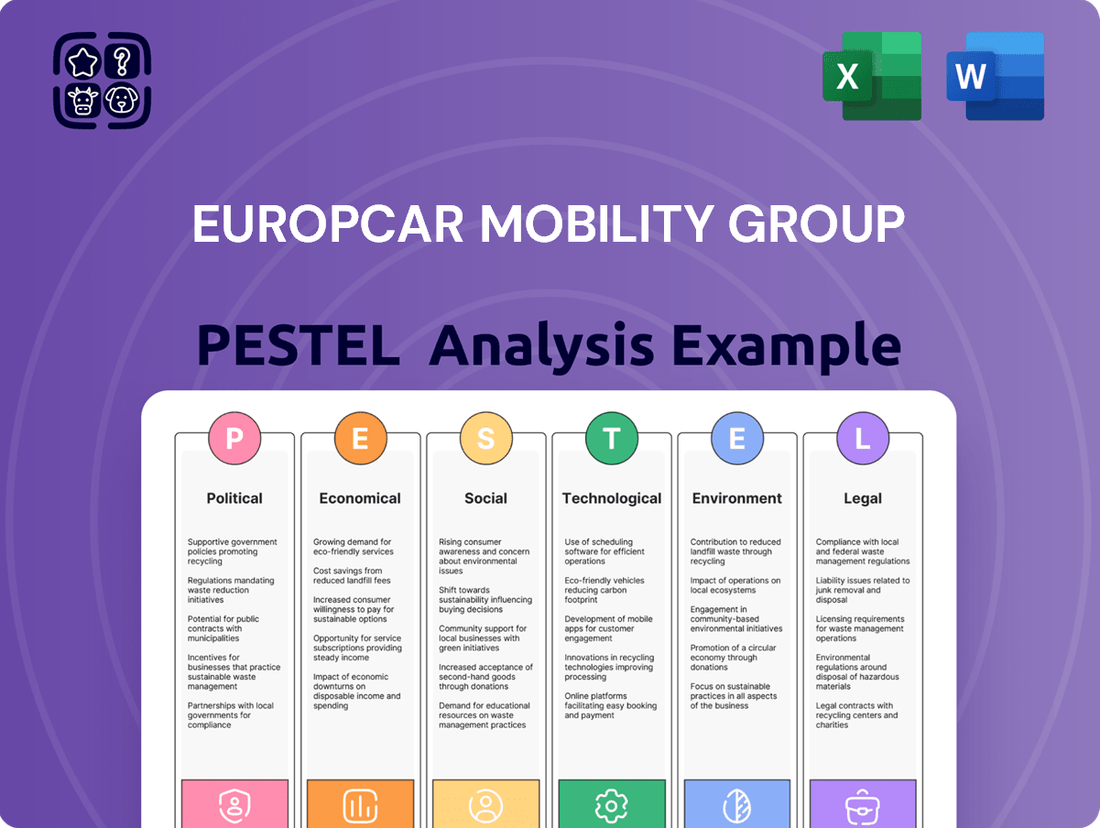

Europcar Mobility Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europcar Mobility Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Europcar Mobility Group's future. Our expert-crafted PESTLE analysis reveals how these external forces present both challenges and opportunities for the company's strategic direction. Download the full version now to gain actionable intelligence and sharpen your competitive edge.

Political factors

Governments worldwide are tightening regulations on the mobility sector, pushing companies like Europcar to prioritize sustainable transport and lower emissions. This means Europcar must adapt its fleet, potentially increasing operational costs as it shifts towards greener options.

Policies encouraging electric vehicles (EVs), such as subsidies or outright mandates, are accelerating Europcar's transition to an EV-centric fleet. However, this transition necessitates substantial investment in charging infrastructure, a key challenge for the company's future operations.

International trade agreements and cross-border policies also play a crucial role, affecting Europcar's ability to operate seamlessly across different markets and access new customer bases.

Antitrust regulations in major European markets, such as Germany and France, actively scrutinize vehicle rental companies for potential market dominance. For instance, the European Commission has previously investigated mergers within the sector to ensure fair competition. These policies can impact Europcar's ability to acquire competitors or influence its pricing strategies, aiming to prevent monopolistic practices and ensure a competitive landscape for consumers.

Government policies significantly shape the tourism landscape, directly impacting Europcar Mobility Group's demand. For instance, streamlined visa processes and the hosting of major international events, like the 2024 Paris Olympics, can drive substantial increases in tourist arrivals, thereby boosting car rental volumes. The European Union's efforts to harmonize travel regulations across member states also aim to facilitate easier cross-border travel, benefiting companies like Europcar.

Conversely, restrictive travel measures, such as those seen during the COVID-19 pandemic, or geopolitical tensions can severely curtail international travel. In 2023, while global tourism saw a strong rebound, reaching 88% of pre-pandemic levels by year-end according to the UNWTO, localized restrictions or safety concerns can still lead to unpredictable dips in rental demand for Europcar in specific regions.

