EPAM Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPAM Systems Bundle

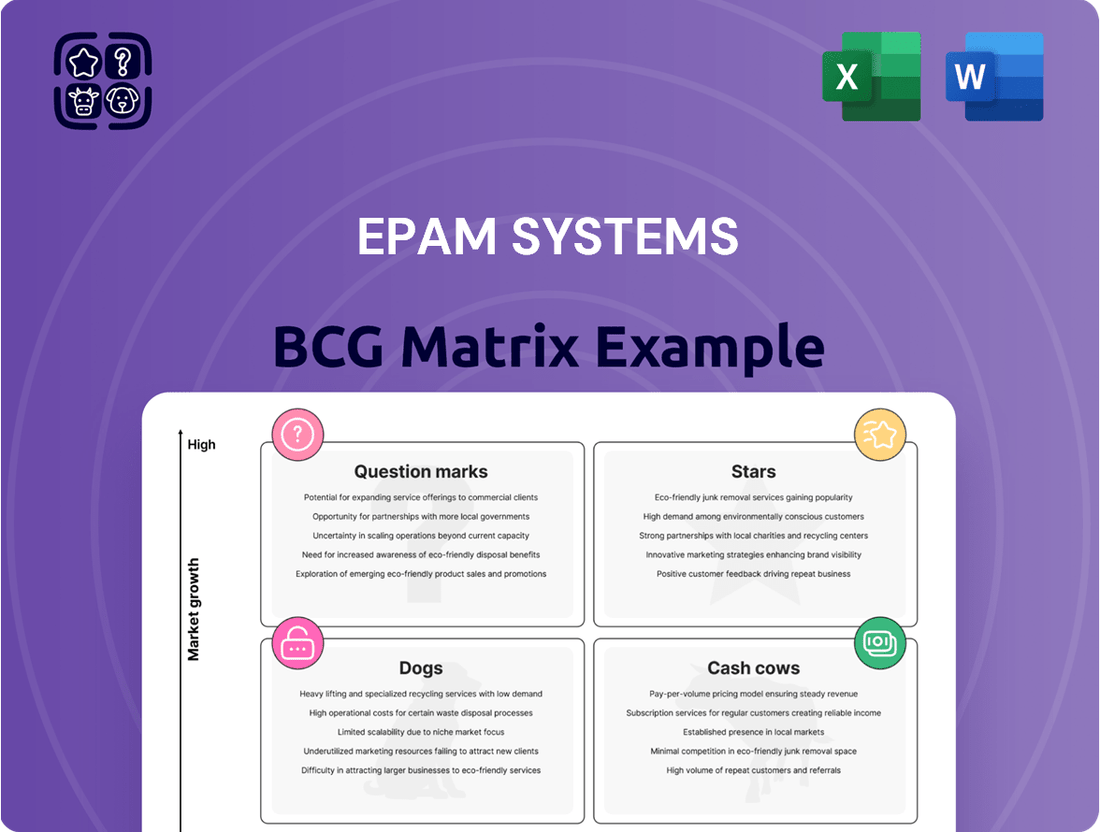

Curious about EPAM Systems' strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges.

Unlock the full potential of this analysis by purchasing the complete EPAM Systems BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable strategies for optimizing their product mix and driving future success.

Don't miss out on the detailed insights and data-backed recommendations that will empower your own strategic decision-making. Invest in the full report today and navigate the competitive landscape with confidence.

Stars

EPAM Systems is seeing impressive growth in its AI and Generative AI (GenAI) services, with revenues climbing at a strong double-digit rate each quarter. This surge is a clear indicator of the market's demand for these advanced solutions.

The impact of AI is substantial, as evidenced by the fact that 40% of EPAM's new client contracts now incorporate AI-driven solutions. This highlights the integration of AI into the core of their client offerings.

EPAM's commitment to innovation is further demonstrated through its proprietary platforms like DIAL 3.0 and its strategic alliances with leading cloud providers such as AWS and Google Cloud. These efforts position EPAM as a key player in the dynamic and high-growth AI market.

Digital Product and Platform Engineering is a cornerstone of EPAM Systems, fueling its growth through extensive digital transformation projects worldwide. EPAM's recognized excellence in cloud-native services and intricate software development solidifies its market position.

