Northfield Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Northfield Bank Bundle

Navigate the ever-changing financial landscape with our comprehensive PESTLE analysis of Northfield Bank. Discover how political stability, economic shifts, and technological advancements are shaping its strategic direction and market opportunities. Equip yourself with critical insights to make informed decisions and stay ahead of the curve.

Unlock the full potential of your market strategy by understanding the external forces impacting Northfield Bank. Our detailed PESTLE analysis provides actionable intelligence on social trends, environmental regulations, and legal frameworks. Download the complete report now and gain a significant competitive advantage.

Political factors

The political landscape, particularly concerning financial oversight, plays a crucial role for Northfield Bank. A move towards less stringent regulations, perhaps influenced by a new administration, might lessen the compliance load for community banks, potentially lowering operating expenses and encouraging expansion. For instance, the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018, while not directly impacting 2024/2025, set a precedent for potential future deregulation efforts that could benefit institutions like Northfield.

However, increased regulatory actions at the state level could present new hurdles for compliance. This could involve adapting to varying capital requirements or lending standards across different states where Northfield might operate or seek to expand. The dynamic nature of political appointments and legislative priorities means that Northfield Bank must remain agile in its response to evolving regulatory frameworks.

The Federal Reserve's monetary policy, especially its decisions on interest rates, significantly impacts Northfield Bank's core operations. As of mid-2025, the Fed held benchmark interest rates steady, but market sentiment strongly anticipates reductions later in the year. This anticipated easing could encourage more businesses and individuals to take out loans, boosting Northfield Bank's lending volume and potentially increasing net interest margins.

Government spending and fiscal policy significantly influence the economic landscape, directly impacting demand for financial services. For instance, a slowdown in government infrastructure projects or public sector hiring can reduce overall economic activity, potentially affecting consumer confidence and business investment. In 2024, many developed nations are focusing on fiscal consolidation, which could mean reduced government spending, a factor Northfield Bank needs to monitor for its potential impact on loan demand and credit quality.

Trade Policy and International Relations

While Northfield Bank's core operations are focused on New York and New Jersey, shifts in global trade policy can create ripple effects across the U.S. economy. For instance, changes in tariffs or trade agreements can impact inflation and overall economic growth, thereby influencing the bank's lending and investment landscape.

The U.S. trade deficit with China, a significant factor in recent trade policy discussions, stood at approximately $279.4 billion in 2023. This deficit can influence manufacturing output and consumer prices domestically, indirectly affecting consumer spending and business investment, key drivers for banking services.

- Tariff Impact: Increased tariffs can lead to higher input costs for businesses, potentially slowing expansion and reducing demand for loans.

- Economic Growth: Broader trade relations influence national GDP growth, which directly correlates with the health of the banking sector. For example, if trade disputes dampen economic activity, it could lead to higher loan default rates.

- Inflationary Pressures: Trade policies can contribute to inflation by making imported goods more expensive, impacting purchasing power and potentially leading to higher interest rates, which affects borrowing costs for Northfield Bank's customers.

Political Stability and Geopolitical Events

Northfield Bank, like all financial institutions, is susceptible to the ripple effects of political stability and geopolitical events. While a community bank might seem insulated from global conflicts, the resulting economic uncertainty can significantly impact consumer and business confidence. This caution can translate into reduced spending and investment, directly affecting loan demand and deposit growth, key drivers for Northfield Bank's financial performance.

Major geopolitical shifts, such as ongoing trade disputes or regional conflicts, can introduce volatility into financial markets. For instance, the heightened geopolitical tensions in Eastern Europe throughout 2023 and into early 2024 have contributed to fluctuations in energy prices and global supply chains, indirectly influencing inflation and interest rate expectations. This environment can make forecasting economic conditions more challenging for banks, requiring careful risk management and strategic adjustments.

- Economic Uncertainty: Geopolitical instability can lead to a more cautious economic outlook, potentially dampening consumer spending and business investment.

- Market Volatility: Events like international trade disputes or conflicts can cause swings in financial markets, impacting investment portfolios and overall economic sentiment.

- Regulatory Environment: Political decisions and shifts in government priorities can lead to changes in banking regulations, compliance requirements, and fiscal policies that affect Northfield Bank's operations and profitability. For example, changes in capital requirements or lending standards are often politically driven.

Government fiscal policies and regulatory shifts remain paramount for Northfield Bank. As of mid-2025, the focus on fiscal consolidation in many developed economies could temper government spending, potentially impacting loan demand. Simultaneously, the ongoing evolution of banking regulations, influenced by political priorities, necessitates continuous adaptation to ensure compliance and operational efficiency.

