Eurobio Scientific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurobio Scientific Bundle

Uncover the critical external factors shaping Eurobio Scientific's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are impacting the company's operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full PESTLE analysis now and gain a significant competitive advantage.

Political factors

Government healthcare policies are a major driver for companies like Eurobio Scientific. For instance, in France, the government's commitment to strengthening diagnostic capabilities, as outlined in its 2023 healthcare reform plans, directly boosts demand for advanced testing solutions. This focus on public health infrastructure means increased opportunities for companies providing essential diagnostic products and services.

Changes in reimbursement rates for specific diagnostic tests can significantly alter revenue streams. In 2024, European Union member states are continually reviewing and adjusting these rates based on clinical efficacy and cost-effectiveness, impacting the profitability of Eurobio Scientific's offerings. Political decisions on national healthcare spending directly shape the market size for diagnostic players.

Furthermore, political stability and government support for the life sciences sector are paramount. Countries with robust political backing for research and development, such as Germany's ongoing investment in biotechnology hubs, create a more favorable environment for innovation and growth within the diagnostic industry, benefiting companies like Eurobio Scientific.

The in-vitro diagnostics (IVD) sector operates under a robust regulatory umbrella, necessitating strict adherence to both national and international benchmarks. For Eurobio Scientific, navigating evolving regulations from bodies like the European Medicines Agency (EMA) and various national health authorities is critical. These updates directly influence product development timelines, the ability to access markets, and the overall cost of operations.

Compliance with these frameworks is not merely a procedural step but a fundamental requirement for securing product approvals and maintaining a significant market presence. For instance, the transition to the European Union's In Vitro Diagnostic Regulation (IVDR) has presented significant challenges for many IVD companies, requiring extensive data generation and re-certification processes, which began in May 2022 and has a grace period until May 2025 for certain products.

Eurobio Scientific, as a French entity with a global footprint, is significantly influenced by international trade relations. Trade agreements, such as those within the European Union, facilitate smoother cross-border transactions for raw materials and finished goods, impacting cost efficiencies and market access.

Geopolitical tensions, however, pose a direct threat. For instance, ongoing trade disputes or the imposition of new tariffs between major economic blocs could disrupt Eurobio Scientific's supply chain, increasing the cost of imported components or limiting export opportunities in key markets. The company's reliance on international partners for distribution means that political instability in those regions can directly affect product availability and sales.

The economic climate in 2024 and projected into 2025 highlights the volatility of global trade. For example, the World Trade Organization (WTO) has revised global trade growth forecasts multiple times, reflecting persistent uncertainties. Any escalation in trade friction could lead to increased operational costs for Eurobio Scientific, potentially impacting its pricing strategies and profitability in international markets.

Public Health Initiatives

Government-backed public health initiatives, such as those focusing on early detection of diseases, directly influence the market for diagnostic solutions. For instance, expanded national screening programs for conditions like cancer or infectious diseases, which saw significant investment in 2024, create a substantial demand for Eurobio Scientific's testing products. These campaigns often unlock dedicated government funding streams, providing a stable revenue base and encouraging innovation in diagnostic technologies.

Eurobio Scientific's ability to align its product portfolio with these public health priorities, such as providing rapid testing kits for emerging infectious threats or advanced diagnostics for chronic disease management, can unlock significant market opportunities. The company's responsiveness in developing or adapting its offerings to meet the needs of these large-scale public health campaigns, as seen with the push for more accessible genetic testing in 2025, can lead to substantial sales growth and market penetration.

- Increased demand for infectious disease diagnostics: Government-funded vaccination and testing programs, like those for influenza and COVID-19 variants in late 2024, directly boost sales of relevant diagnostic kits.

- Focus on chronic disease management: Public health campaigns promoting early detection of conditions such as diabetes and cardiovascular disease in 2025 are driving demand for advanced diagnostic tools.

- Funding opportunities: Dedicated government grants and procurement contracts for public health initiatives provide a stable revenue stream and support research and development for new diagnostic solutions.

Political Stability and Investment Climate

Eurobio Scientific's operational regions, primarily France and Germany, have historically demonstrated strong political stability, which is a cornerstone for investor confidence. This stability directly impacts the company's ability to engage in long-term strategic planning and research investment, crucial for its diagnostics and R&D-focused business model. For instance, the French government's commitment to healthcare innovation, evidenced by its ongoing investment in life sciences research and development programs, creates a favorable environment for companies like Eurobio Scientific. Similarly, Germany's robust regulatory framework and consistent economic policies provide a predictable landscape for business operations and capital allocation.

Political stability is not just about avoiding disruption; it actively fosters growth by encouraging investment in research and development. In 2024, European Union member states, including France and Germany, continued to prioritize funding for biotechnology and medical research, with significant allocations directed towards diagnostics and personalized medicine. This consistent governmental support is vital for Eurobio Scientific's pipeline and market penetration strategies, minimizing the risks associated with abrupt policy shifts or geopolitical instability that could otherwise deter capital and talent.

