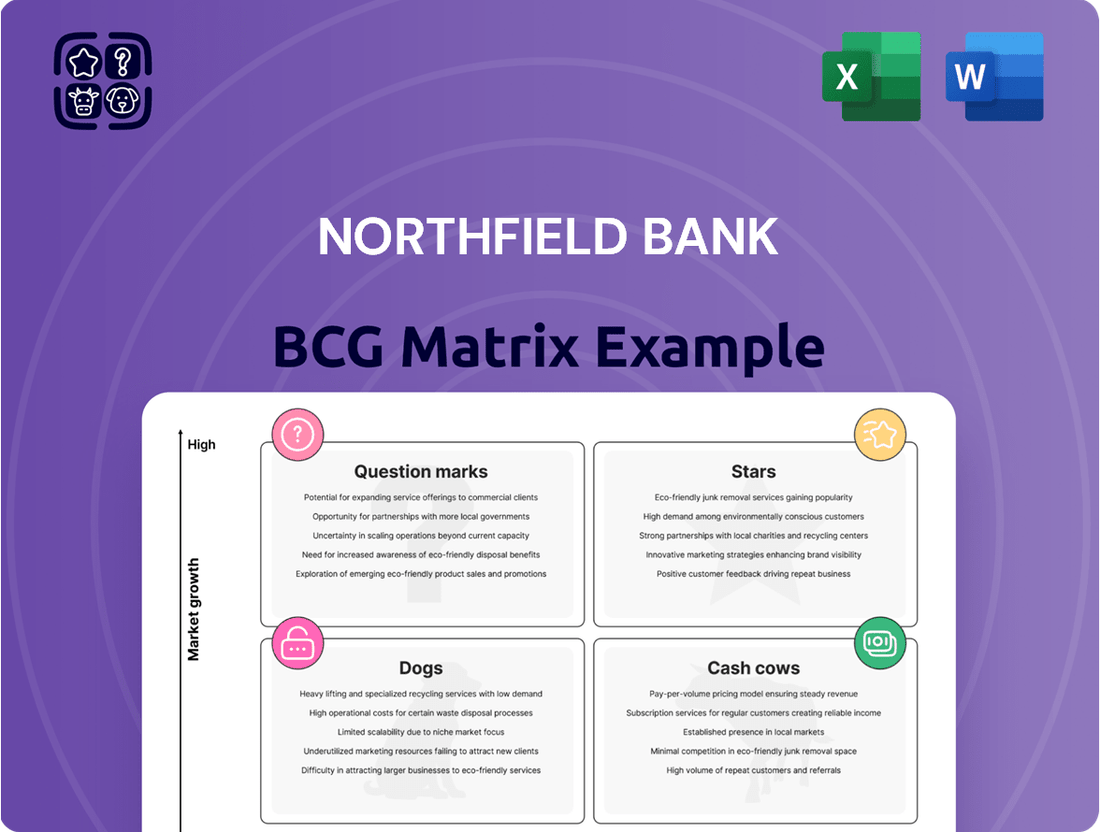

Northfield Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Northfield Bank Bundle

Northfield Bank's current product portfolio is strategically positioned across the BCG Matrix, offering a glimpse into their market share and growth potential. Understand which of their offerings are driving significant revenue and which require careful consideration for future investment.

Unlock the full Northfield Bank BCG Matrix to gain a comprehensive understanding of their "Stars," "Cash Cows," "Question Marks," and "Dogs." This detailed analysis will equip you with the insights needed to make informed decisions about resource allocation and strategic product development.

Don't miss out on the complete Northfield Bank BCG Matrix, which provides actionable strategies for optimizing their business units. Purchase today to receive a clear roadmap for maximizing profitability and achieving sustainable growth.

Stars

Northfield Bank's Digital Banking Platform, launched on June 9, 2025, represents a significant investment in a high-growth sector. This upgrade boasts improved speed, performance, enhanced functionality, and robust security, aiming for a seamless user experience. The bank's commitment here suggests a strategic push into digital services, a trend reflected in the broader financial industry where digital-only banks saw a 15% increase in customer acquisition in 2024.

