Equatorial Energia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equatorial Energia Bundle

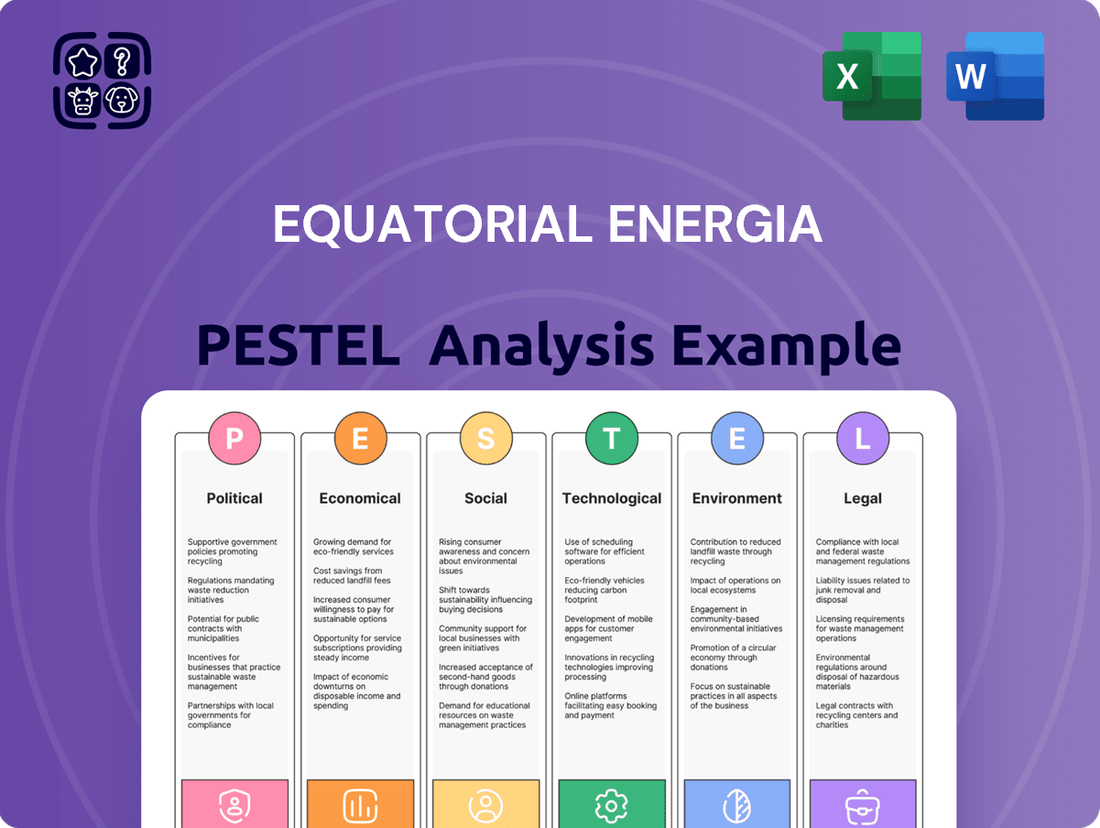

Navigate the complex external forces impacting Equatorial Energia with our comprehensive PESTLE analysis. Understand the political landscape, economic shifts, social trends, technological advancements, environmental regulations, and legal frameworks that are shaping the company's operations and future growth. Gain a strategic advantage by leveraging these crucial insights.

Unlock the full potential of Equatorial Energia's market position. Our PESTLE analysis provides a deep dive into the external factors driving change, offering actionable intelligence for investors, strategists, and decision-makers. Don't miss out on critical market understanding.

Equip yourself with the knowledge to anticipate and adapt. This PESTLE analysis of Equatorial Energia breaks down the key external influences, empowering you to make informed strategic choices and mitigate risks. Purchase the full report for immediate access to this vital market intelligence.

Political factors

Equatorial Energia navigates Brazil's dynamic electricity market, where government policies and regulations are paramount. Shifts in energy strategies, like those promoting renewable sources or upgrading grid infrastructure, directly shape the company's future plans and capital allocation. For instance, the National Energy Transition Policy, introduced in August 2024, targets growth in the green economy and aims to draw substantial investment into renewables, a move that complements Equatorial Energia's commitment to sustainable energy.

Brazil's continued push for privatization, especially in utilities, creates significant avenues for Equatorial Energia. The company's history of acquiring state-owned distributors demonstrates its readiness to capitalize on these opportunities. For instance, Equatorial Energia was a bidder for the privatization of Companhia de Saneamento do Paraná (Sanepar) in 2023, indicating its strategic focus on this sector.

