Equatorial Energia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equatorial Energia Bundle

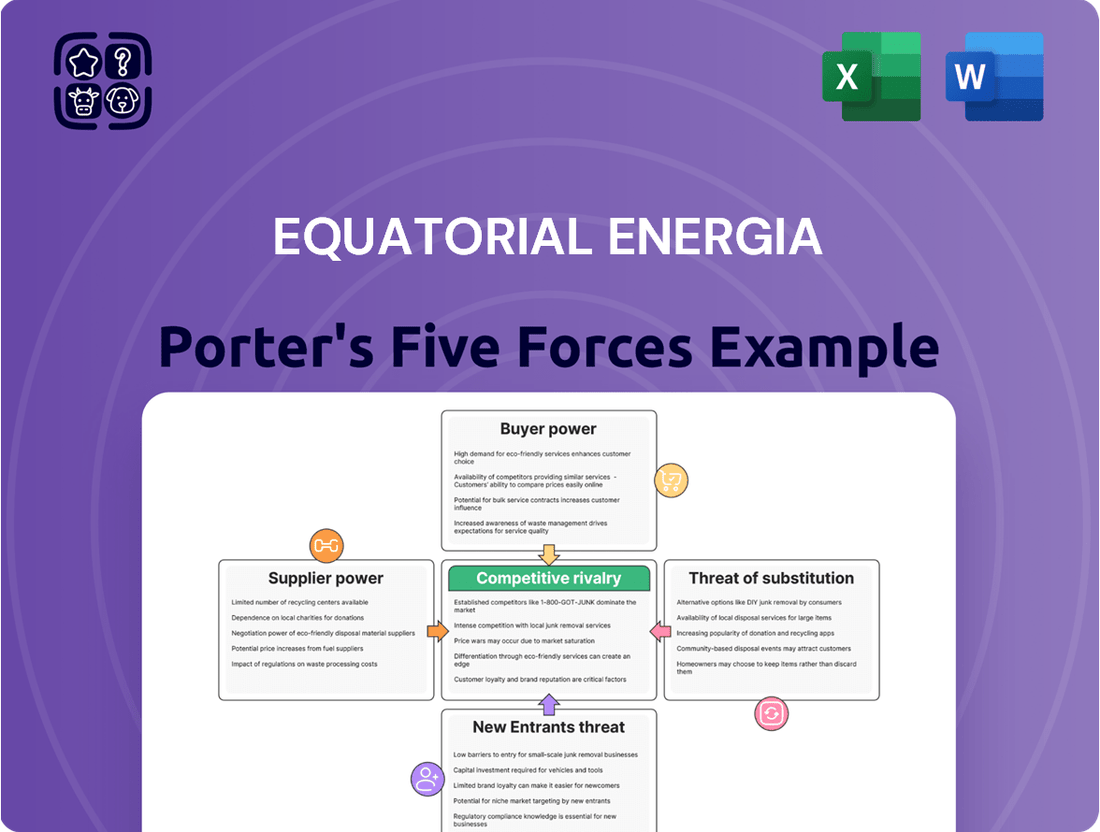

Equatorial Energia faces moderate bargaining power from buyers due to the essential nature of electricity, but intense competition from existing players and potential new entrants shapes its market. The threat of substitutes, while present in alternative energy sources, is currently less impactful for core electricity provision. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Equatorial Energia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Equatorial Energia is generally moderate to high, especially concerning specialized equipment crucial for large-scale energy generation and advanced transmission infrastructure. While Brazil boasts a varied energy generation mix, the specialized nature of components for power plants and grid modernization means a reliance on a smaller pool of manufacturers and technology providers. This concentration grants these suppliers a degree of leverage in negotiations.

Switching costs for Equatorial Energia can be quite substantial, particularly when it comes to essential infrastructure and long-term energy supply contracts. For instance, changing major equipment providers or renegotiating existing power purchase agreements could lead to significant financial outlays and operational disruptions, thereby bolstering the bargaining power of suppliers.

