EQT Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT Bundle

Understanding EQT's competitive landscape is crucial for any stakeholder. This analysis delves into the five key forces that shape its industry, revealing the intensity of rivalry and the bargaining power of both buyers and suppliers.

Discover how the threat of new entrants and substitutes impacts EQT's market position and profitability. This brief overview only scratches the surface of these critical dynamics.

Unlock the full Porter's Five Forces Analysis to explore EQT’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the knowledge to navigate its complex market.

Suppliers Bargaining Power

Suppliers of highly specialized drilling equipment, advanced completion technologies, and unique midstream construction services wield considerable bargaining power. This is due to the niche markets they serve and the substantial investment required for their offerings, making them indispensable for EQT's efficient operations and production goals.

EQT's dependence on these cutting-edge techniques for shale development highlights the critical role these suppliers play. For instance, in 2024, the demand for specialized hydraulic fracturing equipment remained robust, with rental costs for high-spec units seeing an upward trend, reflecting the suppliers' leverage.

The limited availability of viable alternatives for certain advanced services further restricts EQT's ability to negotiate favorable pricing. This scarcity can directly impact EQT's cost structure and project timelines, underscoring the suppliers' strong position in the value chain.

The availability of skilled labor, such as engineers, geologists, and field technicians, significantly impacts supplier power for EQT. In areas with high drilling activity, like the Appalachian Basin, a scarcity of these specialized professionals can drive up wages and service costs.

A tight labor market for crucial roles within the natural gas sector means EQT faces higher operational expenses due to increased compensation demands. This is particularly true given the specialized expertise needed to navigate complex shale plays.

For instance, in 2024, reports indicated a persistent shortage of experienced petroleum engineers, with demand outstripping supply. This dynamic directly translates to greater bargaining power for recruitment agencies and individual contractors, allowing them to command premium rates from companies like EQT.

The bargaining power of suppliers for EQT, particularly concerning raw materials like steel for pipelines and proppants for hydraulic fracturing, is a significant factor. Prices for these essential inputs are subject to global supply and demand dynamics, directly influencing EQT's operational costs. For instance, fluctuations in steel prices can notably impact the expense of constructing new infrastructure.

While EQT's substantial size offers some leverage through bulk purchasing, considerable price swings in commodities like sand or steel can empower suppliers and negatively affect the profitability of EQT's projects. This volatility underscores the importance of strategic sourcing and risk management in the energy sector.

EQT's strategy to manage capital expenditures efficiently, by capitalizing on efficiency gains and potentially lower midstream spending, also plays a role in mitigating supplier power. By optimizing its own operations and capital deployment, EQT can better absorb or negotiate input costs, even amidst market volatility.

Midstream Infrastructure Providers

While EQT has been actively integrating its midstream operations, it still necessitates the use of third-party gathering, processing, and transmission services for certain regions or to access key demand centers. The substantial capital outlay and regulatory complexities associated with constructing new midstream infrastructure grant these third-party providers leverage, particularly for specialized takeaway capacity or processing needs.

EQT's strategic acquisition of Equitrans Midstream Corporation in 2023, a move valued at approximately $7.5 billion, has significantly bolstered its vertical integration. This integration is designed to diminish EQT's dependence on external midstream suppliers and expedite the realization of operational synergies.

- Reduced Reliance: EQT's enhanced vertical integration lessens its exposure to price fluctuations and capacity constraints imposed by independent midstream providers.

- Synergy Potential: The acquisition is projected to yield substantial cost savings and operational efficiencies, estimated at $50 million annually by EQT.

- Infrastructure Control: Greater control over midstream assets allows EQT to optimize its production flow and reduce transportation costs.

- Market Access: Integrated midstream capabilities improve EQT's ability to connect its production to premium markets, potentially increasing realized prices.

