EPAM Systems Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPAM Systems Bundle

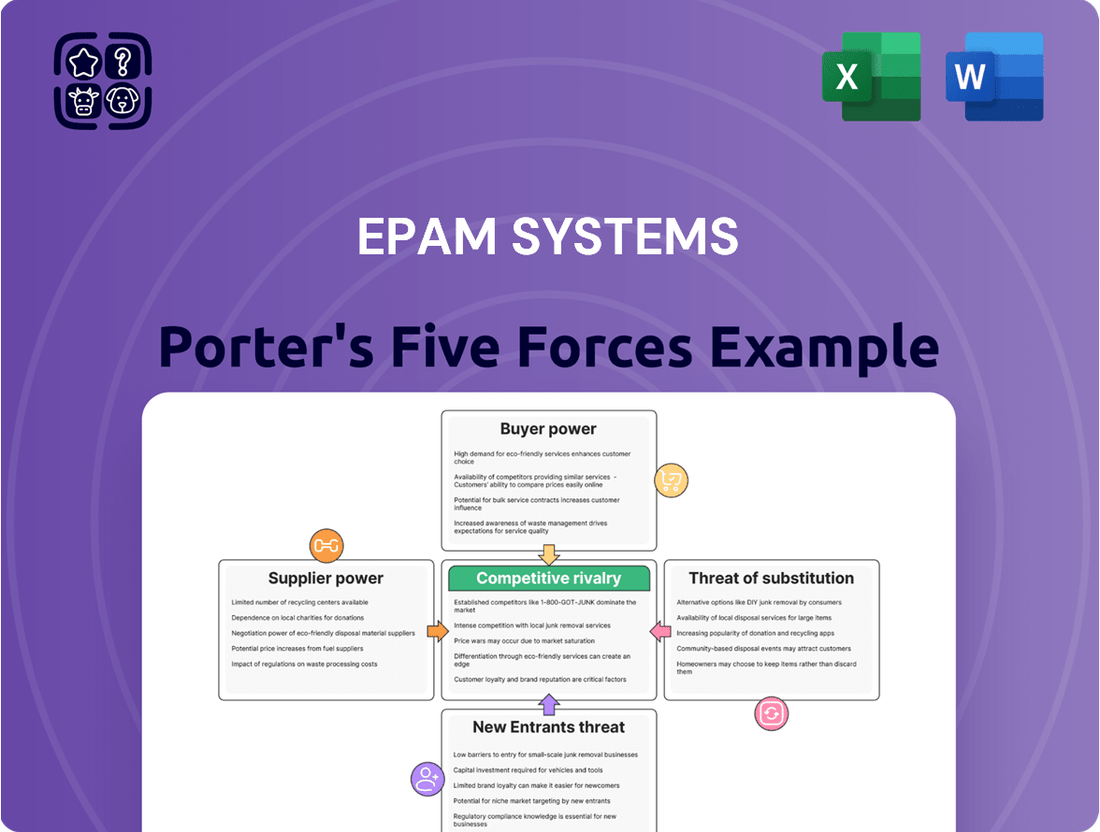

EPAM Systems operates in a dynamic IT services landscape where buyer power is significant, and the threat of substitutes is ever-present as technology evolves rapidly. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping EPAM Systems’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EPAM Systems' reliance on a highly skilled workforce, especially in cutting-edge fields like digital platform engineering, AI, and cloud technologies, significantly impacts supplier bargaining power. The limited availability of professionals with these niche proficiencies grants them considerable leverage.

The intense demand for cybersecurity, AI, data analytics, and cloud computing experts is projected to continue outpacing supply through 2025. This scarcity empowers individual employees and specialized talent agencies, as companies like EPAM compete fiercely for top talent, driving up compensation and benefits.

EPAM's reliance on specialized third-party software and platforms can influence supplier bargaining power. While EPAM develops proprietary tools like EPAM DIAL, its service delivery often depends on external technologies. If these tools are highly specialized with few alternatives, or essential for core operations, their providers can command greater leverage.

