Enero Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enero Group Bundle

The Enero Group's market position is a dynamic interplay of robust industry experience and emerging digital opportunities. While their established reputation offers a significant advantage, understanding the nuances of their competitive landscape and potential internal limitations is crucial for strategic foresight.

Want the full story behind Enero Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enero Group's strength lies in its diverse portfolio of marketing and communications agencies, spanning creative (BMF), PR (Hotwire Group), digital, and ad-tech. This broad spectrum of services allows Enero to address a wide array of client requirements across various sectors.

This diversification is a significant advantage, enabling the group to offer integrated solutions. Notably, in FY24, a substantial 66% of Enero's revenue was generated from clients collaborating with multiple agencies or operating in different countries within the group, highlighting the success of this cross-selling strategy.

Enero's Australian agencies, BMF and Orchard, are key strengths, with both achieving impressive double-digit revenue growth in FY24. This robust performance highlights their market relevance and effective strategies.

BMF's creative effectiveness and strategic acumen have been validated by significant new business wins, including the prestigious Westpac account. This demonstrates their ability to attract and retain high-value clients.

Orchard has also excelled, particularly within the competitive healthcare sector. Their success in earning awards for integrated channel engagement underscores their capability in delivering impactful, multi-faceted campaigns.

Enero Group's strategic focus on high-growth sectors, particularly through its Technology, Healthcare, and Consumer (THC) Practice, is a significant strength. This practice, encompassing businesses like Hotwire Group and Orchard, is a primary engine for the company's expansion.

The THC Practice demonstrated robust performance, achieving a 17% EBITDA growth in the first half of fiscal year 2025. This impressive growth occurred even amidst broader challenging market conditions, highlighting the resilience and strategic positioning of these segments.

By concentrating on these dynamic industries, Enero is well-positioned to benefit from and contribute to future market expansion. This targeted approach allows Enero to capitalize on emerging trends and increasing demand within these key sectors.

Global Reach and Capabilities

Enero Group boasts a significant global footprint, with operations strategically positioned across Australia, the United Kingdom, Europe, and the United States. This international presence enables the company to cater to a broad spectrum of clients across various markets, fostering a diverse and adaptable service offering.

Their global capabilities translate into a substantial advantage, allowing Enero to tap into a wide pool of talent and expertise. This distributed network facilitates the sharing of best practices and innovative approaches across different regions, enhancing overall service delivery and client solutions. For instance, in 2023, Enero reported revenue growth driven by its international operations, demonstrating the commercial viability of its global reach.

- Global Operations: Agencies established in Australia, UK, Europe, and the US.

- Diverse Client Base: Ability to serve customers worldwide.

- Resource Leverage: Access to collective expertise and resources across markets.

- Market Adaptability: Capacity to understand and respond to diverse regional demands.

Financial Resilience and Strategic Capital Management

Enero Group showcases strong financial resilience, highlighted by a 7% increase in like-for-like net profit for FY24, even amidst fluctuating market dynamics. This performance underscores the company's ability to navigate economic headwinds effectively.

The company's robust balance sheet and healthy cash conversion rates empower strategic capital management. This financial strength allows Enero to pursue value-enhancing initiatives such as share buyback programs and consistent dividend distributions, benefiting shareholders.

- Financial Resilience: Achieved a 7% like-for-like net profit increase in FY24.

- Strong Balance Sheet: Maintains healthy cash conversion, supporting strategic actions.

- Capital Management: Ability to fund share buybacks and dividends.

Enero's integrated service model is a core strength, with 66% of FY24 revenue coming from clients engaging multiple agencies. This cross-selling approach is further bolstered by the strong performance of its Australian agencies, BMF and Orchard, which both saw double-digit revenue growth in FY24.

The company's strategic focus on high-growth sectors, particularly through its Technology, Healthcare, and Consumer (THC) Practice, is driving significant expansion. This practice, including Hotwire Group and Orchard, achieved an impressive 17% EBITDA growth in the first half of FY25, outperforming challenging market conditions.

