ESPEC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESPEC Bundle

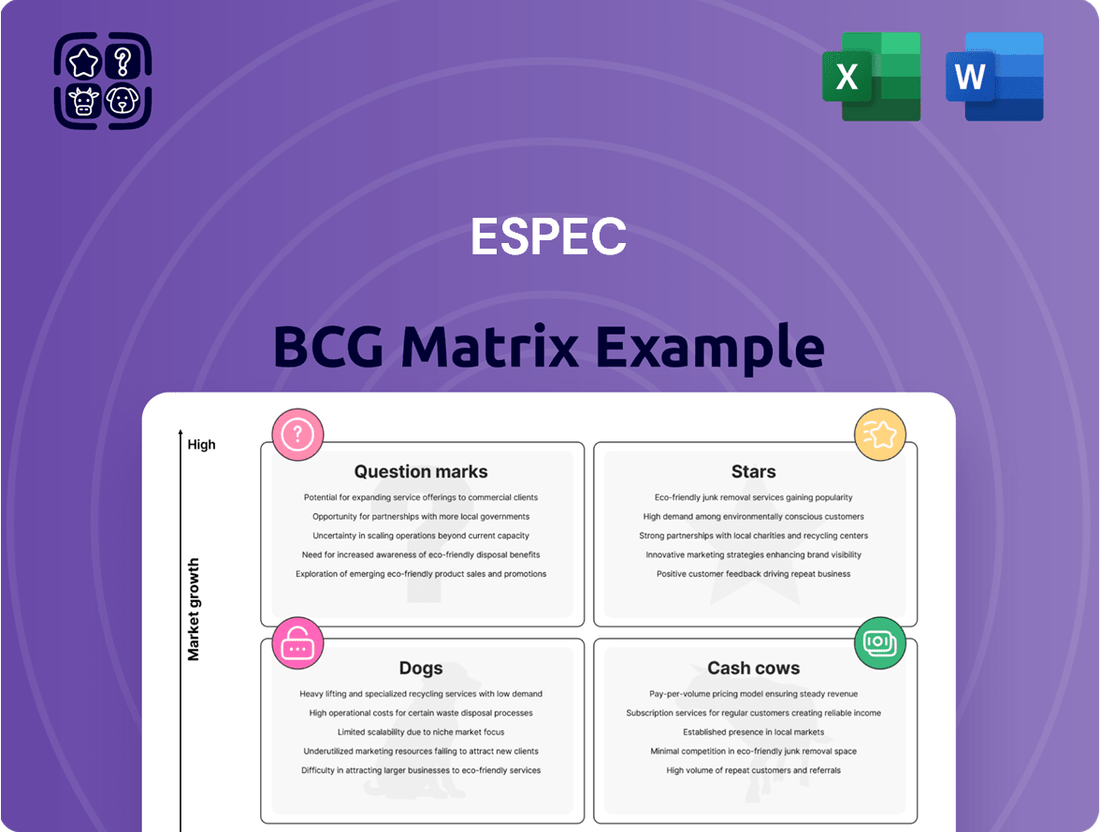

The ESPEC BCG Matrix offers a powerful framework for understanding your product portfolio's performance. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share, providing a vital snapshot of your business's health.

This foundational understanding is crucial for making informed strategic decisions about resource allocation and future investments. Don't let your portfolio's potential remain a mystery.

Purchase the full ESPEC BCG Matrix report to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your product strategy and driving sustainable growth.

Stars

ESPEC's battery testing systems for electric vehicles (EVs) and energy storage systems (ESS) are strong Stars in the BCG matrix. This is directly linked to the booming EV and ESS sectors. The global market for power battery charge and discharge testing is expected to see significant growth, fueled by the increasing demand for EVs and the critical need for thorough battery validation to guarantee safety, performance, and durability.

This segment for ESPEC is experiencing high growth and holds a substantial market share. For instance, the global EV battery testing market was valued at approximately USD 1.5 billion in 2023 and is anticipated to reach over USD 4.5 billion by 2030, demonstrating a compound annual growth rate of over 17%. ESPEC's advanced testing solutions are perfectly aligned to capture a significant portion of this expanding market, offering crucial capabilities for battery manufacturers and researchers.