For instance, EPAM's strategic partnerships with major cloud providers such as Amazon Web Services (AWS) and Google Cloud are vital for its advanced AI and data analytics services. In 2024, cloud infrastructure spending continued to grow, underscoring the critical nature of these relationships and the potential bargaining power of these key technology suppliers.

EPAM Systems relies heavily on infrastructure and cloud providers, making their bargaining power a significant factor. Major cloud platforms like Amazon Web Services (AWS) and Google Cloud, with whom EPAM holds strategic partnerships, wield considerable influence. This is due to the indispensable role cloud computing plays in modern IT operations, especially with cloud adoption projected to continue its strong growth trajectory through 2025.

The critical nature of these services and the substantial costs associated with migrating large-scale, complex IT operations create high switching costs for companies like EPAM. This dependence allows cloud providers to potentially dictate terms, impacting EPAM's operational expenses and flexibility.

Geographic Concentration of Talent

EPAM Systems, like many IT services firms, has historically relied on concentrated talent pools. For instance, Ukraine has been a significant source of skilled IT professionals for EPAM. While the company has actively diversified its global delivery footprint, any lingering concentration in regions facing geopolitical or economic instability can amplify the bargaining power of local talent, potentially leading to increased labor costs or operational disruptions.

The company's strategic expansion into new delivery centers across India, Western and Central Asia, and Latin America is a direct response to mitigate this risk. This diversification aims to reduce dependence on any single region, thereby softening the bargaining power of suppliers in any one location. For example, as of late 2023, EPAM reported having a significant presence in India, which offers a vast and growing pool of IT talent.

- Geographic Talent Concentration: Historically, EPAM had significant talent concentration in regions like Ukraine.

- Diversification Strategy: Expansion into India, Western/Central Asia, and Latin America aims to reduce reliance on single talent pools.

- Impact on Bargaining Power: Remaining geographic concentrations in unstable regions can increase local talent's bargaining power.

- Mitigation Efforts: Diversification helps to balance the bargaining power of suppliers by creating alternative talent sources.

Limited Number of Niche Technology Partners

When cutting-edge and emerging technologies are involved, EPAM Systems may find that the pool of truly advanced and reliable technology partners is quite small. This scarcity can significantly boost the negotiation leverage of these specialized partners, particularly when EPAM requires unique or nascent technological capabilities for its projects.

For instance, in the rapidly evolving AI landscape, securing exclusive access to proprietary algorithms or highly specialized AI development tools from a limited number of providers can place those providers in a strong bargaining position. EPAM's strategic investments and partnerships in AI development, as highlighted by their ongoing expansion in this area, aim to mitigate this dependency, but the initial reliance on niche partners can still present a challenge.

- Limited availability of specialized tech expertise can lead to higher costs for EPAM.

- Partnerships for niche technologies might involve less favorable contract terms due to supplier leverage.

- EPAM's investment in building in-house capabilities for emerging tech, like AI, is a direct response to this supplier power.

The bargaining power of suppliers for EPAM Systems is notably influenced by the scarcity of highly specialized talent and critical technology platforms. Companies like EPAM must navigate these dynamics to maintain competitive pricing and operational efficiency. The ongoing demand for advanced skills in areas like AI and cloud computing, projected to outstrip supply through 2025, grants significant leverage to skilled professionals and their agencies.

EPAM's reliance on key cloud providers, such as AWS and Google Cloud, further amplifies supplier bargaining power. The critical nature of cloud infrastructure, with continued strong growth anticipated in 2024 and beyond, coupled with high switching costs, allows these providers to potentially dictate terms. This dependence impacts EPAM's operational expenses and strategic flexibility.

