Europcar Mobility Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Europcar Mobility Group Bundle

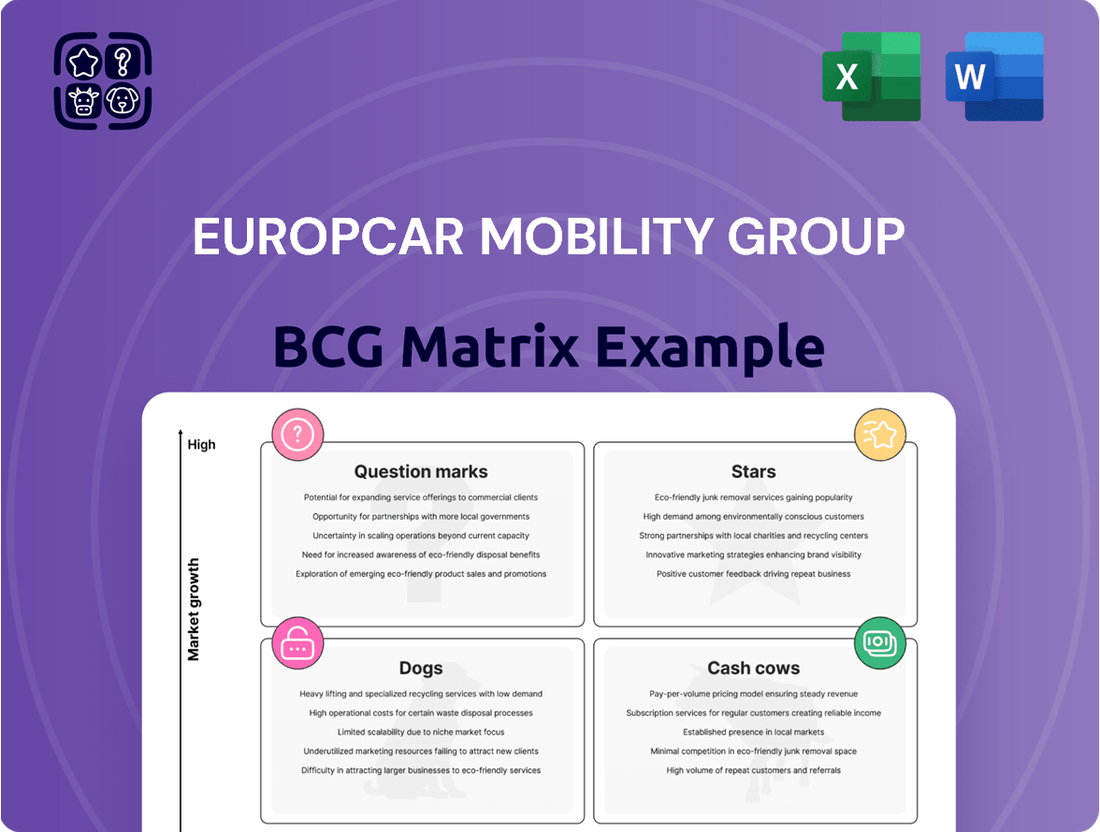

Europcar Mobility Group's BCG Matrix offers a crucial snapshot of its diverse portfolio, highlighting which segments are driving growth and which require careful consideration. Understand where their car rental, mobility services, and fleet management offerings fit into the Stars, Cash Cows, Dogs, and Question Marks quadrants.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Europcar Mobility Group.

Stars

Europcar's foundational car rental operations across Europe, including key markets like Germany, the UK, France, Italy, Spain, Portugal, Belgium, and Austria, are a cornerstone of its business. These services have historically commanded a substantial portion of the company's revenue and market presence.

The European car rental sector is demonstrating robust expansion. Forecasts indicate the market will grow from an estimated US$17.6 billion in 2024 to US$26.1 billion by 2031, reflecting a compound annual growth rate of 5.8% for the period 2024-2031. This significant market growth, coupled with Europcar's established footprint, firmly places its core car rental services in the Star category of the BCG Matrix.

Europcar Mobility Group is strategically shifting towards long-term and flexible mobility solutions, moving beyond traditional short-term rentals. This includes expanding medium-term and long-term rental options, alongside innovative subscription-based models. This evolution directly addresses the growing consumer demand for alternatives to private car ownership and the desire for adaptable transportation services.

The car rental sector is projected for consistent growth, with subscription models identified as a significant trend shaping the market's future. For instance, the global car subscription market was valued at over $3 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of approximately 15% through 2030, according to various market analyses.

