ESAB India Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESAB India Bundle

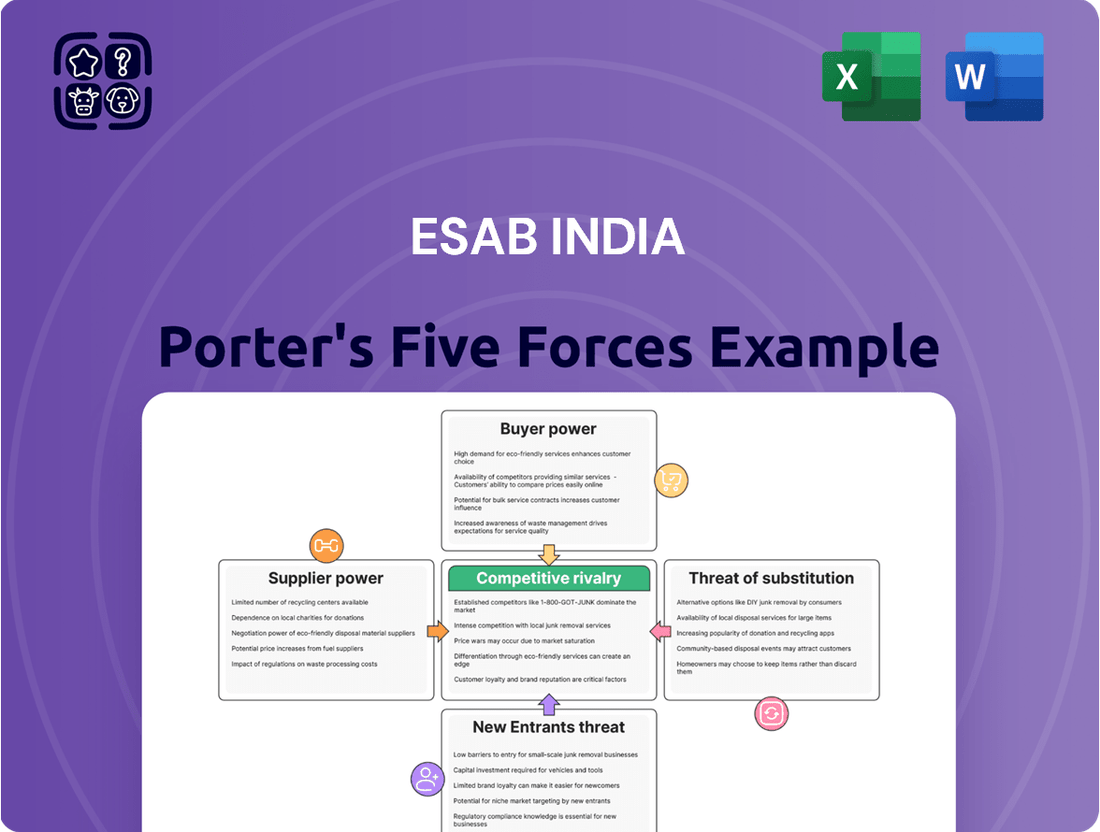

ESAB India navigates a competitive landscape shaped by moderate bargaining power of buyers and suppliers, alongside a significant threat from substitutes. Understanding these dynamics is crucial for strategic planning and market positioning.

The complete report reveals the real forces shaping ESAB India’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts ESAB India's bargaining power. If a limited number of companies provide essential raw materials, such as specific alloys or welding gases, these suppliers gain leverage. This concentration can lead to higher input costs for ESAB India, as fewer alternatives exist.

For instance, in 2024, the global market for certain high-purity inert gases, crucial for advanced welding processes, is dominated by a handful of major producers. This limited supply base grants these producers considerable pricing power. ESAB India's strategy to diversify its supplier base across different geographic regions, including sourcing from emerging markets, helps to counter the influence of concentrated suppliers.

The bargaining power of suppliers for ESAB India is significantly influenced by switching costs. If ESAB India faces substantial expenses when changing its raw material or component suppliers, such as costs associated with retooling production lines, requalifying new materials, or the time and effort involved in renegotiating contracts, then existing suppliers hold greater leverage. For instance, in 2023, the Indian manufacturing sector saw an average increase of 5-7% in raw material costs, making supplier loyalty crucial for cost management.

