Euronet Worldwide Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euronet Worldwide Bundle

Curious about Euronet Worldwide's strategic positioning? This glimpse into their BCG Matrix highlights key areas of opportunity and challenge, but to truly understand their market dominance and potential growth, you need the full picture.

Unlock the complete Euronet Worldwide BCG Matrix to pinpoint their Stars, Cash Cows, Dogs, and Question Marks with precision. Gain actionable insights and a clear roadmap for optimizing their product portfolio and investment strategies.

Don't miss out on the detailed quadrant analysis and data-driven recommendations that will empower your strategic decision-making. Purchase the full report today for a comprehensive understanding of Euronet Worldwide's competitive landscape.

Stars

Ria Money Transfer's digital services are a shining Star within Euronet Worldwide's portfolio. Its expanding digital network, now connecting to billions of bank accounts and digital wallets globally, is tapping into a rapidly growing market. This segment is well-positioned to capitalize on the projected 17.4% CAGR for digital money transfer services between 2025 and 2033.

Strategic alliances, like the integration of Ria and Xe services with Google, are further solidifying Ria's position. These collaborations are crucial for driving digital transaction volume and expanding Euronet's reach in the competitive digital payments landscape.

Euronet's Epay segment, specifically its digital branded payments, is classified as a Star within the BCG matrix. This is due to its dominant position in the fast-expanding prepaid card and digital wallet sector, a market projected to hit US$2.13 trillion by 2025.

The strong performance is further evidenced by the fact that 70% of epay transactions are now fully digital. This strategic emphasis on digital channels within a high-growth industry firmly establishes Epay as a key driver of Euronet's future expansion.

Euronet Worldwide's expansion of its cross-border payments network, now connecting 4.1 billion bank accounts and 3.2 billion wallet accounts, firmly positions this segment as a Star in its BCG Matrix. This impressive reach directly addresses the escalating global need for efficient international money transfers, a trend that is only expected to accelerate.

Merchant Acquiring Business within EFT

Euronet Worldwide's Merchant Acquiring business within its EFT segment is a clear Star in their BCG portfolio. While the overall ATM market shows moderate growth, this particular segment has been a standout performer, achieving double-digit growth rates. This robust expansion is fueled by increasing international travel and a growing demand for comprehensive merchant services.

This high-growth area within a more mature segment highlights its strong market position and future potential. Euronet's ability to capitalize on these trends is evident in its financial performance.

- Double-digit growth: The merchant acquiring business has consistently delivered strong growth, outpacing the broader EFT market.

- Market tailwinds: Increased international travel and the expansion of digital payment acceptance at merchant locations are significant drivers.

- Strategic advantage: Euronet's established infrastructure and service offerings position it well to capture further market share.

- EBITDA contribution: In 2024, Euronet's EFT segment, which includes merchant acquiring, reported a significant contribution to the company's overall EBITDA, underscoring the segment's profitability and importance.

Strategic Digital Transformation Focus

Euronet Worldwide's strategic digital transformation is a cornerstone of its business, aiming to capture a larger share of the burgeoning digital economy. This involves a deliberate pivot towards high-value digital payments and increasingly complex cross-border transactions, positioning these segments as key growth drivers for the company.

This strategic emphasis is crucial for maintaining market leadership and ensuring sustained growth in an ever-evolving payments landscape. By focusing on digital innovation, Euronet is adapting to changing consumer behaviors and the increasing demand for seamless, secure digital financial services.

- Digital Economy Focus: Euronet is actively shifting its business mix towards digital services, including high-value digital payments.

- Cross-Border Transactions: The company is prioritizing growth in cross-border payment solutions, a key area within the digital economy.

- Market Leadership: This forward-looking strategy is designed to secure and enhance Euronet's position in the competitive payments market.

- Sustained Growth: The digital transformation efforts are aimed at driving long-term, sustainable revenue growth and profitability.

Euronet's Ria Money Transfer, with its expanding digital network reaching billions of bank accounts and digital wallets, is a prime example of a Star. This segment benefits from a projected 17.4% CAGR for digital money transfer services through 2033, bolstered by strategic integrations like those with Google, enhancing transaction volumes and global reach.