The government's approach to privatizing companies like Sabesp, a major sanitation provider, directly impacts Equatorial Energia's expansion strategy. The specifics of concession agreements, such as how tariffs are regulated and the mandatory investment levels, are critical political factors that will shape the company's financial performance and growth prospects in the coming years.

Brazil's political landscape directly impacts Equatorial Energia's investment climate. Recent years have seen efforts to improve governance and attract foreign direct investment, with Brazil aiming to be among the top global destinations for FDI. For instance, in 2023, Brazil's FDI inflows were reported to be around $60 billion, reflecting a growing confidence, though fluctuations can occur based on political developments.

Regulatory Agency Influence (ANEEL)

The Brazilian Electricity Regulatory Agency, ANEEL, significantly shapes Equatorial Energia's operating environment. ANEEL's decisions on tariff adjustments, such as the average tariff increase of 5.7% for distribution companies approved in July 2024, directly influence Equatorial's revenue streams. Furthermore, ANEEL's oversight of investment approvals for grid modernization and expansion projects is crucial for the company's long-term development.

ANEEL's 2024-2025 agenda is particularly relevant. Key areas include the ongoing monitoring of the wholesale electricity market (MAST) and the development of regulatory frameworks for offshore power generation. These initiatives present both opportunities and challenges for Equatorial Energia, potentially opening new avenues for growth while also introducing new compliance requirements. For instance, ANEEL's push for greater market competition could lead to revised rules for energy trading that Equatorial must navigate.

Infrastructure Investment Programs

Government-led infrastructure programs, like the 'Luz Para Todos' (Light for All) initiative, are pivotal for Equatorial Energia, directly influencing its distribution network expansion and overall service accessibility. These programs, often fueled by substantial public and private capital, create avenues for the company to grow its customer base and enhance infrastructure in areas that have historically lacked adequate service. This focus on underserved regions presents a significant growth opportunity.

Equatorial Energia is actively participating in these government initiatives. For example, Equatorial Pará secured a substantial contract under the 'Luz Para Todos' program. This agreement is specifically designed to bring electricity to approximately 280,000 individuals by the year 2025, underscoring the direct impact of these programs on the company's operational reach and social contribution.

- Government Infrastructure Programs: Initiatives like 'Luz Para Todos' drive network expansion and service improvement for Equatorial Energia.

- Investment Opportunities: Public and private investments in these programs allow for customer base growth and infrastructure upgrades in underserved areas.

- Equatorial Pará's Contract: A key agreement under 'Luz Para Todos' aims to benefit around 280,000 people by 2025.

Government policies significantly shape Equatorial Energia's operational landscape, with a focus on energy transition and infrastructure development. The National Energy Transition Policy, effective August 2024, targets renewable energy growth, aligning with Equatorial's strategic investments. Furthermore, government-backed programs like 'Luz Para Todos' directly fuel network expansion, with Equatorial Pará securing a contract to serve an estimated 280,000 individuals by 2025.

| Policy/Program | Objective | Impact on Equatorial Energia | Key Dates/Targets |

| National Energy Transition Policy | Promote renewable energy and green economy growth | Drives investment in sustainable energy projects | Introduced August 2024 |

| Luz Para Todos (Light for All) | Expand electricity access to underserved areas | Facilitates network expansion and customer base growth | Equatorial Pará contract to serve ~280,000 by 2025 |

| Privatization Initiatives | Increase private sector participation in utilities | Creates acquisition and expansion opportunities | Ongoing, e.g., Sanepar bid in 2023 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Equatorial Energia across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights into how these evolving factors present both threats and opportunities for strategic decision-making and proactive business planning.

A PESTLE analysis for Equatorial Energia provides a clear, summarized version of external factors, relieving the pain point of information overload during strategic planning by offering easy referencing for meetings and presentations.

Economic factors

Equatorial Energia's fortunes are intrinsically linked to Brazil's economic vitality. A robust economy translates directly into higher energy consumption across all sectors. Brazil's GDP experienced a healthy expansion of 3.4% in 2024, primarily fueled by strong performances in the services and industrial segments.

Looking ahead, the Brazilian economy is forecasted to grow by 2.0% in 2025. This projected growth indicates a continued, albeit moderated, expansion in economic activity, suggesting a generally supportive environment for increased energy demand, which benefits companies like Equatorial Energia.

Inflation and interest rates significantly influence Equatorial Energia's financial health. Rising inflation can escalate operational costs for materials and services, while higher interest rates directly increase the expense of servicing its substantial debt.

Equatorial Energia's net debt stood at R$44.1 billion as of the first quarter of 2025, highlighting the critical impact of financial expenses on profitability and investment capacity. Elevated interest rates make it more costly to finance new projects and refinance existing debt, potentially slowing growth initiatives.

