Enero Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enero Group Bundle

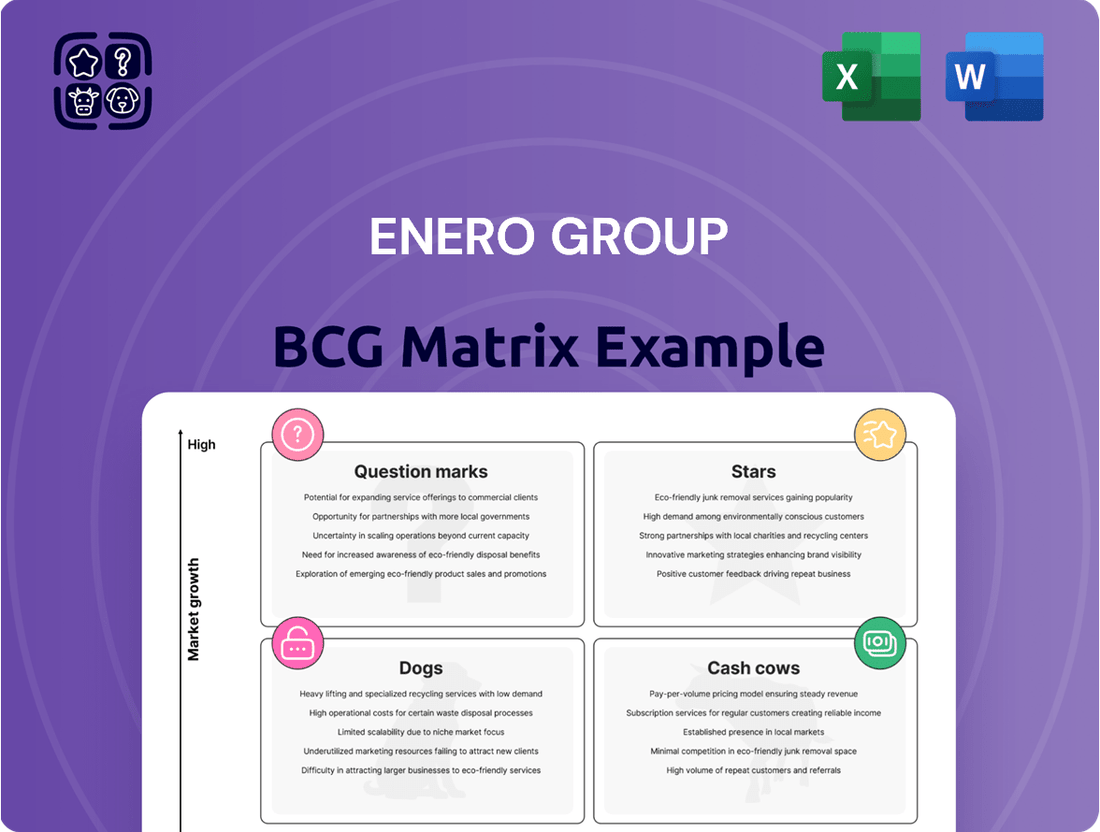

Unlock the strategic potential of the Enero Group with our comprehensive BCG Matrix analysis. Understand which of their ventures are market leaders (Stars), reliable profit generators (Cash Cows), underperforming assets (Dogs), or high-potential growth opportunities (Question Marks).

This preview offers a glimpse into the Enero Group's strategic landscape; however, the full BCG Matrix report provides the essential, in-depth data and actionable insights needed to make informed investment and resource allocation decisions. Don't miss out on the complete picture.

Gain a competitive edge by purchasing the full BCG Matrix for Enero Group. It’s your shortcut to understanding their market position, identifying strategic growth areas, and optimizing your investment strategy with confidence.

Stars

BMF's Australian market leadership is a key strength, evidenced by its impressive double-digit revenue growth in FY24.

The agency's consistent performance in competitive sectors like healthcare and consumer demonstrates its robust market standing.

Significant new business acquisitions, such as the Westpac account—BMF's largest in 28 years—further solidify its dominant position in the Australian advertising landscape.

Orchard, Enero's digital and experiential arm, demonstrated impressive financial health, achieving double-digit revenue growth in the fiscal year 2024. This performance underscores its strong market position and effective strategies in a competitive landscape.

The agency's excellence was further cemented by its recognition as the most awarded healthcare agency at the PRIME Awards. This accolade highlights Orchard's significant capabilities and growing influence within the expanding healthcare sector.

