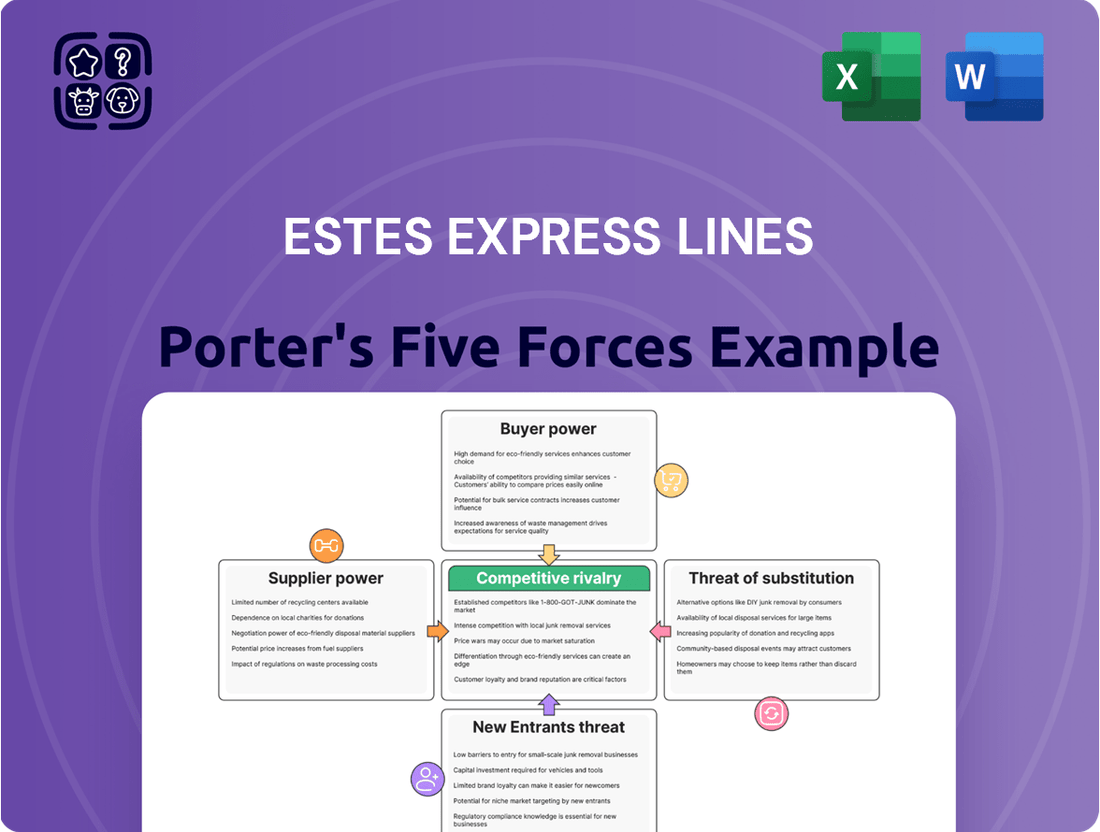

Estes Express Lines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estes Express Lines Bundle

Estes Express Lines operates within a competitive landscape shaped by several key forces. Understanding the intensity of rivalry among existing carriers, the bargaining power of both customers and suppliers, and the threat of new entrants or substitute services is crucial for strategic planning. While Estes likely enjoys a strong market position, a deeper dive into each of these pressures reveals nuanced challenges and opportunities.

The complete report reveals the real forces shaping Estes Express Lines’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The less-than-truckload (LTL) sector, which Estes Express Lines operates within, is notably dependent on a concentrated group of suppliers providing critical equipment like heavy-duty trucks and trailers. These manufacturers, producing specialized and capital-intensive assets, often wield considerable influence over pricing and terms. This limited supplier base can restrict Estes' choices for acquiring and maintaining its fleet.

For instance, the heavy-duty truck market, a cornerstone for LTL operations, is dominated by a few major players. In 2024, major truck manufacturers like Daimler Truck North America (which includes Freightliner) and PACCAR (maker of Kenworth and Peterbilt) continued to hold significant market share, making it challenging for large fleet operators like Estes to find readily available, cost-effective alternatives if negotiations falter. The specialized nature of freight transport equipment, requiring specific engineering for durability and efficiency, further solidifies the bargaining power of these key suppliers.

