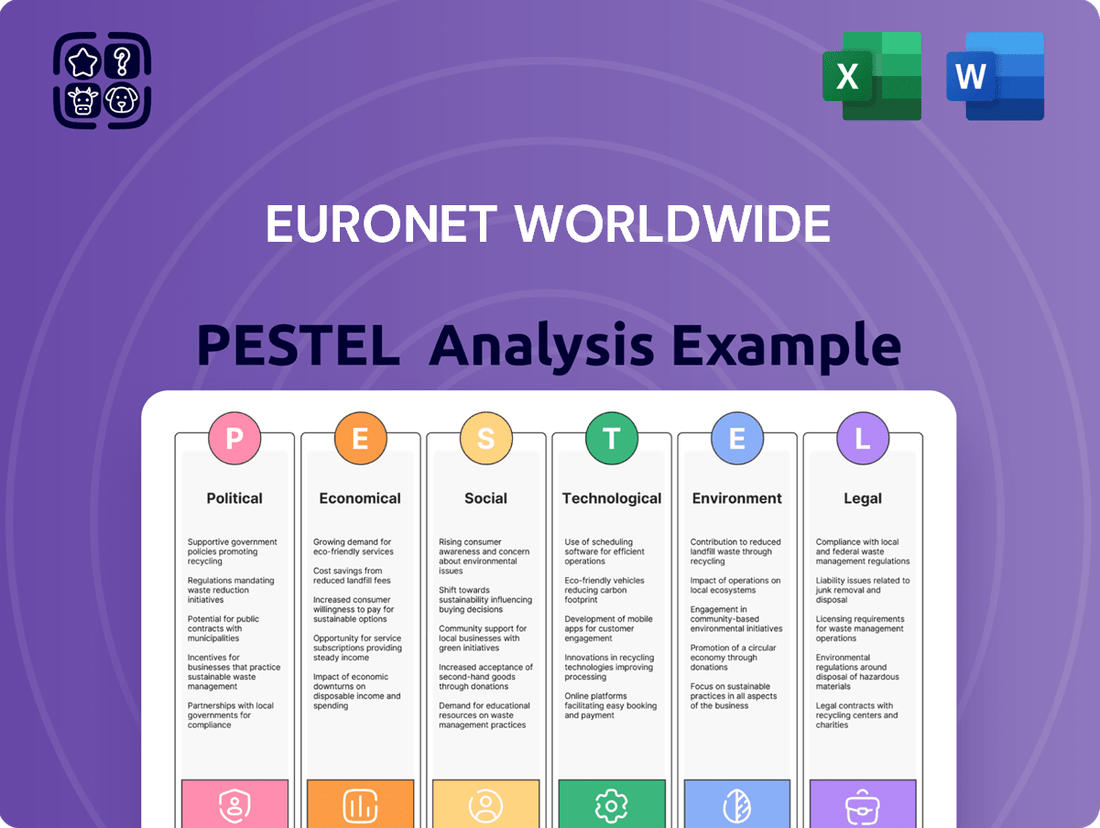

Euronet Worldwide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euronet Worldwide Bundle

Navigate the complex external forces shaping Euronet Worldwide's future with our expert-crafted PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are impacting the payments industry. Gain a competitive edge by leveraging these critical insights for your strategic planning. Download the full report now for actionable intelligence.

Political factors

Governments globally are tightening their grip on digital payments, a trend directly impacting Euronet Worldwide's core operations. Stricter licensing, capital requirements, and operational mandates are becoming more common, influencing how Euronet conducts business across its EFT, Money Transfer, and Epay segments. For instance, the European Union's Payment Services Directive 2 (PSD2) has reshaped the competitive landscape by fostering open banking and increasing compliance burdens for payment providers.

Euronet Worldwide's extensive global footprint means it's directly impacted by geopolitical shifts and evolving trade agreements. For instance, ongoing conflicts in Eastern Europe, while not directly impacting all of Euronet's operations, create a climate of uncertainty that can influence cross-border payment flows and investor sentiment towards emerging markets where Euronet has a presence.

Trade disputes, such as those that have emerged between major economic blocs in recent years, can lead to increased compliance costs or even temporary disruptions in the movement of funds. Euronet's reliance on seamless international transactions means that tariffs or sanctions imposed between countries could directly affect its ATM network and money transfer services, potentially lowering transaction volumes in affected corridors.