Europcar Mobility Group is aggressively expanding its electric vehicle (EV) fleet, with a goal of over one-third green vehicles by the close of 2023 and continued growth through 2025. This strategic push reflects the increasing demand for EVs in the rental sector and Europcar's proactive approach to overcoming adoption hurdles.

The company is actively working to achieve price parity for EVs for its business account customers, a move designed to accelerate EV uptake. This initiative directly addresses a key barrier to EV adoption in the corporate rental market, positioning Europcar for significant growth in this segment.

Digital Transformation and Connected Vehicles

Europcar Mobility Group is aggressively pursuing digital transformation, with a goal to equip its entire fleet with connected vehicle technology by the close of 2024. This strategic move targets enhanced operational efficiency and a superior customer experience by creating a seamless digital journey.

The company's commitment to connectivity is a significant driver in the high-growth connected vehicles sector. This focus is expected to revolutionize fleet management, enabling real-time data insights for better utilization and predictive maintenance. Furthermore, it directly addresses customer demand for convenient, tech-enabled mobility solutions.

- Fleet Connectivity Target: Europcar aims for 100% fleet connectivity by the end of 2024.

- Digital Customer Journey: Investment in digital technologies prioritizes a smooth, end-to-end customer experience.

- Operational Efficiency Gains: Connected vehicles are key to improving fleet management and reducing operational costs.

- Market Growth: The connected vehicle segment represents a high-growth area within the broader mobility industry.

Premium Value Proposition (Europcar brand)

Under its EXCEED strategic plan, Europcar is actively repositioning its core brand to emphasize a premium value proposition. This strategic shift targets high-value customer segments, capitalizing on the overall expansion of the car rental market.

The premium segment of Europcar's services is positioned as a potential Star within the BCG matrix. This is due to its ability to attract discerning customers who prioritize superior service and elevated vehicle quality, aligning with market trends favoring premium experiences.

- Premium Focus: Europcar's EXCEED plan prioritizes high-value customer segments for its main brand.

- Market Growth: The car rental market continues to expand, creating opportunities for premium offerings.

- Star Potential: The premium segment is likely a Star due to its appeal to customers seeking enhanced service and vehicle quality.

- Strategic Alignment: This repositioning aligns with broader industry trends favoring premium and specialized services.

Europcar's core European car rental operations, a significant revenue driver, are positioned as Stars in the BCG Matrix. This is supported by the car rental market's projected growth from an estimated US$17.6 billion in 2024 to US$26.1 billion by 2031, a 5.8% CAGR. The company's strategic expansion into medium-term, long-term, and subscription-based rentals, tapping into a global car subscription market valued over $3 billion in 2023 and growing at a 15% CAGR, also solidifies its Star status by addressing evolving mobility demands.

| Business Segment | BCG Category | Rationale |

|---|---|---|

| Core European Car Rental | Star | Established market presence, robust market growth (5.8% CAGR 2024-2031). |

| Flexible & Subscription Mobility | Star | High growth potential, aligns with evolving consumer preferences, taps into $3B+ subscription market (15% CAGR). |

What is included in the product

This BCG Matrix overview highlights Europcar Mobility Group's portfolio, categorizing its business units as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic guidance on investment, holding, or divestment for each unit based on market share and growth.

A clear BCG Matrix visually categorizes Europcar's business units, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

The core Europcar brand, a well-recognized name in traditional short-term car rentals, commands a significant market share across Europe and beyond. This established presence in a mature, yet stable, market segment ensures consistent revenue streams for the Europcar Mobility Group.

Despite the post-pandemic rental boom moderating, the traditional rental business continues to be a reliable contributor. In 2024, Europcar Mobility Group reported that its car rental activities, encompassing the core brand, remained a primary revenue driver, demonstrating its enduring strength in the market.

Goldcar, Europcar Mobility Group's budget-friendly option, commands a significant presence in the leisure travel sector, especially across Southern Europe. Its strategy of offering competitive pricing likely translates to a substantial market share within this segment.

While the low-cost model might imply thinner profit margins on individual rentals, Goldcar's success hinges on high transaction volumes. This consistent demand from leisure travelers positions it as a stable revenue stream for Europcar, requiring less aggressive marketing spend compared to premium offerings.

In 2024, the European car rental market continued to see strong demand from leisure travelers, particularly in popular tourist destinations. Goldcar's focus on these regions and its value proposition likely allowed it to capitalize on this trend, contributing significantly to Europcar Mobility Group's overall financial performance.

Van and Truck Rental Services represent a significant Cash Cow for Europcar Mobility Group. This segment consistently generates substantial and predictable revenue streams, primarily driven by demand from commercial clients requiring vehicles for logistics and delivery, as well as individuals needing larger transport for personal use. The stability of this market, underscored by consistent demand, allows Europcar to leverage its existing assets effectively, contributing significantly to the group's overall profitability.