| Metric | FY24 (Actual) | H1 FY25 (Actual) |

|---|---|---|

| Like-for-like Net Profit Growth | 7% | N/A |

| BMF & Orchard Revenue Growth | Double-digit | N/A |

| THC Practice EBITDA Growth | N/A | 17% |

| Revenue from Multi-Agency Clients | 66% | N/A |

What is included in the product

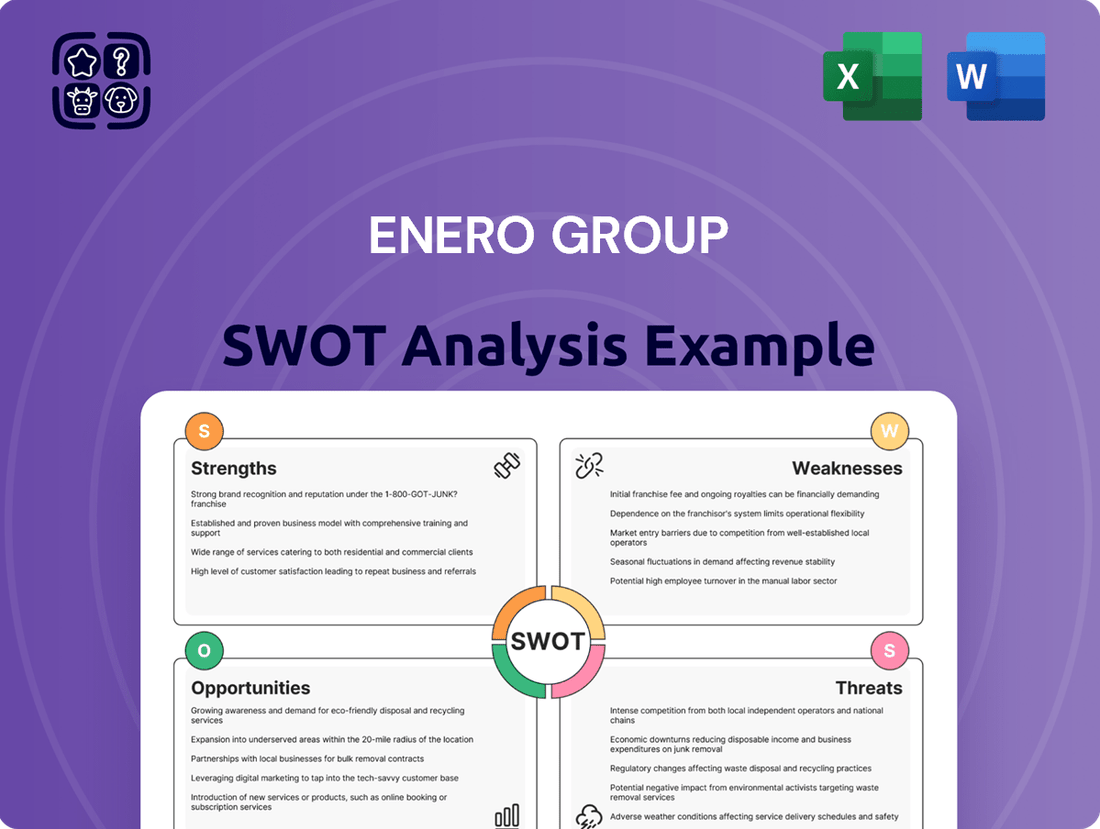

Delivers a strategic overview of Enero Group’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses and external threats.

Weaknesses

Enero Group has faced a notable downturn in its financial performance. Net revenue saw a 6% decrease on a like-for-like basis in fiscal year 2024, and this trend continued with a 12% decline in the first half of fiscal year 2025.

This revenue contraction has directly impacted the group's bottom line, evidenced by a substantial 52% drop in net profit after tax during the first half of fiscal year 2025. These figures highlight a challenging financial climate affecting Enero Group's overall profitability.

Enero Group's reliance on its ad-tech platform, OBMedia, exposed it to significant market shifts. Google's introduction of its Related Search on Content (RSOC) product fundamentally altered the ad-tech landscape, directly impacting OBMedia's revenue streams.

This vulnerability materialized in substantial projected financial declines for OBMedia. For the fiscal year 2025, the company anticipated a net revenue drop of 35% to 39% and an EBITDA decrease ranging from 49% to 64% due to these market changes. The subsequent sale of OBMedia underscores the severity of this weakness.

Enero's Hotwire Group, a key component of its Technology, Health, and Communications (THC) Practice, is navigating persistent global headwinds stemming from uncertainty within the technology sector. This challenging environment directly impacts Hotwire's trading conditions, as evidenced by the broader tech industry's slowdown in advertising spend and project pipelines observed throughout 2024.

The ongoing difficulties in this significant market segment necessitate strategic adjustments for Enero, including the careful re-balancing of resources across its various divisions. Furthermore, the group must maintain a vigilant approach to cost management to mitigate the impact of these sector-specific pressures on overall financial performance.

Restructuring Costs and Fair Value Losses

Enero Group faced significant financial headwinds in the first half of FY25. The company reported substantial restructuring costs amounting to $2.6 million. Additionally, a fair value loss on contingent consideration of $1.4 million was recorded.

