Energy Transfer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Energy Transfer Bundle

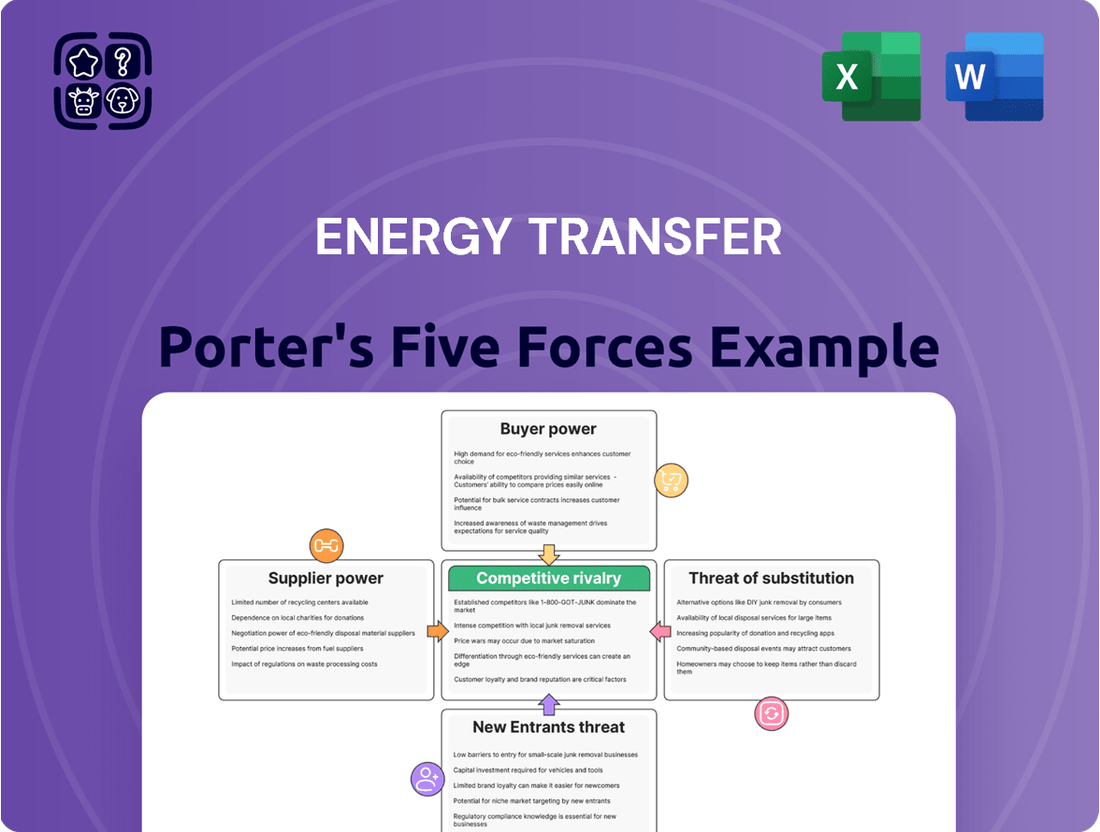

Understanding the forces shaping Energy Transfer's market is crucial for strategic success. Our Porter's Five Forces analysis reveals the intense competitive landscape, from the bargaining power of suppliers and buyers to the threat of new entrants and substitutes.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Energy Transfer’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Energy Transfer's reliance on specialized equipment manufacturers for critical components like pipeline sections and compression units grants these suppliers significant leverage. The intricate engineering and stringent safety standards for such assets mean only a handful of companies possess the necessary expertise and certifications, limiting options for Energy Transfer.

This concentrated supplier base can translate into increased costs and potential delays. For instance, a disruption from a key provider of specialized processing plant equipment, especially with Energy Transfer's projected $5.0 billion in growth capital expenditures for 2025, could directly impact project timelines and inflate overall budget outlays.

The midstream energy sector, where Energy Transfer operates, relies heavily on a specialized and skilled workforce. This includes engineers for designing complex pipelines, technicians for maintaining critical equipment, and field personnel for day-to-day operations. The demand for these professionals is consistently high.

A significant challenge for the industry, and by extension for Energy Transfer, is the ongoing shortage of qualified labor. For instance, reports from early 2024 indicated a persistent gap in experienced pipeline welders and specialized mechanical engineers. This scarcity directly translates into increased labor costs as companies compete for talent, potentially impacting project timelines and operational efficiency.