Euronet's Epay segment, particularly its digital branded payments, is also a Star. Its dominance in the rapidly growing prepaid card and digital wallet sector, expected to reach US$2.13 trillion by 2025, is a key indicator. The fact that 70% of epay transactions are now digital underscores its strong position in this high-growth market.

The company's expanded cross-border payments network, connecting 4.1 billion bank accounts and 3.2 billion wallet accounts, firmly establishes this segment as a Star. This extensive reach directly addresses the increasing global demand for efficient international money transfers.

Furthermore, Euronet's Merchant Acquiring business within its EFT segment is a standout Star, consistently achieving double-digit growth rates. This performance is driven by increased international travel and a growing demand for comprehensive merchant services, as evidenced by its significant EBITDA contribution in 2024.

| Segment | BCG Category | Key Growth Drivers | Supporting Data |

| Ria Money Transfer (Digital) | Star | Expanding digital network, strategic alliances | 17.4% CAGR (2025-2033) for digital money transfer |

| Epay (Digital Branded Payments) | Star | Dominance in prepaid/digital wallets, high digital transaction rate | US$2.13 trillion market size by 2025, 70% digital transactions |

| Cross-Border Payments Network | Star | Extensive account connectivity, growing global demand | 4.1 billion bank accounts, 3.2 billion wallet accounts connected |

| Merchant Acquiring (EFT) | Star | Double-digit growth, increased international travel, demand for merchant services | Significant EBITDA contribution in 2024 |

