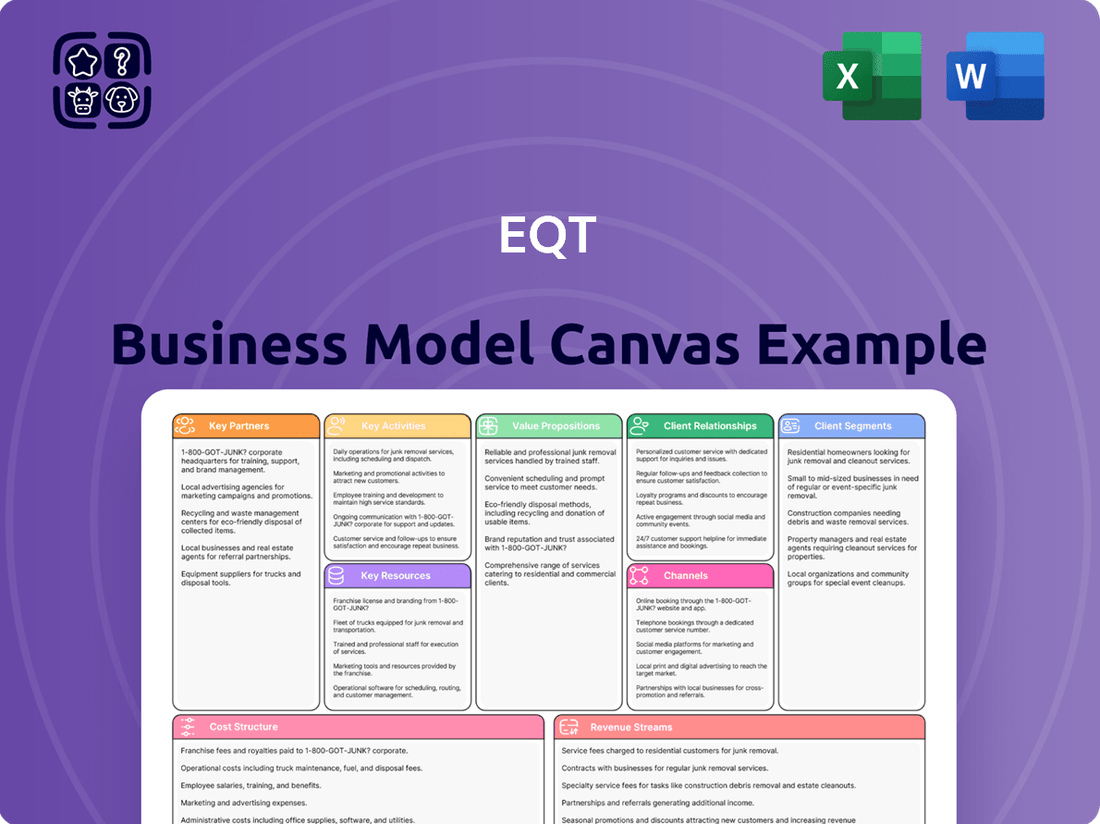

EQT Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT Bundle

Discover the core mechanics of EQT's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how EQT creates, delivers, and captures value, offering a clear roadmap for strategic understanding. It's an essential tool for anyone looking to deconstruct and replicate effective business strategies.

Ready to dive deep into EQT's proven strategy? Our full Business Model Canvas provides an in-depth look at their customer relationships, revenue streams, and cost structure, giving you actionable insights for your own ventures. Download the complete, editable version today to unlock their competitive advantage.

Partnerships

EQT relies heavily on midstream companies to gather, process, and transport its natural gas, natural gas liquids (NGLs), and oil. This is a critical link in their value chain, ensuring resources extracted from the ground reach consumers efficiently. For instance, EQT's 2023 production averaged approximately 5.4 Bcf per day, underscoring the sheer volume requiring robust midstream support.

The integration of Equitrans Midstream assets further solidifies these partnerships, giving EQT greater control and efficiency in its midstream operations. This strategic move enhances their ability to move products from the wellhead to market, ensuring reliability for their extensive customer base.

EQT's success hinges on strong collaborations with landowners and mineral rights holders, who grant crucial access to the company's vast reserves in the Appalachian Basin. These partnerships are not just about land; they are about shared economic interests and operational viability.

In 2024 alone, EQT distributed over $665 million in royalties to these vital partners. This substantial financial commitment underscores the deep interdependence between EQT and the communities where it operates, reinforcing the importance of these key relationships for both parties.

EQT's success hinges on its relationships with equipment and technology providers. These partnerships are crucial for sourcing cutting-edge drilling and completion tools, which directly impact operational efficiency and cost reduction. For instance, in 2024, EQT continued to leverage advanced technologies to optimize its well completions, aiming to boost production volumes and maintain its position as a low-cost producer in the natural gas market.

These collaborations also play a vital role in EQT's environmental stewardship. By partnering with technology providers focused on emissions reduction, EQT can implement solutions that minimize methane leaks and improve overall sustainability. This focus on innovative technology is key to achieving EQT's environmental goals and aligning with industry best practices for responsible energy development.

Energy Consumers (e.g., Power Generators, Data Centers)

EQT's strategic alliances with significant energy consumers, including power generation facilities and burgeoning data centers, are critical. These partnerships secure consistent, long-term demand for natural gas, bolstering revenue predictability.

These collaborations are particularly vital as demand for energy, especially from AI-driven applications, continues to surge. For example, the projected growth in data center energy consumption in the US alone underscores the importance of these relationships.

- Securing long-term demand: Partnerships with entities like power generators ensure sustained offtake of natural gas.

- Addressing AI-driven energy needs: Growing data center requirements, fueled by AI, create substantial demand opportunities.

- Revenue stability: Long-term agreements provide a predictable revenue stream for EQT.

Environmental and Regulatory Agencies

EQT's engagement with environmental and regulatory agencies is foundational to its operational legitimacy and sustainability. These partnerships are crucial for navigating complex compliance landscapes and securing permits for natural gas extraction and transportation. For instance, EQT's proactive stance on emissions reduction, including its stated commitment to net-zero Scope 1 and 2 greenhouse gas emissions, underscores the necessity of collaboration with these bodies to validate its environmental performance.