In 2024, the global landscape continues to be shaped by these tensions. For example, the International Monetary Fund (IMF) has repeatedly warned that trade fragmentation could reduce global GDP growth by as much as 2% in the medium term, a figure that would naturally translate to slower growth in transaction volumes for companies like Euronet that facilitate global commerce and remittances.

Global anti-money laundering (AML) and counter-terrorism financing (CTF) initiatives are intensifying, directly impacting financial service providers like Euronet. These heightened efforts translate into significant compliance costs and operational complexities.

Euronet must consistently allocate resources to sophisticated AML/CTF technologies and ongoing employee training to meet increasingly stringent international regulations. Failure to comply can result in substantial fines; for instance, in 2023, regulators worldwide levied billions in AML-related penalties against financial institutions.

Data Protection and Privacy Laws

The increasing global focus on data protection and privacy, exemplified by regulations like the EU's General Data Protection Regulation (GDPR) and similar laws enacted worldwide, significantly shapes Euronet Worldwide's operational landscape. These stringent regulations directly govern how Euronet collects, processes, and stores sensitive customer financial data across its various payment processing and money transfer services.

Compliance necessitates substantial investment in robust data security measures and privacy-enhancing technologies. For instance, the financial services sector, which Euronet heavily serves, faces escalating cybersecurity threats, making adherence to these evolving legal frameworks a critical operational imperative. Euronet's 2023 annual report highlighted ongoing investments in compliance and security infrastructure to meet these demands.

- GDPR Fines: Non-compliance with GDPR can result in fines up to 4% of global annual revenue or €20 million, whichever is higher, impacting Euronet's financial performance if breaches occur.

- Data Localization: Some countries are implementing data localization laws, requiring customer data to be stored within their borders, which could increase Euronet's infrastructure costs and complexity.

- Consumer Trust: Strong data privacy practices are crucial for maintaining consumer trust, a key asset for Euronet in the competitive digital payments market.

- Innovation Impact: Privacy regulations can influence the development and deployment of new payment technologies, requiring careful consideration of data handling from the outset.

Government Support for Financial Inclusion

Many governments worldwide are prioritizing financial inclusion, recognizing its importance for economic growth and social equity. Policies encouraging digital payments and expanding access to financial services in previously underserved regions are becoming more common. For instance, India's Pradhan Mantri Jan Dhan Yojana, launched in 2014, aimed to provide universal access to banking facilities, insurance, and pension schemes, significantly boosting financial inclusion. By August 2023, over 500 million accounts had been opened under this scheme, demonstrating the scale of government commitment.

This governmental push creates fertile ground for companies like Euronet Worldwide. Their ATM and money transfer services are well-positioned to capitalize on these initiatives, potentially expanding into new markets where governments are actively seeking to improve financial access. Such initiatives often come with incentives or opportunities for public-private partnerships, further facilitating Euronet's growth.

- Government initiatives like India's Pradhan Mantri Jan Dhan Yojana have opened over 500 million bank accounts by August 2023, fostering financial inclusion.

- Policies promoting digital payments are a key focus for governments aiming to reach unbanked populations.

- Euronet can leverage government support for financial inclusion to expand its ATM and money transfer services into new, underserved markets.

Governments worldwide are increasingly regulating the digital payments sector, impacting Euronet's operational framework through stricter licensing and compliance demands, as seen with the EU's PSD2. Geopolitical instability and trade disputes can disrupt cross-border transactions, with the IMF projecting trade fragmentation could reduce global GDP growth by up to 2% in 2024, directly affecting transaction volumes. Intensifying global anti-money laundering (AML) and counter-terrorism financing (CTF) efforts necessitate significant investment in compliance technologies and training, with billions in AML penalties levied globally in 2023 highlighting the stakes.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Euronet Worldwide, offering a comprehensive view of its external operating landscape.

A concise Euronet Worldwide PESTLE analysis that highlights key external factors impacting the company, serving as a pain point reliever by providing clarity for strategic decision-making.

Economic factors

Global economic growth, projected to expand by 2.7% in 2024 and 3.2% in 2025 according to IMF forecasts, directly impacts Euronet Worldwide's transaction volumes. Robust economic expansion typically correlates with increased consumer spending, boosting demand for Euronet's payment processing and money transfer services.