What is included in the product

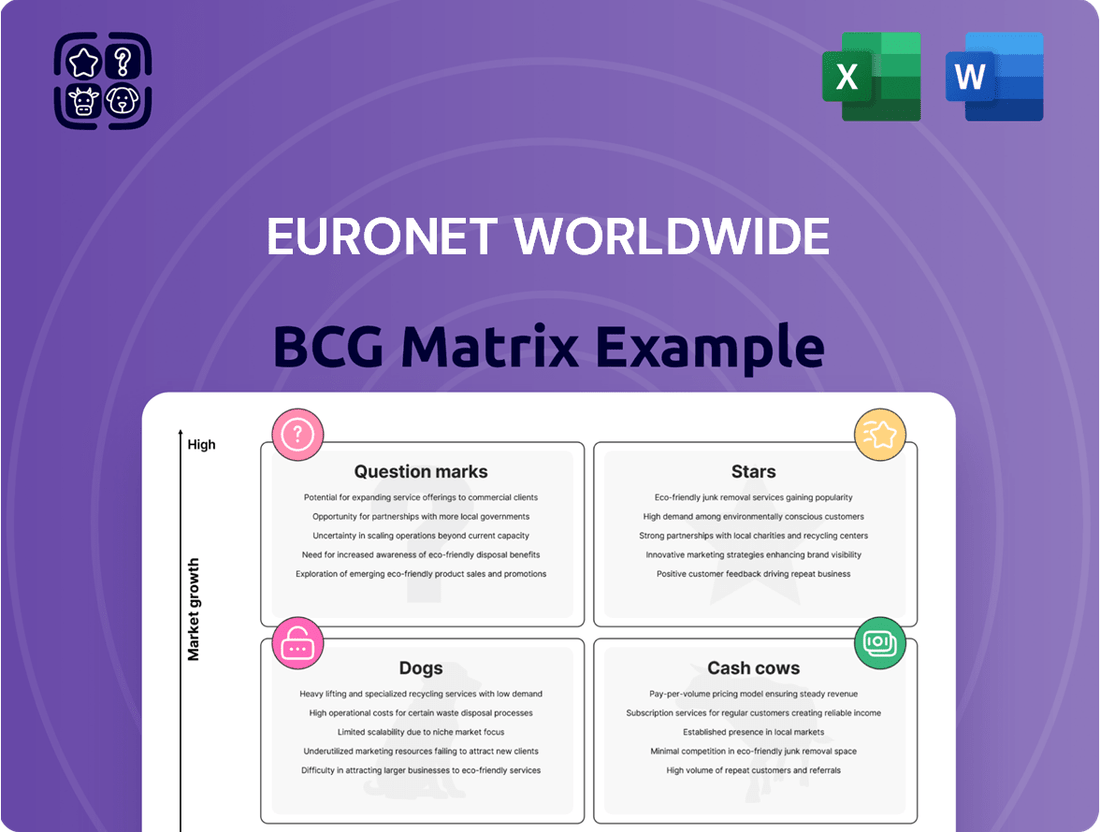

The Euronet Worldwide BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear Euronet Worldwide BCG Matrix visualizes strategic positioning, relieving the pain of unclear business unit performance.

Cash Cows

Euronet's traditional ATM processing network, particularly its independent ATMs across Europe, is a classic Cash Cow. This segment is a reliable generator of significant revenue and operating income, as evidenced by the EFT Processing segment's impressive 38% EBITDA margin in Q3 2024.

Despite operating in a mature market, Euronet's established presence allows this segment to maintain a strong market share. Its consistent performance provides the financial stability needed to support other, more growth-oriented ventures within the company.

Euronet Worldwide's mature EFT services portfolio, primarily its ATM and point-of-sale (POS) operations in established markets, clearly fits the Cash Cow quadrant of the BCG matrix. These services benefit from a significant market share, generating substantial and consistent profits. While the market growth is relatively low, it remains stable, ensuring a reliable revenue stream.

The global ATM market, for instance, is anticipated to expand at a compound annual growth rate (CAGR) between 3.6% and 4.9% from 2025 onwards. This indicates a mature but steady environment where Euronet's established presence allows it to leverage its existing infrastructure and customer base for continued profitability.

Euronet Worldwide's strong partnerships with financial institutions for ATM and point-of-sale (POS) services are a prime example of its Cash Cows. These established relationships generate a predictable and stable revenue stream, a hallmark of this category in the BCG matrix.

The company's extensive network and reliable transaction processing ensure consistent cash flow. For instance, in 2024, Euronet continued to leverage these long-standing agreements, which don't necessitate substantial new investments to maintain or grow market share, allowing capital to be redirected to other business segments.

Efficient Infrastructure Utilization

Euronet Worldwide's EFT segment leverages its substantial ATM network, a prime example of efficient infrastructure utilization, to consistently generate significant cash flow. This existing footprint is a mature asset, meaning that further growth is less of a focus than optimizing its current operations to maximize returns.

Investments here are strategically directed towards enhancing efficiency, such as upgrading software or improving transaction speeds, rather than broad expansion. This approach directly boosts the cash generated from each touchpoint.

- ATM Network Size: Euronet operates a vast network of ATMs globally, with a significant presence in key markets.

- Efficiency Gains: Focus on technological upgrades and process optimization within the EFT segment to improve per-transaction profitability.

- Cash Generation: The mature and efficient infrastructure of the EFT segment is a strong contributor to Euronet's overall cash flow.

Leveraged Scale and Cost Management

Euronet Worldwide's EFT segment truly shines due to its impressive scale and sharp focus on cost management. This combination allows the company to generate significant profits and a steady stream of cash, effectively acting as a cash cow. This strong financial performance means it can passively 'milk' gains, freeing up capital to invest in other, perhaps less mature, parts of its business.

This segment's ability to generate substantial cash flow is a direct result of its operational efficiency. In 2024, Euronet's EFT segment continued to demonstrate robust performance, with its electronic fund transfer services forming a core pillar of its profitability. The company's strategic investments in technology and infrastructure have further amplified its scale, enabling more transactions at a lower per-unit cost.

- Leveraged Scale: Euronet's extensive network of ATMs and payment processing capabilities allows it to handle a high volume of transactions efficiently.

- Cost Management: Continuous efforts to optimize operational expenses, including technology investments and staffing, contribute to higher profit margins.

- Profitability: The EFT segment consistently delivers strong profitability, making it a reliable source of cash for the company.

- Capital Generation: The cash generated is crucial for funding growth initiatives and supporting other business units within Euronet Worldwide.