This segment is critical to EPAM's overall strategy and value delivery. For instance, in 2023, EPAM reported that its digital transformation and platform engineering services accounted for a significant portion of its revenue, demonstrating strong market demand and the company's capabilities.

EPAM Systems is positioned strongly in the data modernization and analytics market, a sector experiencing significant growth. IDC MarketScape recognized EPAM as a leader in this domain in 2024, highlighting their capabilities in helping organizations transform their data landscapes.

EPAM's approach focuses on leveraging deep data and analytics expertise, augmented by AI-integrated tools. This allows them to assist clients in not only building new data capabilities but also scaling them effectively to meet future needs.

This strategic focus on data modernization is crucial for businesses aiming to remain agile and make informed, data-driven decisions in today's dynamic environment. The global data analytics market was valued at over $27 billion in 2023 and is projected to grow substantially.

Financial Services Technology Solutions

EPAM's Financial Services Technology Solutions are a key driver of its business, demonstrating robust expansion. In the first quarter of 2025, this segment experienced a substantial 29.3% year-over-year growth, indicating a powerful recovery and strong market demand.

This upward trajectory is further bolstered by strategic moves, including the acquisition of First Derivative. This acquisition significantly strengthens EPAM's capabilities within the capital markets, a high-value area for financial services technology. The integration of First Derivative's expertise allows EPAM to offer more comprehensive solutions to its clients.

EPAM is strategically positioned to leverage the continuous digital transformation needs of financial institutions. Their expanded offerings cater to evolving market demands, ensuring they remain a competitive force.

- Segment Growth: Q1 2025 saw a 29.3% year-over-year increase in EPAM's Financial Services segment.

- Strategic Acquisition: The acquisition of First Derivative enhances offerings in capital markets.

- Market Position: EPAM is well-equipped to address the ongoing digital needs of financial institutions.

- Future Outlook: The company is poised to capitalize on digital transformation trends in the financial sector.

Cloud Transformation Services

Cloud Transformation Services are a significant driver for EPAM Systems, reflecting the booming global demand for cloud adoption. EPAM's expertise in building cloud-native applications and guiding businesses through migration and optimization positions them favorably in this high-growth sector.

This service is vital for businesses aiming to enhance their IT infrastructure's scalability and operational efficiency. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the substantial opportunity.

- Market Growth: The cloud transformation market continues its robust expansion, driven by digital initiatives.

- EPAM's Strength: EPAM demonstrates strong capabilities in cloud-native development and migration assistance.

- Client Value: These services are essential for enterprises seeking improved scalability and efficiency.

- Industry Trend: Cloud adoption remains a critical strategic imperative for businesses worldwide.

EPAM's AI and Generative AI services are clearly stars in their BCG Matrix. With revenues growing at a strong double-digit rate each quarter and 40% of new client contracts incorporating AI, the market demand is undeniable.

Their proprietary platforms like DIAL 3.0 and partnerships with AWS and Google Cloud solidify their leadership in this high-growth, dynamic sector, making them a key player to watch.

Digital Product and Platform Engineering also shines as a star. This segment fuels EPAM's growth through extensive digital transformation projects, with recognized excellence in cloud-native services and complex software development, demonstrating strong market demand and capability.

EPAM's Data Modernization and Analytics is a star, recognized by IDC MarketScape as a leader in 2024. Their AI-augmented approach helps clients build and scale data capabilities, crucial for remaining agile in a market valued at over $27 billion in 2023.

The Financial Services Technology Solutions are also stars, evidenced by a 29.3% year-over-year growth in Q1 2025. The acquisition of First Derivative further strengthens their capital markets offerings, positioning them to meet evolving financial institution needs.