Conversely, economic slowdowns or recessions can dampen consumer confidence and disposable income, leading to reduced ATM withdrawals, fewer cross-border remittances, and lower spending on prepaid cards. For instance, a significant global economic contraction could see a noticeable dip in the 2.5 billion transactions Euronet processed in 2023, affecting its revenue streams.

Rising inflation, a persistent concern throughout 2024 and projected into 2025, directly impacts Euronet Worldwide by diminishing consumer purchasing power. This erosion of discretionary income can lead to reduced spending on prepaid services and a general slowdown in transaction volumes, affecting a core revenue stream.

Interest rate volatility presents a dual challenge for Euronet. Higher rates increase the cost of borrowing for the company, potentially impacting its capital expenditures and overall profitability. Conversely, fluctuating rates can alter the profitability of its Electronic Funds Transfer (EFT) segment, particularly concerning its cash management services.

Currency exchange rate volatility presents a significant challenge for Euronet Worldwide, given its role as a global money transfer and cross-border payment provider. Fluctuations in currency values directly affect the real worth of international transactions processed through its network. For instance, if the US dollar strengthens considerably against the Euro, the value of remittances sent from the US to Europe would decrease when converted back to Euros, impacting both the sender and receiver. This dynamic can also influence Euronet's reported revenues, as earnings from different geographic regions are translated into its reporting currency, typically the US dollar. A stronger dollar, for example, would make earnings from weaker currency regions appear lower.

In 2024, the global foreign exchange market experienced notable shifts. The US Dollar Index (DXY), which measures the dollar's strength against a basket of major currencies, saw periods of both appreciation and depreciation. For Euronet, this means that the profitability of its money transfer services, particularly those with significant cross-border flows, can be directly impacted. For example, if a large volume of transactions occurs between countries with rapidly depreciating currencies against the US dollar, Euronet's revenue from those corridors could be negatively affected.

Competition in the Digital Payments Market

The digital payments landscape is incredibly crowded. Euronet Worldwide faces stiff competition not only from nimble fintech startups but also from established banks and tech giants like Apple Pay and Google Pay, all vying for consumer transactions. This dynamic necessitates continuous innovation and cost management to retain customers and profitability.

This fierce rivalry puts pressure on pricing models, potentially squeezing margins for all players. For Euronet, staying ahead means investing in advanced technologies and unique service offerings that set it apart from the competition. For example, in 2024, the global digital payments market was valued at over $3.5 trillion, projected to grow significantly, highlighting both the opportunity and the intensity of the battle for market share.

- Intense Competition: Fintechs, banks, and tech giants are all active participants.

- Pricing Pressures: Competition can drive down transaction fees.

- Innovation Imperative: Differentiation through technology and service is crucial for Euronet.

- Market Size: The digital payments market exceeded $3.5 trillion in 2024, indicating high stakes.

Remittance Market Trends and Migratory Patterns

The global remittance market, a key driver for Euronet's Ria Money Transfer, is directly shaped by evolving migratory patterns and economic conditions worldwide. As of 2024, remittances continue to be a vital financial lifeline for many developing nations, with global flows projected to remain robust.

Economic health in both sending (host) and receiving countries plays a crucial role. For instance, strong employment in developed economies typically correlates with higher remittance volumes, while economic downturns can lead to reduced transfer amounts. Similarly, shifts in immigration policies in major remittance-sending countries can significantly impact the number of individuals able to send money home.

- Global remittance flows are a significant economic factor, with the World Bank projecting continued growth in 2024 and 2025.

- Economic stability and employment rates in countries like the United States and European nations directly influence the capacity of migrants to send remittances.

- Changes in migration policies, such as visa regulations or deportation enforcement, can alter the size and stability of migrant populations, thereby affecting remittance volumes.

- Recipient countries' economic performance also matters; a stronger local economy might reduce the urgency or amount of remittances needed by families.

Global economic growth, projected at 2.7% for 2024 and 3.2% for 2025 by the IMF, directly influences Euronet's transaction volumes. Economic downturns, however, can reduce consumer spending and disposable income, impacting ATM withdrawals and remittances, as seen in the 2.5 billion transactions processed in 2023.

Inflationary pressures in 2024 and into 2025 diminish consumer purchasing power, potentially slowing spending on prepaid services and affecting Euronet's core revenue. Interest rate volatility also poses a challenge, increasing borrowing costs and impacting the profitability of its EFT segment.