These considerable one-off expenses directly impacted the company's reported net loss for the period. While these costs are linked to necessary adaptations to evolving market conditions, they undeniably exerted downward pressure on short-term profitability.

- Restructuring Costs: $2.6 million in FY25 H1.

- Fair Value Loss on Contingent Consideration: $1.4 million in FY25 H1.

- Impact: Contributed to net loss and affected short-term profitability.

Reliance on Key Australian Agencies for Growth

Enero Group's reliance on its Australian agencies, such as BMF and Orchard, for growth presents a notable weakness. While these agencies have demonstrated robust performance, the overall group's financial results have been impacted by struggles in other business segments. This suggests a potential over-dependence on a select few high-performing entities to counterbalance broader market headwinds.

This concentration risk is amplified by the fact that if the performance of these key Australian agencies were to falter, the group's overall trajectory could be significantly jeopardized. For instance, while BMF reported strong revenue growth in the first half of FY24, other divisions faced challenges, highlighting this imbalance.

- Over-reliance on Australian agencies: Enero's growth is heavily tied to the success of its Australian-based creative and digital agencies.

- Offsetting performance: Strong results from agencies like BMF have been needed to compensate for weaker performance elsewhere within the group.

- Vulnerability to market shifts: A downturn in the Australian market or specific challenges affecting these key agencies could disproportionately impact Enero's overall financial health.

- Mitigation challenges: Diversifying revenue streams and improving performance across all segments remains a critical challenge for the group.

Enero's financial performance has been significantly hampered by substantial restructuring costs and fair value losses. In the first half of fiscal year 2025, the company incurred $2.6 million in restructuring expenses and a $1.4 million fair value loss on contingent consideration, directly contributing to a net loss and impacting short-term profitability.

The group's heavy reliance on its ad-tech platform, OBMedia, proved to be a critical weakness. Google's introduction of its Related Search on Content (RSOC) product disrupted the ad-tech market, leading to projected revenue declines of 35% to 39% and EBITDA decreases of 49% to 64% for OBMedia in fiscal year 2025, ultimately necessitating its sale.

Hotwire Group, a key part of Enero's Technology, Health, and Communications practice, faces ongoing challenges due to global economic uncertainty and a slowdown in the technology sector's advertising spend throughout 2024. This necessitates careful resource allocation and cost management to mitigate impacts.

Enero exhibits a degree of over-reliance on its Australian agencies, such as BMF and Orchard, for growth. While these agencies perform well, their success is needed to offset weaker performance in other divisions, creating concentration risk where a downturn in the Australian market could disproportionately affect the group.

| Financial Metric | FY24 (Like-for-Like) | FY25 H1 |

|---|---|---|

| Net Revenue Change | -6% | -12% |

| Net Profit After Tax Change | N/A (Significant Decline) | -52% |

| Restructuring Costs | N/A | $2.6 million |

| Fair Value Loss on Contingent Consideration | N/A | $1.4 million |

What You See Is What You Get

Enero Group SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You'll receive a comprehensive breakdown of Enero Group's Strengths, Weaknesses, Opportunities, and Threats, ready for immediate use.

Opportunities

The marketing and communications sector is increasingly adopting AI, with over 80% of businesses now utilizing AI as a core technology. This presents a significant opportunity for Enero Group to deepen its AI integration across its service offerings.

By leveraging AI, Enero Group can enhance client solutions, as demonstrated by Hotwire's introduction of AI technology and consulting services. This strategic move can boost operational efficiency and unlock new avenues for revenue generation.

Clients increasingly expect a unified brand message across all touchpoints, from traditional advertising to digital campaigns and public relations efforts. This trend, driven by evolving consumer behaviors and the proliferation of media channels, creates a significant opportunity for Enero Group. Their established expertise in areas like advertising, digital transformation, and brand strategy positions them to deliver these cohesive, multi-channel experiences that businesses are actively seeking.

Enero's Technology, Healthcare, and Consumer (THC) Practice is experiencing significant growth, with the healthcare and consumer sectors showing particular strength. This momentum is expected to continue as demand for expert communication in these essential industries remains robust.

The company's strategic focus on these resilient sectors is a key opportunity. For instance, in 2024, the global healthcare market was projected to reach over $10 trillion, and the consumer goods sector continues to be a major economic driver, offering substantial avenues for Enero's specialized services.

Strategic Acquisitions and Partnerships

Enero's robust financial standing, evidenced by its healthy balance sheet and ample cash reserves, positions it favorably for strategic growth initiatives, including potential acquisitions. This financial flexibility allows Enero to explore opportunities that align with its expansion objectives.

