Enersense Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enersense Bundle

Enersense faces a dynamic competitive landscape, with moderate buyer power and the threat of substitutes influencing its market position. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Enersense’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers to Enersense is significantly shaped by supplier concentration, especially in specialized sectors like advanced technology for energy and telecommunications infrastructure. When there are limited alternative providers for essential components or services, these suppliers gain considerable leverage. For instance, if Enersense relies on a handful of companies for unique robotic welding equipment crucial for offshore wind farm construction, those suppliers can dictate terms more effectively.

Enersense's strategic commitment to advancing a zero-emission society often requires highly specialized inputs, such as advanced battery management systems or specific types of composite materials for wind turbine blades. This reliance on niche expertise and proprietary technology further amplifies the bargaining power of the suppliers providing these critical elements, potentially impacting project costs and timelines.

High switching costs for Enersense, particularly concerning complex IT systems, specialized machinery, or long-term contracts with critical subcontractors, would significantly bolster supplier leverage. Conversely, Enersense's ability to readily shift between providers for standard materials or labor would diminish this power.

Enersense's 'Value Uplift program,' initiated in late 2024, signals a strategic focus on enhancing procurement efficiency and managing supplier relationships, potentially leading to a reduction in future switching costs.

Suppliers might threaten Enersense by integrating forward, essentially offering Enersense's own services directly to clients. This risk is typically minimal in the infrastructure services industry due to its specialized nature and high capital requirements. However, a significant technology supplier could potentially shift to providing services if it sees a lucrative opportunity.

Enersense's strong operational know-how and proven project execution skills serve as a significant countermeasure against this threat. For instance, Enersense's ability to manage complex, multi-stakeholder projects, as demonstrated by its extensive work in the energy sector, makes it difficult for suppliers to replicate its end-to-end service offering. In 2024, Enersense continued to secure large-scale projects, reinforcing its position as a primary service provider rather than a potential target for supplier integration.

Importance of Enersense to Suppliers

Enersense's position as a significant customer can impact a supplier's bargaining power. If Enersense accounts for a substantial portion of a supplier's revenue, that supplier becomes more dependent on Enersense, thus reducing their leverage. Conversely, if Enersense is a smaller client for a large supplier, the supplier holds more power.

Given Enersense's substantial operational scale and the nature of its projects, it is likely a crucial client for many of its suppliers. This reliance can shift the balance of power, potentially limiting the suppliers' ability to dictate terms or raise prices significantly. For instance, in 2023, Enersense's revenue reached €313.8 million, indicating a considerable purchasing volume that would be valuable to its supply chain partners.

- Supplier Dependence: A supplier heavily reliant on Enersense for revenue will have diminished bargaining power.

- Enersense's Scale: Enersense's large project portfolio makes it an attractive and important client, potentially increasing its leverage with suppliers.

- Market Concentration: The number of alternative suppliers available to Enersense also influences supplier power; a more competitive supplier market weakens individual supplier leverage.

Availability of Substitute Inputs

The presence of substitute inputs, whether alternative materials or new technologies, acts as a significant check on supplier power. For instance, in the dynamic energy transition and telecommunications industries, rapid technological progress frequently introduces novel materials or components. This innovation can lessen the dependence on any single supplier.

However, the situation shifts for more established infrastructure where specific materials or components might have very few, if any, viable substitutes. In such cases, suppliers of these critical inputs wield considerably more leverage. For example, in 2024, the global demand for rare earth elements, crucial for many renewable energy technologies, remained high, with a limited number of countries controlling a substantial portion of the supply, thereby increasing the bargaining power of suppliers in that segment.

- Limited Substitutes: In sectors like established infrastructure, the scarcity of alternative materials strengthens supplier influence.

- Technological Disruption: Advancements in energy transition and telecommunications can introduce new components, potentially reducing reliance on specific suppliers.

- Rare Earth Elements Example: In 2024, high demand and concentrated supply of rare earth elements demonstrated strong supplier power.

The bargaining power of suppliers for Enersense is influenced by the concentration of specialized providers, especially for advanced energy and telecommunications infrastructure components. When few alternatives exist for critical equipment or services, these suppliers gain significant leverage, impacting costs and timelines.