Suppliers offering specialized components for high-voltage transmission or advanced smart grid technologies often possess significant leverage. These unique or highly differentiated inputs mean Equatorial Energia has fewer readily available substitutes, strengthening the supplier's ability to dictate terms. For instance, in 2024, the global market for advanced grid management software, a crucial element for efficiency, saw limited providers with truly cutting-edge solutions, giving them considerable bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Equatorial Energia's distribution and transmission business is generally low. This is primarily because entering these regulated segments requires massive capital investments and navigating complex regulatory frameworks, creating significant barriers. For instance, establishing a new distribution network involves substantial costs for infrastructure like substations and power lines, making it economically unfeasible for most suppliers.

However, a nuanced view suggests that large energy generators could potentially pose a threat. These entities might explore direct commercialization of electricity to end consumers or invest in smaller, localized distribution networks. This strategic move could enhance their bargaining power by bypassing intermediaries like Equatorial Energia, especially in markets with less stringent regulations on new entrants.

While direct forward integration by traditional energy suppliers into Equatorial Energia's core regulated operations is unlikely, the potential for large generators to exert influence through alternative models remains. For example, in 2024, the Brazilian energy market saw continued discussions around distributed generation and the role of independent power producers, hinting at evolving supplier strategies that could indirectly impact established distributors.

- Low Capital Barriers to Entry for Distribution: The significant capital requirements for building and maintaining electricity distribution infrastructure act as a strong deterrent for most suppliers.

- Regulatory Hurdles: Stringent regulations governing the energy distribution and transmission sectors in Brazil create substantial compliance costs and operational complexities for potential new entrants.

- Potential for Generator Forward Integration: Larger energy generation companies may explore direct sales or smaller-scale distribution models to increase their market power and capture more value.

- Market Dynamics in 2024: Trends in distributed generation and the increasing role of independent power producers suggest a evolving landscape where suppliers might seek alternative routes to market.

Importance of Equatorial Energia to Suppliers

Equatorial Energia's substantial presence as one of Brazil's largest electricity groups, serving around 14 million consumers, makes it a critical client for its suppliers. This considerable customer base grants Equatorial Energia a degree of bargaining power.

The potential loss of Equatorial Energia as a customer could represent a significant blow to a supplier's revenue streams. For instance, if a key equipment manufacturer relies heavily on contracts with Equatorial Energia, the prospect of losing that business could incentivize the supplier to offer more favorable terms.

- Significant Customer Base: Equatorial Energia serves approximately 14 million consumers across Brazil.

- Supplier Dependence: Suppliers of essential goods and services, like transmission equipment or specialized maintenance, may depend significantly on Equatorial Energia's contracts.

- Potential Revenue Impact: Losing Equatorial Energia as a client could severely impact a supplier's financial performance.

Suppliers of specialized equipment and technology for Equatorial Energia's operations possess considerable bargaining power due to high switching costs and limited alternatives. For example, in 2024, the market for advanced smart grid components saw a concentration of providers, allowing them to negotiate favorable terms. This leverage is amplified when suppliers offer unique or highly differentiated inputs essential for maintaining and upgrading Equatorial Energia's extensive infrastructure, which serves approximately 14 million consumers across Brazil.

While Equatorial Energia's large customer base offers some counter-leverage, the specialized nature of its needs often tips the scales towards suppliers. The threat of suppliers integrating forward into Equatorial Energia's business is low due to significant regulatory and capital barriers in Brazil's energy distribution sector. However, trends in distributed generation and the evolving role of independent power producers in 2024 suggest potential shifts in supplier strategies that could indirectly influence market dynamics.

| Factor | Assessment | Implication for Equatorial Energia |

|---|---|---|

| Supplier Specialization | Moderate to High | Increased reliance on fewer providers for critical equipment. |

| Switching Costs | High | Significant financial and operational disruption if changing suppliers. |

| Forward Integration Threat | Low (for traditional suppliers) | Barriers to entry in distribution are substantial. |

| Equatorial Energia's Customer Base | Large (14 million consumers) | Provides some leverage, but often outweighed by supplier specialization. |

What is included in the product

This Porter's Five Forces analysis for Equatorial Energia dissects the competitive intensity within the Brazilian electricity distribution sector, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitutes.

