Estes Express Lines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estes Express Lines Bundle

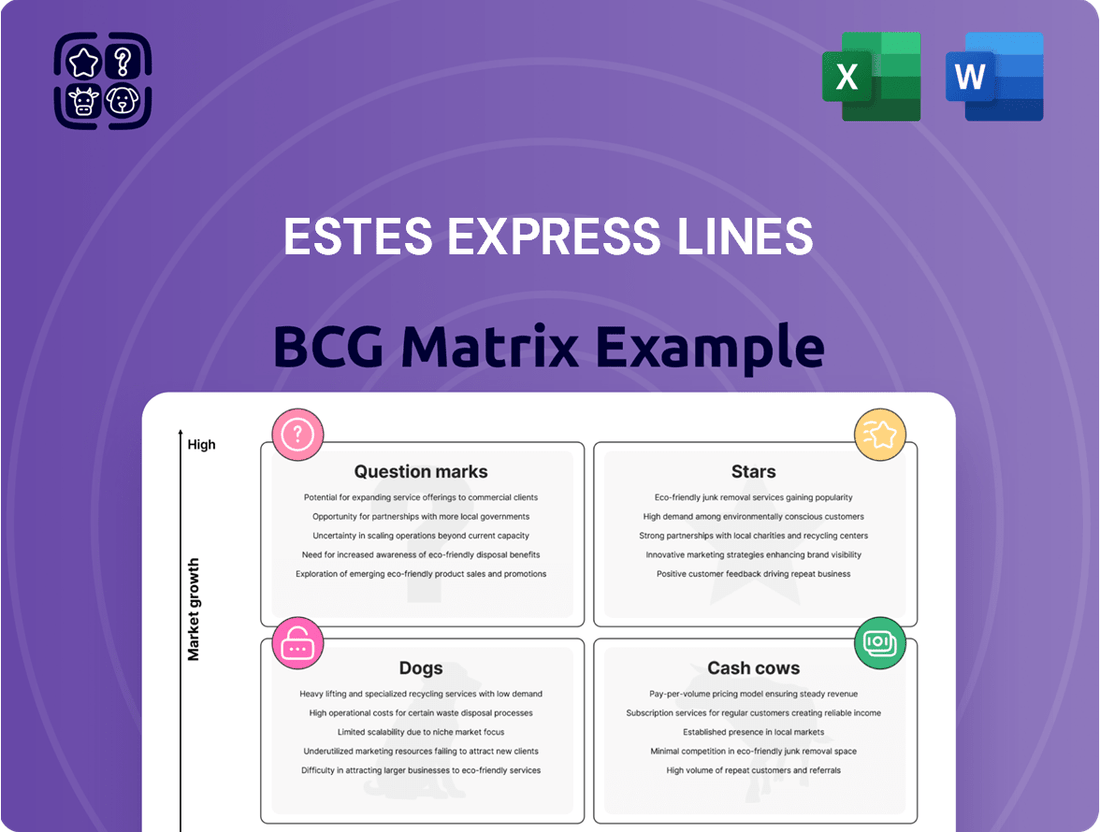

Uncover the strategic positioning of Estes Express Lines within the competitive transportation landscape. This preview offers a glimpse into their product portfolio's potential, hinting at where their strengths and weaknesses lie. Are their services Stars poised for growth, or Cash Cows generating steady revenue?

Understanding this dynamic is crucial for any stakeholder looking to leverage Estes' market presence. This initial overview sparks curiosity about their operational efficiency and market share across different service offerings.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Estes Express Lines' time-critical and expedited LTL services are a shining star in their portfolio. This segment is experiencing robust growth, fueled by the ever-increasing demand for rapid delivery in sectors like e-commerce and just-in-time manufacturing. The company's extensive network and proven reliability give it a distinct advantage in securing a larger piece of this lucrative market. Significant investments in specialized handling equipment and advanced transit technologies further cement its star status.

The surging e-commerce landscape is a major growth engine for the Less-Than-Truckload (LTL) sector, characterized by an uptick in smaller, more frequent shipments. Estes Express Lines is well-positioned as a star in this rapidly expanding market by providing specialized logistics solutions for online businesses and adapting its services to accommodate the increasing demand for speed and flexibility in deliveries.

Estes' ongoing commitment to enhancing its network infrastructure and investing in advanced technologies underpins its leadership in e-commerce fulfillment. For instance, the company's 2024 investments in network modernization are designed to expedite transit times, a critical factor for online retailers aiming to meet customer expectations for rapid delivery.