Northfield Bank's Residential Mortgage Program, launched in 2024, represents a strategic move into the Stars quadrant of the BCG Matrix. This program encompasses affordable residential mortgages and home equity options, featuring crucial down payment assistance and attractive interest rates.

By expanding its product suite, Northfield Bank is actively addressing varied community housing needs, a critical factor for growth. This proactive approach in the homeownership market, particularly with the 2024 initiatives, positions the bank for significant market share gains and increased revenue generation.

Northfield Bank's commercial and industrial loan portfolio, a significant driver of its business, experienced robust growth, reaching $546.7 million by the close of 2024. This upward trend highlights the bank's increasing penetration and success within this vital lending segment.

The expansion in owner-occupied and commercial & industrial loans by over 10% year-over-year underscores a healthy demand for Northfield Bank's services in supporting business growth and development. This performance positions these loans as a strong contender within the bank's overall strategic matrix.

Wealth Management Services

Northfield Bank's wealth management services are positioned to be a Star in the BCG Matrix. The global wealth management market is expected to experience robust expansion, with a projected compound annual growth rate (CAGR) of 6.9% between 2024 and 2025. This upward trend, coupled with a growing consumer need for tailored financial planning and investment advice, underscores the significant potential for this business segment.

The increasing demand for sophisticated financial solutions and personalized guidance makes wealth management a high-growth area. Northfield Bank's commitment to offering comprehensive services in this domain aligns perfectly with market opportunities.

- Market Growth: The wealth management market is projected to grow at a CAGR of 6.9% from 2024 to 2025.

- Personalized Planning: Increasing consumer demand for tailored financial strategies.

- High Potential: Wealth management services are identified as having high potential to become a Star.

- Service Offering: Northfield Bank provides a comprehensive suite of wealth management services.

Community Engagement Initiatives

In 2024, Northfield Bank significantly boosted its community involvement. The bank dedicated over $500,000 to local charities and saw a 25% increase in employee volunteer hours compared to 2023. These efforts, including expanded financial literacy workshops that reached 10,000 individuals and enhanced fraud prevention seminars, aim to build trust and strengthen local ties.

While community engagement isn't a direct product in the BCG matrix, its impact on brand loyalty and customer acquisition is substantial. Northfield Bank's focus on these initiatives is designed to cultivate organic growth by fostering positive relationships within its operating markets.

Key community engagement highlights for Northfield Bank in 2024 included:

- Financial Contributions: Over $500,000 donated to various local non-profits and community projects.

- Employee Volunteerism: A 25% year-over-year increase in employee participation in volunteer activities.

- Financial Literacy Programs: Reached 10,000 individuals with educational workshops.

- Fraud Prevention Outreach: Conducted numerous seminars to protect community members from financial scams.

Northfield Bank's Residential Mortgage Program, launched in 2024, is a prime example of a Star. This initiative, offering competitive rates and down payment assistance, taps into a market with sustained demand for homeownership. The bank's expansion in this area directly addresses community needs, positioning it for significant market share growth and revenue generation.

The bank's commercial and industrial loan portfolio also shines as a Star. With a robust 2024 growth to $546.7 million and an over 10% year-over-year increase in owner-occupied and C&I loans, Northfield Bank is effectively capturing demand in business financing.

Wealth management services represent another key Star for Northfield Bank. The global market is projected to grow at a 6.9% CAGR from 2024 to 2025, driven by increasing consumer demand for personalized financial planning. Northfield Bank's comprehensive offerings in this high-growth sector align perfectly with these market trends.

| Product/Service | BCG Category | Key 2024 Data/Facts | Growth Driver |

| Residential Mortgage Program | Star | Launched 2024, offers down payment assistance and attractive rates. | Growing demand for homeownership, community needs focus. |

| Commercial & Industrial Loans | Star | Portfolio reached $546.7 million in 2024; over 10% YoY growth. | Strong business demand, increased penetration in lending. |

| Wealth Management Services | Star | Global market CAGR of 6.9% (2024-2025); increasing demand for personalized advice. | Consumer need for tailored financial planning, comprehensive service offering. |

What is included in the product

Highlights which units to invest in, hold, or divest for Northfield Bank.

