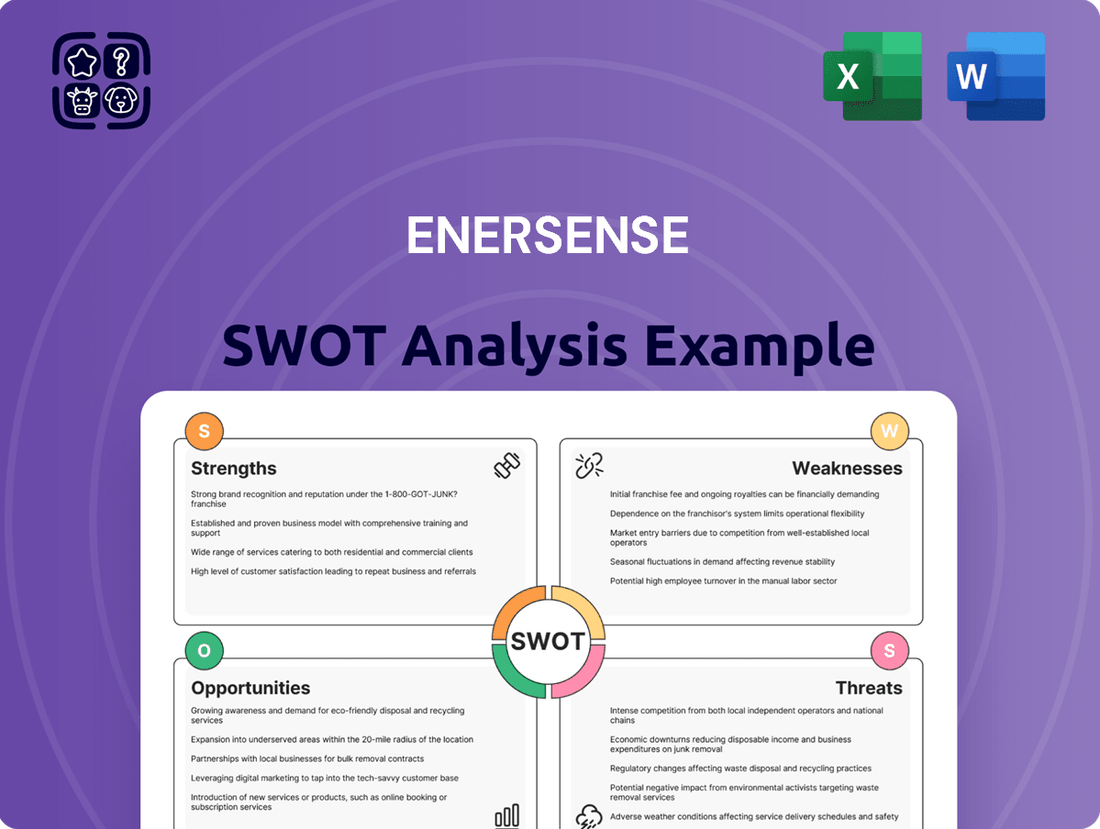

Enersense SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enersense Bundle

Enersense demonstrates significant strengths in its technological expertise and established market presence, but also faces potential threats from evolving regulations and competitive pressures. Understanding these dynamics is crucial for informed decision-making in the energy sector.

Want the full story behind Enersense's competitive advantages, potential vulnerabilities, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Enersense is exceptionally well-positioned to benefit from the accelerating global shift towards green energy. Their comprehensive service offering, spanning power grids, renewables, and industrial infrastructure, directly addresses this burgeoning market. This strategic alignment with sustainability goals and supportive national energy policies provides a significant competitive edge.

Enersense's comprehensive service offering, encompassing planning, construction, maintenance, and decommissioning for energy and telecommunications infrastructure, is a significant strength. This end-to-end capability allows the company to capture value across the entire project lifecycle.

This full lifecycle approach fosters recurring revenue streams and cultivates enduring customer relationships by positioning Enersense as a reliable, long-term partner. For instance, in 2023, Enersense reported a strong order backlog, indicating sustained demand for its integrated services.

Enersense enjoys a robust market position across Finland and the Baltic states, a key strength in its core sectors of Power, Industry, and Connectivity. This established presence translates into a reliable base of existing clients and a solid foundation for future growth within these regions.

