Eurobio Scientific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurobio Scientific Bundle

Unlock the strategic potential of Eurobio Scientific with a comprehensive look at its product portfolio. Understand which products are poised for growth as Stars, which are reliably generating cash as Cash Cows, and which require careful consideration as Dogs or Question Marks.

Don't settle for a glimpse; dive into the full Eurobio Scientific BCG Matrix for detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investment and product development strategies.

Purchase the complete BCG Matrix today and gain the competitive clarity needed to navigate the dynamic life sciences market with confidence.

Stars

GenDx, now part of Eurobio Scientific, is a standout performer. In 2024, its products saw a robust growth of roughly 19% across key global markets including Europe and the United States. This impressive expansion was partly fueled by significant one-off international distribution agreements.

The momentum continued into the first half of 2024, with GenDx sales surging by an impressive 32%. This highlights the strong market demand for its offerings and its significant contribution to Eurobio Scientific's overall success.

Eurobio Scientific is a dominant player in France for HLA tests crucial for transplantation diagnostics, a niche yet expanding sector. The European organ transplant diagnostics market is experiencing significant growth, estimated at $1.16 billion in 2023 and forecasted to reach $3.35 billion by 2033.

The company leverages its proprietary reagents and software for matching patients and donors and monitoring chimerism, solidifying its market position. This specialized segment offers substantial opportunities due to increasing demand for organ transplantation.

Eurobio Scientific's proprietary molecular diagnostics for infectious diseases, including RT-PCR kits like Eurobioplex, DermaScreen, and DermaXtract, are performing well. These products are seeing active market launches, with notable traction in the UK. This segment represents a significant growth opportunity for the company.

The company's strategy centers on boosting the contribution of its proprietary products to total sales, aiming for a 50% share within the next five years. This focus on in-house developed diagnostics underscores their high growth potential and strategic importance in the infectious disease market, which consistently demands advanced solutions.

Fungiline Fast

Fungiline Fast, a key offering from Eurobio Scientific, represents a proprietary lateral flow diagnostic range designed for the rapid detection of invasive fungal infections. This innovative product line directly tackles the critical need for swift and economical diagnostic tools within emergency departments and various clinical environments.

The Fungiline Fast range’s ability to deliver rapid results positions it favorably within the expanding market for infectious disease diagnostics. Its innovative approach and cost-effectiveness contribute to its potential as a Star in Eurobio Scientific's portfolio, reflecting strong market growth and a competitive advantage.

- Market Potential: Invasive fungal infections are a significant global health concern, with diagnostic needs continually increasing.

- Innovation: Fungiline Fast offers a proprietary lateral flow technology for faster results compared to traditional methods.

- Cost-Effectiveness: The rapid nature of Fungiline Fast contributes to reduced healthcare costs by enabling quicker treatment decisions.

- Strategic Fit: As a Star, Fungiline Fast aligns with Eurobio Scientific's strategy to provide advanced diagnostic solutions in high-growth areas.

Oncology Genomic Tests (Post-Acquisition Integration)

Eurobio Scientific's acquisition of EndoPredict® and Prolaris® genomic tests in August 2024 positions them within the dynamic oncology testing market, despite a reported 10% sales decrease and negative EBITDA for these assets in 2024. This strategic move, aimed at securing second-generation genomic solutions, highlights the company's ambition to capture significant market share.

The company is actively bolstering its commercial presence in this high-growth segment, signaling a dedicated effort to drive adoption and market penetration for these acquired assets. This expansion, alongside the collaboration with Biovica for DiviTum, demonstrates a clear strategy of aggressive investment in innovative oncology diagnostics.

- Market Position: Operating in the high-growth oncology genomic test market.

- 2024 Performance: Experienced a 10% sales decrease and negative EBITDA.

- Strategic Acquisition: Acquired EndoPredict® and Prolaris® from Myriad Genetics in August 2024.

- Future Outlook: Aiming to transition these assets into strong market leaders through expanded commercial efforts and partnerships.