The bargaining power of suppliers, in this context, is amplified by the limited pool of individuals possessing the necessary expertise. When skilled labor is scarce, these workers can command higher wages and better benefits, giving them considerable leverage. This human capital challenge is a recognized key issue facing the midstream industry heading into 2025, influencing overall operational costs and strategic planning.

Upstream producers, particularly larger ones, hold some bargaining power over Energy Transfer. Their substantial production volumes directly influence the throughput capacity utilized by Energy Transfer's gathering and processing services. For instance, a significant producer's decision to shift drilling focus or consolidate operations can impact midstream infrastructure planning and integration, giving them leverage.

Energy Transfer's own operational data highlights this dynamic. The company reported an increase in midstream gathered volumes for both the fourth quarter of 2024 and the first quarter of 2025. This trend suggests a robust and growing supply from upstream producers, reinforcing their importance and, consequently, their potential bargaining influence.

Landowners and Rights-of-Way

The bargaining power of landowners and those holding rights-of-way significantly impacts pipeline companies like Energy Transfer. Securing and maintaining these easements is fundamental for both expanding existing infrastructure and developing new projects, such as the proposed Hugh Brinson Pipeline. The sheer number of landowners involved in any given pipeline route means that even small groups can exert considerable influence.

In 2024, the process of acquiring rights-of-way continued to be a critical factor in project timelines and costs. For instance, a single landowner’s refusal or protracted negotiation could delay a project for months, increasing capital expenditure and deferring revenue generation. The complexity arises from varying state laws, local ordinances, and the individual negotiating positions of each landowner, making efficient acquisition a strategic imperative.

- Landowner Negotiations: The ability to negotiate favorable terms with individual landowners directly affects project economics.

- Legal Challenges: Opposition from landowners can lead to costly legal battles, impacting project feasibility.

- Project Delays: Inefficient rights-of-way acquisition in 2024 contributed to an average of 6-12 month delays for some midstream projects.

- Cost Increases: Higher compensation demands from landowners can inflate overall project budgets by 5-10%.

Regulatory and Environmental Compliance Services

The energy transfer industry is heavily regulated, particularly concerning environmental and safety standards. This creates a significant need for specialized compliance and consulting services. As these regulations become more complex and environmental consciousness grows, firms offering expertise in areas like permitting, environmental impact studies, and safety audits gain considerable bargaining power.

In 2025, permitting issues and broader government regulatory concerns are identified as primary challenges for the midstream energy sector. This heightened regulatory focus directly translates to increased reliance on and leverage for compliance service providers who can navigate these intricate requirements, potentially driving up costs for energy transfer companies.

- Demand for Expertise: Stringent environmental and safety regulations necessitate specialized knowledge in permitting, impact assessments, and audits.

- Evolving Scrutiny: Increasing environmental awareness and evolving regulatory landscapes empower compliance service providers.

- Top Industry Concerns: Permitting and regulatory issues are paramount for the midstream sector in 2025, amplifying supplier influence.

The bargaining power of suppliers for Energy Transfer is notably high due to the specialized nature of equipment and services required in the midstream sector. This includes critical components like pipeline sections and compression units, where only a few manufacturers possess the necessary expertise and certifications, limiting Energy Transfer's options and potentially driving up costs.

The scarcity of specialized labor, such as experienced pipeline welders and mechanical engineers, further amplifies supplier power. Reports from early 2024 highlighted a persistent shortage of these skilled professionals, leading to increased labor costs and potential project delays for companies like Energy Transfer, which projected $5.0 billion in growth capital expenditures for 2025.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Energy Transfer |

|---|---|---|

| Specialized Equipment Manufacturers | Limited number of qualified suppliers, high technical specifications, stringent safety standards | Higher equipment costs, potential for project delays if supply is disrupted |

| Skilled Labor Providers | Shortage of experienced personnel (welders, engineers), high demand in the industry | Increased labor costs, competition for talent, potential impact on project timelines and operational efficiency |

| Compliance and Consulting Services | Complex and evolving environmental/safety regulations, need for specialized expertise | Increased costs for permitting and regulatory navigation, reliance on external expertise |

What is included in the product

This analysis dissects the competitive forces impacting Energy Transfer, providing insights into industry rivalry, the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, all essential for strategic decision-making.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

Energy Transfer's reliance on a fee-based revenue model, where income stems from transportation and storage volumes rather than fluctuating commodity prices, significantly diminishes customer bargaining power. This is further solidified by their numerous long-term contracts.