EPAM's diversification strategy, including its significant presence in India as of late 2023, aims to mitigate the bargaining power derived from geographic talent concentration. By expanding its global delivery footprint, EPAM seeks to reduce reliance on any single region, thereby softening the leverage of local talent pools and creating more balanced supplier relationships.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on EPAM Systems | Mitigation Strategies | 2024 Relevance |

|---|---|---|---|---|

| Skilled IT Talent | Scarcity of niche skills (AI, Cloud, Cybersecurity), high demand | Increased labor costs, competition for top talent | Global talent pool diversification, in-house training programs | Continued high demand for AI/cloud expertise |

| Cloud Infrastructure Providers (e.g., AWS, Google Cloud) | Criticality of services, high switching costs, limited viable alternatives | Potential for unfavorable contract terms, increased operational expenses | Strategic partnerships, multi-cloud strategies, optimizing cloud spend | Strong growth in cloud spending |

| Specialized Software/Platform Providers | Uniqueness of technology, limited substitutes, essential for operations | Higher licensing fees, less favorable contract terms | Developing proprietary tools (e.g., EPAM DIAL), evaluating alternative solutions | Reliance on specialized AI development tools |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to EPAM Systems' position in the IT services industry.

Instantly gauge competitive intensity across all five forces, enabling EPAM to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

EPAM Systems caters to a substantial base of large enterprise clients, including many from the Forbes Global 2000 list. This significant client volume grants these entities considerable bargaining power. They can leverage their substantial business contributions to negotiate competitive pricing, demand highly customized solutions, and secure favorable contract terms.

The company's strategic focus on cultivating long-term partnerships is evident in its client relationships. EPAM maintains an average relationship tenure of 13 years with its top 20 clients, demonstrating a commitment to sustained engagement and a deep understanding of their evolving needs.

Switching costs for clients in the IT services sector can be a significant factor. While complex, custom-built solutions or deep integration with a client's existing infrastructure can lead to substantial costs and effort if a client decides to switch providers, the use of standardized technologies or the availability of many similar vendors can lower these perceived barriers. For instance, if a client is using widely adopted platforms like Salesforce or SAP, the effort to migrate to another provider offering similar services might be less daunting.

EPAM Systems actively works to increase these switching costs by specializing in intricate software engineering and digital transformation initiatives. These projects often involve deep customization, proprietary methodologies, and significant integration with a client's unique business processes. This complexity makes it more challenging and expensive for clients to move their operations to a competitor, thereby strengthening EPAM's bargaining power with its customer base.

EPAM's reliance on project-based engagements, where roughly 85% of revenue stems from time and material contracts, significantly influences customer bargaining power. This structure grants clients considerable flexibility to change vendors upon project conclusion, or even mid-project if EPAM's performance falters.

When customers have readily available alternatives for their subsequent projects, their ability to negotiate terms with EPAM intensifies. This leverage is amplified in a market with numerous skilled IT service providers, allowing clients to seek competitive pricing and better service agreements.

In-house Capabilities and Low-Code/No-Code Solutions

Customers are increasingly building their own IT capabilities, lessening their need for external partners like EPAM. This shift means clients can manage more in-house, directly impacting the demand for outsourced services.

The rise of low-code/no-code platforms is a significant factor. These tools enable clients to create applications rapidly with minimal technical staff. By 2025, it's projected that 70% of new business applications will be developed using these more accessible technologies, directly reducing the need for traditional, outsourced development.

- Internal IT Expansion: Clients are investing in and growing their own IT departments.

- Low-Code/No-Code Adoption: Platforms like Microsoft Power Apps and OutSystems empower citizen developers.

- Reduced Outsourcing Demand: This trend can decrease reliance on external IT service providers for certain tasks.

- Cost Efficiency for Clients: Developing in-house or using low-code can be perceived as more cost-effective for specific projects.

Macroeconomic Conditions and Cost Sensitivity

During economic downturns, clients often become more price-conscious. This can lead them to scrutinize IT budgets more closely, potentially delaying projects or seeking more economical alternatives. EPAM has observed this trend, noting that some clients have temporarily opted for less expensive solutions before ultimately returning for the company's specialized services and quality.

EPAM's financial reports from 2023 indicated a cautious spending environment among some clients, particularly in sectors more susceptible to economic fluctuations. For instance, the technology sector, a key market for EPAM, experienced a slowdown in IT investment as companies focused on cost optimization. This macro environment directly impacts the bargaining power of customers, as they have more leverage to negotiate pricing or demand greater value for their spending.

- Economic Uncertainty: Periods of high inflation or recession can increase customer price sensitivity.

- Cost Reduction Initiatives: Clients may actively seek to reduce their IT expenditures, putting pressure on service providers like EPAM.