Estes' strategic acquisition of former Yellow terminals in late 2024 and early 2025 significantly bolstered its cross-border Less-Than-Truckload (LTL) capabilities, especially for shipments destined for or originating from Canada and Mexico. This expansion into vital North American trade routes, fueled by the ongoing nearshoring trend, positions Estes in a high-growth market where it is actively pursuing increased market share.

The company's enhanced network is designed to accommodate the surging demand at key cross-border gateways, reflecting a proactive response to evolving trade dynamics. For instance, U.S.-Mexico trade alone reached an all-time high of over $779 billion in 2023, underscoring the immense potential in these corridors.

Advanced Supply Chain Visibility & Optimization Tools

Estes Express Lines is heavily investing in advanced supply chain visibility and optimization tools, signaling a strategic move towards a high-growth "Stars" category within their business. This includes leveraging cutting-edge AI, such as Optym RouteMax, to refine route planning and enhance pickup and delivery operations. These technological investments are directly translating into a superior customer experience, offering real-time shipment tracking and greater transparency, a critical factor in today's demanding logistics landscape.

The adoption of these sophisticated digital solutions by customers seeking greater efficiency and predictability is on the rise. For example, Estes reported a significant increase in the utilization of their digital tracking features throughout 2023, indicating strong customer engagement with their technology offerings. This growing demand positions their digital solutions as a key driver of future revenue and market leadership.

- Investment in AI-powered route optimization: Tools like Optym RouteMax are being implemented to boost efficiency.

- Enhanced customer experience: Real-time updates and transparency are key benefits.

- Growing customer adoption: Demand for sophisticated logistics management solutions is increasing.

- High-growth potential: Digital solutions are identified as a star performer for Estes Express Lines.

Specialized LTL for High-Value & Sensitive Goods

While not explicitly labeled as a standalone service, Estes Express Lines' dedication to reliability and low claims ratios positions them well for the growing demand in specialized Less-Than-Truckload (LTL) for high-value and sensitive goods.

Industries such as healthcare, which saw a significant surge in demand for specialized logistics throughout 2024, and the expanding high-tech manufacturing sector are driving the need for transport that prioritizes security, precision, and minimal damage. Estes' proven track record in maintaining high service standards naturally aligns with these requirements.

This segment represents a potentially lucrative area for Estes, leveraging their existing strengths to cater to a discerning clientele.

- Market Growth: The specialized LTL market for high-value goods is expanding, driven by sectors like pharmaceuticals and electronics.

- Estes' Strength: Estes' commitment to a low claims ratio (often below industry averages, with reported figures in the range of 0.1-0.3% of revenue for claims) highlights their capability in handling sensitive freight.

- Customer Need: Businesses requiring secure, temperature-controlled, or high-value transport are increasingly seeking LTL providers with proven reliability.

- Strategic Advantage: Estes' investment in advanced tracking and specialized handling equipment can further solidify their position in this niche.

Estes Express Lines' time-critical and expedited LTL services are a shining star, experiencing robust growth fueled by e-commerce and just-in-time manufacturing demands. Their extensive network and investments in specialized handling equipment and advanced transit technologies solidify this position. The company's 2024 network modernization efforts are specifically aimed at expediting transit times, a crucial factor for online retailers. Estes' 2024 and early 2025 acquisitions of former Yellow terminals significantly bolstered their cross-border LTL capabilities, particularly for Canada and Mexico trade routes, a high-growth market driven by nearshoring trends.

Estes is also heavily investing in advanced supply chain visibility and optimization tools, leveraging AI like Optym RouteMax to refine route planning and enhance operations. This focus on digital solutions translates into a superior customer experience with real-time tracking and greater transparency, a critical factor in today's logistics. Customer adoption of these sophisticated digital solutions is on the rise, with Estes reporting a significant increase in digital tracking feature utilization in 2023, positioning these offerings as key revenue drivers.

