ESAB India PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESAB India Bundle

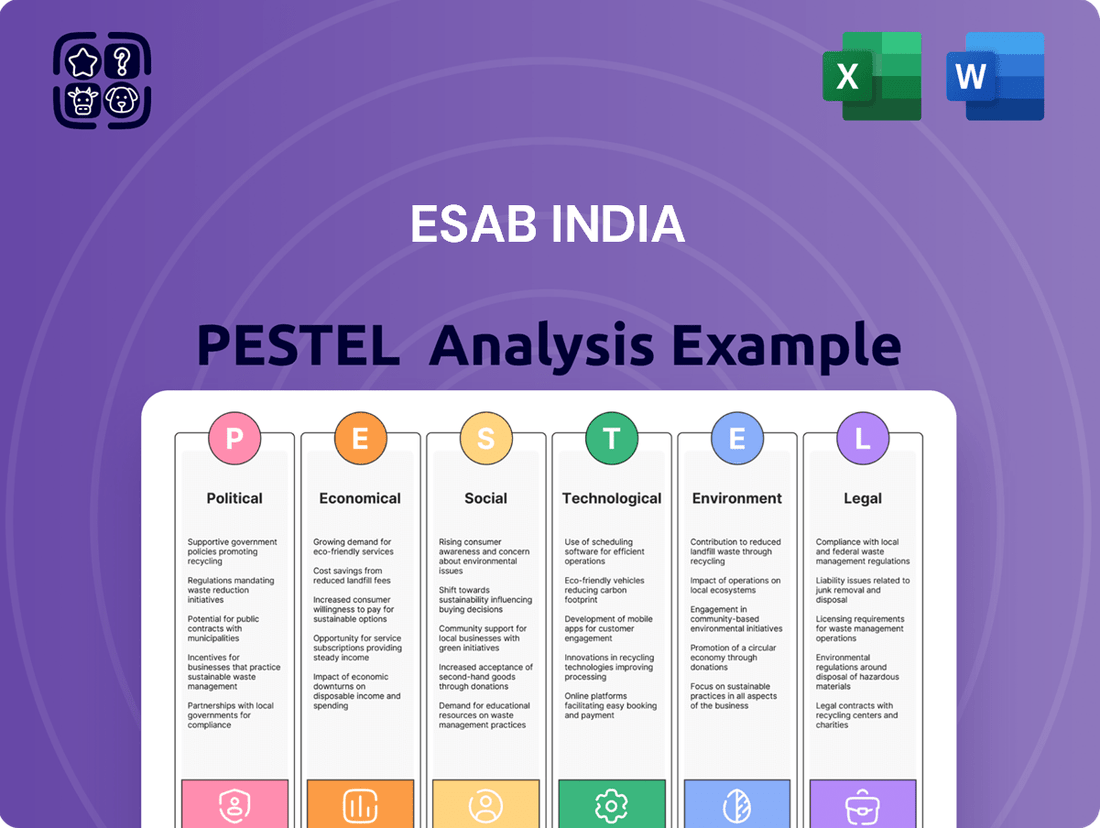

Navigate the dynamic Indian market with our comprehensive PESTLE analysis of ESAB India. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its operational landscape and future growth. Equip yourself with actionable intelligence to refine your market strategies and gain a competitive edge. Download the full PESTLE analysis now for a deeper dive into these critical external factors.

Political factors

The Indian government's strong push for domestic manufacturing through initiatives like 'Make in India' and Production-Linked Incentive (PLI) schemes directly bolsters ESAB India's operational landscape. These policies are designed to foster local production and decrease reliance on imports, making it more attractive for ESAB India to expand its manufacturing footprint within the country. For instance, the PLI scheme for the automobile and auto component sector, which ESAB India's welding and cutting solutions serve, has seen significant uptake, indicating robust government commitment.

The Indian government's ambitious infrastructure development initiatives, such as the PM Gati Shakti National Master Plan and the Bharatmala Pariyojana, are creating substantial demand for welding and cutting solutions. These projects, aimed at enhancing logistics and connectivity, involve extensive construction and fabrication work. For instance, the National Highways Authority of India (NHAI) plans to award contracts worth ₹1.6 trillion (approximately $19.2 billion) for road construction in the fiscal year 2024-25, directly benefiting companies like ESAB India that supply essential equipment to these sectors.