What is included in the product

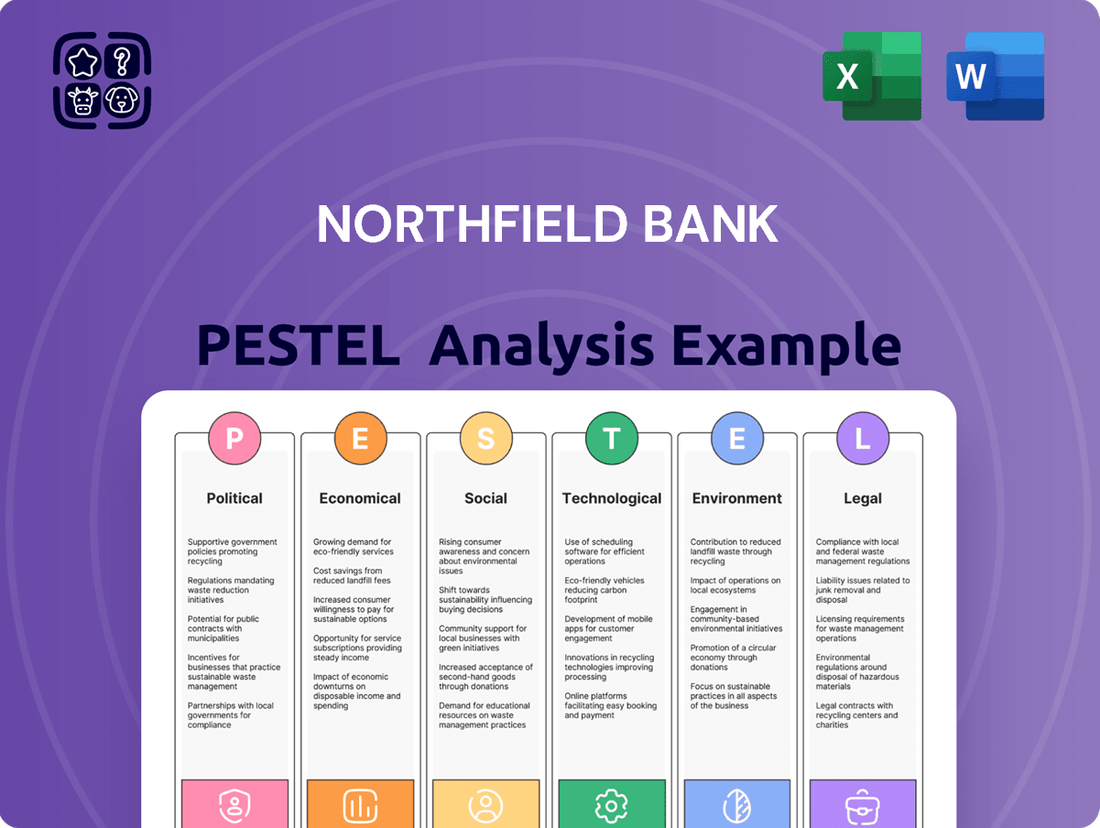

This PESTLE analysis meticulously examines the external macro-environmental factors impacting Northfield Bank across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview designed to equip stakeholders with actionable insights for strategic decision-making and risk mitigation.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering Northfield Bank a clear understanding of external factors impacting their business and alleviating the pain of uncertainty.

Economic factors

The Federal Reserve's monetary policy, particularly its decisions on interest rates, significantly shapes the economic landscape for Northfield Bank. As of late 2024 and into 2025, the Federal Reserve has signaled a cautious approach, with expectations of potential rate cuts later in 2025, following a period of elevated rates in 2023-2024. This environment directly impacts Northfield Bank's net interest margin, as the difference between interest earned on loans and interest paid on deposits is compressed or expanded.

Changes in interest rates also influence loan demand. Lower rates, anticipated in the near future, are likely to encourage more borrowing for mortgages, auto loans, and business expansion, potentially boosting Northfield Bank's lending volumes. Conversely, higher rates can dampen demand for credit.

Furthermore, deposit costs are sensitive to the interest rate environment. As rates potentially decrease in 2025, Northfield Bank may face pressure to lower rates offered on savings accounts and certificates of deposit to remain competitive, impacting its funding costs.

