Enersense Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enersense Bundle

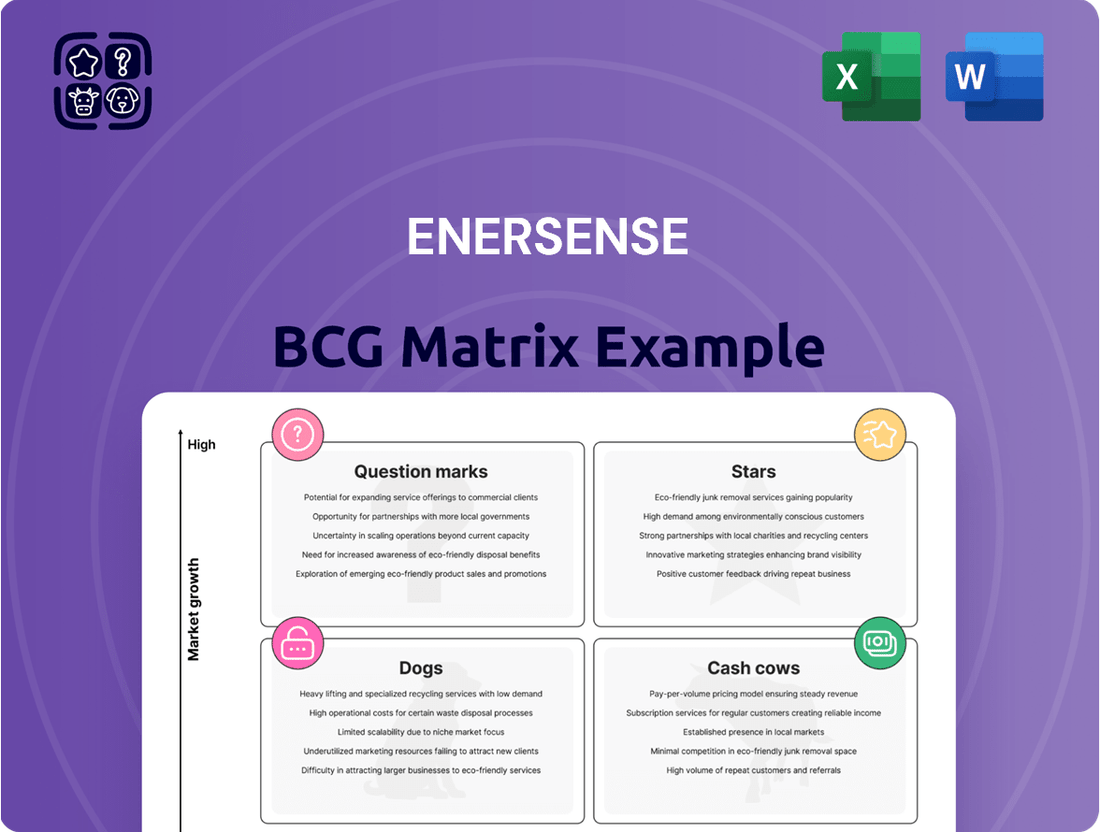

Discover the strategic positioning of Enersense's product portfolio with our insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth. Purchase the full BCG Matrix for a comprehensive analysis, including data-driven recommendations and actionable strategies to optimize Enersense's market performance and investment decisions.

Stars

Enersense's power grid construction and maintenance operations in Finland are a clear Star within its business portfolio. The company enjoys a robust market position, particularly in building and servicing substations and high-voltage lines. This segment benefits from substantial demand fueled by the critical energy transition and the ongoing necessity for dependable electricity infrastructure.

The market for power grid development is experiencing significant growth, a trend expected to continue. Enersense's strategic wins, such as securing major projects with Fingrid, a key player in the Finnish transmission system, underscore its expanding market share. This positions the company favorably within a high-growth sector, demonstrating its capacity to capitalize on evolving energy needs.

Enersense's renewable energy infrastructure services are a significant growth driver, capitalizing on the global shift towards sustainable energy. The company acts as a lifecycle partner, offering essential maintenance and operational support for wind farms and solar parks. This positions them squarely within a high-growth sector, as evidenced by the increasing global investment in renewables.

