Europcar Mobility Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europcar Mobility Group Bundle

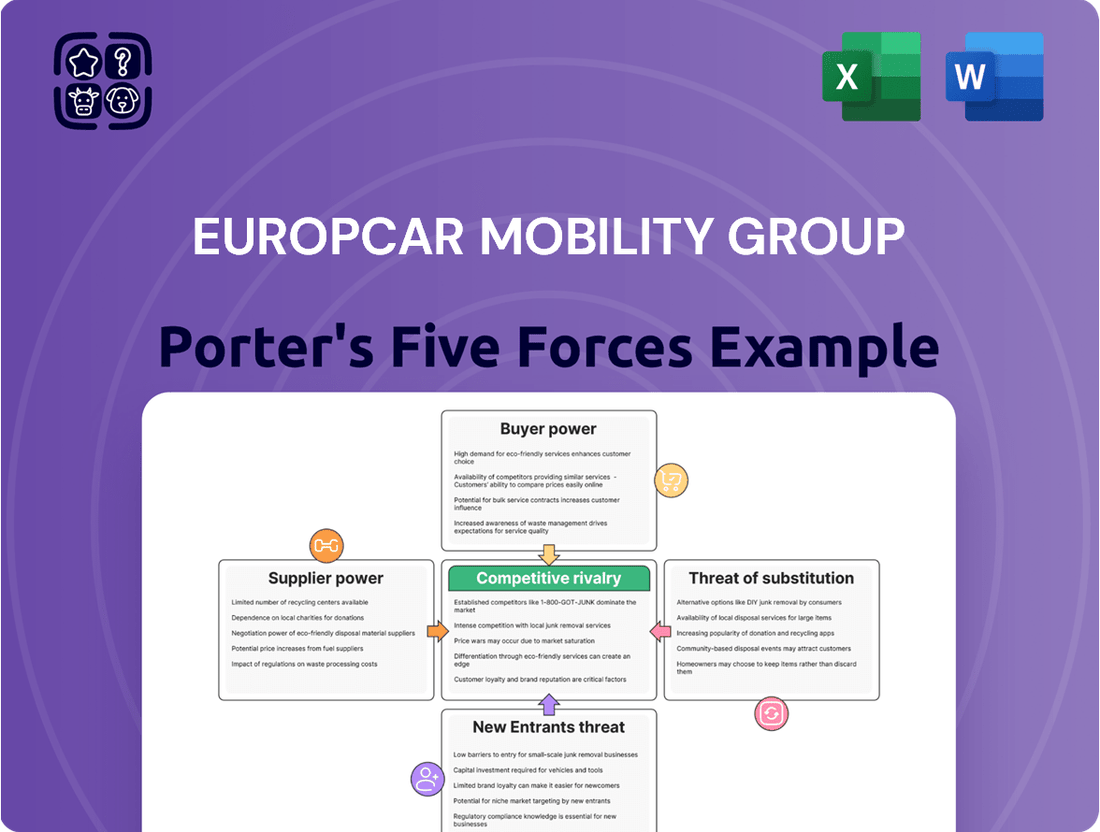

Europcar Mobility Group navigates a competitive landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes like ride-sharing. Understanding these forces is crucial for strategic success.

The complete report reveals the real forces shaping Europcar Mobility Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Europcar Mobility Group's reliance on a concentrated supplier base for its vehicle fleet is a significant factor. Major automotive manufacturers, often with limited direct competitors for specific vehicle types, can exert considerable influence over pricing and supply terms. This concentration means Europcar has fewer alternatives if a key manufacturer dictates unfavorable conditions.

Beyond vehicle acquisition, Europcar's dependence on financial institutions for fleet financing also plays a role in supplier bargaining power. Interest rates and loan covenants set by these lenders directly affect Europcar's capital costs. Similarly, technology providers crucial for digital platforms and booking systems hold sway, as disruptions or increased costs in this area can impact customer experience and operational efficiency.

