Eurobio Scientific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurobio Scientific Bundle

Eurobio Scientific operates within a dynamic market shaped by intense competition and evolving customer demands. Understanding the interplay of these forces is crucial for strategic success.

The complete report reveals the real forces shaping Eurobio Scientific’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Eurobio Scientific hinges significantly on the concentration of suppliers for its critical inputs. If a few dominant players control the supply of specialized reagents or unique equipment essential for in-vitro diagnostics (IVD) and life sciences, their leverage over Eurobio Scientific would be substantial.

Conversely, a fragmented supplier base, with numerous providers offering similar materials, would naturally diminish supplier power, granting Eurobio Scientific greater flexibility in sourcing and negotiation. For instance, a report from 2023 indicated that the IVD market relies on a diverse range of raw materials, but certain high-purity chemicals and advanced diagnostic components are sourced from a more limited number of specialized manufacturers.

Eurobio Scientific's strategic approach, which includes developing proprietary products alongside distributing third-party offerings, creates a nuanced dynamic. Its own innovations can reduce dependence on external suppliers for those specific product lines. However, the distribution of third-party products inherently ties the company to the supplier relationships of those external partners, meaning supplier power remains a relevant consideration in those segments.

Suppliers gain leverage when their offerings are distinct and lack readily available alternatives. For Eurobio Scientific, this could manifest if they depend on patented diagnostic reagents or highly specialized manufacturing equipment that few other companies can provide. For instance, if a key supplier for a unique immunoassay component used in Eurobio Scientific's diagnostic kits has no comparable substitutes, that supplier's bargaining power is significantly amplified.

Switching costs for Eurobio Scientific can significantly impact supplier bargaining power. If it's costly or complex for Eurobio Scientific to change its suppliers for critical diagnostic reagents or equipment, existing suppliers gain leverage. This is especially true in the In Vitro Diagnostics (IVD) sector, where re-validation and regulatory approvals can be substantial barriers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Eurobio Scientific's market presents a significant lever of bargaining power. If a key supplier were to begin directly producing and selling diagnostic tests or life science products, they would effectively become a competitor, potentially disrupting Eurobio Scientific's established business model. This scenario is particularly concerning for Eurobio Scientific if its suppliers possess unique technological expertise or control critical intellectual property.

While the overall threat of forward integration by suppliers for Eurobio Scientific might be considered moderate, it's crucial to assess this on a case-by-case basis for each supplier. For instance, suppliers of highly specialized, proprietary components may have a lower propensity or capability to integrate forward due to the complexity and capital investment required to enter Eurobio Scientific's specific market niche. Conversely, technology licensors or those providing more commoditized, yet essential, inputs could pose a more credible forward integration threat.

For example, in 2024, the life sciences sector saw increased M&A activity, with some component manufacturers exploring vertical integration to capture more value. While specific data for Eurobio Scientific's suppliers is not publicly detailed, a hypothetical scenario could involve a supplier of a critical reagent for a widely used diagnostic kit considering direct market entry if the profit margins within the diagnostic testing value chain are sufficiently attractive. This would directly impact Eurobio Scientific's competitive landscape and pricing power.

- Supplier Forward Integration Risk: Assesses the likelihood of suppliers entering Eurobio Scientific's core business.

- Impact on Competition: Forward integration by suppliers would transform them into direct rivals.

- Industry Specifics: The threat varies based on supplier specialization and technological capabilities.

- Market Dynamics: Trends like M&A in life sciences can heighten this integration risk.

Importance of Eurobio Scientific to Suppliers

Eurobio Scientific's importance to its suppliers significantly influences its bargaining power. If Eurobio Scientific constitutes a substantial portion of a supplier's overall sales, that supplier's leverage over Eurobio Scientific is reduced, as they are more dependent on the revenue generated from this partnership.

Conversely, if Eurobio Scientific is a minor client for a large, well-diversified supplier, its ability to negotiate favorable terms or prices is inherently weaker.

Eurobio Scientific's strategic moves, such as acquisitions and international expansion, are broadening its market footprint. This growth can enhance its standing with certain suppliers, potentially improving its bargaining position by making it a more critical customer for them.

For example, in 2023, Eurobio Scientific reported revenues of €211.7 million, indicating a considerable scale of operations that would likely make it a significant customer for many of its suppliers.

- Supplier Dependence: If Eurobio Scientific is a major revenue source for a supplier, the supplier's bargaining power is weakened.

