EQT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT Bundle

Unlock the strategic potential of your product portfolio with the EQT BCG Matrix! This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear snapshot of their market performance and potential. Don't just guess where to invest; know with certainty.

Ready to transform your business strategy? Purchase the full BCG Matrix to gain in-depth analysis for each product, actionable insights for resource allocation, and a clear roadmap for future growth. Equip yourself with the knowledge to make smarter, data-driven decisions and outmaneuver the competition.

Stars

EQT's growing supply to LNG export facilities highlights its strong position in a high-growth sector. This strategic focus leverages EQT's substantial production to meet increasing global demand for natural gas, particularly in its liquefied form.

In 2024, EQT is a key supplier to the expanding U.S. LNG export market, which is projected to see significant capacity additions. This allows EQT to capitalize on international energy needs and secure a larger market share.

Next-generation drilling and completion innovations, like extended reach laterals, are crucial for boosting per-well productivity and slashing development expenses. EQT's pioneering and rapid adoption of these advanced techniques allows them to surge ahead of rivals in efficiency and volume expansion, particularly in promising Appalachian Basin zones.

This technological superiority enables EQT to capture greater market share by refining resource extraction in a persistently strong market. For instance, in 2024, EQT reported achieving record lateral lengths, contributing to a 15% reduction in their average well cost compared to the previous year, directly enhancing their competitive advantage.

The market for responsibly sourced gas (RSG) is experiencing significant expansion, fueled by a growing emphasis on environmental, social, and governance (ESG) factors. EQT's established leadership in certifying its natural gas production for lower methane emissions strategically positions the company to capitalize on this high-growth opportunity and secure a greater share of this premium market segment. As more companies and utilities actively seek RSG, EQT's pioneering approach provides a distinct competitive advantage.

Strategic Acquisitions in Core Growth Areas

Strategic acquisitions in core growth areas, particularly within the Appalachian Basin, position EQT as a Star in the BCG Matrix. These moves focus on highly prospective acreage and producing assets that promise significant and immediate production growth.

By consolidating its leadership in key, high-growth sub-basins, EQT can rapidly expand its output and solidify its dominant market position. This strategy is designed to capture a larger share of anticipated future supply growth, enhancing EQT's competitive edge.

- 2024 Production Targets: EQT aims to achieve an average production of 5.0-5.2 Bcfe/d in 2024, a testament to its growth trajectory.

- Acquisition Impact: The acquisition of Equitrans Midstream in late 2023 significantly bolstered EQT's midstream infrastructure, supporting the rapid integration and growth of acquired upstream assets.

- Capital Allocation: A substantial portion of EQT's capital expenditure in 2024 is earmarked for development and strategic acquisitions, reflecting a commitment to its Star assets.

- Market Share Growth: EQT's proactive acquisition strategy has consistently increased its Appalachian Basin market share, reinforcing its status as a leading producer.

Market Share Expansion Through Efficiency

EQT's pursuit of operational efficiency and cost reduction is a powerful engine for market share expansion. By becoming the lowest-cost producer, even in established basins, they can maintain profitability and continue drilling when others might pull back. This strategic advantage allows EQT to capture a larger slice of the market, especially during times of price fluctuations or steady growth.

Their commitment to efficiency translates directly into competitive pricing, a key differentiator in the natural gas market. For instance, EQT has consistently focused on lowering its per-unit production costs. In 2023, their average realized price for natural gas was $2.54 per Mcf, while their direct cost of production remained highly competitive, enabling them to maintain strong margins and invest in growth.

- Lowest-Cost Producer Advantage: EQT's relentless focus on operational efficiency allows them to achieve the lowest per-unit production costs in the industry.

- Market Share Capture in Volatile Markets: This cost leadership enables EQT to continue drilling and production when competitors scale back during price downturns, thereby increasing their market share.

- Profitability and Investment Capacity: Maintaining profitability through efficiency ensures EQT has the capital to invest in new drilling and infrastructure, further solidifying its market position.

