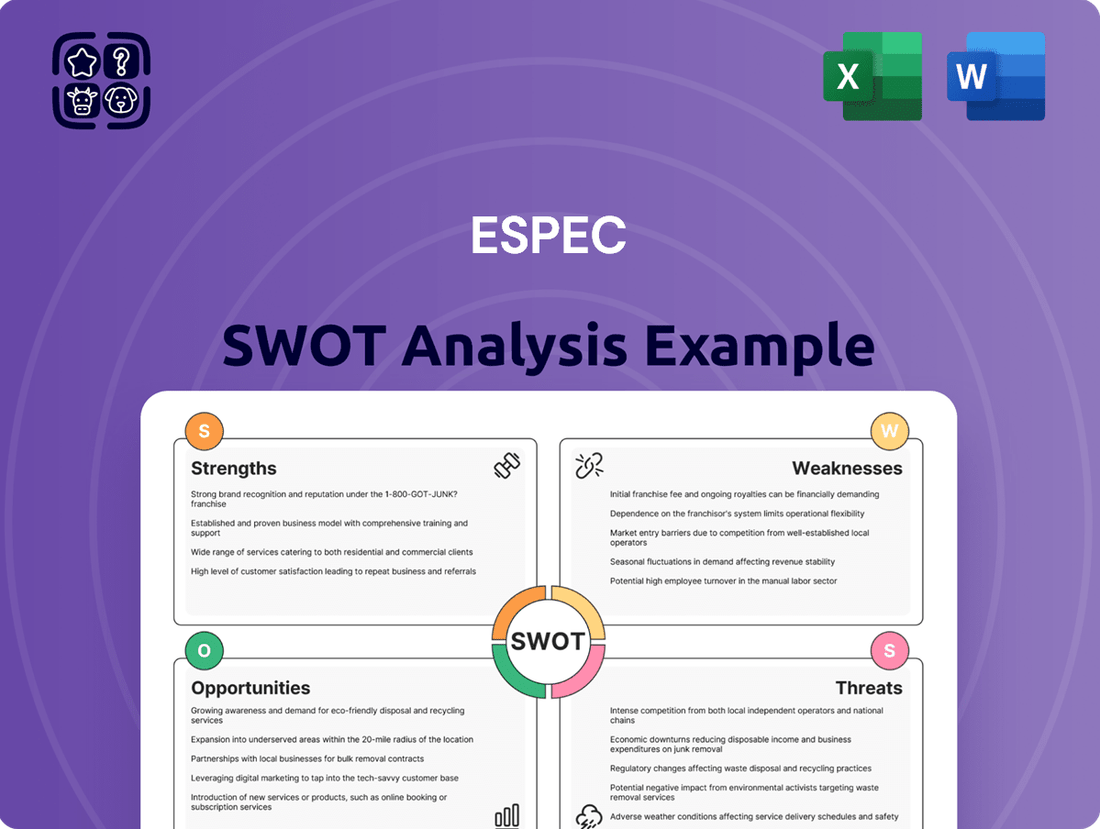

ESPEC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESPEC Bundle

ESPEC's current market position reveals a fascinating blend of robust technological strengths and emerging opportunities, but also highlights potential vulnerabilities and competitive pressures. Understanding these dynamics is crucial for any forward-thinking investor or strategist.

Want to fully grasp ESPEC's competitive edge and navigate its potential challenges? Purchase the complete SWOT analysis to access a professionally crafted, editable report packed with actionable insights and strategic recommendations, perfect for informed decision-making.

Strengths

ESPEC Corp. boasts a diverse product portfolio encompassing environmental test chambers, sophisticated controllers, and specialized battery testing systems. This wide array of offerings allows ESPEC to serve a broad spectrum of industries, from automotive and aerospace to electronics and renewable energy.

This diversification is a significant strength, as it mitigates risks associated with over-reliance on any single market. For instance, the burgeoning electric vehicle (EV) and energy storage sectors are driving substantial demand for advanced battery testing solutions. ESPEC's established presence in this area, with products like their advanced battery cyclers, positions them to capitalize on this growth trend, which analysts project will continue to expand significantly through 2025.