- Customer Scale: Eurobio Scientific's bargaining power is lower when dealing with large, diversified suppliers where it represents a small portion of their business.

- Market Presence: Acquisitions and international expansion by Eurobio Scientific can increase its importance to suppliers, potentially boosting its negotiating leverage.

- Revenue Impact: Eurobio Scientific's 2023 revenue of €211.7 million underscores its potential significance as a customer, influencing supplier relationships.

The bargaining power of suppliers for Eurobio Scientific is influenced by the concentration of specialized input providers. If a few key suppliers control essential reagents or advanced diagnostic components, their leverage increases, as seen in the 2023 IVD market where high-purity chemicals often come from specialized manufacturers.

Switching costs, particularly the need for re-validation and regulatory approvals in the IVD sector, grant existing suppliers greater power over Eurobio Scientific.

The threat of suppliers integrating forward into Eurobio Scientific's market, a trend observed with increased M&A in life sciences during 2024, could transform suppliers into direct competitors, especially those with unique technological expertise.

Eurobio Scientific's substantial 2023 revenue of €211.7 million likely makes it a significant customer for many suppliers, thereby reducing their individual bargaining power.

| Factor | Impact on Eurobio Scientific | Example/Data Point |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Limited suppliers for specialized IVD components. |

| Switching Costs | High switching costs empower suppliers. | Regulatory re-validation in IVD is a barrier. |

| Forward Integration Threat | Potential for suppliers to become competitors. | Life sciences M&A in 2024 may drive this. |

| Customer Importance | Eurobio Scientific's significance to suppliers. | 2023 revenue of €211.7 million indicates scale. |

What is included in the product

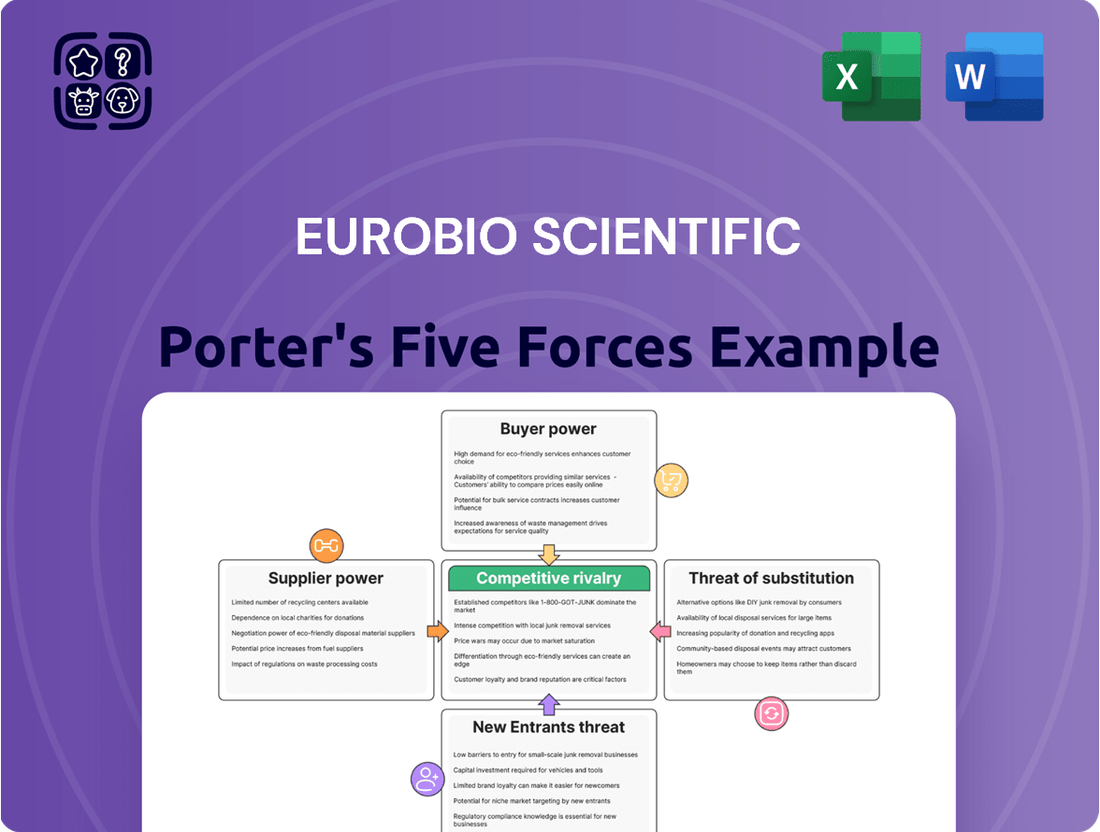

Eurobio Scientific's Porter's Five Forces Analysis reveals the intensity of competition, buyer and supplier power, threat of new entrants, and the impact of substitutes within the diagnostics market.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