The demand for maintaining and extending the life of renewable energy assets is robust. For instance, the global renewable energy market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly in the coming years. Enersense's specialized expertise in this area allows them to capture a substantial share of this expanding market.

Enersense is actively engaged in industrial energy transition projects, notably in the construction and upkeep of green hydrogen facilities. This strategic focus places the company squarely within a burgeoning, high-potential market essential for achieving a zero-emission future.

The company’s participation in these critical zero-emission initiatives highlights a substantial growth avenue, signaling Enersense’s ambition to be a frontrunner in this developing yet rapidly expanding sector.

Telecommunications Network Construction and Maintenance

Enersense's telecommunications network construction and maintenance services, especially those focused on fiber optic networks, are performing well in a market experiencing sustained expansion. The company's ability to secure major contracts, such as those with Telia and GlobalConnect, highlights its significant position within this consistently growing sector.

These services are likely categorized as Stars within the BCG matrix due to their strong market share in a high-growth industry. For instance, in 2024, the global fiber optic market was projected to reach over $100 billion, demonstrating the substantial demand Enersense is tapping into.

- Strong Market Growth: The demand for fiber optic networks continues to rise, driven by increasing data consumption and the need for faster internet speeds.

- Significant Contract Wins: Enersense's agreements with major players like Telia and GlobalConnect indicate a solid market presence and client trust.

- High Revenue Potential: As a Star, this segment contributes significantly to Enersense's overall revenue and is expected to continue doing so.

- Investment Focus: Continued investment in this area is crucial for maintaining market leadership and capitalizing on future growth opportunities.

Lifecycle Partner Model for Critical Infrastructure

Enersense is strategically evolving into a comprehensive lifecycle partner for critical infrastructure. This means they are not just involved in one phase, but across the entire spectrum from initial design and construction through to ongoing operation, maintenance, and future upgrades. This integrated model is designed to foster deeper, more enduring relationships with clients.

This strategic pivot is particularly impactful in the current market, where demand for holistic infrastructure solutions is on the rise. By offering end-to-end services, Enersense aims to capture a larger share of the market and build a more stable, recurring revenue stream. This approach positions them for sustained growth and potential market leadership.

Key aspects of Enersense's lifecycle partner model include:

- Design and Engineering: Providing foundational expertise for infrastructure projects.

- Construction and Project Management: Overseeing the physical build and ensuring timely, efficient execution.

- Operation and Maintenance: Guaranteeing the ongoing functionality and longevity of infrastructure assets.

- Upgrades and Modernization: Implementing improvements to enhance performance and adapt to future needs.

Enersense's power grid construction and maintenance, along with its renewable energy infrastructure services, are strong Stars. These segments benefit from robust demand driven by the energy transition and significant investments in renewables. The company's strategic wins and focus on lifecycle services further solidify their position in these high-growth areas.

The telecommunications network construction and maintenance, particularly fiber optics, also represent Stars. This is due to sustained market expansion and Enersense's ability to secure substantial contracts with key industry players. The global fiber optic market's projected growth underscores the potential for this segment.

| Business Segment | BCG Category | Key Growth Drivers | Market Position Indicator |

|---|---|---|---|

| Power Grid Construction & Maintenance | Star | Energy transition, infrastructure upgrades | Major project wins (e.g., Fingrid) |

| Renewable Energy Infrastructure Services | Star | Global shift to renewables, asset lifecycle support | Increasing global investment in renewables |

| Telecommunications Network Construction & Maintenance (Fiber Optics) | Star | Rising data consumption, demand for faster internet | Secured contracts with major telecom providers |

What is included in the product

The Enersense BCG Matrix provides a strategic overview of business units based on market share and growth, guiding investment decisions.

Enersense's BCG Matrix offers a clear, one-page overview, instantly clarifying business unit performance to alleviate strategic uncertainty.

Cash Cows

Enersense's established power transmission and distribution services are a classic example of a Cash Cow. These operations have a strong foothold in maintaining existing, mature infrastructure, a segment that demands consistent, albeit slow-growing, investment. The company's deep expertise and existing contracts in this area ensure a reliable stream of revenue.