The predictability afforded by stable political systems directly influences Eurobio Scientific's capacity to attract and retain both financial capital and skilled personnel. A secure operating environment reduces perceived risk for investors, potentially leading to lower capital costs and greater access to funding for expansion and innovation. Furthermore, a stable political climate contributes to a positive business reputation, making it easier to recruit top scientific and managerial talent, which is essential for maintaining a competitive edge in the fast-evolving diagnostics sector. For example, France's proactive stance in supporting its domestic biotech sector through initiatives like the "France 2030" plan, which includes substantial funding for health technologies, underscores this supportive political environment.

Government healthcare policies significantly shape the market for diagnostic solutions, with initiatives like France's 2023 healthcare reform directly boosting demand for advanced testing. Reimbursement rate adjustments by EU member states in 2024, based on clinical efficacy, directly impact Eurobio Scientific's revenue and profitability.

Political stability in key markets like France and Germany fosters investor confidence and supports long-term R&D investment. For instance, Germany's consistent economic policies and France's "France 2030" plan provide a predictable and supportive environment for biotech innovation.

International trade relations, facilitated by EU agreements, impact Eurobio Scientific's supply chain and market access, while geopolitical tensions and tariffs pose risks to operational costs and distribution networks.

What is included in the product

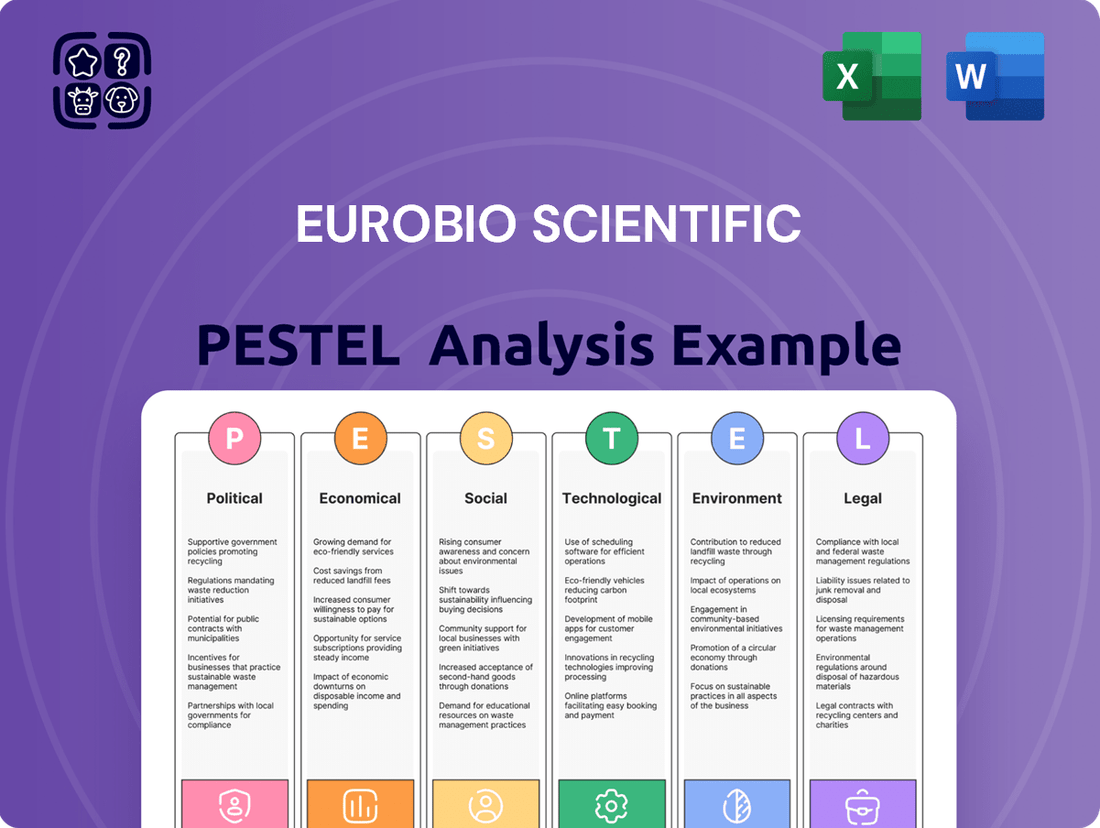

This PESTLE analysis meticulously examines the external macro-environmental factors influencing Eurobio Scientific across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting specific threats and opportunities relevant to Eurobio Scientific's operational landscape.

A clear, actionable summary of Eurobio Scientific's PESTLE factors, designed to quickly identify and address external challenges impacting strategic decisions.