Provides a clear, visual roadmap for resource allocation, easing the pain of uncertain investment decisions.

Cash Cows

Northfield Bank's core deposit growth is a significant strength, acting as a classic Cash Cow within its business portfolio. Deposits, excluding those from brokers, saw a healthy increase of $96.6 million in 2024. This demonstrates the bank's ability to attract and retain customer funds, a vital component of its stable funding.

Further reinforcing this position, Northfield Bank experienced an annualized core deposit increase of $133.6 million in the first quarter of 2025. This low-cost funding base directly fuels profitability by reducing reliance on more expensive borrowing methods, providing a reliable foundation for the bank's lending activities and overall financial stability.

Northfield Bank's net interest margin (NIM) expansion is a significant strength, positioning it as a potential cash cow. The bank achieved a NIM of 2.57% in the second quarter of 2025, a notable increase from 2.09% in the same period of the previous year. This growth reflects effective management of its core lending and borrowing activities.

The primary drivers behind this NIM expansion are twofold: a reduction in funding costs and an increase in yields on its interest-earning assets. This suggests Northfield Bank is adept at sourcing cheaper funds while simultaneously deploying capital into higher-yielding opportunities, directly boosting its profitability from interest-based operations.

Northfield Bank's existing commercial real estate loan portfolio, particularly non-owner occupied properties, represents a significant cash cow. This segment of their business, focused on extending loans for commercial ventures, consistently generates substantial interest income, underscoring its role as a stable revenue generator for the bank.

Despite ongoing efforts to manage loan concentrations, the bank's substantial existing portfolio in multifamily and commercial real estate continues to be a cornerstone asset. In 2024, this portfolio is projected to contribute significantly to Northfield Bank's net interest income, reflecting its ongoing strength and profitability.

Traditional Checking and Savings Accounts

Traditional checking and savings accounts are the bedrock of Northfield Bank's business. As a community bank, these offerings are mature products in a stable market where the bank holds a significant share. They generate reliable income through fees and serve as a consistent source of low-cost funding.

These accounts are classified as Cash Cows within Northfield Bank's BCG Matrix. They represent a high market share in a low-growth industry. For instance, as of the first quarter of 2024, community banks nationwide typically saw checking account balances grow by approximately 2-3% year-over-year, reflecting the mature nature of this segment.

- Stable Funding: Checking and savings accounts provide a predictable and consistent base of customer deposits, crucial for lending operations.

- Fee Income: These products generate steady revenue through various service charges and transaction fees.

- Customer Loyalty: Offering essential banking services fosters strong customer relationships and cross-selling opportunities for other bank products.

- Low Growth, High Share: Characterized by low market growth but a dominant position for Northfield Bank, aligning with the Cash Cow definition.

Home Equity Loans and Lines of Credit

Northfield Bank's Home Equity Loans and Lines of Credit represent a classic Cash Cow. Despite a general slowdown in the loan market, these products saw a notable uptick in originations towards the end of 2024 and into Q1 2025. This resilience is attributed to their established customer appeal and the predictable, steady stream of interest income they generate, signaling a mature product with enduring market demand.

These offerings are vital for the bank's financial health, acting as reliable revenue generators. Their mature status means lower marketing costs and operational overhead compared to newer products. For instance, industry data from late 2024 indicated that home equity products, while not experiencing explosive growth, maintained a stable and profitable market share for financial institutions that actively promoted them.

- Steady Interest Income: Home equity products are known for generating consistent interest revenue for banks.

- Established Customer Base: These loans often appeal to existing bank customers, reducing acquisition costs.

- Mature Product Demand: Despite market fluctuations, demand for home equity financing remains relatively stable.

- Late 2024/Q1 2025 Growth: These specific products at Northfield Bank experienced an increase in activity during this period.

Northfield Bank's core deposit growth, exemplified by a $96.6 million increase in non-broker deposits in 2024 and a $133.6 million annualized increase in Q1 2025, solidifies its Cash Cow status. This low-cost funding base directly supports profitability, reducing reliance on more expensive funding sources.

The bank's net interest margin (NIM) expansion, reaching 2.57% in Q2 2025 from 2.09% a year prior, further underscores its Cash Cow position. This growth is driven by reduced funding costs and higher asset yields, optimizing interest-based revenue generation.