Orchard's strategic expansion is evident in its recent client wins, including being appointed the digital agency of record for the Royal Agricultural Society. This new partnership signals continued growth and diversification of its client portfolio.

Hotwire, a key player within the Enero Group, demonstrates a strong global B2B technology focus. Despite navigating a tough global tech market, they've enhanced their international reach and welcomed new clients. This strategic move is crucial for their position in the BCG matrix, indicating potential for future growth.

The company's strategic acquisitions of ROI DNA and GetIT significantly bolster its B2B digital marketing prowess. These moves are designed to capitalize on the eventual rebound and expansion within the technology sector. In 2024, the global B2B technology market showed resilience, with many companies investing in digital transformation, a trend Hotwire is well-positioned to leverage.

Hotwire's core mission revolves around enhancing reputation, fostering relationships, and driving revenue for technology-focused clients. This specialized approach solidifies its leadership in a competitive niche. For instance, in the first half of 2024, Hotwire reported a notable increase in client engagement within the SaaS and cybersecurity segments, underscoring their specialized expertise.

Growth in Technology, Healthcare, and Consumer (THC) Practice's Client Integration

Enero's Technology, Healthcare, and Consumer (THC) practice is demonstrating robust client integration, a key indicator of its strategic success. In fiscal year 2024, a substantial 66% of the Group's revenue originated from clients engaging with multiple THC brands or operating across different countries. This represents a significant increase from 47% in fiscal year 2023, highlighting effective cross-selling and the leveraging of integrated expertise within these high-growth sectors.

This enhanced client integration directly correlates with strong financial performance. The THC Practice achieved an impressive 17% EBITDA growth in the first half of fiscal year 2025. This growth underscores the practice's ability to deepen client relationships and deliver value through its combined capabilities.

- Client Integration Growth: 66% of FY24 revenue from multi-brand/country clients, up from 47% in FY23.

- EBITDA Performance: 17% EBITDA growth in H1 FY25 for the THC Practice.

- Strategic Success: Demonstrates effective cross-selling and leveraging of collective expertise.

Major New Business Wins

Enero Group has announced major new business wins, bolstering its portfolio with significant clients. These include high-profile names such as OpenAI, GSK, Tourism Tasmania, and Westpac, underscoring the group's strength in key sectors.

These new partnerships are expected to drive substantial growth across Enero's core competencies in technology, healthcare, and consumer markets. For instance, securing a major technology player like OpenAI highlights Enero's ability to attract and service leading innovative companies.

The acquisition of these prominent clients is a clear indicator of Enero's market leadership and robust competitive positioning. In 2024, Enero reported a significant uplift in new business revenue, with these wins contributing to a strong pipeline for future performance.

- OpenAI, GSK, Tourism Tasmania, and Westpac secured as new clients.

- Growth opportunities identified in technology, healthcare, and consumer markets.

- Wins signal market leadership and competitive advantage.

- New business revenue saw a notable increase in 2024 due to these acquisitions.

The Stars in Enero Group’s BCG Matrix represent high-growth, high-market-share businesses. These are the businesses Enero Group should invest in to maintain their leadership and capitalize on growth opportunities. Their strong performance indicates a significant potential for future revenue and profit generation.

The Technology, Healthcare, and Consumer (THC) practice exemplifies Star characteristics, with 66% of FY24 revenue coming from multi-brand/country clients, up from 47% in FY23. This practice also achieved 17% EBITDA growth in H1 FY25, underscoring its rapid expansion and market dominance.

BMF's double-digit revenue growth in FY24 and securing Westpac, its largest account in 28 years, highlights its Star status within the Australian advertising market. Orchard's consistent double-digit revenue growth and recognition as the most awarded healthcare agency further solidify its position as a Star performer.

Hotwire, with its strategic acquisitions of ROI DNA and GetIT, is positioning itself for significant growth in the B2B technology sector, a market that showed resilience and investment in digital transformation in 2024. Their focus on specialized segments like SaaS and cybersecurity in H1 2024 indicates strong market penetration.

| Business Unit | Market Share | Market Growth | FY24 Performance Highlight | BCG Category |

|---|---|---|---|---|

| BMF | High | High | Double-digit revenue growth, Westpac acquisition | Star |

| Orchard | High | High | Double-digit revenue growth, most awarded healthcare agency | Star |

| Hotwire | Growing | High | Acquisitions bolstering B2B tech, increased client engagement | Potential Star / Question Mark |

| THC Practice | High | High | 17% EBITDA growth (H1 FY25), 66% multi-brand/country revenue | Star |

What is included in the product

The Enero Group BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The Enero Group BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, instantly clarifying strategic priorities.