The Union Budget 2024-25 and ongoing tax policy adjustments significantly influence ESAB India's financial landscape. Potential extensions of concessional tax regimes, particularly those aimed at manufacturing companies, could directly boost ESAB India's profitability and inform its capital expenditure plans. For instance, if the government continues or enhances incentives for capital investment, ESAB India might see a lower effective tax rate, freeing up capital for R&D or capacity expansion.

Defense and Shipbuilding Sector Focus

India's strategic push to become a global shipbuilding powerhouse, aiming for a top five position by 2047, directly fuels demand for advanced manufacturing solutions. This national ambition is supported by substantial government investment in defense modernization and infrastructure development, creating a fertile ground for companies like ESAB India. The company's welding and cutting technologies are indispensable for constructing complex naval vessels and defense equipment, aligning perfectly with these national priorities.

The Indian defense budget for fiscal year 2024-25 has seen an increase, with capital expenditure allocated for modernization and procurement, further underscoring the government's commitment to strengthening its defense industrial base. This financial commitment translates into tangible projects and opportunities for suppliers of critical components and manufacturing processes. ESAB India is well-positioned to capitalize on this growth, providing essential solutions for the sector's expansion.

- Defense Budget Growth: India's defense capital outlay for FY2024-25 is projected at INR 1.75 lakh crore, a significant increase supporting domestic manufacturing initiatives.

- Shipbuilding Ambition: The target to rank among the top five shipbuilding nations by 2047 necessitates massive investment in yards and technology.

- Strategic Importance: ESAB India's welding and cutting solutions are vital for the high-precision requirements of naval shipbuilding and defense equipment manufacturing.

- Industry Linkage: Government initiatives like 'Make in India' and the Defense Production Corridors directly benefit companies contributing to advanced manufacturing in these strategic sectors.

Trade Policies and Import Regulations

Changes in trade policies, including new agreements or adjustments to tariffs, directly impact ESAB India's operational costs and market positioning. For instance, the Indian government's focus on 'Make in India' initiatives and potential adjustments to Free Trade Agreements (FTAs) could alter the landed cost of imported raw materials and finished goods, influencing ESAB India's pricing strategies and overall competitiveness in the domestic market.

Import regulations and duties are crucial considerations. As of early 2024, India continues to review its trade policies, with a general trend towards encouraging domestic manufacturing. This could translate into higher duties on certain imported welding consumables or equipment, potentially benefiting local production but also increasing input costs if ESAB India relies on imported components for its manufacturing processes. The World Trade Organization's (WTO) most favored nation (MFN) tariff rates, which India adheres to, are subject to periodic review and negotiation, impacting the cost structure for imported goods.

- Impact on Raw Material Costs: Fluctuations in import duties on steel, alloys, and other critical raw materials directly affect ESAB India's production expenses.

- Competitiveness of Imported vs. Local Products: Shifting tariff structures can make imported welding products more or less competitive against ESAB India's offerings.

- Supply Chain Adjustments: Policies promoting local sourcing might necessitate changes in ESAB India's supply chain management to reduce reliance on imports.

- Trade Agreement Revisions: Any changes to India's FTAs, particularly those involving major manufacturing hubs, could significantly alter import and export dynamics for ESAB India.

The Indian government's focus on national security and defense modernization directly benefits ESAB India. Increased defense capital outlay for FY2024-25, projected at INR 1.75 lakh crore, fuels demand for advanced welding and cutting solutions essential for shipbuilding and defense equipment manufacturing. This aligns with India's ambition to be a top global shipbuilding nation by 2047, creating significant opportunities for ESAB India.

Government initiatives like 'Make in India' and Production-Linked Incentives (PLI) schemes are pivotal for ESAB India's growth. These policies encourage domestic manufacturing, reducing import reliance and making India a more attractive base for expansion. The PLI scheme for the auto sector, for instance, highlights government commitment and directly impacts industries ESAB India serves.

Infrastructure development, driven by projects like PM Gati Shakti and Bharatmala Pariyojana, is a major demand driver. The National Highways Authority of India's planned ₹1.6 trillion (approx. $19.2 billion) in road construction contracts for FY2024-25 will require substantial fabrication, benefiting ESAB India.

Trade policies and import regulations significantly influence ESAB India's cost structure and market competitiveness. Potential adjustments to tariffs on raw materials and finished goods, alongside any revisions to Free Trade Agreements, require careful monitoring to manage input costs and pricing strategies.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting ESAB India, providing a comprehensive overview of the external forces shaping its operational landscape.

It offers actionable insights for strategic decision-making, enabling ESAB India to navigate market complexities and capitalize on emerging opportunities.