Labor Laws and Employment Policies

Changes in labor laws, such as potential increases in minimum wages and social security contributions across key European markets, could directly impact Europcar's operational costs. For instance, if Germany, a significant market for Europcar, were to raise its minimum wage by 5% in 2024, this would add to payroll expenses. Furthermore, evolving flexible work regulations might necessitate adjustments in staffing models for rental stations and maintenance depots, affecting overall human resource management and potentially increasing administrative overhead.

Compliance with the patchwork of national labor frameworks throughout Europcar's global footprint is a constant challenge. For example, navigating the differing regulations on working hours and employee benefits between France and Spain requires dedicated legal and HR resources. These policies also play a critical role in shaping the availability and cost of skilled personnel, from customer service agents at rental counters to mechanics responsible for fleet maintenance, directly influencing service quality and operational efficiency.

- Minimum Wage Impact: A hypothetical 5% increase in minimum wage in Germany in 2024 could raise Europcar's payroll by an estimated €5-7 million annually, depending on the number of affected employees.

- Social Security Contributions: Fluctuations in social security contribution rates in countries like Italy could add further pressure to operational expenses, potentially increasing them by 1-2% for affected payroll segments.

- Flexible Work Regulations: Stricter regulations on part-time work or gig economy arrangements in the Netherlands could impact Europcar's ability to flexibly staff peak season demand at rental locations.

- Talent Acquisition Costs: Increased demand for skilled automotive technicians, driven by evolving vehicle technologies and potentially stricter labor laws regarding training, could raise recruitment and retention costs for Europcar's maintenance teams.

Political Stability and Geopolitical Risks

Europcar Mobility Group's operations are significantly influenced by political stability across its key markets. For instance, the ongoing geopolitical tensions in Eastern Europe, particularly the conflict in Ukraine, have created a volatile operating environment, impacting travel patterns and consumer confidence in nearby regions throughout 2024. This instability directly affects Europcar's ability to deploy its fleet and secure its investments in affected areas, posing a tangible risk to profitability and operational continuity.

Geopolitical risks can manifest in various ways, from localized conflicts to broader trade disputes. These events can lead to disruptions in international travel, damage to essential infrastructure, and an overall unpredictable business climate. For Europcar, this translates to potential challenges in fleet management, ensuring customer safety, and maintaining consistent service delivery, especially in regions experiencing heightened tensions. The company's financial performance in 2024 and projected into 2025 will likely reflect these external political pressures.

- Impact on Travel: Geopolitical instability can deter international tourism and business travel, directly reducing rental demand for Europcar.

- Infrastructure Risk: Conflicts or civil unrest can damage rental locations, vehicles, and transportation networks, leading to operational disruptions and repair costs.

- Regulatory Changes: Political shifts can result in new regulations affecting vehicle emissions, labor practices, or foreign investment, requiring adaptation and potentially increasing compliance costs.

- Economic Sanctions: International sanctions imposed due to geopolitical events can limit Europcar's ability to operate in certain countries or conduct financial transactions.

Government regulations are a major force shaping Europcar's strategy, particularly concerning environmental standards and fleet modernization. Policies promoting electric vehicles (EVs) are accelerating this shift, though significant investment in charging infrastructure remains a hurdle. Antitrust regulations in key European markets ensure fair competition, potentially influencing Europcar's acquisition strategies and pricing. The company must also navigate a complex web of international trade agreements and differing national labor laws, which impact operational costs and talent acquisition.

| Policy Area | Impact on Europcar | 2024/2025 Relevance |

|---|---|---|

| Environmental Regulations | Fleet transition to EVs, increased operational costs for sustainable options. | EU's Green Deal targets and national emission standards will continue to drive fleet upgrades. |

| Labor Laws | Potential increases in payroll expenses due to minimum wage hikes and social security contributions. | Several European countries are reviewing minimum wage levels in 2024, impacting labor costs. |

| Trade Agreements | Facilitates or hinders cross-border operations and market access. | Ongoing negotiations and potential changes in trade pacts can affect Europcar's international business. |

| Antitrust Scrutiny | Impacts mergers, acquisitions, and pricing strategies to ensure market competition. | Regulatory bodies continue to monitor market concentration in the vehicle rental sector. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Europcar Mobility Group, detailing how political shifts, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks create both challenges and opportunities for the company.

This PESTLE analysis for Europcar Mobility Group acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategic planning, ensuring all stakeholders understand potential market shifts and risks.

Economic factors

Economic growth is a key driver for Europcar Mobility Group. As economies expand, consumer confidence and disposable income tend to rise, leading to increased demand for leisure travel. For instance, the Eurozone's GDP growth, projected to be around 1.7% in 2024 and 1.8% in 2025, directly supports higher travel spending.

A healthy business environment also fuels corporate travel, a significant segment for rental companies like Europcar. When businesses are performing well, they tend to increase travel for meetings, conferences, and client visits. Strong business activity in major European markets in 2024 and anticipated for 2025 translates into more corporate rental opportunities.

Conversely, economic slowdowns or recessions present challenges. During downturns, both individuals and businesses cut back on discretionary spending, including travel. A projected dip in consumer spending growth in some European countries during late 2024 could therefore negatively impact Europcar's rental volumes and overall revenue.

