ESPEC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESPEC Bundle

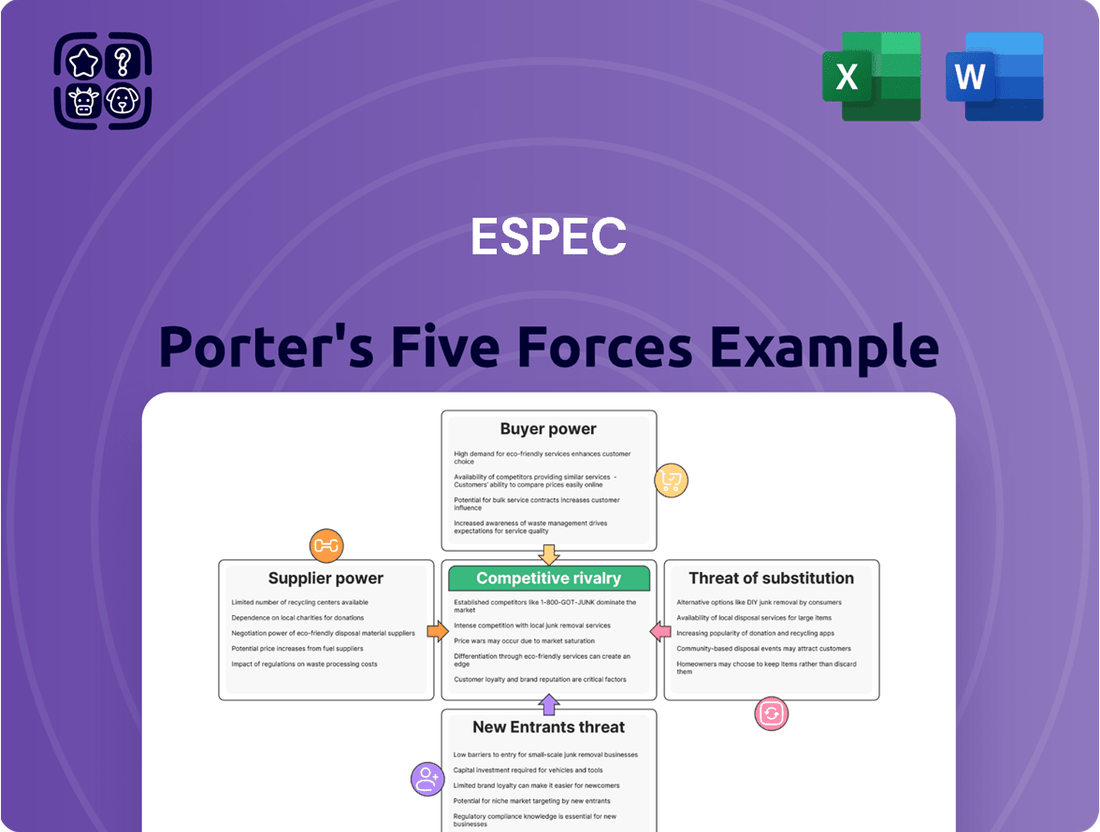

ESPEC's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for navigating the industry effectively. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore ESPEC’s competitive dynamics, market pressures, and strategic advantages in detail, including supplier power and the intensity of rivalry.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts their bargaining power. When few suppliers provide essential components for environmental test equipment, they can command higher prices and stricter terms. For instance, if only two or three companies globally manufacture a highly specialized sensor crucial for advanced climate chambers, their leverage is substantial.

Suppliers gain significant leverage when they offer unique or highly differentiated inputs essential for ESPEC's advanced testing equipment. For instance, if a supplier provides proprietary sensor technology or specialized refrigeration components that are difficult for ESPEC to replicate or source elsewhere, their bargaining power increases substantially. This reliance is amplified when these critical inputs are not easily substitutable, making ESPEC more vulnerable to supplier-driven price hikes or supply disruptions.

High switching costs significantly bolster a supplier's bargaining power. For a company like ESPEC, if substantial investments have been made in integrating a specific supplier's components or proprietary systems, the financial and operational hurdles to transition to a new provider become considerable. This often necessitates costly product re-designs, extensive re-tooling of manufacturing lines, and comprehensive retraining of staff, making a change prohibitively expensive.

