Euronet Worldwide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euronet Worldwide Bundle

Euronet Worldwide operates in a dynamic payments landscape, facing moderate threats from new entrants and substitutes, while buyer power is significant due to industry fragmentation.

The full Porter's Five Forces Analysis reveals the real forces shaping Euronet Worldwide’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Euronet Worldwide's reliance on technology providers for essential components like ATM hardware, software, and network infrastructure grants these suppliers a degree of bargaining power. This power can escalate significantly when dealing with specialized or proprietary technologies where alternative options are scarce.

The company's strategic acquisition of CoreCard in 2023, valued at approximately $270 million, is a key move to bolster its digital offerings and potentially diminish its dependence on external suppliers for critical services, thereby mitigating supplier power.

Telecommunication companies and network providers are essential for Euronet Worldwide's operations, underpinning its electronic transaction processing and money transfer services. The leverage these suppliers hold can fluctuate significantly based on geographic location and the presence of competing service providers.

In regions where telecommunication infrastructure is less developed or concentrated among a few providers, Euronet may face heightened supplier bargaining power. This can translate into less favorable contract terms for network access and data transmission, impacting Euronet's cost structure. For instance, in 2024, Euronet's capital expenditures included investments in network infrastructure upgrades, suggesting a continuous need to manage these supplier relationships effectively.

Suppliers of crucial cash management services, such as cash-in-transit companies and vault operators, hold significant sway over Euronet Worldwide's ATM operations. The efficiency and reliability of these services directly impact the profitability of Euronet's EFT segment, as uninterrupted cash flow is paramount. For instance, in 2024, the logistics of managing cash for a vast ATM network means that disruptions, even minor ones, can lead to increased operational costs and potential revenue loss, thereby amplifying supplier leverage.

Supplier Power 4

Financial institutions and banks are crucial partners for Euronet Worldwide, acting as both suppliers of essential payment network access and banking services. The bargaining power of large global banks can be substantial, given their extensive customer bases and significant regulatory sway. For instance, in 2024, major banks continued to consolidate their market positions, potentially increasing their leverage in negotiations with payment processors like Euronet.

Euronet actively works to mitigate this supplier power. The company's Ren platform is designed to create a more unified and efficient ecosystem for financial transactions, potentially reducing reliance on individual banking partners. Furthermore, the Dandelion network aims to expand Euronet's direct reach, thereby strengthening its negotiating position with established financial institutions.

- Significant Leverage: Major global banks possess considerable bargaining power due to their extensive reach and regulatory influence, impacting Euronet's operational costs and partnership terms.

- Strategic Mitigation: Euronet's Ren platform and Dandelion network are strategic initiatives designed to enhance its negotiating leverage and reduce dependence on individual financial institutions.

- Market Dynamics: As of 2024, the ongoing consolidation within the banking sector suggests that the bargaining power of key financial partners for payment processors may continue to be a significant factor.

Supplier Power 5

The bargaining power of suppliers for Euronet Worldwide is significantly influenced by the availability and cost of skilled labor, particularly in IT and cybersecurity. The intense demand for these specialized professionals within the fast-growing fintech sector grants them considerable leverage. This can directly affect Euronet's operational expenses and its capacity for crucial innovation.

This dynamic is a pervasive challenge throughout the payments industry, where the need for cutting-edge technological expertise is paramount. For instance, in 2024, the global demand for cybersecurity professionals was projected to reach over 4.7 million unfilled positions, highlighting the scarcity of talent.

- High demand for IT and cybersecurity talent in fintech.

- Skilled professionals possess significant bargaining power.

- Impact on operational costs and innovation capabilities.

- Industry-wide challenge in the evolving payments landscape.

Suppliers of essential hardware, software, and network infrastructure hold considerable sway over Euronet Worldwide, particularly when their offerings are specialized or proprietary. This power is amplified by the critical nature of these components to Euronet's transaction processing and ATM operations. For instance, the company's 2024 capital expenditures on network infrastructure upgrades underscore the ongoing need to manage these supplier relationships effectively, as concentrated providers in less developed regions can dictate less favorable terms.