- Shift to Lower-Cost Alternatives: Some customers have temporarily moved to less expensive options, highlighting their willingness to trade down when cost is a primary driver.

- EPAM's Response: The company's ability to retain clients after such shifts demonstrates the long-term value proposition of its quality and expertise.

EPAM's large enterprise client base, many from the Forbes Global 2000, wield significant bargaining power. They can negotiate pricing, demand custom solutions, and secure favorable terms due to their substantial business contributions, averaging 13-year relationships with top clients. This leverage is amplified by the availability of numerous IT service providers and clients building internal IT capabilities, especially with the rise of low-code/no-code platforms projected to account for 70% of new business applications by 2025.

| Factor | Impact on EPAM | Client Leverage |

|---|---|---|

| Large Enterprise Client Base | High revenue concentration | Ability to negotiate pricing and terms |

| Client IT Capability Growth | Reduced demand for outsourcing | Less reliance on external providers |

| Low-Code/No-Code Adoption | Potential shift in development needs | Faster, cheaper internal development |

| Economic Downturns | Increased price sensitivity | Negotiating power for cost savings |

Preview Before You Purchase

EPAM Systems Porter's Five Forces Analysis

This preview showcases the complete EPAM Systems Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the IT services industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The IT services and software development landscape is incredibly fragmented and spans the globe, meaning EPAM constantly contends with a vast array of competitors. These range from massive global enterprises to niche, specialized companies, all vying for market share across diverse service lines and geographic regions.

This intense competition is a defining characteristic of the industry, which is expected to grow significantly. Projections indicate the global IT services market will surpass $2.5 trillion by 2030, highlighting the sheer scale of the battlefield where EPAM operates.

EPAM Systems operates in a highly competitive landscape, facing off against formidable global IT services giants like Accenture, Cognizant, Infosys, TCS, IBM Global Services, Capgemini, and Deloitte. These established players often boast more extensive service offerings, a wider reach with larger client portfolios, and deeply entrenched global delivery infrastructures, presenting a significant challenge to EPAM's market position.

EPAM Systems thrives on its specialization in digital platform engineering and software development, a focused approach that sets it apart from competitors offering broader IT services like traditional outsourcing and infrastructure management. This distinction means EPAM faces unique competitive pressures, often aligning with clients seeking deep technical expertise rather than a comprehensive, one-stop-shop IT solution.

While some rivals may boast a wider service portfolio, EPAM's strength lies in its concentrated engineering prowess. For instance, in 2023, EPAM reported revenues of approximately $4.8 billion, a testament to its success in its chosen niche, demonstrating that depth in specialized services can be a powerful differentiator in the IT services market.

Rapid Technological Advancements (e.g., AI)

The relentless march of technology, particularly in artificial intelligence and generative AI, significantly fuels competitive rivalry within the IT services sector. Companies like EPAM Systems are locked in a race to not only adopt but also to lead in developing and deploying cutting-edge AI-powered solutions. This rapid innovation cycle means that firms must constantly invest in R&D and talent to stay relevant, as those who lag behind risk obsolescence and market share erosion.

By 2025, AI and generative AI are no longer niche technologies but fundamental drivers of business growth and efficiency, becoming deeply embedded in client operations. EPAM's ability to integrate these advanced capabilities into its service offerings is critical for maintaining its competitive edge. For instance, the demand for AI-driven automation and data analytics services saw substantial growth in 2024, with many industry reports highlighting double-digit percentage increases in project spending in these areas.

- Intensified Innovation Race: Companies are aggressively investing in AI/GenAI to differentiate their offerings and capture market share.

- Talent Acquisition and Retention: The demand for AI specialists creates intense competition for skilled professionals, driving up labor costs.

- Platform and Tool Development: Firms are developing proprietary AI platforms and tools to enhance service delivery and create competitive moats.

- Client Expectations: Clients increasingly expect AI-integrated solutions, pushing service providers to rapidly upskill and adapt their portfolios.