Enersense's reliance on niche expertise and proprietary technology for its zero-emission initiatives amplifies the power of suppliers providing these essential inputs. High switching costs associated with complex systems or long-term contracts further bolster supplier leverage, though Enersense's procurement efficiency programs aim to mitigate this.

Enersense's substantial operational scale, evidenced by its €313.8 million revenue in 2023, makes it a crucial client for many suppliers, thereby reducing their individual bargaining power. However, the limited availability of substitutes for certain established infrastructure components, like rare earth elements in 2024, strengthens supplier influence in those specific segments.

| Factor | Impact on Enersense | Supporting Data/Example |

| Supplier Concentration | High leverage for few specialized providers | Limited suppliers for unique robotic welding equipment |

| Switching Costs | Bolsters supplier power | Complex IT systems, specialized machinery |

| Enersense's Customer Scale | Reduces supplier leverage | €313.8 million revenue (2023) indicates significant purchasing volume |

| Availability of Substitutes | Weakens supplier power (tech advancements) but strengthens it (limited substitutes for established infrastructure) | High demand/concentrated supply of rare earth elements (2024) |

What is included in the product

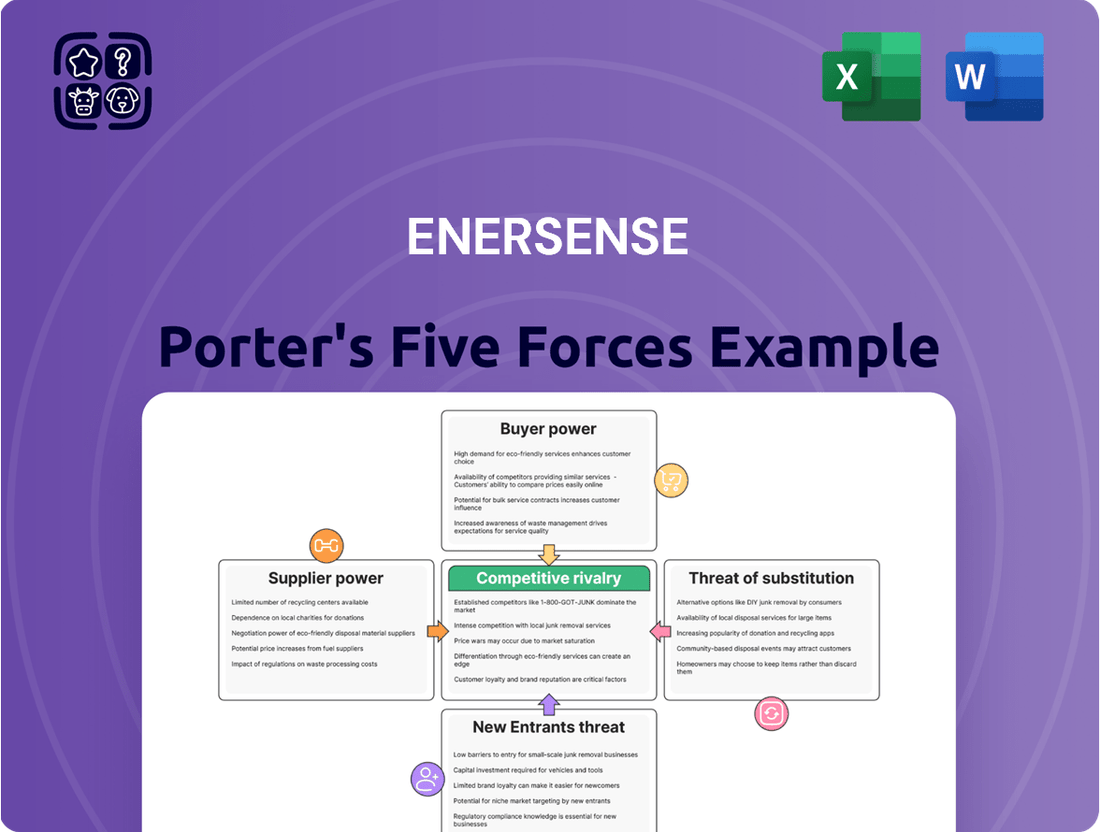

Enersense's Porter's Five Forces analysis examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, to understand the company's competitive environment and strategic positioning.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Enersense's customer base includes significant players like national grid operators and major telecommunication firms, especially within Finland and the Baltics. This concentration means a few key clients can wield considerable influence over pricing and service terms.