The bargaining power of suppliers for Euronet Worldwide is also evident in the market for skilled labor, especially in IT and cybersecurity. The intense demand for these professionals within the fintech sector in 2024, with millions of unfilled cybersecurity positions globally, grants them significant leverage. This scarcity directly impacts Euronet's operational costs and its capacity for innovation, presenting an industry-wide challenge.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Euronet | Mitigation Strategies |

|---|---|---|---|

| Technology Providers | Proprietary technology, availability of alternatives | Increased costs for hardware/software, potential operational disruptions | Strategic acquisitions (e.g., CoreCard), platform development (Ren) |

| Telecommunication Companies | Geographic concentration, competition | Variable network access costs, potential for unfavorable contract terms | Infrastructure investments, exploring diverse providers |

| Cash Management Services | Reliability, efficiency of cash-in-transit | Higher operational costs, revenue loss from disruptions | Optimizing logistics, strong contractual agreements |

| Financial Institutions | Market share, regulatory influence | Negotiating leverage on payment network access, partnership terms | Expanding direct reach (Dandelion network), platform integration |

| Skilled Labor (IT/Cybersecurity) | Talent scarcity, demand in fintech | Increased labor costs, challenges in innovation and operational capacity | Competitive compensation, talent development programs |

What is included in the product

This analysis of Euronet Worldwide's competitive landscape reveals intense rivalry, significant buyer power, and the threat of new entrants, alongside moderate supplier power and the constant challenge of substitutes.

Identify and mitigate competitive threats by clearly visualizing the intensity of each of Porter's Five Forces impacting Euronet Worldwide.

Customers Bargaining Power

Financial institutions and major retailers, as key clients for Euronet's EFT and Epay services, wield considerable influence. Their substantial transaction volumes mean they can negotiate favorable terms, pushing for competitive pricing and tailored solutions. For instance, Euronet's continued partnerships with prominent global banks underscore their commitment to meeting the demands of these high-volume customers.

While individual consumers using Euronet Worldwide's ATM, money transfer, or prepaid services possess limited bargaining power on their own, their collective choices significantly influence the company. The sheer volume of transactions and the ease with which consumers can switch providers or utilize digital alternatives means they can collectively demand better terms, such as lower fees and improved security features. For instance, in 2024, the global digital payments market continued its robust growth, with transaction volumes in the billions, underscoring the collective influence of consumers seeking cost-effective and convenient financial solutions.

Small and medium-sized businesses (SMBs) using Euronet's point-of-sale (POS) or prepaid services generally possess moderate bargaining power. This leverage is often tied to how easily they can switch payment processors and the specific value-added services Euronet provides. For instance, if alternative payment solutions offer comparable features at a lower cost, SMBs have more leverage.

The increasing availability of embedded finance solutions and the strategic use of loyalty programs by businesses can further influence their decision-making and bargaining strength with providers like Euronet. In 2024, the competitive landscape for payment processing saw continued innovation, with many fintechs offering flexible terms that empower smaller clients.

Buyer Power 4

Governments and public sector entities represent a significant source of buyer power for companies like Euronet Worldwide, particularly when dealing with large-scale payment disbursements or government benefit programs. Their substantial contract volumes and regulatory oversight can impose rigorous demands and necessitate competitive bidding, thereby influencing pricing and service terms.

The bargaining power of customers is amplified when they operate collectively or represent substantial market segments. For instance, in the realm of electronic payments, large financial institutions or consortiums of businesses can exert considerable influence over transaction fees and service level agreements. Euronet's reliance on these entities for transaction volume means their ability to negotiate favorable terms is a key consideration.

- Government Contracts: Public sector entities, such as those managing social security or welfare programs, often issue large, multi-year contracts for payment processing. In 2023, government spending on digital payment infrastructure and services globally continued to expand, driven by initiatives for financial inclusion and efficient disbursement of public funds.

- Consolidated Purchasing Power: Large banks and payment networks, acting as intermediaries or direct customers, possess significant bargaining clout due to the sheer volume of transactions they process. This allows them to negotiate lower fees and demand advanced technological capabilities from service providers like Euronet.

