Equatorial Energia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equatorial Energia Bundle

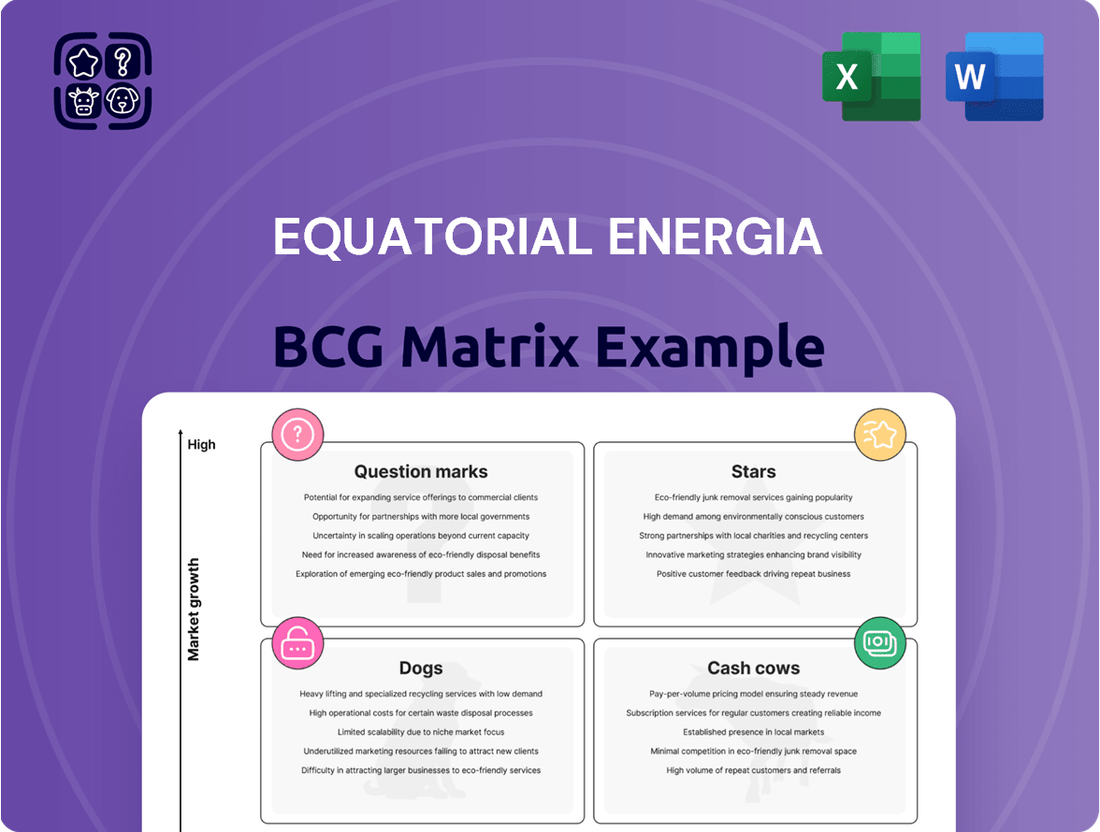

Equatorial Energia's BCG Matrix offers a strategic lens into its diverse portfolio, highlighting which segments are driving growth and which require careful management. Understanding these dynamics is crucial for any investor or analyst seeking to grasp the company's market position and future potential.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Equatorial Energia.

Stars

Equatorial Energia's bold move into new electricity distribution concessions, especially in areas needing better service, firmly places these operations in the Stars category of the BCG Matrix. This strategy is designed to capitalize on the burgeoning Brazilian power market.

Urbanization and industrial growth in Brazil are fueling a significant rise in electricity demand. Equatorial's expansion into these developing regions allows them to secure a larger slice of this growing market, making these Star segments prime for substantial investment to support ongoing expansion and service upgrades.

In 2023, Equatorial Energia reported a 10.5% increase in adjusted net income, reaching R$4.0 billion, partly driven by its expanding distribution network. The company's commitment to investing in these high-growth areas is a key factor in its overall performance and strategic positioning.

Equatorial Energia's significant investments in large-scale solar parks, exemplified by Barreiras I, position these projects as strong Stars within the BCG Matrix. These ventures represent high-growth, high-investment assets in a sector experiencing remarkable expansion.