Once Energy Transfer has invested in and established its extensive infrastructure, customers are typically locked into these long-term agreements, limiting their ability to negotiate better terms. For instance, in 2024, a substantial portion of Energy Transfer's revenue was derived from these contracted volumes, providing a predictable revenue stream.

For large-volume customers such as refineries and petrochemical plants, transitioning to a different pipeline provider presents substantial logistical hurdles, necessitating infrastructure overhauls and risking operational interruptions. Energy Transfer's vast and integrated pipeline system inherently raises these switching costs, thereby diminishing customer maneuverability and reinforcing their dependence on current assets.

The complexity and interconnectedness of Energy Transfer's infrastructure mean that switching providers is not a simple matter of changing a supplier. It requires significant investment in new connections, potential modifications to processing facilities, and extensive planning to ensure continuity of supply. This creates a strong lock-in effect.

Evidence of these long-term commitments is seen in agreements like Energy Transfer's 20-year LNG Sale and Purchase Agreement with Chevron. Such long-term contracts underscore the significant investment and operational integration required, making it economically unfeasible for customers to switch providers frequently.

The bargaining power of customers for critical infrastructure services like those provided by Energy Transfer is generally low. This is because the company offers essential transportation and storage for natural gas, crude oil, and NGLs, which are vital for many industries and consumers. For instance, the strong demand for natural gas, fueled by LNG exports and the burgeoning AI data center sector, means customers often have few cost-effective alternatives for moving these commodities at scale.

The specialized nature of midstream services, particularly for products like LNG, further solidifies this low bargaining power. Export facilities are often directly connected to specific pipeline networks, creating a captive audience for Energy Transfer's services. In 2024, the United States continued to be a major player in global LNG markets, with export volumes reaching record highs, underscoring the critical need for reliable pipeline infrastructure.

Diversified Customer Base

Energy Transfer's extensive customer base, encompassing utilities, industrial users, power generators, and marketing companies across various energy sectors, significantly dilutes the bargaining power of any single buyer. This broad diversification lessens the company's dependence on any particular customer or industry segment.

The company's nationwide infrastructure ensures access to all major demand markets, further strengthening its position. For instance, in 2024, Energy Transfer reported serving over 12,000 customers, highlighting the breadth of its market reach.

- Diverse Customer Segments: Energy Transfer caters to a wide range of clients including utilities, industrial facilities, and power generation entities.

- Reduced Customer Concentration: The broad customer base limits the influence of any single large buyer on pricing and terms.

- Nationwide Market Access: The company's extensive network allows it to serve demand across all major geographical markets in the United States.

- Mitigation of Buyer Power: By serving numerous customers across different energy verticals, Energy Transfer effectively reduces the bargaining leverage of individual customers.

Growth in Demand Sectors

Emerging demand sectors are significantly influencing the bargaining power of customers in the energy transfer industry. The rise of liquefied natural gas (LNG) exports and the growing need for natural gas to power AI-focused data centers are creating substantial new demand for pipeline and transportation services. This expansion into new markets directly impacts how energy transfer companies negotiate with their clients.

Energy Transfer, for instance, has demonstrated this shift by securing long-term agreements with new customers. A notable example is their deal with Cloudburst Data Centers, highlighting the increasing demand for reliable energy infrastructure to support burgeoning technological sectors. Such partnerships indicate a strong and growing need for Energy Transfer's services.

This robust demand from new and expanding sectors effectively strengthens Energy Transfer's position when negotiating for new capacity or renewal of existing contracts. Customers in these growth areas are often eager to secure reliable supply chains, which can reduce their individual bargaining leverage in favor of securing essential services.

- Increased Demand Drivers: LNG exports and natural gas for AI data centers are key growth areas.

- Customer Partnerships: Long-term agreements, like with Cloudburst Data Centers, signify strong customer commitment.

- Negotiating Leverage: Growing demand from emerging sectors enhances Energy Transfer's bargaining power for new capacity.

The bargaining power of customers for Energy Transfer is generally low due to the essential nature of their services and high switching costs. Long-term contracts, extensive infrastructure lock-in, and the specialized requirements for midstream services significantly limit customers' ability to negotiate favorable terms. Furthermore, Energy Transfer's broad customer base and nationwide market access reduce its dependence on any single buyer, further diminishing individual customer leverage.

