Enero Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enero Group Bundle

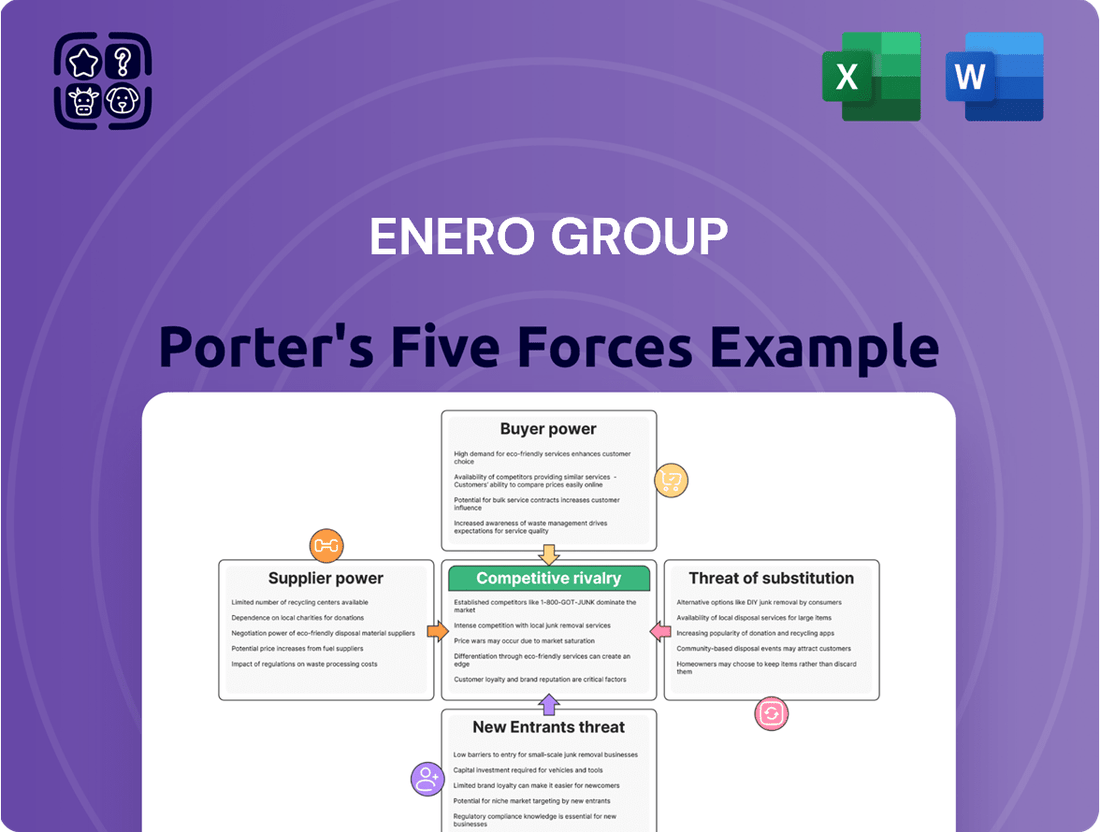

Enero Group operates within a dynamic energy sector, where understanding the interplay of competitive forces is crucial for strategic success. Our Porter's Five Forces analysis delves into the bargaining power of buyers and suppliers, the intensity of rivalry, and the threats posed by new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Enero Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The specialized nature of marketing and communications, particularly in rapidly evolving fields like digital transformation and brand strategy, creates a significant talent pool scarcity. This means that companies like Enero Group often compete for a limited number of highly skilled professionals and creative minds.

When the supply of this specialized talent is restricted, Enero Group can expect to see increased recruitment costs and upward pressure on salaries. For instance, in 2024, the average salary for a senior digital marketing manager in Australia, a key market for Enero, saw a notable increase due to this competitive landscape.

This scarcity also presents challenges in retaining key personnel. High demand for these sought-after skills means that employees may have multiple attractive offers, potentially leading to higher turnover and the ongoing expense of finding and onboarding replacements.

