Energy Transfer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Energy Transfer Bundle

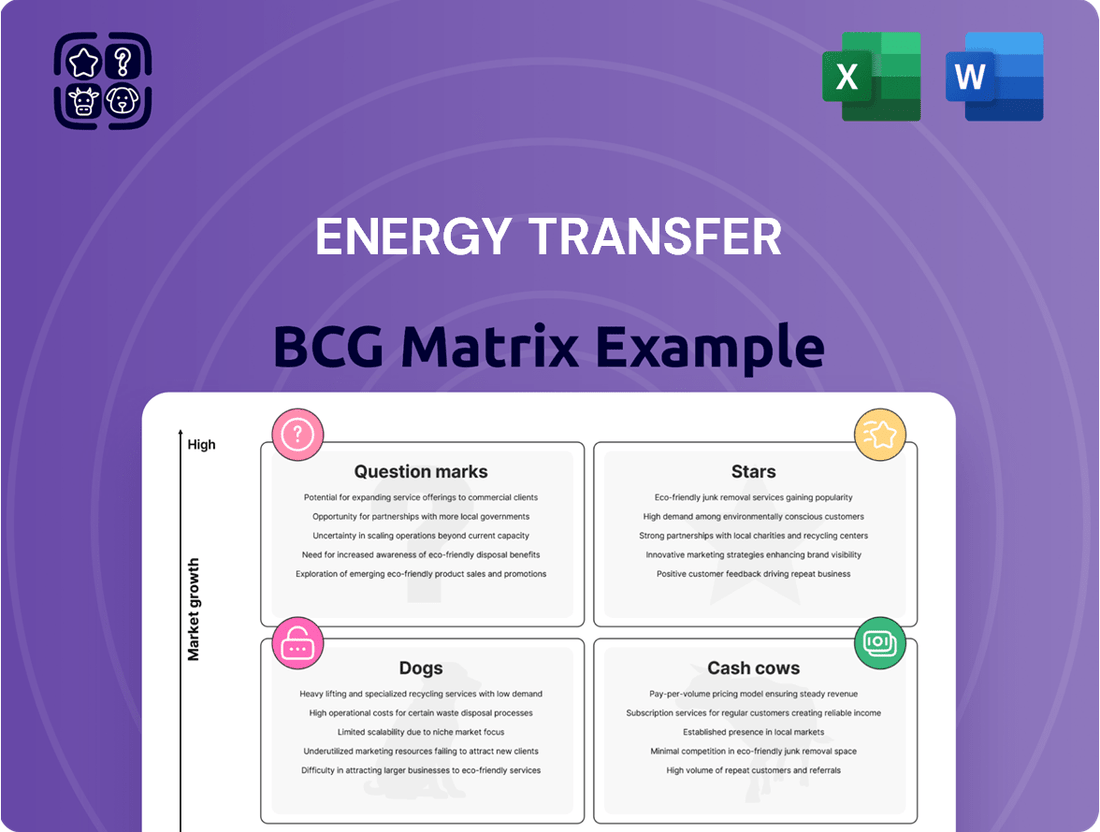

Understand the core of the Energy Transfer BCG Matrix, revealing how its diverse portfolio navigates market growth and share. This snapshot highlights key product positions, but to truly unlock strategic advantage, you need the full picture.

Purchase the complete BCG Matrix for a detailed quadrant breakdown, including in-depth analysis of each business unit's potential. Gain actionable insights to optimize resource allocation and drive future growth.

Stars

Energy Transfer is significantly bolstering its NGL export and fractionation infrastructure. Key projects like the Frac IX facility at Mont Belvieu and the Nederland Flexport expansion are set to substantially increase capacity by mid-2025 and late 2026, respectively.

With an approximate 20% share of the global NGL export market, Energy Transfer is a dominant player in a sector experiencing robust growth fueled by rising international demand. This strategic expansion solidifies its position as a leader in a high-demand market.