Their commitment to reliability and low claims ratios, often below industry averages (e.g., 0.1-0.3% of revenue), positions them well for the growing demand in specialized LTL for high-value and sensitive goods. Industries like healthcare and high-tech manufacturing, which saw significant demand surges in 2024, require transport that prioritizes security and minimal damage. Estes' proven track record naturally aligns with these stringent requirements, making this a lucrative niche leveraging their existing strengths.

| Business Area | BCG Matrix Category | Key Growth Drivers | Estes' Strengths | 2024 Data Points |

|---|---|---|---|---|

| Time-Critical/Expedited LTL | Star | E-commerce growth, Just-in-Time manufacturing | Extensive network, Reliability, Specialized equipment | Network modernization investments for faster transit |

| Cross-Border LTL (Canada/Mexico) | Star | Nearshoring trends, High North American trade volume | Acquisition of former Yellow terminals, Enhanced gateway capacity | U.S.-Mexico trade exceeded $779 billion in 2023 |

| Digital Solutions & Visibility | Star | Customer demand for efficiency & predictability | AI route optimization (Optym RouteMax), Real-time tracking | Increased utilization of digital tracking features in 2023 |

| Specialized LTL (High-Value/Sensitive Goods) | Potential Star/Question Mark | Healthcare & High-tech logistics demand | Low claims ratios (0.1-0.3%), Proven reliability | Increased demand for secure, low-damage transport |

What is included in the product

Estes Express Lines' BCG Matrix highlights strategic directions for its service offerings, focusing on optimizing investment and resource allocation.

Clear visualization of Estes Express Lines' business units within the BCG matrix, simplifying strategic decision-making.

Cash Cows

Estes Express Lines' core Less-Than-Truckload (LTL) freight services are a classic cash cow within their business portfolio. As North America's largest privately owned freight carrier, Estes commands a significant market share in the mature LTL sector. Their specialized service for shipments between 150 and 15,000 pounds consistently delivers robust cash flow, fueled by a loyal customer base and highly efficient operations.

Estes Express Lines boasts an impressive terminal network, a key component of its Cash Cow status within the BCG Matrix. By the close of 2024, the company anticipates operating over 12,750 doors across more than 280 North American terminals. This expansive infrastructure is a direct result of strategic growth, including the acquisition of former Yellow Corp. terminals, enhancing their operational footprint and efficiency.

This robust and mature asset base forms a stable foundation for Estes, enabling optimized freight movement and consistent service delivery. The sheer scale of their terminal network, coupled with ongoing expansion and integration of acquired assets, ensures high capacity and reliable operations. This translates directly into predictable and substantial cash flow generation, characteristic of a Cash Cow.

Estes Express Lines' Volume LTL Services represent a significant cash cow. This segment, focusing on shipments between 7,000 to 20,000 pounds, captures a dominant share of the Less-Than-Truckload (LTL) market's revenue.

This core offering is a cornerstone for Estes, serving manufacturers, wholesalers, and retailers who need to move substantial inventory. It’s a high-growth area within a mature market, meaning Estes enjoys a strong position.

The consistent, high-volume nature of these shipments translates into predictable and substantial revenue streams. This stability allows Estes to invest less in promotional activities compared to newer or more volatile market segments.

For context, the LTL market in the United States saw robust growth, with total revenue estimated to be in the tens of billions of dollars annually. Estes, as a major player in the volume LTL space, benefits directly from this foundational segment's economic activity.

Standard Truckload Services

While Estes Express Lines is renowned for its Less Than Truckload (LTL) expertise, its Standard Truckload Services function as a solid Cash Cow within its portfolio. This segment likely benefits from established routes and consistent demand for general freight, allowing for high operational efficiency and strong market presence.

The truckload division capitalizes on Estes' extensive existing fleet and robust distribution network, ensuring reliable and cost-effective transportation. This service is a vital contributor to Estes' stable revenue streams and consistent cash flow, complementing its core LTL offerings and solidifying its position as a comprehensive logistics provider.

- Established Network Leverage: Estes' truckload services benefit directly from their existing nationwide infrastructure and established carrier relationships.

- Stable Revenue Generation: This segment provides predictable income, acting as a reliable source of cash flow for the company.

- Complementary Service: Truckload offerings enhance Estes' overall service suite, appealing to a broader customer base.

- Efficiency Focus: For routine and high-volume lanes, the truckload division likely operates with optimized logistics and high asset utilization.

Established Regional LTL Lanes

Established regional LTL lanes represent Estes Express Lines' core strength and a significant cash cow. With nearly 7,000 next-day lanes, the company leverages deep market penetration and decades of optimized routing. These established routes generate consistent, high-margin cash flow, requiring minimal new investment to maintain their strong performance.

The predictability of these regional operations is a key advantage. Estes' extensive network in these areas allows for efficient load consolidation and reduced transit times, directly contributing to profitability. This stability ensures a reliable revenue stream, underpinning the company's overall financial health.