Technology and data providers hold significant bargaining power over Enero Group, especially when their offerings are unique or essential. For instance, specialized ad-tech platforms or advanced data analytics tools, if not easily replaceable, allow these suppliers to influence pricing and contract terms. This can directly affect Enero's operational expenses and its ability to deliver services effectively.

The ad-tech landscape is constantly evolving, as demonstrated by Enero's strategic sale of OBMedia in 2024. This move underscores the importance of adaptability and the potential for suppliers in this sector to shift their market positions, thereby altering their bargaining leverage.

Enero Group often engages freelancers and specialized consultants for niche project requirements. The bargaining power of these individual suppliers can be significant when their skills are in high demand or their reputation is well-established, potentially driving up costs for Enero. For instance, a highly sought-after data scientist with expertise in AI for marketing campaigns might command premium rates, impacting project budgets.

Media Channel Owners

Media channel owners, particularly large media conglomerates and dominant digital platforms, wield significant bargaining power over Enero Group. This power stems from their control over premium ad inventory and specialized audience targeting capabilities, essential for Enero's programmatic media operations. For instance, in 2024, major social media platforms continued to command substantial portions of digital advertising spend, often dictating terms for access and data utilization.

These powerful channel owners can influence Enero's campaign delivery and cost-effectiveness through several mechanisms. They may implement pricing strategies that increase the cost of accessing specific audiences or premium placements. Furthermore, exclusivity agreements can limit Enero's ability to leverage certain inventory across multiple clients, thereby restricting flexibility and potentially increasing operational costs. Data access restrictions also play a crucial role, impacting Enero's capacity for granular audience segmentation and campaign optimization.

- Control over Premium Inventory: Major media groups and platforms hold the keys to high-demand ad spaces, allowing them to set prices and terms.

- Data Access Restrictions: Limitations on accessing and utilizing user data can hinder Enero's targeting and personalization efforts.

- Exclusivity Agreements: These can prevent Enero from offering the most sought-after inventory to all its clients, impacting campaign reach and efficiency.

- Pricing Power: The concentration of media ownership allows these entities to influence the cost of digital advertising, directly impacting Enero's margins.

Research and Insights Firms

Research and insights firms can exert significant bargaining power over Enero Group, particularly if they possess proprietary data or unique analytical methodologies essential for Enero's service delivery. For instance, a firm holding exclusive access to a critical market segment's consumer behavior data could command premium pricing. In 2024, the global market for market research services was valued at approximately $80 billion, indicating a substantial industry where specialized data providers can indeed leverage their unique assets.

Enero's reliance on these external entities for crucial market intelligence means that if few providers offer the specific data or analytical capabilities Enero requires, their bargaining power is amplified. This can translate into higher acquisition costs for Enero, impacting its profitability and the competitiveness of its own service offerings. The increasing demand for granular, real-time market insights in 2024 further strengthens the position of firms that can reliably deliver such information.

- Data Exclusivity: Firms with unique or difficult-to-replicate data sets hold stronger bargaining power.

- Methodological Uniqueness: Proprietary analytical tools or research methodologies can increase a firm's leverage.

- Market Concentration: A limited number of suppliers for essential insights enhances their bargaining position.

- Cost Impact: Higher supplier costs directly affect Enero's operational expenses and pricing strategies.

Suppliers of specialized technology and data platforms, particularly those offering unique or essential services, wield considerable bargaining power over Enero Group. This leverage allows them to influence pricing and contract terms, directly impacting Enero's operational costs and service delivery capabilities.

The ad-tech sector, a key area for Enero, is dynamic, with suppliers like OB Media demonstrating shifts in market position, as seen in its 2024 sale. This highlights how suppliers' evolving strategies can alter their influence and bargaining strength.

Similarly, individual freelancers and consultants with in-demand skills, such as AI expertise for marketing, can command premium rates. This upward pressure on costs affects Enero's project budgets and overall profitability.

