Enterprise Bank & Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enterprise Bank & Trust Bundle

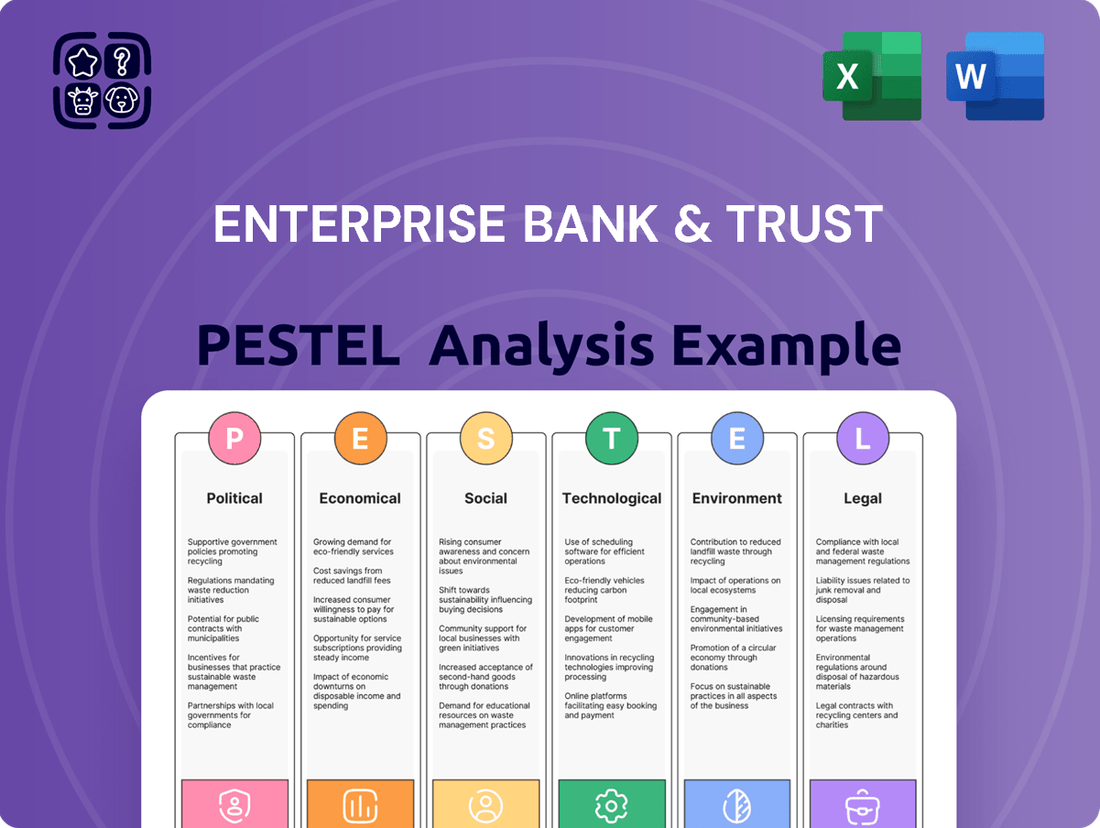

Unlock the critical external factors shaping Enterprise Bank & Trust's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges for the bank. Equip yourself with actionable intelligence to refine your strategies and gain a competitive advantage. Download the full PESTLE analysis now for an in-depth understanding.

Political factors

Government policy shifts significantly affect Enterprise Bank & Trust. For instance, the Federal Reserve's interest rate decisions, like the series of hikes throughout 2022 and 2023 aimed at curbing inflation, directly influence borrowing costs and loan demand. Continued fiscal policies, such as infrastructure spending initiatives announced in 2024, could stimulate economic activity and boost demand for corporate banking and treasury services.

Regulatory compliance remains a critical operational factor. The banking sector is subject to stringent oversight from bodies like the FDIC and OCC. Changes in capital adequacy ratios or new consumer protection laws, such as those evolving from the Biden-Harris administration's focus on fair lending practices, require continuous adaptation and investment in compliance infrastructure by Enterprise Bank & Trust.

Political stability is paramount for investor confidence and business expansion. Regions experiencing political uncertainty can deter investment, impacting loan origination and wealth management services. Conversely, stable political environments foster economic growth, creating a more favorable climate for Enterprise Bank & Trust's lending and investment banking activities.

Monetary policy decisions, especially those concerning interest rates, directly impact Enterprise Bank & Trust's profitability. For instance, the Federal Reserve's decision in mid-2024 to maintain the federal funds rate at 5.25%-5.50% following a series of hikes in 2023 influences the bank's net interest margin. Higher rates can increase funding costs for Enterprise Bank & Trust while potentially boosting returns on its loan portfolio, but this balance is delicate and subject to economic conditions.

While Enterprise Bank & Trust focuses on domestic operations, global trade policies and international relations still cast a shadow. For instance, the US trade deficit with China stood at $279.4 billion in 2023, a figure that can impact supply chains and the financial health of businesses involved in international commerce. Changes in tariffs or the emergence of new trade agreements can directly affect the profitability and operational stability of Enterprise Bank & Trust's commercial clients.