Cloud Transformation Services are another star segment for EPAM, capitalizing on the booming global cloud adoption market, projected to exceed $600 billion in 2024. EPAM's expertise in cloud-native development and migration is vital for businesses seeking enhanced scalability and efficiency.

| Segment | BCG Classification | Growth Driver | Key Metrics/Data Points |

|---|---|---|---|

| AI & Generative AI | Star | Market demand for advanced AI solutions | Double-digit quarterly revenue growth; 40% of new contracts include AI |

| Digital Product & Platform Engineering | Star | Global digital transformation projects | Extensive project portfolio; recognized excellence in cloud-native and software development |

| Data Modernization & Analytics | Star | Need for data-driven decision making | IDC MarketScape Leader (2024); global market >$27B (2023) |

| Financial Services Technology | Star | Digital transformation in financial institutions | 29.3% YoY growth (Q1 2025); First Derivative acquisition |

| Cloud Transformation Services | Star | Global cloud adoption | Global cloud market >$600B (2024 projection); expertise in cloud-native and migration |

What is included in the product

EPAM Systems BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides EPAM's investment decisions, highlighting which units to grow, maintain, or divest for optimal resource allocation.

EPAM Systems BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of complex data analysis for strategic decision-making.

Cash Cows

EPAM's established software development services, a cornerstone of their business, are clear Cash Cows. With over 30 years of experience, these mature service lines consistently deliver high-margin revenue. For example, EPAM's revenue in 2023 reached $4.83 billion, showcasing the enduring strength of these foundational offerings.

These services benefit from deep-rooted client relationships and well-honed methodologies, allowing them to generate stable, predictable income. The need for significant new investment is minimal, as these operations are already highly efficient and optimized for profitability.

EPAM's core IT consulting and advisory services, including its integrated EPAM Continuum practice, function as significant cash cows. These services leverage a 'Systems Thinking' approach to tackle intricate business problems for a global clientele, capitalizing on EPAM's deep industry expertise and established client relationships.

These advisory offerings are known for generating stable and predictable revenue streams, contributing substantially to EPAM's overall financial health. For instance, in 2023, EPAM reported revenue of $4.83 billion, with consulting and digital platform engineering being key drivers, underscoring the maturity and consistent performance of these established business units.

EPAM Systems' acquisition of First Derivative has bolstered its managed services and consulting for capital markets, establishing a strong market presence. This segment is poised to be a significant cash cow, generating consistent and substantial revenue due to its specialized expertise and loyal clientele. In 2023, EPAM's overall revenue reached $4.83 billion, and this strategic integration is expected to contribute positively to future earnings, reflecting the growing demand for specialized financial services.

Enterprise Systems Modernization

Enterprise Systems Modernization is a strong Cash Cow for EPAM Systems. The company has a significant history of helping major global businesses update their critical IT infrastructure and boost their tech capabilities.

These projects are often complex and span extended periods with existing clients, generating reliable and ongoing revenue. The constant need for businesses to maintain up-to-date enterprise systems creates a stable market demand for EPAM's services in this area. For instance, in 2023, EPAM reported that its digital transformation services, which heavily include modernization, accounted for a substantial portion of its revenue, demonstrating the consistent performance of this segment.

- Proven Expertise: EPAM has a deep understanding of legacy system migration and cloud adoption strategies.

- Recurring Revenue: Long-term contracts with large enterprises provide predictable income.

- Stable Market: The ongoing necessity for businesses to modernize ensures consistent demand.

- Client Retention: Successful modernization projects often lead to further engagements and deeper client relationships.

Quality Engineering and Testing Services

EPAM's Quality Engineering and Testing Services are a prime example of a Cash Cow within its BCG Matrix. These services are fundamental to the software development lifecycle, ensuring the reliability and performance of digital products. Their consistent demand across diverse industries, including financial services and healthcare, solidifies their position as a stable revenue generator for EPAM.

EPAM reported that its Software Engineering segment, which heavily includes quality engineering and testing, generated approximately $3.6 billion in revenue in 2023. This highlights the significant and ongoing contribution of these services. Clients rely on EPAM's expertise to validate complex digital transformations, making these offerings a foundational and predictable income stream.

- Consistent Demand: Quality engineering and testing are essential for all digital initiatives, ensuring client satisfaction and product integrity.

- Reliable Revenue Stream: EPAM's established expertise in this domain leads to a steady flow of projects and recurring business.

- Foundational Service: These services are critical for clients' digital investments, providing assurance and reducing risks.