Euronet Worldwide's EFT Processing segment, particularly its established ATM network, operates as a classic Cash Cow. This segment benefits from a substantial market share in mature markets, consistently generating strong revenue and operating income. For instance, the EFT Processing segment reported an impressive 38% EBITDA margin in Q3 2024, underscoring its profitability.

The company's focus on efficiency within this segment, such as upgrading software and optimizing transaction speeds, further enhances its cash-generating capabilities. These strategic investments in existing infrastructure, rather than broad expansion, allow Euronet to maximize returns from its mature assets, providing stable capital for other growth areas.

Euronet's strong partnerships with financial institutions for ATM and POS services are key to this Cash Cow status. These long-standing relationships ensure a predictable revenue stream without requiring significant new investments, a hallmark of a mature, profitable business unit.

| Segment | BCG Category | Key Characteristics | Q3 2024 Performance Metric |

|---|---|---|---|

| EFT Processing (ATM Network) | Cash Cow | Mature market, high market share, stable revenue, low investment needs | 38% EBITDA Margin |

Delivered as Shown

Euronet Worldwide BCG Matrix

The Euronet Worldwide BCG Matrix you are currently previewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic overview of Euronet's product portfolio, ready for immediate application in your business planning. You can confidently expect the same high-quality, professionally formatted report for your decision-making needs.

Dogs

Certain legacy ATM locations, particularly those in regions experiencing a downturn in cash dependency or a surge in digital payment methods, might be categorized as Dogs within Euronet Worldwide's portfolio. These specific ATMs often exhibit low transaction frequencies and necessitate continuous upkeep, yet fail to yield adequate profitability.

For instance, by the end of 2023, Euronet reported that while its overall transaction volumes saw growth, specific markets showed a greater shift towards digital. This indicates that older, less strategically placed ATMs in these evolving environments could be underperforming, contributing to higher operational costs relative to their revenue generation.

Within Euronet Worldwide's Epay segment, certain legacy physical prepaid products, such as older reloadable cards distributed through traditional retail channels, may be classified as Dogs. These offerings often struggle to compete with more agile digital payment solutions and face declining consumer adoption. For instance, if a significant portion of their revenue generation has stagnated or declined year-over-year, it signals a lack of growth potential.

These outdated physical products can become cash traps, consuming valuable capital and resources for minimal return on investment. In 2024, a physical prepaid product line that saw a decline of over 15% in transaction volume compared to 2023, while its operational costs remained high, would exemplify this Dog category. Such a scenario indicates a clear need for strategic divestment or a complete overhaul.

Inefficient Traditional Agent Networks (Non-Digital) within Euronet Worldwide's BCG Matrix represent those legacy money transfer locations struggling against the digital tide. These are the brick-and-mortar branches that haven't adapted, seeing their customer base dwindle as online and mobile solutions become the norm.

These units are often characterized by declining transaction volumes and profitability, potentially becoming cash traps for the company. For instance, while Euronet's overall digital growth is strong, specific legacy agent networks might be experiencing negative revenue growth, a key indicator of a 'Dog' status.

Geographically Isolated ATM Operations

Geographically isolated ATM operations, particularly those in remote areas with minimal growth prospects, often fall into the Dogs category of the BCG Matrix. These operations typically face challenges in achieving economies of scale, leading to lower profitability and limited potential for expansion.

In 2024, Euronet Worldwide, a major player in payment processing, continued to manage a diverse portfolio. While specific data on isolated ATM operations is not publicly detailed, the general trend for such ventures is a struggle for profitability. For instance, a significant portion of ATMs in rural America, which represent similar isolated operations, often have lower transaction volumes compared to urban centers. This can result in a lower return on investment for the deployer.

- Low Market Share: These ATMs serve a small, often declining, customer base.

- Limited Growth Potential: The geographic isolation and demographic trends in these areas restrict future expansion.

- Profitability Challenges: High operational costs relative to transaction volume make these units less profitable.

- Strategic Consideration: Companies often evaluate divesting or consolidating such assets to reallocate resources to more promising ventures.