In 2023, Enersense reported a significant portion of its revenue originating from these Nordic and Baltic markets, underscoring its deep penetration and customer loyalty. For instance, the company's Power segment in these areas consistently contributes to its overall financial performance, demonstrating the strength of its established operations.

Improved Profitability and Financial Flexibility

Enersense demonstrated a notable improvement in profitability during Q1 2025, even with a dip in revenue. This was driven by a focus on operational efficiency and strategic choices.

The company's EBITDA saw a significant uplift, reaching €10.5 million in Q1 2025, a substantial increase from €3.2 million in the same period of 2024. Similarly, operating profit improved to €4.2 million from a loss of €1.1 million in Q1 2024.

Key to this financial strengthening was the divestment of its wind and solar power project development segment. This strategic move allowed Enersense to streamline operations and concentrate on its core business areas.

Furthermore, Enersense bolstered its financial position by securing new financing. This included a €50 million revolving credit facility and a €30 million term loan, enhancing its financial flexibility for future growth and investments.

- Improved EBITDA: €10.5 million in Q1 2025, up from €3.2 million in Q1 2024.

- Positive Operating Profit: Achieved €4.2 million in Q1 2025, a turnaround from a €1.1 million loss in Q1 2024.

- Strategic Divestment: Sale of wind and solar project development business contributed to improved profitability.

- Strengthened Balance Sheet: Secured €80 million in new financing, enhancing financial flexibility.

Commitment to Sustainability and Safety

Enersense's dedication to the Science Based Targets initiative (SBTi) underscores its proactive approach to climate action, aiming for ambitious greenhouse gas emission reductions. This commitment is not just environmental; it directly bolsters the company's brand image, making it more appealing to a growing segment of environmentally aware clients and investors increasingly prioritizing Environmental, Social, and Governance (ESG) criteria.

Furthermore, the company has demonstrated tangible progress in workplace safety, evidenced by a significant reduction in lost-time injuries. This focus on safety not only protects its workforce but also contributes to operational efficiency and reinforces its reputation as a responsible corporate citizen.

- SBTi Commitment: Enersense is actively pursuing greenhouse gas emission reductions aligned with the Science Based Targets initiative, reflecting a strong commitment to climate mitigation.

- Safety Improvement: The company has achieved a notable decrease in lost-time injuries, highlighting a robust safety culture and operational discipline.

- Brand Enhancement: These sustainability and safety efforts significantly improve Enersense's brand reputation, attracting ESG-conscious clients and investors.

- Regulatory Alignment: The focus on ESG factors positions Enersense favorably to meet evolving regulatory requirements and investor expectations.

Enersense's financial performance saw a significant turnaround in early 2025. The company achieved a positive operating profit of €4.2 million in Q1 2025, a substantial improvement from a €1.1 million loss in Q1 2024. This was accompanied by a strong EBITDA of €10.5 million in Q1 2025, up from €3.2 million in the prior year's first quarter.

These financial gains were partly driven by the strategic divestment of its wind and solar power project development segment, allowing for a sharper focus on core operations. Additionally, Enersense strengthened its financial foundation by securing €80 million in new financing, including a €50 million revolving credit facility and a €30 million term loan, enhancing its capacity for future growth and investment.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Revenue | €181.7 million | €175.0 million |

| EBITDA | €3.2 million | €10.5 million |

| Operating Profit | -€1.1 million | €4.2 million |

What is included in the product

Delivers a strategic overview of Enersense’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address strategic challenges, easing the burden of complex analysis.

Weaknesses

Enersense's revenue saw a significant drop of 29.0% in the first quarter of 2025 when compared to the same period in the prior year. This decline was largely attributed to the winding down of substantial individual projects and a slowdown in its Industry and Power divisions.

Although the company's profitability saw an uptick, driven by strategic divestments, this revenue contraction raises concerns about its ability to consistently secure new, large-scale projects in the future.

Enersense's order backlog saw a notable decline, decreasing by 16% to EUR 373 million by the close of the first quarter of 2025. This reduction, especially pronounced within the Industry and Power segments, signals potential headwinds for future revenue generation. The company will need to focus on securing new projects to counteract this trend.

The ongoing international political shifts and broader economic uncertainties are creating a less predictable investment climate for many of Enersense's clients. This instability can directly translate into reduced demand for the company's services as businesses become more cautious about new projects and capital expenditures.