ESAB India's PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations by highlighting key external factors impacting the business.

Economic factors

India's industrial sector is experiencing robust expansion, with key segments like automotive and construction showing significant upward trends. For instance, the automotive sector is projected to grow at a compound annual growth rate (CAGR) of around 10% through 2025, driving demand for fabrication processes. This overall industrial vitality directly fuels the need for ESAB India's welding and cutting solutions.

Capital expenditure (CapEx) in these core industries is a strong indicator of market health for equipment manufacturers. In 2024, India's infrastructure spending is expected to reach approximately $1.4 trillion, a substantial increase that will necessitate advanced welding and cutting technologies. This heightened investment signals a favorable environment for ESAB India's product offerings.

India's commitment to infrastructure development is a significant tailwind for ESAB India. The government's National Infrastructure Pipeline (NIP) aims to invest ₹111 lakh crore (approximately $1.3 trillion) by 2025, focusing on roads, railways, and urban infrastructure. This substantial spending directly translates to increased demand for the welding and cutting solutions ESAB India provides, as these are fundamental to construction and manufacturing processes within these projects.

Private sector participation is also robust, with significant investments flowing into areas like renewable energy infrastructure and logistics. For instance, the Indian government has set ambitious targets for renewable energy capacity, requiring extensive welding for solar panel structures and wind turbine components. These ongoing and planned projects ensure a consistent market for ESAB India's specialized equipment and consumables throughout 2024 and into 2025.

The Indian welding equipment market is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of approximately 7.5% through 2028. This upward trajectory suggests a very positive market environment for companies like ESAB India.

Key drivers fueling this expansion include the nation's aggressive push for industrialization across sectors like automotive and manufacturing, coupled with significant investments in infrastructure projects such as roads, railways, and energy. Furthermore, the adoption of advanced welding technologies, including automated and robotic welding solutions, is also contributing to market dynamism.

Raw Material Costs and Supply Chain Dynamics

Fluctuations in the prices of key raw materials like steel and various metals significantly impact ESAB India's manufacturing costs for welding consumables and equipment. For instance, global steel prices saw considerable volatility in 2024, with benchmarks like the TSI North European Hot Rolled Coil index experiencing swings of over 15% within quarters, directly influencing ESAB India's input expenses and profit margins.

Global supply chain stability is equally critical. Disruptions, whether from geopolitical events, shipping challenges, or natural disasters, can lead to increased lead times and higher logistics costs for ESAB India. The ongoing Red Sea shipping crisis in early 2024, for example, led to rerouting and extended transit times, adding an estimated 10-20% to freight costs for many manufacturers, including those supplying or receiving components for ESAB India's operations.

- Steel Price Volatility: Global steel prices can fluctuate by more than 15% quarterly, impacting ESAB India's production costs.

- Supply Chain Disruptions: Events like the Red Sea crisis can increase shipping costs by 10-20% and extend delivery times.

- Raw Material Sourcing: ESAB India's profitability is directly tied to the cost and availability of essential metals like iron ore and alloying elements.

- Logistics Costs: Global freight rates, influenced by fuel prices and geopolitical stability, add another layer of cost variability for imported materials and finished goods.

Inflation and Interest Rates

Inflation and interest rates are critical macroeconomic forces that significantly shape consumer and industrial spending patterns, as well as the cost of borrowing for businesses. These factors directly influence overall economic stability, which in turn affects companies like ESAB India.

For ESAB India, high inflation can lead to increased operational costs for raw materials and energy, potentially squeezing profit margins. Simultaneously, elevated interest rates can dampen customer demand by making financing more expensive for their clients, impacting sales volumes. For instance, India's retail inflation was reported at 4.83% in April 2024, a slight decrease from the previous month, while the Reserve Bank of India's repo rate remained steady at 6.50% as of April 2024, indicating a cautious monetary policy stance.

- Inflationary pressures: Rising costs of steel, energy, and transportation can directly impact ESAB India's manufacturing expenses.

- Interest rate sensitivity: Higher borrowing costs for ESAB India's customers, particularly in construction and manufacturing sectors, could reduce demand for welding and cutting equipment.

- Consumer spending: Inflation erodes purchasing power, potentially leading to decreased spending on non-essential goods and services, indirectly affecting industrial demand.

- Economic outlook: Stable inflation and interest rate environments foster business confidence and investment, benefiting ESAB India's long-term growth prospects.

