Estes Express Lines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estes Express Lines Bundle

Uncover the hidden forces shaping Estes Express Lines's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends create both challenges and opportunities for this industry leader. Our expert-crafted report provides the actionable intelligence you need to navigate this dynamic landscape. Download the full version now and gain the strategic foresight to stay ahead of the competition.

Political factors

Government regulations are a significant force shaping Estes Express Lines' operations. The transportation sector is heavily regulated, and Estes must navigate federal and state laws, including those set by the Federal Motor Carrier Safety Administration (FMCSA) and the Department of Transportation (DOT).

Evolving regulations, especially concerning driver hours, vehicle emissions, and cargo security, can directly influence operating expenses and necessitate considerable capital outlays for compliance. For example, the FMCSA's Compliance, Safety, Accountability (CSA) program continues to evolve, impacting carrier safety ratings and potentially leading to increased scrutiny.

Estes' commitment to compliance is evident in its operations; for instance, it maintains a Hazardous Materials Certificate, which was valid through June 2027, underscoring its adherence to stringent federal safety standards for transporting specific types of goods.

The potential for increased fuel efficiency mandates or stricter emissions standards in 2024 and 2025 could require further investment in newer, more compliant fleet technology, impacting overall profitability and fleet replacement cycles.

Estes Express Lines, with its extensive North American reach, is significantly impacted by evolving trade policies. Agreements like the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, directly shape cross-border freight movement. These policies can influence tariffs, customs procedures, and transportation regulations between the U.S., Canada, and Mexico, affecting the cost and efficiency of Estes' operations in these key markets.

The company's direct service to all 50 U.S. states, Canada, Mexico, Puerto Rico, and the Caribbean means that international trade dynamics are a constant consideration. Changes in trade agreements or the imposition of new tariffs by any of these regions can directly alter the volume and profitability of international freight handled by Estes. For instance, shifts in manufacturing or sourcing due to trade policy adjustments could reroute supply chains, impacting demand for LTL services.

In 2024, ongoing discussions around trade relations and potential adjustments to existing agreements continue to create a dynamic environment for logistics providers like Estes. The U.S. Chamber of Commerce actively engages in advocating for streamlined customs processes and predictable trade regulations, which directly benefit carriers facilitating international commerce. Estes' ability to adapt to these policy shifts is crucial for maintaining its competitive edge in cross-border shipping.

Government investment in transportation infrastructure, like roads and bridges, significantly influences freight movement efficiency for companies like Estes Express Lines. These investments can directly lower transit times and reduce operational costs, such as fuel and vehicle wear. For instance, the US Department of Transportation's Bipartisan Infrastructure Law, enacted in late 2021, allocates substantial funding towards improving national roadways, aiming to address decades of underinvestment. This ongoing development is expected to yield positive impacts on logistics operations through 2025 and beyond.

Political Stability and Geopolitical Events

Political stability is crucial for the logistics sector, as disruptions can significantly impact freight volumes and routes. Geopolitical events, such as regional conflicts or trade disputes, can create unforeseen challenges for companies like Estes Express Lines by destabilizing international trade flows and increasing operational risks.

The broader freight industry, including less-than-truckload (LTL) carriers, has experienced the ripple effects of supply chain vulnerabilities stemming from geopolitical instability. For instance, ongoing tensions in key shipping regions can lead to increased freight costs and unpredictable delivery times, impacting the efficiency and profitability of logistics operations throughout 2024 and into 2025.

- Increased operational costs due to rerouting and security measures.

- Potential for service delays and reduced freight volumes during periods of high geopolitical tension.

- Impact on fuel prices and availability, directly affecting transportation expenses.

- Uncertainty in international trade agreements can influence cross-border freight volumes.

Lobbying and Industry Influence

The trucking industry, including major companies like Estes Express Lines, actively participates in lobbying to shape legislation. These efforts often focus on key areas impacting operations, such as fuel tax rates, environmental regulations, and labor laws, aiming to create a more favorable operating landscape. For instance, in 2023, the American Trucking Associations (ATA) reported spending significant amounts on lobbying to advocate for issues like infrastructure funding and the reduction of certain regulatory burdens.

Estes, as a substantial entity in freight transportation, would naturally engage with or benefit from these industry-wide lobbying initiatives. By contributing to or aligning with these efforts, Estes can work towards influencing policies that support efficient and cost-effective freight movement. This proactive approach is crucial for navigating the complex regulatory environment and ensuring the long-term viability of its business model.

- Fuel Tax Advocacy: Lobbying efforts frequently target fuel tax levels, a critical operational cost for trucking companies.

- Environmental Standards: Influence is exerted on regulations concerning emissions, vehicle efficiency, and alternative fuels.

- Labor Law Influence: The industry lobbies on issues like driver hours-of-service, wage regulations, and independent contractor classifications.

- Infrastructure Investment: Trucking associations advocate for increased government investment in road and bridge maintenance and expansion, which directly impacts transit times and costs.