Talent Competition and Wage Inflation

The competition for highly skilled IT professionals remains intense, driving significant wage inflation. This makes it a constant challenge for companies like EPAM to both acquire and keep their best people. To stay ahead, EPAM needs to consistently invest in programs that attract, train, and retain top-tier talent, which directly affects their operating expenses.

The ongoing scarcity of specialized IT workers, especially in areas like cybersecurity, artificial intelligence, data analytics, and cloud computing, presents a major hurdle in 2025. This talent gap means higher salary demands and increased recruitment costs for companies aiming to build and maintain robust technical teams.

- Talent Scarcity: A significant shortage of skilled IT professionals is projected for 2025, particularly in high-demand fields.

- Wage Inflation: Fierce competition for talent is directly contributing to rising salary expectations and increased labor costs.

- Retention Challenges: Companies face ongoing difficulties in retaining their most valuable IT employees due to competitive offers from rivals.

- Investment in Talent: Continuous investment in recruitment, training, and retention strategies is crucial for maintaining a competitive edge.

The competitive rivalry for EPAM Systems is fierce, stemming from a highly fragmented global IT services market. EPAM competes directly with major IT consultancies and software development firms, many of which possess larger scale and broader service portfolios. For instance, in 2023, EPAM reported revenues of approximately $4.8 billion, while industry giants like Accenture reported over $60 billion in revenue for their fiscal year ending August 31, 2023, illustrating the scale difference.

The rapid advancement of technologies like AI and generative AI intensifies this rivalry, as companies race to integrate these capabilities into their offerings. The demand for AI-driven automation and data analytics services saw substantial growth in 2024, with many industry reports highlighting double-digit percentage increases in project spending in these areas. This necessitates continuous investment in research and development and talent to maintain market relevance.

EPAM's strategic focus on digital platform engineering and software development differentiates it from competitors offering more generalized IT solutions. However, this specialization also means facing unique competitive pressures from firms that excel in deep technical expertise. The intense competition for skilled IT professionals, particularly in AI and cybersecurity, drives wage inflation and recruitment costs, impacting operational expenses.

| Competitor | Approximate 2023 Revenue (USD Billions) | Key Differentiator/Focus |

| EPAM Systems | 4.8 | Digital Platform Engineering, Software Development |

| Accenture | 62.1 (FY23) | Broad IT Services, Consulting, Digital Transformation |

| Cognizant | 19.4 | Digital, Technology, Consulting, Operations |

| Infosys | 18.2 (FY23) | Digital Services, Cloud, Automation |

SSubstitutes Threaten

The threat of substitutes for EPAM Systems' services is significantly influenced by the growing trend of large enterprises bolstering their in-house IT departments. Companies like Microsoft and Amazon, for instance, are making substantial investments in their internal digital transformation capabilities, potentially reducing their reliance on external IT consultancies for core development and strategic initiatives.

This internal build-up is a direct substitute, as businesses can leverage their own resources to manage IT operations and innovation. In 2024, the global IT services market is projected to reach over $1.3 trillion, with a notable portion of this spending allocated to internal IT functions, indicating a substantial capacity for in-house substitution.

The increasing availability of off-the-shelf software and SaaS solutions presents a significant threat of substitution for EPAM Systems. Businesses can often find existing, pre-built applications that address their operational requirements, thereby diminishing the need for custom-developed software. This trend is particularly impactful as enterprise software spending is projected to reach $1.25 trillion in 2025, indicating a robust market for readily available solutions.

Low-code and no-code development platforms offer a compelling alternative to traditional software development, allowing individuals with little to no coding experience to build applications. This rise of 'citizen developers' directly challenges the need for extensive custom development services that companies like EPAM Systems provide.

The impact is substantial, with projections indicating that by 2025, a significant 70% of new business applications will be developed using these user-friendly technologies. This shift means clients may opt for faster, more cost-effective in-house solutions rather than engaging external development firms for many projects.

Generative AI Tools and Automation

The increasing sophistication of generative AI tools presents a significant threat of substitution for EPAM Systems. These AI advancements can automate substantial parts of the software development lifecycle, including coding and testing, potentially diminishing the demand for traditional human engineering services. For instance, generative AI is already estimated to contribute around 30% of enterprise code output, a figure expected to grow.