- Regulatory Influence: Government bodies can set standards and regulations that directly impact payment service providers, influencing operational costs and service offerings. For example, mandates related to data security or transaction transparency can increase compliance burdens, which customers may leverage in negotiations.

- Switching Costs: While customers may face switching costs, the availability of alternative payment processors and the ongoing evolution of payment technologies mean that customers retain a degree of power. Companies that can demonstrate superior service, lower costs, or innovative solutions are better positioned to mitigate this customer leverage.

Buyer Power 5

The increasing adoption of digital payment methods and mobile wallets significantly empowers customers, offering them a wider array of choices and greater leverage. This trend compels Euronet Worldwide to continuously innovate its offerings, ensuring seamless digital experiences to both retain existing customers and attract new ones across its diverse business segments.

Euronet's reliance on digital transactions as a key growth driver means that customer power directly impacts its revenue streams and market position. For instance, in 2024, the global digital payments market was projected to reach over $11 trillion, highlighting the substantial influence of consumer preferences in this rapidly evolving landscape.

- Increased customer choice: Digital payment platforms and mobile wallets provide consumers with numerous alternatives, reducing their dependence on any single provider.

- Demand for seamless experiences: Customers expect intuitive and efficient digital transactions, pushing Euronet to invest in user-friendly interfaces and robust backend systems.

- Impact on Euronet's growth: As digital transactions are a core component of Euronet's strategy, customer satisfaction and adoption rates directly influence its financial performance and market share.

- Competitive pressure: The ease with which customers can switch between digital payment providers intensifies competition, forcing Euronet to maintain competitive pricing and superior service quality.

The bargaining power of customers for Euronet Worldwide is significant, particularly among its institutional clients like financial institutions and large retailers. These entities, processing vast transaction volumes, can negotiate favorable pricing and demand customized solutions, directly impacting Euronet's revenue and service agreements. For example, in 2024, the continued growth in global electronic payments, projected to exceed $11 trillion, underscores the immense leverage these major clients hold.

| Customer Segment | Bargaining Power Drivers | Impact on Euronet |

|---|---|---|

| Financial Institutions & Large Retailers | High transaction volumes, ability to switch processors, demand for tailored services | Negotiate lower fees, influence service level agreements, drive product development |

| Individual Consumers | Ease of switching providers, availability of digital alternatives, collective influence | Pressure for lower transaction fees, demand for improved security and user experience |

| Small & Medium Businesses (SMBs) | Moderate switching costs, availability of alternative payment solutions | Seek competitive pricing, demand value-added services |

| Governments & Public Sector | Large contract volumes, regulatory oversight, competitive bidding processes | Influence pricing, necessitate adherence to strict service standards |