If Eurobio Scientific's customer base is concentrated, meaning a few major hospital groups or national health systems represent a substantial portion of its revenue, these customers wield significant bargaining power. They can leverage this position to negotiate lower prices or more favorable contract terms.

Eurobio Scientific's operations within the hospital sector inherently suggest a degree of customer concentration. For instance, in 2023, the company reported that its top ten customers accounted for approximately 35% of its total sales, highlighting the influence these larger entities can exert.

Customers tend to be more sensitive to price when the products they buy are similar and don't offer unique features. This sensitivity also increases if the product's cost is a large part of their overall budget or if they themselves are facing strong competition.

In the In Vitro Diagnostics (IVD) sector, particularly for common, routine tests, price sensitivity can be quite pronounced. This is especially true as reimbursements for biological procedures have seen downward trends, directly affecting the gross margins of companies operating in this space. For instance, in 2024, many healthcare providers are experiencing tighter budgets, making them more inclined to seek the most cost-effective IVD solutions, even for established diagnostic tests.

Customers wield significant bargaining power when a wide array of substitute diagnostic tests, equipment, or life science reagents are readily accessible from competing suppliers. This ease of switching directly impacts Eurobio Scientific's pricing flexibility and market share.

While Eurobio Scientific's investment in proprietary products is designed to create differentiation and thus reduce customer reliance on alternatives, the company also distributes third-party products. For these distributed items, the availability of comparable substitutes from other manufacturers can empower customers to demand lower prices or better terms.

The in-vitro diagnostics (IVD) market, particularly for laboratory-based testing, is characterized by a semi-consolidated structure. This means that while there are dominant players, the presence of multiple key suppliers and distributors indicates that customers generally have viable alternative sources for their needs, thereby bolstering their bargaining power.

Threat of Backward Integration by Customers

Customers can increase their bargaining power if they possess the capability and willingness to produce diagnostic tests or reagents internally, or to set up their own distribution channels. This potential for backward integration allows them to exert pressure on suppliers like Eurobio Scientific.

While the development of highly specialized in-vitro diagnostic (IVD) products makes this threat less prevalent, large hospital groups or significant research institutions might explore in-house manufacturing for specific, less complex diagnostic needs. This could involve developing simpler reagents or testing kits that don't require the same level of advanced technology.

For Eurobio Scientific, the threat of backward integration is generally considered lower. This is due to the company's focus on specialized and often proprietary diagnostic solutions that require significant R&D investment and technical expertise, making it difficult for most customers to replicate independently.

- Customer Integration Risk: The possibility of large customers developing their own diagnostic solutions or distribution networks poses a threat to Eurobio Scientific's market position.

- Specialized Product Defense: Eurobio Scientific's portfolio of specialized IVD products acts as a natural barrier against customer backward integration due to high R&D and technical requirements.

- Limited Applicability: While possible for less complex needs, the overall threat is mitigated as replicating Eurobio Scientific's advanced offerings is challenging for most customer entities.

Information Availability to Customers

Customers with more complete information about pricing, product alternatives, and supplier costs inherently possess greater bargaining power. This transparency allows them to make more informed decisions and leverage knowledge to secure better terms.

In the medical diagnostics sector, where Eurobio Scientific operates, customers, especially large institutional buyers like hospitals and laboratories, often have access to detailed product specifications and competitive pricing data. This information empowers them significantly in their negotiations with suppliers.

- Informed Purchasing: Access to comprehensive product data and pricing benchmarks allows institutional customers to identify the most cost-effective solutions.

- Negotiation Leverage: Knowledge of competitor pricing and supplier cost structures provides a strong basis for negotiating discounts and favorable contract terms.

- Market Dynamics: The increasing availability of online comparison tools and industry reports further amplifies customer awareness, intensifying competitive pressures on suppliers.