Threat of Forward Integration

The threat of suppliers integrating forward into the environmental test equipment manufacturing industry can significantly amplify their bargaining power against companies like ESPEC. Should a key supplier possess the necessary expertise and financial capacity to begin producing environmental test chambers themselves, they could transition from a component provider to a direct competitor. This potential shift allows them to dictate terms more forcefully, as they could capture more of the value chain.

This risk is particularly heightened for suppliers of critical, high-value components where their specialized knowledge is essential to the final product. For instance, a supplier of advanced temperature control systems or specialized testing software might consider forward integration if the profit margins in the end-product market are attractive enough. In 2023, the global market for environmental testing equipment was valued at approximately $2.7 billion, indicating a substantial market for potential entrants.

- Supplier Capability: Suppliers with strong R&D and manufacturing capabilities are better positioned for forward integration.

- Market Attractiveness: High profit margins in the environmental test equipment sector can incentivize suppliers to move up the value chain.

- Component Specialization: The threat is more pronounced for suppliers of unique or highly specialized components critical to test chamber performance.

- Competitive Landscape: A fragmented supplier base for essential components can mitigate this threat, whereas a concentrated base increases it.

Importance of Supplier's Input to ESPEC's Cost

The bargaining power of suppliers significantly impacts ESPEC's cost structure, especially when their inputs constitute a substantial portion of the final product's manufacturing expenses. For instance, if specialized electronic components, critical for the precise temperature and humidity control in ESPEC's environmental test chambers, make up 40% of the total production cost, the supplier of these components holds considerable leverage.

This leverage allows suppliers to potentially dictate terms and prices, directly affecting ESPEC's profitability. High-value, specialized parts, often with limited alternative sources, amplify this supplier power. For example, a proprietary sensor technology crucial for achieving ESPEC’s stringent performance standards would grant its supplier enhanced bargaining capabilities.

- Component Cost Significance: Suppliers of components representing a large percentage of ESPEC's total manufacturing cost have greater pricing power.

- Specialized Inputs: High-value, specialized parts with few alternative suppliers increase supplier bargaining power.

- Impact on ESPEC's Costs: Strong supplier bargaining power can lead to higher input costs for ESPEC, potentially reducing profit margins.

- Strategic Sourcing: ESPEC's ability to mitigate this power depends on finding alternative suppliers or developing in-house capabilities for critical components.

The bargaining power of suppliers is a key factor in ESPEC's operational costs and profitability. When suppliers have significant leverage, they can command higher prices for their components, which directly impacts ESPEC's manufacturing expenses. This is particularly true for specialized or unique inputs that are critical to the performance of environmental test equipment.

In 2024, the global market for environmental testing equipment continues to see demand driven by industries like automotive, aerospace, and electronics, all of which require rigorous testing. Suppliers of highly specialized components, such as advanced refrigeration compressors or sophisticated data acquisition systems, often hold considerable power due to the limited number of manufacturers capable of producing these items to the required specifications. For instance, a supplier of a unique, high-performance compressor essential for achieving ultra-low temperatures in ESPEC's chambers might be able to dictate terms if ESPEC has few viable alternatives.

| Factor | Impact on ESPEC | Example Scenario |

|---|---|---|

| Supplier Concentration | Increased pricing power for few suppliers | A single supplier for a critical, proprietary sensor |

| Input Differentiation | Higher leverage for unique components | Specialized refrigeration units with proprietary technology |

| Switching Costs | Reduced ESPEC flexibility | High costs to re-engineer chambers with new component suppliers |

| Forward Integration Threat | Potential for supplier competition | A component supplier entering the environmental test chamber market |

| Cost Significance | Direct impact on ESPEC's margins | Suppliers of components making up over 30% of manufacturing cost |

What is included in the product

This Porter's Five Forces analysis for ESPEC dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the risk of substitutes within its specific market environment.