Switching car manufacturers or core technology providers presents Europcar Mobility Group with considerable costs. These include challenges in integrating new fleets, the expense of retraining staff on different systems, and the potential for operational disruptions during a transition. For instance, in 2024, a significant fleet overhaul could easily run into tens of millions of euros, considering vehicle acquisition, disposal of older models, and the logistical complexities involved.

These substantial switching costs effectively empower Europcar's existing suppliers. The financial and operational barriers make it difficult for Europcar to readily change its primary partners. This situation solidifies the bargaining power of these suppliers, as Europcar is less inclined to seek alternative providers due to the significant investment and risk associated with such a move.

While standard car rentals might see suppliers offering similar products, the uniqueness of Europcar's offerings, particularly in specialized or premium segments, can significantly alter supplier power. For instance, a limited number of manufacturers can provide high-demand luxury vehicles or cutting-edge electric models, giving those suppliers more leverage in negotiations with Europcar.

Europcar's strategic pivot towards a greener fleet, heavily emphasizing electric vehicles (EVs), directly impacts supplier bargaining power. The availability of specific EV models and the necessary charging infrastructure components is concentrated among fewer manufacturers, potentially increasing their ability to dictate terms and pricing to Europcar. In 2024, the global EV market continued its rapid expansion, with major automotive groups consolidating their EV production capabilities, meaning fewer, larger suppliers might dominate the EV supply chain for rental companies.

Supplier Importance to Europcar

Europcar's reliance on vehicle manufacturers and financing institutions means suppliers hold significant bargaining power. Consistent access to new vehicles at competitive prices is crucial for maintaining fleet availability and customer satisfaction. For instance, in 2024, the automotive industry continued to navigate supply chain challenges, which could have impacted vehicle acquisition costs for Europcar.

Favorable financing terms are equally vital for managing the large capital expenditure associated with fleet acquisition and depreciation. Suppliers of financing, such as banks and leasing companies, can exert pressure through interest rates and loan conditions. Any increase in these costs directly affects Europcar’s operational expenses and profitability.

- Vehicle Manufacturers: Major automakers are key suppliers. Their pricing, production capacity, and willingness to offer fleet discounts directly influence Europcar's cost of goods.

- Financing Institutions: Banks and leasing companies provide the capital for fleet purchases. Their lending rates and terms are critical to Europcar's financial health.

- Impact of Supply Disruptions: Shortages or delays in vehicle production, as seen in recent years, can limit Europcar's fleet size and revenue potential.

- Cost of Capital: Fluctuations in interest rates directly impact the cost of financing Europcar's extensive vehicle fleet, affecting profitability.

Forward Integration Threat

The threat of forward integration by suppliers, particularly car manufacturers, poses a significant challenge to Europcar Mobility Group. As automakers shift their focus towards providing comprehensive mobility solutions, they may choose to enter the rental market directly, thereby diminishing their dependence on established rental firms.

This trend is exemplified by Volkswagen's strategic acquisition of Europcar Mobility Group in 2022. This move allows Volkswagen to integrate Europcar's rental operations into its own broader mobility ecosystem, effectively transforming a key supplier into a direct competitor and platform builder.

- Forward Integration Threat: Car manufacturers like Volkswagen are increasingly integrating forward into the mobility services sector, as seen in their acquisition of Europcar Mobility Group.

- Reduced Reliance: This integration allows manufacturers to reduce their reliance on traditional rental companies and control more of the customer journey.

- Competitive Landscape: The acquisition signifies a strategic shift where suppliers are becoming direct competitors, potentially impacting Europcar's market position and profitability.

Europcar Mobility Group faces considerable bargaining power from its key suppliers, primarily vehicle manufacturers and financing institutions. The concentration within the automotive sector, especially for specialized vehicles like EVs, means fewer suppliers can dictate terms. For instance, in 2024, the ongoing demand for electric vehicles and the limited number of manufacturers producing them gave these suppliers increased leverage over rental companies like Europcar.

The financial institutions that provide capital for Europcar's substantial fleet are also powerful. Their lending rates and loan covenants directly impact Europcar’s cost of capital. In 2024, rising interest rates globally meant that financing a large fleet became more expensive, directly benefiting these financial suppliers.