Quickly identify and neutralize competitive threats to Equatorial Energia's market position with a streamlined, actionable Five Forces analysis.

Customers Bargaining Power

Equatorial Energia's customer base is incredibly diverse and spread out across multiple Brazilian states, encompassing everyone from individual households to large industrial operations. This wide distribution means that no single customer, or even a small group of customers, holds significant sway over the company's pricing or service agreements. In 2023, Equatorial Energia served over 10 million consumer units, highlighting the sheer scale and fragmentation of its customer landscape. This vastness inherently limits the bargaining power of any individual customer.

For Equatorial Energia's electricity distribution operations, customers face exceptionally high switching costs. This is primarily due to the regulated monopoly structure governing service provision within its concession territories. In 2023, Equatorial Energia served over 10 million customers across Brazil, highlighting the vast captive audience.

Electricity is a fundamental necessity for both households and businesses, meaning customers cannot easily opt out of purchasing it. This non-discretionary nature of electricity significantly curtails their ability to negotiate prices or switch providers based on cost alone, thereby diminishing their bargaining power.

Regulatory Oversight on Tariffs

The bargaining power of customers within Equatorial Energia is significantly influenced by regulatory oversight on tariffs. In Brazil, the National Electric Energy Agency (ANEEL) sets and regulates electricity distribution tariffs. This established framework is designed to safeguard consumer interests by preventing arbitrary price hikes, thereby limiting the direct negotiation leverage customers might otherwise possess.

This regulatory environment, while protective of consumers, also shapes their bargaining power in specific ways:

- Tariff Setting Process: ANEEL's tariff reviews, which occur periodically, provide a structured avenue for customer representation and input, though not direct bilateral negotiation.

- Price Controls: The regulated nature of tariffs means customers benefit from a level of price stability and predictability, reducing their need to bargain individually.

- Limited Direct Negotiation: Customers cannot directly negotiate their electricity rates with Equatorial Energia; these are determined by ANEEL's established methodologies and approved adjustments.

- Consumer Protection: Regulations include mechanisms for addressing service quality and billing disputes, offering customers recourse beyond direct price bargaining.

Growth of Distributed Generation

The increasing adoption of distributed generation, especially solar photovoltaic (PV) systems, is beginning to influence customer bargaining power within the energy sector. While still a nascent trend, this shift allows some customers to produce their own electricity, thereby creating an alternative to traditional grid-supplied power.

This growing capability can gradually enhance customer leverage, particularly for those who can benefit from favorable solar conditions or are larger energy consumers. For instance, by 2024, the installed capacity of distributed solar PV in Brazil, Equatorial Energia's primary market, continued its upward trajectory, offering a tangible alternative for a segment of its customer base.

- Distributed Solar PV Growth: The installed capacity of distributed solar PV in Brazil reached over 30 GW by the end of 2023, with continued expansion expected through 2024.

- Customer Choice Expansion: This growth provides customers with a viable option to reduce reliance on grid electricity, thereby increasing their ability to negotiate terms or seek alternative energy providers.

- Impact on Utilities: For utilities like Equatorial Energia, this trend necessitates adapting business models to accommodate and potentially integrate these distributed resources, influencing their traditional revenue streams and customer relationships.