While EPAM actively integrates AI into its own operations and client solutions, the widespread adoption of these tools by clients could directly substitute some of EPAM's core service offerings. This means clients might opt for AI-driven solutions that perform tasks previously outsourced to EPAM's engineers.

- Generative AI's growing role in code generation: AI tools now account for approximately 30% of enterprise code creation.

- Automation of development and testing: AI can automate significant portions of software engineering, reducing reliance on human effort.

- Potential for service substitution: Clients may leverage AI to fulfill needs previously met by EPAM's traditional services.

- EPAM's AI integration strategy: EPAM is incorporating AI, but client-side adoption poses a competitive threat.

Business Process Outsourcing (BPO) for IT Functions

The threat of substitutes for EPAM Systems' IT BPO services is moderate. Clients may consider broader Business Process Outsourcing (BPO) providers that bundle IT services with other functions, offering a more comprehensive package. For example, large consulting firms or generalist BPO companies might present a less specialized, but still viable, alternative for certain IT needs.

While EPAM excels in product engineering and digital transformation, some clients might find value in a single vendor for a wider array of business processes, including IT support. This can simplify vendor management, even if it means sacrificing deep specialization in IT. In 2023, the global BPO market was valued at over $270 billion, indicating a substantial market where IT services are often integrated into broader offerings.

- Broader BPO Providers: Offer integrated services that may include IT, potentially appealing to clients seeking a single vendor.

- Less Specialized Alternatives: While not as focused on product engineering as EPAM, these providers can fulfill basic IT outsourcing needs.

- Vendor Management Simplification: A key driver for clients considering these substitutes is the desire to streamline their supplier relationships.

The threat of substitutes for EPAM Systems is growing, driven by advancements in technology and evolving business strategies. Companies are increasingly looking inward or towards more generalized solutions, impacting the demand for specialized IT services.

The rise of low-code/no-code platforms is a significant substitute, enabling faster, more cost-effective application development with less specialized expertise. By 2025, it's projected that 70% of new business applications will be built using these technologies, directly challenging custom development services.

Generative AI is another potent substitute, automating coding and testing tasks. With AI already contributing around 30% of enterprise code, clients may leverage these tools to reduce their reliance on external engineering talent.

Furthermore, the trend of large enterprises strengthening their in-house IT capabilities, coupled with the availability of off-the-shelf software, presents a substantial substitution threat. The global IT services market, projected to exceed $1.3 trillion in 2024, includes significant internal IT spending, highlighting the capacity for in-house substitution.

| Substitute Type | Impact on EPAM | Key Data Point |

|---|---|---|

| In-house IT Development | Reduces reliance on external consultancies | Global IT services market > $1.3 trillion (2024) |

| Off-the-shelf Software/SaaS | Diminishes need for custom solutions | Enterprise software spending $1.25 trillion (2025) |

| Low-code/No-code Platforms | Challenges custom development demand | 70% of new apps by 2025 via these platforms |

| Generative AI | Automates development tasks | AI contributes ~30% of enterprise code |

Entrants Threaten

Entering the digital platform engineering and software development arena, particularly at EPAM Systems' level of specialization and global reach, demands substantial upfront capital. This includes significant investment in attracting and retaining highly skilled engineers, acquiring cutting-edge technology, and building robust global delivery centers. For instance, EPAM reported revenues of $4.83 billion in 2023, showcasing the scale of operations that new entrants would need to match.

EPAM's strong brand reputation and deep-rooted client relationships act as a significant barrier to new entrants. Established players like EPAM have cultivated trust and demonstrated consistent delivery over years, making it challenging for newcomers to replicate this level of confidence, especially with large enterprise clients who prioritize stability and proven performance. For instance, EPAM maintains an impressive average tenure of 13 years with its top 20 clients, highlighting the stickiness and value derived from these partnerships.

The intense demand for highly skilled IT professionals, particularly those proficient in cutting-edge fields like artificial intelligence, presents a formidable barrier for new companies attempting to enter the market. Attracting and holding onto top-tier talent in today's fiercely competitive global landscape is an ongoing struggle.