The significant costs and operational complexities involved in switching vehicle manufacturers or technology providers further solidify supplier power. For Europcar, a fleet refresh in 2024 could involve millions in new vehicle acquisitions and disposal of older models, making it difficult to change partners easily.

| Supplier Type | Key Influence Factors | Impact on Europcar (2024 Context) |

|---|---|---|

| Vehicle Manufacturers | Pricing, Production Capacity, EV Availability, Fleet Discounts | Higher acquisition costs due to EV demand and potential supply chain constraints affected fleet expansion. |

| Financing Institutions | Interest Rates, Loan Covenants, Capital Availability | Increased borrowing costs due to rising interest rates impacted profitability and fleet investment capacity. |

| Technology Providers | Platform Fees, System Integration Costs, Service Reliability | Costs associated with maintaining and upgrading digital booking and management systems remained a key operational expense. |

What is included in the product

This analysis unveils the competitive forces impacting Europcar Mobility Group, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Quickly identify and address competitive pressures in the car rental market, from supplier power to new entrants, to proactively safeguard Europcar's profitability.

Customers Bargaining Power

Customers in the car rental sector, particularly leisure travelers, are very sensitive to price. This is largely because comparison websites and mobile apps make it incredibly easy to see what different companies are charging. For instance, in 2024, online travel agencies and aggregators continued to be primary booking channels for many consumers, highlighting the importance of competitive pricing.

This easy access to information means customers can quickly compare offers from various providers, including Europcar's brands, directly influencing their choices. This transparency significantly boosts their bargaining power, forcing rental companies to keep their rates competitive to attract and retain business.

The availability of numerous transportation choices significantly strengthens the bargaining power of Europcar's customers. Options like extensive public transit networks, readily accessible ride-hailing services such as Uber and Bolt, and a growing number of car-sharing platforms provide consumers with viable alternatives to traditional car rentals. For instance, in 2024, ride-hailing services continued to capture market share, with global revenue projected to reach over $300 billion, demonstrating their widespread adoption and appeal.

For many Europcar customers, the cost and effort to switch to a competitor are quite low. Online booking platforms have made it incredibly simple to compare prices and reserve vehicles from different companies, often with just a few clicks. This ease of switching means customers can readily take advantage of better deals or specific vehicle availability elsewhere.

While Europcar's loyalty programs and brand recognition do offer some retention, they don't entirely eliminate the threat of customers easily moving to a rival. For instance, a customer might choose a competitor for a specific trip if they offer a 10% discount or a more convenient pickup location, demonstrating the low barriers to entry for new providers in influencing customer choice.

Customer Information and Digital Tools

The widespread availability of digital tools, including online booking platforms and customer review sites, significantly boosts customer bargaining power. This empowers travelers to easily compare prices, services, and vehicle options across various providers, including Europcar Mobility Group. For instance, in 2024, platforms like Kayak and Skyscanner reported millions of searches daily for rental cars, demonstrating the extensive reach and influence of these digital aggregators.

Customers can now access a wealth of information, from detailed vehicle specifications to peer reviews, allowing them to make highly informed decisions. This transparency means they can readily identify and demand better service or pricing, knowing alternatives exist. The collective voice amplified through review sites can pressure companies to improve their offerings and customer experiences.

- Informed Decisions: Digital platforms provide easy access to pricing, vehicle types, and customer feedback, enabling renters to make well-researched choices.

- Price Sensitivity: Comparison sites highlight competitive pricing, increasing customer sensitivity to cost and encouraging negotiation or switching providers.

- Service Expectations: Online reviews and social media discussions set benchmarks for service quality, leading customers to expect higher standards from rental companies.

- Brand Loyalty Impact: Negative online feedback can quickly damage a brand's reputation, forcing companies like Europcar to address customer grievances to maintain market standing.

Diverse Customer Segments

Europcar Mobility Group serves a broad customer base, encompassing both business and leisure travelers. These segments exhibit distinct priorities; for instance, business clients often value service reliability and corporate agreements, whereas leisure travelers may be more price-sensitive and focus on vehicle availability. This diversity means Europcar must adapt its strategies to meet varied demands.