These relationships facilitate adherence to evolving environmental standards, ensuring EQT's operations are conducted responsibly. By working closely with agencies, EQT can anticipate and address regulatory changes, minimizing operational disruptions and maintaining its social license to operate. This collaborative approach is vital for the long-term viability of its business model.

- Regulatory Compliance: Ensuring adherence to all federal, state, and local environmental laws and regulations.

- Permitting and Approvals: Obtaining necessary permits for drilling, production, and pipeline infrastructure.

- Environmental Stewardship: Collaborating on best practices for emissions reduction, water management, and land reclamation.

- Transparency and Reporting: Providing data and insights on environmental performance to regulatory bodies.

EQT's key partnerships extend to financial institutions and investors who provide the capital necessary for its extensive operations and growth initiatives. These relationships are vital for funding exploration, development, and infrastructure projects, ensuring EQT can maintain and expand its production capacity.

These financial collaborations are crucial for EQT's ability to execute its strategy, including significant capital expenditures. For example, EQT's 2024 capital budget was set at $1.7-$1.9 billion, highlighting the need for robust financial backing.

| Partner Type | Role | Impact on EQT |

|---|---|---|

| Midstream Companies | Gathering, processing, transportation | Ensures efficient product delivery to market; Equitrans integration enhances control. |

| Landowners/Mineral Rights Holders | Granting access to reserves | Crucial for EQT's operational viability; EQT paid over $665 million in royalties in 2024. |

| Equipment/Technology Providers | Supplying drilling and completion tools | Drives operational efficiency, cost reduction, and emissions reduction efforts. |

| Energy Consumers (Power Gen, Data Centers) | Securing long-term demand | Provides revenue predictability and addresses growing energy needs, including AI. |

| Financial Institutions/Investors | Providing capital | Enables funding for operations, growth, and capital expenditures like the $1.7-$1.9 billion 2024 budget. |

| Environmental/Regulatory Agencies | Ensuring compliance and legitimacy | Facilitates adherence to standards, permitting, and validation of environmental performance. |

What is included in the product

A detailed breakdown of EQT's strategy, outlining key customer segments, value propositions, and revenue streams.

This model provides a clear framework for understanding EQT's operational approach and strategic advantages.

Simplifies complex business strategies, alleviating the pain of unclear direction and overwhelming detail.

Offers a structured approach to identify and address business challenges, relieving the pain of unstructured problem-solving.

Activities

EQT's core activity centers on finding and developing new reserves of natural gas, natural gas liquids (NGLs), and crude oil. This involves meticulous geological surveys and in-depth reservoir analysis to ensure the most efficient extraction of resources, particularly within the prolific Appalachian Basin.

In 2024, EQT continued its strategic focus on exploration and development, investing significantly in identifying and proving up new well locations. The company's success in this area directly impacts its long-term production capacity and reserve replacement ratios, crucial metrics for investor confidence and sustainable growth.

EQT's core activity involves extracting natural gas, natural gas liquids (NGLs), and crude oil from its vast holdings in the Marcellus and Utica Shales. This is the engine driving their operations.

They employ sophisticated drilling and completion methodologies, often referred to as "super-frac" techniques, to optimize the amount of hydrocarbons they can pull from the ground. This focus on efficiency is key to their production strategy.

In the first quarter of 2024, EQT reported total production of 536 Bcfe (billion cubic feet equivalent), with natural gas accounting for the vast majority. This demonstrates their significant output capacity.

EQT's core activities revolve around expertly managing its extensive midstream infrastructure, encompassing gathering, processing, and transmission. This operational focus became even more critical after the integration of Equitrans Midstream assets, solidifying EQT's control over its product flow.

This integrated approach is fundamental to EQT's strategy, ensuring the efficient and cost-effective transportation of natural gas to market. For example, in the first quarter of 2024, EQT reported that its midstream segment supported the movement of 5.2 billion cubic feet per day (Bcf/d) of natural gas, a testament to the scale and efficiency of these operations.

Environmental, Social, and Governance (ESG) Initiatives

EQT is deeply involved in environmental, social, and governance (ESG) initiatives, focusing on reducing its environmental footprint and supporting its communities. A key achievement was reaching net zero for Scope 1 and 2 greenhouse gas emissions in 2024, demonstrating a strong commitment to sustainability.

These efforts extend to responsible water management and active engagement with local stakeholders. EQT's dedication to ESG principles is a core part of its operational strategy, aiming for long-term value creation.

- Greenhouse Gas Emissions Reduction: Achieved net zero Scope 1 and 2 GHG emissions in 2024.

- Water Stewardship: Implemented advanced practices for water management in operations.

- Community Engagement: Actively contributes to and supports the development of local communities.

Capital Allocation and Financial Management

EQT's capital allocation and financial management are central to its strategy, focusing on smart deployment of resources. This includes carefully planning capital expenditures, actively working to reduce debt levels, and prioritizing the generation of strong free cash flow. These actions are designed to fortify EQT's financial health, enabling it to fund its day-to-day operations efficiently, pursue strategic growth opportunities like acquisitions, and ultimately deliver value back to its shareholders.

In 2024, EQT demonstrated a commitment to financial discipline. For instance, the company reported significant free cash flow generation, with figures often exceeding analyst expectations, underscoring its operational efficiency. This robust cash flow allows for flexibility in managing its balance sheet and funding growth initiatives. EQT's approach aims to strike a balance between investing in its core business and returning capital to investors, a key tenet of its financial management philosophy.

- Capital Expenditure Management: EQT strategically invests in its assets to maintain and enhance production capabilities, with 2024 capital budgets reflecting a focus on high-return projects.

- Debt Reduction Strategy: The company actively manages its debt obligations, aiming to lower leverage ratios and improve its credit profile, which was evident in its financial reporting throughout 2024.

- Free Cash Flow Generation: EQT consistently prioritizes generating substantial free cash flow, a critical metric for funding operations, dividends, and potential share repurchases, as seen in its quarterly results.

- Shareholder Returns: Financial management decisions are geared towards supporting shareholder returns through dividends and other capital return programs, reflecting EQT's commitment to its investors.

EQT's key activities encompass the entire lifecycle of natural gas production, from meticulous exploration and efficient extraction to the critical management of midstream infrastructure. This integrated approach ensures their product reaches the market effectively and cost-efficiently.