Technology and Software Vendors

Technology and software vendors hold significant bargaining power over EQT, especially those providing advanced solutions for reservoir modeling, data analytics, and operational automation. As EQT increasingly relies on technologies like AI, IoT, and machine learning to boost efficiency and improve decision-making, the leverage of these suppliers grows. The proprietary nature of specialized software and the substantial costs involved in switching integrated systems further solidify vendor influence.

EQT's commitment to technological innovation, including the adoption of AI-driven systems, underscores the critical importance of these supplier relationships. For instance, in 2023, EQT highlighted its continued investment in digital transformation initiatives aimed at optimizing well performance and reducing operational costs, directly increasing reliance on sophisticated software providers.

- Increasing reliance on specialized AI and data analytics platforms for operational efficiency.

- High switching costs associated with integrating and customizing advanced software solutions.

- Proprietary nature of some technology offerings limits alternative vendor options.

Suppliers of specialized drilling equipment and completion technologies hold significant power due to the niche nature of their offerings and the high investment required, making them essential for EQT's operations. In 2024, the demand for high-spec hydraulic fracturing equipment rental saw an upward trend, reflecting these suppliers' leverage.

The limited availability of alternatives for advanced services directly impacts EQT's cost structure and project timelines. Furthermore, a tight labor market for specialized roles, like petroleum engineers, in 2024, drove up wages and service costs, enhancing supplier bargaining power.

EQT's vertical integration, particularly the 2023 acquisition of Equitrans Midstream for approximately $7.5 billion, aims to reduce reliance on external midstream suppliers and capture an estimated $50 million in annual synergies. This move grants EQT greater control over its production flow and transportation costs.

Technology and software vendors also wield considerable power, especially those providing AI and data analytics solutions. EQT's increasing reliance on these platforms, coupled with high switching costs for integrated systems, strengthens vendor influence.

| Supplier Category | Key Factors Influencing Power | Impact on EQT | 2024 Data Point |

|---|---|---|---|

| Specialized Equipment & Technology | Niche markets, high investment, limited alternatives | Increased operational costs, potential project delays | Upward trend in high-spec hydraulic fracturing equipment rental costs |

| Skilled Labor | Scarcity of specialized professionals (e.g., petroleum engineers) | Higher wages, increased service costs | Persistent shortage of experienced petroleum engineers driving premium rates |

| Midstream Services (Pre-Integration) | Capital intensity, regulatory complexity, specialized capacity needs | Dependence on third parties, potential for price fluctuations | EQT's acquisition of Equitrans Midstream for $7.5 billion in 2023 |

| Technology & Software Vendors | Proprietary solutions, high switching costs, increasing reliance on AI/analytics | Elevated software licensing and implementation costs | Continued investment in digital transformation initiatives for optimized well performance |