The purchasing power of Brazilian consumers directly impacts Equatorial Energia's revenue and its ability to collect payments for electricity services. When consumers have more disposable income, they are more likely to pay their bills on time and potentially increase their electricity consumption.

Indicating a positive trend for energy providers, household electricity consumption in Brazil saw a notable increase of 4.8% in 2024. This rise suggests that Brazilian households have greater capacity and willingness to utilize electricity, benefiting companies like Equatorial Energia.

Beyond individual households, the overall demand for energy in Equatorial Energia's service areas is closely tied to broader economic activity and population growth. A robust economy and a growing population naturally translate into higher energy consumption, supporting the company's growth prospects.

Foreign Investment and Capital Availability

Equatorial Energia's growth hinges on its access to foreign investment and robust capital markets. The company has actively pursued strategic asset sales to optimize its financial structure, a move that can free up capital for reinvestment. For instance, in 2023, Equatorial Energia completed the sale of its stake in CEAL for R$1.4 billion, demonstrating its commitment to financial flexibility.

Securing international financing is also vital. The company has previously partnered with institutions like the International Finance Corporation (IFC), which provided loans to support projects aimed at improving energy access and system reliability in Brazil. The cost and availability of such capital directly influence Equatorial Energia's capacity to undertake significant infrastructure development and expansion initiatives.

- Foreign Investment Impact: Access to foreign capital is essential for Equatorial Energia to fund its ambitious expansion plans and critical infrastructure upgrades.

- Strategic Financial Moves: The company's strategy includes divesting non-core assets to strengthen its financial position and enhance capital availability.

- International Partnerships: Loans from international financial bodies, such as the IFC, underscore the importance of global capital markets in supporting Brazil's energy sector development.

- Capital Cost Sensitivity: The overall cost of capital significantly dictates the feasibility and scale of Equatorial Energia's large-scale project financing.

Sector-Specific Investment Trends

Investment trends in Brazil's energy sector are heavily favoring renewables and transmission infrastructure, directly impacting Equatorial Energia's expansion. In 2024, Brazil continued its robust investment in wind and solar power, with new capacity additions expected to reach record levels. Equatorial Energia's strategic direction aligns with this, as evidenced by its significant capital expenditure plans for renewable energy generation and grid modernization projects throughout 2024 and into 2025.

The increasing focus on sustainability and energy security is driving substantial investment into advanced technologies like energy storage and smart grids. These advancements offer Equatorial Energia new avenues for growth and operational efficiency. For instance, the company has outlined plans to invest in smart meter deployment and grid automation, aiming to reduce losses and improve service reliability.

- Renewable Energy Growth: Brazil's installed renewable capacity is projected to surpass 200 GW by the end of 2025, with wind and solar leading the charge.

- Transmission Investment: Over R$50 billion is slated for investment in Brazil's transmission lines through 2029, a critical area for Equatorial Energia's expansion.

- Grid Modernization Focus: Equatorial Energia plans to allocate a substantial portion of its 2024-2025 CAPEX to smart grid technologies and distribution network upgrades.

- Energy Storage Potential: The burgeoning energy storage market in Brazil presents future opportunities, with pilot projects and regulatory frameworks developing rapidly.

Brazil's economic performance directly fuels Equatorial Energia's revenue through increased energy demand. With GDP growth projected at 2.0% for 2025, following a 3.4% expansion in 2024, the outlook for energy consumption remains positive. Household electricity consumption rose 4.8% in 2024, indicating enhanced consumer spending capacity.

Inflation and interest rates are critical financial considerations for Equatorial Energia. The company's net debt of R$44.1 billion as of Q1 2025 makes it sensitive to rising borrowing costs. Higher interest rates directly impact profitability by increasing debt servicing expenses and potentially limiting capital for new investments.

Equatorial Energia relies on access to capital markets and foreign investment to fund its growth initiatives. The company's strategic asset sales, such as the R$1.4 billion CEAL divestment in 2023, aim to improve financial flexibility. Partnerships with institutions like the IFC highlight the importance of international financing for infrastructure development.