India's economic growth trajectory is a significant factor for ESAB India. The nation's GDP is projected to expand by approximately 6.5% in fiscal year 2024-25, according to the Reserve Bank of India's projections. This robust economic expansion fuels industrial activity and infrastructure development, directly benefiting demand for welding and cutting solutions.

Government initiatives like Make in India and the Production Linked Incentive (PLI) schemes are further bolstering manufacturing and industrial output. These policies encourage domestic production and technological advancement, creating a favorable environment for companies like ESAB India that supply essential industrial equipment. For instance, the PLI scheme for the automotive sector aims to boost manufacturing output significantly by 2025.

The increasing disposable income and urbanization trends in India are also contributing to higher demand for manufactured goods and infrastructure, which in turn drives the need for welding and fabrication services. This sustained economic momentum provides a solid foundation for ESAB India's continued growth and market penetration through 2024 and 2025.

| Economic Indicator | Value/Projection (2024-2025) | Impact on ESAB India |

|---|---|---|

| GDP Growth Rate | ~6.5% (Projected) | Increased industrial activity and infrastructure spending |

| Make in India Initiative | Ongoing focus on manufacturing | Boosts demand for industrial equipment and fabrication |

| PLI Schemes | Targeting sectors like Automotive, Electronics | Encourages production, requiring advanced welding solutions |

| Urbanization Rate | Continued upward trend | Drives demand for construction and infrastructure projects |

What You See Is What You Get

ESAB India PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This ESAB India PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a comprehensive understanding of the external forces shaping ESAB India's strategic landscape.

Sociological factors

India's manufacturing sector, a key area for ESAB India, grapples with a pronounced shortage of skilled labor, especially in specialized technical fields such as welding and fabrication. This deficit directly affects ESAB India's capacity to secure and retain qualified personnel, underscoring the critical need for robust internal training programs.

The National Skill Development Corporation reported in 2023 that only 5.4% of the total workforce in India had received formal skill training, a stark contrast to developed nations. This statistic highlights the broader challenge ESAB India faces in sourcing readily trained talent, making investment in upskilling and reskilling initiatives a strategic imperative for operational efficiency and growth.

The Indian workforce is experiencing a notable shift, with younger generations increasingly favoring white-collar or 'cleaner' jobs over traditional manufacturing roles. This cultural evolution presents a significant hurdle for industries like welding, which require hands-on, shop-floor labor. ESAB India must actively work to rebrand and enhance the appeal of these essential positions to attract and retain skilled workers.

In 2024, reports indicated a growing preference among Indian youth for careers perceived as less physically demanding and more technologically advanced. This trend, amplified by increased access to education and information, means ESAB India needs to highlight the technological advancements and career progression opportunities within welding and fabrication to counter this aspirational drift.

Growing emphasis on worker well-being is pushing industries like fabrication and construction to adopt more rigorous safety protocols. This heightened awareness, coupled with stricter regulatory enforcement, means companies are actively seeking equipment that minimizes risks, directly benefiting suppliers of advanced welding and cutting technology like ESAB India.

In 2024, reports indicated a significant rise in workplace safety audits across India's manufacturing sector, with a particular focus on heavy industries. This trend is expected to continue, driving demand for ESAB India's safety-certified products as businesses prioritize compliance and the protection of their workforce.

Urbanization and Industrial Clusters

India's rapid urbanization is a significant driver for ESAB India. As more people move to cities, the demand for infrastructure, housing, and manufacturing facilities surges, directly benefiting companies like ESAB that supply welding and cutting solutions. This trend is further amplified by the formation of industrial clusters, concentrating economic activity and creating localized, robust markets.

These clusters, often specializing in sectors like automotive, heavy engineering, and infrastructure development, represent concentrated hubs of demand for ESAB India's advanced welding consumables and equipment. For instance, the National Capital Region (NCR) and the Mumbai Metropolitan Region are prime examples of these burgeoning urban and industrial centers.

- Urban Population Growth: India's urban population is projected to reach 672 million by 2035, a substantial increase from 471 million in 2020, indicating sustained demand for construction and related industries.

- Industrial Cluster Development: Major manufacturing and automotive hubs, such as those in Gujarat and Tamil Nadu, are experiencing significant growth, directly translating to increased need for welding technologies.

- Infrastructure Spending: The Indian government's focus on infrastructure development, with a capital expenditure target of ₹10 lakh crore (approximately $120 billion) for FY2024-25, fuels demand for construction machinery and fabrication work where ESAB's products are essential.