Geopolitical tensions, such as those observed in Eastern Europe, can create ripple effects through global markets, influencing commodity prices and investor confidence. These broader economic shifts can indirectly impact loan demand and credit risk for the bank. By tracking these international dynamics, Enterprise Bank & Trust can better anticipate shifts in client needs and proactively manage potential risks within its commercial lending and treasury services portfolios.

Political Stability and Elections

Political stability is a key consideration for Enterprise Bank & Trust. For instance, the 2024 U.S. Presidential election, with its potential for policy shifts, introduces a layer of market uncertainty that could influence loan demand and deposit growth.

Upcoming elections, both domestically and in key international markets where Enterprise Bank & Trust might operate or have investments, can lead to fluctuations in business and consumer confidence. This can directly impact the bank's lending activities and overall financial performance.

Enterprise Bank & Trust must closely monitor election outcomes and potential policy changes. For example, shifts in fiscal policy, such as changes to corporate tax rates or government spending on infrastructure projects, could present both new lending opportunities and potential regulatory challenges.

Strategic planning for Enterprise Bank & Trust needs to incorporate scenarios reflecting different political outcomes. This includes anticipating potential impacts on interest rates, regulatory frameworks, and the overall economic climate, which are all critical for the bank's long-term stability and growth.

Government Spending and Infrastructure Projects

Government spending, especially on infrastructure and economic development, presents substantial opportunities for banks like Enterprise Bank & Trust. These initiatives often necessitate robust financing, sophisticated treasury management, and a suite of banking services, directly benefiting commercial lending and wealth management arms. For instance, the U.S. government's commitment to infrastructure, as highlighted by the Infrastructure Investment and Jobs Act, allocated approximately $1.2 trillion in 2022, with a significant portion earmarked for transportation and energy projects. This translates to increased demand for corporate lending and project finance.

Enterprise Bank & Trust should closely track government budgets and regional development plans to pinpoint growth avenues and forge strategic alliances. A proactive stance enables the bank to align its offerings with evolving economic landscapes.

- Infrastructure Investment and Jobs Act: Allocated around $1.2 trillion in 2022, boosting opportunities for financial institutions involved in project financing and corporate lending.

- Regional Development Initiatives: State and local governments often launch programs requiring significant capital, creating demand for banking services from participating businesses.

- Public-Private Partnerships (PPPs): These collaborations on infrastructure projects necessitate specialized financial products and advisory services, a key area for bank engagement.

- Economic Stimulus Measures: Government spending aimed at economic recovery or growth can lead to increased business activity and, consequently, higher demand for banking and credit facilities.

Government policy and political stability are crucial for Enterprise Bank & Trust. For instance, the Federal Reserve's monetary policy, including the federal funds rate range of 5.25%-5.50% maintained in mid-2024, directly impacts the bank's net interest margins and loan demand. Upcoming elections, such as the 2024 U.S. Presidential election, introduce potential policy shifts that could influence economic conditions and the bank's operational landscape.

Regulatory frameworks, overseen by bodies like the FDIC and OCC, necessitate continuous adaptation. Evolving consumer protection laws and capital adequacy requirements demand ongoing investment in compliance infrastructure. Global trade policies and geopolitical tensions, such as trade deficits and regional conflicts, also indirectly affect the bank by influencing the financial health of its commercial clients and overall market sentiment.

Government spending, particularly on infrastructure as evidenced by the Infrastructure Investment and Jobs Act's allocation of approximately $1.2 trillion in 2022, creates significant opportunities for Enterprise Bank & Trust in project finance and corporate lending. Monitoring regional development plans and public-private partnerships is key to identifying growth avenues and aligning banking services with economic development initiatives.

Enterprise Bank & Trust must remain agile in response to political developments. Strategic planning should incorporate scenarios reflecting potential policy changes, such as alterations in corporate tax rates or government stimulus measures. This proactive approach allows the bank to navigate market uncertainties and capitalize on emerging opportunities in the evolving financial environment.

What is included in the product

This PESTLE analysis for Enterprise Bank & Trust examines how political, economic, social, technological, environmental, and legal factors present both challenges and opportunities for the bank's strategic planning and growth.

The Enterprise Bank & Trust PESTLE analysis provides a clear, summarized version of the full analysis, acting as a pain point reliever by enabling easy referencing during meetings or presentations.

Economic factors

The prevailing interest rate environment is a critical economic factor for Enterprise Bank & Trust. As of mid-2024, the Federal Reserve's benchmark interest rate remains elevated, influencing the bank's net interest income, a primary revenue driver. This environment directly impacts the cost of funds for Enterprise Bank & Trust and the rates it can charge on loans.

Higher interest rates can expand margins on variable-rate loans, a positive for profitability. However, this also elevates the risk of loan defaults, a key concern for financial institutions. Conversely, a falling rate environment, while potentially compressing margins, could stimulate greater loan demand, offering a different set of challenges and opportunities for the bank's strategic planning.