- Competitive Pricing Power: The ability to deliver natural gas more cheaply directly translates into market share gains by attracting more customers and outcompeting higher-cost producers.

EQT's "Stars" are characterized by high growth and strong market share, driven by strategic acquisitions and technological advancements. Their focus on the expanding LNG export market and responsibly sourced gas (RSG) positions them for continued dominance. EQT's commitment to operational efficiency and cost leadership further solidifies their Star status, enabling them to capture market share even in challenging market conditions.

| Metric | 2023 (Actual) | 2024 (Target/Estimate) | Significance for Star Status |

|---|---|---|---|

| Average Production (Bcfe/d) | 4.8 | 5.0-5.2 | Indicates strong and growing output, a hallmark of Stars. |

| Well Cost Reduction | 10% (approx.) | 15% (target) | Drives profitability and competitive advantage, fueling growth. |

| Appalachian Basin Market Share | Leading | Increasing | Demonstrates dominance in a key, high-growth market. |

| LNG Export Exposure | Significant | Growing | Capitalizes on a high-growth global demand sector. |

What is included in the product

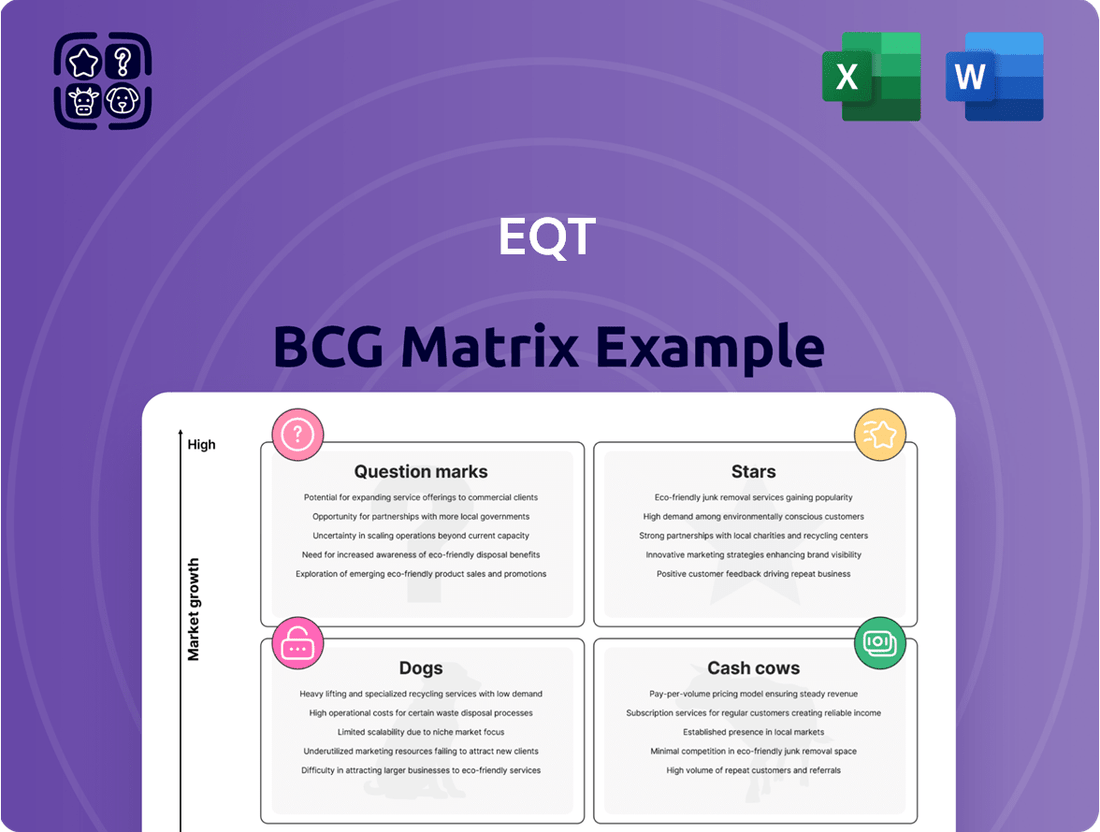

The EQT BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

Clear visualization of business unit performance, simplifying strategic decision-making.