- Industry-Wide Applicability: Demand spans across numerous sectors, from technology and finance to healthcare and manufacturing, demonstrating broad market penetration.

EPAM's established software development services, a cornerstone of their business, are clear Cash Cows. With over 30 years of experience, these mature service lines consistently deliver high-margin revenue. For example, EPAM's revenue in 2023 reached $4.83 billion, showcasing the enduring strength of these foundational offerings.

These services benefit from deep-rooted client relationships and well-honed methodologies, allowing them to generate stable, predictable income. The need for significant new investment is minimal, as these operations are already highly efficient and optimized for profitability.

EPAM's core IT consulting and advisory services, including its integrated EPAM Continuum practice, function as significant cash cows. These services leverage a 'Systems Thinking' approach to tackle intricate business problems for a global clientele, capitalizing on EPAM's deep industry expertise and established client relationships.

These advisory offerings are known for generating stable and predictable revenue streams, contributing substantially to EPAM's overall financial health. For instance, in 2023, EPAM reported revenue of $4.83 billion, with consulting and digital platform engineering being key drivers, underscoring the maturity and consistent performance of these established business units.

EPAM Systems' acquisition of First Derivative has bolstered its managed services and consulting for capital markets, establishing a strong market presence. This segment is poised to be a significant cash cow, generating consistent and substantial revenue due to its specialized expertise and loyal clientele. In 2023, EPAM's overall revenue reached $4.83 billion, and this strategic integration is expected to contribute positively to future earnings, reflecting the growing demand for specialized financial services.

Enterprise Systems Modernization is a strong Cash Cow for EPAM Systems. The company has a significant history of helping major global businesses update their critical IT infrastructure and boost their tech capabilities.

These projects are often complex and span extended periods with existing clients, generating reliable and ongoing revenue. The constant need for businesses to maintain up-to-date enterprise systems creates a stable market demand for EPAM's services in this area. For instance, in 2023, EPAM reported that its digital transformation services, which heavily include modernization, accounted for a substantial portion of its revenue, demonstrating the consistent performance of this segment.

EPAM's Quality Engineering and Testing Services are a prime example of a Cash Cow within its BCG Matrix. These services are fundamental to the software development lifecycle, ensuring the reliability and performance of digital products. Their consistent demand across diverse industries, including financial services and healthcare, solidifies their position as a stable revenue generator for EPAM.

EPAM reported that its Software Engineering segment, which heavily includes quality engineering and testing, generated approximately $3.6 billion in revenue in 2023. This highlights the significant and ongoing contribution of these services. Clients rely on EPAM's expertise to validate complex digital transformations, making these offerings a foundational and predictable income stream.

| EPAM Cash Cow Services | Description | 2023 Revenue Contribution (Estimated) | Key Strengths |

|---|---|---|---|

| Software Development Services | Mature, high-margin revenue generation with deep client relationships. | Significant portion of $4.83 billion total revenue. | Proven expertise, long-term contracts, stable market demand. |

| IT Consulting & Advisory (EPAM Continuum) | Leverages 'Systems Thinking' for complex business problems. | Key driver of $4.83 billion total revenue. | Deep industry expertise, established client base, predictable income. |

| Capital Markets Managed Services & Consulting (Post-First Derivative acquisition) | Specialized expertise in financial services. | Expected positive contribution to future earnings. | Loyal clientele, specialized knowledge, growing demand. |

| Enterprise Systems Modernization | Updating critical IT infrastructure for global businesses. | Substantial portion of digital transformation revenue. | Complex, long-term projects, recurring revenue, stable market. |

| Quality Engineering & Testing | Ensuring reliability and performance of digital products. | Approximately $3.6 billion within Software Engineering segment. | Consistent demand, foundational service, industry-wide applicability. |

Full Transparency, Always

EPAM Systems BCG Matrix

The EPAM Systems BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a polished, analysis-ready document designed for strategic decision-making.

What you see now is the exact EPAM Systems BCG Matrix file that will be delivered to you upon completing your purchase. It has been meticulously prepared with actionable insights and a professional layout, ensuring you get a high-quality tool for evaluating EPAM's business portfolio without any further modifications required.