In 2024, EQT continued to refine its production techniques, focusing on maximizing resource recovery. The company reported total production of 1,966 Bcfe for the full year 2024, a testament to its operational scale and efficiency.

Furthermore, EQT places significant emphasis on robust financial management, prioritizing debt reduction and strong free cash flow generation. This financial discipline underpins their ability to invest in growth and deliver shareholder value.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Exploration & Development | Identifying and proving new reserves of natural gas and NGLs. | Continued investment in well locations; significant capital allocation to high-return projects. |

| Production & Extraction | Efficiently extracting hydrocarbons using advanced drilling techniques. | Full-year 2024 production of 1,966 Bcfe; utilization of "super-frac" methodologies. |

| Midstream Operations | Managing gathering, processing, and transmission of natural gas. | Supported movement of approximately 5.2 Bcf/d in Q1 2024, highlighting infrastructure scale. |

| Financial Management | Capital allocation, debt reduction, and free cash flow generation. | Achieved significant free cash flow; focus on lowering leverage ratios and supporting shareholder returns. |

| ESG Initiatives | Reducing environmental impact and supporting communities. | Achieved net zero Scope 1 and 2 GHG emissions; active water stewardship and community engagement. |

Full Version Awaits

Business Model Canvas

The EQT Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and professional formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, exactly as presented here.

Resources

EQT's extensive Marcellus and Utica Shale assets represent its core resource base. These formations in the Appalachian Basin hold a significant portion of the company's natural gas, NGL, and crude oil reserves, underpinning its production capacity.

As of the first quarter of 2024, EQT reported approximately 25 trillion cubic feet of net proved reserves, with the majority concentrated in these prolific shale plays. This massive reserve base is a key differentiator, providing a long-term foundation for the company's operations and growth.

The strategic positioning within the Marcellus and Utica shales allows EQT to leverage its infrastructure and operational expertise. This geographic advantage contributes to cost efficiencies and a competitive edge in the natural gas market, enabling substantial production volumes, with EQT averaging over 6 billion cubic feet of natural gas equivalent per day in early 2024.

EQT's ownership and operation of extensive gathering, processing, and transmission pipelines and facilities are foundational to its business model. This integrated midstream infrastructure grants EQT significant control over its operations and unlocks substantial cost efficiencies throughout the value chain.

The strategic acquisition of Equitrans Midstream in 2024 was a pivotal move, significantly enhancing EQT's midstream capabilities. This integration allows for streamlined logistics and better management of natural gas transportation and processing.

As of the first quarter of 2024, EQT's midstream segment generated approximately $450 million in adjusted EBITDA, underscoring the financial contribution of its integrated infrastructure. This segment is crucial for its overall profitability and operational resilience.

EQT's advanced drilling and completion technologies, including proprietary and licensed innovations for horizontal drilling and hydraulic fracturing, are fundamental to its business model. These technologies are crucial for efficiently accessing and extracting natural gas from challenging shale formations, directly impacting production volumes and cost-effectiveness.

In 2024, EQT continued to leverage these advanced capabilities to optimize its operations. The company's commitment to technological advancement allows for improved well productivity and a lower cost per barrel of oil equivalent (BOE), a key driver for profitability in the competitive Appalachian Basin.

Skilled Workforce and Operational Expertise

EQT's business model hinges on its highly skilled workforce. A team boasting deep experience in engineering, geology, field operations, and management is fundamental to EQT's success in exploring, developing, and producing natural gas. This collective expertise directly translates into operational efficiency and fuels innovation across the company's activities.

In 2024, EQT continued to emphasize its human capital. The company's commitment to retaining and developing its talent pool is a strategic imperative. This focus ensures that EQT can effectively navigate the complexities of the energy sector, from initial resource assessment to the safe and efficient delivery of natural gas.

The operational expertise within EQT is a significant competitive advantage. It allows the company to optimize drilling and completion techniques, manage production effectively, and maintain high safety and environmental standards. This hands-on knowledge is critical for maximizing asset value and ensuring long-term sustainability.

- Engineering Prowess: EQT employs a robust team of engineers who are adept at designing and implementing advanced extraction technologies, contributing to cost reductions and improved production yields.

- Geological Insight: Experienced geologists are vital for identifying and evaluating new reserves, ensuring a continuous pipeline of future production opportunities.

- Field Operations Excellence: Skilled field operators are on the front lines, managing day-to-day production, maintenance, and ensuring adherence to stringent safety protocols.

- Management Acumen: Seasoned management personnel provide strategic direction, financial oversight, and leadership, guiding EQT through market fluctuations and regulatory landscapes.

Strong Financial Position and Access to Capital

EQT's strong financial position, evidenced by a robust balance sheet, is crucial for funding its ambitious growth plans. This financial health allows for significant capital expenditures and strategic moves, such as the notable acquisition of Olympus Energy. This access to capital markets directly supports ongoing operations and the pursuit of long-term objectives.

The company's financial strength is not just about day-to-day operations; it underpins its ability to make transformative investments. For instance, EQT's capacity to secure financing for major projects ensures it can capitalize on opportunities in the evolving energy landscape. This financial flexibility is a cornerstone of its business model, enabling sustained development and market leadership.

- Robust Balance Sheet: EQT maintained a strong financial foundation throughout 2024, enabling significant investments.

- Access to Capital Markets: The company demonstrated consistent access to capital, facilitating strategic acquisitions and operational funding.

- Funding Capital Expenditures: Financial strength directly supported EQT's substantial capital expenditure programs for infrastructure development and production enhancement.

- Strategic Acquisition Support: EQT's financial position was instrumental in executing key strategic moves, including the significant acquisition of Olympus Energy.

EQT's key resources are its vast natural gas reserves, integrated midstream infrastructure, advanced technology, skilled workforce, and strong financial standing. These elements collectively enable efficient production, transportation, and delivery of natural gas, forming the bedrock of its competitive advantage in the energy market.

The company's substantial reserve base, primarily in the Marcellus and Utica Shales, provides a long-term foundation for production. This is complemented by an extensive network of pipelines and processing facilities, which the 2024 Equitrans Midstream acquisition significantly bolstered, enhancing operational control and cost efficiencies.