Investment trends in Brazil's energy sector are increasingly focused on renewables and transmission. Equatorial Energia is aligning its capital expenditure with this trend, planning significant investments in smart grids and renewable energy generation through 2025. Brazil is expected to add record levels of wind and solar capacity, with transmission infrastructure investments projected to exceed R$50 billion by 2029.

| Economic Indicator | 2024 (Actual/Estimate) | 2025 (Forecast) |

|---|---|---|

| Brazil GDP Growth | 3.4% | 2.0% |

| Household Electricity Consumption Growth | 4.8% | N/A |

| Equatorial Energia Net Debt (Q1 2025) | R$44.1 billion | N/A |

Preview the Actual Deliverable

Equatorial Energia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Equatorial Energia covers all critical external factors impacting its operations, providing a comprehensive strategic overview.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into the Political, Economic, Social, Technological, Legal, and Environmental influences shaping Equatorial Energia's business landscape.

The content and structure shown in the preview is the same document you’ll download after payment. Equip yourself with a thorough understanding of the market dynamics affecting Equatorial Energia's strategic decisions and future growth.

Sociological factors

Brazil's demographic shifts, including a growing population and increasing urbanization, directly impact electricity demand. As more people move to cities, the need for consistent and robust energy infrastructure intensifies, creating expansion opportunities for Equatorial Energia.

Equatorial Energia is well-positioned to capitalize on these trends, serving approximately 14 million consumers across multiple Brazilian states. The ongoing movement of populations into urban centers drives demand for expanded distribution networks and increased energy supply, areas where Equatorial Energia can grow its customer base and infrastructure.

Consumer behavior is shifting, with a growing preference for energy-efficient appliances and a rise in distributed generation, like rooftop solar. This trend directly influences energy consumption patterns, potentially impacting Equatorial Energia's revenue streams. For instance, a significant portion of Brazilian households, around 70% as per recent surveys, are increasingly aware of energy efficiency, leading to a demand for smarter, less energy-intensive solutions.

Understanding these evolving consumer preferences is crucial for Equatorial Energia to adapt its service offerings and investment strategies. By recognizing the growing adoption of technologies that reduce reliance on traditional grid power, the company can better position itself for future market dynamics and maintain its competitive edge in the evolving energy landscape.

Equatorial Energia significantly bolsters socio-economic development by expanding electricity access, especially in historically underserved and lower-income regions. This commitment is crucial for improving living standards and fostering economic activity.

The company's participation in programs like 'Luz Para Todos' directly addresses energy poverty, aiming to connect remote communities to the grid. In 2023, Equatorial Energia reported significant progress in expanding its distribution network, reaching thousands of new households, a key component of its growth and social inclusion agenda.

Public Perception and Corporate Social Responsibility

Public perception significantly shapes how energy companies like Equatorial Energia are viewed, impacting everything from customer loyalty to regulatory favor. Concerns about service reliability, environmental footprint, and overall social responsibility are paramount for stakeholders. For instance, in 2023, Equatorial Energia reported a 9.1% increase in customer satisfaction scores in certain operating regions, partly attributed to improved service quality and community engagement initiatives.

Equatorial Energia actively addresses these perceptions through its commitment to sustainability, detailed in its annual sustainability reports. These reports highlight the company's progress on Environmental, Social, and Governance (ESG) targets, which are increasingly scrutinized by investors and the public alike. Their 2024 sustainability report, released in May 2024, detailed a 15% reduction in greenhouse gas emissions intensity compared to 2022 levels.

The company's efforts to foster positive public perception are crucial for navigating the evolving energy landscape. This includes transparent communication about their environmental impact and social contributions.

- Customer Satisfaction: Equatorial Energia saw a 9.1% rise in customer satisfaction in key areas by the end of 2023.

- Environmental Performance: The company achieved a 15% reduction in greenhouse gas emissions intensity in 2024 compared to the previous year.

- ESG Focus: Public perception is increasingly tied to a company's demonstrated commitment to Environmental, Social, and Governance (ESG) principles.

- Transparency: Sustainability reports are vital tools for Equatorial Energia to communicate its ESG efforts and build trust.

Labor Market Dynamics and Skilled Workforce Availability

The availability of a skilled workforce is crucial for Equatorial Energia's success, impacting everything from day-to-day operations to ambitious expansion plans. In 2024, Brazil's energy sector faced a persistent demand for specialized technicians and engineers, with reports indicating a shortage in certain technical fields. This scarcity can directly influence project timelines and the cost of acquiring and retaining talent.

Labor market dynamics, such as evolving wage expectations and increasingly complex labor regulations, present ongoing challenges. For instance, changes in minimum wage laws or new collective bargaining agreements can directly affect Equatorial Energia's operational expenditures. In 2025, projections suggest continued upward pressure on wages in specialized technical roles within the energy industry, necessitating careful financial planning and talent management strategies.

- Skilled Workforce Shortage: Reports in late 2024 highlighted a national deficit in experienced electrical engineers and grid technicians, directly impacting the energy sector's ability to staff new projects and maintain existing infrastructure.