Brazil's solar energy sector is poised for substantial growth, with projections indicating an addition of 19.2 GW in 2025 alone. This robust market trajectory underscores the Star status of Equatorial's solar initiatives, solidifying its leadership in this dynamic renewable energy segment.

Strategic Acquisitions in Expanding States

Acquisitions like Equatorial Goiás and CEEE-D are prime examples of Equatorial Energia's strategic moves to bolster its position in the BCG Matrix. These acquisitions significantly expanded its customer base and geographical reach into rapidly growing Brazilian states. For instance, the acquisition of Equatorial Goiás in 2021 added approximately 3 million customers, representing a substantial increase in its operational scale.

While these newly integrated distribution companies require initial investment for modernization and efficiency improvements, they operate in markets exhibiting high growth potential. The strategic intent is to leverage these investments to establish market leadership, thereby positioning them as future Cash Cows for the company. This focus on expansion and integration in high-potential regions is a key driver of Equatorial Energia's overall growth strategy.

Grid Modernization and Infrastructure Investments

Equatorial Energia's significant commitment to grid modernization and infrastructure upgrades positions its distribution segment as a Star in the BCG matrix. These investments are vital for accommodating rising energy demand and incorporating new renewable energy sources, thereby boosting operational efficiency and customer satisfaction.

The company's strategic focus on enhancing grid reliability and reducing energy losses is a key driver of its strong performance. For instance, in 2023, Equatorial invested R$2.3 billion in its distribution concession areas, a substantial portion dedicated to modernization and expansion projects.

- Grid Modernization Investments: Equatorial's ongoing capital expenditures in upgrading its distribution networks are crucial for meeting increasing energy consumption and integrating distributed generation.

- Reliability Enhancements: Investments focus on reducing technical and non-technical losses, improving service quality, and ensuring a stable power supply to millions of customers.

- Market Position: These infrastructure improvements reinforce Equatorial's competitive edge by delivering superior service and supporting economic growth in its operational regions.

- 2024 Outlook: Continued significant investment is expected in 2024, with plans to further expand and modernize the grid, anticipating a 5% growth in energy demand across its concessions.

Developing Transmission Lines for Renewable Integration

Developing new transmission lines, particularly those designed to link the burgeoning renewable energy sources in Brazil's Northeast to key consumption hubs, positions this venture as a Star within the BCG Matrix. Brazil's strategic focus on expanding its transmission infrastructure is crucial for accommodating its rapidly growing renewable energy sector. This necessitates substantial capital outlay for high-growth infrastructure projects, which are essential for securing future market dominance and generating consistent revenue.

The Brazilian government has underscored the importance of transmission expansion, with plans to auction new transmission lines totaling thousands of kilometers in the coming years. For instance, auctions held in 2023 and early 2024 have already allocated significant investment for new lines aimed at integrating renewable capacity. These projects are vital for ensuring grid stability and enabling the efficient transport of clean energy, thereby supporting the nation's decarbonization goals.

- High Growth Potential: The increasing share of renewables in Brazil's energy mix, projected to grow significantly by 2030, drives demand for new transmission capacity.

- Strategic Investment: Investments in transmission infrastructure are critical for Equatorial Energia to capitalize on the renewable energy boom and secure long-term revenue.

- Market Expansion: Connecting remote renewable generation sites to demand centers opens new markets and strengthens Equatorial Energia's competitive position.

- Government Support: Favorable regulatory frameworks and government prioritization of transmission expansion create a conducive environment for these projects.

Equatorial Energia's strategic expansion into new electricity distribution concessions, particularly in underserved areas, firmly places these operations in the Stars category of the BCG Matrix. This focus on growth markets aligns with Brazil's increasing energy demand, driven by urbanization and industrialization. Equatorial's proactive approach to acquiring and integrating new concessions, such as Equatorial Goiás and CEEE-D, which added millions of customers, demonstrates a clear strategy to capture market share in high-potential regions.

The company's substantial investments in large-scale solar parks, like Barreiras I, also represent Star assets, capitalizing on Brazil's burgeoning solar energy sector, which is projected to add significant capacity in the coming years. Furthermore, the development of new transmission lines to connect renewable energy sources to consumption hubs is a critical Star initiative, supported by government prioritization and significant investment in the sector.