Indeed, the scarcity of qualified IT workers, especially in critical areas such as cybersecurity, AI, data analytics, and cloud computing, is a substantial hurdle for businesses in 2025. For instance, a 2024 report indicated that over 70% of IT leaders identified talent shortages as their primary concern, directly impacting project timelines and innovation capacity.

Technological Complexity and Rapid Evolution

The intricate and fast-changing landscape of digital platform engineering and software development demands perpetual investment in research and development, alongside a constant effort to adapt to emerging technologies. New players entering this arena would confront a significant learning curve and the necessity for considerable, ongoing capital outlay simply to remain competitive.

The digital transformation imperative is accelerating, fueled by advancements in key areas such as IT services, cloud computing, sophisticated data analytics, robust cybersecurity measures, and artificial intelligence. For instance, the global IT services market was projected to reach over $1.5 trillion in 2024, highlighting the scale of investment and innovation required.

- High R&D Investment: Companies like EPAM Systems invest heavily in staying ahead, with R&D expenses often forming a significant portion of their operational costs to master new tech stacks.

- Talent Acquisition & Training: The demand for specialized skills in areas like AI and cloud engineering is intense, requiring substantial resources for recruitment and continuous upskilling of the workforce.

- Barrier to Entry: The steep learning curve and the need for substantial, ongoing investment to keep pace with technological evolution create a formidable barrier for potential new entrants.

Regulatory and Compliance Hurdles

The threat of new entrants for EPAM Systems is significantly influenced by regulatory and compliance hurdles, particularly given its global operations and service to highly regulated sectors like financial services and healthcare. New players must dedicate substantial resources to understanding and implementing diverse compliance frameworks across various jurisdictions. For instance, the Banking, Financial Services, and Insurance (BFSI) sector, which represented the largest market share in IT consulting services in 2023, demands rigorous adherence to data privacy, security, and financial regulations, creating a high barrier to entry.

These compliance demands create a substantial cost and complexity for any new company aiming to compete. Navigating the intricate legal landscapes of multiple countries and industries requires specialized expertise and ongoing investment. This complexity acts as a significant deterrent, protecting established players like EPAM who have already built the necessary infrastructure and knowledge base.

- High Capital Requirements: Significant investment is needed to establish compliance infrastructure and legal expertise.

- Industry-Specific Regulations: Adherence to sector-specific rules (e.g., GDPR in Europe, HIPAA in US healthcare) is critical.

- Global Compliance Complexity: Operating internationally necessitates understanding and complying with a patchwork of national and regional regulations.

- Reputational Risk: Non-compliance can lead to severe penalties and damage brand reputation, a risk new entrants are less equipped to absorb.

The threat of new entrants into the digital engineering and IT services market, where EPAM operates, remains moderate but is influenced by several factors. High capital requirements for talent acquisition and technology infrastructure present a significant hurdle. For example, EPAM's substantial revenue of $4.83 billion in 2023 underscores the scale required to compete effectively.

Established players like EPAM benefit from strong brand recognition and long-standing client relationships, making it difficult for newcomers to gain trust, particularly with large enterprises. The intense competition for skilled IT professionals, especially in areas like AI and cloud computing, further elevates the barrier to entry, with over 70% of IT leaders citing talent shortages as a primary concern in 2024.

| Factor | Impact on New Entrants | EPAM's Position |

| Capital Requirements | High (Talent, Tech, Infrastructure) | Established scale and investment capacity |

| Brand Reputation & Client Relationships | Challenging to replicate | Deep-rooted, long-term partnerships (e.g., 13-year average tenure with top clients) |

| Talent Acquisition | Intense competition, high costs | Strong employer brand, extensive global talent pool |

| R&D and Technology Adaptation | Requires continuous, significant investment | Proven track record of innovation and adaptation |

| Regulatory & Compliance | Complex and costly, especially globally | Existing infrastructure and expertise for global compliance |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EPAM Systems leverages a comprehensive set of data, including EPAM's annual reports and SEC filings, alongside industry-specific market research from firms like Gartner and Forrester. This blend ensures a robust understanding of competitive dynamics, supplier influence, and buyer power within the IT services sector.