What is included in the product

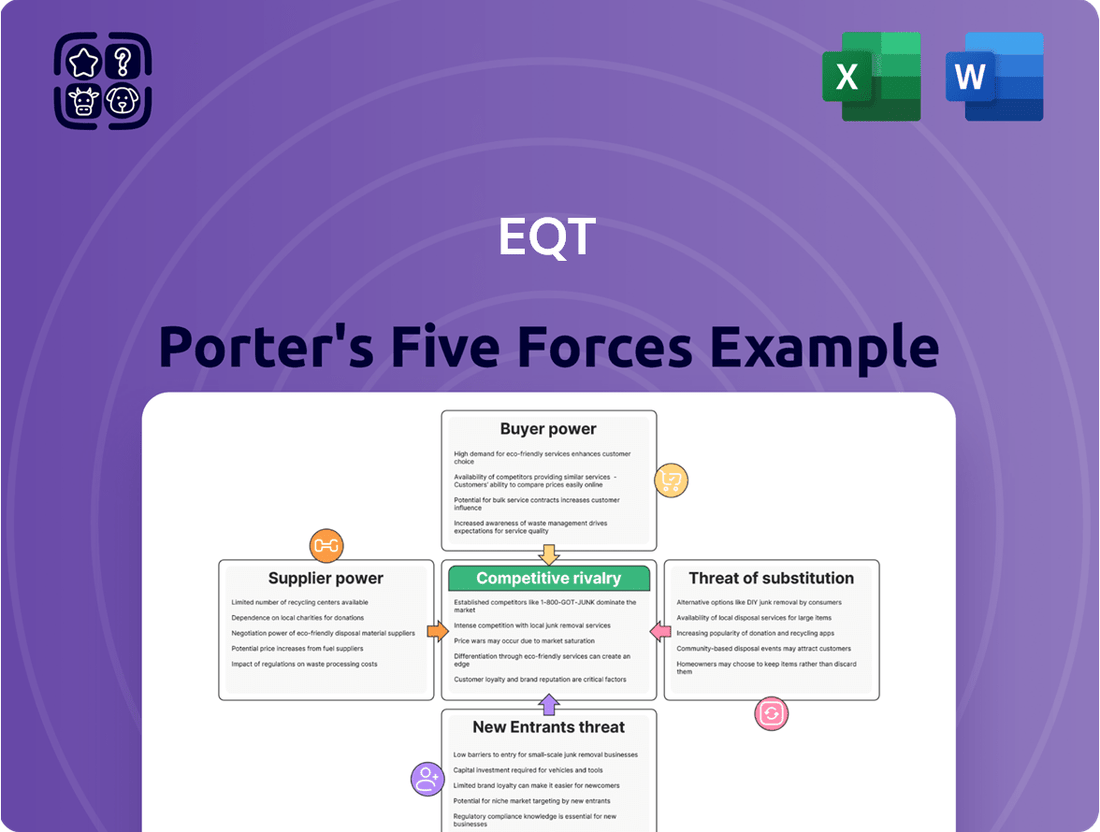

This analysis dissects the competitive forces impacting EQT, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the natural gas industry.

Instantly identify and prioritize competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

EQT's significant customer base comprises large utility companies and industrial users, many of whom are substantial purchasers of natural gas. These major clients typically employ advanced procurement strategies, enabling them to exert considerable purchasing power to secure advantageous pricing and contract conditions.

The inherent commodity status of natural gas, particularly when supply is plentiful, amplifies the leverage these large buyers possess in negotiations. For instance, in the first quarter of 2024, EQT reported that its average realized price for natural gas was $2.47 per thousand cubic feet (Mcf), a figure influenced by the pricing power of its industrial and utility customers.

Customers' bargaining power is heavily tied to natural gas price volatility. In 2024, periods of ample supply and lower prices allowed customers to push for reduced rates, a dynamic EQT navigated by strategically limiting output to preserve value.

However, extreme weather events in 2024, such as the unusually cold winter, drove prices up, temporarily strengthening the position of producers like EQT. This price sensitivity underscores the constant negotiation customers exert in the market.

The availability of substitutes for end-use significantly impacts EQT's bargaining power with its customers, primarily power generators. For electricity generation, EQT's natural gas faces competition from coal, renewable sources like solar and wind, and nuclear power.

In early 2025, the market observed a shift where elevated natural gas prices began to push some power generators back towards coal. This displacement highlights customer price sensitivity and their willingness to switch to alternatives when natural gas becomes less economical. For instance, reports indicated a notable increase in coal-fired power generation in certain regions during Q1 2025, directly linked to the higher cost of natural gas.

This competitive environment, where power generators have viable alternatives, grants them substantial bargaining power. They can credibly threaten to switch fuel sources if EQT's pricing or terms become unfavorable, forcing EQT to remain competitive to retain its customer base.

Geographic Concentration of Demand

EQT's geographic concentration of demand is centered on the Appalachian Basin, but its reach extends to the Gulf Coast's burgeoning LNG export market. This diversification of demand avenues, particularly with increased LNG export capacity, offers EQT new customers and potentially lessens the bargaining power of purely regional buyers.