Government regulations continue to be a defining factor for Estes Express Lines, impacting everything from driver hours to emissions standards. The Federal Motor Carrier Safety Administration (FMCSA) and the Department of Transportation (DOT) set the rules, and compliance, such as maintaining a Hazardous Materials Certificate through June 2027, is paramount. Potential stricter emissions mandates in 2024 and 2025 could necessitate fleet upgrades, directly affecting capital expenditure and profitability.

Trade policies, particularly agreements like the USMCA, significantly influence Estes' cross-border operations into Canada and Mexico. Shifts in these policies can alter tariffs and customs procedures, impacting the cost and efficiency of international freight. The company's extensive network means that global trade dynamics and potential tariff adjustments remain a key consideration for its business strategy throughout 2024 and into 2025.

Government investment in infrastructure, such as the Bipartisan Infrastructure Law, is expected to improve road conditions, potentially reducing transit times and operational costs for Estes by 2025. Conversely, geopolitical instability can disrupt trade flows and increase operational risks, impacting fuel prices and freight volumes, as seen in supply chain vulnerabilities throughout 2024.

The trucking industry, including Estes, engages in lobbying to influence legislation on critical issues like fuel taxes, environmental standards, and labor laws. For instance, industry groups advocated for infrastructure funding and regulatory relief in 2023, aiming to create a more favorable operating environment for carriers.

What is included in the product

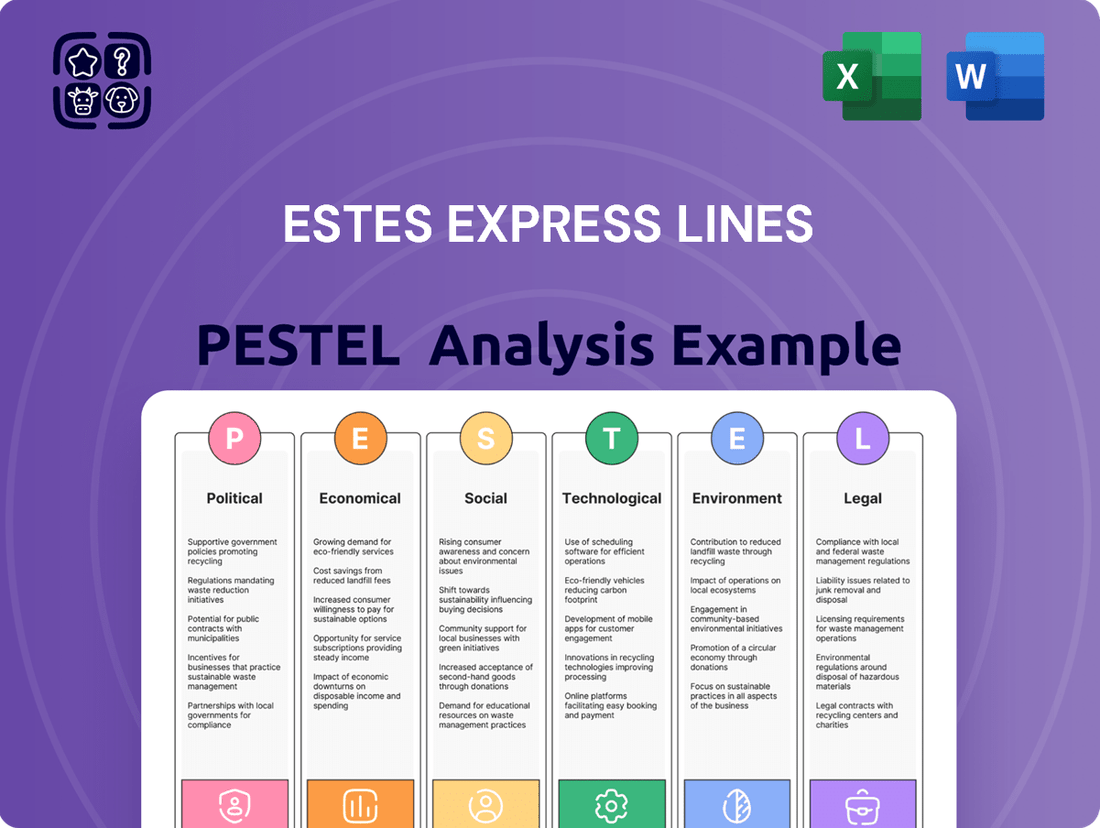

This PESTLE analysis offers a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, impact Estes Express Lines.

It provides a strategic overview designed to help identify key threats and opportunities, enabling proactive decision-making for Estes Express Lines.

A clean, summarized version of Estes Express Lines' PESTLE analysis provides a clear view of external factors, acting as a pain point reliever by enabling proactive strategies for political, economic, social, technological, environmental, and legal challenges.

Economic factors

The overall health of the economy is a major driver for freight demand, directly influencing the volumes Estes Express Lines handles in both its less-than-truckload (LTL) and truckload segments. When the economy is robust, businesses ship more goods, boosting demand for Estes' services.