Eurobio Scientific's GenDx, a key acquisition, is a prime example of a Star within the BCG Matrix. Its significant growth, particularly the 32% surge in the first half of 2024, demonstrates strong market acceptance and rapid expansion. This performance is bolstered by its dominant position in the vital organ transplantation diagnostics market, a sector projected for substantial growth.

The company's proprietary reagents and software for patient-donor matching and chimerism monitoring solidify its competitive edge. Furthermore, Eurobio Scientific's infectious disease diagnostics, such as the Eurobioplex range, are gaining traction, especially in the UK market. This strategic focus on proprietary, high-growth products positions these segments as Stars, poised for continued market leadership.

| Product/Segment | 2024 Performance Highlight | Market Context | Strategic Importance |

|---|---|---|---|

| GenDx | 32% sales growth (H1 2024) | Organ transplantation diagnostics (est. $1.16B in 2023) | Market leader, proprietary tech |

| Infectious Disease Diagnostics (e.g., Eurobioplex) | Active market launches, traction in UK | Growing demand for advanced solutions | Key growth area, proprietary focus |

| Fungiline Fast | Rapid detection of fungal infections | Expanding infectious disease diagnostics market | Innovative, cost-effective solution |

What is included in the product

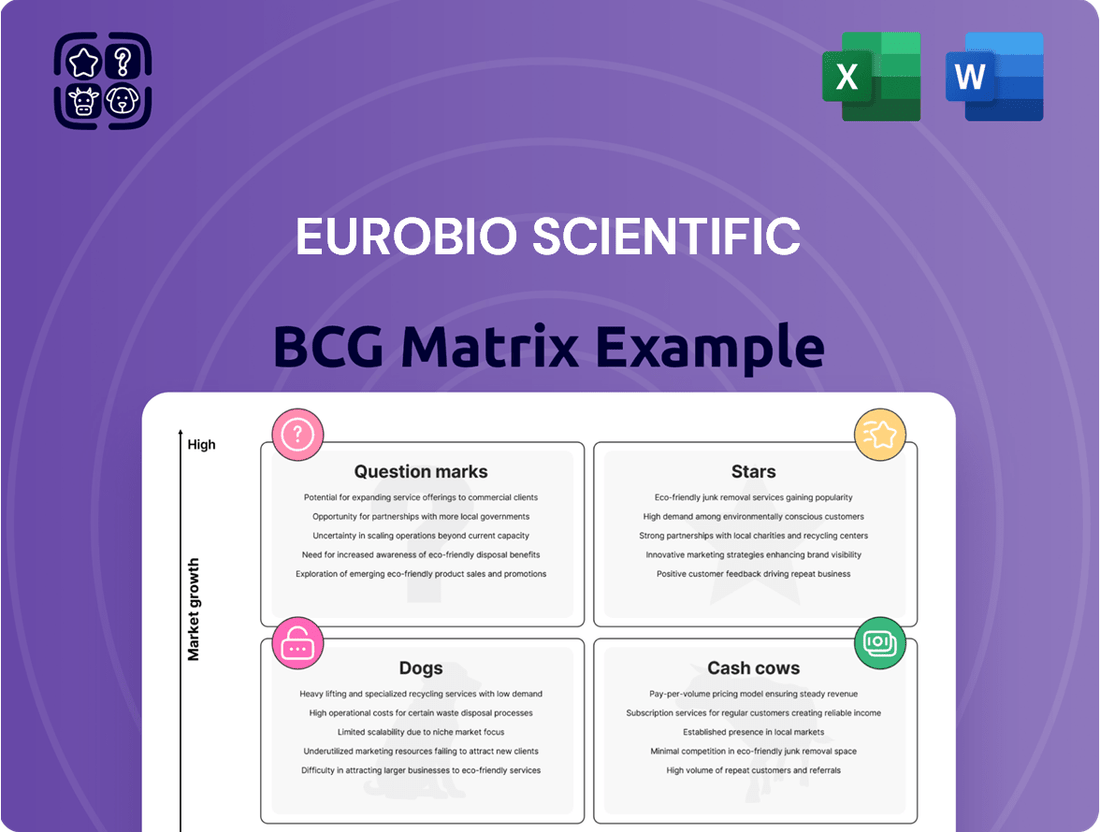

The Eurobio Scientific BCG Matrix provides a strategic overview of its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

Streamlined data analysis for faster diagnostic insights.