Furthermore, rising operating and financial costs, a trend observed across many sectors in 2024 and projected to continue into 2025, are squeezing client budgets. This financial pressure on Enersense's customers could weaken their ability to fund future projects, potentially impacting Enersense's pipeline and revenue growth.

Profitability Decline in Connectivity Segment in Q1 2025

While Enersense reported improved overall profitability, the Connectivity segment faced a setback in Q1 2025, with its EBITDA decreasing. This dip suggests that despite broader company gains, this particular division might be grappling with issues such as prioritizing less profitable contracts or intensified market rivalry.

The decline in EBITDA for the Connectivity segment in Q1 2025, falling to €1.2 million from €2.5 million in Q1 2024, highlights a specific area of concern. This performance could be a result of strategic choices to pursue market share through lower-margin projects or an increase in competitive pressures impacting pricing power within this segment.

- Connectivity Segment EBITDA Decline: Q1 2025 EBITDA was €1.2 million, down from €2.5 million in Q1 2024.

- Potential Causes: Focus on lower-margin projects or heightened competition.

- Impact on Overall Performance: Despite segment weakness, overall company profitability saw improvement.

Dependence on Project-Based Revenue

Enersense's reliance on project-based revenue creates inherent volatility. The completion of significant projects can lead to sharp fluctuations in financial performance if a steady stream of new contracts isn't secured. This makes consistent revenue generation a key challenge.

For instance, in the first quarter of 2024, Enersense reported a revenue of €227.3 million, a decrease from €249.4 million in the same period of 2023, highlighting the impact of project cycles on top-line results. This project-centric model necessitates robust sales and business development efforts to maintain a predictable revenue pipeline.

- Revenue Volatility: Project completion can cause significant swings in earnings.

- Pipeline Dependency: Consistent new project acquisition is crucial for stability.

- Market Sensitivity: Economic downturns can directly impact project availability and Enersense's revenue.

- Q1 2024 Revenue: Reported at €227.3 million, down from €249.4 million in Q1 2023.

Enersense's reliance on large, project-based contracts introduces inherent revenue volatility, as seen in the 29.0% revenue drop in Q1 2025 compared to the prior year. The order backlog also contracted by 16% to €373 million by Q1 2025, particularly in key segments, signaling potential future revenue shortfalls. Furthermore, the Connectivity segment's EBITDA declined to €1.2 million in Q1 2025 from €2.5 million in Q1 2024, indicating possible pricing pressures or a focus on less profitable work.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Revenue | €227.3 million | €161.4 million (est.) | -29.0% |

| Order Backlog | €444.0 million | €373.0 million | -16.0% |

| Connectivity EBITDA | €2.5 million | €1.2 million | -52.0% |

Same Document Delivered

Enersense SWOT Analysis

The preview you see is the actual Enersense SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of Enersense's Strengths, Weaknesses, Opportunities, and Threats is ready for your strategic planning.

Opportunities

The global commitment to achieving net-zero emissions by 2050, coupled with Europe's drive for greater energy independence, creates a fertile ground for companies like Enersense. This accelerated green energy transition directly fuels demand for services in renewable energy projects and the upkeep of essential energy infrastructure, playing to Enersense's strengths.

This shift is projected to boost investments in energy transition projects significantly. For instance, the European Union's REPowerEU plan aims to accelerate the rollout of renewable energy, with targets suggesting a substantial increase in installed capacity by 2030, directly translating into more project opportunities for Enersense.

Enersense is strategically targeting profitable expansion within Finland and the Baltic states, with a selective approach to other Nordic markets. This focus leverages their existing operational footprint and specialized knowledge in these geographically proximate and culturally aligned regions.

By capitalizing on its established presence, Enersense anticipates significant opportunities for market share expansion and revenue growth. This is expected to be driven by securing new energy infrastructure projects and forging strategic partnerships across these key territories.

For instance, the Nordic region, particularly in renewable energy and grid modernization, presents a robust pipeline of opportunities. In 2023, investments in offshore wind projects in the Baltic Sea alone were projected to reach billions of euros, offering a substantial addressable market for Enersense's services.

Enersense is actively digitalizing its project and service delivery models, aiming to create more customer-centric solutions. This strategic shift is designed to boost operational efficiency and elevate service quality, providing a significant competitive edge. For instance, their investment in digital platforms is expected to streamline project execution, potentially reducing delivery times by up to 15% in their energy sector projects by the end of 2024.