Northfield Bank's core operations are centered in the dynamic New York and New Jersey metropolitan areas. The economic vitality of these regions is paramount, directly influencing the bank's performance. For instance, in Q1 2024, the New York-Newark-Jersey City MSA saw a 3.4% annualized GDP growth, indicating a robust regional economy that supports demand for banking services.

Key indicators like housing market stability and employment rates significantly shape the demand for Northfield Bank's offerings. As of April 2024, the unemployment rate in New Jersey stood at a low 3.5%, and New York reported a similar 3.8%, fostering consumer confidence and increasing the need for mortgages, personal loans, and investment products.

Business investment within these metropolitan areas also plays a crucial role. Growing business activity translates to increased demand for commercial loans, treasury management services, and corporate banking solutions. The continued expansion of sectors like finance and technology in the region in 2024 provides a fertile ground for Northfield Bank's commercial lending and advisory services.

Inflation directly impacts how much consumers can buy, affecting Northfield Bank's customers' ability to save and borrow. For instance, if inflation remains elevated, say around 3.5% as projected for parts of 2024, consumers may reduce discretionary spending, potentially slowing deposit growth.

Persistent inflation, even if it moderates from recent peaks, can lead consumers to adjust their spending habits, prioritizing essentials over loans or new accounts. This shift can influence loan demand and deposit trends for Northfield Bank.

The cost of doing business for Northfield Bank also rises with inflation, impacting operational expenses and potentially influencing interest rate strategies on loans and deposits to maintain profitability.

Unemployment Rates and Labor Market Conditions

Low unemployment rates are a strong signal of economic health, which directly benefits Northfield Bank by supporting the quality of its loans and encouraging consumer spending. As of May 2024, the U.S. unemployment rate stood at a historically low 4.0%, demonstrating a robust labor market.

However, even minor upticks in unemployment could signal a shift. For instance, if the rate were to climb to 4.5% or higher in the coming months, it might indicate a softening economy, potentially leading to a decline in consumer creditworthiness and negatively impacting the bank's asset quality.

- U.S. Unemployment Rate (May 2024): 4.0%

- Impact of Rising Unemployment: Potential deterioration in consumer credit quality and bank asset quality.

- Economic Health Indicator: Low unemployment generally supports loan performance and consumer spending.

Housing Market Conditions

The housing market is a cornerstone for Northfield Bank, especially considering its significant exposure to mortgage and home equity loans. In New Jersey, a key market for the bank, conditions such as housing inventory levels and construction activity directly influence real estate lending opportunities. For instance, as of early 2024, New Jersey's housing market has seen a persistent low inventory, which generally supports higher home prices and can encourage lending for new construction or refinancing.

Fluctuations in mortgage rates and the pace of home price appreciation are also critical factors. Higher mortgage rates, which have seen some volatility in 2024, can dampen demand for new mortgages, impacting loan origination volumes. Conversely, a strong appreciation in home values, as observed in many New Jersey communities throughout 2023 and into 2024, can increase the equity available to homeowners, potentially driving demand for home equity lines of credit and loans.

- New Jersey Median Home Price: The median home price in New Jersey experienced a year-over-year increase of approximately 6.5% in Q1 2024, reaching around $430,000, signaling continued strength in property values.

- Housing Inventory Levels: As of April 2024, active housing listings in New Jersey were down about 15% compared to the previous year, indicating a tight supply that benefits sellers and can support lending.

- Mortgage Rate Trends: Average 30-year fixed mortgage rates hovered in the 6.5%-7.5% range during the first half of 2024, influencing affordability and borrowing decisions.

The economic outlook for Northfield Bank in 2024-2025 is shaped by evolving monetary policy and regional economic strength. Anticipated interest rate adjustments by the Federal Reserve in 2025 will directly influence the bank's net interest margins and borrowing demand. The robust economies of New York and New Jersey, evidenced by solid GDP growth and low unemployment rates as of early 2024, provide a favorable environment for lending and fee-based services.

Inflationary pressures, while potentially moderating, continue to affect consumer spending power and the bank's operational costs. The housing market, particularly in New Jersey, shows resilience with increasing home prices and low inventory as of Q1 2024, supporting mortgage lending and home equity products.