The availability of substitutes for critical inputs plays a vital role in assessing supplier bargaining power. For a company like Estes Express Lines, while numerous manufacturers produce trucks and trailers, the specialized nature of heavy-duty, reliable fleet equipment means the pool of truly suitable substitutes is smaller.

Top-tier suppliers offering consistent quality, robust maintenance networks, and proven reliability are essential for minimizing downtime, a critical factor in the logistics industry. Estes, like many large carriers, likely relies on established relationships with a few key manufacturers to ensure operational continuity.

Switching between these major truck and trailer suppliers can involve substantial costs. These include expenses for retraining mechanics on new equipment specifications, retooling maintenance bays, standardizing spare parts inventory, and integrating new vehicle technologies with existing fleet management systems. These switching costs can significantly reduce the perceived availability of viable substitutes and thus bolster the bargaining power of incumbent suppliers.

The persistent truck driver shortage across North America is a major force amplifying the bargaining power of labor, especially for experienced Less-Than-Truckload (LTL) drivers. This scarcity means companies like Estes must contend with escalating recruitment expenses, upward pressure on wages, and greater difficulty in retaining their drivers. For instance, in 2023, the American Trucking Associations reported a shortage of over 78,000 drivers, a figure that has continued to be a significant concern into 2024, directly impacting operational costs and the ability to meet service demands.

Fuel Costs and Energy Suppliers

Fuel costs represent a significant operational expenditure for freight carriers like Estes Express Lines. Fluctuations in global oil prices, heavily influenced by geopolitical events and market dynamics, directly impact profitability. Estes, like many in the industry, acts as a price-taker for fuel, meaning they have limited ability to control the cost of this essential commodity.

While Estes can implement fuel surcharges to pass on some of the increased costs to customers, these mechanisms may not always fully compensate for rapid or sustained price volatility. For instance, in early 2024, diesel prices saw considerable swings. The average on-highway diesel price in the U.S. hovered around $4.00 per gallon, with some regions experiencing higher costs due to supply chain issues or regional demand spikes, impacting margins for carriers who cannot immediately adjust their surcharges.

- Major Expense: Fuel is a primary cost driver for Estes, directly affecting operational margins.

- Price-Taker Status: Estes has minimal control over global fuel prices, which are dictated by broader market forces.

- Surcharge Limitations: Fuel surcharges help mitigate price hikes but might not fully cover unpredictable cost increases.

- Market Influence: Geopolitical factors and global energy markets significantly determine the cost of fuel for the company.

Technology and Software Providers

Technology and software providers hold significant bargaining power over Estes Express Lines, especially as the company ramps up its investment in advanced systems. Estes' commitment to AI for route optimization and predictive analytics means that specialized providers of these solutions can command higher prices and more favorable terms. In 2024, the demand for such sophisticated logistics software saw a notable increase, with many trucking companies investing heavily to improve operational efficiency.

The leverage of these suppliers is further amplified when their proprietary technologies offer unique competitive advantages that are difficult for Estes to replicate. For instance, advanced freight management systems that integrate seamlessly with existing infrastructure and provide real-time visibility are highly sought after. The market for these specialized tech solutions is often concentrated, with a limited number of providers dominating, thereby increasing their negotiating strength.

- Increased Reliance: Estes' growing dependence on AI and advanced analytics for operational efficiency strengthens the bargaining power of technology and software vendors.

- Proprietary Solutions: Providers of unique, hard-to-replicate software offer significant leverage due to the competitive advantages they enable for Estes.

- Market Concentration: A limited number of specialized providers in key technology areas can dictate terms due to reduced competition among suppliers.

- Investment Trends: In 2024, the logistics sector saw substantial investment in digital transformation, increasing demand and thus the power of tech suppliers.