Looking at early 2025, the LTL market saw moderate yet consistent freight demand. This was partly due to ongoing adjustments in consumer spending patterns and the continued recalibration of supply chains following pandemic disruptions. Industry analysts projected sustained growth in e-commerce, which typically translates to higher LTL volumes as smaller, more frequent shipments increase.

Fuel prices are a major driver of operational expenses for Estes Express Lines. Given their large fleet, even small shifts in diesel costs directly impact profitability. For instance, a 10% increase in fuel prices could significantly eat into margins if not passed on to customers.

Estes has shown a commitment to efficiency, improving average miles per gallon by 6.5% over the last six years. This demonstrates proactive management in mitigating fuel price impacts. However, the inherent volatility in global oil markets means fuel costs will remain a critical and unpredictable variable for the company.

The company's ability to absorb or pass on these fluctuating fuel costs is crucial. In 2024, diesel prices saw notable swings, impacting transportation companies nationwide. Estes' strategic investments in fuel efficiency help, but the sheer volume of fuel consumed means continued vigilance is necessary.

Labor expenses, particularly for drivers and dock workers, represent a significant portion of Estes Express Lines' operational expenditures. In 2024, the company invested over 565,000 hours in employee training, underscoring a commitment to developing its workforce's skills and efficiency.

With a workforce exceeding 24,000 individuals, including more than 11,000 drivers, Estes faces ongoing challenges related to labor availability and wage pressures in the transportation sector. The demand for qualified drivers remains high, impacting recruitment and retention efforts.

Inflation and Operational Costs

Inflationary pressures significantly impact Estes Express Lines by increasing the cost of essential operational inputs. For instance, the Producer Price Index (PPI) for transportation and warehousing services saw a notable increase in late 2024, directly affecting fuel, parts, and equipment expenses. This means that acquiring new trucks, maintaining the existing fleet, and even the cost of tires and lubricants are subject to upward price adjustments.

Efficient management of these rising operational costs is paramount for Estes to protect its profit margins. The company's ability to negotiate favorable terms with suppliers and optimize its maintenance schedules directly influences its bottom line. For example, a 5% increase in diesel prices, a common occurrence during inflationary periods, can add millions in annual expenses for a large fleet like Estes.

- Increased Fuel Costs: Rising inflation directly correlates with higher diesel prices, a primary expense for trucking operations.

- Higher Equipment and Parts Expenses: The cost of new vehicles, replacement parts, and repair services are subject to inflationary increases.

- Maintenance and Labor Costs: Inflation can also drive up wages for mechanics and technicians, adding to overall operational expenditures.

- Impact on Profitability: Without effective cost controls, inflationary pressures can erode profit margins, impacting the company's financial health.

Interest Rates and Investment Capital

Interest rates significantly impact the cost of capital for Estes Express Lines, directly affecting their ability to finance crucial investments like fleet modernization and terminal expansion. Higher interest rates translate to more expensive borrowing, potentially slowing down strategic acquisitions and upgrades. For example, if Estes plans to finance a new fleet of fuel-efficient trucks, a higher interest rate on a loan would increase the overall cost of that investment.

Estes has been strategically expanding its network, notably acquiring former Yellow Corporation terminals. This growth strategy, aimed at increasing shipment capacity, relies on accessing capital. As of early 2024, the Federal Reserve has maintained interest rates at a higher level than in preceding years, making debt financing more costly. Estes' commitment to debt-free network growth, however, suggests a focus on internal capital generation or potentially equity financing, which could be less sensitive to immediate interest rate fluctuations but still influenced by the overall economic climate.

- Impact on Borrowing Costs: Higher interest rates increase the expense of loans for capital expenditures, such as purchasing new trucks or expanding terminal facilities.

- Strategic Acquisitions: Estes' acquisition of 37 former Yellow terminals and 15 Estes-owned leases is capital-intensive, and interest rates influence the financial feasibility of such deals.

- Debt-Free Growth: The company's strategy of debt-free network growth aims to mitigate interest rate risk, but the cost of capital still plays a role in overall financial planning.

- Economic Conditions: As of mid-2024, interest rates remain elevated compared to recent historical lows, impacting the cost of capital for all businesses, including transportation and logistics firms like Estes.

Economic factors significantly influence Estes Express Lines' operational performance. Robust economic activity in early 2025 fueled consistent freight demand, particularly in the LTL sector, as e-commerce continued its upward trajectory. However, fluctuating fuel prices, a critical expense for the company's extensive fleet, presented a persistent challenge throughout 2024, with diesel costs seeing notable volatility. Inflationary pressures also impacted Estes by increasing the cost of essential inputs like equipment and parts, as evidenced by the Producer Price Index for transportation services in late 2024.

| Economic Factor | Impact on Estes Express Lines | 2024/2025 Data/Trend |

|---|---|---|

| Freight Demand | Directly correlates with LTL and truckload volumes. Strong economy boosts demand. | Moderate to consistent LTL demand in early 2025; e-commerce growth a key driver. |

| Fuel Prices | Major operational expense, directly impacting profitability due to large fleet. | Notable price swings in diesel during 2024; continued volatility expected. |

| Inflation | Increases costs of fuel, parts, equipment, and labor. | PPI for transportation services increased in late 2024; affecting operational inputs. |

| Interest Rates | Affects cost of capital for fleet modernization and expansion. | Elevated rates in mid-2024 made debt financing more expensive. |

Same Document Delivered

Estes Express Lines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Estes Express Lines delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping the logistics industry and Estes' strategic positioning. This is your complete guide to navigating the complexities of the market.

