EPAM Systems SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPAM Systems Bundle

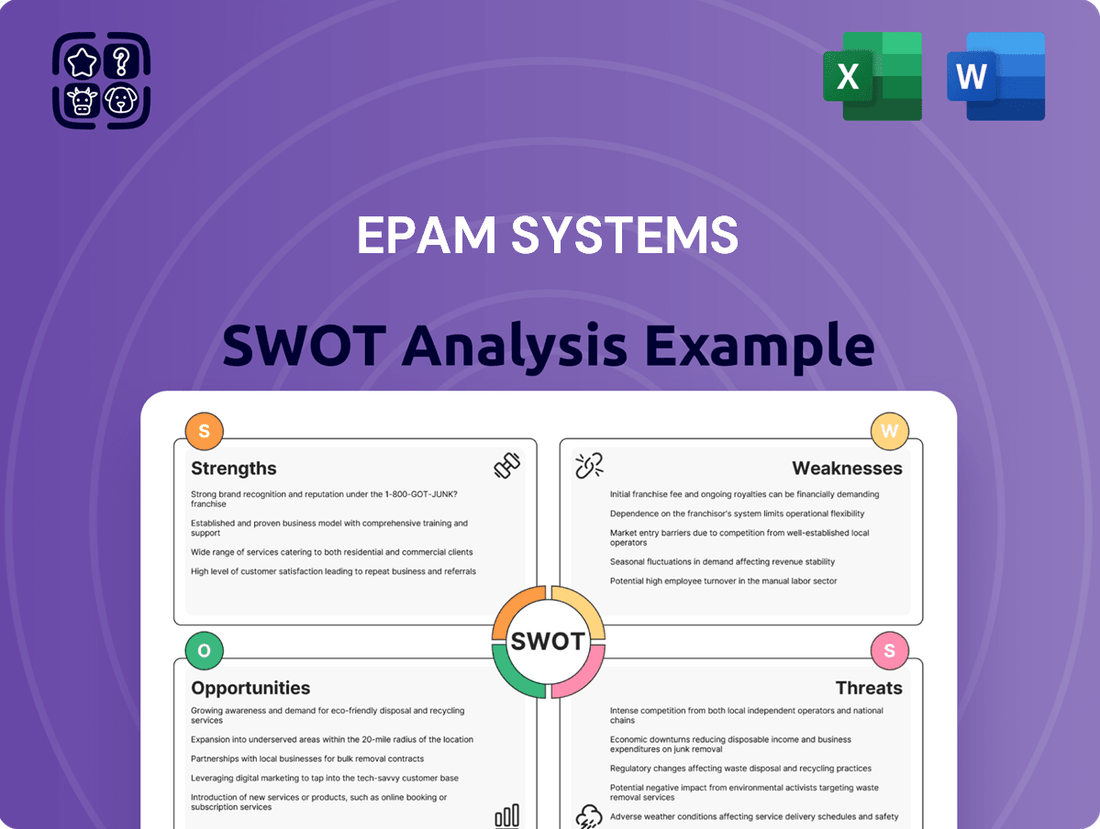

EPAM Systems leverages its robust engineering talent and global delivery model as key strengths, but faces challenges in intense market competition and potential economic downturns. Understanding these dynamics is crucial for navigating the future of digital transformation services.

Want the full story behind EPAM's competitive edge, potential vulnerabilities, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

EPAM Systems commands a powerful presence in the IT services sector, consistently ranking among the leading providers within the Fortune 1000. This robust market standing is a testament to its enduring brand reputation, further amplified by consistent recognition from prominent industry analysts such as Forrester and Gartner. These accolades, alongside numerous workplace awards, significantly enhance EPAM's appeal to both top-tier talent and a discerning client base, underscoring its ability to attract and retain business.

EPAM Systems boasts over three decades of deep engineering and digital transformation expertise, specializing in complex software development, digital platform creation, and AI-driven solutions. This extensive experience allows them to tackle intricate client challenges, setting them apart in the competitive IT services landscape.

Their core strength lies in delivering highly customized enterprise applications and robust digital solutions, a testament to their concentrated focus on engineering excellence. This specialization enables EPAM to provide tailored services that precisely meet diverse client needs.

EPAM effectively blends strategy, design, and technology consulting with strong engineering execution. This integrated approach is crucial for accelerating client time-to-market and fostering innovation, as evidenced by their consistent growth in digital transformation projects.