When customers are concentrated, meaning a few large entities make up a significant portion of sales, they gain considerable leverage to negotiate better prices or terms. Eurobio Scientific's reliance on major hospital groups, for example, means these clients can exert substantial influence. In 2023, the top ten customers represented about 35% of total sales, underscoring this concentration.

Customer price sensitivity increases when products are similar, represent a large cost component, or when customers themselves face competitive pressures. In the In Vitro Diagnostics (IVD) market, routine tests with readily available substitutes are particularly susceptible to price demands, especially as healthcare budgets tighten, as seen in 2024.

The availability of numerous substitute diagnostic tests and reagents from various suppliers empowers customers, limiting Eurobio Scientific's pricing power. While proprietary products offer some defense, the distribution of third-party items means customers can often find alternatives, pushing for lower prices.

Customers can enhance their bargaining power by developing their own diagnostic solutions or distribution channels, though this is less feasible for highly specialized products. For less complex needs, larger institutions might consider in-house production, but replicating Eurobio Scientific's advanced offerings remains a significant challenge.

Preview Before You Purchase

Eurobio Scientific Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Eurobio Scientific, detailing the competitive landscape and strategic positioning within its industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You will receive this exact, professionally formatted analysis immediately after purchase, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry.

Rivalry Among Competitors

The In Vitro Diagnostics (IVD) and life science sectors are characterized by a diverse competitive landscape, featuring both large, globally recognized companies and smaller, niche players. This mix creates a dynamic environment where Eurobio Scientific faces rivalry from entities of varying scales and resource levels.

A significant number of competitors, particularly those possessing comparable size and financial backing to Eurobio Scientific, directly contribute to heightened competitive rivalry. This intensity is further underscored by the semi-consolidated nature of the lab-based IVD market, which signals a substantial degree of existing competition among established firms.

The global in-vitro diagnostics (IVD) market is indeed experiencing growth, with projections indicating a healthy expansion. This generally suggests that new entrants can find space, potentially easing direct rivalry. However, growth alone doesn't eliminate competitive intensity.

Eurobio Scientific's own 2024 performance highlights this nuance. While the market offers opportunities for expansion, the company reported pressure on its margins. This suggests that even in a growing market, companies are finding it challenging to maintain profitability, indicating that competition remains a significant factor, forcing price adjustments or increased investment in innovation.

When products are highly differentiated, the competitive rivalry tends to be less intense because customers develop preferences for specific features, brands, or the overall value proposition. This loyalty means switching costs can be higher, reducing the immediate pressure to compete solely on price.

Eurobio Scientific's strategic emphasis on proprietary product development is a key driver for differentiation. For instance, their innovative diagnostic kits, often backed by unique technological platforms, allow them to command premium pricing and foster customer loyalty, thereby mitigating direct price competition on these specific offerings.

However, Eurobio Scientific also distributes a significant portfolio of third-party products. For these less differentiated items, competition often intensifies, shifting the focus towards factors like price competitiveness, efficient logistics, and superior customer service to win market share. This dual approach means rivalry varies considerably across their product lines.

Switching Costs for Customers

For Eurobio Scientific, low switching costs for customers would mean that clients can easily move to a competitor's diagnostic solutions. This ease of switching intensifies competition, forcing companies to constantly innovate and maintain competitive pricing. In 2024, the In Vitro Diagnostics (IVD) market, while seeing innovation, still faces this dynamic where accessibility to alternative solutions can impact customer loyalty.

Conversely, high switching costs can significantly dampen competitive rivalry. If a customer has invested heavily in a specific diagnostic platform, including training and integration, the cost and effort to switch to a different system become substantial barriers. This creates a more stable customer base for the incumbent provider.

In the IVD sector, these switching costs are not uniform. They can range from minimal for simple reagent-based tests to very high for complex, integrated laboratory equipment. For instance, adopting a new molecular diagnostic platform might involve considerable upfront investment in hardware, software, and staff retraining, thereby increasing switching costs for laboratories.

- Low switching costs generally increase competitive rivalry in the IVD market.

- High switching costs, such as significant investment in diagnostic platforms, tend to reduce rivalry.

- Switching costs in IVD vary based on equipment complexity and integration needs.

Exit Barriers

High exit barriers can indeed trap companies in unprofitable markets, potentially leading to intensified competition. For Eurobio Scientific, the specialized nature of in vitro diagnostics (IVD) manufacturing, requiring significant investment in research and development, regulatory compliance, and specialized production facilities, likely contributes to these barriers. These factors can make it difficult and costly for firms to divest or shut down operations, potentially keeping even underperforming entities active in the market.