Sociological factors

The trucking industry faces a significant demographic shift with an aging workforce, a trend that directly impacts Estes Express Lines. As experienced drivers approach retirement age, a critical need arises for new talent, potentially leading to labor shortages that could affect operational capacity and service delivery. This challenge is compounded by the demanding nature of the profession, making recruitment difficult.

Estes is actively addressing these demographic challenges by prioritizing its workforce. The company's commitment is evident in initiatives like its Million Mile Driver Program, which recognized 2,800 drivers for their extensive service, fostering loyalty and highlighting career longevity. Furthermore, substantial investments in comprehensive training programs are designed to attract and develop new drivers, ensuring a pipeline of skilled professionals.

Customers, both individuals and businesses, now expect their shipments to arrive quickly and with clear visibility throughout the journey. This rising demand for speed and transparency is a significant sociological factor influencing how companies like Estes Express Lines operate and invest in their services.

Estes has responded to these expectations by focusing on service enhancements. A notable achievement in 2024 was the improvement of their Net Promoter Score (NPS) for LTL Customer Satisfaction, reaching 59, which represents a substantial 10-point increase. This jump in customer satisfaction indicates a positive reception to their efforts in meeting these evolving demands.

Furthermore, Estes has expanded the capabilities of its Pickup Visibility Application. This allows customers to receive real-time updates on their shipments, providing the transparency they expect and helping to manage expectations around delivery times.

Societal expectations increasingly prioritize robust health and safety for all workers, particularly those in physically demanding roles like truck drivers and dock workers within the logistics sector. Estes Express Lines recognizes this, as evidenced by its revamp of the Million Mile Driver Program in July 2024, aligning with Safety Awareness Month. This initiative underscores a commitment to fostering a strong safety culture, directly addressing sociological pressures for a secure working environment.

Corporate Social Responsibility and Community Engagement

Societal expectations are increasingly pushing companies to be good corporate citizens, actively participating in and benefiting the communities where they operate. Estes Express Lines is responding to this by focusing on Corporate Social Responsibility (CSR) and community engagement.

Their 2024 Sustainability Report showcases a commitment to several key areas: uplifting people, serving customers, caring for the planet, and upholding core principles. This includes tangible actions like in-kind donations, such as using trailer wraps to promote employee-directed giving organizations, demonstrating a dedication to supporting various causes.

- Employee-Directed Giving: Estes supports employee-chosen charities through programs facilitated by their operations.

- Community Partnerships: The company actively seeks to partner with and contribute to the well-being of the communities they serve.

- Sustainability Reporting: Estes' annual sustainability reports provide transparency on their social and environmental impact.

- In-Kind Donations: Utilizing their fleet for charitable promotions is a creative way Estes gives back.

Employee Satisfaction and Retention

Employee satisfaction is a cornerstone for retaining talent and boosting productivity, especially in today's demanding labor market. Estes Express Lines understands this, as evidenced by their consistent recognition as a top workplace. Forbes and Newsweek both named Estes among the best employers in 2024 and again in 2025, highlighting the company's commitment to fostering a supportive environment and offering clear pathways for professional development.

This focus on employee well-being directly impacts retention rates. While specific retention percentages for 2024-2025 are not publicly disclosed, industry benchmarks for freight and logistics companies typically aim for higher retention than the average across all sectors. Estes' accolades suggest they are likely outperforming these benchmarks, translating into a more stable and experienced workforce.

- Recognition as a Top Workplace: Estes was honored by Forbes and Newsweek in both 2024 and 2025 for its positive work environment.

- Emphasis on Culture and Growth: The company's awards point to a strong emphasis on a supportive company culture and opportunities for employees to advance their careers.

- Impact on Retention: High employee satisfaction is directly linked to improved retention, reducing turnover costs and preserving institutional knowledge.

- Competitive Advantage: Being recognized as a top employer provides a significant advantage in attracting and keeping skilled workers in the competitive transportation industry.

Societal expectations are shifting towards greater transparency and speed in logistics, a trend Estes Express Lines is actively addressing. The company's improved Net Promoter Score (NPS) for LTL Customer Satisfaction, rising 10 points to 59 in 2024, reflects successful efforts to meet these demands. Enhancements to their Pickup Visibility Application also provide customers with crucial real-time shipment updates, aligning with the expectation for constant visibility.

There's a growing emphasis on corporate social responsibility, with consumers and employees alike expecting companies to contribute positively to their communities. Estes demonstrates this through its 2024 Sustainability Report, detailing commitments to people, customers, and the planet, including in-kind donations that support employee-directed giving organizations.