- Deep Market Penetration: Estes has cultivated strong customer relationships and brand loyalty in these established regional markets.

- Optimized Routing: Decades of experience have led to highly efficient and cost-effective route planning, maximizing profitability.

- High-Margin Cash Generation: The mature nature of these lanes allows for consistent, predictable, and high-margin cash flow.

- Minimal Growth Investment: Unlike growth-stage businesses, these cash cows require limited capital expenditure to maintain their market position and revenue generation.

Estes Express Lines’ extensive terminal network, a critical asset supporting its Cash Cow status, is projected to encompass over 12,750 doors across more than 280 terminals by the end of 2024. This significant footprint, bolstered by strategic acquisitions like former Yellow Corp. facilities, ensures high operational capacity and efficiency. The sheer scale and ongoing optimization of this infrastructure generate predictable and substantial cash flow, a hallmark of a mature and dominant business segment.

| Segment | Description | BCG Matrix Status | Key Supporting Fact |

|---|---|---|---|

| LTL Freight Services | Core business, handling shipments between 150-15,000 pounds. | Cash Cow | North America's largest privately owned freight carrier with a significant market share. |

| Volume LTL Services | Focuses on larger LTL shipments (7,000-20,000 pounds). | Cash Cow | Captures a dominant share of LTL revenue from manufacturers, wholesalers, and retailers. |

| Standard Truckload Services | General freight transportation utilizing Estes' fleet and network. | Cash Cow | Leverages existing infrastructure and established carrier relationships for stable revenue. |

| Established Regional LTL Lanes | Nearly 7,000 next-day lanes with deep market penetration. | Cash Cow | Generates consistent, high-margin cash flow due to optimized routing and minimal new investment needs. |

Full Transparency, Always

Estes Express Lines BCG Matrix

The preview of the Estes Express Lines BCG Matrix you are currently viewing is the complete, unwatermarked document you will receive immediately after purchase. This report has been meticulously prepared with comprehensive market analysis, offering a ready-to-use strategic tool for understanding Estes Express Lines' business portfolio. You can confidently expect the same professional formatting and actionable insights in the downloadable file, enabling immediate application in your business planning or presentations.

Dogs

Any lingering manual processes within Estes Express Lines, especially concerning data entry or legacy planning methods, would be classified as Dogs in the BCG matrix. These are likely inefficient, prone to mistakes, and drain resources without offering substantial competitive advantages in today's tech-driven logistics landscape.

For instance, if Estes still relies on manual tracking for certain freight types or employs traditional paper-based dispatch systems, these would fall into the Dog category. Such methods are incredibly slow compared to digital solutions. In 2023, the logistics industry saw a significant push towards digital transformation, with companies investing heavily in automated systems to reduce operational costs and improve accuracy, a trend Estes is actively participating in.

Within Estes Express Lines' broader truckload operations, certain niche lanes might be classified as underperformers. These are segments where Estes may not possess a strong competitive edge, economies of scale, or reliable, consistent demand.

These underperforming niche lanes could be characterized by break-even results or even cash consumption, particularly if they lack robust growth potential. In 2024, for instance, a trucking industry report indicated that specialized, low-volume lanes often struggled with profitability compared to core, high-density routes.

Such segments tie up valuable assets and resources that could be more effectively deployed in areas with higher growth prospects or stronger competitive positions. This situation typically arises when Estes holds a low market share within a market that itself is experiencing limited or no growth.

Inefficient legacy IT systems at Estes Express Lines likely fall into the 'Dog' category of the BCG Matrix. These older, less integrated systems, such as outdated dispatch or tracking software, could be costly to maintain, with IT maintenance costs for legacy systems often exceeding 80% of the total IT budget in some industries. Such systems would hinder operational efficiency, potentially slowing down delivery times or increasing error rates, and offer limited strategic value in a competitive logistics market.

Non-Core, Low-Demand Global Freight Routes

Within Estes Express Lines' broader global operations, certain niche international freight routes may fall into the 'Dogs' category of the BCG Matrix. These are typically characterized by low growth and low market share, meaning they don't contribute significantly to the company's overall performance.

These routes might represent legacy business segments or partnerships in regions experiencing stagnant economic growth or declining trade volumes. For instance, a specific less-trafficked trans-Pacific lane with limited demand for LTL (Less Than Truckload) services could exemplify such a scenario. Estes' presence might be minimal, with low profitability and little prospect for expansion.

- Low Market Share: Estes may hold a very small percentage of the total freight volume on these specific international lanes.