Inflationary pressures in 2024 and 2025 can significantly impact Enterprise Bank & Trust by increasing operating expenses and eroding the real worth of its assets. For instance, if inflation averages 3% in 2024, the bank's cost of doing business, from salaries to technology, will likely rise.

Conversely, deflationary periods, though less common recently, could lead to a decline in asset values and dampen overall economic activity, affecting loan demand and potentially increasing loan defaults. This scenario would challenge the bank's ability to maintain profitability.

Managing its balance sheet effectively is crucial for Enterprise Bank & Trust to counter inflation's impact on its loan portfolio and deposit base. For example, adjusting interest rates on loans and deposits in line with inflation can help preserve the real value of its earnings.

Furthermore, high inflation can alter consumer spending and business investment, directly influencing the demand for the bank's lending and wealth management services. As of early 2024, inflation rates in the US have shown some moderation from their peaks, but remain a key consideration for strategic planning and performance forecasting.

The overall health of the economy, as reflected in Gross Domestic Product (GDP) growth, directly impacts the demand for banking services. For instance, in the United States, real GDP grew at an annualized rate of 1.3% in the first quarter of 2024, a slowdown from previous periods, indicating a moderating economic environment.

A strong economy typically fuels business expansion, boosts consumer spending, and encourages investment, thereby increasing the need for commercial and retail loans, deposit services, and wealth management. Conversely, economic slowdowns or recessions tend to dampen loan demand, increase the likelihood of loan defaults, and depress asset values, all of which can negatively affect a bank's profitability.

Enterprise Bank & Trust's financial performance is intrinsically linked to the economic vitality of the geographic areas it operates within. This close relationship mandates continuous monitoring of key macroeconomic indicators to anticipate and adapt to changing economic conditions.

Unemployment Rates and Consumer Confidence

Low unemployment rates are a strong signal of economic health, typically boosting consumer confidence. This confidence translates into a greater capacity for both individuals and businesses to manage and repay loans, which is vital for a bank's financial stability. For instance, in May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from April's 3.9%, yet still indicative of a relatively tight labor market.

Conversely, periods of high unemployment can strain a bank's portfolio. Increased joblessness often results in a rise in loan defaults and a noticeable dip in demand for various retail banking services. This trend directly impacts a bank's profitability and risk assessment. The Federal Reserve's projections for 2024 anticipate unemployment to average around 4.0%.

Consumer confidence is a powerful driver of financial behavior, influencing decisions about saving, investing, and borrowing. This, in turn, directly shapes a bank's deposit base and its ability to attract new clients for wealth management services. A strong consumer sentiment, often correlated with low unemployment, generally leads to more robust deposit growth and increased assets under management.

- U.S. Unemployment Rate (May 2024): 4.0%

- Federal Reserve's 2024 Unemployment Projection: Averaging around 4.0%

- Impact of Low Unemployment: Increased consumer confidence, higher loan repayment capacity, and stronger deposit growth.

- Impact of High Unemployment: Increased loan defaults, reduced demand for banking services, and potential strain on the bank's financial health.

Real Estate Market Trends

The real estate market's trajectory is a critical factor for Enterprise Bank & Trust, especially concerning its commercial and retail lending activities. Shifts in property values, construction rates, and office space occupancy directly influence the bank's loan portfolio health and credit risk exposure.

A robust real estate market presents ample lending opportunities, whereas a contraction can lead to a rise in delinquent loans. For instance, the U.S. commercial real estate market experienced a significant slowdown in late 2023 and early 2024, with vacancy rates in office buildings reaching multi-year highs, impacting the performance of related loan portfolios.

Key indicators to monitor include:

- National Housing Starts: In March 2024, U.S. housing starts were at a seasonally adjusted annual rate of 1,127,000, a decrease from the previous year, signaling potential shifts in consumer demand and construction lending.

- Commercial Real Estate Vacancy Rates: Office vacancy rates across major U.S. markets hovered around 19% in early 2024, a level that challenges property owners and their lenders.

- Property Value Appreciation: While residential property values have shown resilience, commercial property values, particularly for office spaces, have seen downward pressure, affecting collateral values for loans.

Enterprise Bank & Trust must proactively manage its exposure to these real estate market cycles, given the substantial portion of its business tied to this sector.

The stability of the U.S. dollar and its exchange rate against other major currencies is an important economic consideration for Enterprise Bank & Trust. Fluctuations can impact the profitability of international transactions and the value of foreign-denominated assets or liabilities.

A stronger dollar can make U.S. exports more expensive, potentially slowing international trade, while a weaker dollar can boost exports but increase the cost of imports. For a bank like Enterprise Bank & Trust, managing currency risk is essential, especially if it has international clients or investments.