The bargaining power of suppliers for Estes Express Lines is considerable, particularly from truck manufacturers and technology providers. The limited number of heavy-duty truck manufacturers, like Freightliner and Peterbilt, means Estes has fewer options for fleet acquisition, allowing these suppliers to influence pricing and terms. Similarly, specialized logistics software and AI solutions are often provided by a concentrated group of firms, enhancing their leverage, especially as Estes invests more in these areas for operational efficiency.

| Supplier Type | Key Suppliers (Examples) | 2024 Market Dynamics | Impact on Estes |

|---|---|---|---|

| Heavy-Duty Truck Manufacturers | Daimler Truck North America (Freightliner), PACCAR (Kenworth, Peterbilt) | Dominated by a few major players, limited availability of specialized equipment. | Reduced negotiation flexibility, potential for higher capital expenditure. |

| Logistics Software & AI Providers | Specialized tech firms offering route optimization, predictive analytics. | Increased demand for advanced logistics tech, concentrated market for unique solutions. | Higher software costs, reliance on proprietary systems for competitive edge. |

What is included in the product

This Porter's Five Forces analysis for Estes Express Lines dissects the competitive intensity within the Less-Than-Truckload (LTL) trucking industry, examining buyer and supplier power, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Estes Express Lines' Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making and identifying key areas of focus.

Customers Bargaining Power

Estes Express Lines benefits from serving a diverse array of industries, which naturally spreads its customer base. This broad reach means that no single customer typically holds overwhelming leverage. For instance, while a large automotive manufacturer might represent a significant portion of freight, Estes's overall business isn't solely dependent on it.

However, the sheer volume of goods that major shippers move can still grant them considerable bargaining power. Companies like Amazon, a major player in e-commerce and a significant customer for many logistics firms, can negotiate better pricing due to the immense scale of their shipping needs. This is a constant dynamic in the freight industry.

The evolving landscape of e-commerce further influences customer power. The increasing trend towards smaller, more frequent shipments from a multitude of online retailers means Estes handles a larger volume of individual transactions. While each transaction is small, the aggregate volume can still be a point of negotiation for larger e-commerce platforms.

While customers can switch Less Than Truckload (LTL) carriers, these transitions aren't always seamless. Integrating a new carrier's systems, retraining staff on new procedures, and establishing fresh working relationships all represent tangible switching costs. These factors can make a complete change more burdensome than a simple price comparison.

Estes Express Lines benefits significantly from its established reputation for dependable service. High customer satisfaction ratings, consistently reported in industry surveys, act as a powerful deterrent against switching. Customers often prioritize reliability and service quality over minor price differences, especially when their own supply chains depend on it.

In the highly competitive Less-Than-Truckload (LTL) sector, customers typically exhibit significant price sensitivity, particularly for routine shipping needs where distinguishing features are scarce. This sensitivity is amplified in the current freight landscape, marked by a gradual and uneven economic recovery and prevailing uncertainties. Shippers are actively pursuing the most cost-effective options, intensifying their focus on competitive pricing structures offered by carriers like Estes Express Lines.

Availability of Alternative Carriers

The availability of alternative carriers significantly impacts the bargaining power of customers in the Less-Than-Truckload (LTL) sector, where Estes Express Lines operates. While the LTL market is relatively consolidated, it still includes several substantial players. Companies like Old Dominion Freight Line, XPO Logistics, and Saia Inc. offer customers choices, preventing any single carrier from dictating terms. This competitive landscape means customers can often negotiate pricing or service levels based on readily available alternatives.

The recent acquisition of Yellow Corporation's terminals by various carriers, notably including Estes, has indeed reshaped capacity across the industry. However, this consolidation has largely benefited customers by redistributing assets and maintaining a competitive environment. For instance, Old Dominion acquired 22 Yellow locations, XPO took 20, and Saia secured 17, among others. This redistribution ensures that customers still have multiple viable options for their LTL shipping needs, thereby enhancing their bargaining power.

- Market Players: Key competitors like Old Dominion, XPO Logistics, and Saia Inc. provide customers with multiple LTL carrier choices.

- Capacity Redistribution: Acquisitions of Yellow's terminals by major carriers, including Estes, have maintained a competitive, multi-option environment for shippers.

- Customer Choice: The presence of several strong LTL providers allows customers to compare services and pricing, increasing their negotiation leverage.

- Competitive Pricing: The availability of alternatives encourages competitive pricing strategies among carriers, benefiting the end customer.