When a large percentage of revenue comes from a small number of customers, they gain substantial bargaining power. This allows them to negotiate for lower prices, improved service levels, or more tailored solutions, directly impacting Enersense's profitability.

Customer switching costs are a significant factor in Enersense's industry. These costs can be substantial because infrastructure projects are often long-term, requiring deep integration of services and specialized knowledge from the existing provider. This makes it difficult and expensive for customers to switch to a new company, thereby reducing their bargaining power.

Enersense actively works to increase these switching costs by positioning itself as a lifecycle partner for its clients. This strategy means they are involved from the initial stages through to ongoing maintenance, further embedding their services and making a change less appealing for the customer.

Customers in the energy and telecommunications infrastructure sectors are generally well-informed. They understand prevailing market prices and the various service options available, which naturally gives them leverage when negotiating with companies like Enersense. This knowledge empowers them to seek the best deals.

Given the substantial capital outlay required for infrastructure projects, customers often exhibit a high degree of price sensitivity. This means that the cost of services is a critical factor in their decision-making process. For Enersense, this necessitates a careful approach to pricing.

Enersense needs to strike a delicate balance. While offering competitive pricing is crucial to attract and retain business, it's equally important to demonstrate the value and quality of their services. Customers are not just looking for the lowest price; they are also seeking reliable and high-performing solutions for their long-term infrastructure needs.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Enersense is generally considered low. This is because potential customers would need to invest heavily in specialized expertise, significant capital, and navigate complex regulatory environments to replicate Enersense's core services in energy and telecommunications infrastructure.

For instance, a large utility company might consider building its own fiber optic network or managing its own power grid maintenance. However, the capital expenditure required for such an undertaking is substantial. In 2024, the average cost to deploy a new fiber optic network can range from $20,000 to $50,000 per mile, depending on the terrain and technology. Similarly, establishing in-house capabilities for large-scale energy infrastructure maintenance would involve acquiring specialized equipment and training a dedicated workforce, adding considerable overhead.

- High Capital Investment: Building and maintaining energy and telecom infrastructure demands significant upfront capital, often in the billions of dollars for large-scale projects.

- Specialized Expertise Required: Enersense's operations rely on highly skilled engineers, technicians, and project managers with specific knowledge in areas like grid modernization and 5G deployment.

- Regulatory Hurdles: The energy and telecommunications sectors are heavily regulated, requiring permits, compliance with safety standards, and adherence to various government policies, which can be a deterrent for new entrants.

- Economies of Scale: Enersense benefits from economies of scale in procurement, labor, and operational efficiency, making it difficult for individual customers to achieve similar cost advantages through backward integration.

Importance of Enersense's Services to Customers

Enersense's services are fundamental to the uninterrupted operation of its clients' critical infrastructure, including power transmission, distribution, and telecommunication networks. This inherent necessity significantly curtails the bargaining power of customers. Any lapse in Enersense's service delivery can trigger severe operational disruptions and reputational damage for its clients, compelling them to prioritize reliability and service quality over mere cost considerations.

The criticality of Enersense's offerings means customers are less likely to switch providers due to price alone. For instance, in 2024, the global market for electrical infrastructure maintenance and construction, a key area for Enersense, was valued at over $200 billion, with reliability being a paramount concern for utility companies. This dependence creates a strong incentive for customers to maintain stable relationships with dependable service providers like Enersense.

- Critical Infrastructure Dependence: Enersense's clients rely on its expertise for the continuous functioning of essential services, making them sensitive to service interruptions.

- High Switching Costs: The complexity and risk associated with changing providers for critical infrastructure management deter customers from seeking lower-cost alternatives.

- Prioritization of Reliability: In 2024, utility companies reported that the cost of downtime for power grids could range from hundreds of thousands to millions of dollars per hour, underscoring the value placed on reliable service.

- Reputational Risk Mitigation: Customers view Enersense as a partner in safeguarding their public image and operational integrity, further diminishing their willingness to exert price pressure.