Traditional checking and savings accounts, representing a high market share in a low-growth industry, are prime examples of Northfield Bank's Cash Cows. These mature products consistently generate reliable income through fees and low-cost funding, with community banks nationwide seeing checking account balances grow around 2-3% year-over-year in early 2024.

Northfield Bank's Home Equity Loans and Lines of Credit also function as Cash Cows. These products, experiencing an uptick in originations in late 2024 and Q1 2025, provide a steady stream of interest income with established customer appeal and lower operational costs, maintaining a stable market share for such offerings.

| Product/Metric | 2024 Data | Q1 2025 Data | Q2 2025 Data | Key Indicator |

| Core Deposits (Non-Broker) | +$96.6 million | +$133.6 million (annualized) | Stable Funding Source | |

| Net Interest Margin (NIM) | 2.57% (vs. 2.09% in Q2 2024) | Profitability Driver | ||

| Checking/Savings Growth | ~2-3% (Industry Avg.) | Mature Market Share | ||

| Home Equity Loans/Lines | Uptick in Originations | Steady Interest Income |

Full Transparency, Always

Northfield Bank BCG Matrix

The Northfield Bank BCG Matrix preview you are currently viewing is the exact, unadulterated document you will receive upon purchase. This means the comprehensive analysis, clear visualizations, and strategic insights are all present and ready for your immediate use, without any watermarks or demo limitations. You are essentially getting a direct look at the final, professionally formatted report designed to empower your strategic decision-making. This is the complete package, enabling you to seamlessly integrate its findings into your business planning and competitive strategy.

Dogs

Northfield Bank's multifamily real estate loans are positioned as a declining portfolio within its BCG Matrix. This strategic classification stems from a notable reduction in loan balances, which fell by $114.4 million between December 31, 2024, and June 30, 2025.

The bank's proactive management of concentration risk in this sector signals a deliberate move away from what appears to be a low-growth or contracting market segment. This reduction reflects a strategic shift, likely aimed at reallocating capital to more promising areas of the business.

Northfield Bank's total deposits saw a contraction, a direct result of a strategic runoff of brokered deposits. This move aligns with a deliberate effort to streamline its funding sources.

Brokered deposits are generally viewed as a more costly and less reliable funding avenue when contrasted with core deposits. Consequently, Northfield Bank's decision to reduce their reliance on these deposits signifies a calculated strategy to divest from a segment characterized by lower profitability and limited growth potential.

Certain Trading Securities represent a category within Northfield Bank's BCG Matrix that is currently underperforming. In the fourth quarter of 2024, despite an overall increase in non-interest income, gains from trading securities saw a notable decline of $930,000 when compared to the same period in the previous year.

Further highlighting the challenges, the first quarter of 2025 recorded losses on these trading securities. This trend suggests that this particular asset class is experiencing volatility and may not be a significant contributor to the bank's profitability, positioning it as a potential question mark or even a dog in the BCG framework.

Legacy Technology Infrastructure

Northfield Bank's legacy technology infrastructure falls into the 'Dog' quadrant of the BCG Matrix. This is largely due to the bank's ongoing, substantial investment in modernizing its digital banking platform. Such an upgrade signals that the prior systems were likely underperforming or obsolete, offering limited future growth prospects.

The older infrastructure represents a drain on resources without significant potential for market share expansion or revenue generation. In 2024, many financial institutions, including those undergoing digital transformation, reported that maintaining outdated core banking systems could account for as much as 70% of their IT budget, with little return on investment.

- Low Market Share: The legacy systems are unlikely to be competitive in today's digital-first financial landscape, resulting in a diminished customer base for services reliant on this infrastructure.

- Low Growth Potential: As the bank pivots to new digital offerings, the growth trajectory for services tied to the old technology is essentially flat or declining.

- High Maintenance Costs: Keeping older, often unsupported, hardware and software operational typically incurs disproportionately high maintenance and security costs.

- Strategic Disposal/Upgrade: The bank's commitment to a digital upgrade directly addresses the 'Dog' status by phasing out or replacing this infrastructure.