The ability to tap into global markets via LNG exports means EQT isn't solely reliant on local industrial or utility customers. For instance, as of early 2024, U.S. LNG export capacity has been steadily growing, with new terminals coming online, creating a larger pool of potential buyers for natural gas produced in the Appalachian region.

- Diversified Demand: Access to LNG export markets provides EQT with alternative buyers beyond its traditional Appalachian customer base.

- Reduced Regional Reliance: Increased export capacity can dilute the concentration of demand within the Appalachian Basin, potentially weakening the bargaining power of large regional customers.

- Market Access: EQT's strategic location and infrastructure allow it to connect to these growing export markets, enhancing its market reach.

- 2024 Outlook: Projections for 2024 indicated continued strong demand for U.S. LNG exports, a trend that benefits producers like EQT by offering more competitive pricing opportunities.

Long-Term Contracts and Spot Market Dynamics

The balance between long-term contracts and spot market sales significantly shapes customer bargaining power. Long-term agreements offer price predictability for both EQT and its customers, mitigating volatility. Conversely, a greater reliance on the spot market allows customers more leverage during times of abundant supply, enabling them to negotiate favorable short-term rates.

EQT's integrated business model is designed to generate resilient free cash flow, even when commodity prices are subdued. This integration helps EQT manage its exposure to market fluctuations, potentially reducing its dependence on the spot market and thereby influencing customer negotiation power.

- Long-Term Contracts: Provide price stability and predictable revenue streams for EQT, reducing short-term customer leverage.

- Spot Market Dynamics: High supply periods on the spot market empower customers with greater short-term negotiation flexibility.

- Integrated Business Model: EQT's structure aims for durable free cash flow, potentially softening the impact of spot market volatility on customer power.

- 2024 Outlook: While specific contract mixes fluctuate, EQT's strategic focus on operational efficiency is intended to maintain financial strength irrespective of short-term market conditions.

Customers, particularly large utility and industrial buyers, wield significant bargaining power due to their substantial purchasing volumes and sophisticated procurement strategies. The commodity nature of natural gas, especially during periods of ample supply, further amplifies this leverage, allowing them to negotiate favorable pricing and contract terms. For instance, EQT's average realized price of $2.47 per Mcf in Q1 2024 reflected this customer influence.

The availability of substitutes, such as coal, renewables, and nuclear power for electricity generation, gives customers considerable leverage. When natural gas prices rise, as seen with increased coal usage in Q1 2025 due to higher gas costs, customers can credibly threaten to switch fuel sources, forcing EQT to remain competitive.

EQT's access to the growing LNG export market in 2024 provides alternative demand avenues, potentially diminishing the bargaining power of purely regional buyers. This broader market access, supported by increasing U.S. LNG export capacity, offers EQT more flexibility in its customer negotiations.

The mix of long-term contracts versus spot market sales also impacts customer power. While long-term contracts offer price stability, a greater reliance on the spot market empowers customers during times of high supply, enabling them to secure lower short-term rates.

| Factor | Impact on EQT's Customer Bargaining Power | 2024/2025 Context |

|---|---|---|

| Customer Concentration | High (Large utilities/industrials) | Major buyers use advanced procurement, influencing prices. |

| Commodity Nature | Amplifies buyer leverage | Plentiful supply in 2024 allowed customers to push for lower rates. |

| Availability of Substitutes | Significant | Power generators can switch to coal or renewables if gas prices rise. |

| Market Access (LNG Exports) | Reduces regional reliance | Growing LNG capacity in 2024 offered EQT alternative buyers. |

| Contract Structure | Influences negotiation flexibility | Spot market reliance empowers customers during high supply periods. |

Same Document Delivered

EQT Porter's Five Forces Analysis

This preview showcases the comprehensive EQT Porter's Five Forces Analysis you will receive. The document displayed here is the exact, professionally formatted report you’ll get, providing a detailed examination of competitive forces within the energy sector. You're looking at the actual analysis; once you complete your purchase, you’ll get instant access to this complete file, ready for your strategic planning.