Same Document Delivered

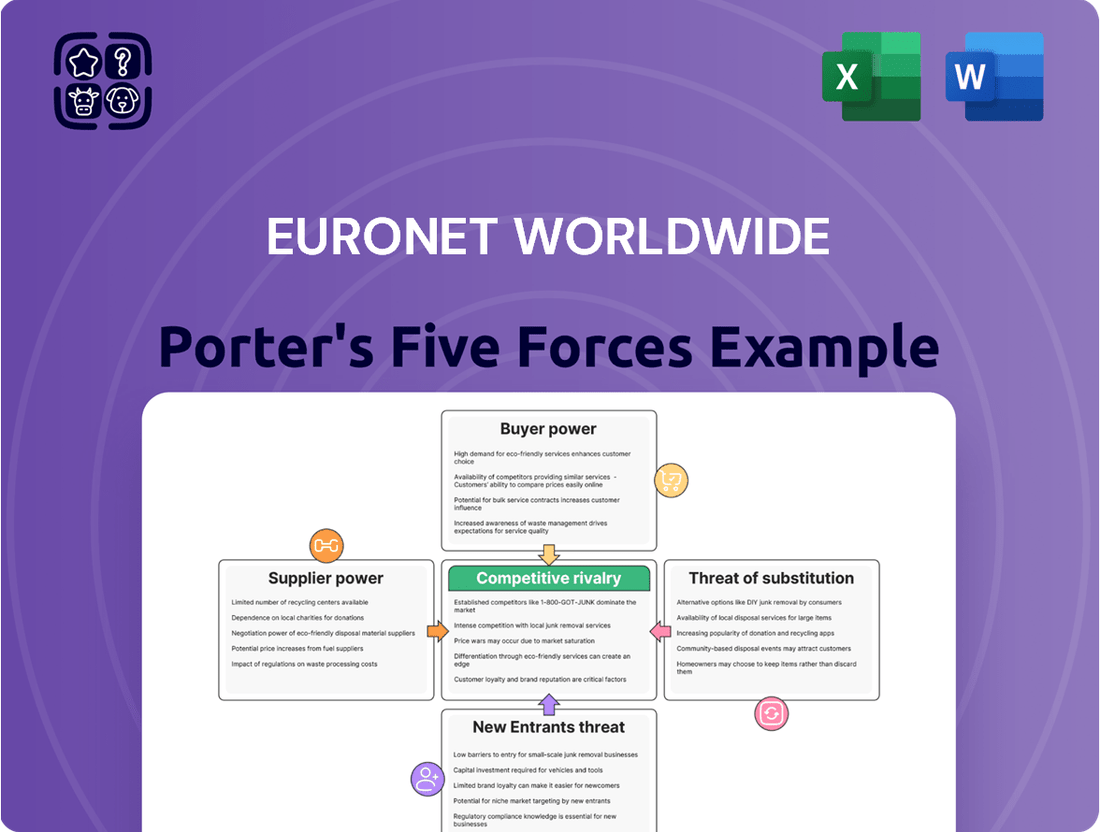

Euronet Worldwide Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis of Euronet Worldwide delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of competitive rivalry within the payment processing industry. This detailed report provides actionable insights into the strategic landscape Euronet operates within.

Rivalry Among Competitors

The electronic payments and money transfer sectors are intensely competitive, with established financial institutions and nimble fintech companies vying for market share. Euronet Worldwide contends with global remittance giants such as Western Union and MoneyGram, alongside numerous banks offering Electronic Funds Transfer (EFT) processing services, creating a dynamic and challenging landscape.

The ATM market, though expanding, is seeing increased competition as providers focus on newer, advanced ATMs and the rise of contactless transactions. Euronet Worldwide's commitment to its ATM network, evidenced by its growth in active ATMs, faces pressure from these evolving payment trends and digital alternatives.

The prepaid card market is experiencing robust growth, creating an intensely competitive landscape. Euronet's Epay segment faces significant rivalry not only from established giants like Visa and Mastercard, which offer extensive networks and brand recognition, but also from agile, tech-forward companies such as PayPal and Apple. These newer entrants are leveraging digital payment solutions and user-friendly interfaces to capture market share, particularly among younger demographics.

To navigate this dynamic environment, Euronet's Epay segment must prioritize continuous innovation. This includes developing differentiated product offerings, enhancing digital capabilities, and potentially exploring strategic partnerships to stay ahead of evolving consumer preferences and technological advancements. The ability to adapt quickly and offer compelling value propositions will be crucial for maintaining and growing its position in the prepaid market.

Competitive Rivalry 4

The competitive rivalry within the digital remittance sector, a key area for Euronet Worldwide's Ria Money Transfer and Xe brands, is exceptionally fierce. New digital remittance platforms and established fintech companies are aggressively competing for market share by emphasizing speed, user convenience, and reduced transfer costs.

These competitors are leveraging technology to offer seamless cross-border payment solutions, directly challenging Euronet's existing customer base and revenue streams. For instance, by mid-2024, several leading digital remittance providers reported significant year-over-year growth in transaction volumes, indicating a strong consumer shift towards these platforms.

- Intense Competition: Digital remittance platforms, including both startups and established fintechs, are actively vying for market share.

- Value Proposition: Competitors focus on offering faster, more convenient, and cost-effective cross-border money transfers.

