilize the property market, a crucial factor for developers like Evergrande. Measures introduced in 2024 and early 2025 include reduced mortgage rates and directives for local governments to acquire unsold housing stock. This directly impacts Evergrande's pricing strategy by potentially creating a price floor, although it also signals underlying market fragility.

Asset Valuation and Discounted Sales

Evergrande's financial struggles have forced asset disposals, with liquidators aiming to recover funds for creditors. This pressure often results in assets being sold at significant discounts from their earlier valuations. The ongoing efforts to sell off properties and other holdings underscore the difficulty in realizing value from the company's extensive portfolio.

Recent reports from mid-2024 indicate that the sale of Evergrande's assets is proceeding, though often at prices well below their book value. For instance, the sale of its Hong Kong headquarters, once valued at over $1 billion, was reportedly completed for a considerably lower sum, reflecting the distressed nature of the transaction.

- Asset Fire Sales: Pressure to raise cash means assets are often sold below their intrinsic value.

- Creditor Recovery: Liquidators are prioritizing recouping funds for those owed money by Evergrande.

- Valuation Gap: The difference between pre-crisis valuations and current sale prices highlights the depth of Evergrande's financial distress.

- Ongoing Challenges: The process of selling off a vast number of assets remains complex and time-consuming.

Perceived Value vs. Market Reality

Evergrande's historical strategy focused on delivering quality, but recent events have significantly impacted how consumers perceive the value of their properties. The widespread concern over unfinished projects has eroded buyer confidence, making them hesitant to pay premium prices. This shift in sentiment directly affects Evergrande's pricing power.

The broader Chinese property market has faced a downturn, with consumer confidence plummeting. This has resulted in fewer property purchases and a general recalibration of consumer spending habits. For Evergrande, this means a tougher market where price becomes a more critical factor than it has been in the past.

Key data points illustrating this shift include:

- Declining Sales: Evergrande's property sales have seen a dramatic drop. For instance, in the first half of 2023, the company reported a significant year-on-year decrease in contracted sales, reflecting the market's apprehension.

- Price Adjustments: To stimulate demand, developers, including Evergrande, have been forced to offer substantial discounts on properties, indicating a clear disconnect between historical perceived value and current market reality.

- Consumer Sentiment Surveys: Reports from late 2023 and early 2024 consistently show a low consumer sentiment index for the real estate sector in China, directly impacting purchasing decisions and willingness to pay.

- Unfinished Projects Impact: The sheer volume of unfinished projects across the country, exacerbated by Evergrande's own situation, has created a ripple effect, making buyers wary of any developer's promises.

Evergrande's pricing strategy has shifted from competitive market share capture to desperate asset liquidation. The company's inability to service its massive debt, exceeding $300 billion as of late 2023, and its liquidation order in January 2024 have rendered its pricing power virtually non-existent.

Assets are being sold at deep discounts, a stark contrast to previous valuations, as liquidators prioritize debt recovery. For example, the sale of its Hong Kong headquarters realized a price significantly lower than its prior estimated value of over $1 billion.

Government interventions, such as reduced mortgage rates and local government purchases of unsold stock in 2024-2025, aim to create a price floor. However, this also highlights the underlying market fragility and Evergrande's limited ability to dictate prices.

Consumer sentiment, severely impacted by unfinished projects and the broader market downturn, forces price reductions. Declining sales figures, such as those reported in the first half of 2023, underscore the need for substantial discounts to stimulate any demand.

| Metric | Value/Trend | Impact on Evergrande Pricing |

|---|---|---|

| China New Home Prices (Month-on-Month) | 62 of 70 major cities saw decreases in April 2024 | Downward pressure on all property valuations, including Evergrande's |

| Evergrande Debt | Exceeding $300 billion (late 2023) | Forces distressed asset sales at discounted prices |

| Consumer Sentiment (Real Estate) | Low index in late 2023/early 2024 | Reduced willingness to pay premium prices, necessitates discounts |

| Asset Sale Discounts | Significant discounts from book value reported mid-2024 | Reflects severe financial distress and lack of pricing control |

4P's Marketing Mix Analysis Data Sources

Our China Evergrande Group 4P's Marketing Mix Analysis is constructed using a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate data from real estate industry reports, news archives, and analyses of their property development projects to capture their product offerings and market positioning.