Inflationary pressures in 2024 and early 2025 are significantly impacting Europcar's operational expenses. Rising fuel prices, coupled with increased vehicle acquisition costs and maintenance expenses, are directly affecting the company's bottom line. For instance, the average price of gasoline in key European markets saw a notable increase throughout 2024, directly translating to higher operating costs for Europcar's rental fleet.

Furthermore, the prevailing higher interest rate environment, a trend expected to continue through much of 2025, elevates the cost of financing Europcar's substantial vehicle fleet. This increased financing burden necessitates careful financial management to maintain profitability. Europcar faces the delicate task of absorbing these escalating costs while simultaneously striving to offer competitive pricing to its customer base, a critical balancing act in the current economic climate.

Interest rates significantly influence Europcar Mobility Group's ability to finance its substantial vehicle fleet. For instance, a rise in benchmark rates, such as the European Central Bank's main refinancing operations rate, directly translates to higher borrowing costs for new vehicle acquisitions and existing debt. In 2024, with central banks navigating inflation, these rates have remained elevated, impacting the cost of capital for fleet expansion and renewal programs.

Increased financing expenses can squeeze profit margins for Europcar, potentially leading to higher rental prices for consumers or a slowdown in fleet modernization. Access to competitive financing terms is therefore paramount for maintaining fleet quality and availability, which are critical for customer satisfaction and operational efficiency.

Tourism Industry Performance

The performance of the global tourism industry is a critical economic factor for Europcar Mobility Group, directly influencing its leisure rental segment. For instance, in 2023, international tourist arrivals reached 97% of pre-pandemic levels, signaling a strong recovery and increased demand for travel services. This upward trend is a significant tailwind for Europcar's business.

Key indicators like the number of international tourist arrivals and major global events directly impact car rental demand. The World Tourism Organization (UNWTO) reported a 22% increase in international arrivals in the first quarter of 2024 compared to the same period in 2023, further underscoring the positive economic environment for companies like Europcar.

- Global tourism recovery: International tourist arrivals in 2023 were 97% of 2019 levels.

- Year-on-year growth: Q1 2024 saw a 22% increase in international arrivals compared to Q1 2023.

- Economic impact: A robust tourism sector directly boosts demand for car rental services.

Currency Exchange Rate Volatility

Currency exchange rate volatility significantly impacts Europcar Mobility Group due to its extensive international presence across Europe, North America, and other global markets. Fluctuations in exchange rates directly affect the company's reported revenues and operational costs. For instance, a strengthening of local currencies against the Euro can lead to higher prices for international tourists, potentially dampening demand for Europcar's services.

Conversely, a weaker Euro can increase the cost of Europcar's operations in foreign countries when profits are repatriated. This dynamic was evident in recent financial reporting, where currency headwinds, particularly from a weaker British Pound and US Dollar against the Euro in late 2024, presented challenges. For example, the company noted that foreign exchange impacts could shave off a percentage point or two from its reported revenue growth in certain quarters.

- Revenue Impact: A stronger Euro can make Europcar's services more expensive for international customers, potentially reducing rental volumes.

- Cost Impact: A weaker Euro increases the cost of operating in non-Eurozone countries and repatriating profits, affecting profitability.

- 2024/2025 Trends: Observed volatility in GBP/EUR and USD/EUR rates in late 2024 indicated potential for reduced reported revenue growth due to currency translation effects.

- Hedging Strategies: Europcar likely employs hedging strategies to mitigate some of these currency risks, though significant movements can still impact financial performance.

Economic growth is a major driver for Europcar Mobility Group, with Eurozone GDP projected at 1.7% in 2024 and 1.8% in 2025, boosting both leisure and corporate travel demand. However, inflationary pressures in 2024 and 2025 are increasing operational costs, notably fuel and vehicle acquisition expenses, impacting profit margins. Furthermore, elevated interest rates throughout 2025 raise financing costs for Europcar's fleet, requiring careful financial management to maintain competitive pricing and fleet quality.

| Economic Factor | 2024/2025 Data/Trend | Impact on Europcar |

|---|---|---|

| GDP Growth (Eurozone) | Projected 1.7% (2024), 1.8% (2025) | Increases demand for leisure and corporate rentals. |

| Inflation | Persisting pressures on fuel, vehicle costs | Raises operational expenses, potentially squeezing margins. |

| Interest Rates | Elevated, expected to continue through 2025 | Increases cost of financing vehicle fleet, impacting capital expenditure. |

| Global Tourism Recovery | 97% of pre-pandemic levels (2023), 22% YoY growth Q1 2024 | Boosts demand for leisure travel and car rentals. |

| Currency Exchange Rates | Volatility observed (e.g., GBP/EUR, USD/EUR) | Affects reported revenue and operational costs due to international presence. |

Full Version Awaits

Europcar Mobility Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Europcar Mobility Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges and opportunities facing the company.

Sociological factors

Societal trends increasingly favor flexible, on-demand transportation over the traditional model of personal car ownership. This shift directly benefits companies like Europcar Mobility Group, whose business model is built around providing accessible mobility solutions. For instance, in 2024, the global car-sharing market was valued at over $6 billion and is projected to grow significantly, demonstrating this strong preference.