Currency exchange rate volatility is a significant factor for Euronet's global operations. Fluctuations affect the real value of international transactions and can impact reported revenues when translated into its reporting currency, the US dollar, as observed with the US Dollar Index (DXY) movements in 2024.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Euronet |

| Global GDP Growth | 2.7% | 3.2% | Higher transaction volumes with growth, lower with contraction. |

| Inflation Rate (Global Average) | Elevated (specific figures vary by region) | Moderating but persistent | Reduced consumer spending power, potential transaction slowdown. |

| Interest Rates (Major Economies) | Volatile, generally higher than pre-2022 | Continued volatility | Increased borrowing costs; potential impact on EFT segment profitability. |

| Currency Exchange Rates | Significant Volatility (e.g., DXY fluctuations) | Continued Volatility | Affects value of cross-border transactions and reported earnings. |

What You See Is What You Get

Euronet Worldwide PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Euronet Worldwide PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights upon purchase.

Sociological factors

The world is increasingly moving away from cash, with digital payments becoming the norm. This trend is fueled by the sheer convenience and ongoing technological leaps in payment systems. For instance, global digital payment transaction values are projected to reach over $15 trillion by 2027, highlighting this significant shift.

This societal move towards digital transactions presents a dual-edged sword for Euronet Worldwide. While it might signal a potential decrease in reliance on traditional ATM services, it simultaneously boosts the demand for Euronet's core offerings in digital money transfer and prepaid services, which are well-positioned to capitalize on this evolving consumer behavior.

Consumers are increasingly demanding financial services that are not only convenient but also instantaneous and readily available, with a strong preference for mobile-centric platforms. This shift is evident in the growing adoption of digital wallets and peer-to-peer payment apps, which offer unparalleled ease of use.

Euronet, particularly within its Electronic Funds Transfer (EFT) and Epay divisions, must proactively adapt its product portfolio to align with these evolving consumer expectations. For instance, by Q3 2024, mobile banking transactions globally were projected to exceed 70% of all retail banking interactions, highlighting the critical need for Euronet to enhance its mobile capabilities to stay competitive.

Increasing financial literacy directly fuels demand for Euronet's services. For instance, in 2024, a significant portion of the global population, particularly in developing economies, still lacks basic financial knowledge, creating a substantial opportunity. As financial inclusion initiatives gain traction, more people are entering the formal financial system, boosting the adoption of digital payments and ATM services, areas where Euronet is a key player.

Trust and Security Concerns in Digital Transactions

Public trust in the security of digital transactions is paramount for Euronet Worldwide. As of early 2024, reports indicate a growing consumer apprehension regarding data breaches, with a significant percentage of individuals expressing concern over the safety of their financial information online. Euronet's commitment to robust cybersecurity is therefore not just a technical necessity but a crucial element of its social license to operate.

Maintaining consumer confidence requires ongoing investment in advanced security protocols and clear, accessible communication about how transactions are protected. For instance, Euronet's adoption of multi-factor authentication and real-time fraud monitoring systems directly addresses these sociological concerns. The company's transparency regarding its data protection policies is key to building and sustaining this trust.

- Consumer apprehension regarding data breaches remains high, influencing adoption of digital financial services.

- Euronet's investment in cybersecurity, including multi-factor authentication, directly addresses public trust issues.

- Transparent communication of security measures is vital for maintaining consumer confidence in digital transactions.

Demographic Shifts and Urbanization

Global demographic trends, like the aging populations in Europe and North America versus the youth bulge in parts of Asia and Africa, directly impact payment needs. Euronet must adapt its digital payment solutions to serve both older, potentially less tech-inclined users and younger generations accustomed to mobile-first transactions. For instance, by 2025, the global population aged 65 and over is projected to reach nearly 800 million, a significant segment requiring accessible payment methods.

Increasing urbanization concentrates populations, creating hubs for digital commerce and requiring robust, high-volume transaction processing. As more people move to cities, the demand for seamless, instant payment options for everything from public transport to online retail surges. By 2025, it's estimated that 60% of the world's population will live in urban areas, presenting concentrated opportunities for Euronet's payment infrastructure.

- Aging Population Needs: Focus on user-friendly interfaces and secure, reliable transaction methods for older demographics.

- Youthful Demographics: Develop innovative, mobile-centric payment solutions catering to digital natives' preferences.

- Urban Concentration: Enhance capacity for high-volume, real-time transaction processing in densely populated areas.