In 2023, Equatorial Energia's adjusted net income rose by 10.5% to R$4.0 billion, partly due to its expanding distribution network. The company invested R$2.3 billion in its distribution concession areas in 2023, with a significant portion allocated to modernization and expansion, underscoring its commitment to these Star segments. For 2024, continued significant investment is anticipated to further expand and modernize the grid, anticipating a 5% growth in energy demand across its concessions.

| BCG Category | Key Initiatives | Market Growth | Equatorial's Investment Focus | 2023/2024 Data Points |

| Stars | New Electricity Distribution Concessions | High (Urbanization, Industrial Growth) | Capital Expenditures for Expansion & Service Upgrades | 10.5% increase in adjusted net income (2023); R$2.3 billion invested in distribution (2023); 5% anticipated demand growth (2024) |

| Stars | Large-Scale Solar Parks | Very High (Renewable Energy Boom) | Capital Outlay for Project Development | Brazil to add 19.2 GW solar capacity in 2025 |

| Stars | New Transmission Lines | High (Renewable Integration) | Infrastructure Development for Connectivity | Government auctions for thousands of km of new lines; significant investment allocated in 2023/2024 auctions |

| Stars | Grid Modernization & Reliability | High (Increasing Demand & Renewables) | Infrastructure Upgrades, Loss Reduction | R$2.3 billion invested in distribution concession areas (2023) |

What is included in the product

This BCG Matrix analysis highlights Equatorial Energia's strategic positioning, identifying units for investment, divestment, or maintenance based on market growth and share.

A clear BCG Matrix visual for Equatorial Energia simplifies strategic decisions, relieving the pain of complex portfolio analysis.

Cash Cows

Equatorial Energia's established electricity distribution concessions, like Equatorial Alagoas, are classic Cash Cows. These operations benefit from a large, stable customer base, ensuring consistent and significant cash flow due to their high market share in an essential service sector.

These mature businesses, requiring minimal investment for promotion and market placement, are vital for funding other areas of the company. In 2023, Equatorial Energia's distribution segment, which includes these concessions, reported a robust Adjusted EBITDA of R$ 13,993 million, demonstrating their reliable revenue generation capabilities.

Equatorial Energia's core electricity transmission assets, prior to recent divestitures, served as its cash cows. These assets are characterized by regulated and stable revenue streams, ensuring a predictable income for the company.

These infrastructure components held a significant market share in their respective segments, meaning they were well-established and dominant. The need for substantial new investment to maintain their operational capacity was minimal, allowing them to generate consistent cash flow without requiring significant capital expenditure.

In 2023, Equatorial Energia's transmission segment contributed R$ 3.2 billion in revenue, showcasing its consistent performance. This segment's stability is crucial for funding growth initiatives in other areas of the business.

Equatorial Energia's energy commercialization segment, essentially its electricity trading arm, is likely a Cash Cow. This business unit benefits from a mature market position, allowing it to generate steady profits by buying and selling power.

The segment's strength lies in its ability to capitalize on existing market knowledge and established customer relationships. This translates into reliable profit margins with minimal need for significant new investments, thereby providing a consistent and stable source of cash flow for the broader Equatorial Energia group.

Operational Efficiency and Cost Discipline

Equatorial Energia's unwavering commitment to operational efficiency and rigorous cost discipline across its established business segments is the bedrock of its Cash Cow status. This focus allows the company to extract maximum profitability from its high-market-share operations, ensuring a steady and substantial inflow of cash. For instance, in 2023, Equatorial reported a significant reduction in operational costs, contributing to a robust EBITDA margin of 55.8% in its distribution segment, a testament to its cost-control prowess.

This strategic emphasis translates directly into strong financial performance and the ability to fund growth initiatives or shareholder returns. The company's continuous efforts to optimize processes and manage expenses effectively in its mature businesses are key drivers of its consistent cash generation. In the first quarter of 2024, Equatorial successfully maintained its operational efficiency, with its distribution segment continuing to be a major contributor to the company's overall financial health.

- Focus on efficiency in mature segments drives profitability.

- Cost discipline enhances profit margins in high-market-share businesses.

- Robust EBITDA margins in distribution, like 55.8% in 2023, highlight success.

- Consistent cash generation from these operations supports overall company strategy.

Hydroelectric Generation Portfolio

Equatorial Energia's mature hydroelectric generation assets would indeed be classified as Cash Cows within a BCG Matrix framework. Brazil's energy landscape is predominantly shaped by hydropower, making established hydroelectric facilities a cornerstone of the nation's power supply.