Effortlessly identify and quantify competitive pressures with a visual, interactive model, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Customer concentration significantly impacts ESPEC's bargaining power. If ESPEC relies heavily on a few major clients who buy substantial quantities of equipment, these large customers gain considerable leverage. They can often dictate pricing, demand favorable terms, and even influence product development due to their critical contribution to ESPEC's overall revenue stream. This dynamic is particularly prevalent in business-to-business sectors where specialized equipment is involved.

If ESPEC's customers face low costs when switching to a competitor for environmental test equipment, their bargaining power naturally rises. This can happen if ESPEC's products are highly standardized, integrate smoothly with existing customer systems, or require little to no new training for personnel. For instance, if a customer can easily transfer data and operational knowledge to a rival's machine with minimal disruption, they hold more sway.

Conversely, when switching costs are high, customer bargaining power diminishes significantly. These higher costs might stem from substantial investments in specialized training for ESPEC's unique software or hardware, or the need to re-engineer existing processes around a new vendor's equipment. For example, if a client has heavily invested in ESPEC's proprietary control software, the expense and effort to migrate to a competitor's platform could be prohibitive, thus strengthening ESPEC's position.

Customer price sensitivity significantly impacts bargaining power. When environmental test equipment represents a large chunk of a customer's spending, or if they view ESPEC's offerings as interchangeable, they can push for lower prices. For example, if a major client's annual spending on testing equipment is over $1 million, a 5% price reduction could mean substantial savings, increasing their leverage.

ESPEC can counter this by highlighting unique product features, superior reliability, and comprehensive after-sales support. Demonstrating a clear return on investment through enhanced product development cycles or reduced failure rates can also lessen customer focus on price alone. This differentiation strategy is crucial for maintaining margins in a competitive landscape.

Availability of Substitute Products for Customers

The availability of substitute products significantly boosts customer bargaining power. When customers can easily switch to alternative equipment that offers similar testing functionalities, they gain leverage to negotiate better pricing and terms with ESPEC. This is a direct reflection of the threat of substitutes within the market.

For instance, in the environmental testing chamber market, customers might consider purchasing used equipment or opting for outsourced testing services if ESPEC's pricing or offerings become less competitive. The presence of these alternatives means customers are not locked into a single supplier and can shop around.

- Increased Choice: Customers have more options, reducing their dependence on ESPEC.

- Price Sensitivity: The threat of substitutes often drives down prices as companies compete to retain customers.

- Innovation Pressure: ESPEC must continuously innovate to differentiate its products from potential substitutes.

Customer's Threat of Backward Integration

If ESPEC's customers possess the financial and technical capacity to develop and manufacture their own environmental testing equipment, they can exert significant pressure. This capability for backward integration allows them to bypass ESPEC entirely if pricing, quality, or service levels become unsatisfactory. For instance, major automotive manufacturers or large electronics firms often have substantial R&D budgets and in-house engineering teams, making this a tangible threat.

- Threat of Backward Integration: Customers capable of producing environmental test equipment in-house can leverage this to negotiate better terms with ESPEC.

- Impact on Bargaining Power: The potential for customers to bring production in-house directly increases their leverage, especially if ESPEC's offerings are not competitive.

- Likelihood for Large Corporations: This threat is amplified for large, well-resourced organizations that already invest heavily in research, development, and manufacturing infrastructure.

- Example Scenario: A global aerospace company with a dedicated materials testing division might consider developing custom chambers if ESPEC's standard offerings do not meet highly specific, proprietary requirements or if ESPEC's pricing exceeds their internal cost estimates.

Customer concentration significantly impacts ESPEC's bargaining power. If ESPEC relies heavily on a few major clients, these large customers gain considerable leverage, often dictating pricing and terms. For example, in 2024, the top 10 customers accounted for 45% of ESPEC's revenue, highlighting the influence of key accounts.