Education and Vocational Training Programs

The effectiveness of government and private vocational training programs in India significantly impacts the availability of skilled labor for industries like ESAB India. As of 2024, the National Skill Development Corporation (NSDC) has been actively working to bridge the skill gap, with initiatives aimed at upskilling and reskilling the workforce. ESAB India can leverage these programs to build a competent talent pool, potentially reducing recruitment and training costs.

Furthermore, ESAB India's strategic engagement with these educational and vocational training initiatives can foster a direct pipeline of qualified personnel. Partnerships could involve curriculum development, internships, and apprenticeships, ensuring graduates possess the specific welding and fabrication skills the company requires. This proactive approach to talent development is essential for maintaining a competitive edge in the evolving industrial landscape.

- Government initiatives like Skill India Mission aim to train millions by 2027, enhancing the pool of employable youth.

- Private sector involvement in vocational training is growing, with companies partnering with ITIs and polytechnics.

- ESAB India's potential to benefit from a skilled workforce directly correlates with the success of these training programs.

- Collaborations can ensure training aligns with industry demands, making graduates job-ready.

Sociological factors significantly shape ESAB India's operational environment, particularly concerning the workforce and societal attitudes towards manufacturing. The persistent shortage of skilled labor, especially in specialized technical areas like welding, remains a critical challenge. In 2023, only 5.4% of India's workforce had formal skill training, underscoring the need for ESAB India to invest heavily in upskilling and reskilling initiatives to secure qualified personnel.

A notable shift in Indian youth preference towards white-collar jobs over traditional manufacturing roles presents an ongoing hurdle. This trend necessitates ESAB India actively rebranding its skilled trades to highlight technological advancements and career progression opportunities to attract and retain talent. Furthermore, the increasing emphasis on worker well-being and safety protocols, driven by heightened awareness and stricter regulations, directly benefits ESAB India by increasing demand for its safety-certified welding and cutting equipment.

| Factor | Description | Impact on ESAB India | Supporting Data (2023-2025) |

|---|---|---|---|

| Skilled Labor Shortage | Deficiency in trained personnel for specialized technical roles. | Affects operational capacity and retention; necessitates investment in training. | 5.4% of Indian workforce formally skilled (2023). |

| Youth Aspiration Shift | Preference for 'cleaner' or white-collar jobs over manufacturing. | Challenges recruitment for hands-on roles; requires rebranding of trades. | Growing trend among Indian youth for less physically demanding careers (2024 reports). |

| Worker Well-being & Safety | Increased focus on safety protocols and employee welfare. | Drives demand for ESAB India's safety-certified, advanced equipment. | Rise in workplace safety audits in heavy industries (2024 reports). |

Technological factors

Continuous innovation in welding and cutting equipment is a significant technological factor. This includes the integration of automation, robotics, and AI-driven solutions, alongside the development of more energy-efficient machines. For example, the global welding automation market was valued at approximately USD 7.5 billion in 2023 and is projected to grow substantially, indicating a strong demand for advanced technologies.

ESAB India's competitiveness hinges on its capacity to adopt and integrate these cutting-edge technologies. By offering advanced welding and cutting solutions, the company can enhance productivity, improve weld quality, and reduce operational costs for its clients, thereby strengthening its market position.

The increasing adoption of Industry 4.0 and smart manufacturing principles is reshaping industrial landscapes, driving demand for advanced, connected welding technologies. ESAB India must integrate Industrial Internet of Things (IIoT) capabilities and robust data analytics into its product lines to meet the evolving needs of intelligent factories.

This shift towards smart manufacturing, with an estimated global market size projected to reach over $300 billion by 2025, necessitates ESAB India's focus on connected welding solutions that offer real-time monitoring, predictive maintenance, and enhanced process optimization.

The Indian manufacturing sector is increasingly embracing automation and robotics, with significant adoption seen in key industries like automotive, electronics, and pharmaceuticals. This surge in industrial robots directly translates into a burgeoning market for advanced welding and cutting solutions. ESAB India is well-positioned to leverage this trend by offering its compatible automated welding equipment and essential integration services, catering to the evolving needs of these rapidly modernizing sectors.

Research and Development Investment

ESAB India's commitment to research and development is a cornerstone for staying ahead in the welding and cutting industry. By investing in R&D, the company can develop next-generation materials, more efficient processes, and advanced equipment, ensuring its product portfolio remains cutting-edge and responsive to market needs.

The Indian government's focus on 'Make in India' and 'Skill India' initiatives, coupled with increasing industrialization, creates a fertile ground for R&D investments. For instance, the Department of Science and Technology (DST) has been actively promoting innovation through various grants and programs, potentially benefiting companies like ESAB India.