- Emerging Markets: Tailor offerings to the unique payment behaviors and infrastructure challenges in rapidly urbanizing developing economies.

Societal shifts towards digital convenience and mobile-first financial interactions are paramount. Euronet's ability to adapt its services, particularly in money transfer and prepaid solutions, to meet these evolving consumer demands is critical for sustained growth.

Public trust in digital security remains a key sociological factor influencing adoption rates. Euronet's proactive investment in robust cybersecurity measures and transparent communication about data protection are essential for maintaining consumer confidence and its social license to operate.

Demographic changes, including aging populations and increasing urbanization, shape payment needs. Euronet must tailor its offerings to diverse age groups and enhance its infrastructure to support high-volume transactions in concentrated urban centers.

| Sociological Factor | Impact on Euronet | Key Data/Trend (2024-2025) |

|---|---|---|

| Digitalization & Convenience | Increased demand for digital money transfer and prepaid services; potential decline in ATM reliance. | Global digital payment transaction values projected to exceed $15 trillion by 2027. Mobile banking transactions expected to surpass 70% of retail banking interactions by Q3 2024. |

| Consumer Trust & Security | Heightened concern over data breaches necessitates strong cybersecurity. | Significant consumer apprehension regarding online financial information safety reported as of early 2024. |

| Demographic Shifts | Need to cater to both tech-averse older populations and digital-native younger generations; urbanization drives demand for high-volume processing. | Global population aged 65+ projected to reach nearly 800 million by 2025. Approximately 60% of the world's population expected to live in urban areas by 2025. |

Technological factors

Euronet Worldwide operates in a dynamic landscape shaped by rapid advancements in payment processing technology. The drive towards faster transaction speeds and more robust security protocols is paramount for maintaining a competitive edge. For instance, the global real-time payments market is projected to reach $31.7 trillion by 2026, highlighting the increasing demand for such capabilities.

To capitalize on these trends, Euronet must consistently invest in modernizing its infrastructure. This includes enabling support for real-time payment systems, which are becoming a global standard, and seamlessly integrating new functionalities across its Electronic Funds Transfer (EFT) and Money Transfer divisions. By doing so, Euronet can enhance user experience and operational efficiency.

The rise of blockchain and distributed ledger technologies (DLT) presents a dual-edged sword for Euronet Worldwide. These innovations hold the promise of significantly streamlining cross-border payments, potentially reducing transaction times and costs, which could be a major boon for Euronet's money transfer operations.

However, Euronet must proactively evaluate how to integrate these emerging technologies to ensure they enhance, rather than disrupt, their existing operational efficiency and cost-effectiveness. For instance, while traditional remittance providers saw transaction fees averaging around 6% in 2023, blockchain-based solutions aim to drastically lower this, potentially impacting Euronet's revenue streams if not adapted to.

The escalating sophistication of cyber threats presents a substantial risk for Euronet Worldwide, especially considering its management of extensive sensitive financial data. In 2023, global cybercrime costs were estimated to reach $10.5 trillion annually, a figure projected to climb. This necessitates ongoing, significant investment in cutting-edge cybersecurity defenses, advanced fraud detection technologies, and stringent data encryption protocols to safeguard its operational infrastructure and customer data.

Artificial Intelligence (AI) and Machine Learning (ML) in Payments

Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally reshaping the payments landscape. These technologies are crucial for advanced fraud detection, offering more sophisticated ways to identify and prevent illicit transactions than traditional rule-based systems. For instance, by analyzing vast datasets in real-time, AI can spot subtle anomalies indicative of fraud, potentially saving companies billions. In 2024, the global AI in financial services market was valued at approximately $14.1 billion, with fraud detection being a significant driver.

Euronet Worldwide can harness AI and ML to bolster its security infrastructure, making its payment processing and ATM networks more resilient. Predictive analytics, powered by AI, can optimize ATM cash replenishment schedules, reducing operational costs and improving customer access to funds. Furthermore, AI enables hyper-personalized customer experiences, tailoring offers and services based on individual transaction patterns, which can significantly enhance customer loyalty and engagement in the competitive money transfer sector.

- Enhanced Fraud Prevention: AI/ML algorithms can detect fraudulent transactions with greater accuracy, reducing financial losses. Global spending on fraud detection and prevention solutions in financial services is projected to reach over $60 billion by 2027.