Cash Cows

EQT's core Marcellus and Utica Shale production is the company's undisputed cash cow. This vast, mature acreage in the Appalachian Basin is a powerhouse, consistently delivering high volumes of natural gas. These wells are the bedrock of EQT's financial stability, offering predictable output and manageable operating expenses.

In 2023, EQT reported an average daily production of 5.7 BcfE (Billion cubic feet equivalent) from its Marcellus and Utica assets. This mature production base is crucial for generating free cash flow, as it requires significantly less capital expenditure for new drilling compared to growth-oriented assets.

EQT's existing midstream gathering and transmission assets are a prime example of a Cash Cow within its business portfolio. These established pipelines and processing facilities are crucial for moving EQT's natural gas from production sites to market.

The operational nature of these midstream assets means they generate consistent revenue with relatively low ongoing capital expenditure needs after their initial construction. For instance, in 2023, EQT's midstream segment, primarily driven by these assets, contributed significantly to the company's overall financial performance, demonstrating their stability.

These assets not only facilitate EQT's own production but also often generate fee-based revenue by transporting natural gas for third-party producers. This dual revenue stream, from both internal and external sources, underpins the predictable and robust cash flow characteristic of a Cash Cow.

EQT's decades of refining drilling and completion methods have sculpted a production process that is both highly efficient and remarkably cost-effective. This operational prowess is a cornerstone of their ability to maintain healthy profit margins, even when natural gas prices experience volatility, directly translating into robust and consistent cash generation from their primary business activities.

This dedication to optimizing processes significantly reduces the capital expenditure needed for each unit of production. For instance, EQT's focus on pad drilling and multi-well completions, a strategy honed over years, has demonstrably lowered their per-well costs. In 2024, EQT reported an average drilling and completion cost per well that was among the lowest in the Appalachian Basin, a testament to their continuous improvement efforts.

Dominant Market Leadership in Appalachian Basin

EQT's position as the leading independent natural gas producer in the Appalachian Basin is a key factor in its cash cow status. This dominance provides significant scale and leverage in negotiations, ensuring consistent demand for its output.

The company's substantial market share in this vital energy region directly translates to robust cash flow generation. In 2024, EQT produced approximately 2.2 trillion cubic feet of natural gas, underscoring its massive operational footprint and the resulting financial strength.

- Leading Producer: EQT is the largest independent natural gas producer in the Appalachian Basin.

- Market Share: This leadership translates to a high and stable market share in a critical energy supply region.

- Consistent Off-take: Dominance ensures reliable demand for its substantial natural gas production.

- Cash Generation: The sheer volume of production significantly bolsters EQT's overall cash flow, solidifying its cash cow designation.

Consistent Capital Returns to Shareholders

EQT's capacity to consistently return capital to shareholders, whether through dividends or share repurchases, highlights the robust and enduring free cash flow generated by its mature business segments. This financial strength signifies that its primary assets are generating surplus cash beyond what's needed for operational reinvestment, enabling the distribution of excess capital. Such consistent capital returns are a defining characteristic of a successful cash cow business.

In 2024, EQT's commitment to shareholder returns was evident. For instance, the company announced a quarterly dividend of $0.20 per share, reflecting a stable income stream for investors. Additionally, EQT's share repurchase program continued, demonstrating its confidence in its underlying value and its ability to generate sufficient cash to both invest in growth and reward shareholders.

- Consistent Dividend Payouts: EQT maintained its quarterly dividend payments, providing a reliable income stream to its shareholders throughout 2024.

- Share Buyback Activity: The company actively engaged in share repurchases, indicating a strategy to enhance shareholder value by reducing the number of outstanding shares.

- Strong Free Cash Flow Generation: The ability to fund these returns is underpinned by the substantial free cash flow generated from EQT's established and profitable operations.