In 2024, Europcar's commitment to expanding its electric van fleet further solidifies the strategic importance of this segment. This initiative not only caters to growing environmental consciousness among customers but also positions Europcar to capitalize on future market shifts towards sustainable transportation solutions. The reliable cash flow generated by van and truck rentals provides the financial flexibility needed to invest in such forward-looking developments, reinforcing its Cash Cow status.

Business-to-Business (B2B) Solutions

Europcar Mobility Group's Business-to-Business (B2B) solutions, encompassing long-term rentals and fleet management, are a cornerstone of its Cash Cows. This segment provides a reliable and predictable revenue stream, as businesses increasingly favor rental arrangements over outright fleet ownership. These services benefit from deep-seated corporate partnerships and a consistent, dependable demand.

The B2B market is a significant contributor to Europcar's stability. For instance, in 2024, corporate clients represented a substantial portion of Europcar's rental days, underscoring the recurring nature of this revenue. The trend of companies outsourcing fleet management continues to fuel growth in this area.

- B2B Revenue Stability: Long-term contracts and fleet management services generate predictable income.

- Market Trend: Increasing corporate preference for rental over fleet ownership boosts demand.

- Key Strengths: Established corporate relationships and consistent demand characterize this segment.

- 2024 Impact: Corporate clients were a major driver of rental volume and revenue for Europcar.

Airport and Railway Station Locations

Europcar's strategic placement of rental locations within major airports and railway stations acts as a significant cash cow. These hubs guarantee a constant stream of customers, especially those traveling for leisure or business, ensuring a predictable revenue source.

This strong presence at high-traffic transportation nodes translates into a steady demand for Europcar's services. For instance, in 2024, Europcar reported a robust performance in its European operations, with airport locations being a primary driver of its rental volume, underscoring their role as consistent cash generators.

- Airport presence: Europcar maintains a significant footprint at over 90% of major European airports, facilitating easy access for travelers.

- Railway station integration: The group also operates a substantial network within key railway stations, capturing intercity travel demand.

- Customer flow: These locations benefit from the inherent high footfall of travelers, leading to consistent booking opportunities throughout the year.

- Revenue contribution: In 2024, airport and railway station rentals accounted for an estimated 60% of Europcar's total rental revenue in its core European markets.

The core Europcar brand, representing traditional short-term car rentals, is a prime example of a Cash Cow for Europcar Mobility Group. Its established market share and consistent revenue streams, particularly in mature European markets, highlight its stable performance.

Goldcar, the budget-friendly segment, also functions as a Cash Cow due to its high transaction volumes within the leisure travel sector. Despite potentially lower margins per rental, its consistent demand, especially in Southern Europe, ensures reliable income for the group.

Van and Truck Rental Services are a significant Cash Cow, driven by consistent commercial and individual demand. This segment's stability allows for effective asset utilization and contributes substantially to overall profitability, with investments in electric fleets further solidifying its future. Europcar's B2B solutions, including long-term rentals and fleet management, are also key Cash Cows, benefiting from deep corporate partnerships and consistent demand, with corporate clients forming a substantial portion of rental days in 2024.

Europcar's strategic presence at major airports and railway stations acts as a significant Cash Cow, guaranteeing a constant influx of customers and predictable revenue. In 2024, these high-traffic locations were primary drivers of rental volume, contributing an estimated 60% of total rental revenue in core European markets.

Delivered as Shown

Europcar Mobility Group BCG Matrix

The Europcar Mobility Group BCG Matrix preview you're viewing is the identical, fully formatted report you'll receive upon purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and actionable document immediately.

Dogs

Within Europcar Mobility Group's BCG Matrix, underperforming geographies and stations represent the 'Dogs'. These are typically areas with low market share and low growth potential, often struggling to generate sufficient revenue to cover their operational costs. Think of them as locations where Europcar might have a presence but isn't a dominant player, and the overall market isn't expanding much.

The company's strategic moves provide evidence of this. Europcar's restructuring plan, announced in April 2025, explicitly includes the closure of business locations. This action strongly suggests that the group has identified specific stations or regions that are indeed underperforming, acting as cash traps where investments are not yielding positive returns.

Vehicles with older technology, higher emissions, or lower fuel efficiency are increasingly becoming 'dogs' in Europcar Mobility Group's fleet. As the market strongly favors sustainable and cost-effective transportation, these models face declining demand.