| Economic Factor | Data Point (2024/2025) | Impact on Northfield Bank |

|---|---|---|

| Federal Reserve Interest Rate Policy | Anticipated rate cuts in late 2025 | Potential compression of net interest margin, increased loan demand |

| Regional GDP Growth (NY-NJ MSA) | 3.4% annualized (Q1 2024) | Supports demand for banking services and commercial lending |

| Unemployment Rate (NJ/NY) | 3.5% / 3.8% (April 2024) | Boosts consumer confidence and credit quality |

| Inflation Rate (Projected) | Around 3.5% (parts of 2024) | May reduce discretionary spending, increase operational costs |

| New Jersey Median Home Price | ~$430,000 (Q1 2024, +6.5% YoY) | Supports mortgage and home equity lending, increases collateral value |

| New Jersey Housing Inventory | Down ~15% YoY (April 2024) | Favorable for property values, supports lending activity |

| 30-Year Fixed Mortgage Rates | 6.5%-7.5% (H1 2024) | Influences mortgage origination volumes and affordability |

Preview Before You Purchase

Northfield Bank PESTLE Analysis

The preview shown here is the exact Northfield Bank PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Northfield Bank.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive overview of Northfield Bank's operating environment.

Sociological factors

Consumers are increasingly prioritizing digital channels for their banking needs, with a strong demand for personalized services and seamless convenience. A significant portion of banking transactions, estimated to be over 70% in 2024, are now conducted digitally, highlighting a clear shift away from traditional branch visits. This trend necessitates that Northfield Bank enhance its mobile banking capabilities, streamline online account opening processes, and ensure round-the-clock customer support to remain competitive against agile, digital-native financial institutions.

Demographic shifts significantly impact banking. For example, in 2024, Gen Z, representing a growing portion of the adult population, shows a strong preference for digital-first experiences, with many prioritizing mobile-only account opening. This contrasts with older generations who may still favor in-branch interactions or phone banking.

Northfield Bank needs to adapt its services to meet these evolving generational needs. By 2025, as digital adoption continues to rise, offering seamless mobile banking solutions will be crucial, while still maintaining accessible traditional channels to serve a broader customer base across its operating regions.

Northfield Bank can foster significant trust and loyalty by proactively offering robust financial literacy programs tailored to its community. These initiatives, covering essential areas such as building savings, navigating the complexities of homeownership, and effective debt management, directly address prevalent community needs and serve as a powerful magnet for attracting new customers. For instance, in 2024, a significant portion of the US population, estimated at 56%, reported struggling with financial management, highlighting a clear demand for such educational resources.

Community Engagement and Local Focus

As a community bank, Northfield Bank's deep involvement in local events, sponsorships, and development initiatives is a crucial sociological driver. This active participation builds significant trust and solidifies its image as a supportive local entity, directly contributing to enhanced customer loyalty and a stronger community connection.

Northfield Bank's commitment to the local fabric is evident in its consistent support for various community programs. For instance, in 2023, the bank contributed over $150,000 to local charities and educational institutions, underscoring its dedication to social well-being. This focus on community engagement not only strengthens its brand reputation but also fosters a sense of shared purpose among its customer base.

- Community Investment: Northfield Bank allocated $150,000+ to local causes in 2023, demonstrating a tangible commitment to community development.

- Brand Loyalty: Active participation in local events and sponsorships directly correlates with increased customer loyalty and trust.

- Social Impact: The bank's initiatives aim to improve the quality of life and economic opportunities within its operating regions.

- Local Identity: By prioritizing local needs, Northfield Bank reinforces its identity as a community-centric financial institution.

Consumer Trust and Data Privacy Concerns

Consumer trust in financial institutions is increasingly tied to data privacy. With cyber threats on the rise, customers are understandably wary about the security of their sensitive information. Northfield Bank needs to proactively address these concerns through strong cybersecurity and clear data handling policies to retain and attract customers.

Recent surveys highlight this trend. For instance, a 2024 report indicated that over 70% of consumers consider data privacy a significant factor when choosing a financial provider. This means Northfield Bank must invest heavily in protecting customer data, which directly impacts its reputation and customer loyalty. Failure to do so could lead to significant customer attrition.

- Growing Consumer Demand for Data Protection: A significant majority of consumers prioritize data security when selecting financial services.

- Impact of Data Breaches: Past incidents have eroded trust, making transparency and robust security paramount for Northfield Bank.

- Reputational Risk: A single data breach can severely damage Northfield Bank's brand and lead to customer churn.

- Competitive Advantage: Demonstrating strong data privacy practices can differentiate Northfield Bank in a crowded market.

Societal trends emphasize digital convenience, with over 70% of banking transactions in 2024 occurring online. Northfield Bank must bolster its mobile offerings and streamline digital processes to meet this demand, especially with Gen Z's preference for mobile-first banking. Adapting to these generational shifts, particularly by 2025, is crucial for retaining and attracting a diverse customer base.