This segment likely boasts a high market share within a low-growth market, a defining characteristic of a Cash Cow. For instance, in 2024, the global power transmission and distribution market was valued at approximately $250 billion, with steady, single-digit annual growth projected. Enersense's established position here allows it to leverage its scale and operational efficiency to generate substantial, predictable cash flows.

Enersense's hydropower plant maintenance services are a prime example of a Cash Cow within their business portfolio. These operations, bolstered by long-term contracts with established clients like Vattenfall and Koskienergia, generate a predictable and substantial revenue stream.

This mature service is essential for the ongoing operation of critical energy infrastructure, ensuring consistent demand. The steady cash flow generated requires minimal additional investment for growth, making it a highly profitable segment for Enersense.

Enersense's maintenance of existing telecommunication infrastructure acts as a stable cash cow. This segment focuses on the upkeep of mast and equipment room infrastructure, a necessity in a mature market. For instance, in 2024, Enersense secured a significant multi-year agreement with a major Nordic telecommunications operator for the maintenance of their network, highlighting the ongoing demand for these services.

Routine Industrial Facility Maintenance

Enersense's routine industrial facility maintenance services, focusing on existing infrastructure rather than new energy projects, are positioned as a Cash Cow. This segment benefits from a stable, high market share within its niche, offering predictable revenue streams.

These services are characterized by their resilience to market volatility, generating consistent, albeit low-growth, cash flow. This stability is crucial for funding other areas of Enersense's business, such as their growth-oriented ventures.

- Stable Revenue: Enersense's established industrial maintenance operations provide a reliable income source, underpinning the company's financial stability.

- High Market Share: The company likely holds a significant portion of the market for routine maintenance of existing industrial facilities, ensuring consistent demand.

- Low Growth, High Cash Flow: While not a rapid expansion area, these services are highly efficient in generating cash, essential for reinvestment and shareholder returns.

- Operational Efficiency: Mature processes and experienced teams contribute to the profitability of these maintenance services, maximizing cash generation.

Specialized Substation Maintenance Services

Enersense's specialized substation maintenance services are firmly positioned as a Cash Cow within the BCG Matrix. This business line benefits from a mature market where Enersense has established itself as a leading operator in both substation construction and ongoing maintenance.

The company's strong reputation and existing long-term contracts provide a stable foundation for high market share. This translates into consistent and predictable cash flow generation, as these services are essential and recurring for energy infrastructure upkeep.

- Market Position: Enersense holds a dominant position in substation maintenance due to its extensive experience and established client base.

- Revenue Stability: The recurring nature of maintenance contracts ensures a reliable and steady stream of revenue.

- Profitability: Mature operations and economies of scale contribute to healthy profit margins.

- Cash Generation: These services are significant cash generators, requiring minimal investment for continued growth.

Enersense's established power transmission and distribution services are a classic example of a Cash Cow. These operations have a strong foothold in maintaining existing, mature infrastructure, a segment that demands consistent, albeit slow-growing, investment. The company's deep expertise and existing contracts in this area ensure a reliable stream of revenue.

This segment likely boasts a high market share within a low-growth market, a defining characteristic of a Cash Cow. For instance, in 2024, the global power transmission and distribution market was valued at approximately $250 billion, with steady, single-digit annual growth projected. Enersense's established position here allows it to leverage its scale and operational efficiency to generate substantial, predictable cash flows.

Enersense's hydropower plant maintenance services are a prime example of a Cash Cow within their business portfolio. These operations, bolstered by long-term contracts with established clients like Vattenfall and Koskienergia, generate a predictable and substantial revenue stream.

This mature service is essential for the ongoing operation of critical energy infrastructure, ensuring consistent demand. The steady cash flow generated requires minimal additional investment for growth, making it a highly profitable segment for Enersense.

Enersense's maintenance of existing telecommunication infrastructure acts as a stable cash cow. This segment focuses on the upkeep of mast and equipment room infrastructure, a necessity in a mature market. For instance, in 2024, Enersense secured a significant multi-year agreement with a major Nordic telecommunications operator for the maintenance of their network, highlighting the ongoing demand for these services.

Enersense's routine industrial facility maintenance services, focusing on existing infrastructure rather than new energy projects, are positioned as a Cash Cow. This segment benefits from a stable, high market share within its niche, offering predictable revenue streams.