Threat of Backward Integration by Customers

The threat of customers integrating backward to perform LTL services themselves is generally low for Estes Express Lines. Building and managing an in-house Less Than Truckload (LTL) fleet is incredibly capital-intensive and operationally complex, requiring significant investment in trucks, trailers, maintenance facilities, and advanced tracking technology. For instance, the average cost of a new Class 8 truck can range from $120,000 to $180,000, and a fleet of any significant size quickly escalates into millions of dollars in upfront capital.

While some very large retailers or manufacturers with consistent, high-volume shipping needs on specific lanes might consider private fleets, this rarely covers the breadth of services an LTL carrier like Estes provides. These specialized private fleets often lack the flexibility and network reach to handle diverse shipping requirements, including less predictable volumes and varied destinations that LTL specialists are equipped for. The technological sophistication and specialized expertise in route optimization, freight consolidation, and regulatory compliance that Estes offers are difficult and costly for most customers to replicate internally.

- Capital Investment: Owning and maintaining an LTL fleet requires substantial upfront capital for vehicles, equipment, and infrastructure, often running into millions for even a moderate-sized operation.

- Operational Complexity: Managing fleet operations, including maintenance, driver recruitment and retention, regulatory compliance, and route planning, demands specialized expertise that most shippers do not possess.

- Network and Technology: LTL carriers like Estes have built extensive networks and invested heavily in technology for tracking, efficiency, and customer service, which are difficult for individual customers to match.

- Economies of Scale: Estes benefits from economies of scale in purchasing, maintenance, and operations, making its services more cost-effective than what most individual customers could achieve by going in-house.

Customers in the Less-Than-Truckload (LTL) sector, where Estes Express Lines operates, possess considerable bargaining power due to price sensitivity and the availability of numerous alternatives. The competitive landscape, featuring major players like Old Dominion Freight Line, XPO Logistics, and Saia Inc., means shippers can readily compare services and negotiate favorable terms. This dynamic is further influenced by the redistribution of capacity following Yellow Corporation's operational changes, which has maintained a robust environment of choice for customers, thereby amplifying their leverage in pricing and service negotiations.

| Competitor | Market Share (Est. 2024) | Key Services |

|---|---|---|

| Old Dominion Freight Line | ~10-12% | LTL, supply chain services |

| XPO Logistics | ~8-10% | LTL, truck brokerage, intermodal |

| Saia Inc. | ~6-8% | LTL, non-asset based brokerage |

| Estes Express Lines | ~9-11% | LTL, dedicated services, logistics |

Same Document Delivered

Estes Express Lines Porter's Five Forces Analysis

This preview shows the exact Estes Express Lines Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It meticulously examines the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the trucking industry. This comprehensive analysis provides actionable insights into the strategic positioning of Estes Express Lines.

Rivalry Among Competitors

The Less-Than-Truckload (LTL) sector, where Estes Express Lines operates, features a concentrated competitive environment. A handful of large, established national and super-regional carriers dominate the market. Key players include Old Dominion Freight Line, XPO Logistics, Saia, and ABF Freight, all vying for market share.

Estes Express Lines itself stands as North America's largest privately owned freight carrier, underscoring the significant presence of major entities. This concentration means that competition is often fierce, with these established players leveraging extensive networks and substantial resources to serve customers across the continent.

The global Less-Than-Truckload (LTL) market is anticipated to expand at a compound annual growth rate of 5.3% from 2025 through 2034. This growth is largely fueled by the ongoing expansion of e-commerce and a rising demand from small and medium-sized enterprises (SMEs). Such a growth trajectory indicates a market with moderate expansionary potential.

While this growth can somewhat temper the intensity of competitive pressures, it's important to note that periods characterized by weaker freight volumes or general economic uncertainty can significantly amplify rivalry among industry players. Estes Express Lines operates within this dynamic environment.

While the fundamental less-than-truckload (LTL) service can appear similar across competitors, differentiation is key in this market. Carriers distinguish themselves through superior service quality, the breadth and efficiency of their distribution networks, and their investment in advanced technology. Estes Express Lines, for instance, actively focuses on delivering exceptional customer service and maintaining high on-time performance metrics to set itself apart.