Equatorial Energia's customer bargaining power remains relatively low due to the essential nature of electricity, high switching costs within regulated territories, and the sheer scale of its over 10 million customer units served as of 2023. While distributed generation, like solar PV, is growing, with Brazil's distributed solar capacity exceeding 30 GW by late 2023, it currently impacts only a segment of the customer base. The regulatory framework set by ANEEL also limits direct customer negotiation on tariffs, providing price stability instead.

| Factor | Impact on Customer Bargaining Power | Supporting Data (as of late 2023/early 2024) |

|---|---|---|

| Customer Base Size & Diversity | Lowers individual power | Over 10 million consumer units served by Equatorial Energia (2023) |

| Switching Costs | High, limiting alternatives | Regulated monopoly structure in concession areas |

| Essential Nature of Product | Reduces ability to forgo purchase | Electricity is a fundamental necessity |

| Regulatory Environment (ANEEL) | Limits direct negotiation, provides price stability | Tariff setting and oversight by ANEEL |

| Distributed Generation (Solar PV) | Emerging alternative, gradually increasing power for some | Brazil's distributed solar PV capacity exceeded 30 GW (late 2023) |

Preview the Actual Deliverable

Equatorial Energia Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Equatorial Energia, providing a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into the industry's dynamics. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Equatorial Energia's operating environment.

Rivalry Among Competitors

The Brazilian electricity sector is characterized by a moderate to high level of competitive rivalry, driven by the presence of several large utility groups actively participating in generation, transmission auctions, and energy commercialization. Equatorial Energia, as the third-largest distribution group in Brazil, operates within a landscape populated by other substantial entities, intensifying competition across various segments of the market.

Brazil's power sector is a hotbed of activity, with projections indicating substantial growth driven by increased demand and a strong push towards renewable energy sources. This expansion creates a more favorable environment for all participants, potentially easing the intensity of direct price competition as companies can pursue new projects and markets.

In 2024, Brazil's energy sector is expected to see significant investment, particularly in expanding generation capacity. For instance, the country's National Electric Energy Agency (ANEEL) has outlined plans for new transmission lines and generation projects, many of which will focus on solar and wind power, offering avenues for growth that can dilute intense rivalry.

This expanding market allows established players like Equatorial Energia to tap into new investment opportunities, whether through acquisitions, greenfield projects, or partnerships. The availability of growth opportunities can act as a buffer against aggressive pricing strategies, as companies can achieve revenue growth through volume and market share expansion rather than solely through price wars.

Equatorial Energia operates in an industry with substantial fixed costs, primarily due to the extensive infrastructure required for electricity generation, transmission, and distribution. These high upfront investments, such as power plants and grid networks, necessitate continuous operation to achieve economies of scale and recover capital. For instance, in 2023, the Brazilian electricity sector saw significant investments in transmission lines, with projects like the one connecting Belo Monte to the national grid requiring billions of dollars in capital expenditure.

Furthermore, significant exit barriers in the electricity sector, including stringent regulatory approvals and the specialized, often non-transferable nature of assets, make it difficult for companies to divest or cease operations. This lack of flexibility can force companies like Equatorial Energia to remain committed to existing markets and assets, potentially intensifying competition as they strive to maintain profitability and market share by aggressively competing for customers and operational efficiency.

Differentiation in Service and Efficiency

While electricity itself is largely a standardized commodity, Equatorial Energia differentiates itself in the competitive landscape through superior service quality, operational efficiency, and the reliability of its energy distribution. This focus on enhancing the customer experience and ensuring consistent power delivery is a key strategy in a sector where such factors are highly valued by consumers and businesses alike.

Equatorial Energia's commitment to improving operational efficiency and the reliability of its energy services directly addresses the intense rivalry within the sector. For instance, in 2023, the company reported significant reductions in average system interruption duration (SAIDI), a key metric for reliability, across its distribution concessions, demonstrating tangible progress in this area.

- Service Quality: Equatorial Energia aims to stand out by offering better customer support and more responsive service, particularly in managing outages and billing inquiries.

- Operational Efficiency: Investments in grid modernization and smart technologies are crucial for reducing energy losses and improving the speed of service restoration, directly impacting operational costs and customer satisfaction.