Cash Cows

Eurobio Scientific's established distribution network acts as a significant Cash Cow. This network efficiently channels third-party reagents and instruments to a broad base of research laboratories and clinical settings.

The extensive reach and strong existing partnerships within this distribution arm translate into a predictable and consistent cash flow. This reliability is a hallmark of a Cash Cow, providing a stable revenue stream for the company.

While this segment may not exhibit rapid growth, its operational efficiency and consistent revenue generation are vital for Eurobio Scientific's financial stability, contributing a substantial portion to its overall financial health.

Eurobio Scientific's routine in vitro diagnostics in France represents a solid cash cow. The company holds a significant market share in France for its specialty diagnostic tests, a testament to its established presence and expertise.

While reimbursement shifts have put some pressure on profit margins, this core French market remains a crucial and reliable source of income. The consistent demand for everyday diagnostic procedures underpins a stable cash flow, which is vital for funding the company's growth and innovation efforts.

For instance, in 2023, Eurobio Scientific reported revenues of €211.5 million, with its diagnostics segment playing a pivotal role in this performance. This segment’s stability is key to supporting investments in newer, potentially higher-growth areas.

The acquisition of Diagnostic International Distribution (DID) in July 2023 has positioned its activities as a significant cash cow for Eurobio Scientific within its BCG matrix. DID, a provider of microbiology laboratory solutions, contributed €6.1 million to Eurobio Scientific's revenue in the first half of 2024, demonstrating its immediate impact.

Now fully integrated, these DID activities represent a stable revenue stream within a mature market segment. This integration solidifies their role as a reliable cash generator for the company.

The acquisition has also expanded Eurobio Scientific's market presence, particularly in Italy. This enhanced footprint further strengthens the company's ability to generate consistent cash flow from these operations.

Life Sciences Product Distribution

Eurobio Scientific's Life Sciences Product Distribution acts as a Cash Cow within its portfolio. This segment, encompassing vital lab supplies like cell culture media and quality controls, serves a mature market with steady demand from research institutions and industries.

The consistent revenue generated from these essential consumables is crucial for covering the company's operational expenses. For instance, in 2024, the life sciences distribution segment was a significant contributor to Eurobio Scientific's overall revenue, demonstrating its stable performance.

- Mature Market: Consistent demand from academic and industrial research labs for essential consumables.

- Predictable Revenue: Distribution of cell culture media and quality controls provides a reliable income stream.

- Operational Support: This segment's steady earnings help fund the company's ongoing operational costs.

- 2024 Contribution: Life sciences distribution played a key role in the company's financial stability during the year.

Certain Legacy Contract Sales

Even though the significant One Lambda contract ended in October 2022, Eurobio Scientific is still seeing revenue from some existing tenders tied to that deal. These are contracts that were already in place and will run their course. This situation is typical for a Cash Cow, where a business unit or product generates more cash than it consumes, even as its market share or growth potential diminishes.

These residual sales represent the final phase of cash generation from a business that is winding down. The company is essentially extracting the remaining value from these legacy contracts before they fully expire. For example, in 2023, while specific figures for these legacy contract sales are not separately itemized, the company's overall revenue from its diagnostics segment, which would include these residual sales, was a significant contributor.

- Legacy Contract Sales: Represents the final cash inflows from expired agreements, such as the One Lambda contract.

- Cash Generation: These sales, though declining, continue to provide a source of revenue without significant new investment.

- Strategic Phase: Eurobio Scientific is maximizing returns from these existing commitments before their complete cessation.

- BCG Matrix Classification: Positioned as a Cash Cow due to its ability to generate cash from a mature or declining business line.

Eurobio Scientific's established distribution network, particularly strengthened by the acquisition of Diagnostic International Distribution (DID) in July 2023, functions as a key Cash Cow. DID's contribution of €6.1 million in revenue during the first half of 2024 highlights its immediate impact and stable revenue generation within a mature market.