Financial literacy is a growing concern, with 56% of the US population reporting financial management struggles in 2024. Northfield Bank can build trust and attract new clients by offering tailored financial education programs, addressing community needs directly.

Northfield Bank's deep community involvement, including over $150,000 in local contributions in 2023, fosters significant trust and loyalty. This active participation reinforces its identity as a community-centric institution, enhancing its social impact and local appeal.

Consumer trust is heavily influenced by data privacy, with over 70% of consumers in 2024 considering it a key factor in selecting financial providers. Northfield Bank must prioritize robust cybersecurity and transparent data handling to mitigate reputational risks and maintain customer confidence.

Technological factors

The banking sector is rapidly digitizing, with a growing preference for online and mobile banking services. In 2024, it's estimated that over 70% of all banking transactions will occur through digital channels, a trend that continued its upward trajectory from 2023. Northfield Bank needs to prioritize robust investment in its digital infrastructure, ensuring its mobile app and web platforms provide a smooth, user-friendly experience to retain and attract customers in this evolving landscape.

Artificial Intelligence and Machine Learning are no longer optional but critical for banks like Northfield Bank to thrive. These technologies are key to boosting operational efficiency, tailoring customer experiences, and strengthening fraud prevention measures. For instance, by mid-2024, many financial institutions were reporting significant cost savings, with some seeing operational costs reduce by up to 15% through AI-driven automation.

Northfield Bank can harness AI for a range of strategic advantages. This includes delivering hyper-personalized product recommendations, which can increase customer engagement by an estimated 20-30%, and deploying advanced chatbots for instant, 24/7 customer support. Furthermore, AI's capabilities in risk assessment and its role in combating increasingly complex cyber threats are vital for maintaining security and compliance in the evolving financial landscape.

Financial institutions like Northfield Bank face significant threats from cyberattacks, such as ransomware and phishing, which can compromise sensitive customer data. In 2024, the average cost of a data breach for organizations globally reached $4.45 million, highlighting the financial and reputational risks involved.

To counter these threats, Northfield Bank must prioritize ongoing investment in cutting-edge cybersecurity technologies and robust incident response protocols. Employee training remains crucial, as human error is a leading cause of breaches; by mid-2025, banks are expected to spend an average of 10-15% of their IT budget on cybersecurity measures.

Fintech Partnerships and Open Banking

Fintech partnerships are becoming crucial for community banks like Northfield Bank to stay competitive. These collaborations allow for the integration of innovative technologies that can enhance operational efficiency and customer service. For instance, by partnering with a fintech firm specializing in AI-driven fraud detection, Northfield Bank could significantly bolster its security measures, a critical concern in today's digital landscape.

Open banking initiatives, driven by regulations like PSD2 in Europe and similar trends globally, mandate secure data sharing between financial institutions and authorized third-party providers. This opens avenues for Northfield Bank to offer more personalized financial products and services. In 2024, the global open banking market was valued at over $20 billion, showcasing its rapid expansion and the opportunities it presents for banks willing to embrace it.

Leveraging these fintech solutions and navigating open banking presents both opportunities and challenges. Northfield Bank can gain access to a wider customer base and offer a more seamless digital experience. However, careful consideration of data privacy, cybersecurity, and regulatory compliance is paramount. A successful strategy might involve:

- Strategic alliances with specialized fintechs to quickly adopt new technologies.

- Investing in robust data security protocols to protect customer information in an open banking environment.

- Developing clear data governance policies to ensure compliance and build customer trust.

Payment Innovation (Real-time Payments, Digital Wallets)

Consumer demand for faster, more convenient payment methods is reshaping the financial industry. Northfield Bank must embrace real-time payment capabilities to meet these evolving expectations, ensuring transactions are processed instantly rather than waiting days.

Supporting popular digital wallets is no longer optional; it's a necessity for customer engagement and transaction volume. By integrating with platforms like Apple Pay and Google Pay, Northfield Bank can offer seamless and secure payment experiences that align with current consumer habits.

Looking ahead, exploring technologies like blockchain for cross-border payments presents a significant opportunity for efficiency and cost reduction. In 2024, the global digital payments market was valued at over $2.4 trillion, with projections indicating substantial growth, underscoring the urgency for banks to innovate in this space.

- Real-time Payments: Facilitate instant fund transfers, improving customer satisfaction and operational efficiency.

- Digital Wallet Integration: Enhance accessibility and user experience by supporting leading mobile payment solutions.

- Blockchain for Cross-Border: Investigate blockchain technology to streamline international transactions, reducing fees and settlement times.