Economic factors

Global healthcare spending is projected to reach $11.6 trillion by 2025, a significant increase that directly impacts the market size for in-vitro diagnostic (IVD) products. This upward trend suggests a growing demand for the types of diagnostic solutions Eurobio Scientific offers.

Economic conditions significantly influence healthcare budgets. For instance, a robust economy in 2024 allows governments and private entities to allocate more funds to healthcare, boosting purchasing power for hospitals and labs. Conversely, economic downturns in 2025 could tighten these budgets, potentially affecting Eurobio Scientific's sales volumes.

Eurobio Scientific's revenue streams are closely tied to these healthcare spending patterns. As of Q1 2024, the company reported a 12.3% increase in revenue, partly driven by increased demand for diagnostic testing, reflecting positive economic influences on healthcare investment.

Public and private R&D funding significantly drives innovation in life sciences. For instance, in 2024, global healthcare R&D spending was projected to reach over $250 billion, with a substantial portion dedicated to diagnostics. This investment landscape directly influences the pace of new diagnostic technology development, shaping Eurobio Scientific's competitive standing and product pipeline.

Economic downturns can restrict R&D investment, potentially slowing the introduction of novel diagnostic solutions. Conversely, periods of economic growth often correlate with increased capital availability for both internal research initiatives and strategic acquisitions. Eurobio Scientific's ability to secure this vital capital directly impacts its capacity to innovate and expand its market presence.

Inflationary pressures are a significant concern for Eurobio Scientific, directly impacting its operational costs. For instance, the European Union experienced an inflation rate of 2.4% in May 2024, a slight decrease from previous months but still a notable figure. This means the cost of raw materials, vital for diagnostic kit production, and manufacturing processes are likely to remain elevated.

Rising energy prices, coupled with increasing labor costs across the Eurozone, further squeeze profit margins. Supply chain disruptions, which have been a persistent issue since 2021, continue to add to these expenses. Eurobio Scientific must implement robust cost management strategies to offset these increases and safeguard its profitability in this challenging economic climate.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Eurobio Scientific, an international player in the diagnostics sector. As the company engages in both importing and exporting, shifts in currency values directly affect its financial performance. For instance, a stronger Euro can make its products less competitive in international markets, potentially dampening export revenues. Conversely, a weaker Euro can inflate the cost of essential imported raw materials or finished goods that are distributed, thereby squeezing profit margins.

The impact is particularly felt when considering the company's reliance on global supply chains and its international sales network. For example, if Eurobio Scientific sources a significant portion of its reagents or equipment from countries with weaker currencies, a strengthening Euro would increase the cost of these imports in Euro terms. Conversely, if a substantial part of its revenue comes from sales in the United States, a weakening US dollar against the Euro would reduce the Euro-denominated value of those sales.

To mitigate these risks, Eurobio Scientific likely employs hedging strategies. These can include forward contracts or options to lock in exchange rates for future transactions, providing a degree of predictability. The effectiveness of these strategies is crucial, especially given the volatility observed in major currency pairs. For instance, the Euro to US Dollar (EUR/USD) exchange rate experienced significant swings throughout 2024, with the Euro trading in a range that could have substantially impacted companies with cross-border operations.

- Impact on Exports: A strong Euro can make Eurobio Scientific's diagnostic kits and services more expensive for international buyers, potentially reducing sales volume.

- Impact on Imports: A weak Euro increases the cost of imported components, reagents, or finished products distributed by the company, thereby raising operational expenses.

- Hedging Strategies: The company may utilize financial instruments like forward contracts to manage currency risk and ensure more stable revenue and cost projections.

- 2024 Volatility: Exchange rates, such as EUR/USD, saw notable fluctuations in 2024, underscoring the importance of currency risk management for international firms like Eurobio Scientific.

Competition and Market Pricing

The in-vitro diagnostics (IVD) and life sciences markets are characterized by fierce competition, directly impacting pricing strategies and profit margins for companies like Eurobio Scientific. In 2024, the global IVD market was valued at an estimated $112.5 billion, with projections indicating continued growth, but also highlighting the intense rivalry.

Eurobio Scientific faces significant pricing pressure from both established multinational corporations with vast economies of scale and agile, specialized niche players. For instance, major players in the IVD sector often leverage their size to offer competitive pricing on high-volume diagnostic tests.

To thrive in this environment, Eurobio Scientific needs to emphasize its unique value proposition, perhaps through innovative product features or superior customer service, while simultaneously optimizing its cost structures. Maintaining market share necessitates a delicate balance between competitive pricing and the ability to invest in research and development.

- Intense Competition: The IVD sector is highly competitive, with numerous global and regional players vying for market share.

- Pricing Pressures: Companies must contend with downward pressure on pricing due to the presence of large competitors and the demand for cost-effective solutions.

- Value Proposition: Differentiating through innovation, quality, and service is crucial for Eurobio Scientific to justify its pricing and maintain profitability.