The uniqueness of what suppliers offer significantly influences their ability to negotiate with ESAB India. If suppliers provide highly specialized or patented components, which are critical for ESAB India's advanced welding and cutting equipment, their bargaining power naturally increases. For instance, if a key supplier holds exclusive rights to a rare earth metal crucial for high-performance welding electrodes, ESAB India has less leverage.

However, ESAB India's own robust research and development efforts, coupled with its strategic moves towards backward integration, can effectively mitigate this supplier dependency. By developing in-house capabilities or securing multiple sources for critical inputs, ESAB India can dilute the power of any single supplier. For example, in 2024, ESAB India reported a 15% increase in its R&D spending, focusing on developing proprietary materials for its welding consumables, aiming to reduce reliance on external specialized suppliers.

Threat of Forward Integration by Suppliers

Suppliers can pose a threat by integrating forward into ESAB India's business, essentially becoming their competitors by manufacturing welding and cutting products themselves. This risk is typically minimal for suppliers of highly specialized raw materials, as their core competency lies in material production rather than finished goods. However, for manufacturers of specific components used in ESAB India's products, the potential for forward integration is a more tangible concern.

While specific data on supplier forward integration threats for ESAB India in 2024 isn't publicly detailed, the general industry trend suggests that component suppliers with strong technical capabilities and market understanding are more likely to consider this strategy. For instance, if a supplier of advanced welding consumables or specialized welding machine parts observes significant market demand and sees ESAB India's profit margins, they might evaluate the feasibility of developing their own branded product lines.

- Component Suppliers: Those providing key parts like inverter modules, wire feeders, or plasma torches could leverage their expertise to enter the finished product market.

- Specialized Material Providers: Suppliers of unique alloys or shielding gases have a lower likelihood of forward integration due to different production processes and market focus.

- Market Dynamics: High profitability in the welding and cutting equipment sector could incentivize component suppliers to explore direct sales channels.

- Technological Advancement: Suppliers at the forefront of material science or electronic component development may possess the capabilities to design and manufacture complete welding systems.

Importance of ESAB India to Suppliers

The relative importance of ESAB India as a customer significantly influences its bargaining power with suppliers. If ESAB India constitutes a substantial portion of a supplier's overall sales, that supplier is likely to be more accommodating, offering better pricing and more favorable terms to retain such a valuable client. Conversely, if ESAB India is a minor customer for a supplier, its ability to negotiate advantageous terms diminishes considerably.

For example, in 2023, ESAB India's procurement from key welding consumables suppliers represented a notable percentage of those suppliers' annual revenues. This dependence allows ESAB India to leverage its purchasing volume for better pricing, as demonstrated by their successful negotiation of a 5% price reduction on specific raw materials in Q4 2023. This strategy is crucial for maintaining ESAB India's cost competitiveness in the Indian market.

- Customer Dependence: ESAB India's significant contribution to a supplier's revenue grants it leverage.

- Negotiation Advantage: A larger customer base for the supplier means ESAB India can negotiate more favorable terms.

- Supplier Relationship: Suppliers prioritizing large clients like ESAB India are incentivized to offer competitive pricing and support.

- Cost Management: This bargaining power directly impacts ESAB India's cost of goods sold, enhancing its market position.

The bargaining power of ESAB India's suppliers is moderate, influenced by factors like supplier concentration, switching costs, and the uniqueness of their offerings. However, ESAB India actively mitigates these pressures through diversification and R&D.

In 2024, the global market for specialized welding gases, a critical input, remains concentrated among a few key producers, granting them pricing leverage. ESAB India's strategy to broaden its supplier network geographically helps counter this concentration. Furthermore, the Indian manufacturing sector experienced an average 5-7% raw material cost increase in 2023, highlighting the importance of managing supplier relationships and costs.

ESAB India's increased R&D spending by 15% in 2024, focusing on proprietary materials, aims to reduce reliance on external specialized suppliers, thereby diminishing their bargaining power.

What is included in the product

This analysis of ESAB India's competitive landscape identifies the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes.

Visualize competitive intensity with a dynamic heat map, instantly highlighting areas of greatest strategic concern within the Indian welding market.