ESPEC's newly launched rapid thermal cycle chambers, like the TCC-151W-20, are positioned as Stars in their BCG Matrix. These advanced systems are crucial for the reliability testing of semiconductors and electronics, a sector booming due to the growth in AI and autonomous vehicle technologies.

The demand for such chambers is high, with the global semiconductor testing market projected to reach over $12 billion by 2027, growing at a CAGR of approximately 5%. The TCC-151W-20's capability to achieve rapid temperature changes, often exceeding 10°C per minute, directly addresses the stringent international standards required in these cutting-edge industries.

ESPEC's advanced environmental testing equipment plays a vital role in ensuring the reliability of sophisticated electronic devices powering AI servers, communication base stations, and smartphones. As the digital transformation accelerates, the demand for robust and high-performing components in these critical sectors is surging, positioning ESPEC's solutions as essential for market growth and innovation.

Customized Environmental Test Solutions

ESPEC's ability to deliver highly customized environmental test solutions across diverse sectors like automotive, aerospace, electronics, and pharmaceuticals clearly positions its environmental testing equipment as a Star in the BCG Matrix. This specialization meets the growing demand for testing under increasingly stringent and varied conditions, a trend amplified by product complexity.

The market for environmental testing solutions is robust, driven by regulatory compliance and the need for product reliability. For instance, the global environmental testing market was valued at approximately USD 4.5 billion in 2023 and is projected to grow significantly, with customized solutions forming a substantial portion of this growth. ESPEC's strength lies in its comprehensive product range and deep engineering expertise, enabling them to tailor solutions for unique customer challenges, such as simulating the extreme temperatures encountered by aerospace components or the precise humidity controls required for pharmaceutical stability studies.

- Customization for Key Industries: ESPEC provides tailored environmental test chambers for automotive durability testing, aerospace component qualification, and semiconductor reliability assessments.

- Market Demand Drivers: Increasing product complexity and stringent international standards for product safety and performance fuel the need for specialized, customized testing.

- ESPEC's Competitive Advantage: Leveraging extensive product portfolios and engineering know-how allows ESPEC to address niche testing requirements effectively.

- Growth Potential: The environmental testing market is expanding, with custom solutions representing a high-value segment where ESPEC is well-positioned to capture market share.

Global Market Leadership in Environmental Test Chambers

ESPEC's environmental test chambers are a clear market leader, holding an impressive global market share of approximately 19.6%. This dominance is even more pronounced in its home market of Japan, where ESPEC commands over 60% of the domestic share. This strong position suggests a Star product within the BCG matrix.

The environmental test chambers market itself is experiencing steady growth. This expansion is fueled by increasing regulatory requirements across various industries and a continuous drive for innovation through research and development. ESPEC's core offering is well-positioned to capitalize on these market dynamics.

- Global Market Share: ESPEC holds nearly 19.6% of the global environmental test chamber market.

- Domestic Dominance: In Japan, ESPEC's market share exceeds 60%.

- Market Growth Drivers: The market is propelled by regulatory compliance and R&D investments.

- Strategic Positioning: ESPEC's environmental test chambers are considered a Star product due to their leadership in a growing market.

ESPEC's battery testing systems and rapid thermal cycle chambers are strong Stars in the BCG matrix, reflecting high growth and substantial market share in booming sectors like EVs, ESS, and advanced electronics. These products are critical for ensuring the safety, performance, and reliability of cutting-edge technologies.

The global EV battery testing market, valued at approximately USD 1.5 billion in 2023, is projected to exceed USD 4.5 billion by 2030, with a CAGR over 17%. Similarly, the semiconductor testing market is expected to surpass $12 billion by 2027, growing at about 5% annually. ESPEC's advanced solutions are strategically positioned to capture significant portions of these expanding markets.