Consider the implications for Eurobio Scientific:

- Specialized Assets: IVD companies often possess unique manufacturing equipment and intellectual property related to specific diagnostic technologies. Divesting these specialized assets can be challenging, as their market value might be limited outside the IVD sector.

- High Fixed Costs: The ongoing costs associated with maintaining regulatory approvals, quality control systems, and specialized personnel in the IVD industry represent substantial fixed expenses. These costs can make exiting the market prohibitively expensive.

- Industry Dynamics: While specific 2024 data on Eurobio Scientific's exit barriers isn't publicly detailed, the broader IVD market in 2024 continued to see consolidation and strategic shifts, underscoring the importance of understanding these cost-intensive exit considerations for any player.

Eurobio Scientific operates in a competitive arena with numerous players, from large global firms to specialized niche companies. This diverse landscape means rivalry is often intense, particularly when competitors offer similar products or services. The semi-consolidated nature of the lab-based IVD market further amplifies this, indicating a significant number of established companies vying for market share.

The company's 2024 performance, showing margin pressure despite market growth, highlights the ongoing competitive intensity. While proprietary products offer some respite through differentiation, the distribution of third-party products often leads to price-driven competition, demanding efficiency in logistics and customer service.

The threat of new entrants is moderate. While the IVD market is growing, the substantial capital investment required for R&D, regulatory approvals, and specialized manufacturing acts as a barrier. For instance, developing and launching a new diagnostic assay can cost millions and take years to navigate complex regulatory pathways, deterring smaller, less-resourced entrants.

However, the existing competitive rivalry is a more immediate concern for Eurobio Scientific. The presence of many competitors, coupled with varying switching costs for customers, means that companies must constantly innovate and maintain competitive pricing. In 2024, the accessibility of alternative diagnostic solutions in the IVD market continued to challenge customer loyalty, making differentiation and value proposition crucial.

SSubstitutes Threaten

The threat of substitutes for Eurobio Scientific is significant, particularly if alternative diagnostic methods or life science research approaches offer comparable or better value at a lower price. For instance, advancements in point-of-care testing or even less invasive diagnostic techniques could draw customers away from Eurobio's more traditional offerings.

In 2024, the market for diagnostic solutions continues to see innovation, with companies exploring novel biomarkers and less complex testing platforms. A key factor for Eurobio Scientific will be its ability to demonstrate a clear price-performance advantage over these emerging alternatives to maintain its competitive edge.

Customers in the diagnostics sector are increasingly open to exploring and adopting novel solutions, even those originating from adjacent or entirely different industries. This willingness is fueled by a constant pursuit of improved diagnostic accuracy, speed, and patient outcomes. For instance, advancements in artificial intelligence are enabling new approaches to image analysis, potentially substituting traditional manual interpretation methods.

Clinical guidelines and robust patient outcome data play a significant role in shaping customer propensities to substitute. When new diagnostic technologies demonstrate superior efficacy or cost-effectiveness, as evidenced by studies published in journals like The Lancet or JAMA, adoption rates tend to accelerate. The drive for faster turnaround times in diagnostics, a key concern for healthcare providers, also pushes customers to consider substitutes that can deliver quicker results.

The relative price of substitutes significantly impacts Eurobio Scientific's market position. If alternative diagnostic solutions become substantially cheaper, even with minor performance differences, customers will likely switch. For instance, in 2024, many healthcare providers faced increased cost pressures, leading to a greater openness to exploring lower-cost diagnostic kits and services, potentially diverting demand from Eurobio Scientific's premium offerings.

Technological Advancements in Other Fields

Rapid advancements in fields like artificial intelligence and direct-to-consumer health technology present significant threats of substitutes for Eurobio Scientific's in-vitro diagnostic (IVD) products. These new technologies could offer alternative methods for achieving diagnostic or research outcomes, potentially bypassing traditional IVD workflows.

For instance, AI-powered diagnostic tools or wearable health trackers that provide real-time health monitoring could emerge as indirect substitutes, diminishing the reliance on laboratory-based IVD tests. The global digital health market was valued at approximately USD 200 billion in 2023 and is projected to grow substantially, indicating a strong trend towards these alternative solutions.

- AI-driven diagnostics: AI algorithms can analyze medical images and patient data to identify diseases, potentially offering faster and more accessible diagnostic pathways.