ESAB India's R&D efforts are likely to concentrate on areas such as:

- Development of advanced welding consumables tailored for emerging industries like electric vehicles and renewable energy infrastructure.

- Integration of digital technologies into welding processes, including IoT-enabled equipment and data analytics for process optimization.

- Enhancement of automation and robotic welding solutions to boost productivity and precision across manufacturing sectors.

- Focus on sustainable and environmentally friendly welding technologies to meet growing regulatory and customer demands for greener solutions.

Digitalization of Sales and Service

The increasing digitalization of sales and service is fundamentally reshaping how ESAB India engages with its market. Online sales platforms are becoming crucial, allowing for broader customer reach and more efficient transaction processing. For instance, the Indian e-commerce market for industrial goods is projected to grow significantly, with estimates suggesting it could reach billions of dollars by 2025-2026, providing a clear opportunity for ESAB India to expand its digital footprint.

Furthermore, the adoption of remote diagnostics and digital customer support tools is enhancing ESAB India's ability to provide timely and effective assistance. This shift not only improves operational efficiency but also elevates the customer experience by offering quicker problem resolution and personalized support. Companies that effectively leverage these digital channels are better positioned to gain a competitive edge.

ESAB India's embrace of digitalization is crucial for maintaining relevance and driving growth. Key impacts include:

- Enhanced Customer Reach: Online platforms open access to a wider customer base across India.

- Improved Operational Efficiency: Digital tools streamline sales, service, and support processes.

- Elevated Customer Experience: Remote diagnostics and digital support lead to faster, more effective problem-solving.

- Data-Driven Insights: Digital interactions generate valuable data for understanding customer needs and market trends.

Technological advancements are rapidly transforming the welding and cutting industry, with automation, robotics, and AI becoming increasingly integral. The global welding automation market, valued at around USD 7.5 billion in 2023, is set for substantial growth, highlighting the demand for sophisticated solutions. ESAB India's ability to integrate these technologies directly impacts its competitiveness, enabling enhanced productivity and superior weld quality for its clients.

The rise of Industry 4.0 principles necessitates ESAB India's focus on connected welding technologies, incorporating Industrial Internet of Things (IIoT) and data analytics for smart manufacturing environments. This trend, with the global smart manufacturing market projected to exceed $300 billion by 2025, requires ESAB India to offer solutions that provide real-time monitoring and process optimization.

The Indian manufacturing sector's increasing adoption of automation and robotics, particularly in automotive and electronics, fuels demand for advanced welding equipment. ESAB India is strategically positioned to capitalize on this by supplying compatible automated welding solutions and integration services.

ESAB India's commitment to research and development is crucial for maintaining its edge, focusing on advanced consumables for sectors like EVs and renewable energy, digital integration, and sustainable technologies. The 'Make in India' and 'Skill India' initiatives, supported by government R&D promotion, provide a conducive environment for such investments.

Digitalization of sales and service is reshaping customer engagement, with online platforms and remote support becoming vital. The industrial goods e-commerce market in India is expected to reach billions of dollars by 2025-2026, presenting a significant opportunity for ESAB India to expand its digital reach and improve customer experience.

Legal factors

ESAB India faces stringent environmental laws that dictate its operational framework. This includes obtaining specific permits for manufacturing plant establishment and ongoing operations, adhering to strict pollution control standards, and managing waste responsibly. Non-compliance can lead to significant penalties and even operational halts, directly affecting production timelines and costs.

The Indian government's focus on environmental protection, particularly in the manufacturing sector, means ESAB India must continually invest in cleaner technologies and robust waste management systems. For instance, the Central Pollution Control Board (CPCB) sets emission and effluent standards that industries must meet, with regular monitoring and reporting requirements. Failure to comply can result in substantial fines, as seen in various instances across Indian industries for exceeding permissible pollution levels.

Industrial safety regulations in India are stringent, particularly for sectors like manufacturing and construction where ESAB India's welding and cutting equipment are heavily utilized. The Factories Act, 1948, and various state-specific rules, such as the Maharashtra Factories Rules, 1963, dictate workplace safety standards, including the proper handling and use of machinery and hazardous materials. These laws are designed to prevent accidents and ensure the well-being of workers.

Compliance with these safety mandates directly influences ESAB India's operations. The company must ensure its product designs meet safety certifications and that its manufacturing processes adhere to safe working conditions. Furthermore, providing comprehensive training to customers on the safe operation of their equipment is a critical aspect of fulfilling these legal obligations and mitigating risks.