Beyond basic LTL, companies compete by offering specialized services. These can include expedited or time-critical delivery options for urgent shipments, and more complex final-mile solutions tailored for specific industries or customer needs. Estes invests in these advanced capabilities, alongside its robust network, to provide a more comprehensive and attractive offering to a wider range of clients.

Exit Barriers

The less-than-truckload (LTL) shipping industry, where Estes Express Lines operates, presents substantial exit barriers. These are primarily driven by the immense capital required to establish and maintain the necessary infrastructure.

Companies need significant investments in terminals, a large fleet of trucks and trailers, and an extensive logistics network. This high fixed-cost structure makes it difficult for firms to simply shut down operations without incurring massive losses.

A stark example of these challenges was the 2023 bankruptcy of Yellow Corporation, a major LTL carrier. Following its collapse, Yellow's assets, including its terminals and equipment, were auctioned off. This event highlighted how exiting the market is not a clean break; instead, assets are often absorbed by surviving competitors, effectively reinforcing the market for those who remain.

The absorption of Yellow's assets by companies like XPO, Saia, and Estes itself demonstrates a consolidation driven by exit barriers, allowing stronger players to expand their networks and market share.

- High Capital Investment: The LTL sector demands significant upfront and ongoing capital for terminals, vehicles, and technology.

- Network Specificity: A well-developed route network is a critical asset that is difficult to replicate or sell off piecemeal.

- Brand and Reputation: Established relationships and a strong brand are hard to divest in a way that recoups initial investment.

- Labor Commitments: Unionized workforces and specialized drivers represent significant ongoing obligations.

Strategic Commitments and Acquisitions

Estes Express Lines is demonstrating aggressive strategic commitments, notably through its acquisition of former Yellow Corporation terminals. This move, alongside significant investments in its network and fleet expansion, directly signals a push to increase capacity and broaden market reach. For instance, Estes acquired 16 former Yellow terminals in October 2023, a substantial investment in physical infrastructure.

This proactive expansion by Estes is met with similar strategic maneuvers from its competitors. Companies like TForce Freight and XPO Logistics are also investing heavily in network upgrades and fleet modernization to maintain or grow their market share. This parallel investment strategy intensifies the rivalry, creating a dynamic environment where competition for available capacity and customer contracts is particularly fierce.

- Estes Express Lines acquired 16 terminals from Yellow Corporation in late 2023.

- This acquisition is part of a broader strategy to enhance network density and service capabilities.

- Competitors are also engaged in substantial capital expenditures to bolster their own networks and fleets.

- The collective strategic commitments lead to heightened competition for market share and operational capacity.

The competitive rivalry within the LTL sector is intense, driven by a few dominant players like Old Dominion, XPO, and Saia, alongside Estes itself. These carriers compete fiercely on service quality, network reach, and technological advancements. Estes' acquisition of 16 former Yellow terminals in late 2023 illustrates this aggressive competition for infrastructure and market share.

The market's growth potential, projected at 5.3% annually through 2034, offers room for expansion but also amplifies competition during economic downturns. Differentiation through specialized services, like expedited delivery, is crucial. For example, Estes focuses on high on-time performance to stand out.

| Competitor | Key Strategic Move (Late 2023/Early 2024) | Focus Area |

|---|---|---|

| Estes Express Lines | Acquired 16 former Yellow terminals | Network expansion, capacity enhancement |

| XPO Logistics | Investments in network upgrades and fleet modernization | Operational efficiency, service quality |

| Saia | Continued network expansion and service improvements | Market share growth, customer acquisition |

| TForce Freight | Substantial capital expenditures on fleet modernization | Reliability, technological integration |

SSubstitutes Threaten

Full Truckload (FTL) shipping presents a significant threat to Less Than Truckload (LTL) carriers like Estes Express Lines, especially for larger shipments that can fill an entire trailer. FTL can offer a direct, often faster, and sometimes more cost-effective solution for these bulk movements compared to consolidating multiple smaller LTL shipments. In 2024, the demand for FTL services remained robust, driven by e-commerce growth and supply chain efficiencies, though capacity constraints and driver shortages continued to influence pricing.