- Cost Efficiency: Streamlining operations and managing expenses effectively are vital to compete on price without sacrificing quality or profitability.

Global healthcare spending is projected to reach $11.6 trillion by 2025, directly influencing the market for in-vitro diagnostic (IVD) products and indicating a growing demand for Eurobio Scientific's offerings.

Economic conditions in 2024 and 2025 impact healthcare budgets; a strong economy boosts spending, while downturns can tighten allocations, affecting sales volumes for companies like Eurobio Scientific.

Eurobio Scientific's revenue saw a 12.3% increase in Q1 2024, partly due to higher diagnostic testing demand, reflecting positive economic influences on healthcare investment.

Public and private R&D funding, projected to exceed $250 billion globally in 2024 for healthcare, fuels innovation in diagnostics, a key area for Eurobio Scientific's competitive edge and product pipeline.

Full Version Awaits

Eurobio Scientific PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eurobio Scientific PESTLE analysis covers all key political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the strategic landscape, enabling informed decision-making.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly 1 in 6 people globally will be 65 or older. This demographic shift directly translates to a growing need for diagnostic tests, particularly for conditions more prevalent in older age groups. Eurobio Scientific, with its focus on diagnostic solutions, is well-positioned to capitalize on this trend.

Specifically, the rising incidence of age-associated diseases like cancer, cardiovascular issues, and neurodegenerative disorders such as Alzheimer's and Parkinson's creates a substantial market opportunity. For instance, the global cancer diagnostics market alone was valued at approximately $200 billion in 2023 and is expected to grow significantly. The increasing prevalence of chronic diseases within this aging demographic further amplifies the demand for Eurobio Scientific's testing and diagnostic capabilities.

The global rise in chronic conditions like diabetes and autoimmune disorders, alongside the persistent threat of infectious diseases, directly shapes the demand for diagnostic solutions. For instance, the World Health Organization reported in 2024 that non-communicable diseases (NCDs) account for an estimated 74% of all deaths worldwide, underscoring the growing need for advanced diagnostics.

Eurobio Scientific's diagnostic offerings are intrinsically linked to these evolving health landscapes, necessitating continuous innovation to address new or resurgent pathogens and changing disease prevalences. The market for tests detecting conditions such as Lyme disease or certain autoimmune markers has seen significant growth as awareness and diagnostic capabilities improve.

Public health crises, such as the ongoing concerns around antibiotic resistance and the potential for new viral outbreaks, can dramatically increase the demand for specific diagnostic tests. In 2024, the focus on pandemic preparedness continues, with governments investing in rapid diagnostic capabilities, which directly benefits companies like Eurobio Scientific that provide such solutions.

Public awareness regarding health and the significance of early diagnosis and preventive measures is on the rise, directly influencing the demand for diagnostic tests. This growing health consciousness means more people are proactively seeking testing, even in the absence of symptoms. For instance, in 2024, the global market for in-vitro diagnostics, which includes many of Eurobio Scientific's offerings, was projected to reach over $100 billion, a figure anticipated to grow as preventive care gains traction.

Societal shifts favoring proactive health management are a key driver for Eurobio Scientific. Educational campaigns and increased access to health information empower individuals to take charge of their well-being, leading to a greater uptake of diagnostic solutions. This trend is evident in the increasing number of people opting for regular health check-ups and screenings, contributing to a more robust market for companies like Eurobio Scientific.

Lifestyle Changes and Disease Patterns

Modern lifestyles, marked by shifts in diet, reduced physical activity, and increased urbanization, are significantly altering disease patterns. This evolving landscape directly impacts diagnostic needs, creating demand for new testing solutions and shifting the focus of existing ones. For instance, the rise in metabolic disorders and certain cancers, often linked to these lifestyle factors, necessitates advanced diagnostic tools.

Eurobio Scientific must remain attuned to these sociological shifts. The World Health Organization (WHO) reported in 2024 that non-communicable diseases (NCDs) like cardiovascular disease and diabetes, heavily influenced by lifestyle, accounted for an estimated 74% of all deaths globally. This underscores the growing market for diagnostics related to these conditions.

Monitoring these trends is crucial for Eurobio Scientific's product development strategy. The company needs to ensure its portfolio addresses:

- The growing prevalence of chronic diseases linked to sedentary lifestyles and poor nutrition.

- Increased demand for early detection and monitoring of conditions such as obesity-related comorbidities and certain autoimmune disorders.

- The need for more sophisticated diagnostic tests that can differentiate between various disease subtypes influenced by environmental and lifestyle exposures.

- The potential for new infectious disease outbreaks exacerbated by urbanization and global travel, requiring rapid and accurate diagnostic capabilities.

Ethical Considerations and Public Acceptance

Societal views on genetic testing are evolving, with increasing awareness of its potential benefits in personalized medicine. However, concerns about data privacy in healthcare remain significant, influencing public acceptance of diagnostic services. For instance, a 2024 survey indicated that over 60% of individuals express reservations about sharing genetic data due to privacy fears, directly impacting companies like Eurobio Scientific.