- Euronet's Brands: Euronet's Ria Money Transfer and Xe brands are directly impacted by this escalating rivalry.

- Market Dynamics: The evolving digital landscape necessitates continuous innovation to maintain a competitive edge.

Competitive Rivalry 5

The payments industry is experiencing a significant digital overhaul, with real-time payments, embedded finance, and AI adoption fueling fierce competition. Euronet's strategic investments in its Ren and Dandelion platforms are pivotal for maintaining its competitive edge in this dynamic environment.

These platforms are designed to foster innovation and streamline payment processes, allowing Euronet to offer more advanced and integrated solutions. For instance, the increasing adoption of real-time payment systems globally, such as the Faster Payments Service in the UK and FedNow in the US, necessitates robust technological infrastructure that Euronet aims to provide.

- Digital Transformation: The payments sector is rapidly evolving with new technologies like AI and blockchain, increasing the pace of innovation and competition.

- Real-Time Payments: Growing demand for instant transactions puts pressure on existing payment infrastructures and providers to adapt quickly.

- Embedded Finance: The integration of financial services into non-financial platforms creates new competitive avenues and requires flexible payment solutions.

- Euronet's Platforms: Investments in Ren and Dandelion are crucial for Euronet to offer competitive, modern payment solutions amidst this intense rivalry.

Competitive rivalry is a significant force for Euronet Worldwide, particularly in the digital remittance and electronic payments sectors. The company faces intense competition from both established financial institutions and agile fintech companies, all vying for market share by offering faster, more convenient, and cost-effective solutions. Euronet's brands like Ria Money Transfer and Xe are directly challenged by new digital platforms and existing tech giants, necessitating continuous innovation to maintain its position.

| Competitor Type | Key Competitive Actions | Impact on Euronet |

|---|---|---|

| Fintech Startups | Aggressive pricing, user-friendly apps, rapid expansion | Erosion of market share in specific corridors, pressure on fees |

| Established Banks | Leveraging existing customer bases, offering integrated services | Competition for cross-border transactions, potential loss of B2B clients |

| Global Remittance Giants | Extensive agent networks, brand recognition, loyalty programs | Direct competition for remittance volumes, particularly in traditional markets |

| Digital Payment Platforms | Focus on speed, convenience, and low costs for digital transfers | Shifting consumer preferences towards digital channels, requiring Euronet to enhance its digital offerings. For example, by early 2024, several digital remittance providers reported over 30% year-over-year growth in transaction volumes. |

SSubstitutes Threaten

Digital payment methods, like mobile wallets and peer-to-peer apps such as PayPal and Venmo, present a substantial threat to Euronet Worldwide's traditional ATM and cash-handling services. These alternatives offer convenience and are rapidly gaining traction globally. For instance, digital payment volumes are expected to see robust growth, with some projections indicating a compound annual growth rate exceeding 10% in the coming years, directly impacting reliance on physical cash transactions.

Cryptocurrencies and blockchain technology present a growing threat of substitution for Euronet Worldwide's traditional remittance services. Solutions leveraging these technologies can offer faster settlement times and potentially lower transaction fees for cross-border money transfers, directly challenging Euronet's core business model.

While widespread adoption is still developing, the increasing recognition and investment in these digital alternatives highlight their potential to disrupt the established remittance market. For instance, by mid-2024, several major financial institutions were actively exploring or piloting blockchain-based payment networks, signaling a tangible shift in the competitive landscape.

The threat of substitutes for Euronet Worldwide's money transfer services is significant, particularly from direct bank transfers and the growing interoperability of national payment systems. These alternatives allow individuals and businesses to move funds directly between bank accounts, bypassing traditional intermediaries like Euronet.

The global expansion of real-time payment systems further amplifies this threat. For instance, by the end of 2023, over 70 countries had implemented or were actively developing real-time payment capabilities, offering faster and often cheaper alternatives for cross-border transactions.