- Optimized Operations: Predictive analytics can improve ATM network efficiency by forecasting cash needs and maintenance requirements, leading to cost savings.

- Personalized Customer Experiences: AI can analyze customer data to offer tailored financial products and services, boosting customer satisfaction and retention.

Mobile Technology and Digital Wallet Proliferation

The pervasive use of smartphones and the surge in digital wallet adoption are fundamentally altering consumer engagement with financial services. Euronet Worldwide needs to proactively integrate its offerings with mobile ecosystems and forge strategic alliances to guarantee seamless access to its prepaid products and money transfer solutions through these dominant platforms.

By 2024, global mobile payment transaction value was projected to exceed $2.5 trillion, highlighting the immense market shift. This trend necessitates Euronet's continued investment in mobile-first strategies.

- Smartphone Penetration: Over 6.9 billion people worldwide are expected to use smartphones by 2024, a significant increase from previous years.

- Digital Wallet Growth: The digital wallet market is forecast to reach over $12 trillion by 2027, indicating a strong consumer preference for convenient, mobile-based transactions.

- Euronet's Strategy: Euronet's ongoing efforts to expand its mobile app functionalities and partnerships with major digital wallet providers are crucial for capturing this evolving market.

Technological advancements are a primary driver for Euronet Worldwide. The company must continually invest in its infrastructure to support real-time payments, a market projected to reach $31.7 trillion by 2026, and integrate emerging technologies like blockchain to streamline cross-border transactions. Cybersecurity is paramount, with global cybercrime costs estimated at $10.5 trillion annually in 2023, requiring robust defenses. AI and ML are also key, with the AI in financial services market valued at $14.1 billion in 2024, offering enhanced fraud detection and operational efficiencies.

| Technological Factor | Impact on Euronet Worldwide | Supporting Data (2023-2025 Projections) |

| Real-Time Payments | Increased demand for faster transactions, requiring infrastructure upgrades. | Global real-time payments market projected to reach $31.7 trillion by 2026. |

| Blockchain/DLT | Potential to reduce cross-border payment times and costs, but requires strategic integration. | Traditional remittance fees averaged ~6% in 2023; blockchain aims for lower costs. |

| Cybersecurity | Critical for protecting sensitive financial data against escalating threats. | Global cybercrime costs reached $10.5 trillion annually in 2023. |

| AI/ML | Enables advanced fraud detection, operational optimization, and personalized customer experiences. | AI in financial services market valued at $14.1 billion in 2024; fraud detection spend projected over $60 billion by 2027. |

| Mobile & Digital Wallets | Necessitates mobile-first strategies and integration with dominant platforms. | Global mobile payment transaction value projected to exceed $2.5 trillion in 2024; digital wallet market to reach $12 trillion by 2027. |

Legal factors

Euronet Worldwide navigates a complex web of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations across its global operations. These rules mandate rigorous customer identification and verification processes, alongside the reporting of any suspicious financial activities to authorities.

Failure to adhere to these stringent requirements can result in severe penalties, including significant financial fines and substantial damage to Euronet's reputation. For instance, in 2023, financial institutions globally faced billions in AML-related fines, highlighting the high stakes involved. Consequently, Euronet must continually invest in robust compliance programs and advanced technological solutions to ensure ongoing adherence and mitigate these risks.

Euronet's compliance with global data privacy laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), is critical due to the sensitive financial information it handles. These regulations mandate stringent rules for data collection, storage, and usage, emphasizing robust data security and explicit user consent across all its operational segments.

Failure to adhere to these evolving legal frameworks can result in significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. In 2023, companies globally faced substantial fines related to data privacy breaches, highlighting the financial and reputational risks associated with non-compliance.

Regulations like Europe's Payment Services Directive 2 (PSD2) and the global push for open banking are fundamentally reshaping the financial services landscape. These directives mandate that banks open up customer data and payment initiation services through Application Programming Interfaces (APIs), fostering a more competitive and innovative environment.

For Euronet Worldwide, this regulatory shift presents a dual-edged sword. While it intensifies competition by allowing third-party providers (TPPs) access to payment infrastructure, it also unlocks significant opportunities for Euronet to forge new partnerships. By integrating with TPPs, Euronet can expand its service offerings and develop innovative payment solutions, potentially tapping into new revenue streams.

