Enterprise Bank & Trust Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enterprise Bank & Trust Bundle

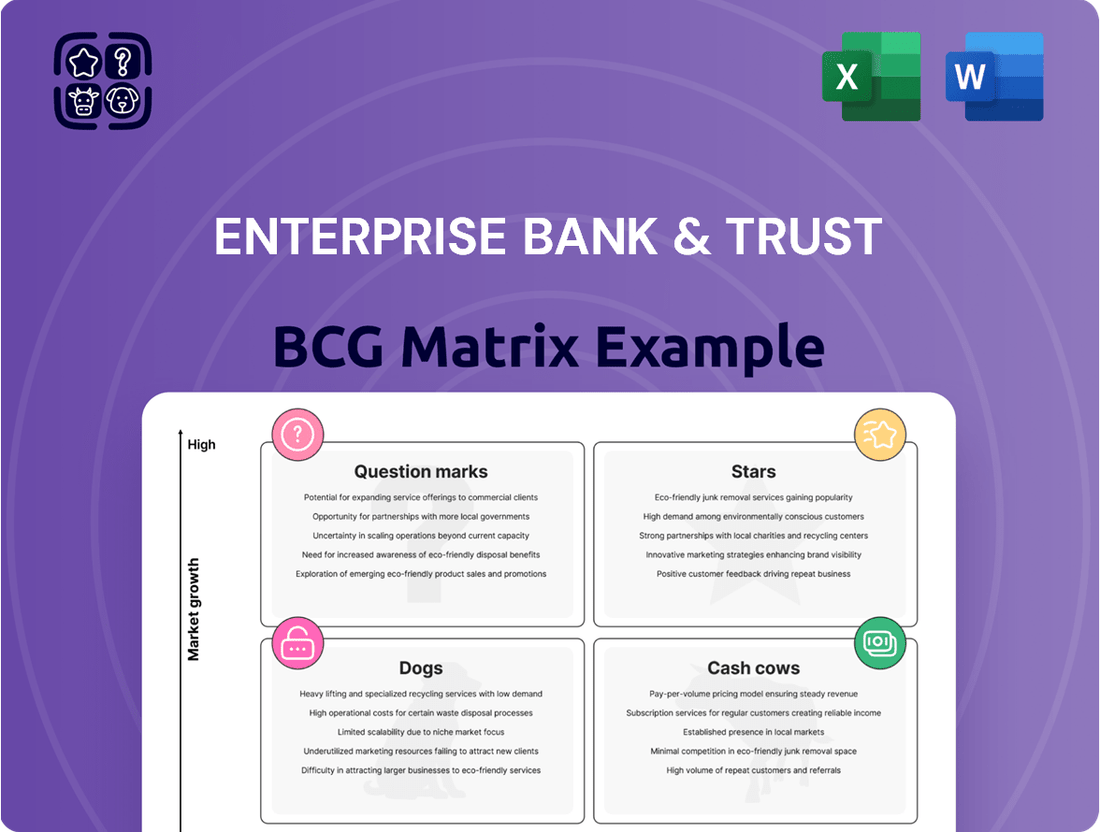

Enterprise Bank & Trust's current BCG Matrix positions its offerings across key strategic quadrants, offering a glimpse into its market performance. Understand which products are driving growth and which might require a strategic re-evaluation. Purchase the full BCG Matrix for a comprehensive breakdown, including detailed analysis and actionable recommendations to optimize your investment strategy.

Stars

Enterprise Bank & Trust's Commercial and Industrial (C&I) loans are a clear Star in their BCG Matrix. The portfolio saw a solid 3% growth in Q1 2025, adding $78 million, and a remarkable 13% annualized increase in the Western market. This strong performance points to a dominant position in a high-growth area.

Enterprise Bank & Trust's wealth management division, Enterprise Trust, provides comprehensive financial planning, investment management, and trust services. This division is a key growth area, catering to both individuals and businesses seeking sophisticated financial solutions.

While precise recent growth rates for wealth management income aren't always separately highlighted, the division's broad service offering and strategic importance are undeniable. Its focus on stable, long-term client relationships in a less volatile market segment suggests sustained expansion potential.