4

The threat of substitutes for Euronet Worldwide's services is present, particularly from alternative lending platforms and microfinance institutions. These entities can offer financial solutions in regions where traditional ATM or prepaid card access might be limited, thereby acting as substitutes for certain core Euronet offerings. Financial inclusion efforts are also fostering new, potentially substitutive, solutions.

These substitutes can impact Euronet’s market share, especially in emerging markets where financial inclusion is a growing priority. For instance, the rise of mobile money platforms in Africa, which saw significant growth in transaction volumes in 2023, presents an alternative for peer-to-peer transfers and bill payments, areas where prepaid cards are often utilized.

- Alternative lending platforms offer credit facilities that might bypass traditional banking channels, including those facilitated by ATM networks.

- Microfinance institutions provide small loans and financial services, catering to unbanked or underbanked populations, a segment Euronet also serves.

- Financial inclusion initiatives are actively promoting digital payment solutions and mobile banking, which can reduce reliance on physical cash and traditional electronic channels.

- Mobile money services, widely adopted in developing economies, offer convenient alternatives for remittances and everyday transactions.

5

The threat of substitutes for Euronet Worldwide is significant, primarily driven by the rapid evolution of payment technologies. Contactless payment solutions, such as those using Near Field Communication (NFC) on mobile devices and cards, are increasingly diminishing the reliance on physical cash. This directly impacts Euronet's Electronic Funds Transfer (EFT) segment, which historically benefited from ATM cash withdrawals and point-of-sale (POS) transactions. For instance, the global contactless payment market was valued at over $1.5 trillion in 2023 and is projected to grow substantially, indicating a clear shift away from traditional cash-based transactions.

Next-generation ATMs are also incorporating these contactless features, aiming to provide a more seamless user experience. However, this also means that the core function of Euronet's ATM network – dispensing cash – faces direct competition from digital payment alternatives that bypass the need for an ATM altogether. This trend is further amplified by the growing adoption of mobile wallets and peer-to-peer payment apps, which offer convenient ways to transfer funds without needing to visit an ATM or use a physical card at a POS terminal.

- Contactless Payments: NFC-enabled cards and mobile payment solutions are reducing the need for cash withdrawals and traditional POS interactions.

- Digital Wallets: The rise of mobile wallets and P2P payment apps provides convenient alternatives to ATM usage.

- ATM Innovation: Even ATMs are adapting with contactless features, which can be seen as a substitute for older cash-dispensing models.

- Market Trends: The global contactless payment market's rapid growth underscores the increasing substitution threat.

The threat of substitutes for Euronet Worldwide is substantial, particularly from digital payment methods that bypass traditional cash and card transactions. Contactless payments, mobile wallets, and peer-to-peer apps offer convenience and are rapidly gaining global traction. For instance, the global contactless payment market was valued at over $1.5 trillion in 2023, indicating a clear shift away from cash.

Cryptocurrencies and blockchain technology also pose a substitution threat to Euronet's remittance services by offering potentially faster and cheaper cross-border transfers. Furthermore, the expansion of real-time payment systems in over 70 countries by the end of 2023 provides direct alternatives for fund transfers, bypassing intermediaries.

| Substitute Type | Impact on Euronet | Growth Trend Example |

| Digital Wallets & P2P Apps | Reduces ATM cash withdrawals and POS transactions | Significant user growth in 2023-2024 |

| Cryptocurrencies/Blockchain | Challenges remittance services | Increasing institutional investment and pilot programs |

| Real-Time Payment Systems | Offers direct, faster fund transfers | Widespread national adoption globally |

Entrants Threaten

The fintech sector, particularly for software-driven payment solutions, presents a relatively low barrier to entry. This allows nimble startups to rapidly introduce novel offerings, often built on cutting-edge technologies like AI and cloud-native architectures. For instance, in 2024, the global fintech market was valued at approximately $1.1 trillion, with a significant portion driven by payment processing innovations.

Technology giants like Apple, Google, and Amazon are increasingly venturing into financial services, leveraging their massive user bases and advanced tech capabilities to offer payment solutions. This poses a significant threat to established companies such as Euronet Worldwide. For instance, Google has already partnered with prominent remittance providers like Ria and Xe to facilitate cross-border transfers, directly competing with Euronet's core services.