In 2024, the rental car market saw continued recovery post-pandemic, with business travel gradually increasing. However, leisure travel remained a significant driver, often seeking value. For Europcar, managing the bargaining power of these diverse customer groups is key.

- Business Segment: Prioritizes convenience, fleet quality, and corporate rates, often with less price elasticity.

- Leisure Segment: More sensitive to price, vehicle options, and promotional offers, leading to higher price competition.

- Impact on Pricing: The differing sensitivities allow Europcar to segment pricing, but competitive pressures in the leisure market can limit overall pricing power.

Europcar's customers possess significant bargaining power, largely driven by the ease of price comparison through digital platforms and a wide array of alternative transportation options. This means customers can readily switch providers for better deals or convenience, forcing Europcar to maintain competitive pricing and service levels.

| Factor | Description | Impact on Europcar |

|---|---|---|

| Information Availability | Online travel agencies and review sites provide transparent pricing and service comparisons. | Increases price sensitivity and demands for better value. |

| Availability of Substitutes | Ride-hailing, car-sharing, and public transport offer alternatives to traditional rentals. | Reduces reliance on car rentals, especially for shorter trips. |

| Low Switching Costs | Digital booking makes changing providers effortless. | Encourages customers to seek out the best available offers. |

| Price Sensitivity | Leisure travelers, in particular, are highly attuned to rental costs. | Pressures Europcar to offer competitive rates and promotions. |

Full Version Awaits

Europcar Mobility Group Porter's Five Forces Analysis

This preview showcases the complete Europcar Mobility Group Porter's Five Forces analysis, detailing the competitive landscape and strategic implications for the company. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into the industry's dynamics. The analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the car rental sector.

Rivalry Among Competitors

The car rental industry is a crowded space, with major global players like Enterprise, Hertz, Avis Budget Group, and Sixt constantly competing with Europcar. This intense rivalry extends to regional and local operators, especially within Europe, creating a highly fragmented market. For instance, in 2023, the global car rental market was valued at approximately $100 billion, with significant portions driven by competition among these key entities.

The car rental sector anticipates growth, fueled by recovering tourism and business travel. However, a significant challenge arises from over-fleeting, where too many vehicles are available in certain markets. This saturation can depress utilization rates and intensify price wars, directly impacting profitability.

Europcar Mobility Group's 2024 performance illustrates this dynamic. While the company reported revenue increases, the issue of over-fleeting hampered its capacity to fully offset rising operational costs through higher rental prices, demonstrating the squeeze on margins in a crowded market.

Competitors in the car rental market actively differentiate themselves by focusing on service quality, offering a diverse fleet that increasingly includes electric and hybrid vehicles, and implementing digital innovations. Loyalty programs also play a significant role in attracting and retaining customers.

Significant investment is being channeled into new technologies. Companies are adopting mobile booking platforms, self-service kiosks, and advanced AI for fleet management to improve both customer experience and operational efficiency. For Europcar Mobility Group, continuous innovation is therefore essential to remain competitive.

Pricing Strategies and Promotions

Car rental companies, including Europcar Mobility Group, frequently engage in aggressive pricing strategies. Discounts and promotional offers are standard tools to draw in and keep customers. This intense price competition can significantly squeeze profit margins if companies struggle to offer unique value beyond price, demonstrating the ongoing pressure on pricing within the sector.

In 2024, the car rental market continued to see aggressive pricing. For instance, major players often run seasonal promotions, offering daily rates that can be as low as €15-€20 for basic economy cars during off-peak periods, a notable decrease from peak season averages which might exceed €50. This constant promotional activity forces companies to carefully manage their fleet utilization and operational costs to maintain profitability.

- Aggressive Pricing: Frequent discounts and promotional offers are a hallmark of the car rental industry.

- Margin Erosion: Intense price competition can reduce profitability if differentiation is lacking.

- Customer Acquisition: Pricing tactics are key drivers for attracting and retaining customers.

- Industry Pressure: The need to remain competitive necessitates continuous evaluation of pricing strategies.