This preview accurately represents the final EPAM Systems BCG Matrix document you'll download after your purchase. You can be confident that the content and structure are precisely what you need for strategic planning, offering immediate usability for presentations or internal analysis.

Dogs

Pure Legacy System Maintenance, within the EPAM Systems BCG Matrix, would likely be categorized as a 'Dog'. These services involve the upkeep of outdated systems with minimal innovation or growth potential. In 2024, EPAM's strategic emphasis remained on digital transformation and product engineering, areas with significantly higher growth prospects and margins compared to pure maintenance.

EPAM Systems' Non-Strategic Regional Operations (Post-Exit) represent units with minimal market presence and growth potential, often remnants of previous strategic focuses. These could include small, winding-down client engagements in regions where EPAM has significantly reduced its footprint, such as certain Eastern European countries following its 2022 exit from Russia. Such operations are typically resource-intensive with little to no return, acting as a drag on overall profitability and strategic focus.

Undifferentiated IT staff augmentation services at EPAM Systems would likely fall into the Dogs quadrant of the BCG Matrix. These offerings typically involve providing basic IT personnel without significant specialization, facing high competition and low profit margins. For instance, in 2024, the IT staffing market saw continued pressure on rates for generalist roles, with average hourly rates for basic developers hovering around $60-$80, a stark contrast to the premium rates for specialized engineering talent.

Unsuccessful or Unscaled Minor Acquisitions

EPAM Systems, in its pursuit of expanding capabilities, has undertaken various acquisitions. However, some of these smaller, older acquisitions may not have achieved successful integration or scaled sufficiently to meaningfully contribute to EPAM's primary, high-growth service areas.

These underperforming acquisitions could be viewed as potentially trapped capital, exhibiting minimal market impact or growth potential. For instance, if an acquisition made several years ago, intended to bolster a specific niche service, has not shown a significant uptick in revenue or client adoption within EPAM’s broader offerings, it might fall into this category.

- Underperforming Acquisitions: Smaller, older acquisitions that haven't scaled or integrated effectively into EPAM's core, high-growth service lines.

- Trapped Capital: These may represent investments with limited market impact or growth, potentially tying up resources without substantial returns.

- Strategic Review: Such acquisitions would typically undergo a strategic review to determine if further investment or divestment is warranted.

- Impact on Growth: Their lack of contribution can dilute overall growth metrics and indicate areas for operational improvement or restructuring.

Support for Obsolete Technology Stacks

EPAM Systems' service lines focused on supporting obsolete technology stacks would likely fall into the Dogs category of the BCG Matrix. These areas, while potentially providing some revenue, are characterized by low market growth and a declining market share as newer technologies gain traction. For instance, a significant portion of EPAM's legacy business might involve maintaining COBOL-based systems or older Java versions, which are no longer primary drivers of new client engagements.

EPAM's strategic emphasis on modern and emerging technologies, such as cloud-native development, AI, and data analytics, means that continued substantial investment in outdated areas is strategically unproductive. Resources allocated to these legacy stacks could be better utilized in high-growth segments. For example, EPAM’s 2024 investor reports highlight substantial growth in their digital transformation and cloud services, overshadowing any gains from legacy support.

- Low Market Growth: The demand for expertise in technologies like older mainframe systems or deprecated programming languages is shrinking.

- Declining Market Share: As clients migrate to modern platforms, EPAM's share in these legacy segments naturally diminishes.

- Resource Misallocation: Continued investment diverts talent and capital from more profitable, high-growth areas.

- Strategic Incompatibility: Focus on obsolete tech contradicts EPAM's stated strategy of leading in digital innovation.

EPAM's legacy system maintenance, including support for obsolete technology stacks and non-strategic regional operations post-exit, would be classified as Dogs. These areas exhibit low market growth and declining relevance, often representing remnants of past strategies rather than future growth engines. For instance, in 2024, EPAM's investor focus remained on high-growth digital transformation and cloud services, which saw significant revenue increases, while legacy support likely contributed minimally to overall growth.

Undifferentiated IT staff augmentation also falls into the Dog category due to intense competition and low margins. The IT staffing market in 2024 continued to show a significant disparity in rates, with basic developer roles averaging $60-$80 per hour, contrasting sharply with specialized engineering talent commanding much higher premiums.