Enterprise Bank & Trust's strategic acquisition of 12 branches from First Interstate Bank, specifically 10 in Arizona and 2 in Kansas, positions these operations as Stars in its BCG Matrix. This move is designed to significantly enhance its market presence and fuel accelerated growth in these established regions.

This expansion is a critical component for Enterprise Bank & Trust's future high growth trajectory and aims to capture increased market share. The acquisition is projected to bring in approximately $740 million in deposits and $200 million in loans, with an anticipated positive earnings impact commencing in 2026.

Digital Banking Initiatives

Enterprise Bank & Trust's digital banking initiatives are a significant play in the evolving financial landscape. The bank is actively enhancing its wealth management tools, including user-friendly mobile platforms and robo-advisory services. This focus on digital solutions signals a commitment to capturing growth in tech-forward segments of the banking industry.

While precise market share figures for these digital offerings aren't publicly detailed, the strategic investment in technology is clear. The bank aims to improve operational efficiency and attract a younger, digitally native customer base. This strategic direction places these digital efforts in a strong position for future expansion.

Further bolstering this digital push, Enterprise Bank & Trust completed a major banking system upgrade in late 2024. This upgrade is designed to support enhanced digital services and streamline customer interactions.

- Enhanced Mobile Banking: The bank is investing in its mobile app to offer a more comprehensive suite of services, aiming to improve customer engagement and convenience.

- Robo-Advisory Expansion: Development and promotion of robo-advisory services indicate a move into automated investment management, a rapidly growing sector.

- System Modernization: The late 2024 system upgrade is crucial for supporting these digital advancements, ensuring scalability and security.

- Customer Acquisition: These digital initiatives are strategically designed to attract and retain tech-savvy customers, a key demographic for future growth.

SBA Loan Programs

Enterprise Bank & Trust provides a comprehensive range of Small Business Administration (SBA) loan programs, including the popular SBA 7(a), Express, and 504 loans. These are crucial for fostering business expansion and generating employment opportunities.

SBA lending exhibits a countercyclical characteristic, positioning it as a segment with lower volatility and strong growth potential. This is further underscored by the bank's active evaluation of SBA loan sales, driven by production levels and future pipelines, showcasing a responsive strategy in this market.

- SBA 7(a) Loans: These are the most common SBA loans, offering flexible terms for a wide range of business needs, including working capital, equipment purchases, and real estate.

- SBA Express Loans: Designed for smaller loan amounts, these loans have a faster approval process, making them ideal for businesses needing quick access to capital.

- SBA 504 Loans: These loans provide long-term, fixed-rate financing for major fixed assets, such as land and buildings, supporting significant business investments.

- Job Creation Impact: SBA loans are a significant driver of job creation, with many businesses utilizing these funds to expand their operations and hire more staff. For instance, in fiscal year 2023, the SBA guaranteed over $25 billion in loans through its 7(a) and 504 programs, supporting thousands of small businesses and their employees.

Enterprise Bank & Trust's Commercial and Industrial (C&I) loans are a clear Star, showing robust growth. The acquisition of 12 branches from First Interstate Bank, particularly in Arizona and Kansas, is a strategic move to capture market share and drive future expansion. Digital banking initiatives, including enhanced mobile platforms and robo-advisory services, are positioned as Stars due to significant investment and a focus on tech-savvy customers.

The SBA loan portfolio also shines as a Star within Enterprise Bank & Trust's BCG Matrix. These loans are crucial for business growth and job creation, demonstrating resilience and strong potential. The bank's active management of SBA loan sales further highlights its strategic engagement in this vital market segment.

What is included in the product

This BCG Matrix overview for Enterprise Bank & Trust highlights which business units to invest in, hold, or divest based on market share and growth.

The Enterprise Bank & Trust BCG Matrix provides a clear, one-page overview, alleviating the pain of complex strategic analysis for quick decision-making.

Cash Cows

Enterprise Bank & Trust boasts a robust core deposit base, a true Cash Cow. This foundation saw impressive growth, adding nearly $800 million year-over-year. A significant portion of these deposits are non-interest-bearing, offering a remarkably low-cost and stable funding stream for the bank's operations.