Rivalry Among Competitors

The U.S. natural gas market, especially in the prolific Appalachian Basin, is highly fragmented with a substantial number of independent producers. This means EQT, while a major player, faces competition from many other companies, both large and small, all seeking to capture market share and resources.

This dense competitive landscape often translates into significant pricing pressure as producers compete to sell their output. For instance, in 2024, the Henry Hub spot price for natural gas has experienced considerable volatility, reflecting the supply and demand dynamics influenced by this numerous competitor base.

Despite a generally positive outlook for natural gas demand in 2024, the industry has seen pockets of oversupply. This overcapacity can dampen production growth in specific areas and intensify price wars. For instance, regions with significant new drilling activity might find their output exceeding immediate market needs, forcing producers to lower prices to move inventory.

When production capacity outstrips demand, companies often resort to aggressive pricing to maintain sales volume. This can significantly squeeze profit margins for all players in the sector. EQT's approach to this challenge is to strategically reduce its output during periods of oversupply. This curtailment aims to support higher natural gas prices and, consequently, maximize the value of its production.

Natural gas, fundamentally a commodity, offers limited avenues for product differentiation. EQT distinguishes itself primarily through its cost leadership and commitment to environmental stewardship. In 2023, EQT reported a realized price of $2.58 per Mcf, underscoring its focus on efficient production.

The company's strategic aim to achieve net-zero Scope 1 and 2 greenhouse gas emissions by 2030 serves as a significant differentiator, appealing to a growing segment of buyers prioritizing sustainability. This focus on environmental performance, coupled with operational reliability, strengthens EQT's competitive standing in a market where such factors are increasingly valued.

High Fixed Costs and Exit Barriers

The natural gas exploration and production (E&P) sector is inherently capital-intensive. Companies must make substantial upfront investments in drilling operations, constructing essential infrastructure like pipelines, and securing land leases. For instance, in 2024, the average cost to drill a horizontal well in the Permian Basin, a major US shale play, can range from $7 million to $10 million, reflecting these significant capital outlays.

These substantial fixed costs compel companies to maintain high production levels, even when natural gas prices are depressed. The goal is to spread these costs over a larger volume of output to cover expenses and avoid significant losses, thereby intensifying competition among existing players. This dynamic means that even during periods of low profitability, companies are incentivized to keep producing, adding to the competitive pressure.

Furthermore, the industry faces considerable exit barriers. Specialized assets, such as drilling rigs and processing facilities, have limited alternative uses, making them difficult to repurpose or sell. Coupled with long-term lease agreements and contractual obligations, these factors make it challenging and costly for less successful or financially strained companies to leave the market. This inability to easily exit sustains competitive pressure and ensures a crowded field of participants.

Key factors contributing to high fixed costs and exit barriers in the natural gas E&P industry include:

- Capital-intensive nature: Significant investments are required for exploration, drilling, and infrastructure development.

- Operational scale: Achieving economies of scale necessitates large-scale operations, increasing fixed cost burdens.

- Specialized assets: Equipment and infrastructure are often highly specialized, with limited resale value or alternative uses.

- Long-term commitments: Lease agreements and supply contracts create long-term financial obligations, hindering quick exits.

Acquisition and Consolidation Activity

The natural gas industry, particularly in the Appalachian Basin where EQT operates, has experienced significant consolidation. EQT's acquisition of Equitrans Midstream in late 2023, a deal valued at approximately $7.4 billion, and its earlier purchase of Olympus Energy for $700 million in 2023, are prime examples. These moves reduce the number of independent players, but the resulting EQT is a larger, more efficient entity, intensifying rivalry with other scaled operators.

This consolidation reshapes the competitive landscape by creating fewer, but more powerful, competitors. The integration of acquired assets allows for greater operational efficiencies and cost synergies, which can be leveraged to gain a competitive edge. For instance, EQT anticipates achieving over $250 million in annual run-rate synergies from the Equitrans acquisition.