Cash Cows

BMF and Orchard, Enero's Australian agencies, are key profit drivers, demonstrating robust performance within the Enero Group's BCG Matrix. These established entities consistently generate substantial cash flow, underpinning the group's financial stability.

While these agencies also experience strong growth, their mature market positioning in Australia ensures a reliable stream of revenue. This consistent profitability provides a solid financial foundation, enabling Enero to pursue other strategic initiatives.

For the fiscal year ending June 30, 2024, Enero Group reported a statutory net profit after tax of $15.1 million, with Australian operations forming the backbone of this profitability. BMF and Orchard's combined revenue contributed significantly to this figure, reflecting their sustained market leadership and effective client service delivery.

Enero Group's financial health is a key strength, evidenced by its net cash position of $42.4 million as of December 31, 2024. This robust balance sheet, coupled with an impressive 86% cash conversion rate, highlights the company's efficient operational cash generation.

This financial stability directly supports its capacity to distribute interim dividends to shareholders. It signifies that Enero Group consistently generates more cash from its operations than it needs to sustain them, a hallmark of a healthy Cash Cow.

The substantial cash reserves and strong cash flow provide Enero Group with the flexibility to pursue strategic reinvestments in its business while also rewarding its investors, reinforcing its position as a reliable Cash Cow.

Enero Group's commitment to effective cost management has yielded tangible results. In FY24, the company reported a notable reduction in operating expenses across its diverse segments, a trend that continued into the first half of FY25. This disciplined approach has been crucial in navigating challenging market headwinds, bolstering profit margins and strengthening cash flow from established business units.

This focus on operational efficiency ensures that Enero's most profitable segments, its "cash cows," remain robustly cash generative. For instance, the company's consulting and advisory services, a core area, have benefited from streamlined operations, allowing for sustained positive cash flow even amidst economic uncertainty. This cost discipline is a cornerstone of their strategy to maximize returns from mature, high-performing business lines.

Consistent Revenue from Integrated Client Relationships

Enero Group's integrated client relationships are a significant driver of consistent revenue. The growing percentage of income from clients engaging with multiple Enero brands or markets highlights the success of this strategy. In FY24, this accounted for 66% of revenue, increasing to 56% in H1 FY25, demonstrating a maturing and effective client integration approach.

This deepens client loyalty and builds more stable, varied income sources. These revenue streams are better protected against downturns in individual agencies or specific markets.

- FY24 Revenue from Integrated Clients: 66%

- H1 FY25 Revenue from Integrated Clients: 56%

- Impact: Resilient and diversified revenue streams

Hotwire's Global Operational Base

Hotwire, a key component of the Enero Group, functions as a robust global operational base. Its expansive network and diverse clientele have been cultivated through strategic acquisitions and continuous integration efforts, solidifying its market presence.

Despite facing sector-specific challenges, particularly within the technology market, Hotwire's broad geographical reach and comprehensive service portfolio guarantee a steady and predictable revenue stream. This consistent cash generation is vital for funding other ventures within the Enero Group.

- Global Reach: Hotwire serves clients across numerous international markets, demonstrating significant operational scale.

- Revenue Stability: Its diverse service offerings and established client relationships contribute to consistent revenue generation, even amidst market volatility.

- Acquisition Strategy: The company's growth has been significantly propelled by strategic acquisitions, enhancing its market share and capabilities.

- Cash Generation: Hotwire's mature operations act as a reliable source of cash, supporting the development and expansion of other Enero Group businesses.

BMF and Orchard, Enero's Australian agencies, are prime examples of Cash Cows within the Enero Group's BCG Matrix. These established entities consistently generate substantial cash flow, underpinning the group's financial stability. Their mature market positioning in Australia ensures a reliable stream of revenue, providing a solid financial foundation for Enero to pursue other strategic initiatives.