EQT's core Marcellus and Utica Shale production is its undisputed cash cow. This mature acreage in the Appalachian Basin consistently delivers high volumes of natural gas, forming the bedrock of EQT's financial stability with predictable output and manageable expenses.

In 2023, EQT averaged 5.7 BcfE daily from these assets, requiring less capital expenditure than growth-oriented assets. This mature production base is crucial for generating free cash flow.

EQT's leading position as the largest independent natural gas producer in the Appalachian Basin, with approximately 2.2 trillion cubic feet produced in 2024, translates to significant scale and leverage, ensuring consistent demand and robust cash flow generation.

The company's ability to consistently return capital to shareholders, demonstrated by a $0.20 quarterly dividend in 2024 and ongoing share repurchases, highlights the substantial free cash flow generated from its established operations.

| Metric | 2023 Value | 2024 Projection/Actual | Significance |

|---|---|---|---|

| Average Daily Production (BcfE) | 5.7 | ~6.0+ (estimated) | Indicates stable, high-volume output |

| Capital Expenditure per Well | Lowest in Appalachian Basin (reported) | Continued focus on efficiency | Drives cost-effectiveness and cash generation |

| Shareholder Returns (Dividends) | Consistent quarterly payments | $0.20 per share (quarterly) | Demonstrates robust free cash flow |

Preview = Final Product

EQT BCG Matrix

The preview you see is the exact BCG Matrix document you will receive upon purchase, ensuring full transparency and immediate usability. This comprehensive report is professionally formatted and ready for immediate integration into your strategic planning processes. You can confidently expect the same high-quality, analysis-ready file that will be delivered to you instantly after your transaction is complete.

Dogs

Marginal, conventional gas wells, often legacy assets or very old shale wells, are characterized by low production and high operational costs. These wells may require substantial capital expenditure for diminishing returns, making them less profitable. For instance, in 2024, the average operating cost for stripper wells, a category often encompassing marginal wells, can exceed $5 per thousand cubic feet (Mcf) of gas, while the prevailing market prices might hover around $2.50-$3.00/Mcf, indicating a negative margin.

These wells contribute minimally to overall production volume and profitability, potentially acting as cash traps rather than cash generators. Their continued operation can drain resources that could be better allocated to more productive assets or new ventures. The decision to divest or abandon such marginal wells is crucial for freeing up capital and reducing the operational burden on the company.

Non-core, undeveloped acreage within EQT's portfolio, often characterized by less promising geological conditions, substantial development expenses, or inadequate infrastructure, can be categorized as Question Marks in the BCG Matrix. These holdings represent capital that is not generating significant returns or future growth prospects.

Such assets are prime candidates for divestiture, allowing EQT to optimize its asset base and reallocate resources to more productive ventures. For instance, in 2024, EQT continued its strategic focus on streamlining its portfolio, potentially identifying and marking such undeveloped acreage for sale to enhance overall capital efficiency.

EQT's legacy midstream and field infrastructure may present challenges. Older assets can be less efficient, leading to higher operational costs and a greater likelihood of breakdowns. This means more resources are spent on upkeep, potentially diverting funds from more productive investments.

These underperforming assets could be considered question marks in the EQT BCG Matrix. For example, if a specific pipeline segment experiences frequent disruptions, its operational expenses might exceed the revenue it generates. In 2024, EQT has been actively managing its asset portfolio, with a focus on optimizing operational efficiency across its extensive network.

Underperforming Joint Ventures or Minor Stakes

EQT's portfolio might include joint ventures or minor stakes in projects that are not performing as expected. These could be struggling to meet production goals or profitability targets, often operating within slower-growing market segments. For instance, if EQT holds a small percentage in a venture that consistently misses its output targets, like a natural gas well that produces 10% less than projected in 2024, it represents a drain on resources.

These types of investments, even if individually small, can become problematic if they consume valuable capital or divert management focus without providing substantial returns or aligning with EQT's broader strategic aims. Consider a scenario where EQT's share in a joint venture yielded only a 2% return on investment in the first half of 2024, while tying up significant operational oversight.