The ethical implications of advanced diagnostic procedures, particularly in sensitive areas like oncology and transplantation, are paramount. Eurobio Scientific's commitment to operating within strict ethical guidelines and fostering public trust is crucial for its long-term success. Maintaining transparency and ensuring robust patient consent processes are therefore non-negotiable, especially as demand for these specialized diagnostics grows.

- Public Trust: Maintaining public trust is vital, especially in sensitive diagnostic fields like oncology.

- Data Privacy: Over 60% of individuals surveyed in 2024 expressed concerns about sharing genetic data due to privacy issues.

- Ethical Guidelines: Adherence to ethical standards and transparent patient consent are critical for acceptance.

- Societal Views: Evolving societal perceptions of genetic testing impact the regulatory and market landscape for diagnostic companies.

Societal shifts toward proactive health management and increased health consciousness are driving demand for diagnostic tests. Growing awareness of preventive care, coupled with rising rates of chronic diseases like diabetes and cardiovascular conditions, directly benefits companies like Eurobio Scientific. For example, in 2024, the global in-vitro diagnostics market was projected to exceed $100 billion, reflecting this trend.

Modern lifestyles, characterized by urbanization and dietary changes, are altering disease patterns, necessitating advanced diagnostic tools for conditions like metabolic disorders. The World Health Organization noted in 2024 that non-communicable diseases, heavily influenced by lifestyle, accounted for 74% of global deaths, highlighting the market need for diagnostics in these areas.

Evolving societal views on genetic testing, while generally positive for personalized medicine, are tempered by significant data privacy concerns. A 2024 survey revealed over 60% of individuals harbor reservations about sharing genetic data, impacting public acceptance of diagnostic services and requiring robust data protection strategies.

The demographic trend of an aging global population, with nearly 1 in 6 people expected to be over 65 by 2050, directly increases the need for diagnostic tests targeting age-related diseases. This demographic shift presents a substantial opportunity for Eurobio Scientific's diagnostic solutions.

Technological factors

Rapid technological progress in molecular diagnostics, next-generation sequencing, and artificial intelligence is transforming the in-vitro diagnostics (IVD) market. Eurobio Scientific needs to invest in R&D and adopt these innovations to stay competitive. For instance, the global IVD market was valued at approximately $90.5 billion in 2023 and is projected to reach $148.7 billion by 2030, growing at a CAGR of 7.4%.

The rise of point-of-care testing (POCT) further emphasizes the need for agility. Eurobio Scientific must either develop its own cutting-edge solutions or strategically partner with technology providers to integrate these advancements. This proactive approach ensures the company can offer relevant and advanced diagnostic tools to meet evolving healthcare demands.

The push towards automation and digital solutions in clinical and research labs is reshaping the market for lab equipment. Laboratories are increasingly investing in robotics and integrated systems to boost throughput and accuracy. This trend directly influences the demand for the types of instruments and platforms Eurobio Scientific offers, particularly those that can be automated and digitally connected.

Eurobio Scientific's focus on automated diagnostic platforms and digital data management solutions aligns perfectly with this industry shift. By providing tools that enhance efficiency and streamline workflows, the company positions itself as a valuable partner for modern laboratories. This digital transformation is not just a trend but a fundamental requirement for future growth and competitiveness in the diagnostics sector.

Breakthroughs in biotechnology, genomics, proteomics, and metabolomics are rapidly expanding the possibilities for diagnostic test development, especially in the realm of personalized medicine. These 'omics' fields are paving the way for highly specific and targeted health solutions.

Eurobio Scientific's core strength in life sciences positions it to capitalize on these advancements, enabling the creation of more precise diagnostic tools. For instance, the global market for genomics was valued at approximately $29.7 billion in 2023 and is projected to grow significantly, highlighting the demand for advancements in this area.

Staying at the forefront of 'omics' research is therefore essential for Eurobio Scientific's continued innovation and competitive edge. The company's ability to integrate these scientific leaps into its product pipeline directly impacts its capacity to offer cutting-edge diagnostic solutions.

Data Analytics and Artificial Intelligence (AI)

The increasing integration of big data analytics and Artificial Intelligence (AI) is a significant technological factor for Eurobio Scientific. These technologies can dramatically improve diagnostic accuracy and speed up crucial research efforts, while also enhancing disease surveillance capabilities. For instance, AI is already transforming how diagnostic data is interpreted, with some studies showing AI algorithms achieving comparable or even superior accuracy to human experts in specific diagnostic tasks. The global AI in healthcare market size was valued at USD 15.4 billion in 2023 and is projected to grow significantly, reaching an estimated USD 187.9 billion by 2030, at a CAGR of 43.0%. This growth underscores the immense potential for companies like Eurobio Scientific.