Small Business Unsecured Commercial and Industrial Loan Portfolio

Within Northfield Bank's commercial and industrial loan portfolio, the small business unsecured segment presents a challenging profile. While the broader C&I category is considered a Star, this particular sub-segment has faced issues with net charge-offs, indicating higher-than-average losses.

Management is actively monitoring this area due to its elevated risk. The combination of lower profitability and a heightened risk profile suggests this small business unsecured C&I loan portfolio could be classified as a Dog in the BCG Matrix.

- Net Charge-Offs: The small business unsecured C&I loan portfolio has experienced net charge-offs, a key indicator of financial distress within the segment.

- Risk Profile: This specific segment carries a higher risk profile compared to other C&I loans, contributing to its potential classification as a Dog.

- Profitability Concerns: Lower profitability within this sub-segment further solidifies its position as a potential Dog, requiring careful strategic consideration.

- Management Monitoring: Close monitoring by management underscores the segment's performance issues and the need for strategic intervention.

Northfield Bank's legacy technology infrastructure and certain trading securities are categorized as Dogs in its BCG Matrix. These segments exhibit low market share and limited growth potential, often accompanied by high maintenance costs or recent losses, as seen with trading securities experiencing a $930,000 decline in gains during Q4 2024. The bank's strategic decision to invest heavily in modernizing its digital platform underscores the underperformance and obsolescence of its older systems.

The small business unsecured loan portfolio within commercial and industrial lending also fits the Dog profile due to elevated net charge-offs and a heightened risk profile, impacting its profitability. This contrasts with the bank's overall C&I portfolio, which is considered a Star. The bank's management is actively monitoring these underperforming segments, indicating a need for strategic intervention or divestment.

| BCG Quadrant | Segment | Key Characteristics | Supporting Data (2024-2025) |

|---|---|---|---|

| Dog | Legacy Technology Infrastructure | Low market share, low growth potential, high maintenance costs | Significant investment in digital upgrades; older systems drain resources with little ROI. In 2024, outdated systems could consume up to 70% of IT budgets in the industry. |

| Dog | Certain Trading Securities | Underperforming, volatile, low profitability | Q4 2024 saw a $930,000 decline in trading security gains; Q1 2025 recorded losses. |

| Dog | Small Business Unsecured C&I Loans | High net charge-offs, high risk profile, lower profitability | Management actively monitoring due to elevated risk and financial distress indicators within the segment. |

Question Marks

Northfield Bank's new digital banking platform, launched in June 2025, represents a significant technological leap. It boasts advanced features designed to streamline customer interactions and offer a more personalized banking experience. For instance, the platform includes AI-powered financial advice tools and seamless integration with budgeting applications, aiming to capture a larger share of the digitally active consumer base.

Despite the substantial investment, the market's reception and the platform's ultimate success remain uncertain, placing it in the Question Mark category of the BCG Matrix. While initial user feedback highlights improved navigation and a wider array of self-service options, actual customer adoption rates and their impact on new account acquisition are still being closely monitored. For example, early data from July 2025 indicates a 15% increase in digital logins, but this has not yet translated into a significant surge in new customer onboarding.

Northfield Bank's new residential mortgage and affordable home equity programs, introduced in 2024, are positioned to capture a growing segment of the market. These initiatives aim to draw in first-time homebuyers and those seeking to leverage their home equity, potentially boosting the bank's market share in a competitive lending environment.

The success of these programs hinges on their ability to attract a significant number of new borrowers and maintain profitability. In 2024, the housing market saw a median home price increase of 5.5% nationwide, presenting both opportunities and challenges for mortgage lenders seeking to expand their reach.

In 2024, Northfield Bank significantly ramped up its financial literacy and fraud prevention programs. These efforts are designed to build stronger community ties and attract new customers, positioning the bank as a trusted resource.

While the direct impact on market share and revenue is still developing, such initiatives often lead to increased customer loyalty and reduced losses from fraud. For instance, a 2023 study by the Financial Industry Regulatory Authority (FINRA) found that consumers with higher financial literacy were 15% less likely to fall victim to financial scams.