Urbanization and evolving consumer values, especially among younger demographics, are key drivers behind this change. These groups often prioritize convenience, cost-effectiveness, and environmental consciousness, making car-sharing, short-term rentals, and subscription services highly attractive. Europcar's strategic acquisitions and development of services like Ubeeqo directly address this demand, positioning them to capture a larger share of this expanding market.

Growing public awareness of environmental issues is a significant sociological factor impacting the transportation sector. Consumers are increasingly prioritizing sustainability, leading to a greater demand for eco-friendly mobility solutions. This trend directly influences choices towards electric vehicles (EVs), hybrids, and other low-emission transport options.

Europcar Mobility Group is responding to this shift by expanding its fleet of greener vehicles. By the end of 2024, the group aimed to have 10% of its fleet in Europe be electric, a figure projected to grow significantly by 2025. This strategic move not only caters to evolving consumer preferences but also bolsters Europcar's brand image as a responsible and forward-thinking company.

Global urbanization continues to accelerate, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This surge in city dwellers intensifies traffic congestion and parking scarcity, diminishing the appeal of private car ownership for many. This societal shift directly fuels demand for flexible mobility solutions like short-term car rentals and car-sharing, particularly for infrequent travel needs or excursions outside urban centers. Europcar's strategic focus on urban mobility services positions it to capitalize on this growing trend.

Demographic Shifts and Lifestyles

Demographic shifts significantly influence Europcar Mobility Group's market. For instance, the aging population in many European countries, with an estimated 20% of the EU population projected to be over 65 by 2030, may increasingly opt for car rental services to maintain mobility without the responsibilities of ownership. Conversely, younger demographics, such as Gen Z, are showing a trend towards delaying car purchases, with many prioritizing access over ownership, which directly benefits car-sharing and rental models.

Evolving lifestyles, particularly the rise of remote work, are reshaping travel patterns and the demand for flexible transportation solutions. As more individuals work from home, the need for daily commuting vehicles diminishes, but the desire for occasional travel or weekend getaways, where rental vehicles are ideal, increases. This trend necessitates that Europcar adapt its offerings to provide convenient, short-term rental options that align with these fluid lifestyle choices.

- Aging Population: Increased demand for convenient mobility solutions without ownership burdens.

- Younger Generations: Trend towards delaying car ownership, favoring access-based mobility services.

- Remote Work: Shift in travel patterns, potentially increasing demand for leisure and occasional rentals.

- Urbanization: Growing urban populations may prefer car-sharing and rental over private vehicle ownership due to parking and congestion.

Influence of Digital Lifestyles

The widespread integration of digital technologies and mobile-centric living fundamentally alters how consumers engage with mobility solutions. This means people are increasingly researching, booking, and managing their travel and transportation needs entirely online. For Europcar Mobility Group, this translates into a critical need to deliver intuitive digital interfaces and responsive mobile applications, ensuring a smooth and immediate customer journey.

Customer expectations are now centered on effortless online experiences, including instant booking confirmations and readily available digital support channels. Europcar's commitment to enhancing its digital platforms, such as its mobile app, is paramount for staying competitive in this evolving landscape. For instance, by mid-2024, many leading mobility providers reported over 70% of bookings originating from digital channels, highlighting this significant shift.

- Digital Dominance: Over 70% of mobility service bookings are now digital, driven by mobile-first consumer habits.

- Seamless Expectations: Customers demand instant bookings and integrated digital customer service.

- Platform Investment: Europcar must continually upgrade its digital and mobile offerings to meet these evolving demands.

- Competitive Edge: A superior digital experience is a key differentiator in the modern mobility market.

Societal trends favor flexible, on-demand transportation, benefiting Europcar's model. The global car-sharing market, valued over $6 billion in 2024, reflects this preference. Urbanization and younger demographics' values for convenience and sustainability drive demand for car-sharing and rentals.

Environmental consciousness increases demand for eco-friendly options, prompting Europcar to expand its EV fleet. By the end of 2024, Europcar aimed for 10% of its European fleet to be electric, with further growth anticipated by 2025. This aligns with consumer preferences and enhances brand image.

Urbanization, with nearly 70% of the world projected to live in cities by 2050, exacerbates congestion and parking issues. This makes car-sharing and rentals more appealing than private ownership for many urban dwellers.

Demographic shifts, including an aging population seeking mobility without ownership burdens and younger generations prioritizing access over ownership, directly impact Europcar's market. Evolving lifestyles, like increased remote work, also boost demand for flexible, occasional rental solutions.

| Sociological Factor | Impact on Europcar | Supporting Data (2024/2025) |

|---|---|---|

| Shift to Flexible Mobility | Increased demand for rental and car-sharing services. | Global car-sharing market projected to grow significantly from its 2024 valuation of over $6 billion. |

| Urbanization & Lifestyle Changes | Higher demand for solutions addressing congestion and parking; increased need for occasional rentals due to remote work. | Nearly 70% of the world population projected to live in urban areas by 2050. |

| Environmental Awareness | Growing preference for EVs and low-emission vehicles. | Europcar's 2024 target of 10% electric fleet in Europe, with ongoing expansion. |

| Demographic Shifts | Demand from aging populations for convenient mobility; younger generations favoring access over ownership. | Estimated 20% of the EU population to be over 65 by 2030. |

Technological factors

The automotive landscape is rapidly shifting towards electric vehicles (EVs), impacting rental companies like Europcar Mobility Group. By the end of 2024, EV sales are projected to reach over 2 million units in Europe, a significant jump from previous years, highlighting a clear consumer and regulatory push.