- Reliability: Consistent power supply is a major differentiator. Equatorial Energia's efforts to minimize blackouts and voltage fluctuations are vital for retaining customers, especially industrial clients who suffer significant losses from power interruptions.

- Comprehensive Solutions: Beyond basic electricity supply, competition is emerging in offering integrated energy solutions, such as distributed generation, energy management systems, and electric vehicle charging infrastructure, areas where Equatorial Energia is also exploring opportunities.

Regulatory Environment and Concessions

Brazil's energy sector is heavily regulated by the National Electric Energy Agency (ANEEL), which dictates the terms of concessions for energy distribution and transmission. This regulatory structure significantly shapes the competitive dynamics within the industry.

While energy distribution is largely characterized by regional monopolies, competition intensifies in the bidding process for new concession auctions. Furthermore, the unregulated energy commercialization market presents another arena for vigorous competition among energy suppliers.

- Regulatory Oversight: ANEEL, Brazil's energy regulator, grants and oversees concessions for electricity distribution and transmission.

- Distribution Monopolies: Distribution segments typically operate as regional monopolies, limiting direct competition within a specific geographic area.

- Concession Auctions: Competition is prevalent in the auction process for new distribution and transmission concessions, where companies bid for operating rights.

- Commercialization Market: The free market for energy commercialization fosters competition among suppliers vying for customers in the unregulated segment.

Competitive rivalry within Brazil's electricity sector is significant, with Equatorial Energia navigating a landscape populated by large utility groups. While distribution is often regional, competition heats up in concession auctions and the free energy commercialization market.

The expanding Brazilian energy market, driven by demand and renewables, offers growth avenues that can temper direct price wars. For instance, 2024 projections show substantial investment in new generation and transmission projects, including solar and wind, providing opportunities for companies like Equatorial Energia to expand without solely relying on price competition.

High fixed costs and substantial exit barriers, such as regulatory hurdles and specialized assets, compel companies to compete aggressively for market share and efficiency. This means Equatorial Energia must focus on operational excellence and service reliability to stand out.

Equatorial Energia differentiates itself through superior service, operational efficiency, and reliability, as evidenced by their 2023 improvements in SAIDI metrics. These efforts are crucial for customer retention in a market where consistent power delivery is highly valued.

| Metric | Equatorial Energia (2023) | Industry Average (Brazil) |

|---|---|---|

| SAIDI (Average System Interruption Duration) | Reduced significantly across concessions | Varies by region and concession |

| Investments in Grid Modernization | Ongoing, focused on smart technologies | Increasing, driven by efficiency goals |

| Market Share (Distribution) | Third largest group in Brazil | Concentrated among top players |

SSubstitutes Threaten

The most significant threat of substitutes for Equatorial Energia stems from the increasing adoption of distributed generation, particularly solar photovoltaic systems. This allows customers to produce their own electricity, lessening their dependence on traditional grid providers like Equatorial Energia.

In Brazil, distributed micro and mini-generation, predominantly solar, represented 5.6% of the country's total electricity generation in 2024. This figure highlights a clear and growing trend towards self-sufficiency in power generation, directly impacting the demand for services offered by established utilities.

The threat of substitutes for traditional grid-based electricity is growing significantly due to rapid advancements in energy storage solutions. Technological leaps in battery technology, for instance, are making off-grid and hybrid energy systems increasingly practical and affordable. For example, by the end of 2023, global installed battery storage capacity reached over 100 GW, a substantial increase from previous years, demonstrating the accelerating adoption of these alternatives.

These evolving storage technologies offer a compelling alternative to relying solely on continuous grid supply. This is particularly impactful for customers in remote locations or those prioritizing energy independence and system resilience against grid disruptions. The declining cost of lithium-ion batteries, which fell by roughly 89% between 2010 and 2023, further enhances the economic viability of these substitute solutions for a wider range of consumers.

The increasing emphasis on energy efficiency presents a significant threat of substitutes for traditional electricity consumption. Consumers and industries are adopting smart appliances, undertaking building retrofits, and optimizing industrial processes to reduce their reliance on purchased power. These efforts directly substitute for the energy Equatorial Energia provides.