Global economic growth trends also play a role. A synchronized global slowdown in 2024 and 2025 could reduce demand for banking services from multinational corporations and impact investment flows.

| Economic Factor | Indicator/Trend (Mid-2024/Early 2025) | Implication for Enterprise Bank & Trust |

| Interest Rates | Elevated benchmark rates (e.g., Fed Funds Rate) | Positive for net interest margin, but increases default risk. |

| Inflation | Moderating but still a concern (e.g., ~3% average in 2024) | Increases operating costs; requires balance sheet management to preserve asset value. |

| GDP Growth | Slowing U.S. growth (Q1 2024: 1.3% annualized) | Moderates demand for loans and banking services. |

| Unemployment Rate | Relatively low (May 2024: 4.0%) | Supports consumer confidence and loan repayment capacity. |

| Real Estate Market | Mixed; residential resilient, commercial office facing headwinds (e.g., ~19% office vacancy) | Impacts loan portfolio health and credit risk in commercial lending. |

Full Version Awaits

Enterprise Bank & Trust PESTLE Analysis

The preview shown here is the exact Enterprise Bank & Trust PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Enterprise Bank & Trust. You'll gain valuable insights into the external forces shaping the bank's strategic landscape.

Sociological factors

Demographic shifts significantly shape banking needs. In 2024, the U.S. population continues to age, with the 65+ demographic projected to reach over 73 million by 2030, increasing demand for wealth management and retirement services. Conversely, the growing millennial and Gen Z populations, who are more digitally native, drive demand for seamless online and mobile banking solutions, as well as products like student loans and first-time homebuyer programs. Enterprise Bank & Trust must adapt its product suite and outreach to resonate with these evolving customer segments.

Consumer preferences are shifting, with a growing demand for convenience, personalization, and digital engagement. For Enterprise Bank & Trust, this means prioritizing seamless online and mobile banking platforms, alongside tailored financial advice. A 2024 survey indicated that over 70% of consumers prefer digital channels for routine banking tasks, highlighting the critical need for robust online infrastructure.

The general level of financial literacy significantly impacts how readily consumers adopt sophisticated financial products and wealth management services. In 2024, a significant portion of the population still struggles with basic financial concepts, with studies indicating that only about 57% of Americans are financially literate. This can directly influence Enterprise Bank & Trust's ability to offer and market its more complex advisory services.

Higher financial literacy fosters more informed investment choices and increased engagement with long-term financial planning, which is a direct benefit to banks like Enterprise Bank & Trust that offer advisory services. For instance, data from 2024 suggests that individuals with higher financial literacy are more likely to participate in retirement savings plans and utilize investment tools. This creates a more receptive market for the bank's expertise.

Conversely, lower financial literacy often necessitates the development of simpler, more accessible financial products and requires banks to invest more in educational outreach. Enterprise Bank & Trust can enhance its reputation and build customer trust by actively participating in community financial education initiatives, thereby cultivating a more informed and engaged customer base for its services.

Cultural Values and Trust in Institutions

Societal trust in financial institutions is a cornerstone for Enterprise Bank & Trust's growth, directly affecting customer acquisition and retention. For instance, a 2023 survey by the American Customer Satisfaction Index (ACSI) showed a slight dip in consumer satisfaction with banks, underscoring the sensitivity of trust. When scandals or data breaches occur, like the Equifax breach in 2017 which impacted millions, public confidence can plummet, making it a significant hurdle for banks to attract and keep clients.

Enterprise Bank & Trust must therefore place a premium on ethical conduct, robust governance, and clear, open communication to cultivate and sustain customer confidence. Building a reputation for unwavering integrity is absolutely crucial in the financial services industry, where perceived trustworthiness is as vital as financial stability. This focus on transparency helps mitigate the negative impact of external events on customer perception.

Furthermore, cultural values surrounding saving, borrowing, and wealth accumulation play a significant role in shaping how individuals interact with banking services and which products they adopt. For example, in regions with a strong cultural emphasis on saving, demand for investment and savings accounts might be higher. Understanding these nuances allows Enterprise Bank & Trust to tailor its offerings and marketing more effectively.

- Customer trust directly impacts acquisition and retention rates, with a 2023 ACSI report indicating a slight decline in overall banking customer satisfaction.

- Past corporate scandals and data breaches, such as the 2017 Equifax incident, have demonstrably eroded public trust in financial institutions.

- Enterprise Bank & Trust's commitment to ethical practices, strong governance, and transparent communication is essential for building and maintaining customer loyalty.

- Cultural attitudes towards saving and borrowing influence banking behavior, requiring tailored product development and marketing strategies.

Income Inequality and Wealth Distribution

Income inequality significantly shapes the demand for banking and wealth management. In 2024, the U.S. saw continued disparities, with the top 10% of households holding a substantial portion of national wealth. This suggests a market split: affluent clients demand complex investment strategies and personalized advisory, while a larger segment needs accessible, low-cost banking solutions. Enterprise Bank & Trust must cater to this divergence.

The bank's strategy should acknowledge these economic realities. For instance, while the median household income in the U.S. was around $74,580 in 2023, the wealth concentration at the top is pronounced. Enterprise Bank & Trust can leverage this by offering tiered services.

- High Net Worth Segment: Sophisticated investment products, estate planning, and private banking.

- Mass Affluent Segment: Integrated financial planning, retirement solutions, and accessible investment platforms.