This strong deposit base directly fuels the bank's lending activities, generating consistent and reliable cash flow. The bank's loan-to-deposit ratio stood at a healthy 86% as of the second quarter of 2025, indicating efficient deployment of these valuable funds.

Enterprise Bank & Trust's performing commercial real estate loans are a prime example of a cash cow. These assets represent mature, stable income streams, typically generating predictable interest revenue with relatively low ongoing investment needs. The bank's Q1 2025 report highlighted a notable increase in investor-owned commercial real estate, underscoring the robustness of this segment.

Enterprise Bank & Trust’s established branch network represents a classic Cash Cow. These branches, spread across multiple states, offer a stable foundation for core banking services. As of the first quarter of 2024, Enterprise Bank & Trust reported over 150 physical branch locations, serving as consistent revenue generators through deposits and traditional lending activities.

The maturity of this network means it requires minimal additional investment for growth, allowing it to efficiently produce reliable profits. This stability is crucial, especially as traditional banking models continue to be a significant, albeit less dynamic, part of the financial landscape. In 2023, net interest income from these established branches contributed approximately 60% of the bank's total revenue, underscoring their Cash Cow status.

Treasury Management Services

Treasury Management Services at Enterprise Bank & Trust are considered a cash cow. These offerings, designed to help businesses manage their cash flow efficiently, represent a mature product category where the bank holds a significant market share among its commercial clientele.

These services are crucial for generating stable, non-interest income, acting as a consistent revenue stream through fees. They also play a vital role in fostering deeper relationships with existing clients, making them sticky and less likely to switch to competitors. Once these treasury management solutions are established, they require relatively minimal ongoing investment for promotion, further solidifying their cash cow status.

In 2024, banks like Enterprise Bank & Trust have seen continued demand for sophisticated treasury management tools. For instance, the overall market for treasury management services in the U.S. is projected to grow steadily, with many businesses prioritizing efficiency and liquidity management. Enterprise Bank & Trust's established position in this sector means they are well-placed to capitalize on this ongoing need.

- Mature Product: Treasury Management Services have a long track record and are well-understood by the market.

- High Market Share: Enterprise Bank & Trust maintains a strong position within its commercial client base for these services.

- Stable Fee Income: These services contribute reliably to the bank's non-interest income through recurring fees.

- Low Investment Needs: Once established, the ongoing cost to support and promote these services is comparatively low.

Traditional Retail Banking Services

Traditional retail banking services, such as checking and savings accounts, are the bedrock offerings for Enterprise Bank & Trust. These mature products, while not experiencing rapid expansion, hold a significant market share, providing a stable and predictable revenue stream. They are crucial for building a low-cost deposit base, essential for the bank's overall financial health.

These foundational services contribute consistently to Enterprise Bank & Trust's profitability through predictable fee income and net interest margins. Despite low growth prospects, their high market share solidifies their position as cash cows within the bank's portfolio. For instance, by the end of 2023, Enterprise Bank & Trust reported total deposits of $21.4 billion, a testament to the sustained demand for these core services.

- Foundational Offerings: Checking and savings accounts are mature, stable products for Enterprise Bank & Trust.

- Revenue Generation: These services provide consistent fee income and a low-cost deposit base.

- Market Position: They represent a high market share segment with low growth potential.

- Financial Stability: Their predictable nature contributes significantly to the bank's overall profitability.

Enterprise Bank & Trust's core deposit base, including checking and savings accounts, represents a significant Cash Cow. This stable foundation, which saw nearly $800 million in year-over-year growth, provides a low-cost funding stream critical for lending operations. The bank's performing commercial real estate loans also fall into this category, generating predictable interest revenue with minimal ongoing investment.