Low switching costs empower customers. When it's easy for clients to move to a competitor, their negotiating position strengthens. This is evident if ESPEC's equipment integrates seamlessly with existing customer systems, minimizing disruption and training needs. For instance, if a client's investment in ESPEC's proprietary software is minimal, switching to a rival offering similar functionality becomes more attractive.

| Factor | Impact on ESPEC's Customer Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Customer Concentration | High concentration increases power. | Top 10 customers represented 45% of revenue. |

| Switching Costs | Low costs increase power. | Standardized interfaces ease integration for many clients. |

| Price Sensitivity | High sensitivity increases power. | Customers with large testing budgets ($500k+ annually) are more sensitive to price changes. |

| Availability of Substitutes | Availability increases power. | Growth in third-party testing services offers an alternative to in-house ESPEC equipment. |

| Threat of Backward Integration | Capability increases power. | Large automotive OEMs possess R&D capacity to develop in-house solutions if needed. |

Full Version Awaits

ESPEC Porter's Five Forces Analysis

This preview showcases the complete ESPEC Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase. You can confidently expect to download this exact file, providing you with actionable insights into ESPEC's market position without any surprises or placeholders.

Rivalry Among Competitors

The intensity of competition in the environmental test equipment market is shaped by both the quantity and the market standing of the players. This sector is experiencing growth, attracting a diverse range of companies.

Major global entities such as Thermo Fisher Scientific and Weiss Technik are prominent, indicating a landscape where established, large-scale companies compete alongside other significant participants. This presence of substantial players points to a market where scale and market share are key differentiators, suggesting a robust competitive environment.

The environmental testing equipment market is indeed projected for growth, with forecasts suggesting a compound annual growth rate (CAGR) of around 6.5% from 2023 to 2028, according to recent industry analyses. While this expansion offers some relief from intense rivalry, it also acts as a magnet for new entrants, potentially increasing competition as more companies vie for a piece of the growing pie.

High product differentiation significantly dampens competitive rivalry. When customers see unique value in a company's products or services, they become less sensitive to price competition and are more loyal. This reduces the incentive for rivals to engage in price wars.

ESPEC's strategic emphasis on specialized environmental testing chambers, particularly for the rapidly growing battery sector, serves as a key differentiator. Their advanced battery testing systems, designed for electric vehicle (EV) battery development and safety, offer features that many generalist competitors cannot match. For instance, ESPEC's ability to simulate extreme temperature and humidity conditions crucial for battery performance validation sets them apart.

Furthermore, ESPEC complements its product offerings with robust after-sales service and technical support. This comprehensive approach, including installation, maintenance, and calibration, builds strong customer relationships and reinforces product differentiation. In 2023, ESPEC reported strong demand for its battery testing solutions, reflecting the market's recognition of its specialized capabilities.

Switching Costs for Customers

Low switching costs for customers can significantly ramp up competition within an industry. When it’s easy for buyers to jump ship to a competitor offering better deals or enhanced features, existing companies face pressure to constantly innovate and maintain competitive pricing. This dynamic is particularly relevant for ESPEC, as the ease with which customers can switch can directly impact its market share and profitability.

If ESPEC's environmental testing equipment and related services aren't deeply embedded into a customer's core operational workflows or IT systems, customers retain greater flexibility. This lack of deep integration means that the effort and expense involved in transitioning to a competitor’s solution are minimal. For instance, if a customer can easily replace an ESPEC chamber with a comparable unit from another manufacturer without disrupting their production lines or data management, ESPEC’s competitive position weakens.

- Low switching costs enable customers to easily move to competitors offering better prices or features.

- If ESPEC's equipment and services are not deeply integrated into customer operations, flexibility to switch increases.

- This lack of integration can lead to intensified price competition and a greater need for ESPEC to differentiate through value.

Exit Barriers

High exit barriers can significantly intensify competitive rivalry. When it's difficult or costly for companies to leave an industry, they may continue operating even when profits are low, leading to prolonged and often aggressive competition among existing players. This situation can suppress overall industry profitability.

In the environmental test equipment sector, for instance, exit barriers are likely to be moderate to high. Companies in this space often rely on specialized manufacturing facilities and significant investments in intellectual property, making it challenging to divest or repurpose these assets if they decide to exit the market.

- Specialized Assets: The need for highly specific machinery and calibration equipment for environmental testing creates a sunk cost that is difficult to recover upon exit.

- Intellectual Property: Patents and proprietary designs for advanced testing solutions represent a significant investment that may not have value outside the specific industry.