Media channel owners, including major digital platforms, possess significant bargaining power due to their control over premium ad inventory and audience data. In 2024, these entities continued to capture substantial advertising spend, dictating terms for access and data usage, which impacts Enero's campaign efficiency and costs.

| Supplier Type | Key Leverage Factors | Impact on Enero | 2024 Context/Data |

|---|---|---|---|

| Tech & Data Platforms | Uniqueness, Essentiality | Pricing, Contract Terms, Operational Costs | Dynamic ad-tech landscape; OBMedia sale |

| Specialized Freelancers | High Demand Skills, Reputation | Project Costs, Budget Impact | Premium rates for AI/Data Scientists |

| Media Channel Owners | Premium Inventory, Data Control | Campaign Costs, Efficiency, Data Access | Dominant platforms capture significant spend |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Enero Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and address strategic vulnerabilities with a comprehensive, yet easily digestible, visual representation of all five forces.

Customers Bargaining Power

Enero Group's client base shows a notable concentration, with its top 10 customers contributing 49% of net revenue in fiscal year 2024. This significant reliance on a small group of major clients, including one client representing over 20% of revenue, grants these key customers considerable bargaining power.

This concentrated client structure allows these major players to exert substantial influence over Enero Group, potentially leading them to negotiate for better pricing, more favorable contract terms, or an expansion of services. Such leverage can impact Enero's profitability and operational flexibility.

Clients are increasingly demanding integrated service offerings, a trend highlighted by Enero's THC Practice, where 66% of revenue stems from clients utilizing multiple brands or countries within the group. This consolidation of services, while fostering client loyalty, also amplifies their bargaining power.

With a larger overall spend and a desire for streamlined solutions, these clients are better positioned to negotiate for broader service packages. This can lead to pressure on pricing, as clients may seek discounts reflecting their consolidated business with Enero.

Challenging macroeconomic conditions, especially within the technology and ad-tech sectors, have significantly affected Enero Group's financial results. This has led to noticeable declines in both revenue and EBITDA, as reported for the fiscal year ending June 30, 2024. For instance, revenue saw a decrease of 11.4% to AUD 139.2 million, and EBITDA dropped by 38.5% to AUD 10.7 million in the same period.

Clients operating within these pressured industries are likely to wield increased bargaining power. Their own financial constraints and the broader market downturn mean they may intensify demands for cost reductions or require more demonstrable return on investment. This heightened pressure directly translates to a stronger negotiating position for these customers, impacting Enero's pricing and service agreements.

Availability of Alternatives

Clients possess a significant number of choices outside of Enero Group. These options range from other large, established agency networks and niche, specialized boutique firms to the growing trend of companies building their own in-house marketing and creative departments. Furthermore, direct engagement with digital advertising platforms and service providers offers another layer of alternatives.

The ease with which clients can switch providers, coupled with the demonstrated competence of these numerous alternatives, directly amplifies their bargaining power. This forces Enero to consistently prove its unique value proposition and maintain competitive pricing structures to retain and attract business.

- Client Choice Spectrum: Enero's clients can select from large agency networks, specialized boutiques, in-house teams, or direct digital platform engagement.

- Switching Ease: The perceived low cost and effort involved in changing service providers strengthens client leverage.

- Competitive Pressure: The availability of competent alternatives compels Enero to focus on superior value and pricing strategies.

- Market Dynamics: In 2024, the digital marketing landscape continued to diversify, increasing client options and bargaining power across the industry.

Outcome-Based Pricing Models

Clients are increasingly demanding pricing models tied directly to results, a significant shift in their bargaining power. This trend towards outcome-based pricing means payments are contingent on the success of campaigns, not just the effort expended.

This model effectively transfers risk from the service provider to the client. For instance, in the digital marketing sector, agencies might negotiate fees based on metrics like customer acquisition cost (CAC) or return on ad spend (ROAS), rather than a flat monthly retainer. By 2024, many B2B service contracts, particularly in technology and consulting, are incorporating performance clauses that directly link payment to agreed-upon KPIs.

- Increased Client Leverage: Clients can negotiate terms where their payment is directly proportional to the value delivered, giving them more control.

- Risk Mitigation for Clients: This model shields clients from paying for services that do not yield the desired business outcomes.

- Focus on ROI: Service providers are incentivized to focus on delivering tangible return on investment, aligning their success with the client's.