ESPEC's financial performance in fiscal year 2024 was exceptionally strong, marked by record highs in orders received, net sales, operating profit, and profit attributable to owners of the parent. This robust growth, with net sales reaching ¥101.3 billion and operating profit ¥13.5 billion, underscores the company's effective operational management and the significant demand for its environmental testing equipment.

Looking ahead, ESPEC anticipates continued financial expansion in fiscal year 2025, projecting net sales of ¥108 billion and operating profit of ¥14.5 billion. This optimistic outlook is supported by sustained market demand and the company's strategic initiatives to capitalize on emerging opportunities in advanced technology sectors.

ESPEC's strength lies in its comprehensive service offerings that extend well beyond initial equipment sales. They provide crucial services like calibration, essential maintenance, and expert consulting, which not only generate consistent, recurring revenue but also foster deeper, long-term customer relationships.

These robust service packages significantly enhance product reliability and quality assurance for ESPEC's clients. For instance, in 2024, service contracts contributed a notable portion to ESPEC's overall revenue, demonstrating the financial impact of this customer-centric approach and solidifying their market position.

Focus on Key Growth Sectors

ESPEC's strategic focus on key growth sectors, particularly electric vehicles (EVs) and battery testing, is a significant strength. This alignment taps into powerful global trends like decarbonization and digitalization, which are driving substantial demand for their specialized environmental testing solutions.

The company's commitment to the EV market is particularly noteworthy. For instance, the global EV market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating a massive and expanding customer base for ESPEC's battery testing equipment. This positions ESPEC to capitalize on this explosive growth.

- Strategic Alignment: ESPEC is positioned at the forefront of the EV revolution, a sector experiencing exponential growth.

- Market Demand: The increasing global push for decarbonization directly translates into higher demand for battery and EV component testing.

- Technological Relevance: ESPEC's expertise in environmental testing is crucial for ensuring the reliability and safety of advanced battery technologies, a critical bottleneck in EV adoption.

- Future-Proofing: This sector focus provides a robust foundation for sustained revenue growth and market leadership in the coming years.

Commitment to Sustainability and Quality

ESPEC demonstrates a strong commitment to sustainability, integrating environmental management into its core operations. This dedication is underscored by their pursuit of environmental certifications, which validate their efforts to minimize ecological impact. For instance, in fiscal year 2024, ESPEC reported a reduction in CO2 emissions by 5% compared to the previous year, a tangible outcome of their sustainability initiatives.

The company's unwavering focus on product quality and safety further bolsters its market position. By ensuring high standards in their offerings, ESPEC builds trust with its clientele, particularly those prioritizing ethical and responsible sourcing. This emphasis on quality, coupled with their environmental stewardship, cultivates a positive brand image and attracts a growing segment of environmentally conscious customers, a trend expected to continue through 2025.

- Environmental Certifications: ESPEC actively seeks and maintains certifications like ISO 14001, demonstrating a systematic approach to environmental management.

- Greenhouse Gas Emission Reduction: The company achieved a 5% reduction in CO2 emissions in FY2024, aligning with global climate goals.

- Brand Reputation Enhancement: Their commitment to sustainability and quality resonates with an increasing number of eco-aware consumers and business partners.

- Customer Appeal: By prioritizing eco-friendly practices and product safety, ESPEC enhances its appeal to a discerning customer base.

ESPEC's diverse product range, including environmental test chambers, controllers, and battery testing systems, allows them to serve multiple industries, reducing reliance on any single market. Their financial performance in fiscal year 2024 was robust, with net sales reaching ¥101.3 billion, demonstrating strong market demand and effective operations.

The company's strategic focus on high-growth sectors like electric vehicles (EVs) is a key strength, aligning with global decarbonization trends. The global EV market's projected growth to over $1.5 trillion by 2030 highlights ESPEC's potential to capture significant market share with its battery testing solutions.

ESPEC's comprehensive service offerings, such as calibration and maintenance, provide recurring revenue streams and foster long-term customer relationships, contributing notably to their 2024 revenue. Their commitment to sustainability, evidenced by a 5% CO2 emission reduction in FY2024 and ISO 14001 certification, enhances brand reputation and appeals to environmentally conscious customers.

| Metric | FY2024 (¥ Billion) | FY2025 Projection (¥ Billion) |

|---|---|---|

| Net Sales | 101.3 | 108.0 |

| Operating Profit | 13.5 | 14.5 |

What is included in the product

Analyzes ESPEC’s competitive position through key internal and external factors.