Eurobio Scientific can strategically leverage AI-driven solutions to gain a competitive edge. This includes developing tools for interpreting complex diagnostic data, which could lead to faster and more precise patient diagnoses. Optimizing laboratory processes through AI can also reduce turnaround times and operational costs. Furthermore, building predictive models for disease progression can enable more proactive patient management and personalized treatment plans. By embracing these advancements, Eurobio Scientific can enhance its service offerings and contribute to better healthcare outcomes.

Specific applications for Eurobio Scientific could include:

- AI-powered image analysis for pathology and radiology, improving diagnostic speed and accuracy.

- Machine learning algorithms to identify patterns in genomic data for personalized medicine.

- AI for optimizing reagent usage and workflow in molecular diagnostics, reducing waste and cost.

- Predictive analytics to forecast demand for specific diagnostic tests, aiding supply chain management.

Intellectual Property Landscape and Innovation Pace

The in-vitro diagnostics (IVD) sector is characterized by rapid innovation, leading to a constantly evolving intellectual property (IP) landscape. Patents are crucial for safeguarding new diagnostic tests, analytical instruments, and associated software. Eurobio Scientific's strategy must involve robust management of its own IP portfolio, alongside careful navigation of the patented technologies held by competitors and collaborators.

Staying competitive in this fast-paced environment demands consistent investment in research and development. For instance, the global IVD market was valued at approximately USD 85 billion in 2023 and is projected to grow significantly, driven by technological advancements and increasing demand for personalized medicine. This growth underscores the necessity for companies like Eurobio Scientific to continually innovate and protect their discoveries.

- Patent Filings: The number of IVD-related patent filings globally has seen a steady increase, reflecting the intense R&D activity.

- R&D Expenditure: Leading IVD companies typically allocate between 10-15% of their revenue to R&D to maintain a competitive edge.

- Licensing and Partnerships: Strategic licensing agreements and collaborations are common as companies seek access to complementary technologies and accelerate market entry.

Technological advancements in areas like AI, next-generation sequencing, and automation are profoundly reshaping the diagnostics landscape. Eurobio Scientific must integrate these innovations, such as AI-driven data analysis which saw the global AI in healthcare market reach USD 15.4 billion in 2023, to enhance diagnostic accuracy and efficiency. The company's focus on automated platforms and digital solutions aligns with the trend of laboratories seeking to boost throughput and accuracy through robotics and integrated systems.

Breakthroughs in 'omics' fields, including genomics and proteomics, are enabling more precise diagnostic tests, particularly for personalized medicine. The global genomics market, valued at approximately USD 29.7 billion in 2023, highlights the demand for these advancements. Eurobio Scientific's expertise in life sciences positions it to leverage these scientific leaps for developing cutting-edge diagnostic solutions.

The intellectual property landscape in diagnostics is dynamic, with patents crucial for protecting new tests and technologies. Eurobio Scientific's R&D investment, typically a significant portion of revenue for leading IVD firms, is vital for innovation and safeguarding its discoveries in a market projected to grow substantially. Strategic licensing and partnerships are also key to accessing complementary technologies and accelerating market entry.

Legal factors

The European Union's In Vitro Diagnostic Regulation (IVDR) significantly elevates the bar for IVD devices, demanding more robust clinical evidence, rigorous performance evaluations, and enhanced post-market surveillance. For Eurobio Scientific, a French group with a substantial European footprint, meeting these stringent IVDR requirements is paramount for continued market access and to sidestep substantial financial penalties.

Navigating IVDR compliance is not a one-time event but an ongoing, resource-intensive endeavor for Eurobio Scientific. This includes substantial investment in clinical studies and data generation, with the IVDR's impact on the IVD market expected to lead to increased costs for manufacturers and potentially fewer products available in the short term as companies adapt.

Healthcare data's sensitive nature necessitates strict adherence to regulations like GDPR, which governs its collection, processing, and storage in Europe. Eurobio Scientific's diagnostic platforms and data management systems must comply with these laws to safeguard patient privacy and prevent substantial penalties. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial imperative for compliance.

Protecting its proprietary diagnostic tests, reagents, and technologies through patents is absolutely critical for Eurobio Scientific to maintain its competitive edge. These legal frameworks are the bedrock that allows the company to stop others from using its innovations without permission and to take legal action if its patents are violated. This means Eurobio Scientific needs strong strategies for filing patents and making sure they are enforced.

Product Liability and Safety Regulations

Eurobio Scientific faces significant legal obligations regarding the safety and performance of its diagnostic products. Stringent product liability laws hold the company responsible for any harm caused by product defects, potentially leading to substantial financial penalties and legal repercussions. For instance, in 2023, the medical device industry saw a rise in product liability claims, with some cases involving millions in damages for faulty diagnostics.