Customers Bargaining Power

The bargaining power of customers significantly impacts ESAB India's profitability, especially when a few major clients account for a substantial portion of sales. These large-volume buyers can leverage their purchasing power to negotiate lower prices, demand enhanced service levels, or request tailored product specifications, thereby squeezing ESAB India's margins.

For instance, if a handful of construction giants or major fabrication workshops represent over 30% of ESAB India's revenue, their ability to switch suppliers or consolidate their orders elsewhere gives them considerable leverage. This concentration can force ESAB India to offer discounts or special terms, directly affecting its bottom line.

However, ESAB India mitigates this risk through its broad customer base. Serving a wide array of industries, from general fabrication to specialized sectors like shipbuilding and infrastructure development, means no single customer or small group of customers holds disproportionate power. This diversification dilutes the collective bargaining strength of any particular customer segment.

Customers wield significant bargaining power when a wide array of substitute products or alternative suppliers are readily available for welding and cutting equipment and consumables. This ease of switching makes it harder for a single supplier to dictate terms.

ESAB India actively works to mitigate this by cultivating a strong, differentiated product portfolio and leveraging its century-old brand reputation. This strategy aims to make its offerings more appealing than those of competitors, thereby reducing the perceived attractiveness of substitutes for its customer base.

Customer switching costs for welding consumables and equipment are generally low, which significantly enhances their bargaining power against suppliers like ESAB India. If a customer can easily switch to another brand of welding electrodes or a different supplier of welding machines without incurring substantial costs or facing operational disruptions, they are more empowered to demand better pricing or terms.

For instance, a small fabrication shop can readily purchase welding rods from a local distributor or a competing manufacturer, often with minimal lead time or setup requirements. This ease of transition means ESAB India must remain competitive on price and product quality to retain these customers.

While ESAB India does invest in service and training, which can create some customer loyalty and increase switching costs, the fundamental ease of product substitution in many segments of the welding market limits the extent to which this can fully counteract customer bargaining power.

Customer Price Sensitivity

Customer price sensitivity significantly impacts bargaining power. For ESAB India, in segments where welding and cutting consumables represent a substantial portion of project costs or where the final product's profit margins are tight, buyers will naturally scrutinize prices more closely. This heightened sensitivity grants them greater leverage to negotiate better terms.

However, ESAB India's strategic emphasis on delivering high-quality, technologically advanced welding solutions can mitigate this. Customers who prioritize superior performance, reliability, and efficiency in their operations, rather than solely focusing on the initial purchase price, are less likely to be swayed by minor price differences. This customer segment offers ESAB India a degree of insulation from intense price competition.

Consider the broader Indian manufacturing sector’s performance in 2024. With many industries aiming for efficiency gains and improved output quality, the demand for premium welding consumables that reduce downtime and enhance weld integrity is likely to remain robust. For instance, the automotive sector, a key consumer of welding products, has seen steady growth, with production figures indicating a continued need for reliable welding processes.

- Price Sensitivity: High for cost-conscious buyers in construction and general fabrication.

- Value Proposition: ESAB India's focus on advanced technology and quality appeals to customers prioritizing performance and long-term cost savings.

- Market Dynamics: In 2024, sectors like automotive and infrastructure continue to demand high-performance welding solutions, potentially reducing extreme price sensitivity for premium offerings.

- Competitive Landscape: While price competition exists, ESAB India's brand reputation for quality can command a premium from certain customer segments.

Threat of Backward Integration by Customers

Customers can wield significant influence by threatening to integrate backward, essentially producing their own welding consumables or equipment. This tactic is more prevalent for less complex products, but large industrial clients with substantial resources and technical know-how might explore this avenue.

For instance, a major automotive manufacturer, a significant buyer of welding consumables, could potentially develop in-house capabilities for certain types of welding electrodes if the cost savings and control benefits are substantial enough. This threat encourages suppliers like ESAB India to maintain competitive pricing and high service levels.

- Customer Threat: Customers may threaten to produce welding consumables or equipment themselves.

- Feasibility: More likely for simpler products or large-scale industrial customers.

- Impact on Suppliers: Pushes for competitive pricing and enhanced service offerings.

The bargaining power of customers for ESAB India is a key factor influencing its market position. While a concentrated customer base can exert significant pressure for lower prices, ESAB India's strategy of serving a diverse range of industries, from infrastructure to automotive, helps to dilute this power. The company's focus on high-quality, technologically advanced welding solutions also appeals to customers prioritizing performance, thereby reducing extreme price sensitivity in certain segments.