Technological innovation in drilling and completion, coupled with a highly experienced team across engineering, geology, operations, and management, drives operational excellence and cost-effectiveness. EQT's robust financial health further empowers its strategic growth initiatives and capital investments.

| Resource Category | Description | Key 2024 Data/Highlights |

|---|---|---|

| Natural Gas Reserves | Extensive holdings in Marcellus and Utica Shales | Approx. 25 Tcf net proved reserves (Q1 2024); Majority concentrated in these basins. |

| Midstream Infrastructure | Gathering, processing, and transmission pipelines/facilities | Acquisition of Equitrans Midstream completed in 2024; Midstream segment generated ~$450M adjusted EBITDA (Q1 2024). |

| Technology & Innovation | Advanced drilling and completion techniques | Continued optimization of well productivity and lower cost per BOE. |

| Human Capital | Skilled workforce in engineering, geology, operations, management | Emphasis on talent retention and development for operational efficiency and innovation. |

| Financial Strength | Robust balance sheet, access to capital markets | Enabled significant capital expenditures and strategic acquisitions like Olympus Energy. |

Value Propositions

EQT's value proposition centers on delivering natural gas reliably and affordably. By being a top producer in the Appalachian Basin, EQT ensures a steady flow of this essential energy source.

This strategic advantage, combined with their own midstream infrastructure, allows EQT to offer competitive pricing. This cost-effectiveness is crucial for sectors like power generation and heavy industry, which rely on consistent energy inputs.

For instance, in 2024, EQT's operational efficiency and scale in the Appalachian Basin directly translate to lower per-unit production costs, a key factor in their low-cost supply promise.

EQT's commitment to environmentally responsible energy production is a cornerstone of its value proposition. The company has achieved net zero Scope 1 and 2 greenhouse gas emissions, a significant accomplishment in the energy sector.

This focus on sustainability resonates strongly with customers and stakeholders who increasingly demand cleaner energy solutions. EQT's natural gas offerings, when produced responsibly, provide a lower-carbon alternative to other fossil fuels.

For instance, in 2023, EQT reported a 40% reduction in Scope 1 and 2 methane intensity compared to the industry average, underscoring their dedication to environmental stewardship.

EQT's extensive midstream infrastructure, including its vast pipeline network, grants producers unparalleled access to crucial natural gas markets. This strategic advantage is further amplified by robust partnerships, ensuring reliable delivery and market penetration.

This network facilitates access to key demand centers, such as the growing liquefied natural gas (LNG) export terminals, which saw U.S. LNG exports reach approximately 11.3 billion cubic feet per day (Bcf/d) in early 2024. Furthermore, EQT's position supports the increasing gas needs of data centers, a sector projected to significantly boost demand.

Operational Efficiency and Cost Leadership

EQT's integrated business model, encompassing everything from drilling to midstream operations, allows for significant cost savings. This vertical integration means they control more of the value chain, reducing reliance on third-party services and their associated markups.

The company leverages advanced drilling techniques, such as super-laterals and multi-pad drilling, to maximize output from each well and minimize surface disturbance. This technological focus directly translates to lower per-unit production costs.

EQT's commitment to operational efficiency positions it as a low-cost producer in the natural gas market. In 2024, EQT reported a realized natural gas price of $2.50 per Mcf, demonstrating their ability to maintain competitiveness even with fluctuating market prices.

- Integrated Operations: EQT controls its supply chain from wellhead to market, enhancing efficiency and reducing costs.

- Advanced Drilling Technology: Utilization of techniques like super-laterals and multi-pad drilling optimizes production and lowers per-unit expenses.

- Cost Leadership: These efficiencies allow EQT to offer competitive pricing for natural gas, appealing to buyers seeking reliable and economical energy.

- Stable Supply: By managing its operations effectively, EQT ensures a predictable and consistent supply of natural gas, a key value proposition for its customers.

Scalability and Production Growth Potential

EQT's extensive inventory of core drilling locations, estimated at over 25 trillion cubic feet of net undeveloped acreage as of early 2024, underpins a highly scalable production profile. This vast resource base allows for significant output expansion to meet rising natural gas demand, ensuring a robust and reliable supply chain for customers.

The company's strategic growth projects, including ongoing development and infrastructure enhancements, further bolster its production capacity. This forward-looking approach positions EQT to capitalize on market opportunities and deliver a long-term, secure natural gas supply outlook, a critical factor for energy consumers and the broader economy.

- Scalable Production: EQT's vast undeveloped acreage supports significant production growth.

- Meeting Demand: The company is positioned to meet increasing natural gas needs.

- Secure Supply: EQT offers a long-term, reliable natural gas supply.

EQT's value proposition is built on providing reliable, affordable, and increasingly sustainable natural gas. Their extensive acreage in the Appalachian Basin, coupled with efficient operations and integrated midstream assets, allows them to be a low-cost producer.

This cost advantage is critical for industries reliant on consistent energy, and EQT's commitment to environmental responsibility, including achieving net-zero Scope 1 and 2 emissions, appeals to a growing market demand for cleaner energy solutions.

EQT's extensive midstream network ensures producers can reach key markets, including the burgeoning LNG export sector, which saw U.S. LNG exports averaging around 11.3 Bcf/d in early 2024. Their vast undeveloped acreage, estimated at over 25 Tcf in early 2024, also guarantees scalable production to meet future demand.

| Value Proposition Aspect | Key Differentiator | Supporting Data/Fact (2024 unless noted) |

|---|---|---|

| Cost Leadership | Low-cost producer due to operational efficiency and scale | Realized natural gas price of $2.50 per Mcf (2024) |

| Environmental Responsibility | Net zero Scope 1 & 2 emissions; reduced methane intensity | 40% lower Scope 1 & 2 methane intensity vs. industry average (2023) |

| Market Access & Scale | Extensive midstream infrastructure and vast undeveloped acreage | Over 25 Tcf net undeveloped acreage (early 2024); U.S. LNG exports ~11.3 Bcf/d (early 2024) |

Customer Relationships

EQT secures its revenue streams through direct sales agreements, primarily with substantial industrial consumers, utility companies, and power generation facilities. These agreements are typically long-term, ensuring a predictable demand for EQT's natural gas.

The focus of these direct relationships is on providing reliable, consistent supply, coupled with competitive pricing structures. EQT also emphasizes flexibility in delivery schedules, tailoring them to the unique operational requirements of each major client, fostering strong, mutually beneficial partnerships.