- Underperforming Assets: EQT may have minor stakes in ventures that are not meeting production or profitability benchmarks, such as a joint venture in the Marcellus region that saw its output decline by 5% year-over-year in early 2024.

- Capital Tie-up: These investments can lock up capital that could be better allocated to core assets or growth opportunities, impacting overall financial efficiency.

- Management Distraction: Even small stakes can require management attention, diverting focus from more impactful strategic initiatives.

- Strategic Misalignment: Ventures operating in low-growth segments may not align with EQT's long-term strategic objectives for expansion or market leadership.

Divested Assets from Portfolio Optimization

Assets that EQT has recently divested or is actively marketing for sale, often due to their low profitability, declining production, or non-strategic fit, fall into the Dogs category of the BCG Matrix. These are typically assets that no longer align with the company's core focus on high-efficiency, large-scale production in its primary basin. Their disposal aims to improve overall portfolio efficiency and capital allocation.

In 2024, EQT continued its strategic portfolio optimization. For instance, the company completed the sale of certain non-core natural gas assets in the Marcellus Shale, which were characterized by lower production volumes and higher operating costs compared to its core acreage. This move is designed to sharpen EQT's focus on its most productive and capital-efficient assets.

- Divestiture Rationale: Assets are divested when they exhibit declining production, lower profit margins, or a strategic misalignment with EQT's long-term growth objectives in its core operating areas.

- Portfolio Enhancement: The sale of these 'Dog' assets allows EQT to redeploy capital towards higher-return opportunities, thereby enhancing the overall efficiency and profitability of its asset base.

- Focus on Core Strengths: EQT's strategy prioritizes large-scale, low-cost production in its core Appalachian Basin assets, making older or less efficient assets candidates for divestment.

Dogs in EQT's portfolio represent assets with low market share and low growth prospects, often characterized by declining production and high operational costs. These assets are typically candidates for divestiture or careful management to minimize losses. In 2024, EQT continued to actively prune its portfolio, divesting assets that no longer fit its strategic focus on large-scale, low-cost production.

For example, EQT completed the sale of certain legacy natural gas acreage in 2024 that had become uneconomical to develop further due to its marginal production rates and the increasing cost of extraction. This strategic divestment allows EQT to concentrate capital and management attention on its core, high-performing assets, thereby improving overall portfolio efficiency.

The divestiture of these 'Dog' assets is a crucial part of EQT's strategy to enhance its financial performance and operational focus. By shedding underperforming or non-core assets, the company can free up capital for reinvestment in more promising growth areas or for returning value to shareholders. This focus on portfolio optimization is key to maintaining EQT's position as a leading, low-cost natural gas producer.

Question Marks

EQT's early-stage Carbon Capture, Utilization, and Storage (CCUS) initiatives, while promising for the energy transition, currently represent a nascent market position for the company. These ventures are characterized by substantial initial capital outlays and a degree of uncertainty regarding their eventual profitability and widespread adoption. For instance, a typical pilot CCUS project can cost tens to hundreds of millions of dollars, with full-scale facilities running into billions, reflecting the high-risk, high-growth profile.

These early efforts, akin to 'Question Marks' in the BCG matrix, demand significant investment to prove their viability and scalability. Success could propel them into 'Stars' as the CCUS market matures. The global market for CCUS is still in its formative years, with projections suggesting significant growth but also highlighting the current developmental stage of the technology and its infrastructure.

New, unproven drilling technologies or formations in the Appalachian Basin, such as exploring deeper shale plays or testing advanced hydraulic fracturing techniques, represent a 'Question Mark' in the EQT BCG Matrix. These ventures, while holding the promise of significant production breakthroughs, are currently characterized by low market share due to their nascent stage and inherent geological or technological uncertainties. The initial capital investment for such projects is substantial, reflecting the high risk involved.

For instance, the development of ultra-deep formations or the implementation of experimental completion fluids could fall into this category. While specific data on these emerging technologies is often proprietary and not widely disclosed, the general trend in the energy sector shows a significant increase in R&D spending on innovative drilling methods. In 2024, the global oil and gas industry's investment in technology and innovation is projected to reach hundreds of billions, with a notable portion allocated to exploring new frontiers and unproven techniques, aiming for higher recovery rates and reduced operational costs.