However, FTL is less suitable for the smaller, fragmented shipments that form the core business of LTL providers. Customers typically need sufficient volume to justify the expense of dedicating an entire truck, making FTL a less attractive option for businesses shipping smaller quantities. The ongoing trend of smaller, more frequent deliveries in certain sectors means that LTL remains a crucial service, but the availability and cost-competitiveness of FTL for larger loads represent a persistent competitive pressure.

Parcel carriers like FedEx and UPS present a threat, especially for smaller Less-Than-Truckload (LTL) shipments where their efficiency and tracking capabilities are highly appealing.

While Estes primarily handles larger freight, the increasing volume of e-commerce is fueling demand for smaller, more frequent deliveries, creating a potential overlap with parcel services at the lower end of the LTL market.

In 2024, the global parcel delivery market was projected to reach over $500 billion, highlighting the significant scale and efficiency of these competitors.

The continued growth of direct-to-consumer shipping and the expectation of rapid delivery times further bolster the competitive advantage of parcel carriers, pushing them to innovate in areas traditionally served by LTL providers.

For long-haul, non-time-sensitive freight, intermodal rail transportation presents a significant substitute threat to LTL trucking services like those offered by Estes Express Lines. This combined mode, utilizing rail for the long haul and trucking for the shorter segments, can offer considerable cost savings, especially for bulkier goods. For instance, in 2024, the average cost per mile for intermodal rail freight was notably lower than for over-the-road trucking, making it an attractive option for shippers prioritizing price over speed.

While intermodal rail provides environmental advantages, often emitting less CO2 per ton-mile than trucking, its primary competitive edge against LTL lies in its cost-effectiveness for specific freight profiles. However, this substitution comes with trade-offs. The inherent flexibility and door-to-door speed of direct LTL road transport remain a key differentiator, as intermodal transfers introduce additional handling and potential transit time delays that LTL generally avoids.

Air Cargo and Expedited Services

Air cargo presents a significant threat to Estes Express Lines, particularly for time-sensitive or high-value shipments. While Estes provides expedited ground services, dedicated air freight offers unparalleled speed, albeit at a considerably higher price point. For businesses where even a few hours can mean the difference between profit and loss, air cargo remains a viable and often preferred alternative, especially when cost is a secondary concern.

The global air cargo market is substantial and growing. In 2024, the International Air Transport Association (IATA) projected a robust recovery and continued growth in air cargo volumes, with demand expected to surpass pre-pandemic levels. This indicates a strong and persistent demand for air freight services that can directly compete with ground-based expedited options offered by companies like Estes.

- Speed Advantage: Air cargo offers significantly faster transit times compared to even the most expedited ground services.

- Cost Trade-off: This speed comes at a premium, making it a substitute for customers prioritizing speed over cost.

- Market Size: The global air cargo market is a multi-billion dollar industry, demonstrating a significant addressable market for substitutes.

- High-Value Goods: Air cargo is particularly attractive for transporting high-value, low-weight goods where the cost of air freight is a smaller percentage of the product's overall value.

In-house Logistics and Private Fleets

Large corporations often consider establishing in-house logistics operations and private fleets to exert more direct control over their supply chains and potentially lower expenses. This strategy, however, demands significant upfront capital for fleet acquisition and infrastructure, alongside continuous investment in maintenance, fuel, and skilled labor. For example, a company might need to invest millions in purchasing trucks and setting up distribution centers.

The operational complexities and the need for specialized expertise in fleet management, route optimization, and regulatory compliance are considerable hurdles. Many businesses find that outsourcing these functions to experienced third-party logistics (3PL) providers, such as Estes Express Lines, is a more efficient and cost-effective approach. Estes, with its extensive network and established operational framework, allows clients to focus on their core competencies rather than diverting resources to logistics management.

- Capital Intensive: Establishing a private fleet requires substantial upfront investment in vehicles, maintenance facilities, and technology, often running into millions of dollars for mid-sized operations.

- Operational Complexity: Managing a fleet involves intricate planning for routing, driver scheduling, fuel procurement, compliance with transportation regulations, and vehicle maintenance.