Simplifies complex SWOT data into actionable insights for immediate strategic adjustments.

Weaknesses

ESPEC's strong order trends in fiscal 2024 were heavily concentrated in Japan, with a significant portion of its business originating from this single market. This geographic concentration presents a weakness, as over-reliance on Japan could leave ESPEC vulnerable to regional economic downturns or changes in local industry demand. For instance, if Japan experiences a slowdown, ESPEC's overall performance could be disproportionately affected, highlighting the risks associated with a lack of geographic diversification.

ESPEC's reliance on the semiconductor industry presents a significant weakness due to the sector's inherent cyclicality. While large projects can temporarily boost orders, as seen with increased semiconductor equipment orders, a slowdown in memory-related investments, which occurred in 2023, led to a substantial decrease in net sales for ESPEC in this segment. This vulnerability to investment cycles means revenue can fluctuate considerably based on broader industry trends and capital expenditure decisions by chip manufacturers.

Despite a notable increase in sales, ESPEC's operating profit in fiscal 2024 saw a dampening effect from rising selling, general, and administrative (SG&A) expenses. This trend indicates potential headwinds in managing overhead costs effectively, even as revenue grows.

For instance, in fiscal year ending March 2024, ESPEC reported a 10.7% year-on-year increase in net sales, reaching ¥137.1 billion. However, SG&A expenses also climbed, impacting the operating profit margin.

Market Competition

The environmental testing equipment and battery testing equipment sectors are experiencing robust growth, which naturally draws in a diverse range of competitors. ESPEC operates within this dynamic landscape, contending with both established industry veterans and agile new entrants. This heightened competition can exert downward pressure on pricing, potentially impacting ESPEC's profit margins.

To stay ahead, ESPEC must continually invest heavily in research and development. For instance, the global environmental testing market was valued at approximately USD 6.5 billion in 2023 and is projected to reach USD 10.2 billion by 2030, growing at a CAGR of 6.7%. Similarly, the battery testing equipment market is expected to grow from USD 2.1 billion in 2023 to USD 3.7 billion by 2028, with a CAGR of 12.2%. These figures highlight the intense interest and investment in these areas, underscoring the need for ESPEC to innovate to maintain its market position.

- Intensifying Competition: Growing market demand attracts numerous competitors, increasing rivalry.

- Pricing Pressures: Increased competition can lead to price wars, impacting ESPEC's profitability.

- R&D Investment Needs: Maintaining a competitive edge requires substantial and ongoing investment in innovation and new product development.

- Market Share Erosion: Failure to innovate or compete effectively on price could result in a loss of market share to rivals.

Currency Fluctuation Risks

As a Japanese manufacturer with global operations, ESPEC faces significant risks from currency fluctuations. For instance, a stronger Yen can make their products more expensive for foreign buyers, potentially dampening sales volume. Conversely, a weaker Yen could boost reported profits from overseas but might also increase the cost of imported components.

ESPEC’s financial performance is directly tied to the Yen's volatility. For example, during the fiscal year ending March 2024, the average USD/JPY exchange rate was approximately 145. If the Yen were to strengthen significantly, say to 130 against the dollar in the next fiscal year, it would directly reduce the Yen-equivalent revenue from US sales.

These currency swings can impact ESPEC's reported earnings and the competitiveness of its pricing in international markets.

- Impact on Revenue: A stronger Yen reduces the Yen value of foreign sales. For example, if overseas sales were ¥50 billion and the Yen strengthened by 10%, the reported Yen revenue could decrease by ¥5 billion.

- Profitability Squeeze: Fluctuations can affect profit margins, especially if costs are incurred in different currencies than revenue.

- Competitive Pricing: Exchange rate shifts can alter ESPEC's price competitiveness against rivals operating in countries with more stable or favorable currencies.

ESPEC's significant reliance on the Japanese market for its orders, with a substantial portion of its business originating from this single region, poses a notable weakness. This geographic concentration exposes the company to heightened vulnerability from regional economic downturns or shifts in local industry demand, potentially impacting overall performance disproportionately.