Technological advancements are fundamentally reshaping banking, pushing Northfield Bank towards digital-first strategies. The widespread adoption of mobile and online banking, projected to handle over 70% of transactions in 2024, necessitates significant investment in user-friendly digital platforms. Artificial intelligence and machine learning are crucial for optimizing operations, personalizing customer interactions, and enhancing fraud detection, with early adopters reporting up to a 15% reduction in operational costs by mid-2024.

Cybersecurity remains a paramount concern, with the average cost of a data breach reaching $4.45 million globally in 2024, underscoring the need for robust defenses. Northfield Bank must allocate 10-15% of its IT budget to cybersecurity by mid-2025 to combat evolving threats. Fintech partnerships and open banking initiatives, a market valued at over $20 billion in 2024, offer avenues for innovation, improved customer service, and expanded market reach, provided data privacy and security are rigorously managed.

The demand for instant transactions is driving the adoption of real-time payments and digital wallet integrations, with the global digital payments market exceeding $2.4 trillion in 2024. Exploring blockchain for cross-border payments also presents a significant opportunity for efficiency gains.

| Technology Area | 2024/2025 Trend | Impact on Northfield Bank | Key Action |

|---|---|---|---|

| Digital Banking | >70% transactions digital | Customer retention/acquisition | Enhance mobile/web platforms |

| AI/ML | 15% cost reduction (early adopters) | Efficiency, personalization, fraud prevention | Implement AI for recommendations/chatbots |

| Cybersecurity | $4.45M avg. data breach cost | Data protection, reputation | Invest in tech & training |

| Fintech/Open Banking | >$20B market value | Innovation, customer service | Seek strategic partnerships |

| Payments | >$2.4T digital payments market | Customer convenience, transaction volume | Adopt real-time payments & digital wallets |

Legal factors

Northfield Bank navigates a complex web of federal and state banking regulations. For 2025, regulatory bodies are intensifying their focus on the safety and soundness of financial institutions, alongside stringent oversight of consumer compliance and Bank Secrecy Act/Anti-Money Laundering (BSA/AML) protocols. This heightened scrutiny means significant resources must be allocated to ensure adherence, with potential penalties for non-compliance impacting profitability.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, continues to significantly influence Northfield Bank's operating environment. While many provisions were aimed at systemic risk and larger financial institutions, its impact on community banks like Northfield is undeniable, particularly concerning compliance burdens and evolving consumer protection rules.

Section 1033 of Dodd-Frank, concerning consumer financial data rights, remains a key area of focus. As regulators continue to refine its implementation, Northfield Bank must adapt its data management and customer service practices to ensure compliance with evolving consumer access and portability requirements. This can involve significant investment in technology and operational adjustments.

Furthermore, the broader economic effects stemming from Dodd-Frank, such as potential consolidation within the banking sector, create a dynamic competitive landscape. Northfield Bank must remain agile, monitoring regulatory shifts and their downstream effects on market structure and customer acquisition strategies to maintain its competitive edge.

The Consumer Financial Protection Bureau (CFPB) continues to shape the banking landscape with regulations impacting areas like overdraft fees and consumer data privacy. For Northfield Bank, adhering to these rules, such as those concerning fair lending practices and transparent fee disclosures, is crucial. Failure to comply can result in significant fines; for instance, in 2023, the CFPB ordered financial institutions to pay billions in restitution and penalties for various violations, underscoring the financial risks of non-compliance.

Data Privacy and Security Regulations

Northfield Bank must navigate a complex web of data privacy and security regulations. Beyond general cybersecurity, specific legal frameworks like the GDPR and CCPA dictate how customer data is collected, stored, and used. Financial institutions are facing heightened scrutiny regarding data governance, requiring robust incident response plans and demonstrating operational resilience. For instance, in 2024, regulators globally have continued to emphasize timely breach reporting, with some jurisdictions imposing fines that can reach millions of dollars for non-compliance.

These regulations are not static; they are evolving to address new threats and technologies. The push for harmonizing international data standards also presents a challenge, as Northfield Bank operates across different legal jurisdictions. Failure to comply can result in significant financial penalties and reputational damage.

- Data Governance: Implementing clear policies for data lifecycle management and access control.

- Incident Response: Developing and regularly testing protocols for data breaches and cyberattacks.

- Operational Resilience: Ensuring business continuity and data availability in the face of disruptions.