The company's routine in vitro diagnostics in France also represents a solid Cash Cow. Despite some margin pressure from reimbursement shifts, this core French market provides a crucial and reliable income stream due to consistent demand for essential diagnostic procedures.

Furthermore, the Life Sciences Product Distribution segment, offering vital lab supplies, consistently generates predictable revenue from academic and industrial research, acting as a stable cash generator to cover operational costs.

Even residual sales from legacy contracts, such as those tied to the One Lambda agreement that ended in October 2022, contribute to the Cash Cow status by providing final revenue streams without requiring new investment.

| Business Segment | BCG Classification | Key Characteristics | 2024 Data/Impact |

|---|---|---|---|

| Distribution Network (incl. DID) | Cash Cow | Established reach, strong partnerships, predictable cash flow | DID contributed €6.1M H1 2024 revenue |

| Routine In Vitro Diagnostics (France) | Cash Cow | Significant market share, consistent demand, stable income | Core French market remains vital |

| Life Sciences Product Distribution | Cash Cow | Mature market, steady demand for consumables, reliable income | Significant contributor to 2024 revenue stability |

| Legacy Contract Sales | Cash Cow | Winding down business line, extracting remaining value | Continued revenue from existing tenders |

Full Transparency, Always

Eurobio Scientific BCG Matrix

The Eurobio Scientific BCG Matrix preview you are viewing is the identical, final document you will receive upon purchase. This means you're seeing the complete, professionally formatted analysis, ready for immediate application in your strategic planning. There are no hidden watermarks or demo content; what you preview is precisely what you get to download and utilize.

Dogs

Eurobio Scientific prudently wrote down its entire €3.6 million investment in Usense. This action was taken because Usense experienced delays in product launches and consistently reported negative financial results.

Usense was a significant drain on cash, failing to generate sufficient returns to justify continued investment. This cash-consuming, low-return profile clearly categorizes Usense as a Dog within the BCG matrix framework.

The complete write-down signifies Eurobio Scientific's assessment that a profitable recovery for Usense was highly improbable, making further capital allocation unwarranted.

Eurobio Scientific's 2024 financial report revealed that several European subsidiaries struggled, negatively impacting the company's overall profit margins. These units are likely facing challenges in gaining significant market share within their regions, thus hindering the group's growth trajectory.

These underperforming subsidiaries, characterized by low market share and minimal contribution to profitability, are prime candidates for the Dogs category in the BCG Matrix. For instance, if a subsidiary's revenue growth is significantly below the industry average and its market share is also low, it fits this profile.

Without a viable strategy to improve performance or a clear path to recovery, these subsidiaries may necessitate divestment or substantial operational restructuring to mitigate further financial strain on Eurobio Scientific.

Older diagnostic platforms, especially those in segments rapidly overtaken by new technology, can become liabilities for Eurobio Scientific. These might be tests with declining sales and market share, requiring continued investment in maintenance and support without yielding substantial returns. For instance, if a legacy PCR test faces competition from advanced next-generation sequencing methods, its revenue potential diminishes significantly.

Such products often fall into the cash trap category within the BCG matrix. Eurobio Scientific's strategy would likely involve phasing out or divesting from these underperforming assets to reallocate capital and human resources towards their stars and question marks, such as their innovative infectious disease diagnostics.

Non-Strategic Distribution Agreements Nearing End-of-Life

Non-strategic distribution agreements for third-party products, much like the situation with One Lambda, are being evaluated for their future. Those nearing the end of their lifecycle, showing limited growth prospects, or holding a small market share are prime candidates for reassessment. In 2024, Eurobio Scientific’s focus is on streamlining its portfolio, meaning these agreements, which may offer break-even or minimal profits, are likely to be phased out rather than renewed.

This strategic shift aims to free up valuable resources, allowing for reallocation to more promising ventures. By allowing these contracts to naturally expire, Eurobio Scientific can optimize its operational efficiency and concentrate on core competencies.

- Portfolio Optimization: Identifying and phasing out low-performing distribution agreements.