These assets are characterized by their significant installed capacity and the low operational costs that follow their initial construction. This translates into a reliable and substantial source of energy, generating consistent and considerable cash flow for the company. For instance, as of the end of 2023, Equatorial Energia managed a significant portfolio of hydroelectric concessions, contributing substantially to its overall revenue generation.

- Stable Cash Flow: Mature hydroelectric plants offer predictable revenue streams due to long-term power purchase agreements and consistent water availability.

- Low Operating Costs: Once operational, the primary costs are maintenance and personnel, leading to high profit margins.

- Market Dominance: In Brazil, where hydropower is key, these assets represent a strong, established market position.

Equatorial Energia's electricity distribution concessions, such as Equatorial Alagoas, are prime examples of Cash Cows. These operations benefit from a large, stable customer base, ensuring consistent and significant cash flow due to their high market share in an essential service sector.

These mature businesses, requiring minimal investment for promotion and market placement, are vital for funding other areas of the company. In 2023, Equatorial Energia's distribution segment, which includes these concessions, reported a robust Adjusted EBITDA of R$ 13,993 million, demonstrating their reliable revenue generation capabilities.

Equatorial Energia's established hydroelectric generation assets are also considered Cash Cows. Brazil's reliance on hydropower means these facilities are a cornerstone of the nation's power supply, characterized by significant installed capacity and low operational costs post-construction.

This translates into a reliable and substantial source of energy, generating consistent and considerable cash flow. For instance, as of the end of 2023, Equatorial Energia managed a significant portfolio of hydroelectric concessions, contributing substantially to its overall revenue generation.

| Segment | BCG Classification | Key Characteristics | 2023 Performance Indicator |

|---|---|---|---|

| Electricity Distribution | Cash Cow | Large, stable customer base, high market share, essential service | Adjusted EBITDA: R$ 13,993 million |

| Hydroelectric Generation | Cash Cow | Significant installed capacity, low operational costs, established market position | Substantial contribution to overall revenue |

Preview = Final Product

Equatorial Energia BCG Matrix

The Equatorial Energia BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic analysis ready for immediate use in your business planning. You can confidently expect the same level of detail and clarity in the downloadable file, empowering you to make informed decisions about Equatorial Energia's business units.

Dogs

Equatorial's sanitation business, Companhia de Saneamento do Amapá (CSA), acquired in 2021, has unfortunately landed in the Dog quadrant of the BCG matrix. This segment has been a consistent drain, reporting losses throughout 2024 and continuing into Q1 2025.

The initial acquisition, intended to bolster Equatorial's portfolio, has been hampered by significant challenges. Low public acceptance of its services and unexpectedly high expansion costs have made profitability an elusive goal for CSA.

Consequently, Equatorial has reclassified CSA as a secondary, lower priority asset, actively pursuing its divestment. This strategic shift reflects a clear decision to exit a business that is no longer aligned with the company's core growth objectives.

Certain wind farms within Equatorial Energia's portfolio, especially those experiencing curtailment mandated by the National Electric System Operator (ONS) to prevent grid strain, can be viewed as potential Question Marks in the BCG Matrix. For instance, during periods of high renewable energy generation in Brazil, the ONS might restrict output from these farms to maintain grid stability. This situation, while occurring in a growth industry, directly impacts revenue realization.

Non-strategic or geographically isolated distribution assets within Equatorial Energia's portfolio could be considered 'Dogs' in the BCG Matrix. These might include older infrastructure in remote regions that don't fit the company's growth strategy.

For instance, if Equatorial has legacy distribution networks in areas with declining populations or limited industrial activity, these assets might demand high operational costs relative to their earnings. In 2023, Equatorial Energia reported significant investments in modernization, but these isolated assets may not benefit from such upgrades, potentially leading to a lower return on investment compared to core operations.

Older, Less Efficient Generation Assets

Older, less efficient generation assets, particularly those dependent on fossil fuels, could be categorized as Dogs within Equatorial Energia's BCG Matrix. These assets face significant challenges in a market increasingly prioritizing renewable energy sources. Their declining market share, coupled with high operational expenditures and constrained growth prospects, positions them as potential liabilities that could negatively impact the company's overall financial performance.

For instance, in 2024, the global energy sector continued its robust transition, with renewable energy capacity additions reaching record levels. Equatorial Energia, like many utilities, must contend with the economic viability of its older, less efficient thermal power plants against the backdrop of falling renewable energy costs and increasing carbon pricing mechanisms. Such assets may struggle to compete on price and environmental standards, leading to reduced utilization rates and profitability.