Underperforming acquisitions, where smaller, older investments haven't scaled or integrated effectively, also represent potential Dogs. These can tie up capital with limited market impact, necessitating strategic review for potential divestment or restructuring to optimize resource allocation towards EPAM's core, high-growth service lines.

Question Marks

EPAM's Emerging Verticals, particularly in areas like advanced AI applications for specialized industries and quantum computing services, represent their Stars. While EPAM reported robust growth in Q1 2025, these nascent offerings are still in their early stages of market penetration. These segments are characterized by high growth potential but currently hold a low market share, demanding substantial investment to build leadership. For instance, their work in generative AI for pharmaceutical research, a nascent area, shows promise but requires continued development and client acquisition to solidify its position.

EPAM's foray into Metaverse and Web3 engineering services positions them in a nascent, high-growth potential market. While current market share is likely minimal, significant investment here could establish EPAM as a leader as these technologies mature. This strategic move aligns with their commitment to innovation and exploring future tech landscapes.

EPAM's proprietary AI platforms, like DIAL and AI/RUN, are currently in the scaling phase, representing a significant investment for the company. While the broader AI services segment is a star performer, these specific platforms are still working to achieve widespread client adoption and build substantial market share.

These platforms hold considerable future growth potential, but their development and market penetration require ongoing cash investment. As of early 2024, EPAM has been actively showcasing these platforms, aiming to convert their technological capabilities into tangible revenue streams and a stronger competitive position in the AI solutions market.

Expansion into New Geographies (Early Stages)

EPAM Systems is strategically venturing into new geographic territories, focusing on regions like Western and Central Asia, and Latin America. These emerging markets are identified as high-growth potential areas, aligning with the characteristics of a question mark in the BCG matrix.

While these nascent operations represent significant future opportunities, they currently hold a modest market share within these new geographies. This necessitates considerable investment in building out infrastructure and recruiting specialized talent to establish a stronger foothold.

- Geographic Focus: Expansion into Western and Central Asia, and Latin America.

- Market Position: Low market share in these new, high-growth regions.

- Investment Needs: Significant capital required for infrastructure and talent development.

- Strategic Goal: To capture future market share and leverage growth potential.

Specialized Cybersecurity Advisory and Advanced Risk Management

EPAM Systems provides specialized cybersecurity advisory and advanced risk management solutions. These services are designed to address evolving threats and stringent compliance requirements, positioning them in a dynamic market segment.

Within the BCG framework, these offerings would likely be categorized as Question Marks. This is because the cybersecurity market is experiencing rapid growth, driven by increasing cyberattacks and regulatory pressures. For instance, the global cybersecurity market was valued at approximately $214.9 billion in 2023 and is projected to reach $345.4 billion by 2026, indicating a substantial growth trajectory.

- High Growth Potential: The increasing sophistication of cyber threats and the expanding digital footprint of businesses create a fertile ground for growth in specialized cybersecurity services.

- Market Uncertainty: While the market is growing, EPAM's specific specialized offerings may still be establishing their market share and competitive positioning.

- Investment Requirement: Significant strategic investment in research, development, and market penetration is typically needed for Question Mark products or services to gain traction.

- Strategic Focus: EPAM's success in this area hinges on its ability to adapt to emerging threats, innovate its service portfolio, and effectively communicate its value proposition to clients facing complex risk landscapes.

EPAM's expansion into new geographic markets, such as Western and Central Asia, and Latin America, fits the profile of Question Marks. These regions represent high-growth potential, but EPAM currently holds a relatively low market share there.

Significant investment is required to build infrastructure and talent in these emerging territories to capture future market share. This strategic move aims to leverage the growth opportunities present in these developing economies.

Specialized cybersecurity advisory and advanced risk management solutions also fall into the Question Mark category. The cybersecurity market is rapidly expanding, but EPAM's specific offerings are still solidifying their market position.

These services require ongoing investment in R&D and market penetration to gain traction against established players and evolving threats. Success hinges on innovation and effectively communicating value in a complex risk environment.

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial disclosures, market research reports, and competitive landscape analysis to provide actionable strategic insights.