These substantial investments and Energy Transfer's leading market position are poised to make its NGL export and fractionation assets crucial contributors to the company's future earnings growth.

Energy Transfer's Permian Basin operations are a cornerstone of its natural gas gathering and processing segment, demonstrating a strong market position. The company's strategic acquisitions, including WTG Midstream, have significantly boosted its gathering pipeline network and processing capacity in this vital production area. As of early 2024, Energy Transfer continues to invest heavily, with new plants like Mustang Draw and Badger coming online, alongside expansions at existing sites, further solidifying its high market share in this prolific basin.

Energy Transfer has seen impressive gains in crude oil transportation, with volumes climbing 15-25% in 2024, setting new partnership records. This surge highlights the company's expanding footprint in a vital energy sector.

Furthermore, the company's crude oil exports experienced a significant jump of 49%, underscoring its growing international reach and market penetration. These robust figures solidify Energy Transfer's position as a key player in global crude oil logistics.

Hugh Brinson Pipeline

The Hugh Brinson Pipeline, a key component of Energy Transfer's strategy, received its Final Investment Decision in December 2024. This project is poised to enhance the transportation of natural gas from the prolific Permian Basin to vital Texas markets.

Phase 1 of the Hugh Brinson Pipeline broke ground in Q1 2025, with operations anticipated to commence by the end of 2026. Meanwhile, discussions for Phase 2 capacity are actively progressing, indicating robust demand and expansion plans.

This pipeline is strategically positioned to capitalize on the increasing demand for natural gas in a key growth corridor. Energy Transfer expects the Hugh Brinson Pipeline to secure a leading market share once fully operational.

- Project FID: December 2024

- Phase 1 Construction Start: Q1 2025

- Phase 1 In-Service Date: Late 2026

- Strategic Importance: Connects Permian Basin gas to Texas markets

Natural Gas Supply to AI Data Centers

Energy Transfer is making a strategic move into supplying natural gas to AI data centers, a sector experiencing rapid expansion. This is highlighted by their long-term agreement with CloudBurst Data Centers, a significant player in this emerging market.

The demand for energy from artificial intelligence is skyrocketing, creating substantial growth opportunities for companies like Energy Transfer that can provide reliable fuel sources. This initiative, though in its nascent stages, is a forward-looking strategy to secure a substantial share of this burgeoning industry.

- AI Data Center Energy Demand: The global AI market is projected to grow significantly, with AI workloads expected to consume an estimated 850 terawatt-hours (TWh) of electricity annually by 2027, a substantial increase from current levels.

- Natural Gas as a Fuel Source: Natural gas offers a more readily available and often cleaner-burning alternative compared to other fossil fuels for powering these energy-intensive facilities, especially during the transition to renewables.

- Energy Transfer's Position: Energy Transfer's extensive midstream infrastructure provides a competitive advantage in efficiently transporting natural gas to these new, high-demand locations.

- Market Potential: The development of AI-specific data centers represents a new, high-value market segment for natural gas suppliers, with potential for substantial revenue growth in the coming years.

Energy Transfer's NGL export and fractionation infrastructure, including projects like Frac IX and Nederland Flexport, positions it as a leader in a high-growth market driven by international demand. This expansion is expected to significantly boost earnings, solidifying its role in the global NGL market.

The company's Permian Basin operations are a strong point, enhanced by acquisitions and new processing plants coming online in 2024, ensuring a high market share in this key region.

Energy Transfer's crude oil transportation volumes saw substantial increases of 15-25% in 2024, with exports jumping 49%, demonstrating its growing influence in global oil logistics.

The Hugh Brinson Pipeline, with FID in December 2024 and Phase 1 starting construction in Q1 2025, will connect Permian gas to Texas markets, aiming for a leading market share.