- EQT's 2023 acquisitions of Equitrans Midstream and Olympus Energy significantly altered the competitive structure.

- These deals reduced the number of independent operators in the Appalachian Basin.

- The consolidation creates larger, more efficient competitors with enhanced scale.

- EQT aims to realize substantial synergies, estimated at over $250 million annually, from these integrations.

The U.S. natural gas market is intensely competitive, characterized by numerous producers vying for market share, which often leads to price pressures. EQT, despite its size, faces this dynamic daily. In 2024, the Henry Hub spot price for natural gas has shown significant fluctuations, a direct result of the abundant competition influencing supply and demand.

The industry's commodity nature limits differentiation, pushing companies like EQT to focus on cost leadership and sustainability. EQT's 2023 realized price of $2.58 per Mcf highlights its efficiency drive. Furthermore, its commitment to net-zero emissions by 2030 offers a distinct advantage in attracting environmentally conscious partners and customers.

The capital-intensive nature of natural gas extraction, with average well drilling costs around $7-10 million in 2024, forces companies to maintain high production. This, combined with high exit barriers due to specialized assets and long-term contracts, ensures a persistently competitive environment. EQT's strategic output curtailments during oversupply periods aim to mitigate these pressures and support price stability.

Recent consolidation, including EQT's substantial 2023 acquisitions of Equitrans Midstream ($7.4 billion) and Olympus Energy ($700 million), has reshaped the competitive landscape. While reducing the number of independent players, these mergers create larger, more efficient entities like EQT, enhancing rivalry with other scaled operators and targeting over $250 million in annual synergies.

| Acquisition | Year | Value | Synergy Target (Annual) |

|---|---|---|---|

| Equitrans Midstream | 2023 | $7.4 billion | > $250 million |

| Olympus Energy | 2023 | $700 million | N/A |

SSubstitutes Threaten

The growing prevalence of renewable energy, particularly solar and wind power, presents a substantial threat to natural gas demand in electricity generation. As renewables become more affordable and efficient, they directly compete with natural gas as a power source.

In 2024, corporate power purchase agreements for renewable energy hit record levels, fueled by significant demand from technology firms and data centers. This surge reflects a tangible shift in how major energy consumers are sourcing their power, potentially diverting demand away from traditional fossil fuels like natural gas in the long run.

The threat of substitutes for natural gas is significantly influenced by the price-performance ratio of alternative energy sources. When natural gas prices surge, options like coal become more appealing. For instance, in early 2025, elevated natural gas costs led to a notable shift, with coal displacing gas in power generation, highlighting this sensitivity.

Conversely, periods of lower natural gas prices enhance its competitiveness. This makes natural gas a more viable option against certain renewable energy sources, particularly for providing consistent, baseload power. The fluctuating cost of natural gas directly impacts its ability to compete with other energy providers.

Government incentives, subsidies, and regulations favoring cleaner energy sources are significantly accelerating the adoption of substitutes for natural gas. For instance, the Inflation Reduction Act of 2022 in the United States provides substantial tax credits for renewable energy projects, driving down the cost of solar and wind power. These policies directly increase the competitive pressure on natural gas by making alternatives more economically viable.

Decarbonization mandates and greenhouse gas emission reduction targets are increasingly influencing investment decisions. Many nations have committed to net-zero emissions by mid-century, prompting a redirection of capital away from fossil fuels. While natural gas is often viewed as a transitional fuel, these overarching climate goals still encourage a faster shift towards truly sustainable technologies, thereby strengthening the threat of substitutes.

Energy Efficiency and Conservation

Improvements in energy efficiency across industrial, commercial, and residential sectors can significantly reduce overall energy demand. This reduction in demand directly lessens the need for natural gas as a primary energy source.