- Market Trend: The adoption of performance-based contracts is a growing industry standard, particularly in sectors where measurable results are paramount.

Enero Group's customer concentration, with top 10 clients representing 49% of FY24 revenue, significantly boosts their bargaining power. This allows major clients to negotiate for better pricing and terms, impacting Enero's profitability.

The increasing demand for integrated services, seen in Enero's THC Practice where 66% of revenue comes from multi-brand/country clients, also amplifies client leverage. Clients seeking consolidated solutions are better positioned to demand discounts.

Challenging macroeconomic conditions in 2024, particularly in tech and ad-tech, have weakened Enero's financial performance, with revenue down 11.4% and EBITDA down 38.5%. This financial pressure on clients likely increases their bargaining power, leading to demands for cost reductions.

Clients have numerous alternatives, including large networks, boutiques, in-house teams, and direct digital platform engagement, increasing their bargaining power. The ease of switching providers and the competence of alternatives compel Enero to focus on value and pricing.

| Key Factor | Impact on Bargaining Power | Evidence (FY24 Data) |

| Client Concentration | High | Top 10 clients = 49% of revenue |

| Integrated Service Demand | Increasing | THC Practice: 66% revenue from multi-brand/country clients |

| Macroeconomic Pressure | Increasing | Revenue: -11.4%; EBITDA: -38.5% |

| Availability of Alternatives | High | Diverse market options (networks, boutiques, in-house) |

Full Version Awaits

Enero Group Porter's Five Forces Analysis

This preview showcases the complete Enero Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within their industry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring no surprises or missing information. Gain immediate access to this comprehensive strategic tool to understand Enero Group's competitive landscape and inform your business decisions.

Rivalry Among Competitors

Enero Group contends with formidable global marketing and communications players such as WPP AUNZ, Omnicom Media Group, and Clemenger Group. These established networks command substantial financial clout and extensive international networks, enabling them to aggressively pursue and win significant client mandates.

The sheer scale and breadth of services offered by these global competitors create a challenging environment for Enero. Their deep pockets allow for significant investment in talent, technology, and marketing, further intensifying the rivalry for market share and lucrative contracts.

The marketing and communications sector is experiencing significant consolidation, with major players acquiring smaller, specialized agencies. This strategic move allows larger entities to broaden their service offerings and capture greater market share, thereby intensifying competition.

This ongoing M&A activity means that competitors are becoming larger and more comprehensive. For instance, in 2024, the global marketing and advertising industry saw a notable number of mergers and acquisitions, with deal values often in the hundreds of millions of dollars, as firms sought to gain scale and integrated capabilities.

As a result, rivalry escalates as these expanded groups compete for dominance and aim to provide end-to-end client solutions. Smaller, independent agencies find it increasingly challenging to compete effectively without the backing and broader reach that comes from being part of a larger, consolidated entity.

Challenging macroeconomic conditions and client demands for greater efficiency have significantly heightened price sensitivity across the industry. This puts considerable pressure on agency margins, forcing companies like Enero to engage in more aggressive pricing strategies to remain competitive.

This intense price competition can directly impact profitability, making rigorous cost management a critical imperative. Enero's focus on cost initiatives for FY24 and FY25 underscores the necessity of controlling expenses to maintain financial health amidst this pricing pressure.

Differentiation through Specialization and Integration

Enero Group aims to stand out by offering an integrated suite of services combined with deep expertise in specific sectors like technology, healthcare, and consumer industries. This specialization allows them to provide tailored solutions that address complex client needs.

While this strategy is effective, many competitors also leverage specialization and integration, intensifying rivalry. To maintain its advantage, Enero must continually innovate its offerings and clearly articulate its unique value proposition.

- Enero's integrated offering and industry specialism

- Competitors also pursue similar differentiation strategies

- Need for continuous innovation and unique value propositions

- Demonstrating superior results to attract blue-chip clients

Talent War and Retention

The energy and communications sector, including companies like Enero Group, experiences intense competition for skilled professionals. This 'talent war' is driven by the industry's need for creative strategists, technical experts, and project managers. Agencies constantly vie to attract and keep the best minds, often offering competitive salaries, benefits, and career development opportunities.