Non-Strategic Legacy Technologies

Non-strategic legacy technologies within Euronet Worldwide's portfolio represent older systems or platforms that, while still operational, offer little in terms of competitive edge or future expansion. These could include outdated payment processing systems or legacy infrastructure that require ongoing maintenance but do not drive significant revenue or market share growth.

These assets often consume valuable resources, such as IT staff time and capital expenditure, without yielding substantial returns or contributing to the company's strategic objectives. For instance, a legacy system that processed a declining volume of transactions might still necessitate security updates and operational oversight, diverting resources from more promising ventures.

- Resource Drain: Older technologies can tie up capital and personnel that could be better allocated to innovative projects.

- Limited Growth: They typically lack the scalability and features needed to compete in rapidly evolving markets.

- Maintenance Costs: Continued upkeep of these systems can become increasingly expensive as specialized support diminishes.

- Competitive Disadvantage: Failure to modernize can lead to slower transaction processing, reduced functionality, and a less appealing customer experience compared to rivals.

Certain legacy ATM locations, particularly those in regions with declining cash dependency or a rise in digital payments, can be classified as Dogs. These ATMs often exhibit low transaction volumes and high maintenance costs, failing to generate adequate profitability.

For example, if an ATM location sees a year-over-year decline of over 10% in transaction volume in 2024, and its operational costs exceed 70% of its revenue, it would likely be considered a Dog. This highlights a need for strategic review, potentially leading to divestment or consolidation.

Similarly, legacy prepaid products within Euronet's Epay segment that face declining consumer adoption and struggle against digital alternatives also fit the Dog category. These products may require significant resources for minimal return, acting as a drain on company capital.

These underperforming assets tie up resources that could be better invested in high-growth areas. Euronet Worldwide's strategic focus in 2024 and beyond is on optimizing its portfolio, which often involves phasing out or divesting such low-performing units.

| Category | Characteristics | Euronet Example | 2024 Data Insight |

| Dogs | Low Market Share, Low Growth Potential, Profitability Challenges | Geographically isolated ATMs, legacy physical prepaid products, inefficient traditional agent networks | ATMs in declining cash-use regions showing <10% annual transaction growth, or legacy products with >15% volume decline YoY |

Question Marks

Euronet Worldwide's recent agreement to deploy its Ren ATM operating and switching product with a major U.S. bank places this venture squarely in the Question Mark category of the BCG matrix. This move targets the lucrative U.S. banking sector, a market ripe for advanced financial technology solutions.

While the potential for growth in advanced ATM technology within the U.S. is substantial, the significant investment required to secure a meaningful market share makes this a high-risk, high-reward proposition. Euronet's success will hinge on its ability to effectively compete against established players and demonstrate the value of its Ren platform.

Euronet Worldwide’s acquisition of CoreCard, a specialized credit card issuing platform, places this venture squarely in the Question Mark quadrant of the BCG Matrix. This strategic move signals Euronet's ambition to penetrate the high-growth credit card market, a sector demonstrating robust expansion and evolving consumer demand.

The credit card market is dynamic, with global transaction volumes projected to reach over $13 trillion by 2025, highlighting the significant opportunity. CoreCard’s technology allows Euronet to offer a comprehensive suite of services, from card design to transaction processing, positioning them to capture a share of this lucrative market.

However, as a relatively new entrant in this specific segment, Euronet faces the challenge of rapidly scaling CoreCard’s operations and establishing a strong competitive position. Success hinges on its ability to attract new issuers, manage risk effectively, and innovate within the rapidly changing fintech landscape to transition this business into a Star performer.

New digital remittance corridors, while part of a growing Star in the overall digital remittance market, can be considered Question Marks for Euronet Worldwide. These new markets demand significant upfront investment in marketing and operational infrastructure to establish a foothold.

Entering these competitive or developing corridors requires substantial capital to build brand awareness and acquire customers, similar to how companies in the early stages of a growth market need to invest heavily. For example, expanding into a new African digital remittance corridor might necessitate partnerships, local regulatory navigation, and aggressive pricing strategies.

The success of these new corridors hinges on Euronet's ability to effectively penetrate the market and achieve critical mass, much like a Question Mark needs to transition into a Star or a Dog. Without sufficient investment and a clear strategy, these ventures risk becoming costly failures.