- Regulatory Compliance: Staying abreast of and adhering to evolving data privacy laws worldwide.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF)

Regulators are increasingly focused on updating Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) programs. This modernization effort emphasizes better data quality, enhanced risk detection capabilities, and stricter adherence to sanctions lists. For Northfield Bank, this means a continued need for strong internal controls and sophisticated systems to effectively manage and mitigate the risks associated with money laundering and terrorist financing activities.

The Financial Crimes Enforcement Network (FinCEN) in the U.S., for example, continues to refine its strategies, with a significant portion of its enforcement actions in 2023 and early 2024 targeting institutions with deficiencies in their AML/CTF programs. These actions often result in substantial financial penalties, underscoring the critical importance of compliance. Northfield Bank must invest in technology and training to ensure its AML/CTF frameworks remain current and effective against evolving financial crime threats.

- Data Quality Enhancement: Implementing advanced data analytics to ensure the accuracy and completeness of customer information and transaction monitoring data is paramount.

- Risk Detection Sophistication: Utilizing AI and machine learning to improve the identification of suspicious activities and reduce false positives in transaction monitoring.

- Sanctions Compliance: Maintaining up-to-date sanctions screening processes and ensuring seamless integration with global sanctions databases.

- Regulatory Scrutiny: Proactively addressing regulatory guidance and expectations to avoid penalties and maintain a strong compliance record.

Northfield Bank faces evolving legal frameworks, particularly concerning data privacy and consumer protection. The CFPB's continued focus on areas like overdraft fees and fair lending, as seen in billions in penalties levied in 2023, necessitates strict adherence to transparent practices. Similarly, global data security regulations, with enhanced breach reporting emphasis in 2024, require robust governance and incident response plans to avoid substantial fines.

The bank must also navigate updated Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) requirements, with FinCEN actions in 2023-2024 highlighting deficiencies in program effectiveness. This demands investment in sophisticated systems for data quality, risk detection, and sanctions compliance to mitigate financial crime risks and avoid penalties.

| Legal Factor | 2024/2025 Focus Areas | Impact on Northfield Bank | Example Data/Trend |

| Consumer Protection | Overdraft fees, fair lending, data privacy | Compliance costs, potential fines, reputational risk | CFPB penalties in 2023 exceeded billions for institutions. |

| Data Privacy & Security | Breach reporting, data governance, cybersecurity | Technology investment, operational resilience needs | Global regulators emphasized timely breach reporting in 2024. |

| AML/CTF | Data quality, risk detection, sanctions screening | System upgrades, enhanced training, compliance oversight | FinCEN actions in 2023-2024 targeted AML program deficiencies. |

Environmental factors

The financial sector, including institutions like Northfield Bank, faces growing recognition of climate change's physical risks. Extreme weather events, such as floods and wildfires, can directly impact the value of properties held as collateral in loan portfolios, particularly affecting mortgage and commercial real estate lending.

For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, causing an estimated $92.9 billion in damages, according to NOAA. This escalating frequency and severity of events pose a tangible threat to the stability of real estate-backed loans and the overall health of financial institutions' asset bases.

Banks are increasingly weaving Environmental, Social, and Governance (ESG) factors into their core strategies. This shift is driven by a desire to resonate with evolving consumer values and to actively contribute to addressing pressing global issues. For instance, a significant majority of consumers, around 70% in some surveys, expect financial institutions to adhere to ESG principles, even if they don't personally make ESG-driven financial choices.

The global shift towards sustainable finance is accelerating, with financial institutions increasingly directing capital towards green initiatives. By 2024, the sustainable debt market, including green bonds, reached over $2.5 trillion globally, reflecting a significant commitment to environmental goals. Banks are actively pursuing net-zero financed emissions targets, a trend that Northfield Bank, as a community-focused institution, can leverage.

Northfield Bank has an opportunity to explore sustainable lending and investment products, such as financing for renewable energy projects or offering green mortgages. This aligns with growing investor and customer demand for environmentally responsible financial services. For instance, in 2024, U.S. banks saw a 20% increase in ESG-focused investment product offerings, indicating a strong market appetite.

Regulatory Focus on Climate Risk Management

Federal regulators are sharpening their focus on how financial institutions, including banks, identify and manage risks stemming from climate change. This heightened scrutiny, evident in guidance from bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC), is pushing banks to integrate climate considerations into their existing risk management frameworks. For instance, the OCC's 2023 Semiannual Report on Bank Supervision highlighted ongoing efforts to assess banks' preparedness for climate-related financial risks, particularly concerning governance and risk management practices.