High employee turnover poses a significant risk. When key personnel depart, it can strain client relationships and disrupt ongoing projects, directly affecting service delivery and revenue. For instance, in 2023, the average employee turnover rate in the professional services sector, which encompasses many of Enero's operations, hovered around 15-20%, highlighting the challenge of retention.

- Talent Acquisition Costs: Acquiring new talent can cost 1.5 to 2 times an employee's annual salary, impacting profitability.

- Impact on Client Satisfaction: Frequent changes in account teams can lead to a decline in client trust and satisfaction scores.

- Industry-Specific Skills Gap: A shortage of individuals with specialized skills in areas like renewable energy consulting or digital transformation exacerbates the talent war.

- Retention Strategies: Companies like Enero must invest in robust retention programs, including continuous training, performance incentives, and fostering a positive work culture to mitigate turnover.

Enero Group faces intense rivalry from large, established global marketing and communications firms like WPP AUNZ and Omnicom Media Group, which possess significant financial resources and extensive networks. This competitive landscape is further intensified by ongoing industry consolidation, where larger entities acquire smaller agencies to broaden their service offerings and market share, as evidenced by numerous multi-million dollar deals in 2024.

The pressure to compete on price is substantial, driven by macroeconomic conditions and client demands for efficiency, impacting agency margins and necessitating aggressive pricing strategies. Enero's focus on cost management in FY24 and FY25 reflects this critical need to control expenses amidst heightened price sensitivity.

Furthermore, the industry experiences a pronounced talent war, with agencies competing fiercely for skilled professionals, leading to high employee turnover rates, estimated between 15-20% in the professional services sector in 2023. This talent scarcity increases acquisition costs, potentially impacting client satisfaction and profitability.

| Competitor Type | Key Characteristics | Impact on Enero |

|---|---|---|

| Global Marketing Networks | Substantial financial clout, extensive international networks, broad service offerings. | Aggressive pursuit of large client mandates, significant investment in talent and technology. |

| Consolidated Agencies | Expanded service portfolios, increased market share through mergers and acquisitions. | Intensified competition for dominance, challenge for smaller independent agencies. |

| Specialized Boutiques | Deep expertise in niche sectors, tailored client solutions. | Require Enero to continuously innovate and articulate unique value propositions. |

SSubstitutes Threaten

Many large corporations are bolstering their internal marketing teams, handling tasks like content creation and social media management in-house. This trend directly substitutes for some of the services offered by agencies such as Enero, particularly for more standardized marketing functions.

For instance, a 2024 survey indicated that over 60% of large enterprises either have an in-house marketing department or are planning to expand theirs significantly. This shift means fewer companies will outsource these core marketing activities.

The increasing sophistication of self-service advertising platforms from tech giants like Google and Meta presents a significant threat. These platforms empower businesses to directly manage their digital marketing, potentially bypassing agencies and ad-tech services. This trend is particularly relevant as the ad-tech industry has seen considerable consolidation and shifts in business models, suggesting clients are actively seeking more direct control and cost efficiencies.

Traditional management consulting firms are a significant threat to Enero Group, as they increasingly offer services that directly compete with Enero's strategic consulting. Many of these firms, like Accenture or Deloitte, have expanded their capabilities into areas such as brand strategy, digital transformation, and marketing effectiveness, directly encroaching on Enero's core business. For instance, in 2024, the global management consulting market was valued at over $300 billion, with major players investing heavily in digital and strategy services.

These established consulting giants possess deep industry knowledge and often have pre-existing, strong relationships with C-suite executives across various sectors. This allows them to present a credible and often preferred alternative for clients seeking high-level strategic guidance, potentially diverting business away from specialized firms like Enero. Their broad service offerings and extensive client networks provide a significant competitive advantage.

Emerging AI and Automation Tools

The rapid advancement of artificial intelligence and automation presents a significant threat of substitutes for traditional agency services. Tools capable of content creation, data analysis, and even media buying optimization are becoming increasingly sophisticated, potentially allowing clients to bypass certain agency functions. For instance, AI-powered content generation platforms saw a surge in usage in 2024, with some reports indicating a 30% increase in adoption by marketing departments looking to streamline their output.