To mitigate these risks, Eurobio Scientific must rigorously adhere to manufacturing standards, implement robust quality control measures, and maintain vigilant post-market surveillance. This commitment ensures product integrity and compliance with evolving regulatory landscapes. The European Union's Medical Device Regulation (MDR), fully applicable since May 2021, imposes even stricter requirements on manufacturers, including enhanced traceability and clinical evidence, impacting companies like Eurobio Scientific.

- Product Safety Compliance: Eurobio Scientific is legally bound to ensure its diagnostic products meet all safety and performance standards.

- Liability for Defects: Failure to meet these standards can result in significant financial and legal consequences due to product liability laws.

- Regulatory Adherence: Maintaining compliance with regulations like the EU's MDR is crucial for minimizing legal exposure.

- Continuous Vigilance: Ongoing quality control and post-market monitoring are essential legal obligations to safeguard against product-related issues.

Anti-Trust and Competition Law

Eurobio Scientific, operating within the In Vitro Diagnostics (IVD) sector, navigates a complex landscape governed by anti-trust and competition laws. These regulations are crucial for preventing monopolistic behavior and ensuring a level playing field for all market participants. For instance, in 2024, the European Commission continued its focus on digital markets, which could indirectly affect distribution and pricing strategies for IVD companies by setting new standards for online sales and data sharing.

Compliance with these laws directly influences Eurobio Scientific's strategic decisions, particularly concerning mergers and acquisitions. Any significant consolidation or partnership must be scrutinized to ensure it doesn't stifle competition. Similarly, distribution agreements and pricing policies are subject to review to prevent unfair advantages or exclusionary practices. The ongoing enforcement of competition law, as seen in various sectors throughout 2024 and projected into 2025, underscores the importance of robust legal frameworks for maintaining market integrity.

- Mergers & Acquisitions Scrutiny: Regulatory bodies closely examine M&A activities to prevent market dominance.

- Distribution Agreements: Terms must be fair and non-discriminatory to avoid anti-competitive practices.

- Pricing Policies: Predatory or collusive pricing is strictly prohibited and subject to legal challenge.

- Market Fairness: These laws are designed to foster a competitive environment beneficial to innovation and consumers.

Eurobio Scientific must navigate stringent intellectual property laws to protect its innovations, like patented diagnostic tests. Failure to secure and enforce patents can lead to competitors replicating its technology, impacting market share and revenue. For example, in 2024, the European Patent Office granted numerous patents in the life sciences sector, highlighting the competitive landscape for innovation protection.

Compliance with European Union regulations, particularly the In Vitro Diagnostic Regulation (IVDR) and the Medical Device Regulation (MDR), is critical for market access and avoiding significant penalties. The IVDR, fully applicable since May 2022, demands extensive clinical evidence and post-market surveillance, increasing operational costs and requiring substantial investment in data generation for companies like Eurobio Scientific.

The General Data Protection Regulation (GDPR) imposes strict rules on handling sensitive health data, with non-compliance carrying fines up to 4% of global annual revenue. Eurobio Scientific's data management systems must align with GDPR to ensure patient privacy and avoid substantial financial repercussions.

Anti-trust and competition laws influence Eurobio Scientific's strategic decisions, especially regarding mergers, acquisitions, and pricing. Ensuring fair competition is paramount, as demonstrated by ongoing regulatory scrutiny of market practices across the EU in 2024 and projected into 2025.

Environmental factors

Eurobio Scientific's operations, particularly in the production and use of In Vitro Diagnostic (IVD) products, inherently generate diverse waste streams, including hazardous biological and chemical byproducts. Stringent environmental regulations govern the collection, treatment, and disposal of this waste, aiming to mitigate pollution and safeguard worker health. For instance, the European Union’s Waste Framework Directive sets clear guidelines for waste management, emphasizing a hierarchy of prevention, reuse, recycling, and recovery.

Compliance with these regulations is paramount for Eurobio Scientific, as improper disposal can lead to significant environmental damage and substantial fines. The increasing global focus on sustainability means that companies like Eurobio Scientific are under greater scrutiny regarding their waste management practices. In 2023, the global IVD market was valued at approximately $110 billion, highlighting the scale of production and the corresponding waste volumes that require responsible handling.

Regulators, investors, and consumers are increasingly pushing companies like Eurobio Scientific to embrace sustainability. This translates to a need for greener operations, from how materials are sourced to the manufacturing process itself. For instance, in 2024, the European Union continued to strengthen its environmental regulations, with directives like the Corporate Sustainability Reporting Directive (CSRD) requiring more detailed disclosure of environmental impact.

Eurobio Scientific can bolster its environmental standing by actively reducing its carbon footprint, optimizing energy consumption, and minimizing water usage across its production sites and supply chain. This proactive approach includes a thorough assessment of suppliers' environmental performance, ensuring alignment with sustainability goals. Companies in the life sciences sector are increasingly investing in renewable energy sources; for example, some European biotech firms reported achieving over 50% renewable energy usage in their facilities by early 2025.