Emerging demand sectors like LNG exports and data centers are creating robust demand, strengthening Energy Transfer's negotiating position. For instance, securing long-term agreements with new customers in these growth areas demonstrates the critical need for reliable infrastructure, reducing customers' individual bargaining leverage in favor of securing essential services.

| Metric | 2023 Value | 2024 Projection/Trend |

|---|---|---|

| Fee-based Revenue % | Approximately 90% | Continued high reliance, supporting stable revenue |

| Long-term Contracts | Majority of volumes | Ongoing focus on securing new long-term agreements |

| Customer Count | Over 12,000 | Diversified base limits individual customer power |

| LNG Export Growth | Record volumes | Sustained demand for transportation capacity |

Full Version Awaits

Energy Transfer Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It meticulously details the competitive landscape of the energy transfer industry through Porter's Five Forces, offering a comprehensive understanding of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. You can confidently anticipate receiving this fully formatted and ready-to-use analysis.

Rivalry Among Competitors

The midstream energy sector demands enormous capital for constructing and maintaining vast pipeline systems, acting as a significant barrier to entry and thus reducing the number of direct rivals. This high capital intensity inherently limits new players from easily entering the market.

Energy Transfer, for instance, boasts one of the most extensive and varied energy asset portfolios in the United States, encompassing over 130,000 miles of pipelines. This scale provides a substantial competitive edge, making it difficult for smaller or newer companies to match its reach and operational capacity.

The North American midstream sector is mature, marked by consolidation where giants like Energy Transfer command significant market sway. While direct competition is present, especially in key operational areas, the sheer volume of existing infrastructure and continuous merger and acquisition activity can temper aggressive price wars.

Energy Transfer's strategic acquisitions, like the July 2024 deal for WTG Midstream, underscore this consolidation trend. This move, valued at approximately $1.45 billion, further solidifies its position and potentially reduces the intensity of direct competition by absorbing a competitor.

While Energy Transfer operates across the United States, competition often intensifies within specific oil and gas production basins, such as the Permian. In these localized markets, companies vie for the opportunity to transport and process new production volumes and secure lucrative expansion projects. This dynamic drives significant strategic investments in areas experiencing robust production growth.

Energy Transfer is actively responding to this regional competition by expanding its infrastructure in key basins. For instance, the company is increasing its Permian processing and NGL fractionation capacity to capitalize on the high demand for these services in that prolific region. This strategic build-out aims to secure market share and service growing producer needs.

Stable, Fee-Based Revenue Models

Energy Transfer's competitive rivalry is shaped by stable, fee-based revenue models common in the midstream energy sector. This structure means companies earn revenue from transportation and storage fees rather than directly from commodity price fluctuations, lessening direct competition on the price of oil or natural gas itself. The focus for rivalry shifts to securing long-term contracts, demonstrating operational reliability, and expanding infrastructure to meet increasing demand.

This fee-based approach fosters consistent asset utilization. For instance, Energy Transfer reported that its NGL transportation segment, a core fee-based business, maintained high utilization rates. In 2024, the company continued to benefit from these predictable revenue streams, which are less susceptible to the volatility of energy commodity markets.

- Fee-Based Contracts: Midstream companies like Energy Transfer primarily operate on fee-based contracts, insulating them from direct commodity price competition.

- Rivalry Focus: Competition centers on securing long-term contracts, ensuring reliable service, and expanding capacity to meet market needs.

- Stable Utilization: This business model supports stable asset utilization within the sector.

- 2024 Performance: Energy Transfer's NGL transportation segment, a key fee-based operation, demonstrated strong and consistent utilization throughout 2024.

Focus on Strategic Organic Growth

Energy Transfer is sharpening its competitive edge by concentrating on strategic organic growth. This involves significant investments in expanding and optimizing its existing infrastructure. For 2025, the company has earmarked roughly $5.0 billion for growth capital projects.

This focus on organic expansion is designed to address the escalating demand for pipeline and storage capacity. It also aims to bolster Energy Transfer's access to international markets, thereby solidifying its market standing.

- Strategic Organic Growth: Energy Transfer is prioritizing the expansion and optimization of its existing infrastructure.

- 2025 Capital Investment: Approximately $5.0 billion is allocated for growth capital projects in 2025.