EPAM Systems is strategically doubling down on Artificial Intelligence and Generative AI, investing heavily in proprietary platforms such as EPAM DIAL, EPAM EliteA™, and EPAM AI/RUN™. This commitment places them as a key player in driving AI-powered digital transformations for clients, offering cutting-edge solutions for automation and swift AI application development.

Their robust AI focus is amplified by strategic alliances with major cloud providers like AWS and Google Cloud, enhancing the reach and effectiveness of their AI services. This synergy allows EPAM to deliver more integrated and powerful AI solutions, keeping them competitive in the rapidly evolving tech landscape.

Robust Financial Health and Acquisition Strategy

EPAM Systems demonstrates robust financial health, underscored by a balance sheet featuring more cash than debt as of Q1 2024, providing significant stability and strategic maneuverability. This strong financial footing enables the company to pursue an aggressive acquisition strategy, targeting tuck-in acquisitions to bolster its global presence and service offerings.

The company's commitment to expansion through acquisition is evident in recent strategic moves. In 2024, EPAM acquired First Derivative, a move aimed at strengthening its financial services vertical and expanding its data and analytics capabilities. Furthermore, the acquisition of NEORIS in early 2025 significantly enhances EPAM's footprint in Latin America and broadens its digital transformation expertise.

- Strong Cash Position: EPAM held approximately $1.4 billion in cash and cash equivalents against roughly $200 million in long-term debt as of the end of Q1 2024, indicating a healthy net cash position.

- Strategic Acquisitions: Recent acquisitions like First Derivative (completed in 2024) and NEORIS (completed in early 2025) highlight EPAM's proactive approach to inorganic growth.

- Geographic and Capability Expansion: These acquisitions are designed to deepen EPAM's market penetration in key regions and enhance its expertise in high-demand areas such as data analytics and digital transformation.

Global Delivery Capabilities and Talent Ecosystem

EPAM Systems boasts a robust global delivery network, strategically expanding its presence in key growth regions like India and Latin America. This geographic diversification allows for greater operational flexibility and access to a wider talent pool, contributing to its competitive edge.

The company's commitment to a 'skills-first' talent philosophy is a significant strength. EPAM actively invests in continuous learning, upskilling, and reskilling initiatives. For instance, in 2023, EPAM reported over 2.9 million hours of learning and development delivered to its employees, ensuring a highly adaptable and technically proficient workforce ready to meet evolving client demands.

- Global Delivery Centers: EPAM operates across North America, Europe, Asia, and Latin America, with significant delivery hubs in India and Eastern Europe.

- Talent Ecosystem: A focus on continuous learning and development aims to attract and retain top-tier tech talent.

- Skills-First Approach: Investment in upskilling and reskilling programs ensures workforce agility.

- 2023 L&D Investment: Over 2.9 million hours of learning delivered, underscoring commitment to talent development.

EPAM Systems benefits from a strong brand reputation, consistently recognized by industry analysts like Gartner and Forrester, which aids in attracting top talent and clients. Their deep engineering expertise, honed over three decades, allows them to tackle complex digital transformation projects, particularly in custom enterprise applications and AI-driven solutions. This specialization, combined with a strategic focus on AI and Generative AI, positions them as a leader in modernizing client operations.

The company's financial stability is a significant asset, with a robust cash position and manageable debt as of Q1 2024. This financial strength supports an aggressive acquisition strategy, as seen with the 2024 acquisition of First Derivative and the early 2025 acquisition of NEORIS, which expand their capabilities and geographic reach. EPAM also maintains a strong global delivery network and invests heavily in employee development, evidenced by over 2.9 million learning hours delivered in 2023, ensuring a highly skilled and adaptable workforce.

| Metric | Q1 2024 | Significance |

|---|---|---|

| Cash & Equivalents | ~$1.4 billion | Provides financial stability and funding for growth initiatives. |

| Long-term Debt | ~$200 million | Indicates a healthy net cash position and low financial risk. |

| Learning Hours Delivered (2023) | >2.9 million | Demonstrates commitment to talent development and workforce agility. |

What is included in the product

Delivers a strategic overview of EPAM Systems’s internal and external business factors, highlighting its strong market position and growth potential while acknowledging competitive pressures and potential economic headwinds.

Offers a clear, actionable framework to identify and leverage EPAM's strengths, mitigate weaknesses, capitalize on opportunities, and address threats.