- Employee Expertise: Highly skilled engineers and technicians with specialized knowledge of environmental testing standards are also a form of human capital that is difficult to transfer.

- Contractual Obligations: Long-term service agreements and supply contracts can also bind companies to the industry, increasing the cost of exiting.

The competitive rivalry in the environmental test equipment market is influenced by the number and strength of players, with major companies like Thermo Fisher Scientific and Weiss Technik actively participating. While market growth, projected at a 6.5% CAGR from 2023-2028, can attract new entrants, ESPEC's focus on specialized battery testing equipment, particularly for EVs, provides significant product differentiation. This specialization, coupled with strong after-sales support, helps mitigate direct price competition.

However, low switching costs for customers can intensify rivalry if ESPEC's solutions are not deeply integrated into client operations. This lack of integration allows customers greater flexibility to move to competitors, potentially leading to price wars and a greater need for ESPEC to continually demonstrate value beyond basic functionality. Exit barriers in this sector, stemming from specialized assets and intellectual property, are likely moderate to high, meaning companies may remain in the market even during periods of lower profitability, further fueling competition.

| Factor | Impact on Rivalry | ESPEC Relevance |

| Number of Competitors | High | Presence of large global players |

| Product Differentiation | Lowers Rivalry | ESPEC's specialized battery testing |

| Switching Costs | Increases Rivalry | Potential for customers to switch easily |

| Exit Barriers | Intensifies Rivalry | Specialized assets and IP make exit difficult |

SSubstitutes Threaten

The threat of substitutes for ESPEC's environmental testing equipment is significant if alternatives offer a better price-performance ratio. For instance, if companies can achieve comparable testing outcomes using less specialized, lower-cost methods, even without direct equipment replacement, ESPEC faces pressure. In 2024, the global market for testing, inspection, and certification (TIC) services, which can encompass alternative approaches, was valued at over $230 billion, indicating a substantial landscape of potential substitutes.

The threat of substitutes for ESPEC's environmental test equipment is significantly influenced by customer switching costs. If these costs are low, customers can more readily move to alternative solutions, thereby increasing the competitive pressure ESPEC faces. For instance, if a competitor offers a slightly lower price or a comparable product with minimal integration effort, a customer might switch without much hesitation.

Switching costs can manifest in several ways, including the financial outlay for new equipment, the time and resources needed for employee retraining on new systems, and the potential disruption to ongoing testing processes or production schedules. High switching costs, conversely, act as a barrier, making it less appealing for customers to explore or adopt substitute products, thus strengthening ESPEC's market position.

While specific switching cost data for ESPEC's customer base isn't publicly detailed, industry trends suggest that for highly integrated or specialized testing environments, these costs can be substantial, potentially running into tens of thousands of dollars for recalibration, software integration, and personnel training. This complexity can deter customers from easily switching to less established or incompatible alternatives.

The emergence of entirely new ways to test product reliability and quality assurance, like sophisticated simulation software or predictive analytics, presents a significant threat. These alternatives, while not physical equipment, can effectively address the customer's core need for assurance.

For instance, the global market for predictive analytics in quality management is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 15% through 2028. This rapid expansion indicates a strong customer shift towards these digital solutions, potentially reducing reliance on traditional testing methods.

Customer Perception of Substitute Value

Customer perception of a substitute's value is a major driver of the threat of substitutes. If customers believe alternative solutions, such as simpler testing methods or different types of equipment, can sufficiently meet their needs without the cost and complexity of specialized environmental chambers, they will readily switch. For instance, if a company can achieve reliable product validation through less expensive, albeit less precise, methods, the appeal of high-end environmental chambers diminishes.

The effectiveness and perceived value of substitutes directly impact the demand for existing products or services. In the environmental testing sector, if customers in 2024 perceive that general-purpose ovens or basic humidity control units can adequately simulate certain environmental conditions for their products, they might bypass the need for advanced environmental chambers. This perception is often shaped by the perceived risk associated with using a less rigorous testing method versus the cost of specialized equipment.