Europcar's strategic response involves substantial investment in expanding its EV fleet and developing necessary charging infrastructure across its rental locations. This transition is crucial for meeting evolving customer expectations and complying with increasingly stringent environmental regulations, such as the EU's CO2 emission standards for new vehicles.

This significant capital expenditure for fleet electrification and charging solutions presents operational challenges. Europcar must manage the complexities of EV maintenance, battery lifecycle management, and ensuring adequate vehicle range to satisfy diverse customer needs and travel patterns throughout 2025.

Europcar's commitment to digitalization is evident in its booking and customer service channels. By enhancing online platforms and mobile apps, the company aims to streamline the rental experience, making it more convenient for users. This digital focus is crucial for staying competitive in the evolving mobility sector.

The integration of AI-driven customer support is a key technological advancement for Europcar, improving response times and personalizing interactions. Sophisticated fleet management systems, also leveraging digital tools, allow for greater operational efficiency and better resource allocation across their diverse fleet.

Data analytics derived from these digital touchpoints are instrumental in optimizing Europcar's business. Insights gleaned from customer behavior and fleet usage data can inform dynamic pricing strategies, improve vehicle placement in high-demand areas, and enable predictive maintenance, thereby reducing downtime and costs.

Telematics systems are becoming standard in Europcar's fleet, offering real-time insights into vehicle location, usage patterns, and mechanical health. This data allows for smarter fleet management, improving vehicle utilization and reducing downtime. For instance, by analyzing telematics data, Europcar can identify underused vehicles and reallocate them to higher-demand areas, boosting operational efficiency.

These connected technologies also significantly enhance the customer experience. Features like keyless entry and remote vehicle unlocking, powered by telematics, streamline the pick-up and drop-off process, making it quicker and more convenient. This digital transformation is crucial for meeting customer expectations in a competitive market, with many rental companies reporting increased customer satisfaction scores following the implementation of such features.

Autonomous Vehicle Development

Advancements in autonomous vehicle technology, while still in early stages for widespread commercial use, are being closely monitored by Europcar Mobility Group as they could fundamentally alter the car rental industry. The potential for self-driving cars to integrate into future mobility services could significantly reduce operational costs associated with drivers and vehicle deliveries. For instance, by 2024, several major automotive manufacturers have announced plans to expand their testing of Level 4 autonomous driving systems in select urban areas, signaling a gradual but persistent move towards greater autonomy.

Europcar is actively considering how these technological shifts might create new service models. Imagine a future where vehicles can reposition themselves to high-demand locations without human intervention, optimizing fleet utilization and customer convenience. This could lead to a more dynamic and efficient operational structure, potentially impacting Europcar's fleet management strategies and customer service offerings. The ongoing investment in AV technology by companies like Waymo, which has already logged millions of autonomous miles, underscores the long-term potential for disruption.

- Cost Reduction: Autonomous technology could cut down on driver wages and associated labor costs, a significant expense in the rental sector.

- Fleet Optimization: Self-driving vehicles might enable more efficient fleet repositioning and maintenance scheduling, boosting asset utilization.

- New Service Models: The development could spawn entirely new mobility-as-a-service offerings, such as on-demand autonomous shuttles or delivery services.

- Operational Efficiency: Reduced human error in driving and delivery could lead to fewer accidents and improved overall operational efficiency.

Cybersecurity and Data Protection

Europcar Mobility Group's reliance on digital platforms for bookings, operations, and customer interactions makes cybersecurity a critical technological factor. Protecting vast amounts of sensitive customer data, including personal information and payment details, is paramount to maintaining trust and brand reputation. Failure to do so can lead to significant financial penalties and reputational damage, especially in light of evolving data protection laws.

The increasing sophistication of cyber threats necessitates continuous investment in advanced cybersecurity measures. This includes safeguarding against data breaches, ransomware attacks, and other malicious activities that could disrupt operations. For instance, the global cost of data breaches reached an average of $4.45 million in 2024, highlighting the substantial financial risks involved.

- Data Protection Compliance: Adherence to regulations like GDPR (General Data Protection Regulation) is non-negotiable, requiring robust data handling and security protocols.

- Operational Continuity: Cybersecurity ensures the uninterrupted functioning of Europcar's booking systems, fleet management, and customer service channels.

- Customer Trust: Demonstrating a strong commitment to data protection builds and maintains customer confidence in Europcar's services.

- Investment in Technology: Ongoing expenditure on firewalls, encryption, intrusion detection systems, and employee training is essential to stay ahead of evolving threats.