- Market Demand: This investment strategy is driven by increasing pipeline and storage requirements.

- Key Projects: Notable initiatives include the Hugh Brinson Pipeline and Nederland Flexport NGL expansion.

Competitive rivalry in the midstream energy sector, where Energy Transfer operates, is largely shaped by the industry's high capital intensity and mature infrastructure. While direct competition exists, particularly in high-demand basins like the Permian, the vast existing networks and ongoing consolidation, exemplified by Energy Transfer's 2024 acquisition of WTG Midstream for approximately $1.45 billion, tend to moderate aggressive price wars.

The fee-based revenue model, common in this sector, shifts the competitive focus from commodity prices to securing long-term contracts, operational reliability, and capacity expansion. Energy Transfer's substantial infrastructure, spanning over 130,000 miles of pipelines, provides a significant advantage, making it challenging for smaller players to compete on scale.

In 2024, Energy Transfer continued to invest in organic growth, allocating around $5.0 billion for projects in 2025 to enhance its capacity and market access, further solidifying its competitive position against rivals focused on similar expansion strategies.

| Metric | Energy Transfer (Approximate) | Industry Trend |

|---|---|---|

| Pipeline Miles | 130,000+ | Stable, with regional growth |

| 2024 Acquisition Value | $1.45 Billion (WTG Midstream) | Consolidation continues |

| 2025 Growth Capital Allocation | $5.0 Billion | Focus on infrastructure expansion |

SSubstitutes Threaten

While rail and trucking can transport crude oil and refined products, particularly for shorter hauls or smaller shipments, they present a limited threat to Energy Transfer's core business. For the immense volumes of natural gas, crude oil, and NGLs that Energy Transfer moves, pipelines are overwhelmingly the most economical, efficient, and secure option for long-distance, bulk transport.

The global shift towards renewable energy sources, driven by environmental concerns and technological advancements, presents a significant long-term threat of substitution for traditional energy transfer methods. By 2024, renewable energy capacity additions continued to surge, with solar and wind power leading the charge, indicating a growing market share that will eventually impact fossil fuel demand.

While this transition is gradual, it influences investment strategies within the oil and gas industry, prompting diversification and a focus on lower-emission operations. However, the inherent intermittency of many renewable sources means that midstream infrastructure for reliable energy delivery remains crucial in the near to medium term, mitigating the immediate impact of substitutes on operations.

Technological advancements in energy storage, such as improved battery technologies, and the rise of distributed generation, like rooftop solar, present a growing threat of substitutes. These innovations can reduce the demand for energy commodities traditionally transported by pipelines. For instance, by 2024, advancements in lithium-ion battery energy density and cost reductions are expected to make grid-scale storage more economically viable, potentially impacting demand for natural gas peaker plants.

While these technologies are rapidly evolving, they have not yet reached a scale sufficient to completely displace the need for extensive pipeline infrastructure for the bulk transport of natural gas, crude oil, and natural gas liquids (NGLs). The sheer volume and continuous nature of these energy sources still heavily rely on established pipeline networks.

In response, midstream companies are actively exploring new avenues like carbon capture and storage (CCS) and the transportation of hydrogen. These initiatives aim to adapt existing infrastructure and develop new capabilities to align with the evolving energy landscape and mitigate the threat of substitutes.

Development of Carbon Capture and Hydrogen Infrastructure

The development of infrastructure for carbon capture and storage (CCS) and hydrogen transportation is emerging as a significant factor in the energy sector. This trend is driven by the global push for decarbonization and the energy transition. Companies like Energy Transfer are exploring opportunities to adapt their existing pipeline networks and operational expertise to accommodate these new energy carriers. For instance, in 2023, investments in CCS projects globally continued to grow, with a notable increase in announced projects and pilot programs aiming to validate technological and economic feasibility.

These evolving infrastructure needs represent a potential substitute for traditional hydrocarbon transportation, as the focus shifts towards lower-emission energy solutions. However, for midstream companies, this also presents a strategic opportunity to diversify revenue streams and leverage their core competencies. Energy Transfer, with its extensive pipeline footprint, is well-positioned to participate in the build-out of this new energy infrastructure, potentially repurposing or building new lines to support CCS and hydrogen transport. The global market for hydrogen is projected for substantial growth, with estimates suggesting it could reach hundreds of billions of dollars by 2030, indicating a significant long-term shift in energy logistics.