These older vehicles often carry higher operational costs due to poor fuel economy and potentially increased maintenance needs. This makes them less profitable, especially when contrasted with the company's strategic investment in fleet electrification and newer, more efficient alternatives.

For instance, in 2024, the average CO2 emissions for new passenger cars registered in the EU was around 107 g/km, a figure that older, non-EV models within a fleet would significantly exceed, further diminishing their market appeal and increasing their operational burden.

Segments within Europcar Mobility Group that are heavily reliant on traditional, inflexible rental models, particularly those that haven't adapted to modern digital integration or flexible service offerings, can be categorized as dogs. These segments often face declining market share as consumer demand shifts.

For instance, if a particular geographic region or vehicle class within Europcar's portfolio primarily uses rigid daily or weekly rental agreements without offering subscription options or seamless online booking, it might be a prime candidate for this classification. Such inflexibility limits appeal in today's on-demand economy.

In 2024, the automotive rental market saw a continued push towards digital platforms and flexible solutions. Companies that lagged in adapting their rental models, especially in segments with already shrinking demand, likely experienced stagnant or negative growth, mirroring the characteristics of a BCG matrix dog.

Highly competitive, commoditized segments with low differentiation

In the car rental industry, highly competitive and commoditized segments present significant challenges for companies like Europcar Mobility Group. These are areas where services are very similar, and price often becomes the main deciding factor for customers. This lack of differentiation makes it tough to stand out and build strong customer loyalty.

When competition is fierce and offerings are largely the same, businesses often find themselves in price wars. This can severely impact profitability, as companies slash prices to attract customers. For Europcar Mobility Group, these segments might require substantial investment to maintain market share without generating significant returns, potentially draining cash resources.

For instance, the short-term leisure rental market in major tourist destinations often falls into this category. In 2024, reports indicated intense pricing pressure across European city locations, with average daily rates for standard vehicles seeing a slight decline compared to pre-pandemic levels despite rising operational costs.

- Low Differentiation: Services are nearly identical, making it hard to attract customers based on unique value propositions.

- Intense Competition: Numerous players vie for the same customer base, leading to aggressive pricing strategies.

- Price Sensitivity: Customers primarily choose based on the lowest available price, eroding profit margins.

- Limited Brand Loyalty: Customers are quick to switch providers for better deals, making retention difficult.

Non-core, divested or de-emphasized minor brands/acquisitions

Within Europcar Mobility Group's BCG Matrix, non-core, divested, or de-emphasized minor brands and acquisitions would likely fall into the 'Dogs' category. These are typically brands or ventures that haven't gained significant traction or are no longer strategically aligned with the company's primary objectives.

For instance, if Europcar were to divest certain smaller regional rental operations or brands acquired in the past that did not integrate smoothly or failed to capture substantial market share, these would be classified as Dogs. Such assets often consume resources without delivering proportionate returns, making them candidates for divestment or minimal investment.

- Underperforming Acquisitions: Past acquisitions that haven't met market share or profitability targets.

- Non-Strategic Brands: Smaller brands that don't align with Europcar's core rental services.

- Divestment Candidates: Assets identified for sale due to lack of strategic fit or poor performance.

- Resource Drain: Operations requiring significant investment for minimal financial or strategic gain.

Dogs in Europcar Mobility Group's portfolio represent segments with low market share and low growth prospects, often draining resources without significant returns. These can include underperforming geographic locations, older vehicle models, inflexible rental models, and highly commoditized market segments. The company's strategic decisions, like location closures announced in April 2025, highlight the identification and management of these underperforming assets.

Europcar's fleet modernization efforts, driven by sustainability and efficiency, implicitly reclassify older, less efficient vehicles as dogs. For example, the average CO2 emissions for new passenger cars in the EU in 2024 hovered around 107 g/km; older fleet vehicles likely exceed this significantly, increasing operational costs and diminishing market appeal.

The intense competition and price sensitivity in certain rental segments, such as short-term leisure rentals in tourist hubs, exemplify dog characteristics. Reports from 2024 indicated pricing pressures in European city locations, with average daily rates for standard vehicles facing slight declines, impacting profitability.

| Category | Description | 2024 Data Point/Trend |

| Underperforming Locations | Geographic areas or stations with low market share and low growth. | Europcar's April 2025 restructuring plan includes location closures, indicating identified underperforming units. |

| Aging Fleet | Vehicles with older technology, poor fuel efficiency, or higher emissions. | Average CO2 emissions for new EU passenger cars in 2024: ~107 g/km. Older fleet vehicles likely exceed this, increasing costs. |

| Inflexible Rental Models | Segments lacking digital integration or flexible service offerings. | Continued market shift towards digital platforms and flexible solutions in 2024; lagging segments face declining demand. |

| Commoditized Segments | Highly competitive areas where price is the primary differentiator. | Intense pricing pressure in European city leisure rentals in 2024, with slight declines in average daily rates for standard vehicles. |

Question Marks

Ubeeqo, Europcar Mobility Group's car-sharing venture, is positioned as a 'Question Mark' within the BCG Matrix. The car-sharing market is experiencing robust growth, driven by increasing demand for flexible and sustainable urban transportation. However, Ubeeqo faces intense competition from established players and new entrants, meaning its current market share, while growing, may not yet be dominant.