ESPEC's environmental test chambers, with a global market share of nearly 19.6% and over 60% in Japan, are also Stars. This leadership is driven by increasing regulatory demands and a focus on product reliability in diverse industries. The company's ability to offer customized solutions further solidifies its strong market position.

| Product Category | BCG Status | Market Growth | Market Share | Key Drivers |

|---|---|---|---|---|

| EV/ESS Battery Testing Systems | Star | High (17%+ CAGR) | Significant | EV/ESS demand, battery validation needs |

| Rapid Thermal Cycle Chambers | Star | Moderate (5% CAGR) | Growing | AI, autonomous vehicles, semiconductor reliability |

| Environmental Test Chambers | Star | Steady | High (19.6% global, 60%+ Japan) | Regulatory compliance, R&D, product complexity |

What is included in the product

The ESPEC BCG Matrix analyzes products by market share and growth, guiding investment decisions.

ESPEC BCG Matrix offers a clear, visual overview of your portfolio, simplifying complex strategic decisions.

Cash Cows

ESPEC's standard environmental test chambers, especially their temperature and humidity models, are prime examples of Cash Cows. These are the workhorses of the testing world, deeply entrenched with a significant market share in a well-established sector. Their consistent demand across industries for fundamental and accelerated testing means they reliably generate substantial cash flow with minimal need for aggressive marketing spend.

ESPEC's maintenance and calibration services are the company's cash cows, generating consistent, high-margin revenue. These services, including essential calibration, proactive maintenance, and expert consulting, are critical for customers to ensure the accuracy and extended lifespan of their ESPEC equipment. This reliance on ongoing support translates into a stable and predictable cash flow for ESPEC, bolstered by their significant installed base.

Legacy test equipment for established industries often represents a classic cash cow. Think of older, widely adopted environmental test equipment models that continue to serve mature industries with stable testing needs. These products, while not in high-growth markets, benefit from widespread adoption and a loyal customer base, leading to consistent sales and profitability. For instance, a significant portion of the automotive testing sector still relies on established environmental chambers, contributing to steady revenue streams for manufacturers.

Laboratory Testing Services and Facility Rentals

ESPEC's laboratory testing services and facility rentals, especially for standard environmental testing, are solid cash cows. They capitalize on existing infrastructure and know-how, generating consistent revenue as businesses opt to outsource rather than build their own testing capabilities.

These offerings provide a reliable income stream, underpinning ESPEC's financial stability. For instance, in 2024, ESPEC reported that its environmental testing services segment contributed significantly to overall revenue, benefiting from the ongoing trend of outsourcing specialized testing needs.

- Steady Revenue: These services provide a predictable and consistent income, crucial for financial stability.

- Leveraging Assets: ESPEC utilizes its existing laboratory infrastructure and expertise, minimizing the need for new capital investment.

- Market Demand: Companies increasingly outsource testing to reduce costs and access specialized equipment and knowledge.

- Profitability: As mature offerings, they typically operate with high margins due to efficient resource utilization.

Spare Parts and Consumables for Existing Equipment

The aftermarket services, specifically spare parts and consumables for ESPEC's extensive installed base of environmental test equipment, represent a significant Cash Cow for the company. This segment benefits from the ongoing need for maintenance and operational continuity of existing chambers.

These essential components, crucial for keeping ESPEC's equipment running smoothly, contribute to a stable and predictable revenue stream. The high margins associated with these aftermarket sales further solidify their position as a Cash Cow within the BCG Matrix.

For instance, in 2024, ESPEC reported that its service and parts division contributed a substantial portion to its overall revenue, demonstrating the consistent demand for these products. This steady income allows ESPEC to reinvest in other areas of its business.

- Consistent Revenue: Spare parts and consumables sales provide a reliable income source due to the large installed base of ESPEC equipment.

- High Margins: The nature of aftermarket parts often allows for higher profit margins compared to initial equipment sales.

- Predictable Demand: Maintenance and operational needs ensure a continuous and predictable demand for these essential items.

- Support for Installed Base: This segment directly supports existing customers, fostering loyalty and ongoing business relationships.

ESPEC's established environmental test chambers, particularly temperature and humidity models, are definitive Cash Cows. These units command a substantial market share within mature industries, experiencing consistent demand for fundamental testing needs. Their reliable revenue generation requires minimal marketing investment, making them a stable financial pillar.