- Lower-to-Middle Income Segment: Basic checking and savings accounts, digital banking tools, and financial literacy resources.

- Underserved Markets: Identifying and developing products for emerging demographic groups or geographic areas experiencing economic growth but lacking tailored financial services.

Societal attitudes towards financial institutions are a critical factor for Enterprise Bank & Trust. Public trust, often influenced by media narratives and the performance of other banks, directly impacts customer acquisition and retention. A 2023 report indicated that consumer trust in banks had seen a slight decline, emphasizing the need for transparency and ethical conduct.

Cultural norms surrounding saving, spending, and investment also shape banking product demand. For instance, regions with a strong cultural emphasis on saving may exhibit higher demand for investment and savings accounts. Enterprise Bank & Trust must be attuned to these cultural nuances to tailor its offerings and marketing effectively, ensuring resonance with diverse customer segments.

The level of financial literacy within the population plays a significant role in how readily consumers engage with complex financial products. With studies in 2024 suggesting that a considerable portion of the population still lacks strong financial literacy, banks like Enterprise Bank & Trust need to invest in educational outreach and offer simplified, accessible products to foster broader engagement and trust.

| Sociological Factor | Impact on Enterprise Bank & Trust | 2024/2025 Data/Trend |

|---|---|---|

| Public Trust in Financial Institutions | Affects customer acquisition and retention. Erosion of trust can lead to significant client attrition. | A 2023 ACSI report showed a slight dip in overall banking customer satisfaction, highlighting the sensitivity of trust. |

| Cultural Attitudes towards Finance | Influences demand for specific banking products and services (e.g., savings vs. borrowing). | Varying regional cultural values necessitate tailored product development and marketing strategies. |

| Financial Literacy Levels | Impacts customer adoption of sophisticated financial products and advisory services. | In 2024, studies indicate only about 57% of Americans are financially literate, requiring banks to focus on accessible products and education. |

Technological factors

Enterprise Bank & Trust must navigate the accelerating digital transformation in banking, where customer expectations for seamless online and mobile access to services like account management, payments, and loan applications are paramount. Failure to innovate in this space risks customer defection and a loss of competitive edge.

As of early 2024, over 70% of banking customers utilize mobile banking apps, highlighting the critical need for robust digital platforms. Enterprise Bank & Trust's investment in user experience, security, and functionality across its digital channels is therefore essential to retain and attract clients in this increasingly digital-first environment.

As Enterprise Bank & Trust navigates an increasingly digital landscape, cybersecurity and data protection are paramount. The escalating sophistication of cyber threats means the bank must continuously invest in advanced security infrastructure to safeguard sensitive customer information. A significant data breach in 2024 could result in substantial financial penalties, with some reports indicating potential fines reaching billions of dollars for major financial institutions failing to comply with regulations like GDPR.

Maintaining customer trust hinges on the bank's ability to demonstrate robust data protection. Compliance with evolving privacy laws, such as state-level data breach notification requirements that became more stringent in late 2023 and early 2024, is non-negotiable. A single security lapse can have devastating consequences, not only financially but also by severely tarnishing the bank's reputation and customer loyalty.

Enterprise Bank & Trust is navigating a landscape increasingly shaped by emerging technologies like AI, blockchain, and fintech. AI is already proving its worth; for instance, many financial institutions reported significant improvements in fraud detection rates, with some seeing reductions of up to 20% in false positives in 2024 through AI-powered systems. This technology also promises to personalize customer interactions and refine lending risk assessments, crucial for a bank's core operations.

Blockchain technology presents another transformative avenue, particularly for payment systems and secure record-keeping. While widespread adoption in traditional banking is still evolving, pilot programs in 2024 demonstrated potential for faster cross-border payments, reducing settlement times by as much as 60% compared to traditional methods. Enterprise Bank & Trust must consider how to leverage these advancements for greater efficiency and security.

The fintech sector continues to challenge established banking models, with venture capital investment in fintech reaching over $100 billion globally in 2024. This surge highlights the rapid innovation occurring outside traditional financial institutions. To maintain a competitive edge, Enterprise Bank & Trust may need to explore strategic partnerships or direct investments in fintech solutions that can enhance its service offerings and operational agility.

Data Analytics and Business Intelligence

Enterprise Bank & Trust can significantly boost its operations by effectively using data analytics and business intelligence. These tools help the bank understand its massive customer and transaction data to make smarter decisions. For instance, by analyzing trends, the bank can better manage risks, create more appealing marketing campaigns, and offer products tailored to individual customer needs, ultimately improving customer satisfaction.

The financial sector is increasingly relying on data-driven strategies. In 2024, global spending on business analytics and business intelligence software was projected to reach over $37 billion, highlighting its importance. For Enterprise Bank & Trust, this means that investing in robust data infrastructure and analytical talent is not just about efficiency, but a critical factor in staying ahead of competitors and meeting evolving customer expectations.

- Enhanced Risk Management: Data analytics allows for more sophisticated identification and mitigation of credit, market, and operational risks.