- Low Growth Market: The overall demand for freight services on these routes is either stagnant or declining.

- Minimal Profitability: These routes likely generate low margins, possibly even operating at a loss due to inefficiencies or high operating costs relative to revenue.

- Strategic Misfit: They might not align with Estes' core competencies or strategic growth objectives in the global logistics landscape.

Underutilized Older Fleet Assets

Underutilized older fleet assets within Estes Express Lines would likely be categorized in the Dogs quadrant of the BCG Matrix. These are assets, such as older trucks or trailers, that may be less fuel-efficient or require more frequent maintenance. Their underutilization, perhaps due to operating in less profitable or declining shipping lanes, means they consume resources without generating substantial returns.

These older, less efficient assets often carry higher operational costs. For instance, older diesel engines might have lower miles per gallon compared to newer models, increasing fuel expenses. Coupled with potentially higher maintenance needs, the revenue generated by these vehicles might not cover their associated costs. Estes' ongoing fleet modernization efforts, aiming for improved fuel efficiency and reduced maintenance, directly addresses the impact of such underperforming assets.

- Higher operational costs: Older trucks can consume 15-20% more fuel than modern equivalents.

- Increased maintenance expenditure: Anecdotal evidence suggests older fleets can see maintenance costs rise by up to 30% annually.

- Declining market segments: If these assets primarily serve routes with reduced shipping volumes, their revenue generation is further hampered.

- Strategic divestment or repurposing: Estes' focus on upgrading its fleet suggests a strategy to phase out or repurpose these less productive assets.

Certain legacy IT systems at Estes Express Lines, particularly those handling manual data entry or outdated dispatch processes, would be classified as Dogs. These systems are often inefficient, prone to errors, and costly to maintain, hindering overall operational agility in a sector increasingly reliant on digital solutions. For example, if Estes still utilizes paper-based bill of lading systems for specific shipments, these would represent a Dog, as they are significantly slower and less accurate than modern electronic data interchange (EDI) systems.

In 2024, the logistics industry continued its digital transformation, with investments in automation and integrated software solutions aiming to reduce operational costs and improve data accuracy. Companies embracing these technologies are gaining a competitive edge, making legacy systems that do not integrate well with newer platforms a clear indicator of a Dog within the BCG matrix.

Underutilized older fleet assets within Estes Express Lines would also fall into the Dogs category. These might include older model trucks or trailers that are less fuel-efficient or require more frequent maintenance, thus consuming resources without generating optimal returns. For instance, older trucks with lower miles per gallon can significantly increase fuel expenses compared to newer, more efficient models, directly impacting profitability on their assigned routes.

These assets often have higher operational costs, with older diesel engines potentially consuming 15-20% more fuel than modern equivalents. Coupled with increased maintenance needs, the revenue generated may not offset these expenses, especially if they are deployed on less profitable or declining shipping lanes. Estes' ongoing fleet modernization efforts are a strategic move to phase out or repurpose such unproductive assets.

| Category | Description | Estes Express Lines Example | 2024 Industry Trend | Financial Implication |

|---|---|---|---|---|

| Dogs | Low market share in a low-growth market. | Legacy IT systems for manual data entry. | Increased adoption of AI and automation for operational efficiency. | High maintenance costs, low ROI. |

| Dogs | Underutilized or inefficient assets. | Older, less fuel-efficient truck fleet. | Focus on fleet modernization for sustainability and cost savings. | Increased fuel and maintenance expenses, reduced profitability. |

Question Marks

Estes Express Lines' investment in electric tractor-trailers and solar power at its terminals positions it within the rapidly growing electrification of fleet sector. This segment, driven by environmental mandates and customer demand for sustainable logistics, presents a high-growth opportunity.

However, the electrification of fleets, including the necessary charging infrastructure, is currently a capital-intensive endeavor. Estes is navigating this space with significant upfront costs and an evolving technological landscape, characteristic of a 'Question Mark' in the BCG Matrix. The return on investment remains somewhat uncertain as the technology and infrastructure mature.

By 2024, the demand for electric trucks is projected to rise significantly, with major manufacturers like Volvo Trucks and Freightliner ramping up production. Estes' proactive investment aligns with this trend, aiming to capture market share in a future where electric freight is the norm, despite the initial high barriers to entry.

Autonomous trucking pilot programs represent a high-growth, yet highly uncertain, frontier for the freight industry. Estes Express Lines, like many major carriers, is likely exploring these nascent technologies. In 2024, companies like Aurora Innovation and TuSimple continued to conduct pilot programs, demonstrating the ongoing industry interest.