The open banking movement is already demonstrating tangible results. For instance, by the end of 2023, the UK's Open Banking Implementation Entity reported over 1,000 regulated TPPs actively participating, processing billions of API calls, highlighting the rapid adoption and integration within the financial ecosystem.

Consumer Protection Laws and Financial Ombudsman Schemes

Euronet Worldwide operates within a stringent regulatory environment, necessitating adherence to consumer protection laws. These laws, such as the European Union's Payment Services Directive (PSD2), mandate transparency in transaction fees, clear dispute resolution processes, and fair treatment of customers. Non-compliance can lead to significant penalties and reputational damage.

Participation in financial ombudsman schemes is vital for Euronet to manage customer grievances effectively and maintain trust. These independent bodies provide a mechanism for resolving disputes outside of court. For instance, the UK's Financial Ombudsman Service resolved over 175,000 cases in the 2023-2024 period, highlighting the importance of such avenues for customer recourse.

- Consumer Protection Laws: Euronet must comply with regulations ensuring transaction clarity, fair practices, and robust dispute resolution mechanisms for its customers.

- Financial Ombudsman Schemes: Engagement with these schemes is critical for Euronet to address customer complaints and maintain a positive brand image.

- PSD2 Compliance: Adherence to directives like PSD2 is essential for Euronet's operations in the European market, impacting areas like payment initiation and account information services.

- Reputational Risk: Failure to meet consumer protection standards can result in legal challenges and a significant erosion of customer confidence.

Licensing Requirements and Cross-Border Operating Permits

Euronet Worldwide's global operations necessitate a complex web of licenses and operating permits for its ATM networks, money transfer services, and prepaid products. For instance, in 2024, Euronet's Money Transfer segment, operating under brands like Ria Money Transfer, processed billions of dollars in remittances, each transaction subject to varying money transfer licenses and anti-money laundering (AML) regulations across jurisdictions.

Changes to these licensing requirements or challenges in securing new permits can directly affect Euronet's market access and expansion plans. For example, stricter data localization laws, which have been evolving in regions like Southeast Asia and parts of Europe, can impose additional compliance burdens and potentially limit the scope of services Euronet can offer without specific, country-level authorizations.

- Global Reach Requires Diverse Licensing: Euronet operates in over 170 countries, each with unique financial service regulations requiring specific licenses for ATM processing, money transfers, and prepaid services.

- Regulatory Evolution Impacts Operations: Evolving AML, Know Your Customer (KYC), and data privacy regulations (like GDPR or similar frameworks in other regions) can necessitate costly updates to compliance systems and operational procedures, potentially affecting service delivery and expansion.

- Cross-Border Permit Challenges: Obtaining and maintaining cross-border operating permits, especially for remittance services, involves navigating differing national banking laws and consumer protection standards, which can be time-consuming and resource-intensive.

Euronet Worldwide's extensive global operations, spanning over 170 countries, necessitate a complex array of licenses and operating permits for its diverse services, including ATM networks, money transfer, and prepaid products. For instance, in 2024, Euronet's money transfer segment, under brands like Ria, processed billions of dollars in remittances, with each transaction subject to varied licensing and anti-money laundering (AML) regulations across different jurisdictions.

Evolving regulations, such as stricter data localization laws observed in Southeast Asia and parts of Europe, can impose additional compliance burdens and potentially restrict the scope of services Euronet can offer without specific country-level authorizations, impacting market access and expansion strategies.

Navigating these cross-border permit challenges, particularly for remittance services, involves managing differing national banking laws and consumer protection standards. This process is often time-consuming and resource-intensive, underscoring the critical need for robust legal and compliance frameworks.

| Legal Factor | Impact on Euronet Worldwide | 2024/2025 Data/Trend |

| Licensing & Permits | Essential for operating ATM, money transfer, and prepaid services globally. | Euronet's Ria processed billions in remittances in 2024, each requiring adherence to local money transfer licenses and AML rules. |

| Data Localization Laws | Can create compliance burdens and limit service scope without specific authorizations. | Increasingly stringent in regions like Southeast Asia and Europe, requiring adaptation of operational models. |

| Cross-Border Regulations | Navigating diverse national banking and consumer protection laws for remittances. | Time-consuming and resource-intensive, demanding significant legal and compliance investment. |

Environmental factors

Euronet Worldwide's vast global ATM network and its data center operations are substantial energy consumers, directly impacting its environmental footprint. For instance, while specific recent figures for Euronet's total energy consumption aren't publicly detailed, the broader financial services sector's data centers alone are estimated to account for a significant portion of global electricity usage, with projections suggesting continued growth in demand.