Enersense's customers, often large utilities and telecom operators, have moderate bargaining power. Their ability to negotiate is influenced by their size, the criticality of the services provided, and the costs associated with switching providers. While price sensitivity exists, the need for reliable infrastructure management often tempers aggressive price demands.

| Factor | Impact on Enersense | 2024 Data/Context |

|---|---|---|

| Customer Concentration | High concentration of revenue from a few large clients increases their leverage. | Key clients in Finland and the Baltics represent a significant portion of Enersense's revenue. |

| Switching Costs | High switching costs for customers due to integrated, long-term infrastructure projects reduce their power. | Deep service integration and specialized knowledge make switching difficult and expensive. |

| Customer Information | Well-informed customers leverage market knowledge for better deals. | Customers understand prevailing market prices and available service options. |

| Price Sensitivity | High price sensitivity in infrastructure projects necessitates competitive pricing. | Cost is a critical factor, requiring Enersense to balance value and price. |

| Backward Integration Threat | Low threat due to high capital and expertise requirements for customers. | Replicating Enersense's specialized services demands substantial investment. |

| Criticality of Services | Lowers customer bargaining power as reliability is paramount. | Service interruptions can cause millions in hourly losses for clients. |

Preview Before You Purchase

Enersense Porter's Five Forces Analysis

This preview displays the complete Enersense Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The energy and telecommunications infrastructure service markets in Finland and the Baltics are populated by a number of significant and established companies. Enersense operates within this competitive arena, facing rivals that offer comparable services.

Tracxn data highlights a fragmented competitive landscape, listing 9 active competitors for Enersense. Notable among these are Suvic, Winda, and Taaleri Energia, underscoring the presence of multiple players vying for market share in these critical infrastructure sectors.

The green energy transition and increasing digitalization are acting as significant growth engines for Enersense's primary business areas: Power, Industry, and Connectivity. This expansionary environment can help to temper intense competitive rivalry, as companies have opportunities to grow their operations by capturing new market demand rather than solely by taking share from existing players. Enersense's strategic emphasis on these burgeoning sectors is designed to leverage this favorable market dynamic.

Enersense distinguishes itself through a holistic approach to energy infrastructure services, covering the entire project lifecycle from initial planning and construction to ongoing maintenance and eventual decommissioning. This comprehensive offering reduces the likelihood of customers seeking out multiple specialized providers, fostering deeper loyalty.

The company's strategic focus on facilitating a zero-emission society, particularly through its expertise in areas like green hydrogen plant development, creates a significant unique selling proposition. This specialization allows Enersense to command premium pricing and avoid intense price wars with less specialized competitors.

Exit Barriers

Enersense faces significant competitive rivalry due to high exit barriers within the infrastructure services sector. These barriers, including specialized assets and long-term project commitments, make it difficult and costly for companies to leave the market, even when facing low profitability. This can lead to prolonged periods of intense competition as firms are essentially locked into operations.

For instance, the infrastructure services industry often requires substantial investments in specialized machinery and equipment, such as heavy-duty cranes, tunneling machines, or advanced surveying tools. These assets have limited alternative uses, meaning their resale value is often significantly diminished if a company decides to exit. Enersense, like its peers, must factor in the substantial capital tied up in such specialized infrastructure.

Furthermore, long-term contracts are a hallmark of the infrastructure services sector. Companies like Enersense often secure multi-year agreements for projects like power grid modernization or renewable energy installations. Fulfilling these contractual obligations, even if market conditions deteriorate, acts as a powerful deterrent to exiting, thereby sustaining competitive pressure among existing players.

The high costs associated with employee severance and retraining also contribute to exit barriers. In a sector requiring skilled labor, companies may face significant financial liabilities if they need to downsize or close operations, further discouraging departure and intensifying rivalry among those remaining.

- High Capital Investment: Specialized infrastructure equipment represents a significant sunk cost for companies like Enersense.

- Long-Term Contracts: Project commitments spanning several years bind companies to the market, limiting flexibility.

- Employee Severance Costs: The expense of laying off a specialized workforce adds to the difficulty of exiting.

- Limited Asset Liquidity: Specialized machinery often has a low resale value, increasing exit costs.

Strategic Commitments of Competitors

Competitors' significant investments in new technologies and market expansion intensify rivalry. Enersense's strategic commitment to divesting non-core businesses and concentrating on its core segments, aiming for enhanced profitability and a stronger market position, underscores this dynamic. This strategic realignment suggests an industry where firms are actively reconfiguring their approaches to gain a competitive edge.