Eurobio Scientific faces increasing scrutiny regarding its environmental footprint, necessitating strict adherence to evolving regulations on emissions, waste management, and chemical usage. Failure to comply can result in significant financial penalties, such as the €10,000 fines levied in France for certain environmental infractions in 2024, and can severely damage its public image.

To mitigate these risks, the company must invest in and maintain rigorous environmental audits and comprehensive internal policies. For instance, companies in the life sciences sector are increasingly adopting ISO 14001 certification, with a notable rise in such certifications observed globally between 2023 and 2024, demonstrating a commitment to operational sustainability and regulatory compliance.

Climate Change Impact on Disease Patterns

Climate change is significantly altering disease patterns globally, with potential implications for diagnostic companies like Eurobio Scientific. Rising global temperatures and changing precipitation patterns can expand the geographical range of disease vectors, such as mosquitoes carrying diseases like Dengue or Zika, potentially increasing demand for related diagnostic tests in previously unaffected regions. For instance, the World Health Organization (WHO) has noted an increase in the geographical spread of vector-borne diseases in recent years, directly linked to climatic shifts.

These environmental shifts necessitate proactive product development and market anticipation. Eurobio Scientific must consider how evolving climate conditions might create new or expanded markets for its diagnostic solutions. The company's ability to adapt its portfolio to address emerging infectious diseases, influenced by environmental factors, will be crucial for sustained growth and relevance in the coming years.

- Vector-borne disease expansion: Climate change is projected to increase the incidence and geographical distribution of diseases like malaria, dengue fever, and Lyme disease, potentially boosting demand for associated diagnostic kits.

- Emerging pathogens: Shifting ecosystems due to climate change can increase human-animal contact, raising the risk of zoonotic disease spillover and the need for rapid diagnostic capabilities for novel pathogens.

- Waterborne and foodborne illnesses: Extreme weather events, such as floods and droughts exacerbated by climate change, can contaminate water sources and impact food safety, leading to potential upticks in gastrointestinal infections requiring diagnostic testing.

Resource Scarcity and Raw Material Sourcing

The availability and cost of critical raw materials for diagnostic test kits, such as specialized plastics and reagents, are directly impacted by environmental factors and global resource scarcity. Eurobio Scientific must prioritize building robust and ethically managed supply chains. This includes actively investigating alternative materials and adopting sustainable sourcing practices to buffer against potential disruptions and price volatility. For instance, the increasing demand for rare earth elements, crucial for some advanced diagnostic components, highlights the need for strategic foresight in securing these finite resources.

Eurobio Scientific's reliance on specific raw materials necessitates proactive strategic planning to navigate potential shortages and price hikes. The company's commitment to resilient supply chains is paramount. By exploring alternative materials and sustainable sourcing, they can mitigate risks associated with resource depletion and geopolitical instability impacting key suppliers. For example, the global shortage of certain chemicals used in molecular diagnostics in late 2023 and early 2024 demonstrated the vulnerability of existing supply lines.

- Supply Chain Resilience: Eurobio Scientific faces challenges in sourcing materials like specific polymers and enzymes due to environmental pressures and increasing global demand.

- Cost Volatility: Fluctuations in the availability of raw materials, influenced by climate events or geopolitical factors affecting extraction and processing, can lead to unpredictable cost increases for diagnostic components.

- Ethical Sourcing: Ensuring that raw materials are sourced responsibly, considering environmental impact and labor practices, is crucial for maintaining brand reputation and regulatory compliance.

- Strategic Material Management: Proactive strategies, such as diversifying suppliers, investing in material research for alternatives, and optimizing inventory, are essential for mitigating risks associated with resource scarcity.

Environmental regulations are a significant factor for Eurobio Scientific, impacting waste management and operational practices. The company must adhere to strict guidelines concerning hazardous biological and chemical waste, with non-compliance potentially leading to substantial fines, such as those seen in France for environmental infractions in 2024.

The increasing global emphasis on sustainability is driving demand for greener operations. Eurobio Scientific is encouraged to reduce its carbon footprint and optimize resource consumption, with many European biotech firms achieving over 50% renewable energy usage by early 2025.

Climate change also presents opportunities and challenges, potentially expanding the market for diagnostics related to vector-borne diseases like Dengue and Zika, as noted by the WHO's observations on increasing geographical spread.

Supply chain resilience is critical, as environmental pressures and global demand affect the availability and cost of raw materials, such as specialized plastics and reagents, leading to price volatility and potential shortages, as evidenced by the chemical shortages in late 2023 and early 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eurobio Scientific draws from a robust blend of official regulatory updates, economic indicators from leading financial institutions, and comprehensive market research reports. We meticulously gather data on technological advancements, socio-cultural trends, and environmental policies to provide a holistic view.