These services are characterized by their resilience to market volatility, generating consistent, albeit low-growth, cash flow. This stability is crucial for funding other areas of Enersense's business, such as their growth-oriented ventures.

Enersense's specialized substation maintenance services are firmly positioned as a Cash Cow within the BCG Matrix. This business line benefits from a mature market where Enersense has established itself as a leading operator in both substation construction and ongoing maintenance.

The company's strong reputation and existing long-term contracts provide a stable foundation for high market share. This translates into consistent and predictable cash flow generation, as these services are essential and recurring for energy infrastructure upkeep.

| Enersense Cash Cow Segment | Market Characteristic | Enersense Position | Financial Contribution |

|---|---|---|---|

| Power Transmission & Distribution Maintenance | Mature, Low Growth | High Market Share | Stable, Predictable Cash Flow |

| Hydropower Plant Maintenance | Mature, Essential Service | Strong Client Base (Vattenfall, Koskienergia) | Substantial Revenue Stream |

| Telecommunication Infrastructure Maintenance | Mature Market | Secured Multi-Year Agreements (2024) | Consistent Demand & Revenue |

| Industrial Facility Maintenance | Mature, Niche Market | Stable, High Market Share | Resilient, Low-Growth Cash Flow |

| Substation Maintenance | Mature Market, Essential Infrastructure | Leading Operator, Strong Reputation | Consistent & Predictable Cash Generation |

What You’re Viewing Is Included

Enersense BCG Matrix

The Enersense BCG Matrix you are previewing is the identical, fully developed document you will receive upon purchase, ensuring complete transparency and immediate usability. This comprehensive analysis, meticulously prepared, will be delivered directly to you without any alterations or watermarks, ready for your strategic decision-making. You can confidently proceed with your purchase, knowing that the preview accurately represents the professional-grade Enersense BCG Matrix report you will download. This means no hidden surprises, just the complete, actionable insights you need to evaluate Enersense's product portfolio.

Dogs

Enersense's strategic decision to ramp down its zero-emission transport solutions business in February 2025 firmly places it in the 'Dog' category of the BCG matrix. This move signals a recognition that the segment suffered from both low market share and limited growth potential, a classic indicator of a struggling business unit.

The discontinuation suggests this venture was likely a cash trap, draining resources without yielding adequate returns. For instance, while the global electric vehicle market was projected to reach $800 billion by 2027, Enersense's specific segment failed to capture significant market share, indicating operational challenges or a misaligned strategy within this rapidly evolving sector.

Enersense's divestment of its wind and solar project development business to Fortum in February 2025 places this segment firmly in the 'Dog' category of the BCG matrix. This move indicates that despite past potential, the business was not generating sufficient returns or market share to justify continued investment within Enersense's strategic focus.

Non-core, underperforming small-scale projects within Enersense's portfolio would likely be categorized as Dogs in the BCG matrix. These are typically smaller service contracts or projects that don't align with the company's strategic direction towards green energy and telecommunications. For instance, if Enersense had a legacy contract for a minor infrastructure upgrade in a non-renewable sector, it would fit this description.

These projects often exhibit low profitability and limited potential for growth, meaning they don't contribute significantly to Enersense's overall market share or revenue expansion. In 2024, such projects might represent a small percentage of overall revenue, perhaps less than 5%, while consuming disproportionate management attention and resources.

Legacy Services with Declining Demand

Certain legacy industrial services offered by companies like Enersense, those not directly tied to the burgeoning green energy sector or telecommunications, are facing a challenging market. These traditional offerings, which might include older forms of industrial maintenance or specialized repair work that have been superseded by newer technologies, are experiencing a noticeable dip in demand. This decline is largely a consequence of ongoing technological advancements and significant shifts in market priorities, pushing these services into a shrinking or stagnant market segment.

Within the Enersense portfolio, these legacy services would likely represent offerings with a low market share in markets that are either contracting or showing minimal growth. For instance, if Enersense historically provided extensive services for older fossil fuel infrastructure, and the global push towards renewables intensifies, the demand for such services would naturally decrease. This places them squarely in the Dogs quadrant of the BCG matrix, indicating a need for careful strategic consideration.