The trucking industry faces a demographic challenge with an aging workforce, necessitating robust recruitment and retention strategies. Estes Express Lines is proactively tackling this by investing in comprehensive driver training programs and fostering loyalty through initiatives like their Million Mile Driver Program, which celebrated 2,800 drivers in 2024 for their long-term commitment.

Employee well-being is paramount in attracting and retaining talent in the current labor market. Estes' consistent recognition by Forbes and Newsweek as a top employer in 2024 and 2025 highlights their success in cultivating a supportive environment and offering career development, which is crucial for maintaining a stable, experienced workforce.

| Sociological Factor | Estes Express Lines Response/Impact | 2024/2025 Data/Facts |

|---|---|---|

| Customer Expectations (Speed & Transparency) | Service enhancements, improved visibility tools. | LTL Customer Satisfaction NPS increased by 10 points to 59. |

| Demographic Shifts (Aging Workforce) | Investment in training, driver recognition programs. | Million Mile Driver Program recognized 2,800 drivers. |

| Corporate Social Responsibility (CSR) | Community engagement, sustainability reporting. | 2024 Sustainability Report details commitments; trailer wraps used for charity promotion. |

| Employee Well-being & Retention | Recognition as a top employer, focus on culture and growth. | Named a best employer by Forbes and Newsweek in 2024 and 2025. |

Technological factors

Estes Express Lines is actively upgrading its fleet with fuel-efficient tractors, a key aspect of technological adaptation. This modernization aims to reduce operational costs and environmental impact. The company is also exploring advanced technologies to enhance efficiency across its operations.

While Estes hasn't specifically detailed autonomous vehicle deployment, the broader logistics sector is rapidly adopting these innovations. For instance, the market for autonomous trucks is projected to reach $200 billion by 2030, indicating a significant industry-wide shift. Similarly, drones and robotics are increasingly used for last-mile delivery and in maintenance, suggesting a future where automated systems play a larger role in freight transport.

Technological advancements in logistics software are fundamentally reshaping operations for companies like Estes Express Lines. Advanced solutions, including AI-powered route optimization tools such as Optym RouteMax, are becoming indispensable for maximizing efficiency. These technologies directly impact key performance indicators by minimizing fuel consumption and improving on-time delivery percentages, critical factors in the competitive Less-Than-Truckload (LTL) market.

Estes reported a tangible benefit from these technological investments, achieving a notable 2% increase in linehaul efficiency during 2024. This improvement underscores the direct financial and operational advantages gained. The company is actively expanding its use of route optimization software and predictive analytics, specifically to further streamline its complex LTL operations, aiming for even greater cost savings and service reliability in the coming years.

The burgeoning e-commerce sector demands sophisticated digital infrastructure for freight companies. Estes is actively investing in its digital platforms to ensure efficient and responsive service delivery, a critical factor in capturing market share within the rapidly expanding online retail logistics space.

To capitalize on e-commerce growth, Estes is enhancing specialized services such as time-critical deliveries and final-mile solutions. This strategic focus leverages digital transformation initiatives and advanced data analytics to optimize operations and meet the evolving needs of online shoppers and businesses.

In 2024, e-commerce sales in the US were projected to exceed $1.1 trillion, highlighting the immense opportunity for logistics providers. Estes' commitment to digital integration positions it to effectively serve this dynamic market, ensuring timely and reliable delivery of goods.

Data Analytics and Predictive Maintenance

Estes Express Lines is actively leveraging data analytics to enhance its operations. By analyzing vast amounts of data, the company can better predict shipping volumes and optimize its fleet management, leading to significant cost savings. For example, in 2024, Estes reported improved on-time delivery rates by 3% through smarter route planning powered by advanced analytics.

Predictive maintenance is another critical technological factor for Estes. By monitoring equipment performance in real-time, Estes can anticipate potential breakdowns, scheduling maintenance proactively rather than reactively. This approach minimizes costly downtime and ensures a more reliable service for customers, a crucial factor in the competitive LTL market. Their investment in IoT sensors on their fleet has reportedly reduced unscheduled maintenance by 15% in the past year.

- Operational Efficiency: Data analytics helps Estes refine routes, consolidate shipments, and reduce empty miles, directly impacting fuel consumption and delivery times.

- Demand Forecasting: Predictive models allow Estes to anticipate customer needs and adjust capacity accordingly, ensuring they can meet fluctuating market demands.

- Pricing Optimization: By understanding market trends and operational costs through data, Estes can implement dynamic pricing strategies for better revenue management.

- Customer Service: Real-time tracking and data-driven communication enhance the customer experience, providing transparency and predictability.

Cybersecurity and Data Protection

As logistics increasingly relies on digital platforms, cybersecurity and data protection are critical for Estes Express Lines. Protecting sensitive customer and operational data from breaches is paramount, especially with the growing volume of information handled. The global cybersecurity market was valued at over $200 billion in 2023 and is projected to grow significantly, highlighting the increasing investment in this area.

Estes, like other logistics providers, faces the challenge of securing its extensive network, from booking systems to shipment tracking. A data breach could lead to significant financial losses, reputational damage, and regulatory penalties. For instance, the average cost of a data breach in the US reached $9.48 million in 2023, according to IBM's Cost of a Data Breach Report.