The competitive landscape is characterized by substantial strategic commitments from players seeking to solidify their market share. For instance, in 2024, several key competitors in the energy services sector announced multi-billion dollar investments in renewable energy infrastructure and digital transformation initiatives. These moves are designed to capture future market growth and improve operational efficiency, directly impacting the competitive intensity for companies like Enersense.

- Strategic Investments: Competitors are channeling significant capital into areas like AI-driven grid management and advanced energy storage solutions, aiming to differentiate their offerings.

- Market Expansion: Aggressive expansion into emerging markets and new service verticals by rivals creates additional competitive pressure.

- Enersense's Response: Enersense's strategic focus on core, high-margin segments and divestment of underperforming assets reflects a proactive approach to managing this heightened rivalry.

- Industry Dynamics: The ongoing strategic adjustments by all market participants indicate a highly competitive environment where strategic commitment is paramount for survival and growth.

Competitive rivalry in Enersense's markets is substantial, driven by a fragmented landscape with established players like Suvic and Winda. High exit barriers, including significant capital tied up in specialized assets and long-term contracts, keep companies engaged even during challenging periods. This dynamic intensifies competition as firms are incentivized to remain operational.

SSubstitutes Threaten

The threat of substitutes for Enersense's services primarily stems from alternative methods customers can employ to meet their needs. For power grids, this could manifest as the increasing adoption of localized micro-grid solutions, which diminish the necessity for extensive centralized transmission infrastructure. For telecommunications, emerging wireless technologies and satellite internet advancements offer potential substitutions for traditional fiber optic network deployments.

The attractiveness of substitutes for Enersense's services hinges on their price-performance ratio. If alternative energy infrastructure solutions become substantially more affordable or offer superior efficiency, the threat of substitution rises. For instance, advancements in smaller-scale, distributed energy generation technologies could present a more cost-effective option for certain clients compared to large-scale grid infrastructure projects that Enersense specializes in.

Customer propensity to substitute for Enersense's services is generally low, especially within critical infrastructure sectors. This is because customers in these areas, such as energy grids or telecommunications, are highly risk-averse. They prioritize reliability and proven performance over potential cost savings from unproven alternatives. For instance, a utility company is unlikely to switch its grid management software to a new, less-tested provider if the existing system is stable and meets regulatory requirements, even if the new option promises lower upfront costs.

The long-term nature of infrastructure projects further solidifies this low propensity to substitute. Investments in these areas are made with decades-long operational lifespans in mind. This means that companies are reluctant to adopt solutions that might become obsolete or unreliable within that timeframe. Enersense's focus on established technologies and robust service delivery directly addresses this concern, making their offerings more sticky and less susceptible to substitution by newer, less proven market entrants.

Technological Advancements

Rapid technological advancements present a significant threat of substitutes for Enersense. Innovations in areas like decentralized energy grids, advanced battery storage solutions, or even novel energy transmission methods could offer alternative ways to achieve energy efficiency and management that bypass Enersense's traditional infrastructure and service models. For instance, the growing adoption of peer-to-peer energy trading platforms, facilitated by blockchain technology, could reduce reliance on centralized grid management services that Enersense provides.

Enersense actively counters this threat by strategically aligning itself with the green energy transition and digitalization trends. By focusing on enabling these very technological shifts, such as developing smart grid solutions and integrating renewable energy sources, Enersense aims to be at the forefront of innovation rather than a victim of it. Their investments in digitalization and smart energy solutions are designed to ensure their services remain relevant and essential as the energy landscape evolves. For example, in 2024, Enersense continued its focus on expanding its smart energy management capabilities, with a reported increase in projects related to grid modernization and renewable energy integration.

- Technological Disruption: New technologies in energy generation, storage, and data transmission could create alternative infrastructure and service delivery models.

- Market Shift: The increasing viability of decentralized energy systems and peer-to-peer energy trading poses a challenge to traditional grid management.

- Enersense's Strategy: The company positions itself as an enabler of the green energy transition and digitalization to mitigate the threat of substitutes.

- Investment Focus: Enersense's commitment to smart energy solutions and grid modernization in 2024 demonstrates a proactive approach to staying competitive amidst technological change.