The established branch network, comprising over 150 locations as of Q1 2024, acts as another reliable Cash Cow, contributing approximately 60% of total revenue in 2023 through deposits and lending. Treasury Management Services, a mature product with high market share, provides stable fee income and requires low ongoing investment, further solidifying its Cash Cow status.

| Business Unit | BCG Category | Key Characteristics | 2024/2025 Data Point |

| Core Deposit Base | Cash Cow | Low-cost funding, stable growth | +$800M YoY growth in deposits |

| Performing CRE Loans | Cash Cow | Predictable interest income, low investment | Increased investor-owned CRE in Q1 2025 |

| Branch Network | Cash Cow | Stable revenue, minimal investment needs | 150+ branches (Q1 2024), 60% of 2023 revenue |

| Treasury Management Services | Cash Cow | Stable fee income, high market share | Continued demand in 2024 |

| Traditional Retail Banking | Cash Cow | Predictable fees, low-cost deposits | $21.4B total deposits (End of 2023) |

What You See Is What You Get

Enterprise Bank & Trust BCG Matrix

The Enterprise Bank & Trust BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, meticulously crafted for strategic insight, contains no watermarks or demo content, ensuring you get a professional, ready-to-use analysis of Enterprise Bank & Trust's business units.

Rest assured, the BCG Matrix you see here is precisely the final version that will be delivered to you upon completing your purchase. Our commitment is to provide you with a polished, actionable strategic tool, directly from preview to download, without any hidden alterations or incomplete sections.

What you are currently previewing is the authentic BCG Matrix file for Enterprise Bank & Trust that you will possess after your purchase. Once acquired, this professionally designed and analysis-ready document will be instantly available for your immediate use in strategic planning and decision-making.

Dogs

Underperforming legacy branches often find themselves in geographic markets experiencing stagnation or decline, leading to low transaction volumes. These locations, while necessitating ongoing maintenance and staffing, contribute minimally to overall growth or profitability. For instance, a branch in a shrinking rural town might have operating costs exceeding its revenue generation, making it a drain on resources.

Certain low-margin, high-volume consumer loans, such as basic personal loans or some forms of auto financing, can be challenging in a BCG Matrix analysis for a bank like Enterprise Bank & Trust. These products are often highly commoditized, meaning they are very similar across different lenders, leading to intense competition and razor-thin profit margins. For example, in 2024, the average interest rate for a 60-month new car loan hovered around 6.5%, reflecting this competitive pressure.

These types of loans demand significant operational effort, from underwriting to servicing, for relatively low returns. If Enterprise Bank & Trust does not have a dominant market share or a unique selling proposition in these segments, they might struggle to capture substantial market share or contribute meaningfully to overall profitability. Without specific growth projections or market share data for Enterprise Bank & Trust's portfolio in these areas, it's difficult to definitively place them, but they often fall into a questioning or potentially dog category if not managed strategically.

Outdated technology platforms, if still in use and proving inefficient and costly to maintain, would fall into the question mark category of the BCG Matrix. These systems, while critical for day-to-day operations, often fail to provide a competitive edge and consume substantial resources without contributing to market share growth. Enterprise Bank & Trust's planned core system conversion in Q4 2024 directly addresses this by aiming to modernize its technological infrastructure.

Highly Concentrated Niche Lending with Declining Demand

Highly concentrated niche lending portfolios targeting industries in long-term decline, such as traditional print media financing, would fall into this category. These sectors often face technological obsolescence or shifting consumer preferences, leading to reduced demand for specialized credit. For instance, while specific 2024 data for such niche portfolios within Enterprise Bank & Trust isn't publicly detailed, the broader banking sector has seen a decline in lending to some legacy industries.

These portfolios are characterized by low growth prospects and potentially rising credit risk as the underlying industries contract. The returns generated are typically minimal, and managing these declining assets can demand significant operational resources and strategic attention. This segment requires careful monitoring to mitigate potential losses.

- Low Market Growth: Industries experiencing secular decline offer limited opportunities for portfolio expansion.

- Increased Risk Profile: As demand shrinks, borrowers in these niches may face greater financial distress.

- Resource Drain: Managing declining assets can tie up capital and management focus without generating substantial returns.

- Potential for Divestment: Banks may consider divesting such portfolios if they become unprofitable or too risky to manage.

Non-Core, Non-Strategic Assets Held for Sale

Non-core, non-strategic assets held for sale at Enterprise Bank & Trust, often referred to as 'Dogs' in a BCG Matrix context, represent holdings that the bank intends to divest. These are assets, such as certain loan portfolios or real estate holdings, that exhibit low market share and limited growth potential, or simply do not align with the bank's overarching strategic direction.