Continuous advancements in areas like building insulation, more efficient appliances, and optimized industrial processes mean that less energy is required to achieve the same output. This implicitly substitutes away from all energy sources, including natural gas, by increasing the efficiency of its use or by enabling the same tasks with less energy input.

- Reduced Demand: Global energy efficiency improvements could cut energy demand by up to 30% by 2050, according to the International Energy Agency (IEA).

- Appliance Efficiency: In 2024, new standards for appliances like refrigerators and HVAC systems are expected to save consumers billions in energy costs, reducing reliance on natural gas for heating and cooling.

- Industrial Processes: Investments in modernizing industrial equipment can lead to energy savings of 10-20% in manufacturing, impacting the demand for industrial natural gas consumption.

Emergence of Renewable Natural Gas (RNG)

The increasing availability of Renewable Natural Gas (RNG), derived from sources like landfill waste and agricultural byproducts, poses a growing threat of substitution for traditional natural gas. This 'green' alternative appeals to industries and consumers prioritizing environmental sustainability and reduced greenhouse gas emissions.

The global RNG market is experiencing robust growth, with projections indicating continued expansion into 2025. For instance, the U.S. Environmental Protection Agency's Renewable Fuel Standard program has spurred significant investment and production increases. This expanding capacity means RNG is becoming a more viable and accessible substitute, capable of leveraging existing natural gas pipelines and infrastructure.

- RNG Market Growth: The global RNG market was valued at approximately $4.9 billion in 2023 and is forecast to reach over $15 billion by 2030, demonstrating substantial growth potential.

- Infrastructure Compatibility: RNG can be injected into existing natural gas grids, requiring minimal modifications and making it a practical substitute for conventional gas.

- Carbon Reduction Goals: Many businesses are actively seeking lower-carbon energy solutions to meet their environmental, social, and governance (ESG) targets, driving demand for RNG.

- Production Expansion: New RNG production facilities are coming online, increasing supply and potentially lowering costs, thereby enhancing its competitive position against conventional natural gas.

The threat of substitutes for natural gas is amplified by the increasing affordability and efficiency of renewable energy sources, especially solar and wind power, directly impacting demand in electricity generation. Record corporate power purchase agreements for renewables in 2024 highlight a tangible shift by major energy consumers, potentially diverting demand from natural gas.

The price sensitivity of natural gas to substitutes is evident; higher natural gas costs in early 2025 led coal to displace gas in power generation, underscoring this vulnerability. Conversely, lower natural gas prices bolster its competitiveness, particularly for providing reliable baseload power against certain renewables.

Government incentives, such as the US Inflation Reduction Act of 2022, and global decarbonization mandates are accelerating the adoption of alternatives like solar and wind, making them more economically viable and increasing competitive pressure on natural gas.

Advancements in energy efficiency across sectors reduce overall energy demand, implicitly substituting away from all energy sources, including natural gas, by enabling tasks with less energy input.

Renewable Natural Gas (RNG), derived from waste, is a growing substitute, appealing to environmentally conscious industries and benefiting from programs like the US EPA's Renewable Fuel Standard, which drives investment and production.

| Substitute | Key Driver | 2024/2025 Impact |

|---|---|---|

| Renewable Energy (Solar/Wind) | Falling costs, corporate demand | Record PPA agreements, increased grid penetration |

| Coal | Natural gas price volatility | Displacement of gas in power generation during high gas price periods (e.g., early 2025) |

| Energy Efficiency | Technological advancements, cost savings | Reduced overall energy demand, less reliance on natural gas |

| Renewable Natural Gas (RNG) | ESG initiatives, policy support | Market growth, infrastructure compatibility, increased supply |

Entrants Threaten

The natural gas exploration and production sector, especially in prolific shale regions such as the Appalachian Basin, demands substantial upfront capital. This includes significant outlays for securing land rights, the complex processes of drilling and completing wells, and building essential infrastructure like pipelines and processing facilities. For instance, EQT's reported capital expenditures for 2024 are projected to be between $2.2 billion and $2.4 billion, illustrating the scale of investment required.