Weaknesses

EPAM Systems faces a significant weakness due to its geographic concentration of revenue, with a substantial portion still stemming from North America. This reliance on a single major market exposes the company to heightened risk from regional economic downturns or adverse regulatory shifts. For instance, in the first quarter of 2024, North America represented approximately 58% of EPAM's total revenue, underscoring this ongoing vulnerability.

EPAM Systems has experienced a noticeable decrease in the utilization rates of its delivery professionals. For instance, in Q1 2024, the company reported a utilization rate of 75.3%, a dip from 77.4% in Q1 2023. This trend suggests potential challenges in aligning employee capacity with client project needs or an oversupply of resources relative to current demand.

EPAM Systems has shown a notable reliance on acquisitions for revenue expansion. For instance, in the first quarter of 2024, while overall revenue grew, the company highlighted that organic constant currency growth was lower. This suggests that a significant portion of their top-line increase is attributable to integrating new businesses rather than internal expansion.

This dependence on inorganic growth can present challenges. Integrating acquired companies is often complex and can lead to unforeseen costs or operational disruptions. While acquisitions can be a powerful tool for market share expansion and capability enhancement, a sustained ability to generate robust organic growth is crucial for demonstrating long-term, stable business health and efficiency.

Margin Pressure from Investments

EPAM's strategic investments in areas like AI infrastructure and ongoing research and development are creating a drag on its operating margins. These forward-looking expenditures, while vital for long-term competitive positioning, are contributing to a near-term squeeze on profitability. For instance, the company's commitment to expanding its AI capabilities is a significant undertaking that requires substantial upfront capital.

The integration costs stemming from recent acquisitions also add to this margin pressure. While these acquisitions are intended to bolster EPAM's service offerings and market reach, the process of merging operations and systems naturally incurs expenses that impact short-term financial performance. Balancing these investment needs with the imperative to maintain competitive pricing and profitability remains a central challenge for the company's management.

- Strategic Investments: Increased spending on AI and R&D impacts profitability.

- Integration Costs: Expenses related to recent acquisitions are pressuring margins.

- Near-Term Contraction: Profitability is expected to be lower in the short term due to these investments.

- Competitive Management: The challenge lies in managing costs while staying competitive.

Vulnerability to Discretionary IT Spending

EPAM's reliance on custom software development and digital transformation projects places it in a vulnerable position. These services are often viewed as discretionary IT spending, meaning clients may postpone or reduce them during economic downturns or periods of uncertainty. This can directly impact EPAM's revenue streams, leading to greater volatility when the broader economy falters.

For instance, while EPAM reported strong revenue growth in previous years, such as a 25% increase in 2022, macroeconomic headwinds in late 2023 and early 2024 have led to a more cautious client spending environment. This discretionary nature of their core offerings means that EPAM is more susceptible to fluctuations in client budgets compared to companies providing essential IT infrastructure or maintenance services.

- Discretionary Spending: Custom software and digital transformation are often the first areas clients reduce when budgets tighten.

- Revenue Volatility: Economic slowdowns can directly translate into unpredictable revenue for EPAM due to project deferrals.

- Competitive Pressure: During weaker economic periods, competition for remaining discretionary IT budgets intensifies.

EPAM Systems faces a significant weakness in its reliance on a few large clients, which can create revenue instability if any of these key accounts are lost or reduced. In the first quarter of 2024, the company noted that its top 10 clients accounted for approximately 30% of its total revenue. This concentration means a substantial portion of their business is tied to the decisions of a limited number of partners.

Full Version Awaits

EPAM Systems SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. Our EPAM Systems SWOT analysis provides a comprehensive overview of their Strengths, Weaknesses, Opportunities, and Threats. The content below is pulled directly from the final SWOT analysis, offering you an accurate representation of the insights you'll gain.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase, giving you a complete understanding of EPAM Systems' strategic position. This detailed analysis will equip you with the knowledge to make informed decisions.

Opportunities

The relentless global push for digital transformation, amplified by the swift integration of AI and generative AI, creates a substantial growth avenue for EPAM. Businesses worldwide are actively seeking sophisticated software engineering and consulting services to overhaul their existing infrastructure, harness the power of data, and deploy AI-powered functionalities.

EPAM's strategic emphasis and dedicated investments in these cutting-edge domains are instrumental in positioning the company to capitalize on this burgeoning market. For instance, in the first quarter of 2024, EPAM reported a 5.5% year-over-year revenue increase, reaching $1.17 billion, underscoring its ability to meet this escalating demand.

EPAM Systems has a significant opportunity to grow its global reach, especially in emerging markets like Latin America and India, which are showing strong economic growth. This geographic expansion allows EPAM to tap into new talent pools and cater to a wider range of clients.