- Expertise Required: Successful in-house logistics demands specialized knowledge in supply chain management, fleet operations, and logistics technology, which can be difficult and costly to develop internally.

- Scalability Challenges: Private fleets can face difficulties scaling up or down rapidly to meet fluctuating demand, potentially leading to underutilization or service disruptions.

Full Truckload (FTL) shipping remains a direct substitute for Less Than Truckload (LTL) for larger shipments, offering potentially faster transit and simpler logistics. In 2024, FTL demand was strong, driven by e-commerce, though driver shortages influenced pricing.

Parcel carriers, like FedEx and UPS, compete for smaller LTL shipments due to their efficiency and tracking. The growing e-commerce sector fuels demand for smaller, frequent deliveries, blurring lines with parcel services.

Intermodal rail offers a cost-effective substitute for long-haul, non-time-sensitive freight, with lower per-mile costs than trucking in 2024. However, LTL trucking maintains an advantage in flexibility and direct, door-to-door transit times.

Air cargo serves as a substitute for time-sensitive or high-value shipments, offering speed at a higher cost. The global air cargo market showed robust growth in 2024, indicating sustained demand for expedited transport.

Entrants Threaten

The Less-Than-Truckload (LTL) shipping sector, where Estes Express Lines operates, is inherently capital-intensive. Establishing a presence requires substantial upfront investment in physical infrastructure, including terminals and cross-docking facilities. For instance, building or acquiring a single modern LTL terminal can easily cost millions of dollars.

Beyond real estate, a significant portion of capital is tied up in maintaining a large fleet of tractors and trailers. Estes Express Lines, like its peers, needs thousands of these assets to serve its extensive network. Acquiring and maintaining this fleet represents a massive financial commitment, often running into hundreds of millions of dollars for established carriers.

Furthermore, the industry increasingly relies on advanced technology for route optimization, tracking, and customer management. Investments in sophisticated software, telematics, and data analytics are crucial for operational efficiency and competitiveness. These technological expenditures add another layer to the already high barrier to entry, making it difficult for new companies to compete on a level playing field.

The extensive network and infrastructure that Estes Express Lines has cultivated over decades presents a significant barrier to new entrants. Building a comprehensive hub-and-spoke system, akin to Estes' more than 280 terminals and thousands of operational lanes across North America, requires immense capital investment and time to optimize for efficiency.

New companies entering the Less Than Truckload (LTL) market would find it incredibly challenging to match the density and reach Estes already possesses. This established infrastructure is not just about physical locations but also about the intricate operational efficiencies and customer relationships built over time, which are crucial for competitive LTL service.

The freight transportation industry, including companies like Estes Express Lines, faces substantial regulatory hurdles that act as a significant barrier to new entrants. These regulations cover a wide array of areas, from stringent safety standards mandated by the Federal Motor Carrier Safety Administration (FMCSA) to environmental regulations concerning emissions. For instance, compliance with Federal Motor Carrier Safety Regulations (FMCSRs) requires significant investment in vehicle maintenance, driver training, and record-keeping systems.

New companies must also navigate complex licensing and permitting processes at federal, state, and local levels. Obtaining the necessary operating authority, complying with hazardous materials transportation rules, and adhering to driver qualification requirements all add layers of complexity and cost. In 2024, the ongoing focus on driver retention and safety initiatives, such as enhanced drug and alcohol testing programs, further increases the operational and compliance burden for any new player entering the market.

Brand Reputation and Customer Relationships

Established carriers like Estes Express Lines possess a significant advantage due to their deeply ingrained brand reputation and robust customer relationships, cultivated over decades of reliable service. For instance, Estes has been a cornerstone of the LTL industry since its founding in 1931, fostering immense trust. New entrants would struggle immensely to replicate this level of credibility and loyalty, making it challenging to attract and retain customers in a highly competitive LTL market.

The threat of new entrants, particularly concerning brand reputation and customer relationships, is considerably low for Estes Express Lines. Established players have invested heavily in building trust and service excellence.

- Brand Loyalty: Long-standing customer relationships mean that businesses are often hesitant to switch carriers, even if a new entrant offers slightly lower prices, due to the proven reliability and personalized service provided by incumbents like Estes.