This immense capital requirement acts as a formidable barrier, effectively discouraging many potential new entrants who simply do not possess the financial muscle to enter the market. Established players like EQT, with their deep financial reserves and existing infrastructure, are better positioned to absorb these costs and operate efficiently, making it difficult for newcomers to gain a foothold.

New companies entering the natural gas market grapple with securing essential midstream infrastructure for moving their product. This includes pipelines for gathering, processing plants, and transportation networks to reach consumers.

EQT's integrated approach, encompassing its own midstream assets, creates a formidable barrier. Newcomers must either invest heavily in duplicating this infrastructure or negotiate access, which can be difficult and expensive. For instance, the lack of sufficient pipeline capacity has previously hampered the expansion of other producers in the Appalachian Basin.

The natural gas sector faces substantial threats from new entrants due to stringent regulatory and environmental requirements. Companies must secure numerous permits and conduct thorough environmental impact assessments, a process that is both time-consuming and expensive. For instance, EQT's commitment to net-zero Scope 1 and 2 greenhouse gas emissions by 2030 highlights the elevated environmental performance standards new players must meet.

Established Player Dominance and Economies of Scale

Established players like EQT benefit significantly from economies of scale. This means they can produce natural gas more cheaply because they operate on a larger scale in drilling, operations, and purchasing supplies. For instance, EQT's focus on being the lowest-cost producer is directly tied to its substantial asset base and operational efficiency, allowing it to absorb costs more effectively than smaller competitors.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the same scale and years of operational experience, they would find it difficult to compete on price against a company like EQT. This cost advantage acts as a strong deterrent, making it challenging for newcomers to gain a foothold in the market.

- Economies of Scale: EQT leverages its large operational footprint to reduce per-unit production costs.

- Cost Leadership: EQT's strategic objective is to be the lowest-cost producer in the industry.

- Barriers to Entry: New entrants struggle to replicate EQT's cost structure due to a lack of scale and experience.

- Competitive Pricing: EQT's cost advantages enable it to offer competitive pricing, further pressuring potential new market participants.

Proprietary Technology and Geological Knowledge

Success in the shale gas sector is intrinsically tied to sophisticated drilling and completion methodologies, alongside a profound grasp of specific geological formations. Companies that have been in the game longer have developed proprietary technologies and amassed extensive data, alongside seasoned teams. This accumulation of knowledge and expertise acts as a significant hurdle for newcomers.

EQT, for instance, leverages cutting-edge drilling and completion techniques across its substantial Marcellus and Utica Shale holdings. This technological edge, honed over years of operation and significant investment, creates a formidable barrier. For example, in 2024, EQT reported an average lateral length of over 15,000 feet for its wells, a testament to its advanced operational capabilities.

- Proprietary Technology: EQT's investment in advanced drilling and completion technologies reduces operational costs and increases extraction efficiency, creating a competitive advantage.

- Geological Expertise: Deep understanding of basin geology allows for optimized well placement and production, a knowledge base that is difficult and time-consuming for new entrants to replicate.

- Data Accumulation: Years of operational data provide EQT with insights into reservoir performance, informing future drilling decisions and de-risking new ventures.

- Intellectual Property: Patents and trade secrets related to drilling and completion processes further solidify EQT's market position, making it challenging for new players to match its technical proficiency.

The threat of new entrants into the natural gas sector, particularly for companies like EQT, is generally low due to significant barriers. These include the immense capital required for exploration, drilling, and infrastructure, as well as the need for specialized technological expertise and established midstream access. Regulatory hurdles and the economies of scale enjoyed by incumbents further deter newcomers.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EQT is built upon a foundation of robust data, including EQT's own investor relations materials, industry-specific trade publications focusing on the energy sector, and government regulatory filings related to natural gas production and distribution.