- Wage Pressures: Projections for 2025 indicate an average wage increase of 6-8% for specialized energy sector roles in Brazil, driven by high demand and limited supply of qualified professionals.

- Regulatory Impact: Evolving labor laws, including those related to contract work and benefits, can add an estimated 3-5% to overall labor costs for companies like Equatorial Energia, requiring ongoing compliance monitoring.

Sociological factors significantly influence Equatorial Energia's operations and strategy. Brazil's demographic trends, including an aging population and a growing middle class, shape energy consumption patterns and demand for services. For example, by the end of 2023, Equatorial Energia served approximately 14 million consumers, a figure expected to grow with ongoing urbanization trends.

Consumer preferences are also evolving, with a greater emphasis on sustainability and digital engagement. Equatorial Energia's 2024 sustainability report indicated a 15% reduction in greenhouse gas emissions intensity, reflecting a response to these societal expectations. Furthermore, public perception, heavily influenced by reliability and social responsibility, is critical; the company reported a 9.1% increase in customer satisfaction in key regions by late 2023.

Technological factors

Equatorial Energia's strategic embrace of smart grid technologies and digitalization is pivotal for enhancing its distribution network's efficiency and resilience. These advancements allow for superior real-time monitoring and control of energy flow, directly impacting operational performance.

The company's investment in projects like the Alcântara Launch Center, which integrates solar power with advanced energy storage, exemplifies this commitment. This initiative highlights a practical application of smart grid principles, aiming to create a more robust and adaptable energy infrastructure.

By leveraging these digital tools, Equatorial Energia can optimize electricity distribution, reduce losses, and improve the overall reliability of service for its customers, a critical factor in today's energy landscape.

Advancements in renewable energy technologies, particularly solar and wind power, are significantly shaping Equatorial Energia's generation capabilities and future investment horizons. These innovations are making clean energy more cost-effective and efficient, directly influencing the company's strategic decisions regarding its energy mix.

Brazil's energy landscape is rapidly shifting towards renewables. By the end of 2024, wind and solar power are projected to constitute a substantial percentage of the nation's electricity generation, highlighting a strong trend that Equatorial Energia is actively participating in and benefiting from.

Equatorial Energia is strategically prioritizing investments in renewable energy projects to align with this national trend and capitalize on the growing demand for sustainable power. This focus is crucial for maintaining competitiveness and expanding its generation portfolio in the evolving energy market.

The rapid advancement and widespread adoption of energy storage solutions, especially battery energy storage systems (BESS), are critical for maintaining grid stability and seamlessly integrating variable renewable energy sources like solar and wind. By mid-2024, global BESS installations were projected to reach over 150 GW, a significant leap reflecting this growing trend.

Equatorial Energia is actively embracing this technological shift, notably by integrating battery storage systems into its smart grid initiatives. This strategic move underscores the company's commitment to leveraging advanced storage capabilities to enhance grid resilience and accommodate a higher penetration of renewables, a key factor in navigating the evolving energy landscape.

Cybersecurity and Data Analytics

The increasing digitalization of energy systems, including smart grid initiatives, places a paramount emphasis on cybersecurity. For Equatorial Energia, robust measures are essential to safeguard its infrastructure against evolving cyber threats. In 2024, the global energy sector experienced a notable rise in cyberattacks, underscoring the need for continuous investment in advanced security protocols.

Data analytics presents a significant opportunity for Equatorial Energia to optimize its operations and enhance customer engagement. By leveraging vast amounts of data generated by smart meters and grid operations, the company can gain deeper insights into energy consumption patterns. This allows for more accurate demand forecasting, proactive maintenance scheduling, and personalized service offerings, ultimately driving efficiency and customer satisfaction.

- Cybersecurity Investment: Equatorial Energia must allocate significant resources to protect its digital assets, especially as smart grid technology expands.

- Data-Driven Efficiency: Utilizing data analytics can lead to an estimated 5-10% improvement in operational efficiency for energy utilities through better demand prediction and resource allocation.

- Customer Service Enhancement: Advanced analytics can enable Equatorial Energia to offer tailored energy solutions and respond more effectively to customer needs, potentially boosting customer retention by up to 15% in competitive markets.

- Regulatory Compliance: Adhering to evolving data privacy and cybersecurity regulations is crucial, with penalties for non-compliance potentially reaching millions of dollars.

Innovation in Transmission and Distribution Infrastructure

Continuous innovation in transmission and distribution infrastructure is vital for improving efficiency and reducing energy losses. New materials, advanced designs, and increased automation are transforming grid operations, leading to enhanced reliability. Equatorial Energia's strategic investments in modernizing its infrastructure directly support its long-term growth trajectory by ensuring a more robust and efficient energy delivery system.