- Personalized Customer Experiences: Analyzing customer behavior enables tailored product recommendations and proactive service, increasing loyalty.

- Optimized Marketing Campaigns: Insights from data lead to more targeted and effective marketing efforts, improving ROI.

- Operational Efficiency Gains: Business intelligence tools can streamline processes, reduce costs, and improve decision-making speed.

Automation and Operational Efficiency

Automation is revolutionizing banking operations at Enterprise Bank & Trust, with routine tasks like loan origination and customer onboarding increasingly handled by sophisticated software. This digital transformation is projected to boost operational efficiency by up to 30% in key departments by the end of 2024, according to industry reports. By leveraging Robotic Process Automation (RPA) and AI-driven tools, the bank can reallocate valuable human resources from repetitive duties to more client-facing and strategic initiatives, thereby elevating service quality and fostering innovation.

The impact of automation extends directly to customer experience, enabling faster transaction processing and query resolution. For instance, many banks have seen a reduction in average customer service wait times by as much as 20% after implementing automated chatbots and self-service portals. This enhanced speed and responsiveness are critical differentiators in today's competitive financial landscape, directly contributing to improved customer satisfaction and loyalty.

Enterprise Bank & Trust's strategic focus on continuous automation allows for the streamlining of internal workflows and the optimization of resource allocation. This proactive approach ensures that the bank remains agile and cost-effective. By the close of 2025, it is anticipated that automated processes will account for over 60% of back-office functions, leading to significant cost savings and a more robust financial performance.

- Enhanced Efficiency: Automation of routine tasks like loan processing and onboarding can reduce processing times by an estimated 25-40%.

- Cost Reduction: Implementing RPA can lead to operational cost savings of 15-25% within the first two years of deployment.

- Improved Service Quality: Freeing up staff allows for greater focus on complex customer needs, potentially increasing customer satisfaction scores by 10-15%.

- Competitive Advantage: Faster service delivery and reduced errors contribute to a stronger market position, attracting and retaining more clients.

The rapid evolution of AI and machine learning presents significant opportunities for Enterprise Bank & Trust to enhance customer service and operational efficiency. By early 2024, AI-powered fraud detection systems were already reducing false positives by up to 20% in many financial institutions, a trend expected to continue.

Blockchain technology offers potential for faster, more secure transactions, with pilot programs in 2024 demonstrating cross-border payment settlement time reductions of up to 60% compared to traditional methods. Enterprise Bank & Trust must assess how to integrate these advancements to remain competitive.

The surge in fintech innovation, fueled by over $100 billion in global venture capital investment in 2024, necessitates that Enterprise Bank & Trust consider strategic partnerships or investments to leverage new technologies and maintain market relevance.

| Technology Area | 2024 Impact/Projection | Enterprise Bank & Trust Relevance |

|---|---|---|

| AI & Machine Learning | 20% reduction in fraud false positives (early 2024) | Enhance fraud detection, personalize customer offers, improve risk assessment |

| Blockchain | 60% faster cross-border payments (pilot programs) | Streamline payment systems, improve transaction security |

| Fintech Investment | >$100 billion global VC funding (2024) | Identify partnership opportunities, adopt innovative solutions |

Legal factors

Enterprise Bank & Trust navigates a complex web of banking regulations, with the Federal Reserve, FDIC, and state departments acting as key enforcers. Adherence to capital adequacy standards, such as Basel III, and stringent anti-money laundering (AML) laws is paramount for operational stability. For instance, in 2024, regulatory scrutiny on cybersecurity and data privacy within financial institutions intensified, requiring significant investment in compliance infrastructure.

Consumer protection laws, like the Truth in Lending Act and the Fair Credit Reporting Act, are crucial for Enterprise Bank & Trust's customer interactions. These regulations mandate transparency in lending, fair credit reporting, and robust data privacy, directly shaping how the bank engages with its retail clients.

Enterprise Bank & Trust must prioritize secure handling of personal information and transparent lending practices to build customer trust. Non-compliance can lead to significant legal disputes and hefty regulatory sanctions, impacting the bank's reputation and financial stability.

Adherence to these consumer protection statutes is vital for maintaining a positive public image and mitigating the risk of costly class-action lawsuits. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces these regulations, with significant fines levied for violations in the banking sector.

Data privacy and security regulations are a critical legal factor for Enterprise Bank & Trust. With the growing digital footprint of banking services, laws like the California Consumer Privacy Act (CCPA) and various state data breach notification laws impose stringent requirements. Enterprise Bank & Trust must invest in advanced data protection measures to secure sensitive customer information, facing substantial fines, legal challenges, and reputational damage for non-compliance. For instance, in 2023, data breaches in the financial sector resulted in an average cost of $5.90 million, highlighting the financial implications of inadequate security.

Anti-Money Laundering (AML) and Sanctions Laws

Enterprise Bank & Trust must adhere to stringent Anti-Money Laundering (AML) and sanctions regulations, such as those enforced by OFAC. This necessitates robust customer verification, continuous transaction monitoring, and prompt reporting of suspicious activities. Failure to comply can result in substantial financial penalties and significant reputational harm.