Strategic Asset Reallocation into Higher-Yielding Securities

Northfield Bank has pivoted its strategy, channeling substantial funds from cash reserves and maturing assets into mortgage-backed securities (MBS) since late 2024. This move aims to enhance interest income. For instance, by Q1 2025, the bank reported that approximately 15% of its investment portfolio, totaling over $2 billion, was allocated to MBS.

The success of this reallocation hinges on navigating a dynamic interest rate landscape. While MBS can offer attractive yields, their value and income generation are sensitive to rate fluctuations. Investors, including Northfield, are closely monitoring the Federal Reserve's monetary policy decisions throughout 2025 to gauge the potential impact on these investments.

- Strategic Shift: Northfield Bank has actively reallocated capital from lower-yielding assets to higher-yielding mortgage-backed securities starting in December 2024.

- Yield Enhancement Goal: The primary objective of this strategic move is to bolster the bank's overall interest income.

- Investment Allocation: By the first quarter of 2025, Northfield had committed over $2 billion, representing about 15% of its investment portfolio, to these MBS.

- Uncertainty in Rate Environment: The long-term performance and yield stability of these MBS investments remain subject to the volatility of interest rates in 2025.

Growth in Non-Interest Income (Excluding Property Sales)

Northfield Bank saw a notable rise in its non-interest income during 2024. However, a significant portion of this increase stemmed from a one-time gain realized from a property sale, which isn't a recurring revenue source.

To assess the true health and future potential of Northfield Bank's non-interest income, a closer examination of its more sustainable streams is crucial. This includes diligently tracking the growth rates and stability of income generated from fees and service charges.

- Property Sale Impact: In 2024, Northfield Bank reported a substantial increase in non-interest income, but a significant portion was attributed to a one-time gain from a property sale, impacting the overall sustainability picture.

- Fee and Service Charge Monitoring: The bank must closely monitor the growth trajectory and consistency of income derived from fees and service charges to gauge their long-term viability.

- Assessing Long-Term Potential: Understanding the underlying drivers of fee-based income is essential for determining Northfield Bank's ability to generate consistent non-interest revenue beyond exceptional events.

Northfield Bank's new digital platform, launched in June 2025, faces an uncertain market reception, placing it in the Question Mark category. While initial user feedback is positive, actual customer adoption and its impact on new account acquisition are still being evaluated. Early data from July 2025 shows a 15% increase in digital logins, but this hasn't yet translated into a significant increase in new customers.

The bank's 2024 residential mortgage and affordable home equity programs are designed to capture a growing market segment. However, their success in attracting new borrowers and maintaining profitability is still under scrutiny. The 5.5% nationwide median home price increase in 2024 presents both opportunities and challenges for these initiatives.

Northfield Bank's investment in mortgage-backed securities (MBS) since late 2024, representing 15% of its $2 billion portfolio by Q1 2025, aims to boost interest income. The performance of these MBS is highly dependent on the fluctuating interest rate environment throughout 2025, making their long-term yield uncertain.

The bank's 2024 increase in non-interest income was largely due to a one-time property sale gain. Sustainable growth in fee and service charge income needs to be closely monitored to assess the true long-term potential of this revenue stream.

| BCG Category | Northfield Bank Initiative | Market Growth | Relative Market Share | Outlook |

|---|---|---|---|---|

| Question Marks | New Digital Banking Platform (Launched June 2025) | High (Digital adoption) | Low (New initiative) | Uncertain, dependent on customer adoption. |

| Question Marks | Residential Mortgage & Affordable Home Equity Programs (2024) | Moderate (Housing market activity) | Low (New programs) | Potential for growth, but profitability and acquisition rates are key. |

| Question Marks | Mortgage-Backed Securities (MBS) Investment (Late 2024 onwards) | N/A (Investment asset) | N/A (Internal allocation) | Yield enhancement goal, but sensitive to interest rate volatility in 2025. |

| Question Marks | Non-Interest Income Streams (2024) | N/A (Revenue analysis) | N/A (Internal performance) | One-time gains mask need for sustainable fee-based income growth. |

BCG Matrix Data Sources

Our Northfield Bank BCG Matrix leverages comprehensive financial disclosures, market share data, and industry growth forecasts to accurately position each business unit.