While larger, more complex banks are often the initial focus of these regulatory directives, the ripple effect is undeniable. As best practices evolve and disclosure expectations become clearer, community banks like Northfield Bank can anticipate a gradual influence on their own risk management strategies and reporting obligations. This trend suggests a future where robust climate risk assessment and transparent disclosure will become more commonplace across the banking sector, potentially impacting capital requirements or operational guidelines.

Key aspects of this regulatory shift include:

- Enhanced Risk Assessment: Regulators expect banks to develop methodologies for identifying and quantifying potential financial impacts from physical climate events (e.g., floods, wildfires) and transition risks (e.g., policy changes, technological shifts).

- Scenario Analysis: Institutions are being encouraged to conduct scenario analyses to understand how their portfolios might perform under various climate futures.

- Disclosure Requirements: While still evolving, there's a growing expectation for banks to disclose their climate-related financial exposures and management strategies, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

- Supervisory Expectations: Regulators are incorporating climate risk into their ongoing supervisory activities, examining banks' governance, risk management processes, and data capabilities related to climate change.

Reputational Risk and Stakeholder Expectations

Public perception and stakeholder expectations regarding environmental responsibility are increasingly crucial for financial institutions. Northfield Bank, like many in the sector, faces growing scrutiny over its role in financing industries with significant environmental footprints. For instance, a 2024 report by the Net-Zero Banking Alliance indicated that member banks are under pressure to demonstrate clear commitments to aligning their financing portfolios with net-zero emissions by 2050, with significant progress expected by 2030.

Even if Northfield Bank's direct operational impact is minimal, its indirect influence through lending and investment decisions can lead to reputational risks. A perceived lack of alignment with broader sustainability efforts, such as financing fossil fuel projects without clear transition plans, could alienate customers, investors, and employees. This is particularly relevant as surveys in late 2024 showed that over 60% of retail banking customers consider a bank's environmental policies when choosing a provider.

- Growing Stakeholder Demand: Customer and investor preferences are shifting towards environmentally conscious financial partners.

- Indirect Impact Matters: Financing and investment decisions carry significant reputational weight, regardless of direct operational footprint.

- Industry Benchmarks: Adherence to initiatives like the Net-Zero Banking Alliance sets expectations for financial sector sustainability.

- Brand Value at Stake: Negative perceptions regarding environmental responsibility can directly impact customer loyalty and market share.

Northfield Bank operates in an environment where climate change is increasingly recognized as a significant financial risk. Extreme weather events, like those causing $92.9 billion in damages across 28 billion-dollar disasters in the U.S. in 2023, can impact collateral values, particularly for real estate loans.

The bank must navigate growing expectations for Environmental, Social, and Governance (ESG) integration, with around 70% of consumers expecting financial institutions to adhere to ESG principles. This aligns with a global sustainable debt market exceeding $2.5 trillion in 2024, and a 20% increase in ESG-focused investment products offered by U.S. banks in 2024.

Regulatory bodies like the Federal Reserve and OCC are intensifying scrutiny on climate risk management, pushing banks to incorporate climate considerations into their frameworks. This includes enhanced risk assessment, scenario analysis, and evolving disclosure requirements, with the OCC specifically highlighting climate risk preparedness in its 2023 report.

Public perception and stakeholder demand for environmental responsibility are critical, with over 60% of retail banking customers considering a bank's environmental policies. Northfield Bank faces reputational risks if its financing decisions are perceived as misaligned with sustainability goals, especially as industry benchmarks like the Net-Zero Banking Alliance set clear net-zero financing targets.

| Environmental Factor | Impact on Northfield Bank | Supporting Data (2023-2024) |

|---|---|---|

| Physical Climate Risks | Decline in collateral value (real estate loans) | $92.9 billion in damages from 28 billion-dollar weather/climate disasters in U.S. (2023) |

| ESG Expectations | Reputational risk, customer/investor preference | ~70% of consumers expect ESG adherence; 20% increase in U.S. ESG product offerings (2024) |

| Regulatory Scrutiny | Need for enhanced risk management, scenario analysis, disclosure | OCC's 2023 Semiannual Report on Bank Supervision highlighted climate risk preparedness |

| Stakeholder Pressure | Reputational risk, customer loyalty | >60% of retail customers consider environmental policies; Net-Zero Banking Alliance targets |

PESTLE Analysis Data Sources

Our PESTLE analysis for Northfield Bank is grounded in a comprehensive review of publicly available data, including reports from financial regulators, economic indicators from government agencies, and industry-specific market research. This ensures a robust understanding of the external factors influencing the banking sector.