Equatorial Energia's own programs promoting energy efficiency, such as those aimed at reducing consumption in residential and commercial sectors, inadvertently contribute to this substitute threat. For instance, if a company successfully reduces its electricity bill by 15% through efficiency measures, that 15% represents demand that is no longer being met by Equatorial Energia's services.

Development of Off-Grid and Micro-Grid Solutions

The rise of off-grid and micro-grid solutions presents a significant threat of substitution for traditional utility providers like Equatorial Energia, especially in regions with less robust grid infrastructure or for specialized industrial needs. These alternative energy systems can operate independently or in parallel with the main grid, effectively bypassing the need for extensive transmission and distribution networks.

For instance, in Brazil, where Equatorial Energia operates, the development of distributed generation, including solar photovoltaic systems for residential and commercial use, has been steadily increasing. By 2024, the installed capacity of distributed generation in Brazil is projected to surpass 30 GW, offering consumers a direct alternative to purchasing power from the traditional grid.

- Growing Adoption: Off-grid and micro-grid systems are becoming more accessible and cost-effective, appealing to customers seeking greater energy independence and resilience.

- Infrastructure Bypass: These solutions circumvent the need for reliance on Equatorial Energia's transmission and distribution infrastructure, reducing customer dependence.

- Market Penetration: In areas with unreliable grid supply or high energy costs, these alternatives can capture market share from traditional utility services.

- Technological Advancements: Innovations in battery storage and smart grid technology further enhance the viability and attractiveness of standalone and localized power solutions.

Regulatory Incentives for Alternative Energy

Government policies and incentives significantly bolster the appeal of alternative energy sources. For instance, tax breaks and favorable net metering policies for solar power make these substitutes more economically viable for consumers and businesses. This regulatory push directly addresses the threat of substitutes by lowering the cost and increasing the accessibility of non-traditional energy options.

Brazil's energy landscape, with its already high renewable energy share, further amplifies this threat. In 2024, Brazil's energy matrix was composed of approximately 88% renewable sources. This existing infrastructure and societal acceptance create a fertile ground for further penetration of alternative energy, making it easier for consumers to switch away from traditional energy providers like Equatorial Energia.

- Government Support: Policies like tax credits and net metering make renewable energy more competitive.

- Brazil's Renewable Dominance: An 88% renewable energy share in 2024 indicates a strong market for alternatives.

- Economic Viability: Incentives improve the cost-effectiveness of substitutes, increasing their attractiveness.

The threat of substitutes for Equatorial Energia is amplified by the increasing adoption of distributed generation, particularly solar PV, and advancements in energy storage. These alternatives allow consumers to generate their own power, reducing reliance on traditional utilities. For example, distributed generation in Brazil represented 5.6% of total electricity generation in 2024, a clear indicator of this trend.

| Substitute Type | Key Driver | Impact on Equatorial Energia | 2024 Brazilian Data Point |

| Distributed Generation (Solar PV) | Falling costs, government incentives | Reduced demand for grid power | 5.6% of total electricity generation |

| Energy Storage Solutions | Battery technology advancements | Increased energy independence, grid bypass | Global installed battery capacity over 100 GW (end of 2023) |

| Energy Efficiency Measures | Smart technology, consumer awareness | Lower overall electricity consumption | Companies reducing consumption by 15% |

Entrants Threaten

Entering Equatorial Energia's electricity distribution and transmission sectors requires immense upfront capital. Building and maintaining power lines, substations, and advanced smart grid technologies can easily run into billions of dollars, creating a formidable financial hurdle for any aspiring competitor.

For instance, in 2023, the Brazilian electricity sector alone saw significant investments in infrastructure upgrades, with companies like Eletrobras committing substantial funds to modernize its grid. This trend underscores the reality that new entrants face a massive capital barrier, making it extremely difficult to establish a competitive presence against established players like Equatorial Energia.