- Regulatory Scrutiny: Banks face increasing regulatory oversight, with fines for AML violations reaching billions globally. For instance, in 2023, major financial institutions paid over $2.5 billion in AML-related fines.

- Compliance Investment: Significant resources are allocated to compliance technology and training to detect and prevent illicit financial flows, a critical aspect of maintaining financial system integrity.

- Reputational Risk: Non-compliance can lead to severe reputational damage, impacting customer trust and business relationships.

- National Security: Adherence to these laws is paramount for national security, preventing the financing of terrorism and other illegal activities.

Contract Law and Commercial Agreements

Enterprise Bank & Trust's core functions, especially in commercial lending and treasury services, are deeply rooted in contract law. Every loan, deposit, and vendor agreement must be legally robust and enforceable to safeguard the bank's interests.

The bank's legal department plays a critical role in drafting and scrutinizing all commercial contracts, a process vital for risk mitigation. For instance, in 2024, financial institutions are increasingly focused on contract lifecycle management to ensure compliance and reduce exposure to litigation, with many investing in AI-powered contract analysis tools.

- Contractual enforceability: Ensuring all loan and deposit agreements are legally sound is paramount for Enterprise Bank & Trust.

- Risk mitigation: Meticulous contract review by the legal team helps protect the bank from potential disputes and financial losses.

- Dispute resolution: Clear dispute resolution clauses within agreements are essential for efficient conflict management.

Enterprise Bank & Trust operates within a stringent legal framework, heavily influenced by consumer protection laws like the Truth in Lending Act and Fair Credit Reporting Act. These regulations ensure transparency in lending and fair credit practices, directly impacting customer interactions and trust. The Consumer Financial Protection Bureau (CFPB) actively enforces these statutes, with significant fines levied for violations, underscoring the critical need for compliance.

Data privacy and security are paramount, with laws such as the CCPA imposing strict requirements on handling sensitive customer information. Failure to comply can result in substantial fines and reputational damage; for instance, data breaches in the financial sector cost an average of $5.90 million in 2023. Enterprise Bank & Trust must invest in robust data protection measures to mitigate these risks.

The bank's commercial lending and treasury services rely heavily on contract law, requiring legally sound agreements for all transactions. In 2024, financial institutions are increasingly adopting AI-powered contract analysis tools to enhance compliance and reduce litigation exposure, highlighting the evolving legal landscape.

| Legal Factor | Impact on Enterprise Bank & Trust | 2023-2024 Data/Trend |

|---|---|---|

| Consumer Protection Laws | Ensures transparent lending and fair credit practices. | CFPB fines for violations remain a significant deterrent. |

| Data Privacy & Security | Mandates secure handling of customer information. | Average cost of data breaches in finance was $5.90M (2023). |

| Contract Law | Governs all loan, deposit, and vendor agreements. | Increased investment in AI for contract analysis by banks. |

Environmental factors

Climate change presents significant physical risks to Enterprise Bank & Trust, affecting its operations and loan portfolio. Properties in areas prone to extreme weather, such as floods or wildfires, face devaluation, directly impacting collateral values and borrower repayment capabilities. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $92.9 billion in damages, according to NOAA data, highlighting the widespread nature of these threats.

Enterprise Bank & Trust must integrate climate-related risk assessments into its lending decisions and overall risk management. This is particularly crucial for sectors like real estate and agriculture, which are highly susceptible to climate impacts. Understanding the bank's geographical exposure to climate hazards is becoming a critical component of financial stability, requiring an evaluation of local infrastructure and economic resilience.

While Enterprise Bank & Trust might not directly mine resources, its clients certainly do. For instance, the energy sector, a significant client base for many banks, saw Brent crude oil prices fluctuate significantly in 2024, averaging around $83 per barrel for the year, impacting the financial health of energy-dependent businesses. This volatility can translate into increased loan default risks for the bank.

Rising energy costs also affect businesses across the board, from manufacturing to transportation, potentially squeezing their profit margins. For example, a 10% increase in industrial electricity prices in a key operating region could reduce a manufacturing client's net income, impacting their debt servicing capacity. This indirect effect necessitates robust risk assessment for loan portfolios.

Furthermore, Enterprise Bank & Trust's own operational costs are subject to energy price fluctuations. In 2024, commercial electricity rates saw an average increase of approximately 3-5% nationally, adding to the bank's overhead. Encouraging energy efficiency within its branches and data centers, alongside advising clients on sustainable energy solutions, can serve as a dual strategy to manage these rising costs and align with ESG goals.

Increasingly stringent environmental regulations, particularly those focused on reducing carbon emissions and promoting sustainable practices, directly impact Enterprise Bank & Trust's client base. For instance, industries like manufacturing and energy, which often have significant environmental footprints, may experience higher operational costs due to compliance mandates. This could affect their ability to service loans, thereby increasing credit risk for the bank.