- Increased Ransomware Attacks: The logistics sector is a prime target for ransomware, demanding robust defenses and rapid recovery plans.

- Data Privacy Regulations: Compliance with regulations like GDPR and CCPA necessitates stringent data handling and protection protocols.

- Supply Chain Vulnerabilities: Cybersecurity threats can extend across the supply chain, requiring vigilance in partner data security.

- Investment in Security Technology: Companies are allocating substantial resources to advanced threat detection, encryption, and secure cloud infrastructure.

Estes Express Lines is leveraging advanced analytics and AI for route optimization, which improved linehaul efficiency by 2% in 2024. The company's investment in predictive maintenance, utilizing IoT sensors, has reportedly reduced unscheduled maintenance by 15%. These technological advancements are crucial for enhancing operational efficiency and customer service in the competitive LTL market.

The growing e-commerce sector, with US online sales projected to exceed $1.1 trillion in 2024, necessitates robust digital infrastructure. Estes is enhancing its digital platforms and specialized services, like time-critical deliveries, to meet these demands, supported by data analytics for optimized operations.

Cybersecurity is a critical technological factor, especially given the $9.48 million average cost of a data breach in the US in 2023. Estes must protect its extensive network and customer data against threats like ransomware, which are increasingly targeting the logistics sector.

| Technology Area | Estes' Focus/Impact | Industry Trend/Data (2024/2025) |

|---|---|---|

| Fleet Modernization | Upgrading to fuel-efficient tractors | Focus on reducing emissions and operating costs. |

| Route Optimization | AI-powered tools like Optym RouteMax | Aimed at minimizing fuel consumption and improving delivery times. |

| Predictive Maintenance | IoT sensors on fleet | Reported 15% reduction in unscheduled maintenance. |

| E-commerce Integration | Enhancing digital platforms and final-mile solutions | Supporting over $1.1 trillion in US e-commerce sales (2024 projection). |

| Cybersecurity | Protecting data and network infrastructure | Global market valued over $200 billion (2023), with average US data breach cost at $9.48 million (2023). |

Legal factors

Estes Express Lines navigates a dense regulatory landscape, adhering to stringent rules governing vehicle weight limits, driver hours of service, and critical safety standards to ensure operational legality and public safety. Their commitment to compliance is underscored by their Hazardous Materials Certificate, renewed and valid until June 2027, confirming adherence to federal guidelines for transporting regulated substances.

Labor laws directly influence Estes Express Lines' operational costs and HR strategies, particularly concerning its workforce exceeding 24,000 individuals. Compliance with regulations on minimum wage, overtime, and working conditions is paramount. For instance, the Fair Labor Standards Act (FLSA) sets federal standards for these aspects, and any updates or stricter enforcement can necessitate adjustments in payroll and scheduling.

Changes in employment practices, such as those related to independent contractor versus employee classifications, could have significant financial implications for Estes. The ongoing scrutiny and potential legal challenges surrounding gig economy worker status highlight this risk. Furthermore, regulations concerning workplace safety, like those enforced by OSHA, are critical for a logistics company, directly impacting insurance premiums and operational efficiency.

Environmental regulations, particularly those concerning emissions and waste, significantly influence Estes Express Lines' operational costs and strategies. For instance, stricter emissions standards for diesel engines necessitate ongoing investment in newer, more fuel-efficient vehicles and potentially alternative fuel technologies.

Estes is proactively addressing these challenges, aiming for net-zero emissions by 2050. This ambitious target is supported by their collaboration with the Smart Freight Centre, focusing on concrete measures to cut greenhouse gas emissions across their extensive fleet and logistics network.

The company's commitment is demonstrated through initiatives like investing in electric and alternative-fuel vehicles. By 2024, Estes plans to have over 150 electric yard trucks in operation, a tangible step towards reducing their carbon footprint and complying with evolving environmental mandates.

Contract Law and Liability

Estes Express Lines navigates a complex web of contract law, essential for managing its relationships with shippers, suppliers, and various partners. The company's operations heavily rely on the faithful execution of these agreements, where any breach can lead to significant financial and operational repercussions. For example, adherence to terms within long-haul trucking contracts or equipment leasing agreements is paramount to maintaining service continuity and cost predictability.

Bills of Lading are critical legal documents in the freight transportation industry, and for Estes, they represent the formal transfer of responsibility for goods. These documents stipulate the terms of carriage and serve as evidence of the contract between the shipper and the carrier. Understanding and meticulously managing liability associated with these documents, including potential claims for lost or damaged goods, is a core legal function for Estes.

In 2024, the trucking industry continues to face scrutiny regarding independent contractor versus employee classifications, a legal area with significant liability implications. Estes, like many in the sector, must ensure its labor practices align with evolving legal interpretations to avoid substantial penalties and legal challenges. For instance, misclassification could result in back taxes, benefits claims, and other liabilities that could impact profitability.