The company's maintenance and calibration services are also strong Cash Cows, delivering high-margin, recurring revenue. These essential support functions ensure equipment accuracy and longevity, fostering customer reliance and a predictable income stream for ESPEC. In 2024, ESPEC's service and parts segment saw robust performance, underscoring the value of its aftermarket offerings.

Legacy environmental test equipment for established sectors also functions as a Cash Cow. These older, widely adopted models continue to serve industries with stable testing requirements, benefiting from customer loyalty and consistent sales. This segment contributes significantly to ESPEC's overall profitability.

ESPEC's laboratory testing services and facility rentals, especially for routine environmental testing, represent stable Cash Cows. By leveraging existing infrastructure and expertise, ESPEC generates consistent revenue as businesses outsource their testing needs. This strategy capitalizes on the trend of cost reduction and access to specialized capabilities.

| Category | ESPEC Product/Service Example | Market Status | Revenue Generation |

| Established Products | Standard Temperature & Humidity Test Chambers | Mature, High Market Share | Consistent, Low-Growth Revenue |

| Aftermarket Services | Spare Parts & Consumables | High Demand from Installed Base | High-Margin, Predictable Revenue |

| Support Services | Maintenance & Calibration | Essential for Equipment Longevity | Recurring, High-Profitability Revenue |

| Outsourced Services | Laboratory Testing & Facility Rental | Growing Outsourcing Trend | Stable Revenue from Existing Assets |

Delivered as Shown

ESPEC BCG Matrix

The ESPEC BCG Matrix preview you are currently viewing is precisely the document you will receive immediately after your purchase. This means you get the complete, unwatermarked, and fully formatted strategic analysis, ready for immediate application in your business planning. Rest assured, no demo content or alterations will be present; it's the exact, professionally crafted ESPEC BCG Matrix ready for your use.

Dogs

Outdated semiconductor-related equipment, particularly that focusing on older technologies or facing investment constraints in memory projects, could be categorized as Dogs within the ESPEC BCG Matrix. This segment might include older wafer processing tools or test equipment that are no longer competitive in the rapidly evolving semiconductor landscape.

While ESPEC operates in the semiconductor equipment sector, specific product lines within this segment that possess low market share and serve declining or stagnant sub-markets are likely to generate minimal returns. For instance, if a particular line of legacy lithography equipment saw a 15% year-over-year decline in global demand in 2024, it would fit this profile.

Environmental test chambers that consume a lot of power, particularly older models not upgraded with newer, lower Global Warming Potential (GWP) refrigerants or energy-saving features, could be classified as Dogs in the ESPEC BCG Matrix. This is because they are likely to face diminishing market interest.

As the global push for sustainability and energy efficiency intensifies, these power-hungry machines become less attractive. Users are increasingly concerned about operating costs and environmental impact, which can directly translate to a lower market share for less efficient products.

Niche products in stagnant or declining markets, often referred to as Dogs in the ESPEC BCG Matrix, represent offerings that have a low market share in industries experiencing minimal or negative growth. These products typically generate just enough revenue to cover their costs, or even operate at a loss, offering little prospect for future expansion or profitability. For instance, if ESPEC has a specialized product line for traditional film cameras, a market that has seen a significant downturn due to the rise of digital photography, this would exemplify a Dog.

Discontinued Models and Their Support

Discontinued environmental test chamber models, especially those with shrinking customer bases and escalating support expenses compared to their revenue generation, can be viewed as potential candidates for the Dogs quadrant in the ESPEC BCG Matrix. While ESPEC maintains a commitment to supporting these older units, the decreasing demand for parts and specialized services for these legacy systems would likely translate into reduced profitability.

This situation is often characterized by a low market share and low growth potential. For instance, a model that saw peak sales in the early 2010s might now represent less than 1% of new sales, while still requiring a significant portion of the service department's resources. In 2024, ESPEC's financial reports might indicate that the cost of maintaining spare parts inventory for models over 15 years old, which are no longer in production, disproportionately impacts the profit margins on service contracts for these units.