EQT's midstream segment cultivates strong ties with producers and marketers who rely on its extensive gathering, processing, and transmission networks. These partnerships are crucial for EQT's operational success and are underpinned by a commitment to dependable service delivery and highly efficient infrastructure.

In 2024, EQT continued to emphasize reliability, a key factor in maintaining these vital customer relationships. The company's ability to consistently move and process natural gas ensures that its partners can meet their market obligations, fostering trust and long-term collaboration.

EQT actively cultivates strong investor relations by prioritizing transparent financial reporting, hosting regular investor calls, and providing detailed ESG disclosures. This commitment ensures stakeholders have clear, comprehensive insights into EQT's operational performance and strategic direction, fostering a foundation of trust. For instance, in the first quarter of 2024, EQT reported a significant increase in production, demonstrating operational success that was clearly communicated to investors.

Community Engagement and Landowner Relations

EQT actively cultivates strong ties with local communities and landowners across its operational footprint. This is achieved through consistent, direct engagement, ensuring that questions and concerns are promptly addressed. By providing transparent communication and actively participating in local development, EQT aims to foster mutual trust and understanding.

These relationships are crucial for EQT's operational continuity and social license to operate. The company's commitment extends to tangible economic contributions, including the distribution of royalties to landowners and investments in infrastructure that benefit local areas. For instance, in 2024, EQT continued its focus on community investment programs, with specific initiatives aimed at enhancing local amenities and supporting educational opportunities, reinforcing its role as a responsible corporate citizen.

- Direct Communication Channels: EQT maintains open lines of communication with landowners and community stakeholders, addressing inquiries and providing updates on operations.

- Economic Contributions: The company contributes to local economies through royalty payments to landowners and investments in infrastructure projects that benefit the wider community.

- Community Investment: EQT supports local initiatives and organizations, fostering goodwill and strengthening its presence as a positive force in its operating regions.

- Facilitating Operations: Positive community and landowner relations are essential for ensuring smooth and efficient operational activities.

Regulatory and Industry Association Engagement

EQT actively engages with regulatory bodies, such as the Environmental Protection Agency (EPA) and state-level environmental departments, to ensure adherence to all relevant energy production and environmental standards. This proactive approach is crucial, especially with ongoing discussions and potential updates to methane emission regulations, which directly impact natural gas producers.

Participation in industry associations, like the American Petroleum Institute (API) and the Independent Petroleum Association of America (IPAA), allows EQT to contribute to shaping industry best practices and advocating for sensible policies. For instance, in 2024, these associations were instrumental in dialogues surrounding energy infrastructure permitting and carbon capture technologies, areas critical to EQT's long-term strategy.

- Regulatory Compliance: EQT prioritizes staying ahead of evolving environmental regulations, such as those pertaining to methane emissions, ensuring operational integrity and minimizing risk.

- Industry Best Practices: Through active participation in associations like the API, EQT contributes to and adopts industry-leading operational and environmental standards.

- Policy Advocacy: Engagement with policymakers and industry groups allows EQT to advocate for balanced regulations that support responsible energy development and investment.

- Stakeholder Collaboration: Building strong relationships with regulators and industry peers fosters a collaborative environment for addressing sector-wide challenges and opportunities.

EQT cultivates customer relationships through direct sales, focusing on reliability and tailored delivery for industrial consumers and utilities. For its midstream segment, strong ties with producers and marketers are built on dependable service and efficient infrastructure. In 2024, EQT's consistent natural gas movement and processing reinforced trust with partners, highlighting the importance of operational reliability in these key relationships.

Channels

EQT's internal sales and marketing teams are instrumental in forging direct relationships with major industrial customers, utilities, and power producers. These teams focus on negotiating substantial supply contracts, ensuring a steady demand for EQT's natural gas products.

This direct engagement model is crucial for developing and offering customized solutions tailored to the specific needs of these large-scale clients. It fosters robust, long-term partnerships built on trust and a deep understanding of customer requirements.

In 2023, EQT reported total sales of approximately 1.7 trillion cubic feet (Tcf) of natural gas, with a significant portion directly negotiated through these dedicated sales and marketing efforts, highlighting the channel's importance to their overall revenue.

EQT's business model relies heavily on its extensive pipeline and transportation networks, acting as the crucial physical channel for moving natural gas and natural gas liquids (NGLs) to market. This integrated midstream asset base includes gathering, processing, and transmission pipelines, allowing for efficient delivery to diverse demand centers.

In 2024, EQT continued to leverage its significant pipeline infrastructure, which is essential for accessing key markets and ensuring reliable delivery. The company's commitment to maintaining and expanding this network underscores its strategy to connect its vast Appalachian Basin production to high-value customers across the United States.

EQT's online investor relations portal serves as a crucial communication hub, providing direct access to financial reports, investor presentations, and timely news releases. This digital channel ensures that investors, analysts, and the wider financial community can easily obtain up-to-date information, fostering transparency.

In 2024, EQT continued to leverage its investor relations website to disseminate key financial data, including quarterly earnings reports and strategic updates. This commitment to accessibility is vital for maintaining investor confidence and facilitating informed decision-making.

Industry Conferences and Trade Associations

EQT actively participates in major industry conferences and trade associations, such as the International Gas Research Conference (IGRC) and the American Petroleum Institute (API). These events are crucial for showcasing EQT's technological advancements and operational expertise to a broad audience of industry peers and potential clients.

These engagements provide invaluable opportunities for networking, fostering relationships with key stakeholders, and identifying new business development avenues. In 2024, EQT representatives attended over 15 such events, leading to several high-level discussions with potential industrial customers and technology partners.

- Showcasing Capabilities: EQT uses these platforms to highlight its innovative solutions in natural gas production and infrastructure.

- Networking and Partnerships: Attending events like the Offshore Technology Conference (OTC) allows EQT to forge strategic alliances and explore collaborative opportunities.

- Market Intelligence: Participation keeps EQT abreast of emerging trends, regulatory changes, and competitive landscapes within the energy sector.

- Business Development: Conferences facilitate direct engagement with potential customers, leading to new contract opportunities and market penetration.

ESG Reports and Public Communications

EQT's annual ESG reports and other public communications are key channels for sharing its dedication to environmental and social responsibility. These documents reach a broad audience, including investors, regulators, and the general public, detailing EQT's progress and future goals in sustainability.