The company's recent acquisitions, including NEORIS and VATES, highlight a strategic move to bolster its nearshore delivery capabilities. This strengthens its presence in regions closer to its key client bases, offering quicker response times and better cultural alignment.

By diversifying its delivery centers, EPAM can mitigate risks associated with concentrating operations in any single geographic area. This strategic diversification improves business continuity and resilience against regional disruptions, ensuring more reliable service delivery for its clients.

EPAM Systems can strategically acquire companies to rapidly expand its service portfolio, integrating new technologies and client bases. This inorganic growth is crucial for staying competitive, especially in fast-evolving sectors like digital engineering and cloud solutions. For instance, EPAM's acquisition of Continuum in 2017 significantly bolstered its design and innovation capabilities, demonstrating the power of this strategy.

Leveraging Emerging Technologies beyond AI

EPAM can expand its service offerings beyond artificial intelligence by deeply integrating other burgeoning technologies like virtual reality (VR) and robotics. As VR and robotics gain traction in various industries, EPAM's established engineering capabilities position it to create cutting-edge solutions and platforms for clients eager to adopt these advancements.

This strategic diversification into areas like VR and robotics presents a significant opportunity for EPAM to tap into new markets and generate additional revenue streams. For instance, the global VR market was valued at approximately $28.2 billion in 2023 and is projected to reach $220.9 billion by 2030, indicating substantial growth potential.

- VR Integration: Developing immersive VR experiences for training, product visualization, and customer engagement.

- Robotics Solutions: Offering expertise in industrial automation, collaborative robots, and autonomous systems.

- Platform Development: Building scalable platforms that enable clients to leverage VR and robotics effectively.

Deepening Client Relationships and Cross-Selling

EPAM's established client base, with many relationships exceeding ten years, presents a significant opportunity to deepen engagement and expand service offerings. This long-term trust, coupled with a thorough understanding of clients' IT infrastructures, enables EPAM to proactively address evolving needs and propose integrated solutions.

The company's ability to offer a full spectrum of services, from initial consulting and design through engineering and ongoing operations, allows for comprehensive client solutions. This client loyalty is a key driver for predictable recurring revenue streams and sustained growth. For instance, EPAM reported that its top 20 clients, representing a substantial portion of its revenue, demonstrate the strength of these long-term partnerships.

- Deepened Engagement: Over a decade of partnership allows for a more profound understanding of client business objectives.

- Cross-Selling Potential: Existing trust facilitates the introduction of new services like cloud migration or AI solutions.

- Recurring Revenue: Long-term contracts and ongoing projects contribute to stable and predictable income.

- Client Loyalty: Strong relationships foster repeat business and reduce client acquisition costs.

EPAM is well-positioned to capitalize on the escalating global demand for digital transformation, particularly with the increasing integration of AI and generative AI technologies. Businesses are actively seeking expert software engineering and consulting services to modernize their systems and implement AI-driven functionalities.

The company has a clear opportunity to expand its global footprint, with emerging markets like Latin America and India presenting significant growth potential due to their robust economic expansion. EPAM's strategic acquisitions, such as NEORIS and VATES, bolster its nearshore delivery capabilities, enhancing client proximity and service responsiveness.

Further diversification into emerging technologies like virtual reality (VR) and robotics offers substantial new revenue streams. The global VR market alone was valued at approximately $28.2 billion in 2023, with projections indicating significant expansion.

Leveraging its strong, long-standing client relationships, EPAM can deepen engagement and expand service offerings. The company's ability to provide end-to-end solutions fosters client loyalty and predictable recurring revenue, exemplified by its top 20 clients contributing significantly to its overall revenue.

| Opportunity Area | Description | Supporting Data/Example |

|---|---|---|

| Digital Transformation & AI | Meeting global demand for AI integration and software engineering. | Q1 2024 revenue: $1.17 billion, up 5.5% YoY. |

| Geographic Expansion | Tapping into growth in emerging markets like Latin America and India. | Acquisition of NEORIS and VATES to strengthen nearshore capabilities. |

| Technology Diversification | Expanding into VR and robotics solutions. | Global VR market projected to reach $220.9 billion by 2030. |

| Client Relationship Deepening | Leveraging long-term partnerships for expanded service offerings. | Top 20 clients represent a substantial portion of EPAM's revenue. |

Threats

The IT services landscape is a battlefield, with giants like Accenture and Infosys constantly vying for market dominance. This fierce competition, evident in the ongoing talent wars and client acquisition efforts, directly impacts pricing power and the ability to secure new contracts.