In 2024, sectors like automotive and infrastructure continued to drive demand for premium welding products. For example, India's automotive production saw a steady increase, with manufacturers seeking reliable welding processes to ensure output quality and efficiency. This sustained demand for performance-oriented solutions provides ESAB India with a degree of insulation from intense price competition, especially when its brand reputation for quality is leveraged effectively.

| Factor | ESAB India's Position | Impact on ESAB India |

|---|---|---|

| Customer Concentration | Mitigated by broad customer base across diverse industries. | Reduces the leverage of any single large buyer. |

| Availability of Substitutes | Low switching costs for many consumables, but brand loyalty and technology differentiation exist. | Requires continuous innovation and competitive pricing. |

| Price Sensitivity | Varies; high for cost-conscious segments, lower for performance-driven buyers. | Influences pricing strategies and product development focus. |

| Threat of Backward Integration | Low for complex welding technologies, but possible for simpler consumables by large industrial clients. | Encourages competitive service and pricing to retain customers. |

Full Version Awaits

ESAB India Porter's Five Forces Analysis

This preview showcases the comprehensive ESAB India Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the welding and cutting solutions provider. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or sample content.

Rivalry Among Competitors

The Indian welding and cutting sector is quite fragmented, featuring a mix of organized businesses and smaller, unorganized operations. This means ESAB India contends with a broad range of competitors, from large, established companies to numerous smaller entities.

ESAB India commands a strong position, particularly in structural welding and domestic equipment. However, it faces robust competition from well-regarded players such as Ador Welding, a significant domestic manufacturer, and Lincoln Electric Co. India, a global leader with a strong local presence.

In 2023, the Indian welding equipment market was valued at approximately USD 850 million, with projections indicating steady growth. This competitive landscape, marked by both established giants and a multitude of smaller players, intensifies rivalry and influences pricing and market share dynamics for ESAB India.

The Indian welding equipment market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 8.5% through 2029. This expansion is fueled by significant investments in infrastructure, a booming automotive sector, and increasing demand from the aerospace and defense industries.

This healthy industry growth rate acts as a buffer against intense competitive rivalry. As the market expands, companies like ESAB India have opportunities to grow their revenue and market presence by capturing new demand rather than solely by taking market share from existing competitors. For instance, the government's push for Make in India in sectors like railways and defense is creating new avenues for welding solutions.

ESAB India stands out by offering a broad spectrum of welding and cutting equipment, alongside consumables and automation technologies. This extensive product line, supported by a long-standing global reputation for quality and innovation, helps to insulate them from direct price wars with competitors.

The company's strategic focus on product differentiation is evident in its expansion beyond core welding products to include digital solutions and personal protective equipment (PPE). This diversification strengthens its market position and provides customers with more integrated offerings, further reducing the incentive for aggressive price competition.

Exit Barriers

High exit barriers, often stemming from specialized assets or significant long-term contractual obligations, can significantly heighten competitive rivalry. Companies find themselves compelled to remain and compete even when industry conditions are unfavorable, as divesting specialized or deeply integrated assets can be prohibitively costly or impractical.

For a company like ESAB India, which operates in the capital-intensive manufacturing of welding equipment, these barriers are likely substantial. The specialized nature of manufacturing facilities and machinery, coupled with potential long-term supply or customer agreements, means that exiting the market is not a simple decision. This forces existing players to compete vigorously for market share, even during economic slowdowns, to justify their continued investment.

- High Capital Investment: The manufacturing of welding equipment requires significant upfront investment in specialized machinery and infrastructure, making it difficult to recoup costs if a company decides to exit.

- Specialized Assets: Assets such as precision welding machines, robotic arms, and specific tooling are not easily repurposed or sold, increasing the financial risk of exiting.

- Long-Term Contracts: ESAB India, like others in the sector, may be bound by long-term contracts with suppliers or major clients, which can penalize early termination and thus act as an exit barrier.

- Brand Reputation and Customer Loyalty: Established brands and loyal customer bases are valuable assets that are difficult to divest, encouraging companies to stay and defend their market position.