Entering the AI data center market, Energy Transfer has a long-term agreement with CloudBurst Data Centers, leveraging its infrastructure to supply natural gas to this rapidly expanding, energy-intensive sector.

| Segment | Key Developments (2024-2025) | Market Position/Growth | Financial Impact |

| NGL Exports & Fractionation | Frac IX & Nederland Flexport expansions | ~20% global NGL export share, robust international demand | Crucial contributor to future earnings |

| Permian Basin Gathering & Processing | WTG Midstream acquisition, new plants (Mustang Draw, Badger) | Strong market share in prolific basin | Cornerstone of natural gas segment |

| Crude Oil Transportation | Volumes up 15-25% (2024), Exports up 49% (2024) | Expanding global reach and market penetration | Setting partnership records |

| Natural Gas Pipelines (Hugh Brinson) | FID Dec 2024, Phase 1 construction Q1 2025, In-service late 2026 | Connects Permian gas to Texas markets, aims for leading share | Secures demand in growth corridor |

| AI Data Center Supply | Long-term agreement with CloudBurst Data Centers | Emerging high-demand market, AI workloads to reach 850 TWh/year by 2027 | New high-value market segment potential |

What is included in the product

The Energy Transfer BCG Matrix analyzes business units based on market growth and share, guiding investment decisions for optimal portfolio balance.

Visualize your energy portfolio's health and guide strategic resource allocation.

Cash Cows

Energy Transfer's extensive natural gas pipeline network, exceeding 130,000 miles across 44 states, functions as a robust cash cow. This immense infrastructure is the backbone of the company's operations, generating highly dependable, fee-based revenues.

These stable revenues, representing roughly 90% of Energy Transfer's EBITDA, underscore the mature and established nature of these assets. The predictability of cash flow from this segment means less capital is required for growth, freeing up resources.

Energy Transfer's existing NGL transportation infrastructure is a prime example of a cash cow within its portfolio. This mature segment consistently generates substantial cash flow due to its high-volume movements and strong operational efficiency across a vast system. The established network, supported by long-term contracts, ensures a reliable and predictable revenue stream.

Interstate and intrastate natural gas transportation forms the bedrock of Energy Transfer's operations, acting as its primary Cash Cows. The company's extensive network of pipelines, including significant assets like the Gulf Run pipeline, generates highly stable, fee-based revenues. This consistent revenue stream is a hallmark of a mature, essential market where Energy Transfer holds a strong position.

These transportation segments are characterized by high market share within a mature, indispensable industry. While volume growth is present, the core strength lies in the predictable and robust cash generation stemming from consistent utilization and long-term contractual commitments from customers. For instance, in the first quarter of 2024, Energy Transfer reported that its NGL and transportation segment generated substantial distributable cash flow, underscoring the reliability of these operations.

Ownership Interest in Sunoco LP

Energy Transfer's ownership interest in Sunoco LP positions it as a significant player in fuel distribution. This stake provides a steady stream of distributable cash flow, capitalizing on Sunoco's established market presence and extensive infrastructure. In 2024, Sunoco LP's performance, particularly its refined products segment, contributed positively to Energy Transfer's overall financial health.

- Stable Cash Flow: Energy Transfer benefits from consistent distributable cash flow generated by Sunoco LP's operations.

- Mature Market Dominance: Sunoco LP holds a high market share within the mature fuel distribution sector.

- Infrastructure Leverage: Energy Transfer leverages Sunoco's vast network of pipelines and terminals for operational efficiency.

- 2024 Performance: Sunoco LP's refined products segment demonstrated robust performance contributing to Energy Transfer's earnings.

Crude Oil Storage and Terminalling

Crude oil storage and terminalling represent a classic Cash Cow for energy infrastructure companies. These operations, often boasting high utilization rates, are strategically positioned at key energy hubs, offering indispensable services to producers and refiners alike. The stability of fee-based revenue streams, largely insulated from the swings in crude oil prices, underpins their cash-generating prowess.