The company can leverage this financial strength to acquire complementary agencies or technology-focused businesses. Such moves would not only broaden Enero's service offerings and technological capabilities but also extend its market penetration and client acquisition efforts, thereby enhancing its already diversified business model.

For instance, in the fiscal year ending June 30, 2024, Enero reported a strong cash conversion cycle, enabling it to maintain a proactive approach to market opportunities. This financial health is crucial for funding potential M&A activities.

Key opportunities stemming from this include:

- Expanding Service Capabilities: Acquiring agencies specializing in emerging digital marketing trends or niche creative services.

- Market Reach Extension: Targeting firms with established presences in new geographic regions or industry sectors.

- Technology Integration: Purchasing companies with proprietary technology that can enhance Enero's existing platforms or create new revenue streams.

- Synergistic Growth: Pursuing partnerships or acquisitions that offer clear cross-selling opportunities and operational efficiencies.

Leveraging Data and Personalization

The growing emphasis on data-driven personalization in marketing presents a prime opportunity for Enero. By bolstering its analytical prowess, the group can craft hyper-personalized client experiences, delivering tailored content and precisely targeted messaging. This approach is crucial for driving campaign effectiveness and nurturing robust client relationships.

Enero can capitalize on this trend by investing in advanced analytics platforms and data science talent. This will enable the company to better understand client needs and market trends, allowing for more impactful and customized service offerings. For instance, in 2024, the digital marketing sector saw a significant increase in demand for personalized customer journeys, with companies reporting up to a 20% uplift in engagement rates through tailored content strategies.

- Enhanced Client Engagement: Personalized communications can lead to higher open rates and click-through rates, boosting campaign performance.

- Improved Client Retention: Tailored experiences foster stronger client loyalty and reduce churn.

- Data-Driven Insights: Deeper analysis of client data allows for more strategic campaign planning and resource allocation.

- Competitive Advantage: Offering superior personalization can differentiate Enero in a crowded market.

The increasing adoption of AI across marketing and communications, with over 80% of businesses now using it, presents a clear path for Enero to enhance its service offerings and client solutions. This technological shift, coupled with a growing client demand for unified brand messaging across all channels, positions Enero to deliver integrated, multi-channel experiences effectively.

Enero's strategic focus on the resilient Technology, Healthcare, and Consumer (THC) sectors, which continue to show robust growth, offers significant opportunities. For instance, the global healthcare market's projected growth to over $10 trillion in 2024 underscores the demand for specialized communication services in essential industries.

The company's strong financial position, with ample cash reserves as evidenced by a healthy balance sheet and a strong cash conversion cycle in FY24, enables strategic growth through potential acquisitions. This financial flexibility allows Enero to expand its service capabilities, market reach, and technological integration by acquiring complementary businesses.

The growing emphasis on data-driven personalization in marketing is another key opportunity, allowing Enero to craft hyper-personalized client experiences and drive campaign effectiveness. Investing in advanced analytics and data science talent, as seen with the 20% engagement uplift reported by companies using tailored content strategies in 2024, will be crucial for differentiation.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| AI Integration | Enhance service offerings and client solutions through AI. | Over 80% of businesses utilize AI as a core technology (2024). |

| Unified Brand Messaging | Deliver cohesive, multi-channel experiences for clients. | Evolving consumer behavior and proliferation of media channels. |

| Sector Growth (THC) | Capitalize on momentum in Technology, Healthcare, and Consumer sectors. | Global healthcare market projected over $10 trillion (2024). |

| Strategic Acquisitions | Expand service capabilities, market reach, and technology. | Strong cash reserves and healthy cash conversion cycle (FY24). |

| Data-Driven Personalization | Craft hyper-personalized client experiences for increased engagement. | Companies report up to 20% uplift in engagement via tailored content (2024). |

Threats

The marketing and communications sector is incredibly crowded, with a multitude of global and local agencies constantly competing for client attention and budgets. This intense rivalry means Enero must continuously innovate and showcase its unique value proposition to stand out.

Enero experiences persistent pressure to differentiate its service offerings, secure and retain skilled professionals, and win new contracts. This challenge is amplified by the presence of well-established industry giants and nimble, specialized newcomers. For instance, the global advertising market reached an estimated $600 billion in 2024, highlighting the scale of competition.

Enero Group has faced challenges due to subdued macroeconomic conditions, which have notably impacted its financial performance, leading to reported declines in both revenue and EBITDA for the fiscal year 2023. This economic slowdown directly translates into client budget constraints, as businesses often pare back discretionary spending, particularly in marketing and advertising, during uncertain times.