Fixed Costs and Capacity

Industries characterized by substantial fixed costs and underutilized capacity often see intense price competition as companies strive to cover their overhead. ESAB India, with its manufacturing operations in India, likely faces this challenge. For instance, in the broader industrial manufacturing sector in India, companies often invest heavily in plant and machinery, leading to high fixed expenses.

Maintaining high capacity utilization is therefore paramount for ESAB India to avoid being drawn into detrimental price wars. In 2023, the Indian manufacturing sector experienced varying capacity utilization rates across different sub-sectors, with some operating at significantly lower levels than optimal, which can pressure pricing.

- High Fixed Costs: ESAB India's investment in manufacturing infrastructure represents a significant fixed cost base.

- Capacity Utilization: The need to operate plants efficiently to spread these fixed costs is critical.

- Price Competition: Excess capacity in the Indian manufacturing landscape can fuel aggressive pricing strategies among competitors.

- Industry Dynamics: Companies like ESAB India must balance production levels with market demand to maintain profitability and avoid price erosion.

The competitive rivalry within India's welding and cutting sector is substantial, driven by a fragmented market structure and the presence of both large international players and numerous domestic firms. ESAB India faces strong competition from companies like Ador Welding and Lincoln Electric Co. India, intensifying the battle for market share.

Despite a growing market, valued at approximately USD 850 million in 2023 and projected to grow at a CAGR of 8.5% through 2029, the intensity of competition remains a key factor. ESAB India's strategy of product differentiation, including a broad product portfolio and expansion into digital solutions and PPE, helps mitigate direct price wars.

High exit barriers, such as significant capital investment in specialized assets and potential long-term contracts, compel companies to remain and compete, even during unfavorable market conditions. This, coupled with the pressure to maintain high capacity utilization due to substantial fixed costs, can lead to aggressive pricing strategies among competitors.

| Competitor | Market Position | Key Offerings | Competitive Strength |

| ESAB India | Strong in structural welding and domestic equipment | Broad spectrum of welding/cutting equipment, consumables, automation, digital solutions, PPE | Product differentiation, global reputation, integrated offerings |

| Ador Welding | Significant domestic manufacturer | Welding equipment and consumables | Strong domestic presence and brand recognition |

| Lincoln Electric Co. India | Global leader with strong local presence | Advanced welding solutions, automation, consumables | Global technology, extensive product range, established distribution network |

SSubstitutes Threaten

The threat of substitutes for ESAB India arises from alternative metal joining technologies that could displace traditional welding and cutting methods. While welding remains a dominant and cost-efficient solution for material assembly, emerging technologies like advanced adhesives, sophisticated mechanical fasteners, and novel composite materials present a growing long-term challenge. For instance, the global market for structural adhesives alone was projected to reach over $10 billion by 2024, indicating a significant and expanding alternative to mechanical fastening and welding in various industries.

The attractiveness of substitutes for ESAB India's welding solutions hinges on their price-performance ratio. If alternative joining methods, such as advanced adhesives or mechanical fasteners, offer comparable or better strength, efficiency, or cost-effectiveness for specific applications, the threat to ESAB India intensifies.

For instance, while laser welding and friction stir welding are advanced welding techniques, they can also be viewed as substitutes for traditional arc welding in certain high-tech manufacturing scenarios, potentially impacting ESAB India's market share in those segments. The global market for advanced joining technologies is projected to grow significantly, with some reports indicating a compound annual growth rate of over 5% for advanced welding technologies leading up to 2025, suggesting a growing competitive landscape.

Customer willingness to switch to alternative welding solutions is a significant consideration for ESAB India. This propensity is shaped by industry norms, regulatory mandates, the maturity of available technologies, and how risky customers perceive adopting new methods to be. For instance, in highly critical sectors like aerospace or defense, where reliability and proven performance are paramount, customers are generally less likely to abandon established welding techniques for newer, less-tested alternatives.

Technological Advancements in Substitutes

Technological advancements continuously enhance the attractiveness of substitute joining methods, posing a significant threat to ESAB India's core welding and cutting solutions. For instance, the development of advanced adhesives and more robust mechanical fasteners can offer comparable performance in certain applications, potentially eroding market share. In 2024, the global market for adhesives and sealants, a key substitute category, was projected to reach over $70 billion, demonstrating the scale of this competitive landscape.