EPAM, like its peers, faces immense pressure to innovate and stand out. For instance, in 2023, the global IT services market was valued at over $1.3 trillion, with growth projected to continue, but this expansion is shared among many. This means EPAM must consistently deliver superior value to maintain its competitive edge and capture a larger share of this expanding market.

The relentless pace of technological change presents a significant threat to EPAM Systems. Failure to adapt to emerging trends and integrate new tools quickly can render existing capabilities obsolete, eroding competitive advantage. For instance, the rapid advancements in AI and machine learning throughout 2024 and into 2025 demand continuous investment in R&D and workforce retraining to maintain relevance in a rapidly evolving digital landscape.

Global economic uncertainties, including persistent inflation and the risk of recessions in key markets, are projected to dampen enterprise IT spending throughout 2024 and into 2025. For instance, many analysts predict a slowdown in digital transformation budgets as companies prioritize cost optimization.

This environment can lead clients to delay or scale back investments in areas like custom software development and cloud migration, directly impacting EPAM's revenue streams and profitability. EPAM's reliance on discretionary spending for many of its digital engineering and consulting services makes it particularly vulnerable to these macroeconomic pressures.

Geopolitical and Regional Instability

EPAM Systems, like many global technology firms, is susceptible to disruptions stemming from geopolitical tensions and conflicts in key operational regions. While EPAM has a diversified workforce, significant instability in any of its major delivery centers could affect service delivery, talent acquisition, and overall financial results. For instance, the ongoing conflict in Eastern Europe, where EPAM has a substantial talent pool, presents a persistent risk. The company's ability to navigate these challenges hinges on proactive business continuity strategies and operational flexibility.

The company's exposure to geopolitical risks is a notable threat, potentially impacting its ability to deliver services seamlessly. For example, in 2022, EPAM reported that a significant portion of its workforce was located in Ukraine and Russia, highlighting the direct impact of regional conflicts. While EPAM has been actively relocating employees and diversifying its delivery locations, the ongoing nature of these geopolitical events necessitates continuous risk assessment and mitigation efforts.

- Geopolitical Instability: Risks associated with conflicts and political unrest in Eastern Europe, a significant operational hub for EPAM.

- Operational Disruption: Potential impact on service delivery and talent availability due to regional instability.

- Talent Diversification: Ongoing efforts to mitigate risks by expanding operations in other geographical locations.

- Business Continuity: The critical need for robust planning to address unforeseen events in operating regions.

Cybersecurity and Data Breaches

As a major player in digital platform engineering, EPAM Systems and its clientele are perpetually in the crosshairs of cyber threats and potential data breaches. The company's reliance on digital infrastructure makes it a prime target, and a significant security lapse could be devastating. For instance, a major breach in 2023 could have resulted in millions in recovery costs and regulatory fines, severely damaging client trust.

A serious cybersecurity incident could cripple EPAM's operations, tarnish its reputation, and negatively affect its financial performance. This would likely lead to a loss of client confidence and substantial legal liabilities, impacting future revenue streams. Protecting sensitive client and company data is paramount, requiring ongoing, robust investment in advanced cybersecurity protocols and constant vigilance against evolving threats.

EPAM’s commitment to cybersecurity is critical for maintaining its market position. In 2024, many IT service firms reported increased spending on cybersecurity, with some allocating upwards of 15% of their IT budget to security measures. EPAM must keep pace with these investments to safeguard its digital assets and client information effectively.

Key considerations for EPAM regarding cybersecurity threats include:

- Constant Vigilance: Maintaining 24/7 monitoring of systems for suspicious activity.

- Proactive Defense: Implementing advanced threat detection and prevention tools.

- Data Protection: Ensuring robust encryption and access control for all sensitive data.

- Incident Response: Developing and regularly testing comprehensive plans to address breaches swiftly.

Intense competition within the IT services sector, with major players like Accenture and Infosys, puts pressure on EPAM's pricing and ability to win new business. The rapid evolution of technology, particularly AI and machine learning, necessitates continuous investment in R&D and workforce retraining to avoid obsolescence. Global economic uncertainties, including inflation and potential recessions, are expected to curb IT spending in 2024-2025, impacting EPAM's revenue from digital engineering and consulting services.

SWOT Analysis Data Sources

This EPAM Systems SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and reputable industry analyses to provide a well-rounded perspective.