Neobanks and challenger banks are emerging as a significant threat to traditional payment processors like Euronet Worldwide. These digital-first institutions, operating with considerably lower overheads than brick-and-mortar banks, are adept at attracting customers who value streamlined, modern banking and payment experiences. For instance, by early 2024, several challenger banks reported millions of active users, demonstrating their rapid customer acquisition capabilities.

Their ability to offer innovative features and competitive pricing can directly siphon customers away from established payment networks, potentially disrupting Euronet's existing market share. The agility of these new entrants allows them to quickly adapt to changing consumer preferences and technological advancements, posing an ongoing challenge to incumbents.

Threat of New Entrants 4

The growing trend of embedded finance, where financial services are seamlessly integrated into non-financial platforms like e-commerce or accounting software, significantly lowers barriers to entry. This allows new players, even those not traditionally in finance, to offer financial solutions. For instance, the market for embedded finance solutions tailored for small businesses is experiencing substantial growth, indicating a fertile ground for new entrants.

This shift means companies that excel in user experience and platform integration, rather than just financial product development, can emerge as formidable competitors. The projected growth in this sector, with some estimates suggesting the embedded finance market could reach trillions of dollars globally in the coming years, highlights the increasing threat from these innovative new entrants.

- Embedded Finance Market Growth: The global embedded finance market is anticipated to expand significantly, with projections indicating it could reach over $7 trillion by 2030.

- New Entrant Capabilities: Companies leveraging technology platforms and customer data can offer financial services without the extensive legacy infrastructure of traditional banks.

- Small Business Focus: The embedded finance segment for small and medium-sized businesses (SMBs) is a particular area where new, agile players are making inroads.

- Competitive Landscape: This trend introduces competition from tech companies and fintech startups, directly challenging established players like Euronet Worldwide.

Threat of New Entrants 5

The threat of new entrants for Euronet Worldwide is influenced by evolving regulatory landscapes. For instance, open banking initiatives, increasingly adopted globally, aim to boost competition and financial inclusion. These regulations can dismantle traditional barriers by allowing new fintech companies to access customer data and build innovative payment services, potentially challenging established players like Euronet.

The payments industry, while capital-intensive in some aspects, sees lower barriers in others due to technological advancements. New entrants can leverage cloud infrastructure and digital platforms to offer specialized services, bypassing the need for extensive physical networks. For example, the rise of mobile payment solutions and digital wallets demonstrates how technology can facilitate market entry.

- Regulatory Shifts: Open banking and similar initiatives can reduce barriers to entry by granting access to customer data and payment infrastructure.

- Technological Advancements: Digital platforms and cloud computing lower the capital requirements for new payment service providers.

- Fintech Innovation: Agile fintech startups can quickly develop and deploy niche payment solutions, attracting specific customer segments.

- Market Response: Euronet's ability to adapt and integrate new technologies will be crucial in mitigating the threat from these emerging competitors.

The threat of new entrants for Euronet Worldwide is substantial, driven by the fintech sector's inherent low barriers to entry for software-based payment solutions. Nimble startups are leveraging advanced technologies like AI, with the global fintech market valued around $1.1 trillion in 2024, showcasing rapid innovation in payments. Furthermore, tech giants and neobanks are increasingly entering the financial services space, offering competitive payment solutions and attracting users with streamlined digital experiences, directly challenging established players.

| Competitor Type | Key Advantage | Example | Impact on Euronet |

|---|---|---|---|

| Fintech Startups | Agility, niche solutions, advanced tech | AI-powered payment platforms | Disrupting specific payment segments |

| Tech Giants | Large user bases, brand recognition, tech capabilities | Google's remittance partnerships | Direct competition on cross-border services |

| Neobanks/Challenger Banks | Low overheads, digital-first experience | Rapid customer acquisition (millions of users by early 2024) | Siphoning customers with competitive pricing and features |

Porter's Five Forces Analysis Data Sources

Our Euronet Worldwide Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research, and news releases from key players in the payment processing sector.