This segment commands a significant market share within a mature yet vital segment of the energy supply chain. For instance, major players in the midstream sector often report consistent revenue from these services. In 2024, many companies in this space continued to see strong demand for storage capacity, driven by global energy market dynamics and the need for efficient logistics. The reliable cash flow generated here is crucial for funding other business ventures or returning capital to shareholders.

- Strategic Asset Location: Terminals situated at major refining centers or export hubs ensure constant demand.

- Fee-Based Revenue: Income is generated through storage fees and throughput charges, minimizing commodity price risk.

- High Asset Utilization: Mature markets often mean consistent, high utilization rates for storage and terminal facilities.

- Mature Market Dominance: Companies with established infrastructure in this segment often hold a leading market share, ensuring steady cash flow.

Energy Transfer's extensive natural gas pipeline network, exceeding 130,000 miles, serves as a primary cash cow. This vast infrastructure, generating approximately 90% of the company's EBITDA, provides highly dependable, fee-based revenues. The stability of these cash flows, bolstered by long-term contracts, requires less capital for growth, freeing up resources for other strategic initiatives.

What You See Is What You Get

Energy Transfer BCG Matrix

The preview you are currently viewing is the identical, fully comprehensive Energy Transfer BCG Matrix report you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations – just the complete, professionally formatted strategic tool ready for your analysis and decision-making.

Rest assured, the Energy Transfer BCG Matrix document you see here is the exact, final version that will be delivered to you upon completing your purchase. It is meticulously crafted to provide clear strategic insights, allowing you to confidently apply its analysis to your business planning and competitive strategies without any surprises.

What you are previewing is the actual, ready-to-use Energy Transfer BCG Matrix file that you will obtain once your purchase is confirmed. This means you'll gain instant access to a professionally designed and analysis-ready document, perfect for immediate editing, printing, or presentation to stakeholders.

Dogs

Within Energy Transfer's extensive network, some older or smaller natural gas processing plants may exhibit lower operational efficiencies. These facilities, while still operational, might hold a smaller market share in their respective areas and necessitate higher maintenance costs relative to their output. For instance, while Energy Transfer reported significant capital expenditures in 2024, a portion of these investments would be directed towards modernizing or potentially consolidating less efficient assets to enhance overall portfolio performance.

Energy Transfer's refined products operations, while part of its broader portfolio, often function as a "Dogs" category within a BCG Matrix analysis. This means they typically operate in mature markets with limited growth potential and may hold a smaller market share compared to the company's more dominant natural gas and crude oil segments.

For instance, while Energy Transfer's overall revenue for the first quarter of 2024 was approximately $17.1 billion, the specific contribution and growth trajectory of its refined products segment may not be as robust. This segment might include smaller pipelines or facilities that encounter intense competition, leading to reduced throughput and consequently, lower growth prospects when contrasted with the company's strategically vital NGL and crude oil infrastructure.

Energy Transfer, a major player in the energy infrastructure sector, continually evaluates its portfolio for assets that may no longer fit its strategic direction. This can involve divesting non-core or underperforming segments to sharpen focus and improve capital efficiency.

While specific recent divestitures are not explicitly categorized as 'dogs' in public disclosures, the company's active management approach implies a process of shedding assets with low growth potential or insufficient returns. For instance, in 2023, Energy Transfer completed the sale of its remaining interest in the Enable Midstream Partners, a move that streamlined its operations and allowed for a more concentrated investment in its core midstream assets.

Small-Scale, Geographically Isolated Pipeline Segments

Within Energy Transfer's vast 140,000-mile pipeline network, certain smaller, geographically isolated segments may be found. These often serve mature or declining production basins, resulting in limited growth prospects and a low market share within their localized areas.

These specific pipeline segments could be considered for minimal capital allocation or potential decommissioning if they lack strategic interconnection and future growth potential. For instance, if a segment primarily serves a region with significantly reduced production, its operational viability might be questioned.

- Limited Growth Potential: These segments typically operate in areas with declining production, capping their expansion opportunities.