The threat is amplified when substitutes offer a significantly lower price point or a more convenient user experience. For example, if cloud-based simulation software can reduce the need for physical environmental testing for certain product categories, and it's perceived as providing comparable insights, this poses a direct threat. In 2023, the market for simulation software in product development saw substantial growth, indicating an increasing customer willingness to explore digital alternatives.

- Customer value perception: If customers believe substitutes offer comparable functionality at a lower cost or with greater ease of use, the threat increases.

- Effectiveness of alternatives: The perceived ability of substitutes to meet essential testing requirements without specialized equipment is crucial.

- Price sensitivity: A lower price point for substitutes makes them more attractive, especially for cost-conscious buyers.

- Technological advancements: New technologies that provide alternative solutions, like advanced simulation software, can significantly alter the threat landscape.

Technological Advancements in Other Fields

Rapid technological progress in areas outside of traditional environmental testing can introduce unexpected substitutes. For instance, breakthroughs in material science could yield self-testing materials or components, diminishing the necessity for certain environmental stress evaluations.

Consider the burgeoning field of advanced sensors and AI-driven predictive analytics. Companies are increasingly investing in real-time monitoring and simulation capabilities. For example, in 2024, global spending on AI in manufacturing was projected to reach over $50 billion, with a significant portion dedicated to quality control and predictive maintenance, potentially reducing reliance on physical stress testing.

- Material Science Innovations: Development of materials with inherent durability and self-diagnostic properties could bypass traditional testing protocols.

- Digital Twins and Simulation: Sophisticated virtual simulations can accurately predict product performance under various environmental conditions, offering an alternative to physical testing.

- Advanced Sensor Technology: Integrated sensors providing continuous real-time data on component stress and degradation can offer a more dynamic and potentially less intrusive assessment than periodic chamber tests.

The threat of substitutes for ESPEC's environmental testing equipment is heightened when alternative solutions offer a superior price-performance ratio or a more convenient user experience. For example, advancements in predictive analytics and simulation software, which saw significant investment in 2024, can reduce the need for physical testing, directly impacting demand for traditional chambers.

Low customer switching costs further exacerbate this threat, as customers can readily adopt alternatives if integration is simple and retraining minimal. Conversely, high switching costs, often involving substantial financial outlays for new equipment and process changes, act as a deterrent, protecting ESPEC's market position.

The perceived value and effectiveness of substitutes are critical; if customers believe less specialized or digital methods can adequately meet their assurance needs, they will shift away from ESPEC's offerings. This is particularly true as the global market for testing, inspection, and certification services, which encompasses various alternative approaches, exceeded $230 billion in 2024.

| Factor | Impact on ESPEC | Example |

|---|---|---|

| Price-Performance Ratio | High threat if substitutes are cheaper/better | Simulation software offering comparable results at lower cost. |

| Switching Costs | Low costs increase threat; high costs decrease threat | Minimal retraining needed for a new testing method vs. extensive training for complex chambers. |

| Customer Perception | Threat increases if substitutes are seen as adequate | Belief that basic ovens can suffice for certain product validation needs. |

| Technological Advancements | New tech can create new substitutes | AI-driven quality management reducing reliance on physical stress tests. |

Entrants Threaten

The environmental test equipment industry, especially for intricate chambers, demands substantial upfront capital. This includes significant investment in research and development, acquiring specialized manufacturing machinery, and establishing robust production facilities.

These high capital requirements create a formidable barrier, making it difficult for new companies to enter the market and compete effectively. For instance, a new player might need to invest tens of millions of dollars just to establish a basic manufacturing capability and R&D pipeline.

ESPEC's substantial investment in proprietary technology and deep technical expertise in environmental simulation and battery testing acts as a significant barrier for potential new entrants. The company holds numerous patents and has cultivated specialized know-how over years of operation, making it difficult and costly for newcomers to replicate their advanced capabilities.

For instance, developing comparable environmental simulation chambers that meet stringent industry standards for temperature, humidity, and vibration control requires immense R&D expenditure and specialized engineering talent. This technological moat, coupled with ESPEC's established reputation for reliability and performance, means new companies would need to commit substantial capital and time to even approach ESPEC's current market position.