- Resource Reallocation: Freeing up capital and personnel for higher-growth opportunities.

- Strategic Focus: Concentrating on core business areas and proprietary products.

Products with Negative EBITDA from Acquisitions (Initial Phase)

The oncology products, EndoPredict® and Prolaris®, acquired from Myriad Genetics, represent a strategic investment for Eurobio Scientific. In 2024, these products reported a negative EBITDA of approximately €1 million. This initial phase highlights their current cash consumption, a common characteristic of early-stage growth assets in competitive markets.

Despite operating within a high-growth oncology sector, the negative EBITDA signals that these acquisitions are not yet self-sustaining financially. Their strategic importance lies in their potential to capture market share and eventually achieve profitability.

- Negative EBITDA: €1 million in 2024 for EndoPredict® and Prolaris®.

- Market Context: Operating in a high-growth oncology market.

- Strategic Importance: Key acquisitions for Eurobio Scientific's oncology portfolio.

- Financial Outlook: Requires further investment to improve performance and market positioning.

Eurobio Scientific's strategic review in 2024 identified several areas fitting the Dog profile. These are typically products or business units with low market share and low growth potential, often consuming resources without generating significant returns. The company's decision to write down its €3.6 million investment in Usense exemplifies this, as Usense consistently reported negative financials and launch delays.

Similarly, underperforming European subsidiaries with minimal market share and low profitability are categorized as Dogs. These units may require divestment or restructuring to prevent them from draining company resources. Legacy diagnostic platforms facing obsolescence due to technological advancements also fall into this category, demanding continued investment for maintenance while offering diminishing returns.

Eurobio Scientific is actively optimizing its portfolio by phasing out non-strategic distribution agreements that show limited growth or market share. This proactive approach aims to reallocate capital and personnel towards more promising ventures, aligning with a strategy to concentrate on core competencies and proprietary products.

| Business Unit/Product | Market Share | Growth Potential | BCG Category | Action |

|---|---|---|---|---|

| Usense | Low | Low | Dog | Write-down (€3.6M investment) |

| Underperforming European Subsidiaries | Low | Low | Dog | Potential divestment/restructuring |

| Legacy Diagnostic Platforms | Declining | Low | Dog | Phasing out/divestment |

| Non-strategic Distribution Agreements | Low | Limited | Dog | Phasing out/non-renewal |

Question Marks

Eurobio Scientific's acquisition of EndoPredict® and Prolaris® in August 2024 signals a strategic move into the burgeoning oncology genomic testing arena. These tests, while targeting a high-growth market, reported negative EBITDA and a sales decline in 2024, placing them firmly in the Question Marks quadrant of the BCG Matrix. This suggests they currently hold a low market share and are a significant drain on the company's resources.

The current financial performance, with negative EBITDA, underscores the need for substantial investment. To elevate these oncology genomic tests from Question Marks to Stars, Eurobio Scientific must significantly boost marketing and sales efforts. This investment is crucial for capturing a larger market share and unlocking their growth potential in the competitive oncology landscape.

Eurobio Scientific's March 2025 collaboration with Biovica to distribute the oncology testing product, DiviTum, positions them in a rapidly expanding market. While the oncology diagnostics sector is projected for substantial growth, Eurobio's current market penetration for DiviTum is minimal, reflecting its status as a Question Mark in the BCG matrix.

Significant investment in product evaluation, specialized sales training, and dedicated commercialization efforts will be crucial for DiviTum's success. This strategic push is necessary to build brand awareness, educate the market, and ultimately secure a meaningful market share in this competitive field.

Eurobio Scientific's strategic priority is international expansion, aiming to unlock new markets and drive growth. In 2024, international sales reached 41% of total revenue, highlighting a significant shift towards global markets.

These new geographic ventures, while targeting growing markets, mean Eurobio Scientific likely holds a low initial market share in these developing regions. This is characteristic of a company investing in future growth opportunities.

Successfully transforming these international ventures into Stars requires considerable investment. Funds are allocated to marketing, building robust distribution networks, and adapting products for local tastes and regulations to gain substantial market penetration.