- Low Market Share: Their localized nature often means they hold a small share of even their niche markets.

- Strategic Re-evaluation: Companies like Energy Transfer regularly assess such assets for their ongoing strategic value.

- Potential Decommissioning: If not economically viable or strategically important, these older, isolated lines might eventually be retired.

Legacy Retail Propane Sales (Non-Export Focus)

Legacy retail propane sales, while a part of Energy Transfer's (ET) operations, likely fall into the 'Dog' category of the BCG matrix. This segment operates in a mature market, often characterized by fragmentation and thinner profit margins when contrasted with ET's substantial midstream and export infrastructure. Without substantial new strategic initiatives or a clear competitive edge, this retail propane business may represent a lower-growth, lower-market-share component of ET's overall portfolio.

The broader propane market itself is considered mature. While the export segment shows considerable growth potential, the domestic retail propane distribution might not be a significant growth engine for Energy Transfer. For instance, in 2024, the U.S. propane market experienced stable demand, but growth was primarily driven by industrial and export sectors, with retail residential demand showing more modest increases.

- Mature Market: The retail propane sector generally exhibits slow growth and high competition.

- Lower Margins: Profitability in retail propane can be constrained by price volatility and operational costs.

- Limited Growth Drivers: Unlike large-scale infrastructure projects, retail propane lacks significant expansion opportunities without substantial investment in new markets or services.

- Strategic Re-evaluation: Companies like ET may consider divesting or minimizing their 'Dog' segments to focus resources on higher-potential areas.

Within Energy Transfer's portfolio, certain legacy pipeline segments serving mature or declining production areas can be classified as Dogs. These operations often face limited growth prospects due to reduced regional output and hold a modest market share. For example, while Energy Transfer's overall capital expenditures in 2024 were substantial, a portion of this investment is aimed at optimizing or potentially consolidating less efficient, smaller-scale assets to improve overall portfolio performance.

The refined products segment, including smaller pipelines or facilities, often fits the Dog profile due to operating in competitive, mature markets with constrained growth. While Energy Transfer reported revenues of approximately $17.1 billion in Q1 2024, the refined products segment's contribution may not mirror the robust growth of its core NGL and crude oil businesses.

Legacy retail propane sales also represent a Dog category. This segment operates in a mature, fragmented market with thinner margins compared to Energy Transfer's core midstream and export infrastructure. The U.S. propane market in 2024 saw stable demand, but growth was concentrated in industrial and export sectors, with retail residential demand showing only modest increases.

Question Marks

The Lake Charles LNG project, a venture by Energy Transfer, is currently in a crucial, capital-intensive development stage following its Final Investment Decision (FID). While it has secured significant long-term Sale and Purchase Agreements (SPAs) with major entities such as Chevron, its contribution to Energy Transfer's EBITDA is still prospective, as it has not yet commenced operations.

This project embodies high growth potential within the burgeoning global LNG market, but it requires substantial upfront investment during its construction phase. Until operational, its direct market share and revenue generation capabilities remain unrealized, classifying it as a significant cash consumer in the short term.

Energy Transfer is actively investigating promising lower-carbon ventures, including carbon capture and sequestration (CCS) and blue ammonia. These nascent sectors are poised for substantial growth, fueled by the worldwide push towards energy transition, with the global CCS market alone projected to reach over $100 billion by 2030.

While these areas offer significant upside, Energy Transfer's current footprint in CCS and blue ammonia is likely minimal. Establishing a strong market position will necessitate considerable investment in research, development, and infrastructure, similar to how early investments in LNG infrastructure were crucial for market entry.

Phase 2 of the Hugh Brinson Pipeline is currently in the customer securing and negotiation stage, a critical juncture for unlocking its full potential. While Phase 1 is already underway with construction, Phase 2 represents a significant growth opportunity that hinges on securing firm commitments for additional capacity. This ongoing negotiation phase highlights the dynamic nature of energy infrastructure development, where market demand and contractual agreements are paramount to realizing future revenue streams.