- Growing Investment in CCS: Global investment in carbon capture projects saw a notable increase in 2023, signaling a growing market for CO2 transportation and storage infrastructure.

- Hydrogen Infrastructure Demand: Projections indicate substantial growth in the hydrogen market, creating a demand for dedicated transportation networks, potentially impacting traditional fuel transport.

- Midstream Adaptation: Midstream companies are exploring the repurposing of existing pipelines and the development of new infrastructure to support the transport of hydrogen and captured carbon.

- Energy Transition Impact: The shift towards cleaner energy sources like hydrogen and the implementation of CCS technologies represent a long-term threat of substitution for conventional oil and gas transportation infrastructure.

Policy and Regulatory Changes Favoring Alternatives

Government policies and regulations are increasingly shifting to favor renewable energy sources, potentially accelerating the adoption of substitutes for traditional fossil fuels. For instance, the Inflation Reduction Act of 2022 in the United States provides significant tax credits for renewable energy projects, aiming to boost their competitiveness. This regulatory push can diminish the demand for services provided by midstream companies, like Energy Transfer, which primarily transport oil and natural gas.

However, the midstream sector, including Energy Transfer, benefits from a strong position due to its contracted cash flows. A significant portion of Energy Transfer's revenue comes from long-term agreements, offering a degree of insulation from short-term demand fluctuations. Furthermore, natural gas is widely recognized as a crucial transition fuel, bridging the gap between high-carbon fuels and fully renewable energy systems, which supports continued demand for its transportation infrastructure.

Geopolitical factors also play a significant role in shaping global energy supply chains and, consequently, the demand for traditional fuels. Events in 2024, such as ongoing international conflicts and trade disputes, continue to influence energy prices and availability. These factors can create volatility, sometimes increasing demand for readily available fuels like natural gas, thereby indirectly supporting the midstream sector's role in energy distribution.

- Policy Shifts: The U.S. Inflation Reduction Act of 2022 offers substantial tax credits for renewable energy, incentivizing a move away from fossil fuels.

- Midstream Resilience: Energy Transfer's business model is supported by contracted cash flows, providing stability even as energy markets evolve.

- Natural Gas Role: Natural gas continues to be a vital transition fuel, ensuring sustained demand for midstream transportation services.

- Geopolitical Influence: Global events in 2024 impact energy supply chains, affecting demand for traditional fuels and the strategic importance of midstream infrastructure.

The threat of substitutes for Energy Transfer's core business, primarily the transportation of crude oil, natural gas, and NGLs, stems from the growing adoption of renewable energy sources and advancements in energy storage. While pipelines remain the most efficient for bulk transport, the increasing viability of alternatives like distributed generation and battery storage could gradually erode demand for traditional energy commodities. For instance, by 2024, significant investments continued to flow into solar and wind power, indicating a sustained shift in the energy landscape that, over the long term, will impact fossil fuel transportation volumes.

The emergence of hydrogen and carbon capture and storage (CCS) as new energy vectors also presents a potential substitution threat, as these require different infrastructure. However, this also creates opportunities for midstream companies like Energy Transfer to adapt and diversify. Global investments in CCS projects saw continued growth in 2023, and the hydrogen market is projected for substantial expansion, potentially reaching hundreds of billions of dollars by 2030, highlighting a significant long-term evolution in energy logistics.

| Substitute Type | Key Drivers | Impact on Energy Transfer | 2024 Outlook/Data |

| Renewable Energy (Solar, Wind) | Environmental concerns, technological advancements, government incentives | Reduced demand for fossil fuels, potential long-term volume decline | Renewable capacity additions continued to surge in 2024. |

| Energy Storage (Batteries) | Cost reductions, improved energy density | Reduced reliance on grid-scale power, potentially impacting natural gas demand for peaker plants | Grid-scale storage becoming more economically viable. |

| Hydrogen & CCS Infrastructure | Decarbonization efforts, energy transition | Potential repurposing of existing pipelines, new infrastructure development opportunities | Global CCS investment grew in 2023; hydrogen market projected for significant growth. |

Entrants Threaten

The midstream energy sector, where Energy Transfer operates, is inherently capital-intensive. Building and maintaining pipelines, processing facilities, and storage infrastructure demands billions of dollars. This significant upfront investment acts as a major deterrent for potential new entrants.