- Declining Competitiveness: Older fossil fuel plants often have higher variable costs compared to newer, more efficient technologies or renewables.

- Regulatory and Environmental Pressures: Increased scrutiny and regulations regarding emissions can lead to higher compliance costs for these assets.

- Limited Investment Appeal: These assets may attract less capital for upgrades or maintenance due to their perceived obsolescence and uncertain future.

Divested Transmission Subsidiaries

Equatorial Energia's divested transmission subsidiaries, including the sale of a unit in July 2024 and the entire transmission segment in May 2025, represent assets categorized as potential divestments within a BCG matrix framework. These sales suggest a strategic move to shed less core or mature business units, likely to improve financial health and reallocate capital. For instance, the July 2024 divestment could have been a tactical move to immediately generate cash, while the broader May 2025 sale indicates a more significant shift in the company's operational focus.

These divested transmission assets, while historically important, were likely viewed as cash cows that had reached a stage where their optimal value could be realized through sale, rather than continued internal investment. Equatorial Energia's decision to sell these units, potentially to reduce debt and fund expansion in higher-growth areas like distribution or renewable energy, aligns with a strategy of portfolio optimization. This approach allows the company to streamline operations and focus resources on segments with greater future potential.

- Divestment Rationale: The sale of transmission subsidiaries in July 2024 and May 2025 indicates a strategic decision to exit or reduce exposure in these segments.

- Financial Restructuring: These divestitures likely served to generate capital for debt reduction and to fund investments in more promising business areas.

- Portfolio Optimization: Equatorial Energia is actively managing its asset portfolio, divesting mature or less strategic units to enhance overall company performance.

- Strategic Repositioning: The sales signal a potential shift in focus towards higher-growth segments within the energy sector.

Equatorial Energia's sanitation business, CSA, acquired in 2021, is firmly in the Dog quadrant. It reported losses throughout 2024 and into Q1 2025, burdened by low public acceptance and high expansion costs. The company is actively pursuing divestment of CSA, deeming it a secondary, lower priority asset due to its persistent unprofitability.

Older, less efficient fossil fuel power plants also fit the Dog category. These assets face declining competitiveness due to higher operational costs compared to renewables, increasing environmental pressures, and limited investment appeal. In 2024, the global energy transition accelerated, making these older plants less viable against falling renewable energy costs and potential carbon pricing.

Non-strategic or geographically isolated distribution assets, such as legacy networks in areas with declining populations, can also be considered Dogs. These might incur high operational costs relative to earnings and may not benefit from modernization investments, leading to lower returns. Equatorial Energia's 2023 investments in modernization highlight the potential disparity for these isolated assets.

| Business Segment | BCG Quadrant | Performance Indicators (2024/Q1 2025) | Strategic Outlook |

|---|---|---|---|

| Sanitation (CSA) | Dog | Consistent losses reported; high expansion costs; low public acceptance | Actively pursuing divestment; reclassified as lower priority |

| Older Fossil Fuel Generation | Dog | Declining competitiveness; high operational costs; limited growth prospects | Faces challenges from renewable energy transition; potential for reduced utilization |

| Isolated Distribution Assets | Dog | Potentially high operational costs vs. earnings; may not benefit from modernization | Lower return on investment compared to core operations; strategic review likely |

Question Marks

Recently acquired distribution companies, still navigating the complexities of integration, represent Equatorial Energia's potential future Stars or Cash Cows. These entities, though currently requiring substantial capital investment for operational enhancements and market share growth, operate within a dynamic and expanding market. For instance, Equatorial Energia's acquisition of CEAL (Companhia Energética Alagoas) in 2019, while not as recent as some others, illustrates this phase; the company embarked on a significant investment program to improve operational efficiency and expand its customer base, aiming to transform it into a more profitable asset.

Equatorial Energia's early-stage distributed generation ventures, like nascent solar projects, would likely be classified as Question Marks in the BCG Matrix. These initiatives are in a rapidly growing market, with Brazil's distributed solar capacity projected to reach over 30 GW by 2026, according to ABSOLAR data.

However, these ventures typically have a low current market share and demand significant capital for development and scaling to compete effectively. Their future success hinges on Equatorial's ability to secure further investment and capture a larger segment of this expanding market.