Investing in Renewable Natural Gas (RNG) projects, such as those utilizing landfill or agricultural waste, would position EQT in a high-growth market where its current market share is minimal. This sector is experiencing significant expansion due to environmental benefits and increasing market demand.

RNG represents a nascent but promising area, aligning with EQT's potential strategic diversification. However, it necessitates distinct expertise and infrastructure compared to EQT's core operations, classifying these initial investments as Question Marks within the BCG matrix. The global RNG market was valued at approximately $3.5 billion in 2023 and is projected to reach over $10 billion by 2030, demonstrating substantial growth potential.

Expansion into New Geographic Midstream Markets

Expansion into new geographic midstream markets for EQT would likely fall under the Question Mark category of the BCG Matrix. This is because such ventures require substantial upfront investment to construct new infrastructure, like pipelines and processing facilities, in regions where EQT currently lacks a footprint.

These new markets present both significant opportunities and considerable risks. While EQT could tap into new customer bases and achieve substantial growth if they successfully capture market share, the initial returns on investment are expected to be low due to the high capital expenditure and the need to establish a competitive presence against existing players. For instance, building new midstream infrastructure can cost hundreds of millions to billions of dollars, depending on the scale and complexity.

- High Capital Expenditure: Building new pipelines and processing plants in uncharted territories demands significant financial commitment.

- Intense Competition: Entering new geographic markets means facing established midstream operators already serving those regions.

- Potential for High Growth: Successful penetration of new markets can unlock substantial long-term revenue streams and market share.

- Low Initial Returns: The substantial upfront investment typically leads to low initial returns relative to the capital deployed.

Advanced Digitalization & AI for Unconventional Plays

Investing heavily in novel digital platforms or AI to boost unconventional well performance, aiming for results beyond current industry norms, fits the 'Question Mark' category. These ventures, while offering the potential for significant future efficiency and a competitive edge, are still in their nascent stages.

The financial commitment is substantial, and the broad market impact remains unproven. Success promises high returns on investment, but the initial risk is considerable.

- High R&D Spend: Companies might allocate over $50 million annually to AI development for enhanced drilling, as seen in some major oil and gas players' digital transformation initiatives in 2024.

- Uncertain ROI: While a breakthrough AI could improve recovery rates by 10-15%, the actual return on these early-stage investments is highly speculative.

- Early Adoption Phase: Only a handful of energy firms are actively piloting these advanced AI solutions, indicating a limited current market share impact.

- Potential Competitive Leap: Successful implementation could lead to a significant cost advantage, potentially reducing breakeven costs for unconventional plays by 5-10% in the long term.

Question Marks represent EQT's investments in areas with low current market share but in high-growth potential markets. These ventures require significant investment to determine their future success.

For example, EQT's exploration of new, unproven drilling technologies or formations, such as deeper shale plays, are classic Question Marks. These initiatives have substantial upfront costs and an uncertain path to profitability, mirroring the high-risk, high-reward profile of this BCG category.

Similarly, investments in Renewable Natural Gas (RNG) and expansion into new geographic midstream markets fall into the Question Mark quadrant. While these sectors show strong growth potential, EQT's current market share is minimal, necessitating considerable investment to establish a foothold and prove their viability.

The company's pursuit of novel digital platforms and AI for well performance enhancement also fits this classification, representing early-stage, high-investment initiatives with unproven market impact but significant potential for future competitive advantage.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Risk Level |

| CCUS Initiatives | High | Low | Very High | High |

| New Drilling Tech/Formations | Potentially High | Very Low | High | High |

| Renewable Natural Gas (RNG) | High | Low | Moderate to High | Moderate to High |

| New Geographic Midstream Markets | Moderate to High | Very Low | Very High | High |

| AI for Well Performance | High | Very Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, customer demographics, and competitive landscape analysis to provide a robust strategic framework.