- Service Reputation: Estes's reputation for on-time delivery and damage-free shipments, built over many years, acts as a significant barrier. New companies must demonstrate this level of consistent performance to even be considered.

- Customer Switching Costs: Beyond price, businesses incur costs and risks when switching logistics providers, including integration challenges, potential service disruptions, and the effort of re-establishing trust and understanding service protocols.

Economies of Scale and Experience Curve

Existing Less-Than-Truckload (LTL) carriers, like Estes Express Lines, possess substantial economies of scale. This scale allows them to achieve lower per-unit costs in areas such as equipment purchasing, fuel, maintenance, and terminal operations due to their high freight volumes. For instance, in 2023, the LTL sector saw continued consolidation, with larger players leveraging their existing infrastructure to absorb smaller competitors, further solidifying the scale advantage.

The experience curve also plays a critical role. Decades of operational refinement have allowed established carriers to optimize routing, load building, and driver management, leading to enhanced efficiency and cost savings. New entrants would face a steep learning curve and would likely incur higher initial operating costs without the benefit of this accumulated operational knowledge. This makes it challenging to match the pricing and service reliability that customers expect from established LTL providers.

- Economies of Scale: Large LTL carriers benefit from bulk purchasing power for trucks, fuel, and equipment, driving down per-unit costs.

- Operational Efficiency: Established players have optimized logistics networks and maintenance schedules, reducing operational expenses.

- Experience Curve Advantages: Accumulated knowledge in route planning, load optimization, and risk management leads to cost efficiencies unavailable to newcomers.

- Capital Investment Barrier: The significant capital required to build a comparable network of terminals, equipment, and technology acts as a substantial deterrent to new entrants.

The threat of new entrants in the LTL sector, where Estes Express Lines operates, is significantly mitigated by the immense capital required. Establishing a competitive LTL network necessitates millions for terminals, thousands of tractors and trailers, and substantial investments in technology, creating a formidable financial barrier. For instance, the cost of a single new LTL terminal can easily exceed several million dollars, and building a fleet comparable to Estes' demands hundreds of millions. These high upfront costs make it exceptionally difficult for new players to enter and compete effectively.

Regulatory compliance and licensing also present substantial hurdles for potential new entrants. Navigating stringent safety standards from bodies like the FMCSA, environmental regulations, and complex permitting processes at multiple government levels requires significant resources and expertise. In 2024, ongoing emphasis on driver safety and retention programs, such as expanded drug and alcohol testing, further elevates the operational and compliance burden for newcomers, making it challenging to match established carriers' adherence to these critical requirements.

Furthermore, the established brand reputation and deep customer relationships held by incumbents like Estes Express Lines are critical deterrents. Estes, with its history dating back to 1931, has cultivated decades of trust and loyalty, making it difficult for new companies to attract and retain business. The costs and risks associated with switching logistics providers, including integration challenges and service disruptions, also reinforce customer loyalty to established players, effectively lowering the threat of new entrants.

Economies of scale and operational efficiencies gained through years of experience also contribute to a low threat of new entrants. Established carriers benefit from bulk purchasing power, optimized logistics, and accumulated knowledge in route planning and load building, leading to lower per-unit costs. For example, continued consolidation in the LTL sector in 2023 saw larger firms leveraging their scale to absorb smaller ones, reinforcing the advantage of established players and making it difficult for new entrants to compete on price and service reliability.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | High investment in terminals, fleets, and technology. | Extremely High Barrier. Building a comparable network requires hundreds of millions in capital. |

| Regulatory Hurdles | Compliance with safety, environmental, and licensing regulations. | High Barrier. Significant resources needed for compliance and permits. |

| Brand Reputation & Customer Loyalty | Established trust and long-term relationships. | High Barrier. New entrants struggle to build credibility and overcome switching costs. |

| Economies of Scale & Experience Curve | Cost advantages from volume and operational optimization. | High Barrier. New entrants face higher initial costs and a steep learning curve. |

Porter's Five Forces Analysis Data Sources

Our Estes Express Lines Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, financial statements from publicly traded competitors, and publicly available government transportation statistics to provide a comprehensive view of the competitive landscape.