Despite this interest, autonomous trucking faces significant regulatory hurdles and requires substantial infrastructure investment. Estes' market share in this nascent segment would be extremely low, placing it firmly in the 'Question Mark' category of the BCG Matrix. This means it requires considerable investment to determine if it can evolve into a future 'Star' performer.

Emerging industries such as green technology and electric vehicle (EV) component manufacturing demand highly specialized logistics. These sectors often involve handling sensitive, high-value, or oversized items that require specific temperature controls, secure transportation, and meticulous tracking. Estes Express Lines is likely exploring or implementing tailored services to meet these unique requirements, recognizing the significant growth potential in these markets.

While these industries represent high-growth opportunities, Estes' market share within these specific niches might currently be modest. For instance, the global electric vehicle market was projected to reach over $800 billion by 2024, with substantial growth in component logistics. To capitalize on this, Estes may need to make strategic investments in specialized equipment, training, and technology to build a stronger presence and capture a larger share of this evolving logistics landscape.

Expansion into New Geographic Market Segments (e.g., deeper rural penetration)

Expanding into deeper rural market segments for Estes Express Lines could be considered a 'Question Mark' in the BCG Matrix. While Estes boasts an extensive North American network, these less-penetrated areas present both opportunity and risk. Significant investment in new routes, localized infrastructure, and targeted marketing would be crucial to capture potential demand.

These rural markets might offer untapped growth avenues, but the viability hinges on the existence of sufficient demand and the ability to establish efficient operations. For instance, in 2024, the demand for less-than-truckload (LTL) services in emerging industrial hubs, often located in more rural settings, has shown a steady uptick, driven by reshoring initiatives and e-commerce growth. However, the operational complexities and cost of serving these dispersed locations can be substantial.

- High Potential Growth: Rural areas may offer new customer bases and reduced competition.

- Significant Investment Required: Building new infrastructure and logistics capabilities in these markets demands substantial capital outlay.

- Demand Uncertainty: The actual demand for LTL services in specific rural segments needs thorough validation before significant investment.

- Operational Challenges: Serving dispersed rural customers can lead to higher per-mile costs and longer transit times.

Development of Advanced AI-Powered Predictive Logistics Platforms

Estes Express Lines is exploring the potential of advanced AI-powered predictive logistics platforms as a strategic growth avenue. This initiative aligns with their existing use of AI tools like Optym RouteMax to boost operational efficiency. The development and eventual commercialization of these sophisticated platforms for clients represent a significant opportunity.

This move into AI-driven logistics platforms falls into the Question Mark category of the BCG Matrix. It’s a high-growth market with the potential to create a substantial competitive advantage for Estes. However, realizing this potential requires considerable investment in research and development, alongside efforts to drive market adoption and establish a strong position.

- High Growth Potential: The demand for predictive logistics solutions is projected to grow, with the global logistics market expected to reach over $15.7 trillion by 2027, driven by AI adoption.

- Significant Investment Needed: Developing and marketing these platforms demands substantial capital for R&D, talent acquisition, and technology infrastructure.

- Competitive Landscape: While Estes is already leveraging AI internally, establishing a distinct, customer-facing predictive logistics platform will require differentiating itself against existing technology providers and logistics companies.

- Market Adoption Challenges: Convincing customers to adopt a new, advanced AI-powered platform will necessitate demonstrating clear ROI and overcoming potential integration hurdles.

Emerging technologies like drone delivery for certain freight segments represent a significant 'Question Mark' for Estes Express Lines. While the potential for faster, more localized deliveries is high, the technology is still maturing, and regulatory frameworks are developing. Estes' market share in this nascent area would be negligible, requiring substantial investment to explore its viability.

The high upfront investment in drone technology and the ongoing uncertainty surrounding widespread adoption and integration into existing logistics networks place this initiative firmly in the 'Question Mark' category. Estes needs to invest heavily to ascertain if this can become a profitable service offering.

By 2024, significant advancements in drone technology for commercial use were evident, with companies receiving FAA approvals for expanded operations. However, the payload capacity and range limitations still present challenges for widespread LTL adoption, making it a speculative venture requiring careful evaluation.

BCG Matrix Data Sources

Our Estes Express Lines BCG Matrix is built on a foundation of verified market intelligence, integrating financial disclosures, industry growth metrics, and competitor benchmarks.