Proprietary Product Development Pipeline

Eurobio Scientific's strategic focus on proprietary product development is a key driver for future growth, with a target of these products representing approximately 50% of sales within the next five years. This ambition places a significant emphasis on their R&D pipeline.

Products currently in the research and development phase or recently launched proprietary solutions that are still building market traction are classified as Question Marks within the BCG framework. These represent potential high-growth opportunities for Eurobio Scientific.

- High Investment Needs: These emerging proprietary products require substantial capital investment for continued research, development, and market entry.

- Uncertain Market Share: Despite potential, their future market share is not yet established, making them inherently risky but also offering high reward potential.

- Strategic Importance: Successful development and market penetration of these Question Mark products are crucial for Eurobio Scientific to achieve its long-term sales diversification goals.

- Focus on Innovation: The company's commitment to innovation is evident in the resources allocated to this segment of its product portfolio.

Entry into New Diagnostic Applications/Technologies

Eurobio Scientific's commitment to innovation drives exploration into new diagnostic frontiers, potentially encompassing emerging technologies in areas like liquid biopsy or advanced molecular diagnostics. These ventures, while holding significant future promise, typically start with a small market footprint, reflecting their nascent stage and the company's initial entry. For instance, the global liquid biopsy market, projected to reach substantial figures in the coming years, represents such an opportunity where Eurobio Scientific might be establishing its presence.

These new diagnostic applications or technologies would likely be categorized as Question Marks in the BCG Matrix. This classification acknowledges both their high growth potential and their current low market share. Strategic decisions regarding investment or divestment are crucial at this stage, as these initiatives need significant resources to scale and compete effectively. Failure to gain traction could lead to divestment, while successful development could see them transition into Stars.

- Emerging Markets: Focus on diagnostic areas with high projected growth rates, such as companion diagnostics or point-of-care testing.

- Low Market Share: Recognize that initial market penetration in novel applications will be limited, requiring focused market development.

- Strategic Investment: Allocate resources for research, development, and market entry to foster growth and competitive positioning.

- Performance Monitoring: Continuously evaluate the progress of these ventures to make informed decisions about continued investment or potential divestiture.

Question Marks represent Eurobio Scientific's investments in high-growth potential areas where the company currently holds a low market share. These ventures, such as the recently acquired oncology genomic tests EndoPredict® and Prolaris®, and the distributed DiviTum, require significant capital for development and market penetration. Their success hinges on strategic investment in marketing, sales, and product adaptation to transform them into future Stars.

The company's international expansion efforts and its focus on developing proprietary products also place them in the Question Mark category. These initiatives are vital for achieving long-term sales diversification and growth, necessitating careful resource allocation and performance monitoring to ensure a successful transition into more established market positions.

Eurobio Scientific's strategic positioning of its emerging oncology genomic tests and international ventures as Question Marks underscores a deliberate approach to capturing future market share in high-growth segments. The company's 2024 international sales, representing 41% of total revenue, highlight a commitment to global expansion, which inherently involves establishing presence in new territories with initially low market share.

These Question Mark initiatives, including new diagnostic frontiers like liquid biopsy, demand substantial investment to build brand awareness and secure competitive positioning. The success of these ventures is critical for Eurobio Scientific's ambition to have proprietary products contribute approximately 50% of sales within five years.

| Product/Venture | Market Growth Potential | Current Market Share | Investment Focus | BCG Quadrant |

|---|---|---|---|---|

| EndoPredict® & Prolaris® | High (Oncology Genomic Testing) | Low | Marketing, Sales, R&D | Question Mark |

| DiviTum (Distribution) | High (Oncology Diagnostics) | Low | Market Education, Sales Training | Question Mark |

| International Expansion | High (Various Markets) | Low (New Territories) | Distribution Networks, Localization | Question Mark |

| Proprietary R&D Pipeline | High (Targeted Segments) | Low (Early Stage) | Research, Development, Market Entry | Question Mark |

| Emerging Diagnostic Technologies | High (e.g., Liquid Biopsy) | Low (Nascent Stage) | R&D, Market Entry Strategy | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.