Strategic Alliances and Acquisitions

The mobility sector is characterized by a dynamic environment where strategic alliances and acquisitions are common. Companies actively pursue these strategies to broaden their market presence, incorporate cutting-edge technologies, or streamline their operations. This consolidation aims to create more robust and integrated mobility solutions.

A prime example of this trend is Volkswagen's acquisition of Europcar Mobility Group. This significant move, completed in 2022, underscores the industry's drive to build comprehensive mobility platforms. Volkswagen's stated goal is to leverage Europcar's extensive network and customer base to create a more integrated and competitive offering in the evolving mobility landscape.

- Strategic Consolidation: The acquisition of Europcar by Volkswagen highlights a broader industry trend towards consolidation, aiming to create larger, more integrated mobility players.

- Market Expansion: Companies engage in alliances and acquisitions to quickly gain access to new geographic markets and customer segments.

- Technological Integration: Such moves often facilitate the integration of new technologies, such as electric vehicle fleets or digital mobility platforms, enhancing service offerings.

The car rental industry is intensely competitive, with Europcar facing strong rivalry from global giants like Enterprise, Hertz, and Avis Budget Group, alongside numerous regional players. This competition is further amplified by aggressive pricing strategies, including frequent discounts and promotions, which can significantly pressure profit margins if not balanced with strong value propositions. For instance, in 2024, daily rental rates for economy cars often hovered around €15-€20 during off-peak times, demonstrating the constant downward pressure on pricing. Companies differentiate through service, fleet diversity (including EVs), loyalty programs, and digital innovation to stand out in this crowded market.

| Key Competitors | Market Presence | Differentiation Tactics |

| Enterprise | Global | Extensive network, strong corporate ties |

| Hertz | Global | Premium services, loyalty programs |

| Avis Budget Group | Global | Brand diversity (Avis, Budget, Zipcar), fleet innovation |

| Sixt | Global | Premium and luxury fleet, strong European presence |

| Europcar Mobility Group | Primarily European | Integrated mobility solutions, growing EV fleet |

SSubstitutes Threaten

The threat of substitutes is significant, particularly from extensive public transportation networks. In many major urban centers, comprehensive systems of buses, trains, and subways provide a cost-effective and often convenient alternative to renting a car. For instance, cities like London or Tokyo boast highly efficient public transit that can easily negate the need for a rental car for short-term urban travel, especially for budget-conscious tourists.

The proliferation of ride-hailing platforms such as Uber and Lyft presents a substantial threat of substitutes for Europcar Mobility Group. These services offer unparalleled convenience and on-demand mobility, particularly for shorter journeys or in urban environments where parking is a significant challenge. In 2024, ride-hailing continued its strong growth trajectory, with global gross bookings expected to reach over $200 billion, directly competing for travel needs that might otherwise be met by traditional car rentals.

Car-sharing services, like Europcar's own Ubeeqo, and the rise of micro-mobility options such as e-scooters and e-bikes present a significant threat of substitution for traditional car rental and ownership models. These alternatives offer greater flexibility and are often more cost-effective for short urban trips, directly impacting demand for longer rental periods. For instance, by 2024, the global car-sharing market was projected to reach over $15 billion, demonstrating a clear shift in consumer behavior towards on-demand mobility solutions.

Personal Vehicle Ownership Trends

While car rental can be an alternative to owning a personal vehicle, certain trends can temper this substitution effect. For instance, the increasing lifespan of personal cars, meaning people are keeping their vehicles longer, reduces the immediate need for rental replacements. Furthermore, in many areas, the deeply ingrained preference for the convenience and flexibility of personal transport remains strong, potentially limiting the appeal of rentals for everyday use.

However, shifts in consumer behavior are creating new opportunities. The declining rate of car ownership, particularly among younger demographics like millennials, is a significant factor expected to boost demand for car rental services. This demographic often prioritizes access over ownership, making rentals a more attractive proposition.

Consider these points regarding personal vehicle ownership as a substitute:

- Extended Vehicle Lifespans: Advances in automotive technology and manufacturing mean personal vehicles are lasting longer, potentially reducing the frequency with which consumers consider rental options as a replacement for aging cars.