Regulatory and Policy Changes

Government regulations and energy policies significantly influence the threat of substitutes for companies like Enersense. For example, shifts in policy that encourage distributed energy generation, such as rooftop solar or microgrids, can directly challenge the demand for traditional grid services that Enersense helps manage and optimize. In 2024, many regions saw continued policy discussions around energy independence and grid resilience, potentially increasing the appeal of localized energy solutions.

Conversely, regulatory frameworks that actively support grid modernization and the integration of large-scale renewable energy sources can actually mitigate the threat of substitution. When policies favor investments in smart grid technologies, advanced metering infrastructure, and utility-scale battery storage – areas where Enersense operates – it strengthens Enersense's position by aligning its services with government priorities. For instance, the Infrastructure Investment and Jobs Act in the US continues to allocate significant funding towards grid modernization efforts, benefiting companies providing such services.

- Policy Impact: Government incentives for renewable energy adoption and grid modernization can either bolster or weaken the threat of substitutes.

- Decentralization Trend: Policies promoting decentralized energy solutions, like microgrids, pose a greater substitution risk to traditional grid services.

- Enersense Alignment: Enersense's focus on grid modernization and renewable integration aligns with supportive policy trends, potentially reducing substitution threats.

- 2024 Context: Ongoing policy debates in 2024 regarding energy infrastructure and resilience shaped the landscape for substitute energy solutions.

The threat of substitutes for Enersense's core services is moderate but growing, driven by technological advancements and evolving market preferences. While critical infrastructure sectors exhibit low customer propensity to substitute due to high risk aversion and long asset lifespans, emerging decentralized solutions and innovative energy technologies present viable alternatives. Enersense's strategy to integrate these trends, particularly in smart energy and grid modernization, aims to preemptively address this threat.

In 2024, the energy sector continued to see significant investment in distributed energy resources (DERs), with projections indicating substantial growth in microgrid installations globally. For instance, the global microgrid market was valued at approximately $30 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, according to various market research reports. This expansion directly competes with traditional centralized grid services that Enersense supports.

Furthermore, advancements in battery storage technology are making localized energy solutions more economically feasible and reliable, directly impacting the demand for large-scale grid infrastructure. The cost of lithium-ion battery packs, for example, has fallen dramatically over the past decade, making them increasingly attractive for grid-scale and behind-the-meter applications. Enersense's focus on smart grid solutions and renewable integration helps position it to capitalize on these shifts rather than be displaced by them.

| Substitute Technology | Potential Impact on Enersense | 2024 Market Trend/Data |

|---|---|---|

| Microgrids & Distributed Energy Resources (DERs) | Reduces reliance on centralized grid infrastructure. | Global microgrid market projected to exceed $30 billion in 2023, with strong CAGR. |

| Advanced Battery Storage | Enhances feasibility and reliability of localized energy solutions. | Significant cost reductions in battery technology making grid-scale storage more viable. |

| Peer-to-Peer Energy Trading Platforms | Challenges traditional grid management and energy distribution models. | Increasing adoption driven by blockchain and smart contract technologies. |

| Emerging Energy Transmission Technologies | Could offer alternative methods for energy delivery, bypassing current infrastructure. | Ongoing research and development in areas like wireless power transfer. |

Entrants Threaten

Entering the energy and telecommunications infrastructure services sector, where Enersense operates, demands a substantial financial outlay. This includes acquiring specialized, high-tech equipment, developing advanced technological capabilities, and securing a highly skilled workforce, all of which represent significant upfront costs.

Enersense's business model, which focuses on project execution and ongoing maintenance within these critical infrastructure areas, necessitates considerable capital investment. For instance, the company's significant fleet of specialized vehicles and machinery, essential for projects like offshore wind farm construction or telecom network deployment, represents millions in capital expenditure.

These high capital requirements act as a formidable barrier to entry for potential competitors. Smaller firms or those with limited access to funding will find it exceedingly difficult to match the scale of investment required to compete effectively, thereby protecting Enersense from a surge of new, less capitalized rivals.

Established players like Enersense leverage significant economies of scale in areas such as bulk purchasing of materials and specialized equipment, leading to lower per-unit costs. For instance, Enersense's large-scale operations in renewable energy infrastructure projects in 2024 likely allowed them to negotiate more favorable terms with suppliers compared to a new entrant. This cost advantage creates a substantial barrier for newcomers attempting to compete on price.