Equatorial Energia's commitment to grid modernization is evident in its ongoing projects. For instance, during 2024, the company planned significant capital expenditures focused on upgrading its transmission and distribution networks. These investments aim to incorporate smart grid technologies, which can better manage energy flow and reduce technical losses, a key performance indicator for efficiency. By adopting these advancements, Equatorial Energia is positioning itself to meet growing energy demands and improve service quality for its customers.

- Improved Efficiency: Innovations in conductor materials and substation designs can reduce energy loss during transmission, directly impacting operational costs and environmental footprint.

- Enhanced Grid Reliability: Automation and smart grid technologies, such as advanced metering infrastructure and remote monitoring systems, allow for faster fault detection and restoration, minimizing downtime.

- Investment in Modernization: Equatorial Energia's capital allocation in 2024 included substantial funds dedicated to upgrading existing infrastructure and expanding its network with more resilient and technologically advanced components.

Technological advancements are reshaping Equatorial Energia's operational landscape, driving efficiency and sustainability. The company's focus on smart grid implementation, including advanced metering and grid automation, is crucial for optimizing energy distribution and reducing losses. By mid-2024, Equatorial Energia was investing heavily in digitalizing its networks, aiming for a more responsive and resilient energy infrastructure.

The integration of renewable energy sources, particularly solar and wind, is a key technological trend influencing Equatorial Energia's strategy. Brazil's energy matrix is increasingly leaning towards renewables, with solar and wind power expected to represent a significant portion of generation by the end of 2024. This shift necessitates robust energy storage solutions, a technology Equatorial Energia is actively adopting to ensure grid stability.

Furthermore, the company is leveraging data analytics to enhance its operations and customer service. By analyzing data from smart meters and grid operations, Equatorial Energia can improve demand forecasting and personalize energy offerings. Cybersecurity remains a paramount concern, with increased investment in protecting digital assets against evolving threats, especially as smart grid technology expands.

| Technology Area | Impact on Equatorial Energia | Key Data/Trend (2024/2025) |

|---|---|---|

| Smart Grid & Digitalization | Improved operational efficiency, reduced losses, enhanced grid resilience. | Projected 5-10% operational efficiency gains through data analytics. |

| Renewable Energy Integration | Expansion of clean energy portfolio, cost-effectiveness. | Brazil's renewable energy share growing significantly; Equatorial Energia investing in solar/wind projects. |

| Energy Storage Systems (BESS) | Grid stability, seamless renewable integration. | Global BESS installations projected to exceed 150 GW by mid-2024. |

| Cybersecurity | Protection of digital assets and infrastructure. | Global energy sector facing increased cyberattack frequency in 2024, requiring robust security protocols. |

Legal factors

Equatorial Energia navigates a complex web of energy sector regulations in Brazil, overseen by the National Electric Energy Agency (ANEEL). These rules dictate everything from how electricity prices are set, impacting revenue streams, to the quality of service provided to millions of customers. For instance, ANEEL's tariff review process, a key regulatory event, directly influences Equatorial's profitability and investment capacity.

The company must maintain numerous licenses for its diverse operations, spanning electricity generation, transmission, and distribution. These licenses are not static; they require ongoing compliance with evolving standards, including environmental protection measures and safety protocols. Failure to adhere to these licensing requirements can result in significant penalties and operational disruptions, as seen in past regulatory enforcement actions within the Brazilian power sector.

Equatorial Energia's operations are heavily influenced by long-term concession agreements, which dictate crucial aspects like investment commitments, service quality benchmarks, and how tariffs are adjusted. These contracts are the bedrock of its business, outlining both its privileges and responsibilities.

Any renegotiation or disagreement regarding the interpretation of these concession agreements can introduce substantial risk and uncertainty for Equatorial Energia. For instance, in 2023, regulatory reviews and potential tariff adjustments in Brazil, where the company has significant operations, highlighted the sensitivity of these contractual frameworks to evolving economic conditions and policy shifts.

Equatorial Energia operates under a stringent environmental regulatory framework, encompassing emissions control, waste disposal, and land use policies. Failure to adhere to these mandates can lead to substantial financial penalties and legal disputes, impacting its operational continuity and public image. The company's 2023 sustainability report, for instance, detailed significant investments in pollution control technologies across its energy generation and distribution networks.

Consumer Protection Laws

Consumer protection laws significantly shape Equatorial Energia's customer interactions, covering aspects like billing transparency, service reliability, and dispute management. For instance, Brazil's Consumer Defense Code (CDC) mandates clear communication and fair practices, directly impacting how Equatorial Energia handles customer complaints and service interruptions. Failure to comply can lead to substantial fines and reputational damage.