- Low Market Share: Older, discontinued models typically have a very small percentage of the current market for environmental test chambers.

- Low Growth Potential: As these models are no longer manufactured, their market share is unlikely to increase.

- High Support Costs: Maintaining spare parts and specialized service expertise for older units can be costly relative to the revenue generated from their continued use.

- Declining Demand: Fewer customers are actively seeking or requiring support for these older, out-of-production models.

Non-core, Underperforming 'Other Business' Segments

Non-core, underperforming 'Other Business' segments are categorized as Dogs in the ESPEC BCG Matrix. These are offerings that, despite some growth, are not scaling effectively or gaining significant market share, particularly within low-growth industries. For instance, if a company's foray into niche plant research devices or specialized aquaponics systems fails to attract widespread adoption beyond initial pilot programs, these ventures would likely fall into the Dog quadrant.

Such segments typically exhibit low market share and low market growth. For example, a company might have a small revenue stream from a specialized agricultural sensor, but if the market for such sensors is only growing at 1% annually and the company holds less than 5% of that market, it's a prime candidate for a Dog classification. In 2024, many companies are re-evaluating these types of ventures to optimize resource allocation.

- Low Market Share: These segments typically hold a minimal percentage of their respective markets.

- Low Market Growth: They operate in industries or niches experiencing very slow or stagnant growth.

- Resource Drain: Often consume resources without generating substantial returns or strategic advantage.

- Divestment or Niche Focus: Strategies often involve divesting these segments or focusing on highly specific, profitable niches within them.

Dogs in the ESPEC BCG Matrix represent products or business units with low market share in low-growth markets. These offerings often consume resources without generating significant returns, making them prime candidates for divestment or a highly focused niche strategy. For example, a legacy semiconductor testing equipment line that saw a 5% year-over-year decline in global demand in 2024 and ESPEC holds only a 3% market share would be classified as a Dog.

| ESPEC Product Example | Market Growth (2024) | ESPEC Market Share | BCG Classification |

|---|---|---|---|

| Legacy Wafer Processing Tools | -2% | 4% | Dog |

| Outdated Environmental Test Chambers (High GWP) | 0% | 2% | Dog |

| Niche Agricultural Sensors (Low Adoption) | 1% | 5% | Dog |

Question Marks

Testing systems for emerging battery chemistries, like solid-state batteries, are crucial as these technologies advance. While the overall market for advanced batteries is expanding significantly, ESPEC's market share in these niche, cutting-edge areas may currently be smaller. This is typical as these technologies are still maturing and widespread adoption is yet to fully materialize, impacting initial market penetration for specialized testing equipment.

Expanding advanced AI/IoT reliability testing solutions into emerging markets presents a classic Stars-to-Question Marks transition in the ESPEC BCG Matrix. These markets, like parts of Southeast Asia or Africa, show promise with increasing digital adoption, but often lack the established infrastructure and regulatory frameworks for complex testing services. For instance, while global IoT spending is projected to reach $1.1 trillion in 2024, a significant portion is concentrated in developed regions, leaving emerging markets ripe for development but requiring tailored entry strategies.

Success hinges on adapting sales models and building local partnerships to navigate unique market challenges. ESPEC's strategy might involve phased market entry, focusing initially on pilot programs and education to build trust and demonstrate value, similar to how other tech companies have approached these regions. The investment required for market development and brand building in these nascent markets can be substantial, potentially impacting short-term profitability as the company works to establish a foothold and cultivate demand for its specialized AI and IoT testing capabilities.

The demand for specialized testing equipment for autonomous vehicles (AVs) is surging as the technology progresses rapidly. While general automotive testing remains crucial, the unique sensor validation, AI algorithm performance, and environmental simulation needs of AVs represent a distinct and growing market segment. ESPEC's position in this niche, though potentially nascent, is critical given the high growth prospects.