In 2023, India reported over 36,000 industrial accidents, highlighting the ongoing importance of robust safety practices. ESAB India's commitment to safety, therefore, is not just a matter of compliance but a core business imperative, impacting product development and customer support strategies to align with government directives and industry best practices.

Changes in India's labor laws, such as the proposed consolidation under the new Labour Codes, could impact ESAB India's operational costs and workforce management. For instance, the Code on Wages, 2019, aims to simplify minimum wage regulations, potentially affecting ESAB India's wage bill.

Compliance with these evolving employment policies is crucial for ESAB India to maintain fair labor practices and avoid potential penalties. Adherence to regulations concerning working hours, contract labor, and social security contributions, as outlined in the new codes, will be a key factor in managing industrial relations.

Product Standards and Certifications

Adherence to stringent national and international product standards and certifications is paramount for ESAB India. This ensures their welding and cutting equipment and consumables meet rigorous quality and safety benchmarks, fostering trust and facilitating market acceptance. For instance, compliance with Bureau of Indian Standards (BIS) certifications is often a prerequisite for selling in the Indian market, and international accreditations like ISO 9001 for quality management further bolster credibility.

Key certifications and standards impacting ESAB India include:

- BIS Standards: Compliance with relevant IS specifications for welding electrodes, equipment, and safety accessories is mandatory for domestic sales.

- International Standards: Adherence to ISO, AWS (American Welding Society), and EN (European Norm) standards enhances product competitiveness in global markets and for export-oriented businesses.

- Safety Certifications: Obtaining certifications related to electrical safety and hazardous material handling is crucial for product approval and consumer confidence.

- Environmental Compliance: Meeting standards related to emissions and material content, such as RoHS (Restriction of Hazardous Substances), is increasingly important for market access and corporate responsibility.

Intellectual Property Rights and Patents

ESAB India’s competitive edge relies heavily on protecting its proprietary welding technologies and product innovations through robust intellectual property rights. Adherence to India's patent laws is crucial for safeguarding these advancements and maintaining a distinct market position.

The Indian government has been actively strengthening its intellectual property regime. For instance, the number of patent applications filed in India saw a significant increase, with domestic filings growing by 23.4% in 2022-23, indicating a more robust environment for innovators.

- Intellectual Property Protection: ESAB India must ensure its unique welding processes and equipment designs are adequately protected under Indian IP laws to prevent unauthorized replication.

- Patent Landscape: Staying abreast of patent filings by competitors in the welding sector is vital for identifying potential infringement and opportunities for licensing or collaboration.

- Enforcement Mechanisms: Understanding and utilizing India's legal framework for enforcing patents and other IP rights is critical for defending its market share and innovations.

- Global Standards: Aligning its IP strategy with international standards, such as those under the TRIPS agreement, helps ESAB India protect its innovations in both domestic and global markets.

ESAB India must navigate India's evolving legal landscape, focusing on environmental compliance, industrial safety, and labor regulations. The Factories Act, 1948, and new Labour Codes, like the Code on Wages, 2019, mandate safe working conditions and fair labor practices, impacting operational costs and workforce management. In 2023, India recorded over 36,000 industrial accidents, underscoring the critical need for strict adherence to safety mandates.

Environmental factors

India's commitment to environmental protection is driving increasingly stringent pollution control and emission standards for manufacturing sectors. This directly affects ESAB India, requiring investments in cleaner production technologies and processes to ensure compliance and minimize environmental impact.

For instance, the Central Pollution Control Board (CPCB) has been progressively tightening emission norms for various industries. While specific data for ESAB India's direct emissions isn't publicly detailed, general manufacturing sector trends indicate a push towards reducing particulate matter and gaseous pollutants. Companies are expected to adopt advanced filtration systems and optimize combustion processes to meet these evolving benchmarks, which can influence operational costs and product design.

India's evolving waste management landscape presents significant considerations for ESAB India. The Ministry of Environment, Forest and Climate Change has been actively strengthening regulations, particularly concerning hazardous waste and the burgeoning e-waste sector. For instance, the E-Waste (Management) Rules, 2022, mandate extended producer responsibility, requiring manufacturers like ESAB India to manage the end-of-life disposal of their products.

The emphasis on promoting circular economy principles is also a key driver. This means ESAB India needs to increasingly focus on the recycling of industrial by-products and scrap materials generated during its manufacturing processes. By adopting robust waste disposal practices and investing in recycling technologies, ESAB India can not only ensure regulatory compliance but also potentially unlock cost savings and enhance its sustainability credentials in the Indian market.