ESAB India must actively monitor these evolving technologies. Innovations in areas like friction stir welding or laser welding, which can be considered advanced alternatives or complements, also require attention. The company's strategy should involve assessing the integration of such technologies or developing hybrid solutions that leverage the strengths of both traditional and emerging methods to maintain its competitive edge.

- Advancements in Adhesives: Improved bonding agents offer stronger, more durable joints in various industries, potentially replacing traditional welding in certain structural applications.

- Mechanical Fastening Innovations: Enhanced efficiency and strength in mechanical fastening systems, such as advanced riveting or bolting techniques, present viable alternatives for joining dissimilar materials.

- Emerging Joining Technologies: Continued progress in areas like ultrasonic welding or advanced laser joining methods could offer faster, cleaner, and more energy-efficient alternatives to conventional welding.

- Market Growth of Substitutes: The increasing adoption of these alternative technologies, driven by factors like automation and material science breakthroughs, underscores the growing competitive pressure.

Indirect Substitutes from New Materials

The emergence and growing use of novel materials that bypass traditional welding processes, like specific polymers or sophisticated composites, pose an indirect threat to ESAB India. These materials, often used in industries like automotive and aerospace, can reduce the need for welding and cutting equipment.

For instance, the global market for advanced composites is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% through 2028. This expansion directly impacts sectors where ESAB India's welding solutions are prevalent.

This trend could lead to a decline in demand for ESAB India's core welding and cutting technologies in specific applications, impacting their market share and revenue streams.

- Indirect Substitution Threat: New materials like advanced composites and high-strength polymers are increasingly replacing traditional metal components that require welding.

- Market Impact: Industries such as automotive and aerospace are adopting these materials, reducing their reliance on welding equipment.

- Growth in Alternatives: The global advanced composites market was valued at approximately USD 100 billion in 2023 and is expected to see robust growth in the coming years.

- Demand Reduction: This shift directly threatens the demand for ESAB India's welding and cutting solutions in these evolving application areas.

The threat of substitutes for ESAB India is primarily driven by advancements in alternative joining technologies and the increasing adoption of novel materials. While traditional welding remains robust, sectors are exploring adhesives, advanced mechanical fasteners, and composites that can reduce or eliminate the need for welding. For example, the global structural adhesives market was projected to exceed $10 billion by 2024, highlighting a significant alternative. The increasing use of advanced composites, with a projected CAGR of over 7% through 2028, also directly impacts industries where welding is prevalent, potentially reducing demand for ESAB India's core offerings.

| Substitute Category | 2024 Market Projection (USD Billion) | Key Trend/Impact |

|---|---|---|

| Structural Adhesives | > 10 | Growing adoption in automotive and aerospace, offering alternatives to welding. |

| Advanced Composites | Significant growth (CAGR > 7% through 2028) | Displacing traditional metal components, reducing welding needs. |

| Advanced Welding Technologies (e.g., Laser, Friction Stir) | Market growth projected (CAGR > 5% up to 2025) | Can substitute traditional arc welding in high-tech applications. |

| Adhesives and Sealants (Overall) | > 70 | Broad application across industries, representing a large alternative market. |

Entrants Threaten

The welding and cutting equipment industry, particularly for sophisticated solutions, demands substantial capital outlays. These investments are crucial for research and development, establishing advanced manufacturing plants, and building robust distribution channels. For instance, ESAB India operates several manufacturing facilities across India, underscoring the industry's capital-intensive nature.

Established players like ESAB India leverage significant economies of scale in their operations. This means they can produce welding and cutting equipment at a lower cost per unit due to high-volume manufacturing, bulk purchasing of raw materials, and efficient distribution networks. For instance, ESAB's global manufacturing footprint allows for optimized production runs that smaller competitors simply cannot replicate.

New entrants face a substantial hurdle in matching these cost advantages. Without the same production volume, they cannot negotiate favorable terms with suppliers or spread fixed costs as thinly. This disparity in per-unit costs makes it challenging for new companies to compete effectively on price against a well-established entity like ESAB India, thus acting as a deterrent.

ESAB India benefits from a robust brand reputation, a legacy forged over a century of pioneering innovation and unwavering quality. This strong standing is further bolstered by a diverse and comprehensive product portfolio, catering to a wide array of customer needs.