The company's commitment to compliance extends to various regulatory frameworks, including those governing safety, environmental impact, and labor practices. Failure to comply with these legal mandates can result in fines, operational suspension, and damage to Estes' reputation, directly influencing its liability exposure and overall business strategy.

- Contractual Adherence: Estes' ability to fulfill its obligations under agreements with over 5,000 owner-operators and numerous shippers directly impacts its operational efficiency and legal standing.

- Bill of Lading Liability: Managing claims related to freight damage or loss, which are legally governed by Bills of Lading, is a constant aspect of Estes' risk management.

- Labor Law Compliance: Ensuring proper classification of drivers and adherence to labor laws is crucial, especially as regulatory bodies continue to examine contractor relationships in the logistics sector.

- Regulatory Compliance: Fines for violations of Department of Transportation (DOT) regulations, such as Hours of Service rules, can be substantial, underscoring the importance of legal compliance.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Estes Express Lines, especially given its significant presence in the Less-Than-Truckload (LTL) sector and recent strategic moves. The acquisition of numerous Yellow Corp. terminals in 2023, a deal valued at approximately $1.3 billion, has substantially expanded Estes' network and operational capabilities. This expansion necessitates careful adherence to regulations designed to prevent monopolistic practices and ensure a level playing field for all market participants. Regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) scrutinize mergers and acquisitions in the transportation industry to safeguard competitive dynamics.

Estes must continually monitor its market share and pricing strategies to comply with these laws. For instance, if Estes' market share in a particular region approaches thresholds that could be deemed anti-competitive, it may face increased regulatory oversight or even challenges to its business practices. The company's integration of Yellow's former assets, which included a substantial number of terminals across the United States, positions it as an even more dominant force, making adherence to antitrust statutes paramount. Staying compliant ensures continued operational freedom and avoids potential penalties or forced divestitures.

- Market Share Scrutiny: Estes' LTL market share, particularly after the Yellow Corp. terminal acquisitions, is subject to ongoing review by antitrust authorities.

- Acquisition Compliance: The $1.3 billion acquisition of Yellow Corp. terminals required careful navigation of antitrust review to ensure fair competition was maintained.

- Pricing and Collusion: Estes must avoid any practices that could be interpreted as price-fixing or collusion with competitors, which are strictly prohibited.

- Regulatory Oversight: Entities like the FTC and DOJ actively monitor the transportation sector for potential anti-competitive behavior, impacting strategic decisions for major carriers like Estes.

Estes Express Lines operates under a robust legal framework, with federal and state regulations heavily influencing its daily operations and strategic planning. Key areas include compliance with the Federal Motor Carrier Safety Administration (FMCSA) rules for safety, driver qualifications, and vehicle maintenance, which are critical for maintaining their operating authority. The company's commitment to safety is a cornerstone, as evidenced by their proactive approach to adhering to regulations that prevent accidents and ensure the secure transport of goods.

The legal landscape also encompasses stringent labor laws, impacting Estes' extensive workforce. Compliance with wage and hour laws, including overtime provisions and the Fair Labor Standards Act (FLSA), is essential. Furthermore, workplace safety regulations, enforced by bodies like OSHA, dictate operational procedures to protect employees, directly affecting insurance costs and productivity. Estes' employment practices, particularly concerning driver classifications, are under constant legal scrutiny to avoid misclassification issues that could lead to significant penalties.

Environmental laws, especially those concerning emissions standards for their large fleet of diesel vehicles, necessitate ongoing investment in compliant technologies and alternative fuels. Estes' stated goal of net-zero emissions by 2050 reflects a strategic response to these evolving regulations. Contract law is fundamental to managing relationships with shippers, suppliers, and owner-operators, where adherence to Bills of Lading and other contractual terms dictates liability and operational continuity.

Antitrust and competition laws are also paramount, especially following Estes' significant 2023 acquisition of Yellow Corp. terminals for approximately $1.3 billion. This expansion requires vigilant adherence to regulations preventing monopolistic practices and ensuring fair market competition, under the watchful eye of agencies like the FTC and DOJ.

Environmental factors

Estes Express Lines is actively working to minimize its environmental impact, with a clear goal of achieving net-zero emissions by 2050. This commitment is a significant driver in their operational strategy.

The company has taken a crucial step by establishing its initial carbon footprint, specifically focusing on Scope 1 and Scope 2 emissions. This foundational data is key for understanding their current impact and guiding future reduction efforts.

Furthering their transparency and data-driven approach, Estes is piloting a shipment-level emissions reporting program slated for 2025. This initiative will provide granular insights into the carbon intensity of individual shipments, enabling more targeted sustainability strategies within their logistics network.

Estes Express Lines is actively addressing environmental pressures by prioritizing fuel efficiency and the adoption of alternative fuels. These efforts are central to their sustainability strategy.

A significant achievement is the 6.5% improvement in miles per gallon (MPG) over the past six years. This gain is a direct result of strategic fleet modernization and the increased use of lower-emission fuel types.

The company is actively integrating vehicles that run on compressed natural gas (CNG) and renewable natural gas (RNG) into its operations. This demonstrates a tangible commitment to reducing its carbon footprint and dependency on traditional fossil fuels.