Europcar's technological trajectory is heavily influenced by the accelerating adoption of electric vehicles (EVs). By the close of 2024, European EV sales are expected to surpass 2 million units, a clear indicator of market and regulatory shifts. This necessitates significant investment from Europcar in expanding its EV fleet and developing charging infrastructure to meet customer demand and comply with stringent emissions standards.

Digitalization remains a core technological driver, enhancing customer experience through improved online platforms and mobile applications. These digital touchpoints, coupled with AI-powered customer support and advanced fleet management systems, are crucial for operational efficiency. Data analytics derived from these digital interactions inform dynamic pricing, optimize vehicle placement, and enable predictive maintenance, ultimately reducing costs and improving service delivery.

Telematics systems are increasingly integrated into Europcar's fleet, providing real-time data on vehicle location, usage, and health. This connectivity facilitates smarter fleet management, boosting utilization and minimizing downtime. Furthermore, features like keyless entry, powered by telematics, streamline the rental process, enhancing customer convenience and satisfaction. The company is also closely monitoring advancements in autonomous vehicle technology, recognizing its potential to revolutionize fleet repositioning and operational models.

Cybersecurity is a critical technological consideration for Europcar, given its reliance on digital platforms for customer data. Protecting sensitive information against increasingly sophisticated threats is paramount to maintaining trust and avoiding financial and reputational damage, especially with the global cost of data breaches averaging $4.45 million in 2024.

| Technological Factor | Impact on Europcar | Key Data/Trend (2024/2025) |

|---|---|---|

| Electrification | Fleet expansion, charging infrastructure development | European EV sales projected over 2 million units in 2024 |

| Digitalization & AI | Enhanced customer experience, operational efficiency | AI in customer support, data analytics for optimization |

| Telematics & Connectivity | Smarter fleet management, improved customer convenience | Real-time vehicle data, keyless entry features |

| Autonomous Vehicles | Potential for new service models, cost reduction | Ongoing AV testing by manufacturers |

| Cybersecurity | Data protection, operational continuity, customer trust | Average cost of data breaches $4.45 million in 2024 |

Legal factors

Europcar Mobility Group navigates a complex web of consumer protection laws across its operating regions, impacting everything from upfront pricing clarity to the fairness of cancellation policies and the mechanisms for resolving customer disputes. For instance, in the European Union, the Consumer Rights Directive ensures consumers receive clear information before making a purchase, which directly affects how rental terms are presented. Failure to comply can result in significant fines; in 2023, the UK's Competition and Markets Authority (CMA) continued to scrutinize the car rental sector for misleading pricing practices, highlighting the financial risks involved.

Strict adherence to these regulations is not merely a legal obligation but a cornerstone for building and sustaining customer loyalty and brand reputation. These consumer protection statutes often set the minimum standards for rental agreements, dictating essential clauses related to damage waivers, fuel policies, and liability limits. For example, many jurisdictions mandate cooling-off periods for certain contractual agreements, which could indirectly influence the flexibility of Europcar's booking and cancellation terms.

Europcar Mobility Group must navigate a complex web of data privacy regulations, most notably the GDPR. This European Union law dictates stringent rules for how customer information is collected, stored, and used. Failure to comply can result in severe penalties, with fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher.

Adhering to these regulations necessitates substantial ongoing investment in robust data security infrastructure and privacy-enhancing technologies. This includes implementing secure data handling procedures and ensuring transparency with customers about data usage.

The reputational risk associated with data breaches or non-compliance is significant. For Europcar, maintaining customer trust is paramount, and any perceived mishandling of personal data could erode that trust, leading to customer attrition and impacting future business.

Europcar Mobility Group's fleet operations are heavily influenced by stringent vehicle safety and emissions standards. For instance, the Euro 7 emissions standard, expected to be fully implemented by 2027, will impose stricter limits on pollutants from vehicles, impacting the types of cars Europcar can acquire and operate. This necessitates continuous investment in newer, compliant vehicles and potentially phasing out older models to avoid penalties and maintain marketability.

Compliance with these evolving regulations, such as those set by the European Union, requires rigorous adherence to inspection and maintenance schedules. Failing to meet these legal obligations can result in significant fines and operational disruptions. For example, in 2023, the European Commission proposed revised CO2 emission standards for cars and vans, aiming for a 55% reduction by 2030 compared to 2021 levels, a target that directly shapes fleet purchasing decisions for companies like Europcar.

Competition and Antitrust Legislation

Europcar Mobility Group operates in a landscape shaped by competition and antitrust legislation, crucial for maintaining fair market practices. These laws are in place to prevent any single entity from dominating the market and to ensure that smaller players have a chance to compete. Regulatory bodies actively monitor mergers, acquisitions, and pricing strategies to identify and curb any anti-competitive behavior.

In 2024, for instance, the European Commission continued its robust enforcement of competition rules across various sectors, including mobility services. Companies like Europcar must navigate these regulations carefully. Failure to comply can result in significant investigations, hefty fines, and damage to the company's reputation. For example, in 2023, the EU fined several companies for anti-competitive practices, highlighting the ongoing scrutiny.