The bank must actively assess the environmental risk profiles of its commercial borrowers. For example, understanding how upcoming regulations, such as those related to water usage or waste management, might affect a client's profitability is crucial. In 2024, many sectors saw increased investment in green technologies driven by regulatory pressures, with the global green bond market projected to reach over $1 trillion by year-end, highlighting the financial implications of environmental compliance.

Enterprise Bank & Trust also needs to consider its own operational environmental impact. As sustainability becomes a core business consideration, the bank's energy consumption, waste management, and supply chain practices are under scrutiny. This internal focus not only aligns with corporate social responsibility but also can lead to cost savings and enhanced reputational capital, which indirectly supports its financial stability and client relationships.

Stakeholder Pressure for Sustainability (ESG)

Stakeholder pressure for sustainability, often framed through Environmental, Social, and Governance (ESG) criteria, is significantly influencing financial institutions like Enterprise Bank & Trust. Investors, customers, and employees are increasingly demanding that banks not only deliver financial returns but also operate responsibly and ethically. This translates into a growing expectation for Enterprise Bank & Trust to embed sustainability into its core business functions, from lending decisions to investment strategies.

This push for ESG integration means Enterprise Bank & Trust faces heightened scrutiny regarding its environmental footprint and its support for sustainable business practices. For instance, a growing number of institutional investors are prioritizing companies with strong ESG ratings. In 2024, for example, global sustainable investment assets were projected to exceed $50 trillion, indicating a substantial capital pool seeking alignment with ESG principles. This trend necessitates that Enterprise Bank & Trust actively offers green financing options, supports businesses committed to sustainability, and transparently reports on its own environmental performance.

- Investor Demand: A significant portion of assets under management in 2024 are linked to ESG mandates, pressuring banks to demonstrate commitment.

- Customer Preferences: Consumers are increasingly choosing financial partners whose values align with their own, favoring institutions with clear sustainability goals.

- Reputational Enhancement: Strong ESG performance can bolster Enterprise Bank & Trust's brand image, attracting talent and mitigating reputational risks.

- Risk Mitigation: Proactive management of environmental and social factors can reduce long-term operational and regulatory risks for the bank.

Natural Disasters and Business Continuity

The escalating frequency and severity of natural disasters, amplified by climate change, present a significant risk to Enterprise Bank & Trust's physical assets, including its branches and data centers. Ensuring employee safety is paramount during these events.

To mitigate these threats, Enterprise Bank & Trust must maintain and regularly test comprehensive business continuity and disaster recovery plans. These plans are vital for guaranteeing uninterrupted service delivery to customers, even amidst disruptions. For instance, the bank needs well-defined protocols for its IT systems and readily available alternative operational sites.

A critical aspect of this preparedness involves assessing the resilience of the bank's infrastructure and its supply chains against natural disaster impacts. This proactive evaluation is key to maintaining operational integrity and preserving customer confidence.

- 2024 Data: Global insured losses from natural catastrophes were estimated to be around $130 billion in 2024, underscoring the growing financial impact of these events.

- Resilience Measures: Enterprise Bank & Trust's business continuity plans should include redundant data backups, geographically dispersed operational centers, and clear communication strategies for employees and customers during emergencies.

- Supply Chain Risk: The bank needs to identify critical third-party vendors and assess their own disaster preparedness to prevent cascading failures in its service delivery.

- Customer Trust: Demonstrating robust preparedness for natural disasters can enhance customer trust and loyalty, as clients rely on banks for consistent access to their funds and services.

Enterprise Bank & Trust faces increasing pressure from stakeholders, including investors and customers, to adopt sustainable practices and manage environmental risks. In 2024, global sustainable investment assets were projected to exceed $50 trillion, highlighting a significant capital shift towards ESG-aligned businesses.

Climate change poses physical risks, impacting collateral values and borrower repayment capabilities, as evidenced by 2023's 28 billion-dollar weather disasters in the U.S. The bank must integrate climate risk into lending and assess geographical exposure to hazards.

Environmental regulations, such as those targeting carbon emissions, can increase operational costs for clients in sectors like manufacturing and energy, potentially affecting loan servicing. The global green bond market's growth to over $1 trillion by year-end 2024 reflects this regulatory push.

| Environmental Factor | Impact on Enterprise Bank & Trust | Supporting Data (2023-2025) |

|---|---|---|

| Climate Change & Natural Disasters | Physical risks to assets, loan portfolio devaluation, business continuity challenges. | 2023: 28 U.S. billion-dollar weather disasters ($92.9B total loss). 2024: ~$130B global insured catastrophe losses. |

| Regulatory Compliance | Increased operational costs for clients, potential credit risk, need for green financing. | Global green bond market projected >$1T by end of 2024. |

| Stakeholder ESG Demands | Reputational risk/enhancement, investor preference for sustainable businesses, need for ESG reporting. | Global sustainable investment assets projected >$50T in 2024. |

| Energy Costs | Increased operational overhead for the bank, impact on client profitability and debt servicing. | 2024: ~3-5% national increase in commercial electricity rates. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Enterprise Bank & Trust is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading economic research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the banking sector.