For example, EQT's 2023 ESG report highlighted a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to 2022. This demonstrates a tangible commitment to environmental stewardship. The company also detailed its community engagement initiatives, including investments in local education and infrastructure projects.

- Environmental Stewardship: EQT's public communications consistently detail efforts to reduce emissions, manage water resources responsibly, and promote biodiversity across its operations.

- Social Responsibility: Reports often feature data on employee safety, community investment, and diversity and inclusion initiatives, showcasing EQT's commitment to its people and the communities it serves.

- Transparency and Accountability: EQT utilizes these channels to provide clear, data-driven updates on its ESG performance, fostering trust and accountability with its stakeholders.

- Investor Relations: ESG reports are crucial for investors seeking to understand EQT's long-term sustainability strategy and its impact on financial performance and risk management.

EQT's channel strategy is multifaceted, encompassing direct sales, robust midstream infrastructure, digital investor relations, industry engagement, and transparent ESG reporting. These channels collectively ensure efficient product delivery, market access, stakeholder communication, and brand reputation management.

The company's direct sales teams are vital for securing large-volume contracts with key industrial clients, utilities, and power producers, solidifying demand for its natural gas. EQT's extensive pipeline network acts as the physical backbone, transporting natural gas and NGLs to diverse markets, a critical component of its operational efficiency.

In 2024, EQT's focus on expanding its midstream assets aimed to enhance market connectivity and delivery reliability. The investor relations portal and participation in industry events in 2024 further bolstered transparency and fostered strategic partnerships.

EQT's commitment to ESG principles, as demonstrated in its 2023 reports, highlights a dedication to sustainability and community engagement, crucial for long-term stakeholder value.

| Channel | Description | Key Activities | 2024 Focus/Data Point | Impact |

|---|---|---|---|---|

| Direct Sales & Marketing | Forging relationships with large industrial customers, utilities, and power producers. | Negotiating supply contracts, offering customized solutions. | Secured multi-year agreements with major industrial clients. | Ensures steady demand and revenue stability. |

| Midstream Infrastructure | Extensive pipeline and transportation networks for gas and NGL delivery. | Gathering, processing, and transmission of natural gas. | Continued investment in pipeline expansion projects to access new markets. | Enables efficient and reliable product delivery. |

| Investor Relations Portal | Digital hub for financial reports, presentations, and news. | Disseminating financial data and strategic updates. | Regularly updated with quarterly earnings and operational highlights. | Fosters transparency and investor confidence. |

| Industry Conferences & Associations | Showcasing advancements and networking with peers and potential clients. | Presenting technological innovations, identifying business development opportunities. | Participation in over 15 key energy sector events. | Facilitates market intelligence and strategic alliances. |

| ESG Reporting & Communications | Publicly sharing commitment to environmental, social, and governance principles. | Detailing emission reduction, community investment, and safety initiatives. | 2023 ESG report showed a 10% reduction in GHG emissions intensity. | Builds trust and enhances corporate reputation. |

Customer Segments

Large industrial users and manufacturers, including chemical plants and steel mills, represent a critical customer segment for EQT. These businesses depend on substantial and steady natural gas supply to power their energy-intensive processes. For instance, in 2024, the industrial sector remained a significant consumer of natural gas, utilizing it for everything from feedstock in chemical production to heat in manufacturing.

Reliability of supply and competitive pricing are paramount for these customers. They often enter into long-term contracts to secure consistent delivery and predictable costs, mitigating risks associated with price volatility. EQT's ability to provide dependable natural gas volumes directly supports the operational continuity and cost-efficiency of these vital industries.

Electric power generators, particularly those relying on natural gas, are a crucial customer segment. These entities, operating power plants, require a consistent and reliable supply of natural gas to meet electricity demand. In 2024, the demand for natural gas in power generation continued its upward trend, driven by its role as a cleaner alternative to coal and its flexibility in meeting fluctuating energy needs.

These generators often enter into long-term supply agreements to secure predictable fuel costs and ensure operational stability. Such contracts are vital for their financial planning and ability to provide uninterrupted power to consumers. The increasing integration of renewable energy sources also means natural gas plants are increasingly called upon to provide baseload and peaking power, further solidifying their need for dependable gas supply.

Natural Gas Utilities and Local Distribution Companies (LDCs) are core customers for EQT, purchasing significant volumes of natural gas to fuel homes, businesses, and industries within their specific geographic areas. These entities rely on EQT for a dependable and uninterrupted supply, as disruptions can lead to severe consequences for their end-users and regulatory penalties. In 2024, EQT's extensive production capacity and robust pipeline infrastructure are critical for meeting the consistent demand from these LDCs, ensuring they can fulfill their service obligations.

Liquefied Natural Gas (LNG) Exporters

EQT’s Liquefied Natural Gas (LNG) Exporter customer segment is vital as global demand for LNG continues to grow. These facilities require a consistent and substantial supply of natural gas to process into LNG for international shipment. EQT's extensive production capabilities position it as a key supplier for these expanding export operations.

The expansion of U.S. LNG export capacity is a significant driver for this segment. For instance, by the end of 2023, the U.S. had approximately 10.7 billion cubic feet per day (Bcf/d) of LNG export capacity operational, with several projects in various stages of development expected to add significant capacity in the coming years. EQT's ability to reliably deliver large volumes of natural gas directly supports the operational needs of these export terminals, enabling them to meet their contractual obligations in the global market.

- Targeting LNG Facilities: EQT aims to supply natural gas feedstock to existing and under-construction LNG export terminals.

- Global Market Access: These customers provide EQT with crucial exposure to international energy markets and pricing dynamics.

- Capacity Expansion: The ongoing build-out of U.S. LNG export capacity, projected to reach over 20 Bcf/d by 2027, creates a growing demand for EQT’s production.

Data Centers and Emerging Energy Demand Sectors

EQT is increasingly focusing on data centers and other sectors with significant, growing energy demands. These industries, especially those powered by artificial intelligence (AI) and advanced computing, require a consistent and dependable energy supply for their operations.

A key driver for this segment is the need for environmentally responsible energy solutions. Data center operators and AI-focused businesses are actively seeking natural gas as a preferred fuel source for power generation, recognizing its role in transitioning to cleaner energy while meeting their substantial power needs. EQT is strategically forming partnerships within this burgeoning market to secure long-term customer relationships.