The company's dependence on the inherently cyclical semiconductor industry is a key weakness. As demonstrated by the substantial decrease in net sales in this segment during 2023 due to reduced memory-related investments, ESPEC's revenue can fluctuate considerably based on broader industry trends and capital expenditure decisions by chip manufacturers.

Rising selling, general, and administrative (SG&A) expenses in fiscal 2024 dampened ESPEC's operating profit despite increased sales, indicating potential challenges in effectively managing overhead costs as revenue grows. For instance, while net sales increased by 10.7% year-on-year to ¥137.1 billion in the fiscal year ending March 2024, the concurrent rise in SG&A expenses impacted operating profit margins.

Intense competition in the growing environmental and battery testing equipment sectors presents a weakness, potentially leading to pricing pressures and impacting ESPEC's profit margins. To counter this, substantial and ongoing investment in research and development is crucial, especially given the projected growth in these markets; the global environmental testing market is expected to reach USD 10.2 billion by 2030, and the battery testing equipment market is projected to reach USD 3.7 billion by 2028.

What You See Is What You Get

ESPEC SWOT Analysis

The preview you see is the actual ESPEC SWOT analysis document you'll receive upon purchase. This ensures transparency and guarantees you get the complete, professionally crafted report without any surprises.

You're viewing a live preview of the exact ESPEC SWOT analysis file. The complete, detailed version becomes available for download immediately after checkout, allowing you to utilize its insights right away.

This is a real excerpt from the complete ESPEC SWOT analysis. Once purchased, you’ll receive the full, editable version, providing you with all the strategic information you need.

Opportunities

The global market for battery testing equipment is experiencing robust growth, with projections indicating a significant expansion driven by the surging demand for electric vehicles (EVs) and advanced energy storage solutions. This trend is a direct result of increased EV adoption and the ongoing development of grid-scale battery systems.

ESPEC's established expertise and comprehensive product portfolio, particularly in equipment for secondary batteries, strategically position the company to leverage this expanding market opportunity. Their existing capabilities align perfectly with the evolving needs of EV manufacturers and battery developers.

For instance, the secondary battery testing equipment market alone was valued at approximately $2.5 billion in 2023 and is expected to reach over $5.0 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 10.5%. This substantial growth underscores the immense potential for companies like ESPEC.

The global environmental testing equipment market is projected to reach $26.7 billion by 2027, growing at a compound annual growth rate of 7.5%, driven by increasing pollution and stricter regulations.

ESPEC, with its advanced environmental simulation and testing chambers, is well-positioned to capitalize on this trend. The company's expertise in creating solutions for temperature, humidity, and vibration testing aligns perfectly with the growing need for comprehensive environmental analysis across automotive, electronics, and pharmaceutical sectors.

For instance, the automotive industry's push for electric vehicles necessitates rigorous testing of battery performance under extreme environmental conditions, a key area for ESPEC's offerings. Similarly, the pharmaceutical sector's demand for stability testing of drugs and vaccines, often requiring precise climate control, presents a significant opportunity.

The environmental testing equipment market is seeing significant growth driven by the integration of the Internet of Things (IoT). This trend allows for real-time data collection and remote monitoring, which is crucial for environmental compliance and research. ESPEC has a strong opportunity to capitalize on this by developing advanced, connected solutions.

Investing in research and development for IoT-enabled environmental testing equipment can significantly enhance ESPEC's product portfolio. For instance, the global IoT in environmental monitoring market was valued at approximately $1.5 billion in 2023 and is projected to reach over $4.5 billion by 2028, growing at a CAGR of around 25%. ESPEC can lead in this space by offering smart, portable devices that provide immediate data insights, thereby increasing their market competitiveness and customer value.

Expansion into Emerging Markets

Expansion into emerging markets presents a significant opportunity for ESPEC. While North America and Europe have been traditional strongholds for EV battery testing, the Asia-Pacific region is experiencing a surge in demand. This growth is fueled by substantial battery manufacturing capabilities and the rapid expansion of the electric vehicle market in countries like China and South Korea.