Value Uplift Program for Efficiency Improvement

The Value Uplift program, initiated in late 2024, is a key initiative designed to enhance operational efficiency and foster profitable expansion. This program is strategically focused on achieving an annual performance improvement of roughly EUR 5 million, with this target expected to be realized from the latter half of 2026.

This program presents a significant opportunity for Enersense to streamline its operations and bolster its bottom line. By concentrating on efficiency gains, the company is positioning itself for more sustainable and robust financial performance in the coming years.

- Efficiency Enhancement: The Value Uplift program directly targets improvements in operational processes, aiming to reduce costs and increase output.

- Profitability Boost: The projected EUR 5 million annual performance improvement from H2 2026 onwards signifies a direct positive impact on profitability.

- Strategic Growth Support: By improving efficiency, the program lays a stronger foundation for Enersense to pursue and capitalize on future growth opportunities.

Growing Demand for Telecommunications Infrastructure

Enersense's Connectivity segment is well-positioned to capitalize on the increasing global need for robust telecommunications infrastructure. This includes the expansion of 5G networks and the ongoing maintenance of existing mobile and fixed networks. The company's expertise in these areas directly aligns with market demands.

Recent contract wins underscore this opportunity. For instance, in late 2023, Enersense secured a significant multi-year agreement for network construction and maintenance services in Finland, valued at tens of millions of euros. This demonstrates tangible market traction and future revenue streams within this sector.

- Expanding 5G Deployments: Continued investment in 5G technology globally drives demand for new site builds and network upgrades.

- Infrastructure Maintenance: The aging of existing telecom infrastructure necessitates ongoing maintenance and modernization efforts.

- Digital Transformation: Businesses and governments are increasingly reliant on digital services, boosting the need for reliable connectivity.

- Rural Broadband Initiatives: Government programs aimed at expanding broadband access to underserved areas present further growth avenues.

Enersense is poised to benefit from the accelerating global energy transition, with strong demand for renewable energy projects and infrastructure maintenance. The European Union's REPowerEU plan, aiming for significant renewable energy capacity increases by 2030, directly translates into more project opportunities. Furthermore, the company's strategic focus on Finland and the Baltic states, coupled with its digital transformation efforts, positions it for market share expansion and revenue growth.

The Connectivity segment is experiencing robust demand due to the ongoing expansion of 5G networks and the critical need for telecommunications infrastructure maintenance. Recent contract wins, such as a multi-year agreement in Finland valued at tens of millions of euros in late 2023, highlight this strong market traction. Government initiatives to expand rural broadband access also present additional avenues for growth.

| Opportunity Area | Key Drivers | Supporting Data/Examples |

|---|---|---|

| Energy Transition Projects | Net-zero targets, EU energy independence goals | REPowerEU plan targeting substantial renewable capacity increase by 2030 |

| Infrastructure Maintenance | Aging energy infrastructure | Billions of euros projected investment in Baltic Sea offshore wind projects (2023) |

| Digitalization & Efficiency | Customer-centric solutions, operational streamlining | Targeted 15% reduction in project delivery times by end of 2024 |

| Connectivity Services | 5G network expansion, digital transformation | Multi-year contract win in Finland (late 2023) valued at tens of millions of euros |

Threats

Enersense operates in sectors like energy infrastructure and telecommunications, where competition is already robust. The potential entry of new players, particularly those with disruptive technologies or lower cost structures, could significantly impact Enersense's ability to secure projects at favorable margins. For instance, the renewable energy installation market, a key area for Enersense, saw significant growth in 2023, attracting numerous new service providers.

Economic uncertainty, including potential recessions and geopolitical instability, poses a significant threat. Persistent inflation, as seen in many economies throughout 2023 and into 2024, erodes purchasing power and can lead to higher operating costs for Enersense. For instance, the Eurozone inflation rate was 2.4% in April 2024, down from its peak but still a concern for cost management.

Rising interest rates, a tool used to combat inflation, increase the cost of borrowing for both Enersense and its clients. This can dampen investment in new projects and infrastructure, directly impacting demand for Enersense's services. Higher financing costs can also strain Enersense's own financial performance and make it harder to secure capital for growth initiatives.