- Direct-to-consumer (DTC) health tech: Wearable devices and home testing kits, often coupled with digital platforms, provide individuals with direct insights into their health, reducing the need for traditional clinical diagnostics.

- Genomic sequencing advancements: While often complementary, rapid progress in personal genomic sequencing could offer alternative insights into predispositions and disease management, sometimes reducing the need for specific IVD panels.

Regulatory Changes Favoring Substitutes

New regulations or shifts in reimbursement policies can significantly bolster the appeal of substitute diagnostic approaches or research methodologies. For instance, if governmental bodies in key markets like Europe or North America introduce incentives for the adoption of less invasive or more cost-effective testing methods, this directly elevates the threat of substitutes for Eurobio Scientific's current offerings.

The healthcare sector is inherently dynamic, with regulatory landscapes constantly evolving. A notable example from 2024 saw increased scrutiny on certain in-vitro diagnostic (IVD) procedures, prompting some healthcare providers to explore alternative, potentially less regulated, or differently reimbursed pathways. This trend directly impacts companies like Eurobio Scientific, as it can lead to a reallocation of budgets away from their established product lines towards emerging alternatives.

- Regulatory shifts can favor alternative diagnostics

- Reimbursement policy changes can impact adoption rates

- 2024 saw increased regulatory scrutiny on certain IVD procedures

- Companies must adapt to evolving healthcare policies

The threat of substitutes for Eurobio Scientific is amplified by technological advancements in diagnostics and healthcare. Innovations like AI-driven analysis and direct-to-consumer health tech offer alternative pathways that could bypass traditional IVD workflows, potentially reducing reliance on Eurobio's established products. For instance, the global digital health market, valued around USD 200 billion in 2023, highlights a strong shift towards these alternative solutions, posing a significant challenge.

The relative cost and performance of these substitutes are critical factors. If alternative diagnostic solutions become substantially cheaper or offer comparable performance with added convenience, customers are likely to switch. In 2024, heightened cost pressures on healthcare providers made them more receptive to exploring lower-cost diagnostic kits and services, which could divert demand from Eurobio Scientific's offerings.

Regulatory shifts and changes in reimbursement policies can also significantly influence the adoption of substitute diagnostic approaches. For example, in 2024, increased scrutiny on certain in-vitro diagnostic procedures prompted some healthcare providers to explore alternative, potentially less regulated or differently reimbursed pathways, directly impacting Eurobio Scientific's market position.

| Substitute Type | Key Characteristics | Potential Impact on Eurobio Scientific | 2024 Market Trend Example |

|---|---|---|---|

| AI-driven Diagnostics | Faster analysis, increased accessibility | Reduced demand for traditional IVD interpretation | Growing adoption in medical imaging analysis |

| Direct-to-Consumer (DTC) Health Tech | Convenience, personalized health insights | Decreased reliance on clinical diagnostics | Expansion of wearable health trackers and home testing kits |

| Genomic Sequencing Advancements | Prognostic and predictive health information | Potential reduction in need for specific IVD panels | Increased availability and affordability of personal sequencing |

Entrants Threaten

New entrants often struggle to match the cost efficiencies enjoyed by established companies like Eurobio Scientific, particularly when those incumbents benefit from substantial economies of scale. For instance, a new player entering the diagnostics market would find it challenging to achieve the per-unit production costs that Eurobio Scientific likely commands across its four manufacturing sites.

Eurobio Scientific's established infrastructure, including its four production units and a robust distribution network, inherently creates significant economies of scale. This means they can spread fixed costs over a larger output volume, a feat difficult for a new entrant to replicate quickly, thereby posing a barrier to entry based on cost competitiveness.

The In Vitro Diagnostics (IVD) and broader life sciences sectors demand significant upfront capital. Companies need to invest heavily in research and development, establish state-of-the-art manufacturing facilities, navigate complex regulatory approval processes, and build robust sales and distribution networks. For instance, developing a new diagnostic test can cost millions of dollars, and establishing GMP-compliant manufacturing can run into tens or even hundreds of millions.

These substantial capital requirements act as a formidable barrier to entry for potential new competitors. Smaller companies or startups often struggle to secure the necessary funding to compete with established players who already possess these critical infrastructure and R&D capabilities. This financial hurdle effectively limits the number of new entrants that can realistically challenge existing market leaders.