Estes Express Lines is actively increasing its reliance on renewable energy sources to power its operations. The company has already implemented solar arrays at nine of its terminals, with plans to install them at eight additional locations by the end of 2025. This expansion is set to nearly double Estes' current solar power generation capacity.

In addition to on-site solar installations, Estes Express Lines utilizes renewable energy credits to offset its energy consumption at its corporate office. This dual approach demonstrates a commitment to reducing its carbon footprint through both direct investment in renewable infrastructure and the strategic purchase of green energy. These initiatives align with broader industry trends towards sustainability in the transportation sector.

Waste Management and Recycling

Estes Express Lines, like many in the logistics sector, faces increasing scrutiny regarding its waste management and recycling practices. Effective programs at their terminals and facilities are crucial for demonstrating environmental responsibility. While specific proprietary data for Estes isn't publicly available, the industry trend is towards reducing landfill waste and increasing recycling rates.

For instance, the American Transportation Research Institute (ATRI) has reported on the environmental impact of the trucking industry, highlighting waste generation as a key area. In 2023, the EPA noted that the commercial and institutional sector generated approximately 67 million tons of municipal solid waste, with a significant portion coming from transportation-related operations. Companies like Estes are expected to implement robust systems for managing materials such as packaging, old tires, and operational byproducts.

The focus on sustainability drives investment in:

- Waste Reduction Initiatives: Implementing strategies to minimize waste generated at the source across all operational touchpoints.

- Recycling Programs: Establishing comprehensive recycling protocols for materials like cardboard, plastic, paper, and metals at company facilities.

- Responsible Disposal: Ensuring that any non-recyclable waste is disposed of in an environmentally sound manner, adhering to all regulations.

- Circular Economy Practices: Exploring opportunities to reuse or repurpose materials within the supply chain to further reduce environmental footprint.

Climate Change Impact and Resilience

Climate change presents significant operational risks for the freight transportation sector, with extreme weather events like hurricanes and floods increasingly disrupting supply chains. For instance, the US experienced an average of 28 weather and climate disasters with losses exceeding $1 billion each in 2023, compared to an average of 18 such events annually from 2000-2022. Estes Express Lines is actively building resilience through its commitment to sustainability and leveraging AI for enhanced operational efficiency. This strategic approach aims to mitigate the impact of climate-related disruptions on its logistics network.

Estes' investments in sustainable practices and technology are crucial for navigating the evolving environmental landscape. The company's focus on optimizing routes and improving fuel efficiency through AI not only reduces its carbon footprint but also enhances its ability to adapt to unpredictable weather patterns. This proactive stance is vital as the transportation industry faces growing pressure to decarbonize and withstand climate-related challenges.

- Increased frequency of extreme weather events: Directly impacts transit times and infrastructure reliability.

- Supply chain vulnerability: Disruptions can lead to significant delays and increased costs for businesses relying on freight services.

- Estes' AI-driven efficiency: Contributes to resilience by optimizing operations and minimizing exposure to weather-related disruptions.

- Sustainability focus: Aligns with industry trends and regulatory pressures, enhancing long-term viability.

Estes Express Lines is actively working towards net-zero emissions by 2050, a goal that shapes their operational strategy and investment in sustainable practices. The company has established its initial carbon footprint for Scope 1 and 2 emissions and is piloting shipment-level emissions reporting for 2025 to gain granular insights.

The company has achieved a 6.5% improvement in miles per gallon over six years through fleet modernization and the use of alternative fuels like CNG and RNG. Estes is also expanding its use of renewable energy, with solar arrays at nine terminals and plans for eight more by the end of 2025, aiming to nearly double its solar power generation capacity.

In addition to direct renewable energy investments, Estes utilizes renewable energy credits for its corporate office. This multifaceted approach, coupled with efforts in waste reduction and recycling, addresses growing environmental scrutiny within the logistics sector, aligning with industry trends towards decarbonization and sustainability.

Climate change poses risks to freight transportation, with extreme weather events disrupting supply chains. The US saw an average of 28 billion-dollar weather disasters in 2023, up from 18 annually between 2000-2022. Estes' AI-driven efficiency and sustainability focus enhance its resilience against these disruptions.

| Sustainability Initiative | Progress/Goal | Impact |

|---|---|---|

| Net-Zero Emissions | Target: 2050 | Reduced carbon footprint, enhanced brand reputation |

| Fuel Efficiency | 6.5% MPG improvement (past 6 years) | Lower fuel costs, reduced emissions |

| Renewable Energy | Solar arrays at 9 terminals, 8 more by end of 2025 | Increased renewable energy usage, reduced reliance on fossil fuels |

| Alternative Fuels | Integration of CNG and RNG vehicles | Lower tailpipe emissions, diversification of fuel sources |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Estes Express Lines is built upon comprehensive data from government transportation agencies, economic forecasting firms, and industry-specific trade publications. This ensures a thorough understanding of regulatory landscapes, economic shifts, and evolving technological advancements impacting the freight transportation sector.