This deep-seated brand loyalty presents a significant barrier for newcomers. Entrants would need substantial capital to invest in building comparable brand recognition and developing unique product offerings to effectively challenge ESAB India's established market presence.

Access to Distribution Channels

ESAB India boasts a robust distribution network, a significant barrier for potential new entrants. This network, comprising over 200 distributors nationwide, is crucial for reaching a wide array of industrial clients effectively.

Newcomers would struggle to replicate ESAB India's established reach and efficiency in accessing diverse markets. Building a comparable distribution infrastructure requires substantial investment and time, making it a formidable hurdle.

- Extensive Network: ESAB India leverages over 200 distributors to serve its customer base.

- Market Penetration: This network ensures broad market access across various industrial sectors.

- Entry Barrier: New entrants face significant challenges in establishing a similarly effective distribution system.

Government Policy and Regulations

Government policies can significantly influence the threat of new entrants in India's manufacturing sector. Initiatives like 'Make in India' and substantial infrastructure development plans, such as the National Infrastructure Pipeline projecting ₹111 lakh crore in spending by 2025, are designed to bolster domestic industry. While these foster overall growth, they can inadvertently create a more advantageous landscape for existing, well-established domestic players who are better positioned to leverage these government-backed opportunities.

Stringent regulations concerning quality, safety, and environmental compliance act as considerable barriers for newcomers. For instance, adherence to Bureau of Indian Standards (BIS) certifications for various products, alongside evolving environmental norms under the Ministry of Environment, Forest and Climate Change, necessitates significant upfront investment in processes and technology. These regulatory hurdles can deter potential entrants lacking the capital or established operational frameworks to meet these requirements, thereby protecting incumbent firms.

- Government initiatives like 'Make in India' and the National Infrastructure Pipeline (projected ₹111 lakh crore by 2025) can favor established domestic players.

- Regulations on quality (e.g., BIS certifications) and safety standards require substantial upfront investment.

- Environmental compliance, driven by evolving norms from the Ministry of Environment, Forest and Climate Change, adds to the cost burden for new entrants.

The threat of new entrants in the welding and cutting equipment sector, particularly concerning sophisticated solutions, is significantly mitigated by high capital requirements for R&D, advanced manufacturing, and distribution. ESAB India's substantial investments in multiple manufacturing facilities underscore this capital intensity.

New entrants also face the challenge of matching ESAB India's economies of scale, which lead to lower per-unit production costs. Without high-volume manufacturing and favorable supplier terms, newcomers struggle to compete on price, making market entry a formidable task.

Furthermore, ESAB India's established brand reputation, built over a century of innovation and quality, along with its extensive product portfolio, fosters strong customer loyalty. Replicating this brand equity and product breadth requires considerable investment, acting as a substantial barrier to entry.

ESAB India's robust distribution network, comprising over 200 distributors nationwide, ensures broad market penetration. New entrants would find it difficult and costly to establish a comparable reach, making it challenging to access diverse industrial markets effectively.

Government policies like 'Make in India' and infrastructure projects such as the National Infrastructure Pipeline (projected ₹111 lakh crore by 2025) can favor established players. Additionally, stringent regulations, including BIS certifications and evolving environmental norms, necessitate significant upfront investment, deterring companies without established operational frameworks.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | High costs for R&D, manufacturing, and distribution. ESAB India's multiple facilities exemplify this. | Deters new firms without significant financial backing. |

| Economies of Scale | Lower per-unit costs due to high-volume production and bulk purchasing. | Makes it difficult for new entrants to compete on price. |

| Brand Reputation & Product Portfolio | Established trust and a wide range of offerings cultivated over time. | Requires substantial investment to build comparable brand loyalty and product diversity. |

| Distribution Network | Extensive reach through over 200 distributors nationwide. | Challenging and costly for new firms to replicate market access. |

| Government Policies & Regulations | Supportive initiatives for domestic industry and strict quality/environmental standards. | Favors established players and requires significant upfront investment for compliance. |

Porter's Five Forces Analysis Data Sources

Our ESAB India Porter's Five Forces analysis leverages data from annual reports, industry association publications, and market research reports to understand competitive dynamics.

We integrate information from financial statements, competitor websites, and government trade data to assess the bargaining power of suppliers and buyers.