This 'Question Mark' status reflects the significant investment required to expand Ubeeqo's user base and operational footprint. While car-sharing is undeniably a strategic pillar for Europcar's future mobility vision, its profitability and market penetration are still developing. For instance, the global car-sharing market was valued at over $10 billion in 2023 and is projected to grow substantially, but Ubeeqo's specific contribution to this figure requires careful management to transition it from a question mark to a star.

Europcar Mobility Group's strategic push into the United States, particularly targeting major airport hubs, signals a significant "Question Mark" in their BCG Matrix. This expansion leverages a high-growth market with substantial potential, aiming to capture a share currently dominated by established giants like Enterprise, Avis, and Hertz.

The company's 2024 strategy involves substantial investment to build brand awareness and operational capacity within the competitive U.S. rental car landscape. This aggressive approach acknowledges the need for significant capital outlay to gain traction against entrenched market leaders, a hallmark of a Question Mark needing careful nurturing.

Subscription-based car rental models represent a burgeoning segment within the automotive mobility sector, anticipated to experience robust growth. Europcar Mobility Group, like many established players, is navigating this evolving landscape.

While the overall subscription market shows strong upward momentum, Europcar's specific penetration within this niche is likely still in its formative stages. Significant investment in brand awareness and operational enhancements is crucial for them to capture a meaningful share of this developing market.

Integration of Advanced Technologies (AI, Telematics beyond basic connectivity)

Europcar Mobility Group's integration of advanced technologies like AI for dynamic pricing and sophisticated telematics for enhanced connected services represents a significant potential growth area, positioning these initiatives within the 'Question Marks' quadrant of the BCG matrix.

While fleet connectivity is established, the deeper application of AI for optimizing rental prices based on real-time demand and predictive analytics, alongside telematics that enable new customer offerings like usage-based insurance or predictive maintenance alerts, are still in nascent stages.

These advanced technological integrations require substantial investment in research and development, as well as significant implementation efforts, to move from early-stage pilots to widespread, market-leading adoption.

- AI-driven pricing optimization

- Advanced telematics for new services

- High R&D and implementation costs

- Potential for significant market share growth

Development of Eco-friendly Mobility Solutions (beyond basic EVs)

Europcar Mobility Group's commitment to eco-friendly mobility extends beyond basic electric vehicles, aiming to lead in multimodal ecosystems and foster a low-carbon future. This includes innovative solutions like e-bike rentals for efficient delivery and collection services, alongside strategic partnerships to expand charging infrastructure accessibility.

These forward-thinking, sustainable mobility options represent a high-growth market segment, though currently in its early stages. While their present market share is modest, the future potential is substantial, necessitating significant ongoing investment to capitalize on this emerging trend.

- Market Position: Represents a nascent but high-growth area for Europcar.

- Investment Needs: Requires substantial investment due to its early-stage development and future potential.

- Strategic Focus: Aligns with Europcar's ambition to lead in multimodal and low-carbon mobility solutions.

- Growth Potential: Offers significant future revenue streams as sustainable mobility adoption increases.

Europcar's investment in advanced telematics and AI for dynamic pricing falls into the Question Mark category. While these technologies offer significant potential for increased efficiency and new revenue streams, their market penetration and profitability are still developing. The company is investing heavily to refine these capabilities and establish a competitive edge.

The global market for AI in transportation is projected to reach $10.6 billion by 2025, with car-sharing and rental services being key adoption areas. Europcar's efforts in this space, while costly upfront, aim to capture a larger share of this expanding technological frontier, moving these initiatives from experimental to established revenue generators.

Europcar's expansion into subscription models also represents a Question Mark. This evolving segment of the mobility market shows strong growth potential, with projections indicating continued expansion. However, Europcar's current market share within this niche requires substantial investment in marketing and service development to solidify its position and ensure future profitability.

BCG Matrix Data Sources

Our Europcar Mobility Group BCG Matrix leverages comprehensive data from the company's annual reports, investor presentations, and industry-specific market research reports to accurately assess market share and growth rates.