Adherence to these regulations is paramount for Equatorial Energia to foster customer loyalty and prevent costly legal battles. In 2023, regulatory bodies across Brazil, including ANEEL (National Electric Energy Agency), imposed fines on energy distributors for various service-related issues, highlighting the strict enforcement environment. Equatorial Energia must ensure its operations align with these consumer-centric mandates to maintain trust.

- Billing Accuracy: Ensuring all charges are clearly itemized and reflect actual consumption, as stipulated by consumer protection codes.

- Service Quality Standards: Meeting defined reliability and continuity of supply metrics, with penalties for deviations.

- Complaint Resolution: Establishing efficient and transparent channels for addressing customer grievances within regulatory timelines.

Corporate Governance and Compliance Frameworks

Equatorial Energia, as a publicly traded entity, navigates a complex web of corporate governance and compliance. This necessitates adherence to rigorous standards for transparent financial reporting, ethical business practices, and robust internal controls designed to mitigate fraud and ensure accountability. In 2023, the company’s sustainability report highlighted its commitment to international reporting methodologies, underscoring its dedication to global compliance benchmarks.

The company’s commitment to good governance is further evidenced by its active participation in regulatory frameworks. For instance, in the first half of 2024, Equatorial Energia continued to implement enhanced internal audit procedures, a key component of its compliance strategy. This focus ensures that operations align with legal requirements and stakeholder expectations.

- Adherence to B3 Corporate Governance Standards: Equatorial Energia, listed on the B3 stock exchange, complies with its corporate governance regulations, aiming for high levels of transparency and accountability.

- Compliance with CVM Regulations: The company follows the rules set by the Brazilian Securities and Exchange Commission (CVM), ensuring proper disclosure and investor protection.

- Focus on ESG Compliance: Equatorial Energia integrates Environmental, Social, and Governance (ESG) principles into its compliance framework, aligning with growing investor and regulatory demands for sustainable business practices.

- Internal Control Enhancements: Ongoing efforts in 2024 have focused on strengthening internal controls to prevent financial irregularities and ensure operational integrity, as detailed in their latest filings.

Equatorial Energia operates under a robust legal framework in Brazil, heavily influenced by the National Electric Energy Agency (ANEEL) and consumer protection laws. Compliance with these regulations, including tariff setting and service quality standards, is critical for its financial performance and operational continuity. For example, ANEEL's tariff review processes directly impact revenue, and adherence to consumer codes ensures fair customer interactions, preventing fines and reputational damage. The company must also maintain various operational licenses, with ongoing compliance requirements for environmental and safety standards, as highlighted by its 2023 sustainability report detailing investments in pollution control.

The company's long-term concession agreements are fundamental, dictating investment obligations and service quality. Any disputes or renegotiations of these contracts, like those observed in Brazil's energy sector in 2023 due to economic shifts, introduce significant risk. Furthermore, Equatorial Energia, as a publicly traded entity, adheres to strict corporate governance and CVM regulations, with ongoing enhancements to internal controls in 2024 to ensure transparency and accountability, aligning with B3 standards and growing ESG demands.

Environmental factors

Equatorial Energia's operations are significantly exposed to the escalating impacts of climate change, particularly extreme weather events. These phenomena, including severe storms, widespread flooding, and prolonged heat waves, pose a direct threat to the reliability of energy supply and can cause substantial damage to critical infrastructure.

The company itself highlighted the challenging operational environment in 2023, noting that this year was characterized by complex climate change dynamics and severe weather conditions. These adverse events directly impacted its operational performance and infrastructure integrity across its service territories.

The global and national drive for renewable energy integration and decarbonization is a major factor shaping Equatorial Energia's investment decisions. Brazil, in particular, is making significant strides, with approximately 90% of its electricity already sourced from renewable resources, positioning it as a leader in the green economy.

Equatorial Energia's strategic focus on expanding its renewable energy portfolio directly supports these national sustainability objectives. This alignment ensures the company is well-positioned to capitalize on the ongoing energy transition and meet future energy demands with cleaner sources.

Brazil's heavy dependence on hydropower, accounting for roughly 60% of its energy matrix, exposes Equatorial Energia to significant risks from water scarcity. Droughts directly impact reservoir levels, curtailing hydroelectric generation and forcing a switch to costlier thermal power sources. This vulnerability was highlighted in 2024, when unfavorable climate conditions led to reduced power generation, impacting the company's operational costs and revenue streams.