- Declining Market Share: Legacy services often possess a small portion of an increasingly smaller market pie.

- Technological Obsolescence: Advancements in technology render traditional service methods less efficient or unnecessary.

- Market Shifts: A move away from older industries (e.g., fossil fuels) reduces the need for associated legacy services.

- Low Growth Potential: The stagnant or shrinking nature of the market for these services offers little opportunity for expansion.

Inefficient or Outdated Operational Processes

Inefficient or outdated operational processes within Enersense, regardless of specific business units, can be classified as internal 'dogs' in the BCG matrix. These are operations that consume resources without generating substantial returns or contributing to a competitive edge. For instance, legacy IT systems that are costly to maintain and slow down data processing, or manual workflows that are prone to errors, fall into this category. In 2024, companies across various sectors have been increasingly focused on digital transformation to streamline operations. A report by McKinsey indicated that organizations prioritizing operational efficiency through technology adoption saw an average of 10-15% reduction in operating costs.

These internal dogs drain capital and management attention, hindering Enersense's overall profitability and agility. Identifying and addressing these areas is crucial for resource reallocation towards more promising growth opportunities. For example, a manual invoicing system that requires significant human intervention can lead to delays and increased administrative overhead. By contrast, implementing an automated accounts payable solution could free up staff time and reduce processing errors.

- Legacy IT Infrastructure: Outdated software and hardware can lead to higher maintenance costs and security vulnerabilities, as seen in many companies struggling with digital modernization in 2024.

- Manual Workflows: Processes that rely heavily on manual data entry or physical paperwork are often slow, error-prone, and resource-intensive.

- Ineffective Supply Chain Management: Poorly optimized logistics or inventory management can result in increased carrying costs and missed sales opportunities.

- Suboptimal Customer Service Processes: Lengthy call wait times or inefficient complaint resolution mechanisms can damage customer loyalty and brand reputation.

Enersense's decision to phase out its zero-emission transport solutions by February 2025, coupled with the sale of its wind and solar project development business in the same month, clearly positions these segments within the 'Dog' category of the BCG matrix. These actions reflect a strategic realization that both ventures struggled with low market share and limited growth prospects, indicating they were likely consuming resources without generating sufficient returns.

These 'Dog' segments, characterized by low market share and low growth potential, represent business units that are not contributing significantly to Enersense's overall performance. For instance, while the global renewable energy sector continued its expansion, Enersense's specific divestments suggest these particular operations failed to capture a meaningful position within their respective markets, potentially due to intense competition or internal execution challenges.

The strategic move to divest or ramp down underperforming units is a common approach for companies to reallocate capital towards more promising areas. In 2024, many companies focused on portfolio optimization, aiming to shed non-core or low-return assets. Enersense's actions align with this trend, prioritizing resources for its core businesses in green energy and telecommunications infrastructure.

The classification of these units as 'Dogs' highlights their status as cash traps, demanding resources without offering a clear path to future profitability or market leadership. This strategic pruning allows Enersense to concentrate its efforts and investments on areas with higher potential for growth and return on investment, thereby strengthening its overall market position.

Question Marks

Enersense's involvement in developing Finland's first green hydrogen plant places it squarely in the "Question Marks" category of the BCG matrix. This segment represents a high-growth potential market, but with currently low market share for Enersense.

Significant capital investment is crucial for Enersense to scale its operations, build out the necessary infrastructure, and capture a meaningful share of this emerging green hydrogen market. The company's strategic decisions and execution in these pioneering projects will be key to its future success.

The success of these early-stage green hydrogen initiatives, such as the one in Finland, will dictate whether Enersense can transform this "Question Mark" into a "Star" by achieving market leadership in a rapidly expanding sector.

Enersense is strategically targeting expansion into the Baltic and select Nordic markets for profitable growth. These regions represent significant opportunities, but Enersense's current presence is likely minimal, positioning these ventures as Stars in the BCG matrix.

The company's focus on these new territories underscores a commitment to diversifying revenue streams beyond its established Finnish base. For instance, in 2024, Enersense announced its intention to explore opportunities in Sweden and Denmark, alongside continued development in Estonia, Latvia, and Lithuania.