New Processing Plants Under Construction (e.g., Mustang Draw, Red Lake IV)

New processing plants, such as Mustang Draw and Red Lake IV, represent significant capital investments for Energy Transfer. While these facilities are currently under construction and not yet fully operational, they are situated in promising, high-growth production basins. Their future classification as Stars in the BCG matrix hinges on successful completion and their ability to capture market share upon startup.

- Capital Allocation: These projects are currently consuming capital, representing an investment phase rather than immediate revenue generation.

- Growth Potential: Their placement in high-growth basins suggests strong future market share potential if operational targets are met.

- Risk Factors: Timely completion, sustained production, and competitive pricing will be crucial for their success and transition into Stars.

- 2024 Context: As of early 2024, these projects are in various stages of construction, with full operational impact expected later in the year or into 2025.

Potential Future Pipeline Expansions Beyond Current Commitments

Energy Transfer actively assesses opportunities for pipeline capacity expansions that go beyond their existing commitments. A prime example is the potential for future phases of the Gulf Run pipeline, which would be contingent on sustained customer demand and further market analysis.

These prospective expansions are considered high-growth avenues, fueled by projections of increasing energy consumption. However, their ultimate success and market positioning remain uncertain until final investment decisions (FIDs) are made and long-term contracts are secured.

- Gulf Run Expansion Potential: Based on customer demand, Energy Transfer is evaluating further capacity additions to the Gulf Run pipeline.

- High-Growth Prospects: These expansions represent opportunities driven by anticipated future energy demand.

- Speculative Nature: Market share is not guaranteed until FIDs are made and contracts are secured, classifying them as question marks.

- Path to Stars: Successful execution and contract acquisition could transition these into 'star' assets within the portfolio.

Energy Transfer's ventures like the potential Gulf Run pipeline expansions are currently in the early, uncertain stages of development. These projects require significant investment and market validation before they can generate substantial revenue or secure a dominant market share. Their future success hinges on securing firm customer commitments and navigating the competitive landscape.

These initiatives represent high-growth potential, aligning with projected increases in energy demand. However, without secured contracts and final investment decisions, their market share is speculative, making them classic examples of Question Marks in the BCG matrix. Successful execution and market penetration could see them evolve into Stars.

The classification as Question Marks reflects their current status: high potential but uncertain outcomes, demanding careful capital allocation and strategic planning. Energy Transfer must secure customer agreements to de-risk these investments and pave the way for future growth.

The company's commitment to exploring lower-carbon opportunities such as carbon capture and sequestration (CCS) and blue ammonia also falls into the Question Mark category. While the global CCS market is projected to exceed $100 billion by 2030, Energy Transfer's current market penetration in these nascent sectors is minimal, requiring substantial investment to establish a competitive position.

| Project/Venture | Current Stage | Growth Potential | Market Share Uncertainty | BCG Classification |

|---|---|---|---|---|

| Lake Charles LNG | Capital-intensive development (Post-FID) | High (Global LNG market) | Prospective (Not yet operational) | Question Mark |

| Hugh Brinson Pipeline (Phase 2) | Customer securing/negotiation | High (Capacity expansion) | Dependent on secured commitments | Question Mark |

| Mustang Draw & Red Lake IV Processing Plants | Under construction | High (High-growth basins) | Requires successful startup & market capture | Question Mark (Potential Star) |

| Gulf Run Pipeline Expansions | Evaluation based on demand | High (Anticipated energy demand) | Speculative until FID & contracts | Question Mark |

| CCS & Blue Ammonia Ventures | Nascent development | Very High (Energy transition) | Minimal current footprint, requires significant investment | Question Mark |

BCG Matrix Data Sources

Our Energy Transfer BCG Matrix is built on a foundation of robust data, incorporating financial performance indicators, market share analysis, and industry growth projections from reputable sources.