Biodiversity and Land Use Impacts

Equatorial Energia's operations, particularly the expansion of its energy infrastructure like transmission lines and new power plants, directly influence local biodiversity and land use patterns. The company is committed to mitigating these effects by strictly following environmental regulations and integrating sustainable development principles into its project planning and execution. This includes careful site selection to minimize habitat disruption and implementing biodiversity protection measures during construction and operation.

Responsible land management is crucial for Equatorial Energia. For instance, in Brazil, where the company has significant operations, the Amazon rainforest faces ongoing deforestation pressures. Equatorial Energia's commitment to responsible land use means actively working to minimize its footprint, often involving reforestation efforts and partnerships with conservation organizations. By prioritizing these practices, the company aims to balance energy provision with ecological preservation.

Key considerations for Equatorial Energia regarding biodiversity and land use include:

- Minimizing Habitat Fragmentation: Strategic routing of transmission lines to avoid critical wildlife corridors and sensitive ecosystems.

- Sustainable Construction Practices: Implementing measures to reduce soil erosion, control pollution, and protect water sources during project development.

- Biodiversity Offsetting: Investing in conservation projects that compensate for unavoidable impacts on biodiversity, often through habitat restoration or protection elsewhere.

- Stakeholder Engagement: Collaborating with local communities and environmental groups to ensure land use decisions are informed and socially responsible.

Waste Management and Pollution Control

Equatorial Energia's operations, particularly in energy generation and distribution, inherently produce waste streams and have the potential to contribute to various forms of pollution. This necessitates robust waste management strategies and stringent pollution control measures to ensure adherence to environmental regulations and to mitigate ecological impact.

The company is actively engaged in improving its environmental performance. For instance, in 2023, Equatorial Energia reported a reduction in its waste generation per megawatt-hour produced, a testament to their ongoing efforts in operational efficiency and waste minimization. They are also investing in technologies to further reduce emissions, with a specific focus on air and water quality in the regions where they operate.

Key aspects of their environmental management include:

- Waste Reduction and Recycling Programs: Implementing initiatives to minimize non-hazardous and hazardous waste, with a target of increasing recycling rates by 15% by the end of 2025.

- Pollution Monitoring and Control: Continuous monitoring of emissions and effluents to ensure compliance with national and international environmental standards, aiming for zero non-compliance incidents.

- Investment in Cleaner Technologies: Allocating capital towards modernizing infrastructure and adopting cleaner energy generation technologies that inherently produce less waste and pollution.

- Environmental Compliance Audits: Conducting regular internal and external audits to verify the effectiveness of waste management and pollution control systems, with findings used to drive continuous improvement.

Equatorial Energia faces significant environmental challenges, with climate change directly impacting its infrastructure and operations through extreme weather events. The company's 2023 performance was notably affected by these complex climate dynamics, underscoring the need for resilience.

Brazil's strong commitment to renewable energy, with nearly 90% of its electricity from green sources, presents both opportunities and risks. While Equatorial Energia is expanding its renewable portfolio, its reliance on hydropower, which constitutes about 60% of Brazil's energy mix, makes it vulnerable to drought-induced water scarcity, as seen in 2024's reduced generation impacting costs.

The company is actively managing its environmental footprint by adhering to strict regulations and integrating sustainable practices into land use and biodiversity protection, particularly in sensitive areas like the Amazon. Equatorial Energia also prioritizes waste reduction and pollution control, reporting a decrease in waste per megawatt-hour in 2023 and investing in cleaner technologies to improve air and water quality.

| Environmental Factor | Impact on Equatorial Energia | 2023/2024 Data/Context |

|---|---|---|

| Climate Change & Extreme Weather | Infrastructure damage, operational disruption, reliability concerns | 2023 characterized by complex climate dynamics and severe weather; direct impact on performance. |

| Renewable Energy Transition & Decarbonization | Strategic investment driver, alignment with national goals | Brazil's energy matrix ~90% renewable; Equatorial Energia expanding renewable portfolio. |

| Water Scarcity (Hydropower Dependence) | Reduced generation, increased reliance on costlier thermal power | Brazil's ~60% hydropower matrix; 2024 unfavorable climate conditions led to reduced power generation. |

| Biodiversity & Land Use | Potential habitat disruption, need for responsible management | Commitment to minimizing footprint, reforestation efforts, partnerships with conservation orgs. |

| Waste Management & Pollution Control | Need for robust strategies, adherence to regulations | Reported reduction in waste generation per MWh in 2023; investment in cleaner technologies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Equatorial Energia is built on a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry-specific reports. We incorporate insights from regulatory bodies, market intelligence firms, and environmental impact assessments to provide a comprehensive overview.