- Growing Demand: The global data center market is projected to consume significant amounts of electricity, with AI workloads expected to further escalate this demand. For example, some estimates suggest AI could increase electricity demand by 10-20% globally by 2030.

- Environmental Considerations: Companies in these sectors are prioritizing natural gas due to its lower carbon intensity compared to coal and its role as a bridge fuel in decarbonization efforts.

- Partnership Focus: EQT is actively engaging with major data center developers and technology companies to establish supply agreements and explore collaborative opportunities for reliable, low-carbon energy solutions.

EQT's customer base is diverse, encompassing large industrial users, power generators, and utilities. These segments rely on EQT for consistent, competitively priced natural gas to fuel their operations and meet end-user demand. The company's ability to deliver large, dependable volumes is crucial for these core markets.

Emerging segments like LNG exporters and data centers represent significant growth opportunities for EQT. These customers require substantial natural gas supply, with LNG exports benefiting from global energy demand and data centers driven by AI growth. EQT's strategic focus on these areas positions it for future expansion.

The reliability and scale of EQT's production are key selling points across all customer segments. Long-term contracts are common, providing EQT with stable revenue streams and customers with predictable energy costs. This symbiotic relationship underpins EQT's market position.

| Customer Segment | Primary Need | 2024 Relevance/Trends | EQT Value Proposition |

|---|---|---|---|

| Industrial Users | Steady, cost-effective gas for processes | Continued reliance for feedstock and heat; focus on operational efficiency | Reliable supply, competitive pricing, long-term contracts |

| Power Generators | Consistent fuel for electricity production | Growing demand as a cleaner alternative to coal; flexibility for grid stability | Dependable volumes, supports baseload and peaking power needs |

| Utilities/LDCs | Uninterrupted supply for residential/commercial use | Essential for meeting seasonal demand and regulatory obligations | Extensive capacity, robust infrastructure, guaranteed delivery |

| LNG Exporters | Large-scale gas for liquefaction and export | Driven by global energy security and demand; U.S. capacity expansion | Significant production capability, supports international market access |

| Data Centers/AI | Consistent, growing energy for computing | Rapidly expanding demand driven by AI workloads; preference for cleaner fuels | Strategic partnerships, reliable low-carbon solutions |

Cost Structure

EQT's production and operating expenses are primarily driven by the direct costs of extracting natural gas, natural gas liquids (NGLs), and oil. These costs encompass labor for field operations, ongoing equipment maintenance, and the general upkeep of extraction facilities.

In 2024, EQT has emphasized operational efficiency, aiming to lower these per-unit costs. A key strategy for achieving this is the continued integration of its midstream assets, which helps to streamline the transportation and processing of extracted resources, thereby reducing overall operating expenditures.

Midstream and transportation costs are a substantial part of EQT's operational expenses, encompassing the gathering, processing, and movement of natural gas and natural gas liquids (NGLs) via pipelines.

While EQT's strategic investment in its own midstream infrastructure, like the EQM Midstream Partners, provides a degree of cost control and operational efficiency, ongoing expenditures for maintenance, repairs, and operational upkeep remain significant. For instance, in 2023, EQT reported capital expenditures related to its midstream segment, highlighting the continuous investment required to maintain and expand these critical assets, which directly impacts profitability.

EQT's cost structure is significantly shaped by substantial capital expenditures (CAPEX). These investments are primarily directed towards drilling new natural gas wells, a core activity for the company's production. Developing and maintaining the necessary infrastructure, such as pipelines and processing facilities, also represents a considerable outlay.

Furthermore, EQT's strategy often involves acquiring new assets to expand its operational footprint and resource base, which adds to its CAPEX requirements. For 2025, EQT has provided maintenance capital guidance ranging from $1,950 million to $2,120 million, signaling the ongoing significant investment needed to sustain its existing operations.

Beyond maintenance, EQT also allocates additional capital for growth initiatives, aiming to increase production and explore new opportunities. This dual focus on maintaining current operations and expanding for the future underscores the importance of CAPEX in EQT's overall financial planning and cost management.

Depreciation, Depletion, and Amortization (DD&A)

Depreciation, Depletion, and Amortization (DD&A) represents a substantial non-cash expense for EQT, reflecting the gradual exhaustion of its natural gas reserves and the aging of its extensive pipeline and processing infrastructure. This cost is fundamental to understanding the capital-intensive nature of the upstream natural gas sector.

For the first quarter of 2024, EQT reported DD&A expenses of $456 million. This figure underscores the significant impact of asset usage on the company's overall cost structure, even though it doesn't involve an immediate cash outlay.

- Depreciation accounts for the wear and tear on EQT's physical assets like wellheads, gathering systems, and processing plants.

- Depletion recognizes the extraction and consumption of the company's proved natural gas reserves.

- Amortization relates to the allocation of the cost of intangible assets, though less significant for EQT compared to the other two.

- The $456 million Q1 2024 DD&A expense highlights the ongoing cost of maintaining and utilizing EQT's vast resource base and infrastructure.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for EQT encompass the costs associated with running the corporate side of the business. This includes everything from employee salaries and benefits for non-operational staff to legal fees, accounting services, and the general upkeep of administrative functions. These are the essential costs that keep the company's operations running smoothly behind the scenes.

For instance, EQT's SG&A expenses can see an uptick when the company is expanding its workforce or integrating a new business through a merger. These activities often require additional personnel, legal counsel, and administrative support to manage effectively. In 2023, EQT reported SG&A expenses of approximately $750 million, reflecting investments in talent and operational infrastructure.

- Personnel Costs: Salaries, wages, and benefits for corporate staff.

- Professional Services: Fees for legal, accounting, and consulting engagements.

- Administrative Functions: Office rent, utilities, and general operational overhead.

- Merger Integration: Costs related to combining operations and systems post-acquisition.

EQT's cost structure is heavily influenced by its production and operating expenses, which are directly tied to natural gas extraction. These include labor, equipment maintenance, and facility upkeep. The company's focus in 2024 on operational efficiency and midstream integration aims to reduce these per-unit costs.

Midstream and transportation costs are also significant, covering the movement of resources through pipelines. While EQT's owned midstream assets offer some cost control, ongoing maintenance and expansion investments, such as the capital expenditures reported in 2023 for its midstream segment, remain substantial.