- Regulatory Scrutiny: Antitrust laws require careful management of pricing and market expansion strategies to avoid accusations of monopolistic behavior.

- Merger & Acquisition Oversight: Any significant consolidation or acquisition by Europcar would be subject to approval by competition authorities to ensure it does not unduly harm competition.

- Compliance Costs: Maintaining compliance involves ongoing legal counsel and internal monitoring, representing a significant operational cost.

- Market Access: These regulations generally promote market access, which can be beneficial for Europcar by fostering a more dynamic and competitive environment, but also presents challenges from new entrants.

Labor and Employment Legislation

Europcar Mobility Group, operating across numerous European countries, must navigate a complex web of labor and employment legislation. These laws dictate crucial aspects of workforce management, including minimum wage requirements, maximum working hours, and stringent health and safety standards. For instance, in 2024, the EU continued to emphasize fair working conditions, with ongoing discussions around potential revisions to directives on working time and temporary agency workers, which could impact Europcar's operational costs and flexibility.

Compliance is not merely a legal obligation but a strategic imperative to prevent costly labor disputes and potential legal challenges. Failure to adhere to these regulations can lead to significant fines, reputational damage, and operational disruptions. For example, a breach of anti-discrimination laws could result in substantial compensation claims and damage to Europcar's employer brand, affecting its ability to attract and retain talent in a competitive market.

Key areas of legal focus for Europcar include:

- Working Hours and Rest Periods: Adherence to national regulations on daily and weekly working hours, as well as mandatory rest periods, is critical for all employees, including those in operational roles.

- Wages and Benefits: Ensuring compliance with minimum wage laws, collective bargaining agreements, and statutory benefits such as paid leave and sick pay across different jurisdictions.

- Workplace Safety and Health: Implementing robust health and safety protocols in line with EU and national directives to protect employees, particularly those in vehicle maintenance and customer-facing roles.

- Anti-Discrimination and Equal Opportunities: Upholding laws that prohibit discrimination based on age, gender, race, religion, or other protected characteristics throughout the employment lifecycle.

Europcar Mobility Group must navigate stringent consumer protection laws across its operating regions, ensuring transparency in pricing and fairness in contracts. Non-compliance, such as misleading pricing practices scrutinized by bodies like the UK's CMA in 2023, can lead to significant financial penalties and damage brand reputation.

Data privacy regulations, particularly the EU's GDPR, impose strict rules on handling customer information, with potential fines up to 4% of global annual turnover for breaches. Europcar's adherence requires substantial investment in data security and transparent data usage policies to maintain customer trust.

The company's fleet is directly impacted by vehicle safety and emissions standards, such as the upcoming Euro 7 regulations and the EU's 2030 CO2 reduction targets. These necessitate ongoing investment in compliant vehicles and rigorous maintenance to avoid penalties and operational disruptions.

Competition and antitrust legislation require Europcar to manage pricing and market strategies carefully to avoid accusations of anti-competitive behavior, as enforced by bodies like the European Commission. Compliance involves ongoing legal oversight and can impact market access and expansion strategies.

Environmental factors

Europcar Mobility Group, like all automotive and mobility providers, is under increasing pressure from governments and society to cut vehicle emissions. This directly influences how they buy and manage their car fleets.

By 2025, the European Union aims for new cars to emit an average of 95 grams of CO2 per kilometer. This pushes Europcar to accelerate its shift to electric and low-emission vehicles. For instance, in 2023, Europcar announced plans to significantly expand its electric vehicle fleet, aiming for a substantial portion of its fleet to be electric by 2025.

Meeting these environmental targets requires substantial strategic planning and investment in new technologies and infrastructure. This transition is crucial for Europcar to remain compliant and competitive in the evolving mobility landscape.

Europcar Mobility Group, like many companies, is navigating a landscape where investors and the public increasingly demand proof of sustainability. This translates into more rigorous Environmental, Social, and Governance (ESG) reporting requirements. For instance, by the end of 2024, many European Union member states are expected to fully implement the Corporate Sustainability Reporting Directive (CSRD), which mandates detailed ESG disclosures for a broader range of companies, including those like Europcar.

To meet these expectations and bolster its reputation, Europcar must showcase tangible environmental efforts. This includes advancing fleet electrification – aiming for a significant portion of its fleet to be zero-emission vehicles by 2030, a target many industry players are also pursuing. Additionally, initiatives focused on waste reduction across its operations are becoming critical metrics for demonstrating environmental stewardship.

Transparency in how Europcar communicates these ESG efforts is paramount. Investors and stakeholders are looking for clear, verifiable data to back up sustainability claims. This means detailed reporting on carbon emissions, waste management, and social impact initiatives will be essential for maintaining strong investor relations and attracting capital in the 2024-2025 period.

Growing concerns about resource scarcity, especially for metals and plastics vital in vehicle production and upkeep, directly impact Europcar Mobility Group's operational expenses and the robustness of its supply chains. For instance, the automotive industry faces increasing pressure on critical raw materials like lithium and cobalt, essential for electric vehicle batteries, a segment Europcar is actively expanding.