The prevailing economic uncertainty in 2024 continues to exert pressure on client budgets. This can result in reduced marketing and advertising expenditures from Enero's clients, directly impacting the agency's revenue streams and overall profitability. For instance, a slowdown in consumer spending or increased interest rates can make clients more cautious with their advertising investments.

The digital marketing landscape is constantly shifting due to rapid technological advancements, particularly in areas like ad-tech and artificial intelligence. Enero Group's reliance on these technologies means that a failure to keep pace with new platforms, tools, or evolving industry standards could significantly impact its market position and revenue streams.

For instance, the shift in Google AdSense for Domains, which affected OBMedia's performance, highlights the vulnerability of businesses to such technological disruptions. If Enero cannot adapt swiftly to these changes, it risks losing market share and experiencing revenue declines as competitors embrace emerging technologies more effectively.

Talent Retention and Acquisition Challenges

The marketing and communications sector thrives on skilled individuals, and Enero Group is no exception. Attracting and keeping top-tier talent is crucial for delivering exceptional client work and fostering innovation. In 2024, the UK marketing sector faced significant challenges in talent acquisition, with reports indicating a 15% increase in advertised roles requiring digital marketing skills, yet a 10% decrease in qualified applicants for senior positions.

The intense competition for experienced professionals means Enero must continually adapt its strategies to remain an employer of choice. A failure to secure or retain key personnel directly impacts the agency's capacity to execute projects effectively and maintain its competitive edge. For instance, a major competitor in the UK market, the Independent Agencies Network, noted in their Q3 2024 report that a lack of specialized digital analytics talent led to a 5% project delay for several of its member agencies.

- Intensified Competition: The global demand for marketing expertise continues to outpace supply, particularly in specialized digital areas.

- Retention Costs: High turnover necessitates increased recruitment and training expenses, impacting profitability.

- Innovation Stagnation: Losing key creative or strategic minds can stifle the development of new services and client solutions.

- Project Delivery Risk: Understaffing or a lack of specific skills can lead to missed deadlines and diminished client satisfaction.

Reputational Risks and Client Trust

Enero, as a collective of communications agencies, faces significant reputational risks. Client dissatisfaction, ethical missteps, or data breaches can quickly erode public trust and client loyalty. For instance, a major data privacy incident in the marketing sector in late 2024 could have a ripple effect, making clients even more cautious about agency data handling practices.

Maintaining client trust is paramount for Enero’s continued success and its ability to attract new business. In the competitive communications landscape, authenticity and a strong ethical compass are not just ideals but essential business requirements. Reports from industry surveys in early 2025 indicate that over 60% of businesses prioritize an agency's ethical reputation when selecting a partner.

- Client Satisfaction: Negative client experiences can lead to public criticism and loss of future business.

- Ethical Considerations: Adherence to ethical standards is crucial for maintaining credibility in the communications industry.

- Data Privacy: Breaches of client data can result in severe financial penalties and irreparable damage to reputation.

- Industry Trust: Building and sustaining trust is fundamental for acquiring new clients and retaining existing ones.

Enero Group operates in a highly competitive marketing and communications landscape, facing constant pressure to innovate and differentiate its services. The global advertising market's estimated $600 billion valuation in 2024 underscores the intensity of this rivalry, demanding continuous efforts to secure and retain skilled professionals amidst a tight talent market. For instance, the UK marketing sector saw a 15% rise in digital marketing roles in 2024 but a 10% drop in qualified senior applicants, impacting agencies like Enero.

Economic headwinds continue to challenge Enero, with subdued macroeconomic conditions in 2023 impacting revenue and EBITDA. The ongoing economic uncertainty in 2024 means clients are likely to maintain cautious spending on marketing, directly affecting Enero's revenue streams. Furthermore, rapid technological shifts in digital marketing, such as advancements in ad-tech and AI, pose a threat if Enero fails to adapt swiftly, as demonstrated by OBMedia's vulnerability to Google AdSense changes.

Reputational risks are a significant concern for Enero, as client dissatisfaction, ethical lapses, or data breaches can quickly damage trust and loyalty. With over 60% of businesses prioritizing an agency's ethical standing in early 2025, maintaining a strong reputation is critical for securing new business. A data privacy incident in late 2024 could have far-reaching consequences, making clients more wary of data handling practices.

SWOT Analysis Data Sources

This SWOT analysis for Enero Group is built upon a foundation of credible data, including their latest financial reports, comprehensive market research, and expert industry analysis to provide a robust strategic overview.