These new markets, while promising, require substantial investment to build brand recognition and secure market share. Enersense's approach acknowledges the need for dedicated resources to nurture these emerging segments, aiming to transform them into future cash cows.

Enersense is strategically investing in the digitalization of its project and service delivery models. This focus aligns with the broader industry trend towards digital transformation, aiming to enhance efficiency and customer experience.

While digitalization promises future growth, the immediate impact on market share and profitability might be tempered as these new models are rolled out and gain traction. For instance, similar digital transformation initiatives in the energy sector often require substantial upfront investment before demonstrating significant market share gains.

The company recognizes that significant capital expenditure is crucial for these digital endeavors to mature into a sustainable competitive advantage. Early-stage digital projects, like those in advanced analytics for grid management, typically see investment levels that outpace immediate revenue generation, a pattern common in the early phases of technological adoption.

Development of Customer-Centric Solutions for Complex Challenges

Enersense’s commitment to developing customer-centric solutions for intricate issues, especially within the rapidly changing energy transition, positions it in a high-growth sector where market share is still being defined. These tailored offerings necessitate significant investment in research and development, alongside robust market penetration strategies, to advance from the 'Question Mark' stage.

The company's approach to tackling complex energy challenges through bespoke solutions requires a deep understanding of individual client needs and the broader market dynamics. For instance, in 2024, the global renewable energy market saw continued expansion, with investments in grid modernization and energy efficiency solutions projected to grow substantially, creating fertile ground for Enersense's specialized services.

- Market Potential: The demand for customized energy solutions is escalating, driven by decarbonization goals and the increasing complexity of energy infrastructure.

- Investment Needs: Moving these solutions from concept to market leadership requires sustained R&D funding and strategic partnerships.

- Competitive Landscape: Enersense aims to differentiate itself by offering highly integrated and adaptable solutions that address specific customer pain points in areas like smart grid deployment and distributed energy resource management.

- Growth Trajectory: Success in this 'Question Mark' category hinges on Enersense’s ability to secure early adoption and demonstrate tangible value, paving the way for future market dominance.

Strategic Assessment of the Marine and Offshore Unit

The Marine and Offshore unit is currently undergoing a strategic review, reflecting considerable uncertainty about its future market standing and growth potential. This assessment places it firmly in the Question Mark category of the BCG matrix.

While the broader offshore wind sector shows promise for expansion, Enersense's specific performance and profitability within this unit are under scrutiny. This means it could potentially evolve into a Star with dedicated investment or be divested if it proves unviable.

- Market Uncertainty: The unit's future market share and growth trajectory are currently unclear, necessitating a strategic evaluation.

- Offshore Wind Potential: The offshore wind industry itself presents significant growth opportunities, creating a favorable external environment.

- Enersense's Position: Enersense's current profitability and competitive standing within this segment are key factors in the ongoing assessment.

- Strategic Options: The unit represents a potential growth area requiring investment to become a Star, or a candidate for divestment if it fails to meet strategic objectives.

Enersense's ventures into green hydrogen and new Nordic markets are classic Question Marks, requiring significant investment to capture nascent market share. These areas offer high growth potential but currently represent low market penetration for the company.

The company's strategic focus on customer-centric solutions for complex energy challenges also falls into this category, demanding substantial R&D and market penetration efforts. Success here hinges on demonstrating tangible value and securing early adoption.

The Marine and Offshore unit's uncertain future market standing and growth potential place it under strategic review, making it another Question Mark. While the offshore wind sector offers promise, Enersense's specific position requires careful evaluation and potential investment to become a Star.

| Business Area | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Green Hydrogen (Finland) | Question Mark | High | Low | High |

| Baltic & Nordic Expansion | Question Mark | High | Low | High |

| Digitalization Initiatives | Question Mark | Medium-High | Low | High |

| Customized Energy Solutions | Question Mark | High | Low | High |

| Marine & Offshore | Question Mark | Medium | Uncertain | Variable (Review Pending) |

BCG Matrix Data Sources

Our Enersense BCG Matrix is informed by comprehensive market research, including competitor financial reports, industry growth projections, and internal sales data to accurately position each business unit.