The deep experience Enersense has accumulated over years, particularly in navigating the complexities of large-scale utility and energy projects, translates into superior project execution and risk management. This accumulated knowledge, evident in their successful completion of numerous projects such as the significant expansion of wind farm capacity in the US in 2024, is a critical intangible asset that new entrants would find incredibly difficult and time-consuming to build.

Enersense's strength lies in its deeply entrenched customer relationships, particularly with national grid operators and major telecom firms. Cultivating these partnerships is a lengthy and resource-intensive process, making it a significant barrier for newcomers. For instance, securing a multi-year framework agreement with a national energy company requires extensive due diligence and proven reliability, a hurdle new entrants would find difficult to overcome quickly.

Government Policy and Regulation

Government policy and regulation present a substantial threat of new entrants in sectors like energy and telecommunications. These industries demand extensive permits, licenses, and strict adherence to safety and environmental standards, creating significant hurdles for newcomers. For instance, in 2024, the average time to obtain all necessary permits for a new renewable energy project in the EU could extend over 18 months, reflecting the regulatory burden.

Enersense's established expertise and proactive compliance with these complex regulatory frameworks serve as a strong deterrent. Their deep understanding and established relationships within regulatory bodies allow them to navigate these requirements more efficiently than a new player. This built-in advantage makes it difficult for new entrants to match Enersense's operational readiness and market access.

- Regulatory Complexity: Energy and telecom sectors require numerous permits and licenses.

- Safety & Environmental Standards: Strict adherence is mandatory, increasing compliance costs for new entrants.

- Enersense's Advantage: Existing expertise and compliance streamline operations, creating a barrier.

- Market Entry Cost: Navigating regulations adds significant upfront costs and time delays for potential competitors.

Proprietary Technology and Expertise

Enersense's significant proprietary technology and deep expertise act as a formidable barrier against new entrants. Their specialized knowledge in constructing and maintaining green hydrogen plants, for instance, requires substantial upfront investment in research, development, and skilled personnel, making it difficult for newcomers to replicate quickly.

This specialized know-how extends to their design and expert services for power transmission grids and substations. Acquiring or developing similar levels of technical proficiency and intellectual property would necessitate considerable time and financial resources, effectively deterring potential competitors from easily entering these niche markets.

- Proprietary Expertise: Enersense holds unique knowledge in green hydrogen plant construction and maintenance.

- Specialized Services: The company offers expert design and services for power transmission grids and substations.

- High Barrier to Entry: New firms would need significant investment to match Enersense's capabilities and intellectual property.

The threat of new entrants in Enersense's operating environment is generally low due to exceptionally high capital requirements, significant economies of scale enjoyed by incumbents, and strong brand loyalty and customer switching costs. For instance, in 2024, the average cost to establish a new utility-scale solar farm, a sector Enersense serves, often exceeded $1 million per megawatt, presenting a substantial financial hurdle for new players.

Furthermore, the specialized nature of infrastructure services, requiring highly skilled labor and advanced technology, creates a steep learning curve and significant upfront investment in training and equipment. Enersense's substantial investment in its workforce and technology, including their advanced digital twin capabilities for grid management, further solidifies this barrier.

The regulatory landscape, with its complex permitting processes and stringent safety standards, also acts as a significant deterrent. For example, obtaining all necessary environmental and operational permits for a new telecommunications tower in 2024 could take upwards of 12-18 months in many jurisdictions, delaying market entry and increasing initial costs.

| Barrier Type | Description | Impact on New Entrants | Enersense's Position |

|---|---|---|---|

| Capital Requirements | High investment in specialized equipment and technology. | Significant financial hurdle. | Established asset base and access to capital. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Price disadvantage for smaller competitors. | Negotiating power with suppliers, optimized operations. |

| Customer Switching Costs | Long-term contracts and integration with existing systems. | Difficulty in acquiring established clients. | Deeply entrenched relationships with major utilities and telecom firms. |

| Regulatory Hurdles | Extensive permits, licenses, and compliance requirements. | Time delays and increased upfront costs. | Expertise in navigating complex regulatory frameworks. |

Porter's Five Forces Analysis Data Sources

Our Enersense Porter's Five Forces analysis is built upon a robust foundation of data, including Enersense's annual reports, industry-specific market research from firms like IHS Markit, and public filings from key competitors. We also incorporate macroeconomic data and regulatory updates relevant to the energy and infrastructure sectors.