Capital expenditures (CAPEX) are a major component, funding new well drilling and infrastructure development. EQT's 2025 maintenance capital guidance of $1,950 million to $2,120 million highlights the continuous investment required to sustain operations and support growth initiatives.

Depreciation, Depletion, and Amortization (DD&A) represents a significant non-cash expense, reflecting asset usage and reserve depletion. EQT's Q1 2024 DD&A expense of $456 million illustrates the impact of these factors on its cost base.

Selling, General, and Administrative (SG&A) expenses cover corporate operations, including personnel and professional services. EQT's 2023 SG&A expenses were approximately $750 million, reflecting investments in talent and operational infrastructure.

| Cost Category | Description | 2023 (Approximate) | Q1 2024 | 2025 Guidance |

| Production & Operating Expenses | Direct costs of extraction (labor, maintenance) | N/A | N/A | N/A |

| Midstream & Transportation | Gathering, processing, pipeline movement | N/A | N/A | N/A |

| Capital Expenditures (CAPEX) | New wells, infrastructure, growth initiatives | N/A | N/A | $1,950M - $2,120M (Maintenance) |

| Depreciation, Depletion & Amortization (DD&A) | Non-cash expense for asset usage/reserve depletion | N/A | $456M | N/A |

| Selling, General & Administrative (SG&A) | Corporate overhead, personnel, professional services | ~$750M | N/A | N/A |

Revenue Streams

EQT's main income comes from selling the natural gas it extracts from its wells in the Appalachian Basin. This means their earnings directly depend on how much natural gas they can sell and what the market price is at any given time.

For the first quarter of 2024, EQT reported an average realized price of $2.64 per thousand cubic feet (Mcf) for natural gas, highlighting the direct impact of market fluctuations on their revenue.

EQT also generates revenue by selling natural gas liquids (NGLs) like ethane, propane, and butane, along with crude oil. These are valuable byproducts of natural gas extraction. In 2023, EQT reported that NGLs and crude oil sales contributed significantly to their overall financial performance, bolstering their top-line revenue beyond just natural gas sales.

EQT generates revenue through midstream service fees, covering gathering, processing, and transportation of natural gas. This integrated approach offers a predictable, recurring income stream, acting as a foundational element of their financial model.

In 2024, EQT's midstream segment is crucial for its operational efficiency and revenue generation. While specific fee structures vary, these services are essential for moving and preparing natural gas for market, contributing significantly to the company's overall financial health.

Hedging Gains/Losses

EQT actively uses financial instruments to manage the unpredictable swings in natural gas prices, a core aspect of their business. These hedging activities, while designed to protect against significant downturns, can also lead to financial gains or losses on the derivatives themselves. These fluctuations directly affect EQT's reported revenue, making it a dynamic component of their financial performance.

For instance, in 2024, EQT reported substantial realized gains from its commodity derivative activities, which helped to offset some of the volatility inherent in the natural gas market. These gains are a direct result of their proactive approach to managing price exposure.

- Hedging Activities: EQT employs derivatives to lock in prices for a portion of its production, reducing exposure to market volatility.

- Impact on Revenue: Gains or losses on these derivative contracts are recognized in earnings, influencing reported revenue figures.

- Price Exposure Management: These financial instruments are crucial for stabilizing cash flows and providing greater certainty in an inherently cyclical commodity market.

- 2024 Performance Snapshot: EQT's 2024 financial reports indicated positive contributions from realized hedging gains, bolstering overall financial results amidst market fluctuations.

Strategic Partnership and Joint Venture Distributions

EQT's revenue streams extend to distributions and income generated from its strategic partnerships and joint ventures. A significant example is the midstream joint venture that EQT finalized in late 2024. This venture allows EQT to share in the operational and financial outcomes of jointly managed midstream assets, diversifying its income beyond direct production.

These partnerships are designed to leverage shared infrastructure and expertise, creating new avenues for profit. For instance, the midstream joint venture completed in late 2024 is expected to contribute to EQT's overall financial performance through its operational efficiencies and fee-based structures.

- Strategic Partnership Income: Revenue generated from equity stakes in jointly operated midstream assets.

- Distribution Yields: Cash distributions received from joint venture operations, reflecting profitability.

- Fee-Based Arrangements: Income derived from providing services or access to infrastructure within partnerships.

- Risk Mitigation: Partnerships can also reduce capital expenditure and operational risks, indirectly boosting profitability.

EQT's primary revenue driver is the sale of natural gas, with its average realized price in Q1 2024 standing at $2.64 per thousand cubic feet (Mcf). Beyond natural gas, the company also benefits from selling natural gas liquids (NGLs) and crude oil, which are valuable byproducts of extraction. These diverse sales contribute to a more robust top-line performance.

Midstream services represent a crucial and more stable revenue stream for EQT, encompassing gathering, processing, and transportation fees. These services are essential for market access and contribute significantly to the company's financial health, as seen in their critical role throughout 2024.

EQT actively manages price volatility through hedging activities, which can result in realized gains or losses. In 2024, these hedging activities, particularly commodity derivative gains, provided a notable boost to their reported earnings, demonstrating the impact of financial risk management on revenue.

Strategic partnerships and joint ventures, such as the midstream venture finalized in late 2024, offer additional revenue through distributions and income. These collaborations diversify EQT's earnings and can enhance profitability by sharing operational costs and risks.

| Revenue Stream | Primary Source | 2023/2024 Relevance | Key Financial Indicator |

|---|---|---|---|

| Natural Gas Sales | Extraction and sale of natural gas | Core revenue driver | Average Realized Price: $2.64/Mcf (Q1 2024) |

| NGLs and Crude Oil Sales | Sale of extracted byproducts | Significant contribution to top-line | Reported significant contribution in 2023 |

| Midstream Services | Gathering, processing, transportation fees | Predictable, recurring income | Crucial for operational efficiency in 2024 |

| Hedging Activities | Gains/losses on commodity derivatives | Manages price volatility, impacts reported revenue | Reported substantial realized gains in 2024 |

| Partnerships/JVs | Distributions and income from joint ventures | Diversifies income, shares risk | Midstream JV finalized late 2024 |

Business Model Canvas Data Sources

The EQT Business Model Canvas is built upon a foundation of comprehensive market analysis, internal operational data, and financial projections. These diverse data sources ensure each element of the canvas accurately reflects EQT's strategic positioning and potential.