- Regional Preferences: In certain regions, cultural norms and infrastructure heavily favor personal car ownership, making rental services a less compelling substitute for daily commuting and travel needs.

- Millennial Mobility Trends: Data from 2024 indicates a continued trend of lower car ownership among millennials and Gen Z, with many opting for ride-sharing, public transport, and car rentals, which is a positive indicator for the rental market's growth.

- Cost Considerations: The total cost of ownership for a personal vehicle, including insurance, maintenance, and depreciation, can be substantial, making car rental a potentially more economical choice for those who do not require a vehicle daily.

Future Mobility Solutions (Autonomous Vehicles)

The rise of autonomous vehicles (AVs) and Mobility-as-a-Service (MaaS) platforms presents a significant long-term threat of substitution for Europcar Mobility Group. These technologies aim to deliver highly efficient, cost-effective, and potentially driverless transportation. For instance, by 2030, it's projected that a substantial portion of vehicle miles traveled in urban areas could be via shared autonomous fleets, directly competing with traditional car rentals.

These future mobility solutions could fundamentally reshape consumer choices, offering convenience and potentially lower per-mile costs than owning or renting a traditional vehicle. As of early 2024, significant investments continue to pour into AV development; Waymo, for example, has already expanded its driverless ride-hailing service in multiple cities, demonstrating the growing viability of this substitute.

- Autonomous vehicles promise lower operational costs through driver elimination.

- MaaS platforms integrate various transport modes, offering seamless travel alternatives.

- By 2035, some analysts predict AVs could capture a significant share of the urban mobility market.

- The convenience and potential cost savings of driverless ride-sharing pose a direct challenge to car rental models.

The threat of substitutes for Europcar Mobility Group is multifaceted, encompassing public transport, ride-hailing, car-sharing, and even personal vehicle ownership trends. These alternatives offer varying degrees of convenience, cost-effectiveness, and flexibility, directly impacting the demand for traditional car rentals.

In 2024, ride-hailing services like Uber and Lyft continued to grow, with global gross bookings expected to exceed $200 billion, presenting a strong alternative for shorter trips and urban mobility needs. Similarly, the car-sharing market, projected to surpass $15 billion by 2024, offers flexible, on-demand solutions that compete with longer rental periods.

While personal vehicles remain a substitute, trends like extended vehicle lifespans and regional preferences for ownership can temper this. However, a significant shift is occurring with younger demographics, particularly millennials and Gen Z, demonstrating lower car ownership rates in 2024 and increasingly opting for rental and shared mobility solutions.

| Substitute Type | 2024 Market Size/Activity | Impact on Europcar |

|---|---|---|

| Ride-Hailing (e.g., Uber, Lyft) | Global Gross Bookings > $200 Billion | Direct competition for urban and short-term travel needs. |

| Car-Sharing | Global Market Projected > $15 Billion | Offers flexibility and cost-effectiveness for short trips, impacting longer rentals. |

| Public Transportation | Varies by urban center (e.g., London, Tokyo) | Cost-effective alternative for urban travel, especially for budget-conscious individuals. |

| Personal Vehicle Ownership | Extended vehicle lifespans, but lower ownership among younger demographics | Tempered by convenience preference, but declining ownership among millennials/Gen Z is a positive for rentals. |

Entrants Threaten

The car rental sector demands a massive upfront investment, primarily for acquiring and maintaining a diverse fleet of vehicles. For instance, Europcar Mobility Group, a major player, manages a substantial fleet, and the cost of purchasing and regularly updating these vehicles runs into billions of euros. This high capital expenditure creates a significant barrier for new companies looking to enter the market.

Established players like Europcar Mobility Group benefit from a substantial existing network of rental locations, strategically positioned at major transportation hubs such as airports and train stations, as well as in key urban centers. This extensive physical footprint and robust operational infrastructure are significant barriers for any new company attempting to enter the market.