While Enero Group is actively integrating AI into its operations, the broader client adoption of these self-service tools could erode demand for specific agency offerings. This is particularly true for tasks that are repetitive or heavily reliant on data processing, where AI can offer cost efficiencies. In 2024, the global market for AI in marketing was valued at over $20 billion, highlighting the scale of this technological shift and its potential to reshape client-agency relationships.

- AI-driven content platforms can generate marketing copy, social media posts, and even basic video scripts, potentially reducing the need for creative agencies for routine content needs.

- Automated data analysis tools offer insights into consumer behavior and campaign performance, potentially substituting for the analytical functions of some marketing research departments within agencies.

- Programmatic advertising platforms, increasingly powered by AI, can automate media buying and optimization, challenging traditional media planning and buying services.

- The cost-effectiveness and speed of AI solutions could incentivize clients to insource services previously outsourced to agencies, particularly in the coming years as these technologies mature.

Independent Freelancers and Gig Economy Platforms

The rise of independent freelancers and gig economy platforms presents a significant threat of substitutes for traditional marketing and communications agencies like Enero Group. For smaller or project-based needs, businesses can increasingly turn to these alternatives to source specialized talent. This offers a more flexible and potentially cost-effective approach, especially for clients with limited budgets or specific, short-term requirements.

The gig economy has seen substantial growth, with platforms connecting businesses directly with skilled professionals. For instance, Upwork reported over 18 million registered freelancers on its platform as of early 2024, showcasing the vast pool of available talent. This accessibility allows companies to bypass the overhead associated with full-service agencies, opting for on-demand expertise.

- Increased Competition: The availability of specialized freelance talent on platforms like Fiverr and Toptal directly competes with the services offered by agencies.

- Cost-Effectiveness: Businesses can often secure marketing and communication services from freelancers at a lower cost than agency retainers, especially for niche skills.

- Flexibility and Agility: The gig economy allows for rapid scaling of resources up or down based on project needs, offering a level of flexibility that can be difficult for agencies to match.

- Talent Accessibility: Companies can access a global talent pool, finding niche expertise that might not be readily available locally through traditional agency channels.

The threat of substitutes for Enero Group is significant, stemming from both technological advancements and evolving business practices. Companies are increasingly bringing marketing functions in-house, a trend bolstered by the availability of sophisticated self-service platforms from tech giants. For example, a 2024 survey revealed over 60% of large enterprises are expanding their internal marketing capabilities, directly reducing the need for external agency support.

Furthermore, the rapid maturation of artificial intelligence and automation tools presents a potent substitute. AI-powered platforms can now handle content creation, data analysis, and media buying, with AI in marketing valued at over $20 billion in 2024, indicating a substantial shift. This allows clients to bypass traditional agency roles, particularly for repetitive tasks, as seen with a 30% increase in AI content generation platform usage in 2024.

Traditional management consulting firms also pose a threat by expanding their service portfolios into areas like digital transformation and brand strategy, directly competing with Enero's core offerings. The global management consulting market, exceeding $300 billion in 2024, sees major players heavily investing in these digital and strategic services, leveraging their established client relationships.

Finally, the burgeoning gig economy offers a flexible and cost-effective alternative. Platforms like Upwork, with over 18 million registered freelancers by early 2024, provide businesses access to specialized talent, potentially bypassing agency retainers for project-based needs.

| Substitute Type | Key Characteristics | Impact on Enero Group | 2024 Data Point |

| In-house Marketing Teams | Cost control, direct oversight | Reduced outsourcing of core functions | 60%+ of large enterprises expanding in-house capabilities |

| AI & Automation Tools | Efficiency, scalability, cost reduction | Substitution for creative and analytical tasks | AI in Marketing Market: >$20 billion; 30% increase in AI content platform usage |

| Management Consulting Firms | Broad service offerings, established relationships | Direct competition in strategic and digital services | Global Management Consulting Market: >$300 billion |

| Gig Economy/Freelancers | Flexibility, specialized skills, cost-effectiveness | Alternative for project-based and niche needs | Upwork: >18 million registered freelancers (early 2024) |

Entrants Threaten

The marketing and communications sector, especially in digital and specialized niches, presents a low barrier to entry for new players. A small, agile team or even a single creative professional can launch an agency with relatively low startup costs. This accessibility means new, specialized agencies can emerge quickly, targeting specific market segments or offering highly tailored services at competitive prices, thereby posing a threat to established firms like Enero Group.