Equatorial Energia's acquisition of a 15% stake in Sabesp, a major Brazilian sanitation company, positions Sabesp as a Question Mark in Equatorial's BCG Matrix. This move represents a significant diversification into a sector where Equatorial has limited direct operational experience, meaning its current market share is low.

The sanitation sector in Brazil, while offering long-term growth potential driven by increasing demand for water and sewage services, requires substantial capital investment to expand and modernize infrastructure. Equatorial's 15% stake means it needs to carefully assess Sabesp's operational efficiency and market position to determine if it can become a future Star performer, demanding significant strategic focus and financial commitment.

Exploration of New Energy Solutions and Technologies

Equatorial Energia's exploration into advanced energy storage systems, like pilot projects for large-scale battery installations, would be classified as Question Marks. These ventures target a rapidly expanding market for grid stability and renewable integration, but Equatorial's current market share in this nascent sector is minimal.

Significant investment is necessary for research, development, and scaling these innovative solutions. For instance, a hypothetical pilot program for a 50 MW battery energy storage system (BESS) could require an initial capital outlay upwards of $40 million. This high investment need, coupled with uncertain future returns, firmly places these initiatives in the Question Mark category.

- High Growth Potential: The global market for energy storage is projected to grow substantially, with forecasts suggesting it could reach hundreds of billions of dollars by the late 2020s, driven by renewable energy adoption and grid modernization.

- Low Current Market Share: Equatorial Energia's participation in advanced energy storage is likely in its early stages, meaning its current market share is negligible compared to established players or the overall market size.

- Significant Investment Required: Developing and deploying smart grid technologies or new storage solutions demands substantial upfront capital for R&D, infrastructure, and market penetration efforts.

- Uncertainty of Success: While promising, the long-term viability and profitability of these new energy technologies for Equatorial are not yet proven, creating a degree of risk.

Future Potential Acquisitions in Nascent Markets

Equatorial Energia's strategic outlook includes potential acquisitions in nascent markets, aiming to capture high-growth opportunities. These moves are designed to build market share in segments with significant future potential, even if current penetration is low. For instance, exploring renewable energy projects in regions of Brazil with underdeveloped solar or wind infrastructure aligns with this strategy.

Such ventures, while promising, demand substantial capital outlay and a long-term vision to overcome initial market entry challenges. Equatorial's approach would involve careful due diligence to identify targets that offer a strong growth trajectory and manageable risk profiles. By investing in these emerging areas, the company seeks to diversify its portfolio and secure future revenue streams.

Consider the company's potential interest in the distributed generation solar market in the Northeast region of Brazil. While currently fragmented, this segment is projected to grow significantly. Data from the Brazilian Photovoltaic Solar Energy Association (ABSOLAR) indicated a substantial increase in installed capacity for distributed generation in 2023, reaching over 37 GW by year-end, with the Northeast showing strong adoption rates.

- Targeting high-growth segments: Equatorial may look to acquire smaller players in Brazil's expanding renewable energy sector, particularly in solar and wind power, where market penetration is still relatively low but demand is rising.

- Geographic expansion: Entry into new Brazilian states where its operational footprint is minimal but economic development and energy demand are projected to increase presents another avenue for growth.

- Investment and risk: These acquisitions will require significant upfront investment and carry inherent risks associated with nascent market development, regulatory uncertainties, and the need to establish brand presence and operational efficiency.

- Strategic alignment: Such moves would position Equatorial to capitalize on long-term energy transition trends and diversify its revenue base beyond traditional distribution and transmission services.

Equatorial Energia's ventures into new, rapidly expanding markets with low current market share are classified as Question Marks. These include early-stage distributed generation projects and potential acquisitions in nascent sectors. Brazil's distributed solar capacity is expected to exceed 30 GW by 2026, highlighting the growth potential in this area.

These initiatives demand significant capital investment for development and scaling, with uncertain future returns. For instance, the company's 15% stake in Sabesp, a sanitation company, represents a diversification into a sector requiring substantial investment for infrastructure modernization.

Similarly, exploring advanced energy storage systems, such as pilot battery projects, requires substantial upfront capital, potentially exceeding $40 million for a 50 MW system, with uncertain market penetration.

BCG Matrix Data Sources

Our BCG Matrix for Equatorial Energia is built on a foundation of official financial disclosures, comprehensive market research, and industry-specific growth forecasts to provide a clear strategic overview.