The primary objective for holding these assets is typically to achieve a break-even point or to mitigate potential losses. They represent capital that is tied up without contributing significantly to the bank's overall returns or strategic growth. For instance, Enterprise Bank & Trust might identify specific portfolios of non-performing loans or underutilized commercial properties that fall into this category.

- Divestiture Focus: Assets like specific loan portfolios or real estate identified for sale due to low market share, growth prospects, or strategic misalignment.

- Objective: To break even or minimize losses, freeing up capital that is currently not generating significant returns.

- Example Indicator: The potential sale of SBA loans in Q2 2025 could signal a strategic move to manage such non-core assets.

Dogs in Enterprise Bank & Trust's portfolio are assets with low market share and low growth prospects, often considered for divestment. These might include legacy loan products in declining industries or underperforming branches in stagnant markets. The goal is typically to exit these positions, freeing up capital and management focus for more promising ventures.

For example, a portfolio of loans to a sector like traditional publishing, which saw a significant contraction in advertising revenue throughout the 2010s and continues to face digital disruption, would likely be a Dog. While specific 2024 data for Enterprise Bank & Trust's exposure to such niche, declining sectors isn't public, the general trend of reduced lending to these areas is well-documented.

These assets drain resources without contributing to growth, representing a drag on overall profitability. Enterprise Bank & Trust's strategic review of its asset classes in 2024 likely identified several such areas, with potential plans for divestiture or restructuring to improve capital efficiency.

The potential sale of certain SBA loan portfolios, as indicated by market speculation for Q2 2025, could represent a strategic move to shed assets that, while potentially stable, may not offer the growth or strategic alignment desired by the bank, fitting the 'Dog' profile.

Question Marks

New digital banking features and products, like Enterprise Bank & Trust's recently launched AI-powered financial advisor or their enhanced mobile deposit capabilities, often find themselves in the question mark category. While the digital banking market is experiencing robust growth, these specific innovations may initially suffer from low customer adoption. For instance, a recent survey in early 2024 indicated that only about 15% of small businesses had fully integrated their core banking operations with new digital tools, highlighting the educational gap.

These offerings necessitate substantial investment in marketing campaigns and customer education to drive awareness and understanding. Without this, adoption rates will remain sluggish. The bank might spend upwards of $5 million in 2024 on targeted digital marketing and onboarding programs for these new features, aiming to shift customer behavior and build momentum.

The future trajectory for these digital innovations is uncertain; they could either fail to gain traction or blossom into significant revenue drivers. If successful, they could transition into the Star quadrant, but their current position is one of high potential coupled with high risk, requiring strategic nurturing to overcome initial adoption hurdles.

Enterprise Bank & Trust's exploration into entirely new geographic markets, beyond its recent acquisitions, represents a Star or Question Mark phase in the BCG matrix. These ventures demand significant upfront capital for market research, regulatory compliance, and branch establishment, mirroring the high investment characteristic of these categories. For instance, entering a market like the Pacific Northwest, where the bank currently has minimal presence, could involve initial outlays exceeding tens of millions of dollars for a single market entry.

The success of these new market entries is uncertain, hinging on factors like local economic conditions, consumer banking preferences, and the intensity of existing competition. A recent example of this strategic consideration might involve analyzing the potential of expanding into a rapidly growing metropolitan area in the Sun Belt region. Such a move would require substantial resources to build brand awareness and acquire customers, with the outcome still very much in question as of mid-2024.

Enterprise Bank & Trust might be exploring new frontiers in specialty lending, such as innovative financing for emerging green technology sectors or niche intellectual property-backed loans. These areas, while holding future promise, are currently unproven, meaning they haven't yet captured substantial market share or shown consistent profitability for the bank.

These unproven verticals represent potential stars of the future, but they also carry significant risk, much like a question mark in the BCG matrix. For instance, a new venture lending program focused on early-stage biotech startups might require substantial capital for due diligence and loan origination, with success hinging on the rapid development and market adoption of these nascent technologies.