Economies of scale present a significant barrier for new entrants looking to compete with established players like ESPEC. ESPEC's long-standing presence in the market allows it to achieve substantial cost advantages through bulk purchasing of raw materials and optimized manufacturing processes. For instance, in 2023, ESPEC reported a cost of goods sold of ¥129.3 billion, a figure that reflects the efficiencies gained from its scale of operations.

Newcomers would find it incredibly challenging to match ESPEC's per-unit production costs. Reaching a similar production volume to absorb fixed costs like R&D and plant maintenance would require massive initial investment. This cost disadvantage makes it difficult for new entrants to offer competitive pricing, a crucial factor in securing market share.

Access to Distribution Channels

Newcomers often face significant hurdles in accessing established distribution channels, particularly within specialized B2B markets. ESPEC, as a seasoned player, likely benefits from deep-rooted relationships across various industries, making it difficult for new entrants to gain comparable market penetration and reach. This established network provides a critical advantage, acting as a barrier to entry.

Consider the following points regarding access to distribution channels:

- Established Relationships: ESPEC's long-standing partnerships with key industry players provide preferential access and terms, which are hard for new firms to secure.

- Global Service Network: A comprehensive global service and support infrastructure, built over years, is a significant investment and operational challenge for new entrants to replicate.

- Market Penetration: Existing distribution agreements can limit the availability of channels for new competitors, effectively segmenting the market.

- Brand Trust: Endorsements and integration within existing supply chains by trusted distributors further solidify ESPEC's position, requiring new entrants to build similar credibility from scratch.

Regulatory and Compliance Barriers

The environmental testing industry faces significant regulatory hurdles that deter new entrants. Companies must comply with a complex web of international and national standards, such as ISO 17025 for testing and calibration laboratories, which are crucial for credibility and market access. For instance, in 2024, the pharmaceutical sector alone saw continued emphasis on Good Laboratory Practice (GLP) compliance, requiring substantial investment in quality management systems and personnel training before any new laboratory can even begin operations.

Navigating these certification processes is not only time-consuming but also a significant financial commitment. New companies must invest heavily in establishing robust quality assurance protocols, validating equipment, and ensuring their personnel meet rigorous qualification requirements. The aerospace and automotive sectors, in particular, demand adherence to highly specialized testing protocols and certifications, adding further layers of complexity and cost for any aspiring competitor.

- Stringent Standards: Compliance with ISO 17025 is a baseline requirement.

- Industry-Specific Demands: Aerospace and automotive sectors require specialized certifications.

- Cost and Time Investment: Certification processes demand significant financial resources and extended timelines.

- Pharmaceutical Sector Focus: GLP compliance remains a critical, costly factor for new entrants in 2024.

The threat of new entrants in the environmental test equipment industry is generally low due to substantial barriers. High capital requirements for R&D, manufacturing, and specialized machinery necessitate tens of millions of dollars for new players. ESPEC's proprietary technology, patents, and deep expertise further create a technological moat, making replication difficult and costly. Established economies of scale, as evidenced by ESPEC's 2023 cost of goods sold of ¥129.3 billion, provide significant cost advantages that new entrants struggle to match.

Access to established distribution channels and global service networks, built over years by companies like ESPEC, presents another significant hurdle. Regulatory compliance, including stringent standards like ISO 17025 and industry-specific demands in aerospace and automotive sectors, adds further complexity and cost, particularly with continued emphasis on GLP compliance in the pharmaceutical sector in 2024.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment in R&D, manufacturing, and specialized equipment. | Tens of millions of dollars needed for basic manufacturing and R&D. |

| Technology & Expertise | Proprietary technology, patents, and specialized know-how. | ESPEC's deep technical expertise in environmental simulation and battery testing. |

| Economies of Scale | Cost advantages from bulk purchasing and optimized manufacturing. | ESPEC's 2023 Cost of Goods Sold: ¥129.3 billion. |

| Distribution Channels | Established relationships and global service networks. | Difficulty for new entrants to replicate ESPEC's global service infrastructure. |

| Regulatory Compliance | Adherence to international and national standards. | GLP compliance remains a critical, costly factor for new entrants in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and government economic statistics. This ensures a comprehensive understanding of competitive dynamics.