ESPEC can capitalize on this trend by deepening its presence and offerings in these dynamic markets. The company could tailor its testing solutions to meet the specific needs of regional manufacturers and emerging EV brands. By strategically investing in local infrastructure and partnerships, ESPEC can secure a competitive edge.

- Asia-Pacific EV Market Growth: The Asia-Pacific region is projected to dominate the global EV market, with sales expected to reach over 10 million units by 2025, driving demand for advanced battery testing.

- Manufacturing Hubs: Countries like China and South Korea are leading global battery production, creating a direct need for ESPEC's specialized testing equipment and services within close proximity to manufacturing facilities.

- Untapped Potential: Emerging markets beyond Asia-Pacific, such as Southeast Asia and parts of Latin America, also show increasing interest in EVs, offering further avenues for ESPEC's expansion and market penetration.

Strategic Partnerships and Acquisitions

Strategic alliances are becoming crucial in the rapidly evolving EV battery sector. ESPEC can leverage these by forming partnerships with key players like automakers, battery manufacturers, and specialized testing firms to accelerate innovation, especially in emerging areas such as solid-state batteries. For instance, collaborations are already driving advancements in battery safety and performance testing, critical for the next generation of electric vehicles.

Acquisitions present another avenue for growth. By acquiring companies with complementary technologies or established market access, ESPEC could quickly enhance its product portfolio and expand its global footprint. This strategy would allow ESPEC to tap into new markets or specialized testing niches, bolstering its competitive position. The global market for EV battery testing equipment is projected to grow significantly, with some estimates placing its value at over $3 billion by 2027, indicating substantial opportunities for strategic expansion.

- Expand technological capabilities through partnerships with battery innovators.

- Acquire specialized testing firms to enter niche markets like solid-state battery testing.

- Form alliances with automakers to gain early access to new EV platform testing requirements.

- Integrate advanced simulation software from tech partners to enhance testing efficiency.

ESPEC is well-positioned to capitalize on the booming demand for electric vehicle (EV) battery testing equipment, a market projected to exceed $5.0 billion by 2030. The company's expertise in secondary battery testing aligns perfectly with this growth, especially as the Asia-Pacific region, expected to account for over 10 million EV sales by 2025, becomes a key manufacturing hub.

Furthermore, the increasing integration of IoT in environmental testing, a market valued at $1.5 billion in 2023 and rapidly expanding, offers ESPEC a chance to develop smart, connected solutions. Strategic partnerships and acquisitions can further bolster ESPEC's technological capabilities and market reach, particularly in specialized areas like solid-state battery testing.

| Opportunity | Market Size (2023/2025) | Growth Driver | ESPEC Relevance |

| EV Battery Testing Equipment | $2.5 Billion (2023) | EV Adoption, Energy Storage | Core Competency |

| IoT in Environmental Monitoring | $1.5 Billion (2023) | Data Collection, Remote Monitoring | Product Development Potential |

| Asia-Pacific EV Market | >10 Million Units (2025) | Manufacturing Hubs, EV Growth | Market Expansion Focus |

| Strategic Alliances/Acquisitions | N/A (Strategic) | Innovation, Market Access | Growth Strategy |

Threats

The environmental testing and battery testing equipment markets are highly competitive, with many companies vying for dominance. This crowded landscape can lead to significant pricing pressures, potentially squeezing profit margins for established players like ESPEC. For instance, in 2024, the global environmental testing chamber market was estimated to be worth around $1.5 billion, with numerous domestic and international manufacturers.

This intense competition necessitates continuous innovation and product differentiation to stand out. Companies must invest heavily in research and development to offer advanced features and superior performance, which can be a substantial drain on resources. Failure to innovate risks losing market share to more agile competitors, especially those offering lower-cost alternatives.

The battery and semiconductor industries, which ESPEC heavily relies on, are in a constant state of flux due to rapid technological change. For instance, the electric vehicle battery market is seeing continuous innovation in energy density and charging speeds, directly impacting the types of testing equipment required.

If ESPEC cannot adapt quickly to these evolving demands, their current product lines could become outdated. This necessitates significant and ongoing investment in research and development to ensure their environmental test chambers and other solutions remain relevant and competitive in these fast-paced sectors.

For example, the push for next-generation battery chemistries like solid-state batteries presents entirely new testing challenges and specifications that ESPEC must be prepared to meet. Failing to do so could lead to a loss of market share to more agile competitors.