Effective waste management is another crucial environmental factor. Europcar must address the disposal and recycling of end-of-life vehicles, tires, and other operational waste. Failure to do so responsibly can lead to regulatory penalties and reputational damage, particularly as environmental legislation tightens across Europe, mandating higher recycling rates for automotive components.

Climate Change and Extreme Weather

Climate change presents significant physical risks to Europcar Mobility Group. More frequent and intense extreme weather events, such as floods and heatwaves, can directly impact operations by damaging rental vehicles, disrupting transport networks, and potentially closing rental locations. For instance, the European Environment Agency reported a notable increase in the frequency of extreme weather events across Europe in recent years, impacting infrastructure and mobility services. This necessitates robust operational resilience plans to safeguard assets and ensure business continuity.

The financial implications of climate change are also substantial. Increased incidence of extreme weather events can lead to higher insurance premiums for Europcar's fleet, directly affecting operating costs. Furthermore, the need for enhanced business continuity planning and potential fleet replacement due to weather-related damage adds to the financial burden. Companies like Europcar are increasingly factoring these climate-related financial risks into their strategic planning and risk management frameworks.

Travel demand itself can be influenced by climate change. For example, extreme heat waves might deter travel to certain regions, while conversely, milder winters could boost tourism in others. Europcar must remain agile in adapting its fleet and service offerings to shifts in travel patterns driven by evolving climate conditions. The group's 2024 sustainability reports highlight ongoing investments in adapting to these environmental shifts.

- Increased frequency of extreme weather events impacting fleet and infrastructure.

- Rising insurance costs and the need for enhanced business continuity planning.

- Potential shifts in travel demand patterns due to climate change impacts.

- Growing importance of operational resilience in mitigating climate-related risks.

Public Perception and Green Mobility

Public awareness of environmental issues is a significant driver in consumer decision-making, with a clear trend towards favoring companies that actively demonstrate environmental responsibility. Europcar's commitment to green mobility solutions, including its expanding fleet of electric vehicles (EVs) and hybrid options, directly addresses this growing consumer preference.

By prioritizing sustainability, Europcar can significantly enhance its brand image. This is particularly relevant as consumers increasingly seek out eco-friendly travel alternatives. For instance, in 2024, a significant portion of European travelers expressed a willingness to pay a premium for sustainable travel options, with some studies indicating over 60% of respondents prioritizing environmental impact when booking. This growing segment of environmentally conscious customers presents a substantial opportunity for Europcar.

Europcar's focus on reducing its carbon footprint not only appeals to this demographic but also serves as a key differentiator in a competitive market. As of early 2025, Europcar Mobility Group has set ambitious targets for fleet electrification, aiming for a substantial increase in its EV fleet share across key European markets. This strategic positioning allows them to capture market share from competitors perceived as less committed to environmental sustainability.

- Growing Consumer Demand: Over 60% of European travelers in 2024 indicated a preference for sustainable travel options.

- Brand Image Enhancement: Europcar's green initiatives resonate with environmentally conscious consumers.

- Competitive Differentiation: A strong eco-friendly offering sets Europcar apart from less sustainable competitors.

- Fleet Electrification Goals: Europcar is actively increasing its electric and hybrid vehicle fleet in 2025 to meet market demand.

Europcar Mobility Group faces stringent environmental regulations, particularly concerning vehicle emissions, as the EU targets an average of 95 grams of CO2 per kilometer for new cars by 2025. This regulatory push compels Europcar to accelerate its transition towards electric and low-emission vehicles, exemplified by their 2023 commitment to significantly expand their EV fleet, aiming for a substantial electric share by 2025.

The company must also navigate increasing investor and public scrutiny regarding sustainability, driven by directives like the Corporate Sustainability Reporting Directive (CSRD), which mandates detailed ESG disclosures for companies like Europcar by the end of 2024. To maintain investor confidence and market appeal in 2024-2025, Europcar needs to provide transparent, verifiable data on its environmental performance, including carbon footprint reduction and waste management initiatives.

Resource scarcity, particularly for materials like lithium and cobalt essential for EV batteries, poses a significant challenge to Europcar's supply chain and operational costs as they expand their EV offerings. Furthermore, climate change impacts, such as extreme weather events, directly threaten fleet assets and operational continuity, necessitating robust resilience planning and potentially leading to increased insurance premiums and fleet replacement costs.

| Environmental Factor | Impact on Europcar Mobility Group | Data/Target (2024-2025) |

|---|---|---|

| Emissions Regulations | Fleet composition shift towards EVs/low-emission vehicles | EU average target: 95g CO2/km by 2025 |

| ESG Reporting | Increased transparency and disclosure requirements | CSRD implementation by end of 2024 |

| Resource Scarcity | Supply chain risks and increased costs for EV components | Growing demand for lithium and cobalt |

| Climate Change Risks | Operational disruptions and increased insurance costs | Increased frequency of extreme weather events |

PESTLE Analysis Data Sources

Our PESTLE analysis for Europcar Mobility Group draws from a comprehensive blend of official government publications, reputable industry analysis firms, and international economic data providers. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the mobility sector.