The Brazilian electricity sector, governed by the Agência Nacional de Energia Elétrica (ANEEL), presents a significant threat of new entrants due to its stringent regulatory framework. New companies must navigate complex licensing procedures and secure long-term concession agreements, a process that is both time-consuming and resource-intensive.

These considerable bureaucratic hurdles and the necessity for government approval act as a formidable barrier, deterring potential new players from entering the market. For instance, in 2024, the average time for obtaining new generation licenses remained substantial, reflecting the ongoing complexity of regulatory approvals.

Economies of scale present a substantial barrier for potential new entrants into the energy sector. Established companies like Equatorial Energia leverage their vast operational scale to achieve lower per-unit costs in areas such as energy generation, transmission, and distribution. For instance, in 2024, Equatorial Energia's extensive network across Brazil allowed for efficient management of energy flow and maintenance, a feat difficult for a newcomer to replicate without massive upfront investment.

Access to Distribution Channels and Customer Base

Equatorial Energia benefits from an extensive, pre-existing customer base, serving around 14 million consumers across multiple Brazilian states. This established network, coupled with a well-developed distribution infrastructure, creates a significant barrier for any new player attempting to enter the market.

New entrants face the daunting task of replicating Equatorial Energia's reach and customer loyalty. Building a comparable distribution network from the ground up would require immense capital investment and time, making it difficult to compete effectively.

The threat of new entrants is therefore considered moderate to low due to these established advantages.

- Established Customer Base: Approximately 14 million consumers served by Equatorial Energia.

- Comprehensive Distribution Network: Existing infrastructure across various states.

- High Entry Costs: Significant investment required for new entrants to build comparable networks.

- Customer Loyalty: Existing customer relationships are difficult to disrupt.

Government Policy and Auction Mechanisms

Government policy, particularly through periodic auctions for new concessions in transmission and distribution, significantly influences the threat of new entrants for Equatorial Energia. These auctions are often designed to favor established companies with proven track records and strong financial backing, effectively raising the entry barrier.

For instance, in 2024, Brazil's energy sector continued to see government-led auctions for new transmission lines, with specific requirements regarding financial capacity and technical expertise. Companies without substantial capital or prior experience in managing large-scale energy infrastructure projects find it challenging to participate and win these bids.

- Auction Design Favors Incumbents: Government auctions for energy concessions typically include stringent financial and technical pre-qualification criteria that new, unproven entrants struggle to meet.

- Capital Intensity: The significant capital required to bid in and execute energy infrastructure projects acts as a substantial deterrent for smaller or newer companies.

- Regulatory Hurdles: Navigating complex regulatory frameworks and obtaining necessary permits can be more challenging and time-consuming for new entities compared to established players.

The threat of new entrants for Equatorial Energia is significantly mitigated by the immense capital required to establish a presence in Brazil's electricity distribution and transmission sectors. Building out a comparable network to Equatorial Energia's, which serves approximately 14 million consumers, demands billions in investment for infrastructure like power lines and substations. This high capital barrier, coupled with stringent regulatory licensing and concession agreements overseen by ANEEL, makes it exceedingly difficult for newcomers to compete.

| Factor | Impact on New Entrants | Equatorial Energia's Advantage |

|---|---|---|

| Capital Requirements | Extremely High (Billions USD for infrastructure) | Established infrastructure and scale reduce per-unit costs. |

| Regulatory Hurdles | Complex licensing, long approval times, government permits | Experience navigating regulations, existing concession agreements. |

| Economies of Scale | Difficult to achieve without massive initial investment | Lower operational costs due to large-scale operations. |

| Customer Base | Challenging to acquire and retain | ~14 million existing consumers, established brand loyalty. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Equatorial Energia is built upon a foundation of publicly available financial reports, including annual and quarterly statements, alongside industry-specific research from reputable energy sector analysts and regulatory filings from relevant government bodies.