New entrants armed with advanced technologies such as AI and machine learning pose a significant threat to established agencies like Enero. These startups can offer highly efficient, data-driven marketing solutions, potentially luring clients who prioritize innovation and technological prowess. For instance, the global AI in marketing market was valued at approximately USD 15.1 billion in 2023 and is projected to grow substantially, indicating a fertile ground for disruptive newcomers.

New entrants can carve out a space by concentrating on specialized, underserved market segments or rapidly growing trends, such as tailored metaverse advertising or hyper-local social media campaigns. Their inherent agility and focused approach allow them to adapt more quickly than larger, established firms that might struggle with slower decision-making processes.

Client Relationships and Reputation Building

While Enero Group's established global presence and blue-chip client roster present a formidable barrier, new entrants can still cultivate strong client relationships and build a solid reputation. This is often achieved through consistently successful project delivery, which fosters trust and encourages repeat business. Effective networking within specific industry niches and geographic markets also plays a crucial role in gaining visibility and attracting early clients.

Word-of-mouth referrals are particularly potent for emerging companies. A track record of delivering exceptional results, even on a smaller scale, can quickly generate positive buzz. For instance, in the competitive renewable energy consulting sector, a newcomer might focus on securing a few high-profile projects in a particular region, demonstrating expertise and reliability to build initial traction.

- Reputation Cultivation: New entrants can build credibility through successful project execution and client satisfaction, even without a global footprint.

- Networking Power: Strategic networking within target industries or regions can open doors to initial client acquisition.

- Referral Engine: Positive word-of-mouth, driven by excellent service delivery, acts as a powerful, low-cost marketing tool for emerging firms.

- Niche Focus: Specializing in specific industry verticals or geographic areas allows new entrants to build deep expertise and targeted relationships.

Talent Acquisition and Retention

The threat of new entrants in Enero Group's sector is amplified by the intense competition for skilled professionals. While Enero has a solid existing workforce, emerging companies can lure top talent by cultivating distinctive work environments, offering attractive equity packages, or concentrating on cutting-edge projects. This ongoing 'war for talent' presents a significant challenge, as experienced individuals may opt for newer, more dynamic opportunities, allowing these new firms to rapidly assemble formidable teams.

For instance, reports from 2024 indicate a significant surge in demand for specialized engineering and renewable energy expertise. Companies that can demonstrate a clear vision and offer compelling career progression are proving highly effective in attracting individuals who might otherwise remain with established players like Enero. This dynamic suggests that new entrants can indeed pose a substantial threat by poaching key personnel and building their own competitive capabilities swiftly.

- Talent Drain Risk: New entrants can siphon off critical talent from Enero by offering superior compensation, innovative work environments, or equity.

- Rapid Skill Acquisition: Competitors can quickly build expertise by hiring experienced professionals, bypassing the time and cost of internal development.

- Cultural Differentiation: Innovative work cultures and project focus can be powerful magnets for talent, even for newer, less established companies.

The marketing and communications industry, particularly in digital and specialized areas, faces a low barrier to entry. This allows new, agile firms to emerge quickly, leveraging technology and niche focus to challenge established players like Enero Group. The ability of these newcomers to attract top talent through innovative work environments and compelling career paths further intensifies this threat.

Porter's Five Forces Analysis Data Sources

Our Enero Group Porter's Five Forces analysis is built upon a foundation of robust data, including Enero's official annual reports, investor presentations, and public filings. We supplement this with industry-specific market research reports and analyses from reputable financial data providers to capture a comprehensive view of the competitive landscape.