Access to distribution channels presents a significant barrier for new entrants in the diagnostics sector. Established players like Eurobio Scientific have cultivated deep-rooted relationships with hospitals, diagnostic laboratories, and research institutions, often complemented by proprietary distribution networks. Building or acquiring such extensive channels is a substantial undertaking, demanding considerable financial investment and time.

Eurobio Scientific specifically leverages its robust distribution network, which ensures efficient delivery and market penetration. Their strong presence within hospital systems, a key customer segment, further solidifies their market position. For instance, in 2023, Eurobio Scientific reported a significant portion of its revenue derived from its established distribution agreements, underscoring the value of these channels.

Proprietary Product Development and Intellectual Property

Eurobio Scientific's strength in proprietary product development, particularly its diagnostic tests and molecular biology offerings, acts as a significant deterrent to new competitors. Their portfolio, built on substantial research and development, creates a high barrier to entry.

The company holds patents for key technologies and unique product formulations. This intellectual property makes it challenging for new players to replicate Eurobio Scientific's offerings without incurring substantial R&D costs or securing costly licensing agreements. For instance, in 2024, the company continued to invest in its R&D pipeline, aiming to bolster its competitive advantage through innovation.

- Proprietary Diagnostics: Eurobio Scientific develops unique diagnostic tests, a key differentiator.

- Intellectual Property Protection: Patents on technologies and formulations safeguard their market position.

- R&D Investment: Continued investment in research and development in 2024 strengthens their product pipeline and barriers to entry.

- Licensing Requirement: New entrants would likely need to license existing technologies, adding significant cost.

Regulatory Barriers

The in-vitro diagnostics (IVD) and broader life sciences sectors are heavily regulated, presenting a substantial barrier to entry. New companies must invest significantly in time and capital to navigate stringent clinical trial requirements and secure approvals from health authorities like the European Medicines Agency (EMA) or the U.S. Food and Drug Administration (FDA). For instance, obtaining CE marking, a prerequisite for many IVD products in Europe, involves detailed technical documentation and quality management system compliance.

These extensive regulatory processes, including adherence to ISO 13485 quality standards, create high upfront costs and lengthy development timelines. This complexity acts as a powerful deterrent, effectively limiting the influx of new competitors who may lack the resources or expertise to overcome these hurdles. Eurobio Scientific, having already established its presence and compliance within these regulated markets, benefits from this existing barrier.

- Regulatory Hurdles: IVD and life science industries demand rigorous clinical trials and approvals from health authorities.

- Cost and Time Investment: Navigating regulations like CE marking and FDA submissions is both time-consuming and expensive.

- Quality Standards: Adherence to quality management systems, such as ISO 13485, is mandatory and adds to the complexity.

- Established Players Advantage: Companies like Eurobio Scientific that have already met these requirements are protected from new, less-prepared entrants.

New entrants face significant hurdles due to Eurobio Scientific's established economies of scale, proprietary technology, and extensive distribution networks. The high capital requirements for R&D, manufacturing, and regulatory compliance, coupled with the need for deep market access, create substantial barriers.

For instance, in 2024, Eurobio Scientific continued its investment in R&D, aiming to strengthen its product pipeline and intellectual property. The company's four manufacturing sites and robust distribution system allow it to achieve cost efficiencies that are difficult for newcomers to match. Securing the necessary approvals, like CE marking for IVD products, also demands considerable financial and time investment, protecting incumbents.

| Barrier Type | Description | Eurobio Scientific's Advantage |

| Capital Requirements | High upfront investment in R&D, manufacturing, and regulatory compliance. | Existing infrastructure and established R&D capabilities. |

| Economies of Scale | Lower per-unit costs for established players due to high production volumes. | Four manufacturing sites enable cost competitiveness. |

| Proprietary Technology | Patented technologies and unique product formulations. | Intellectual property protects against replication and requires licensing for new entrants. |

| Distribution Channels | Established relationships with hospitals and labs, and proprietary networks. | Deep market penetration and efficient delivery through existing channels. |

| Regulatory Compliance | Stringent requirements for product approvals and quality standards (e.g., CE marking, ISO 13485). | Existing compliance and expertise navigate complex regulatory landscapes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eurobio Scientific is built upon a foundation of robust data, incorporating financial reports, industry-specific market research, and regulatory filings. We also leverage insights from competitor disclosures and trade publications to capture a comprehensive view of the competitive landscape.