The sheer scale of investment required to replicate Europcar's established network of over 3,000 locations globally, as reported in their 2024 operational reviews, presents a formidable hurdle. New entrants would need considerable capital and time to build a comparable presence, making it difficult to compete on accessibility and convenience.

Existing players in the mobility sector, like Europcar Mobility Group, benefit from significant brand recognition and deeply ingrained customer trust, cultivated over decades of operation. This allows them to command loyalty and a degree of pricing power.

New entrants must overcome a substantial hurdle in establishing brand credibility and earning customer confidence. In a market where reliability, ease of booking, and consistent service quality are paramount, building this trust from scratch is a costly and time-consuming endeavor.

For instance, in 2024, major established car rental companies continued to leverage their brand equity, with customer surveys consistently showing brand name as a primary factor in rental decisions, often outweighing price alone for a significant portion of travelers.

Regulatory and Compliance Hurdles

The car rental sector faces significant regulatory and compliance challenges that act as a deterrent to new entrants. These include stringent vehicle safety standards, mandatory insurance requirements, and obtaining operational licenses, which vary considerably by jurisdiction. For instance, in 2024, compliance with evolving emissions standards and data privacy regulations like GDPR for customer information adds further complexity and cost.

Navigating this intricate web of rules requires substantial investment in legal counsel, administrative processes, and potentially specialized equipment or training. New companies must dedicate considerable resources to ensure adherence across all operational areas, from vehicle maintenance to customer data handling, making market entry a costly and time-consuming endeavor.

- Vehicle Safety: Compliance with national and international safety regulations, including regular inspections and maintenance protocols, is paramount.

- Insurance Requirements: Obtaining adequate and compliant insurance coverage for fleets and operations is a significant financial commitment.

- Operational Licenses: Securing necessary business licenses and permits to operate in specific geographic regions can be a lengthy and complex process.

- Data Privacy: Adherence to data protection laws, such as GDPR, impacts how customer information is collected, stored, and used.

Technological Advancements and Digital Platforms

Technological advancements and the rise of digital platforms present a significant threat of new entrants for Europcar Mobility Group. New players can leverage these technologies to disrupt traditional rental models, offering more convenient and personalized experiences. For instance, the increasing reliance on mobile apps for booking, vehicle access, and payment requires substantial investment, creating a high barrier for those without established digital infrastructure.

New entrants must possess sophisticated technological capabilities to compete effectively. This includes developing seamless booking systems, robust mobile applications, and advanced data analytics for personalized services and efficient fleet management. Companies like Turo, a peer-to-peer car-sharing platform, demonstrate how technology can lower entry barriers for individuals and create new competitive forces.

- Digital Investment: Europcar's investment in its digital platform, including its mobile app and online booking capabilities, is crucial for maintaining competitiveness against tech-savvy new entrants.

- Data Analytics: The ability to utilize data analytics for personalized offers and optimized fleet management is a key differentiator that new entrants often excel at from inception.

- Seamless User Experience: Competitors are increasingly focused on providing a frictionless customer journey, from booking to vehicle return, which necessitates significant technological development.

The threat of new entrants for Europcar Mobility Group is moderate, primarily due to the substantial capital required for fleet acquisition and the extensive operational infrastructure already in place. However, digital-native startups can leverage technology to bypass some traditional barriers.

New companies entering the car rental market face significant hurdles, including the immense cost of building a diverse vehicle fleet and establishing a widespread network of rental locations. Europcar's global presence, with thousands of locations, represents a considerable competitive advantage that new entrants would struggle to replicate quickly.

Brand loyalty and established customer trust also pose a barrier, as new entrants must invest heavily in marketing and service quality to gain recognition. In 2024, customer preference for established brands remained strong, with brand name often influencing rental choices more than price for a significant segment of travelers.

Regulatory compliance and the need for sophisticated technological platforms add further complexity and cost for potential new players in the mobility sector.

Porter's Five Forces Analysis Data Sources

Our Europcar Mobility Group Porter's Five Forces analysis is built upon a foundation of robust data, including Europcar's annual reports, industry-specific market research from firms like Statista and IBISWorld, and regulatory filings from relevant authorities.