This reality places Euronet under growing pressure from investors, customers, and regulatory bodies to implement energy-efficient technologies and sustainable operational practices. For example, many financial institutions are setting targets for renewable energy sourcing and improving data center cooling efficiency to mitigate environmental impact, trends that Euronet is also navigating.

The lifecycle of Euronet Worldwide's ATMs and payment terminals creates electronic waste, necessitating responsible disposal and recycling. As of 2024, the global e-waste volume is projected to reach 61.3 million metric tons, a significant environmental challenge.

Euronet must implement strong waste management strategies to meet evolving environmental regulations, such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, and showcase its commitment to corporate environmental responsibility.

Investors and the public are increasingly focused on corporate social responsibility and environmental sustainability, putting pressure on companies like Euronet to show their dedication through clear reporting. In 2024, a significant majority of institutional investors surveyed by PwC indicated that ESG (Environmental, Social, and Governance) factors are important in their investment decisions, with a growing emphasis on climate-related disclosures.

Euronet can boost its brand image and attract investors who prioritize ethical practices by developing and sharing specific sustainability goals and initiatives. For instance, companies that set science-based targets for emissions reduction, as encouraged by initiatives like the Science Based Targets initiative (SBTi), often see improved investor confidence and a potential reduction in their cost of capital.

Climate Change Impact on Infrastructure and Operations

The physical impacts of climate change, such as increased frequency and intensity of extreme weather events, pose a direct threat to Euronet Worldwide's physical infrastructure. This includes their extensive network of ATMs and critical data centers, particularly those located in regions susceptible to flooding, hurricanes, or severe heatwaves.

Assessing and proactively mitigating these climate-related risks are paramount for ensuring Euronet's operational resilience and continuity. For instance, in 2024, the global economic impact of natural disasters was estimated to be in the hundreds of billions of dollars, highlighting the financial exposure businesses face.

- Physical Disruption: Extreme weather can damage or disable ATM terminals and data center facilities, leading to service interruptions.

- Operational Resilience: Euronet must invest in robust infrastructure and contingency plans to withstand climate-related shocks.

- Geographic Vulnerability: Identifying and managing risks in specific regions prone to climate impacts is crucial for network stability.

Regulatory Pressure for Green Finance and ESG Compliance

Euronet Worldwide, like many financial services providers, is navigating increasing regulatory scrutiny concerning environmental, social, and governance (ESG) factors. Governments globally are implementing stricter guidelines for financial institutions to embed ESG considerations into their core business strategies and reporting frameworks. This translates into potential requirements for Euronet to disclose its environmental footprint and adopt principles of green finance.

The push for sustainability is evident in various jurisdictions. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) mandates extensive ESG reporting for financial market participants, impacting companies operating within or serving EU markets. While specific regulations directly targeting Euronet's payment processing and money transfer services might be evolving, the broader trend points towards greater accountability for environmental impact and social responsibility. By mid-2024, many major financial regulators were finalizing or implementing frameworks that demand greater transparency on climate-related risks and opportunities.

- Increased Disclosure Requirements: Euronet may face mandates to report on its carbon emissions, energy consumption, and waste management practices.

- Green Finance Integration: Regulations could encourage or require Euronet to offer or support financial products and services aligned with sustainability objectives.

- Alignment with Global Goals: Companies are increasingly expected to demonstrate how their operations contribute to broader sustainability targets, such as those outlined in the Paris Agreement or the UN Sustainable Development Goals.

- Evolving Compliance Landscape: The regulatory environment around ESG is dynamic, requiring continuous adaptation and investment in compliance infrastructure.

Euronet's operations, particularly its extensive ATM network and data centers, contribute to environmental concerns through energy consumption and electronic waste generation. As of 2024, global e-waste is projected to reach 61.3 million metric tons, a challenge Euronet must address through responsible disposal and recycling to comply with regulations like the EU's WEEE Directive.

PESTLE Analysis Data Sources

Our Euronet Worldwide PESTLE Analysis is built on a robust foundation of data from reputable sources, including financial reports from Euronet Worldwide itself, regulatory filings from relevant government bodies, and market intelligence from leading financial and technology research firms.