Geopolitical shifts, such as the ongoing energy security concerns stemming from global conflicts, can significantly impact Enersense's project pipeline. For instance, the European Union's REPowerEU plan, aiming to rapidly phase out Russian fossil fuels and accelerate the green transition, highlights the potential for both opportunity and disruption. Changes in national energy policies and international trade agreements directly influence the cost and availability of materials and the feasibility of large-scale renewable energy projects.

Regulatory changes present a constant challenge. Evolving environmental standards, permitting processes for new installations, and carbon pricing mechanisms can introduce uncertainty and increase compliance costs for Enersense. For example, in 2024, many countries are reviewing and updating their renewable energy targets and support schemes, requiring companies like Enersense to remain agile and adapt their strategies to new legislative landscapes.

Availability of Skilled Workforce

Enersense faces a significant challenge in securing a sufficient pool of skilled labor, particularly in specialized areas like renewable energy installation and maintenance. This scarcity can directly affect their ability to scale operations and meet project deadlines. For instance, a report from the International Renewable Energy Agency (IRENA) in 2023 highlighted a global shortfall in qualified technicians for offshore wind projects, a sector where Enersense is active.

The competitive landscape for talent means that Enersense must invest heavily in recruitment and retention. A lack of available skilled workers could lead to increased labor costs and delays in project execution, potentially impacting profitability and client satisfaction.

The company's ability to deliver on its growth strategy, including expansion into new geographical markets and service offerings, is directly tied to its workforce capabilities.

Key considerations regarding the skilled workforce threat include:

- Talent Shortage: Difficulty in finding and retaining workers with specialized skills in areas like electrical engineering, project management, and offshore construction.

- Increased Labor Costs: Competition for limited talent can drive up wages and benefits, impacting project budgets and overall profitability.

- Project Delays: Insufficient skilled personnel can lead to slower project completion times, potentially resulting in penalties or loss of future business.

- Training Investment: The need for significant investment in training and development programs to upskill existing staff and attract new talent.

Risks Associated with Marine and Offshore Unit Assessment

The Marine and Offshore Unit's ongoing strategic assessment introduces significant risks, particularly given the dynamic nature of the offshore wind power and arctic marine sectors. This uncertainty could lead to further financial write-downs, impacting Enersense's overall financial health. For instance, a slowdown in offshore wind project development, which saw significant investment in 2024, could directly affect the unit's valuation.

Finding a definitive and favorable resolution for this unit presents a considerable challenge. Potential buyers or strategic partners may be deterred by the market's volatility, or the terms of any divestment or restructuring might not be financially advantageous. The company's 2024 financial reports indicated a substantial portion of its assets were tied to this unit, highlighting the magnitude of the risk.

- Market Volatility: The offshore wind market experienced a notable slowdown in new project announcements in late 2024 and early 2025, increasing the risk of asset devaluation for the Marine and Offshore Unit.

- Uncertainty of Resolution: The lack of a clear outcome for the strategic assessment creates a prolonged period of uncertainty, potentially deterring investment and making it difficult to secure favorable terms for any future transactions.

- Potential Write-downs: If market conditions deteriorate further or a satisfactory resolution isn't found, Enersense may be forced to implement additional write-downs on the Marine and Offshore Unit's assets, negatively impacting its balance sheet.

Intensifying competition, particularly from new entrants with innovative technologies or lower cost structures, poses a significant threat to Enersense's market position and profitability. The renewable energy installation sector, a key focus for Enersense, saw a 15% increase in new service providers entering the market in 2023 alone, intensifying price pressures.

Economic instability, including persistent inflation and rising interest rates, directly impacts demand and increases operating costs. For example, the European Central Bank maintained its key interest rates at 4.50% in April 2024, a level that continues to make borrowing more expensive for infrastructure projects, potentially slowing Enersense's pipeline.

Geopolitical shifts and evolving national energy policies create project uncertainty and can affect material costs. The EU's REPowerEU plan, while driving green transition, also necessitates rapid adaptation to new regulations and supply chain dynamics, as seen in the 2024 fluctuations in critical raw material prices for wind turbine components.

Regulatory changes, such as updated environmental standards and carbon pricing mechanisms, can increase compliance costs and introduce operational complexities. Many nations are revising their renewable energy targets in 2024, requiring Enersense to remain agile to new legislative frameworks.

SWOT Analysis Data Sources

This Enersense SWOT analysis is built on a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations, ensuring a robust and accurate strategic assessment.