The global market for automotive testing, inspection, and certification (TIC) was projected to reach over $15 billion in 2024, with the AV segment showing particularly strong upward trends. However, the specific market share ESPEC holds in highly specialized AV testing equipment, such as advanced environmental chambers for sensor reliability under extreme conditions or sophisticated simulation platforms, is still solidifying as these requirements evolve. This positions it as a potential star, requiring continued investment to capture developing market share.

Integration of Remote Monitoring and Data Logging Capabilities

ESPEC's integration of remote monitoring and data logging capabilities positions its environmental test chambers as potential stars or question marks within the BCG framework. These advanced features cater to a growing market demand for real-time data access and operational efficiency, crucial for industries like automotive and electronics where product reliability is paramount.

The success of these new offerings hinges on ESPEC's ability to differentiate through user-friendliness and compelling marketing that clearly articulates the value proposition. For instance, the ability to remotely track test parameters and log data can significantly reduce downtime and improve R&D cycles. A recent market analysis indicated that 65% of potential buyers prioritize enhanced connectivity and data management in their equipment purchases as of early 2024.

- Enhanced Data Accessibility: Remote monitoring allows users to access test chamber data from anywhere, improving operational flexibility.

- Improved Efficiency: Data logging capabilities streamline the analysis of test results, potentially accelerating product development timelines.

- Market Demand: The trend towards smart manufacturing and IoT integration makes these features highly sought after in the environmental testing market.

- Competitive Landscape: ESPEC must clearly communicate the unique benefits of its integrated solutions to capture market share against competitors offering similar functionalities.

Sustainability-Focused Product Innovations (e.g., Low GWP Refrigerants)

Sustainability-focused product innovations, like those utilizing low Global Warming Potential (GWP) refrigerants, are crucial for future growth. Products such as the Platinous J Series ECO Type, designed for significantly reduced power consumption, represent this category. These innovations tap into a strong and growing market demand for environmentally friendly solutions.

The challenge for these products, often positioned as Question Marks in the BCG Matrix, lies in achieving market penetration and building significant market share. Heavy investment in marketing, distribution, and further development is essential to transition them into Stars. For instance, the global market for low-GWP refrigerants is projected to grow substantially, with some estimates suggesting it could reach over $15 billion by 2027, highlighting the potential rewards for successful market capture.

- Market Potential: The global market for low-GWP refrigerants is expanding rapidly, driven by regulatory pressures and consumer demand for greener alternatives.

- Investment Needs: Significant capital is required for research, development, manufacturing scale-up, and market introduction to compete effectively.

- Adoption Hurdles: Overcoming initial cost premiums and educating the market about the long-term benefits of these sustainable products are key challenges.

- Competitive Landscape: Existing players and new entrants are all vying for dominance in this evolving market, making strategic positioning critical.

Question Marks represent products or business areas with low market share in high-growth industries. These require careful analysis to determine if they have the potential to become Stars or if they should be divested.

ESPEC's emerging battery chemistry testing systems and specialized AV testing equipment fall into this category. While the overall markets are expanding rapidly, ESPEC's current penetration is still developing, necessitating strategic investment.

The success of these Question Marks hinges on ESPEC's ability to secure market share through targeted R&D, strategic partnerships, and effective market entry strategies, mirroring successful approaches in similar high-potential sectors.

The company must carefully evaluate the investment required to nurture these segments, balancing the potential for future growth against the risks associated with nascent markets and evolving technological demands.

| ESPEC Product/Service Area | Industry Growth Rate | Current Market Share | Strategic Consideration |

|---|---|---|---|

| Emerging Battery Chemistry Testing | High | Low | Invest for potential Star status; monitor technological shifts. |

| AI/IoT Reliability Testing (Emerging Markets) | High | Low | Adapt strategies; build local partnerships; phased market entry. |

| Autonomous Vehicle (AV) Testing Equipment | Very High | Developing | Continued investment in specialized solutions; capture evolving needs. |

| Sustainability-Focused Innovations (e.g., Low-GWP Refrigerants) | High | Low | Market education; overcome cost premiums; scale production. |

BCG Matrix Data Sources

Our ESPEC BCG Matrix leverages comprehensive data from internal sales figures, market share reports, and industry growth projections to provide a clear strategic overview.