Concerns regarding the availability of critical raw materials are a significant environmental factor for ESAB India. The global push towards sustainability is increasing pressure on manufacturers to adopt responsible sourcing strategies and optimize their use of resources.

For instance, the rising cost of metals like copper and nickel, essential components in welding consumables, directly impacts ESAB India's input costs. Reports from 2024 indicate continued volatility in commodity markets, underscoring the need for ESAB India to secure reliable and sustainably sourced material supplies to maintain competitive pricing and operational continuity.

Climate Change and Energy Efficiency

The intensifying global emphasis on climate change mitigation directly impacts ESAB India. As regulations tighten and consumer demand shifts towards sustainability, companies are increasingly seeking solutions that reduce their environmental footprint. This trend favors ESAB India if it can offer welding and cutting technologies that are more energy-efficient.

The push for energy efficiency presents a significant opportunity for ESAB India to differentiate itself. Innovations in welding processes that consume less power or generate fewer emissions can become a key competitive advantage. For instance, advancements in inverter-based welding machines have already demonstrated substantial energy savings compared to older transformer-based models.

Consider the following points regarding climate change and energy efficiency for ESAB India:

- Growing Demand for Green Technologies: As India commits to ambitious renewable energy targets, sectors like solar and wind power installation will see increased activity, requiring advanced welding solutions that align with sustainability goals.

- Energy Efficiency as a Differentiator: ESAB India's ability to develop and market welding equipment with lower power consumption directly addresses the operational cost concerns of its clients, especially in energy-intensive industries.

- Regulatory Tailwinds: Government policies promoting energy conservation and emissions reduction, such as potential carbon pricing mechanisms or stricter energy performance standards for industrial equipment, will further drive adoption of efficient technologies.

- Product Innovation Focus: A strategic focus on R&D for welding consumables and equipment that minimize waste and energy usage can position ESAB India as a leader in the transition to a low-carbon economy.

Corporate Environmental Responsibility

ESAB India, like many global corporations, faces mounting pressure from stakeholders and consumers to demonstrate robust environmental responsibility. This translates into a need to embed sustainable practices across its entire operational spectrum, from the sourcing of raw materials and manufacturing processes to the end-of-life management of its welding and cutting equipment. The company's commitment to reducing its environmental footprint is becoming a critical factor in maintaining its social license to operate and attracting environmentally conscious investors.

The drive for sustainability is not merely a compliance issue but a strategic imperative. For instance, in 2024, the global manufacturing sector saw a significant uptick in investment towards green technologies, with reports indicating a 15% year-over-year increase in capital expenditure dedicated to emissions reduction and resource efficiency. ESAB India's proactive engagement in these areas is therefore crucial for competitive positioning.

- Growing Demand for Sustainable Products: Consumers and businesses are increasingly prioritizing products with a lower environmental impact, influencing purchasing decisions and brand loyalty.

- Regulatory Compliance and Risk Mitigation: Stricter environmental regulations worldwide necessitate adherence to standards for emissions, waste management, and resource utilization, with non-compliance posing significant financial and reputational risks.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are paramount for investors. Companies with strong environmental performance, such as reduced carbon emissions and efficient waste management, are often viewed more favorably, potentially leading to better access to capital.

- Supply Chain Sustainability: ESAB India's environmental responsibility extends to its supply chain, requiring partners to meet similar sustainability benchmarks to ensure a cohesive approach to corporate environmental stewardship.

India's environmental policies are increasingly shaping industrial operations, pushing ESAB India towards cleaner production and stricter emission controls. The nation's focus on waste management, particularly hazardous and e-waste, mandates responsible end-of-life product handling, impacting ESAB India's operational strategies.

The global emphasis on climate change mitigation and energy efficiency presents both challenges and opportunities for ESAB India. Developing and promoting energy-saving welding technologies can offer a significant competitive edge, aligning with India's renewable energy goals and regulatory tailwinds.

Stakeholder and consumer demand for environmental responsibility is growing, making sustainable practices crucial for ESAB India's social license to operate and investor appeal. This includes responsible raw material sourcing and efficient waste management throughout the product lifecycle.

PESTLE Analysis Data Sources

Our ESAB India PESTLE Analysis is grounded in a comprehensive review of government reports, economic indicators from reputable institutions like the Reserve Bank of India, and industry-specific market research. We also incorporate insights from technology adoption trends and environmental impact assessments relevant to India.