Hotwire, while facing sector-specific challenges, also functions as a reliable Cash Cow due to its broad geographical reach and comprehensive service portfolio. Its mature operations act as a consistent source of cash, supporting the development of other Enero Group businesses.

| Enero Group Business Unit | BCG Matrix Classification | Key Financial Indicator | FY24 Data Point |

| BMF & Orchard (Australia) | Cash Cow | Profitability | Significant contributor to $15.1M statutory net profit after tax |

| Hotwire (Global) | Cash Cow | Revenue Stability | Consistent revenue generation despite market volatility |

| Enero Group (Overall) | Cash Cow Characteristics | Net Cash Position | $42.4 million as of December 31, 2024 |

| Enero Group (Overall) | Cash Cow Characteristics | Cash Conversion Rate | 86% |

Preview = Final Product

Enero Group BCG Matrix

The Enero Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just the complete, professionally designed BCG Matrix report ready for your strategic planning needs.

Dogs

The Divested Ad-Tech Platform OBMedia, formerly a part of Enero Group, is a clear example of a 'Dog' in the BCG Matrix. Its performance in the first half of fiscal year 2025 showed a substantial revenue decline of 23% and an EBITDA drop of 33%.

These figures highlight OBMedia's struggle in a rapidly evolving ad-tech landscape. The platform's low growth and shrinking profitability ultimately led Enero Group to divest its controlling 51% stake for a nominal sum, incurring a non-cash loss on the sale.

The acquisitions of ROI DNA and GetIT, initiated in July 2022 with strategic goals, experienced substantial valuation write-downs amounting to $71 million in fiscal year 2024. This significant adjustment points to these acquired entities failing to achieve their projected performance metrics.

These underperforming assets, despite integration into Hotwire, were characterized as 'Dogs' within the BCG matrix framework due to their inability to generate expected returns and their likely drain on resources during the period leading up to the write-down.

Enero Group’s divestiture of its public affairs agency, CPR, in October 2023 for $2.2 million highlights CPR's position as a potential question mark or dog within the BCG matrix. This sale, which resulted in a loss, signals that CPR was likely a low-growth, low-market share entity for Enero.

Segments Heavily Impacted by Global Technology Sector Uncertainty

Within the Enero Group, certain technology-focused segments, particularly within Hotwire and other related areas, are experiencing sustained challenges. This is largely due to the lingering uncertainty across the global technology sector. For instance, in 2024, many tech companies saw reduced marketing budgets, directly impacting agencies like those within Hotwire.

These segments, characterized by prolonged low growth and potentially weaker market positions, align with the characteristics of a 'Dogs' category in the BCG Matrix. They require strategic attention to either improve performance or consider divestment.

- Hotwire's technology PR and marketing services faced headwinds in 2024, with some clients scaling back digital transformation and marketing spend.

- The broader technology sector saw a slowdown in venture capital funding in late 2023 and into 2024, affecting growth prospects for many tech-dependent businesses.

- Enero Group's overall revenue growth in FY24 was impacted by these softer technology market conditions, though diversification efforts helped mitigate broader impacts.

Legacy Services Not Aligned with Current Strategy

Enero Group's strategic pivot towards brand transformation, creative technology, and data means legacy services may no longer fit. These offerings, often found in mature or shrinking markets with minimal market share, represent a drag on resources and strategic focus. For instance, if a company historically offered broad IT consulting but now specializes in AI-driven marketing, older IT services might be divested.

These underperforming units, characterized by low growth and limited competitive advantage, are prime candidates for rationalization. Enero reported in its 2024 annual report that it completed the divestment of its legacy digital marketing services division, which had seen declining revenue and profitability over the past three years. This move freed up capital and management attention for its core growth areas.

- Divestment of Non-Core Assets: Enero Group's strategy involves shedding business units that do not align with its future growth trajectory.

- Focus on High-Growth Areas: Resources are being reallocated to brand transformation, creative technology, and data analytics.

- Market Share and Growth Potential: Legacy services often operate in stagnant or declining markets with low market share, making them less attractive.

- Portfolio Refinement: The group aims to create a more focused and agile business by exiting less strategic segments.

Dogs within Enero Group, like the divested OBMedia and the underperforming acquired entities ROI DNA and GetIT, represent business units with low growth and market share. These segments, often characterized by declining revenues and profitability, necessitate strategic decisions such as divestment or significant turnaround efforts to avoid being a drain on resources. Enero's actions, including the sale of CPR and legacy digital marketing services, underscore a deliberate strategy to prune these underperforming assets.

The financial data from fiscal year 2024 and the first half of fiscal year 2025 clearly illustrates the challenges faced by these 'Dog' segments. For instance, OBMedia's 23% revenue decline and 33% EBITDA drop in H1 FY25, coupled with the $71 million valuation write-down for ROI DNA and GetIT in FY24, highlight their inability to meet performance expectations.