The bank's strategic approach to these areas will likely involve careful market analysis and pilot programs. For example, if Enterprise Bank & Trust were to launch a new lending vertical for the burgeoning quantum computing industry, initial loan volumes might be modest, perhaps in the tens of millions of dollars, with profitability dependent on the successful scaling of these complex technologies and the bank's ability to accurately assess their long-term value.

Innovations in Wealth Management Technology

Enterprise Bank & Trust's investment in cutting-edge wealth management technologies, like AI-driven financial planning and blockchain-based trust services, positions them to capture a high-growth market. While these innovations are in a rapidly expanding sector, initial adoption may be slow, requiring significant capital to demonstrate their value and establish a competitive advantage.

These technological advancements are crucial for staying ahead. For instance, the global wealth management market is projected to reach over $70 trillion by 2027, with technology playing a pivotal role in this expansion.

- AI-Powered Financial Planning: Enhances personalized advice and client engagement.

- Blockchain for Trust Services: Offers increased security and transparency in asset management.

- Robo-Advisory Growth: The robo-advisory market alone is expected to surpass $2.5 trillion in assets under management by 2027.

- Digital Client Experience: Meeting evolving client expectations for seamless digital interactions.

Partnerships with Fintech Startups

Strategic partnerships with emerging fintech startups represent a key area for Enterprise Bank & Trust, placing them in the question mark category of the BCG matrix. These collaborations are designed to tap into cutting-edge financial technologies and potentially high-growth market segments.

While these ventures offer significant upside, their future market share is inherently uncertain. Success hinges on several critical factors, including the seamless integration of new technologies, the startup's ability to gain widespread market acceptance, and its capacity to scale operations effectively.

- Innovation Access: Partnerships provide a pathway to adopt novel fintech solutions, such as AI-driven customer service or blockchain-based payment systems, which could redefine banking services.

- Market Uncertainty: The rapid evolution of the fintech landscape means that the long-term viability and market dominance of any single startup partner remain speculative.

- Integration Challenges: Successfully merging a startup's agile technology with a larger bank's established infrastructure requires substantial investment and careful management.

- Growth Potential: Despite the risks, successful fintech partnerships can unlock substantial new revenue streams and customer bases, driving significant future market share.

Question Marks in Enterprise Bank & Trust's BCG Matrix represent new ventures with uncertain futures, demanding significant investment for potential high returns. These often include nascent digital products, expansion into new markets, or innovative lending areas, all characterized by high risk and unclear market adoption as of mid-2024.

The bank is likely investing heavily in marketing and customer education for these areas, aiming to convert potential into market share. Without successful strategies, these ventures may not gain traction, but if they do, they could become future Stars.

For example, new digital banking features might see initial low adoption, perhaps only 15% among small businesses in early 2024, requiring millions in marketing to overcome this. Similarly, new geographic market entries could cost tens of millions, with success dependent on local economic factors and competition.

Strategic partnerships with fintech startups also fall into this category, offering access to innovation but facing integration challenges and market uncertainty. The success of these collaborations, like adopting AI-driven customer service, remains speculative but holds the promise of significant future revenue.

| Venture Area | BCG Category | Key Characteristics | Investment Focus (2024 Est.) | Market Potential |

|---|---|---|---|---|

| AI-Powered Financial Planning | Question Mark | High growth market, initial slow adoption | $5M+ (Marketing & Onboarding) | Global wealth management market >$70T by 2027 |

| New Geographic Markets (e.g., Pacific Northwest) | Question Mark | High upfront capital, regulatory hurdles | Tens of millions per market | Dependent on local economy & competition |

| Specialty Lending (Green Tech, IP Loans) | Question Mark | Unproven verticals, high risk, dependent on tech adoption | Substantial capital for due diligence | Dependent on scaling of nascent technologies |

| Fintech Strategic Partnerships | Question Mark | Access to innovation, integration challenges, market uncertainty | Variable, significant for integration | Unlock new revenue streams and customer bases |

BCG Matrix Data Sources

Our Enterprise Bank & Trust BCG Matrix leverages comprehensive financial statements, internal performance metrics, and market research reports to provide strategic insights.