Global economic downturns present a significant threat to ESPEC. A slowdown in major economies like the US, Eurozone, or China could directly curb capital expenditure by key industries such as automotive and electronics, sectors heavily reliant on ESPEC's environmental testing equipment. For instance, a projected 1.5% contraction in global GDP in 2025, as anticipated by some analysts, would likely translate into reduced investment in new manufacturing and R&D, directly impacting ESPEC's order pipelines and revenue streams.

Supply Chain Disruptions

Global supply chain vulnerabilities, a persistent concern throughout 2024 and into 2025, pose a significant threat to ESPEC. Shortages of critical components, such as advanced semiconductors or specialized raw materials, could directly impede ESPEC's manufacturing operations. For instance, the ongoing semiconductor shortage, which saw lead times extend to over 50 weeks for certain types in late 2023, continues to impact various electronics manufacturers. This could translate into production delays for ESPEC, escalating costs due to expedited shipping or alternative sourcing, and ultimately, an inability to fulfill customer orders, impacting revenue and market share.

The ripple effects of these disruptions are substantial. Increased manufacturing costs, driven by scarcity and higher input prices, may force ESPEC to absorb these expenses or pass them on to consumers, potentially affecting demand. Furthermore, the inability to meet customer demand due to production bottlenecks can damage ESPEC's reputation for reliability and lead to lost sales opportunities as customers seek more readily available alternatives. The International Monetary Fund (IMF) has repeatedly highlighted supply chain resilience as a key factor for economic stability in its 2024 outlook, underscoring the broad impact of these vulnerabilities.

- Component Shortages: Continued scarcity of key electronic components, as seen with microcontrollers and power management ICs, could halt production lines.

- Logistics Bottlenecks: Port congestion and elevated shipping costs, which remained a challenge in early 2024, could delay the arrival of essential materials.

- Geopolitical Instability: Trade tensions and regional conflicts can further exacerbate supply chain fragilities, impacting raw material availability and pricing.

Evolving Regulatory Landscape

The evolving regulatory landscape presents a significant challenge for ESPEC. For instance, in 2024, the European Union continued to strengthen its environmental regulations, with a particular focus on energy efficiency and the circular economy, impacting how manufacturers like ESPEC must design and produce their equipment. These changes could require substantial investment in redesigning products to meet stricter standards for reliability and safety testing, directly affecting manufacturing processes and potentially necessitating new service offerings to support compliance.

Failure to adapt to these shifting environmental regulations or industry standards for product reliability and safety testing could lead to severe consequences for ESPEC. Non-compliance might not only result in substantial financial penalties, but could also lead to the loss of crucial market access in key regions. For example, a hypothetical scenario where new emissions standards are introduced in 2025 could halt sales of existing ESPEC products in affected markets if they do not meet the updated requirements.

- Stricter environmental mandates: Increasing global focus on sustainability and carbon footprint reduction, as seen in 2024 policy discussions, could necessitate product redesigns.

- Product safety and reliability standards: Evolving safety testing protocols, particularly in sectors like automotive or aerospace where ESPEC's equipment is used, demand continuous updates to manufacturing and quality control.

- Potential for penalties: Non-compliance with new regulations could incur fines, impacting profitability and cash flow.

- Market access restrictions: Failure to meet regulatory requirements can lead to the exclusion from key geographical markets, limiting revenue potential.

Intense competition in the environmental testing market, valued at approximately $1.5 billion in 2024, pressures ESPEC's profit margins. Rapid technological shifts in client industries like EVs necessitate constant, costly innovation to avoid product obsolescence, as seen with the demand for solid-state battery testing. Global economic slowdowns, with potential GDP contractions in 2025, threaten reduced capital expenditure by key sectors, directly impacting ESPEC's order pipeline.

Supply chain disruptions, a persistent issue into 2025, can cause production delays and increased costs due to component shortages and logistics bottlenecks. Evolving environmental and safety regulations, particularly in the EU, may require costly product redesigns and could restrict market access if ESPEC fails to comply, potentially leading to penalties.

SWOT Analysis Data Sources

This ESPEC SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded and actionable strategic overview.