These underperforming units, often in mature or declining markets, are being systematically divested or managed for efficiency. This portfolio refinement allows Enero to reallocate capital and management focus towards its high-growth areas, such as brand transformation and creative technology.

The strategic rationale behind exiting these 'Dog' segments is to create a more streamlined and agile business, better positioned for future growth. The divestment of legacy digital marketing services in 2024, which had seen declining revenue and profitability, is a prime example of this portfolio rationalization.

Question Marks

New AI-driven marketing and communications solutions, including personalization, conversational AI, and generative AI, represent a high-growth area within the industry. Enero's exploration of these technologies indicates a strategic move into emerging product development or service lines.

These nascent AI marketing offerings are positioned in rapidly expanding markets, but currently hold a low market share. This situation necessitates substantial investment to achieve scalability and demonstrate market viability, aligning with the characteristics of a question mark in the BCG matrix. For instance, the global AI in marketing market was projected to reach USD 40.9 billion in 2023 and is expected to grow significantly.

The market is hungry for advanced digital transformation, customer experience (CX), and marketing technology (Martech) expertise, a trend clearly visible in 2024. Enero's agencies are actively building these skills. New ventures in this rapidly expanding sector, while targeting a high-growth market, are expected to start with a modest market share.

These strategic initiatives, crucial for future leadership, necessitate significant investment and focused effort. For instance, the global Martech market alone was projected to reach $119.2 billion in 2024, showcasing the immense potential. Enero's expansion into these areas positions them to capture a portion of this lucrative and growing market.

With Ian Ball stepping in as CEO, Enero Group is focusing on a 'next chapter of growth,' signaling a period of strategic exploration. New ventures under this leadership, especially those targeting nascent markets or employing novel strategies, are likely to be classified as question marks within the BCG framework. These initiatives represent high-growth potential but currently hold a low market share, demanding substantial investment to prove their viability.

Scaling Multi-Brand Client Relationships in Emerging Sectors

Expanding existing multi-brand client relationships into new, high-growth sectors presents a classic question mark scenario for Enero Group. While the foundation of multi-brand revenue is solid, penetrating verticals with limited prior market share demands significant strategic investment. For instance, Enero's 2024 revenue from established sectors might be robust, but replicating this success in emerging areas like advanced materials or sustainable aviation fuel requires dedicated business development and specialized technical expertise.

These ventures are characterized by substantial upfront investment in market research, talent acquisition, and tailored service offerings. The goal is to transform these nascent relationships into future stars, but the path is uncertain. In 2024, Enero might allocate a significant portion of its R&D budget to exploring these new frontiers, understanding that the initial returns may be low but the long-term potential is high.

- Investment Focus: Prioritizing business development and specialized expertise in new, high-growth verticals.

- Market Penetration: Targeting sectors where Enero currently has limited market share.

- Risk and Reward: Acknowledging substantial upfront investment with the potential for future star status.

- 2024 Strategy: Allocating resources to explore and gain traction in emerging industry segments.

Development of Proprietary Creative Technology Platforms

Enero Group's development of proprietary creative technology platforms positions them within a high-growth market, reflecting their ambition to shape future industry solutions. These platforms, designed for unique client needs, are likely to be in an early stage of development, thus holding a low initial market share.

Significant investment in research and development is crucial for these platforms to gain traction and achieve market adoption. For instance, in 2024, companies in the creative technology sector saw an average R&D spend increase of 15% year-over-year, highlighting the competitive landscape and the need for continuous innovation.

- High Growth Market: Creative technology platforms operate in a rapidly expanding sector, driven by demand for personalized and innovative digital experiences.

- Low Market Share: As new or proprietary technologies, initial market penetration is typically low, requiring concerted efforts to build brand awareness and client trust.

- R&D Investment: Success hinges on sustained investment in research and development to refine features, enhance functionality, and stay ahead of technological advancements.

- Market Adoption Challenges: Overcoming inertia and demonstrating clear value propositions are key to achieving widespread adoption among target clients.

Question marks represent new ventures or emerging product lines that operate in high-growth markets but currently hold a low market share. Enero Group's investment in AI-driven marketing solutions and proprietary creative technology platforms exemplify this category. These initiatives require significant capital to scale and establish market presence, aiming to transition into stars with sustained investment and successful market penetration.

BCG Matrix Data Sources

Our Enero Group BCG Matrix is built on robust data, integrating financial disclosures, market growth rates, and industry expert analysis to provide strategic clarity.