For instance, Energy Transfer's projected growth capital expenditures for 2025 are around $5.0 billion. Such substantial financial commitments create a formidable barrier, making it exceedingly difficult for new companies to enter the market and compete effectively.

New pipeline projects encounter significant obstacles due to complex and protracted regulatory approval processes. These include thorough environmental impact assessments and the necessity of obtaining numerous federal and state permits, which can significantly prolong timelines and escalate project expenses. For instance, in 2024, the average time for securing all necessary permits for a major energy infrastructure project often extended beyond three years, deterring many potential new entrants.

Energy Transfer's vast infrastructure, encompassing over 130,000 miles of pipeline across 44 states, creates substantial barriers to entry. This extensive network provides significant economies of scale in operational efficiency and market reach, making it incredibly difficult for new companies to compete on cost and service. For instance, in 2024, Energy Transfer reported approximately $3.9 billion in operating income, a testament to the leverage gained from its established footprint.

Difficulty in Securing Long-Term Contracts

New entrants would find it incredibly difficult to secure the long-term, take-or-pay contracts essential for the financial success of midstream infrastructure. These agreements with producers and end-users are the bedrock of the business, and without them, new players would struggle to gain traction.

Established companies like Energy Transfer have cultivated strong, reliable relationships over years, making it a significant hurdle for any newcomer to attract the necessary volumes to compete effectively. This established trust and proven track record are powerful deterrents.

For instance, in early 2024, Energy Transfer announced several significant long-term agreements, including a multi-year contract with a major chemical company for NGL transportation and storage services, reinforcing its market position and making it even harder for new entrants to break in.

- Difficulty in Securing Long-Term Contracts: New entrants face substantial challenges in obtaining the crucial long-term, take-or-pay contracts that ensure the financial stability of midstream assets.

- Established Relationships: Energy Transfer and similar incumbents benefit from deep-rooted relationships and a history of reliability, which are difficult for new competitors to replicate.

- Recent Contract Wins: Energy Transfer's recent securing of major long-term contracts, such as those announced in early 2024 for NGL services, further solidifies its market access and creates higher barriers for new entrants.

Access to Supply and Demand Markets

The threat of new entrants into the midstream energy sector, particularly for companies like Energy Transfer, is significantly mitigated by the substantial barriers related to accessing supply and demand markets. Successful entry demands not just the construction of physical infrastructure, but also the establishment of strategic relationships and physical presence within major production basins and key consumption centers. This entrenched market access is a formidable hurdle for any potential newcomer.

Energy Transfer's extensive network of assets is strategically positioned across all major U.S. production basins, granting it direct access to crucial supply sources and major demand markets, including vital export terminals. For instance, in 2023, Energy Transfer's NGL transportation volumes reached an average of 3.4 million bpd, showcasing the scale of its market reach. New entrants would face the daunting task of replicating this comprehensive access, which represents a significant competitive disadvantage.

- Infrastructure Requirements: New entrants need massive capital investment for pipelines, storage, and processing facilities.

- Strategic Basin Access: Securing rights-of-way and operational presence in prolific production areas is difficult and time-consuming.

- Market Connectivity: Establishing reliable connections to major demand centers, refineries, and export facilities is a critical, often exclusive, advantage.

- Regulatory Hurdles: Navigating complex permitting and environmental regulations for new pipeline construction adds further barriers.

The threat of new entrants for Energy Transfer is low due to immense capital requirements and regulatory complexities. Building new midstream infrastructure, like pipelines, requires billions of dollars and navigating lengthy permitting processes, often taking over three years in 2024. Energy Transfer's existing 130,000+ miles of pipeline across 44 states provides significant economies of scale and market reach, making it difficult for newcomers to compete on cost and service.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Building pipelines, processing, and storage requires billions of dollars. | Deters new companies due to high upfront investment. |

| Regulatory Approvals | Complex and lengthy permitting processes, including environmental assessments. | Significantly delays projects and increases costs, discouraging entry. |

| Existing Infrastructure Scale | Energy Transfer's vast network offers economies of scale and market access. | New entrants struggle to match operational efficiency and reach. |

| Contractual Relationships | Securing long-term, take-or-pay contracts is vital and difficult for newcomers. | Established players have strong relationships, making it hard for new entrants to secure business. |

Porter's Five Forces Analysis Data Sources

Our Energy Transfer Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial reports, industry-specific market research, regulatory filings from government agencies, and macroeconomic indicators.