Development of Emerging Digital Payment Solutions

Euronet Worldwide's investments in developing entirely new digital payment solutions or fintech integrations, where market adoption and potential market share are still uncertain, would be categorized as Stars or Question Marks in a BCG Matrix analysis. These initiatives represent high-risk, high-reward ventures, requiring significant capital for research and development.

For instance, Euronet's ongoing exploration into blockchain-based payment systems or novel cross-border remittance platforms falls into this category. In 2024, the global digital payments market was projected to reach over $1.5 trillion, with emerging technologies driving significant growth, yet the success of specific new solutions remains speculative.

- Star/Question Mark Classification: New digital payment solutions with uncertain market adoption.

- Investment Focus: Research and development in fintech integrations and novel payment technologies.

- Market Context (2024): Global digital payments market exceeding $1.5 trillion, with emerging tech as a key driver.

- Risk/Reward Profile: High-risk, high-reward ventures due to unproven market acceptance.

Advanced ATM Functionalities and Smart ATM Deployments

The deployment of advanced ATM features, such as UPI-interoperable cash deposits or multi-currency capabilities, in new markets represents a strategic move for Euronet Worldwide. These innovations aim for higher growth within the ATM space, tapping into evolving consumer needs and digital payment trends. For example, Euronet's expansion into markets with high mobile payment adoption, like India, leverages UPI interoperability to offer seamless cash-in services.

However, these advancements require significant upfront investment in technology and infrastructure, alongside robust market acceptance to gain dominant share. The success hinges on factors like regulatory support for new functionalities and the willingness of consumers to adopt these enhanced services. Euronet's strategy often involves partnering with local financial institutions to navigate these complexities and accelerate adoption.

- UPI-Interoperable Cash Deposits: Facilitates direct cash-to-digital wallet transactions, enhancing financial inclusion and convenience.

- Multi-Currency Capabilities: Caters to international travelers, offering on-demand currency exchange at ATMs, a feature increasingly sought after in global tourism hubs.

- Investment and Market Acceptance: Significant capital is needed for R&D and deployment, with market education and trust-building crucial for uptake.

- Growth Potential: These smart ATM deployments target a segment of the market seeking advanced, integrated financial services, promising higher transaction volumes and fee income.

Euronet Worldwide's ventures into new digital remittance corridors, while part of a larger growing market, can be seen as Question Marks. These initiatives require substantial upfront investment in marketing and building operational infrastructure to establish a presence in competitive or developing markets.

For instance, expanding into a new African digital remittance corridor involves navigating local regulations, forging partnerships, and potentially employing aggressive pricing to gain traction, mirroring the investment needs of early-stage growth companies.

The success of these new corridors is contingent on Euronet's ability to achieve market penetration and critical mass, a common challenge for Question Marks aiming to become Stars.

Euronet's strategic acquisition of CoreCard, a credit card issuing platform, positions this venture as a Question Mark. This move targets the expanding credit card market, with global transaction volumes projected to exceed $13 trillion by 2025, indicating a significant opportunity for Euronet to offer comprehensive services.

| Venture | BCG Category | Rationale | Market Context | Key Success Factors |

|---|---|---|---|---|

| CoreCard Acquisition | Question Mark | Entry into a high-growth, dynamic credit card market. | Global transaction volumes projected over $13 trillion by 2025. | Scaling operations, establishing competitive position, innovation in fintech. |

| New Digital Remittance Corridors | Question Mark | Requires significant upfront investment in new, competitive markets. | Growing digital remittance sector, but new corridors demand heavy marketing and infrastructure build-out. | Market penetration, achieving critical mass, effective local strategies. |

| Advanced ATM Features (e.g., UPI Interoperability) | Question Mark | High investment for new technologies in new markets with uncertain adoption. | Leveraging digital payment trends, e.g., UPI adoption in India. | Technology investment, market acceptance, regulatory support, strategic partnerships. |

BCG Matrix Data Sources

Our Euronet Worldwide BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market analytics, and strategic industry research to provide actionable insights.