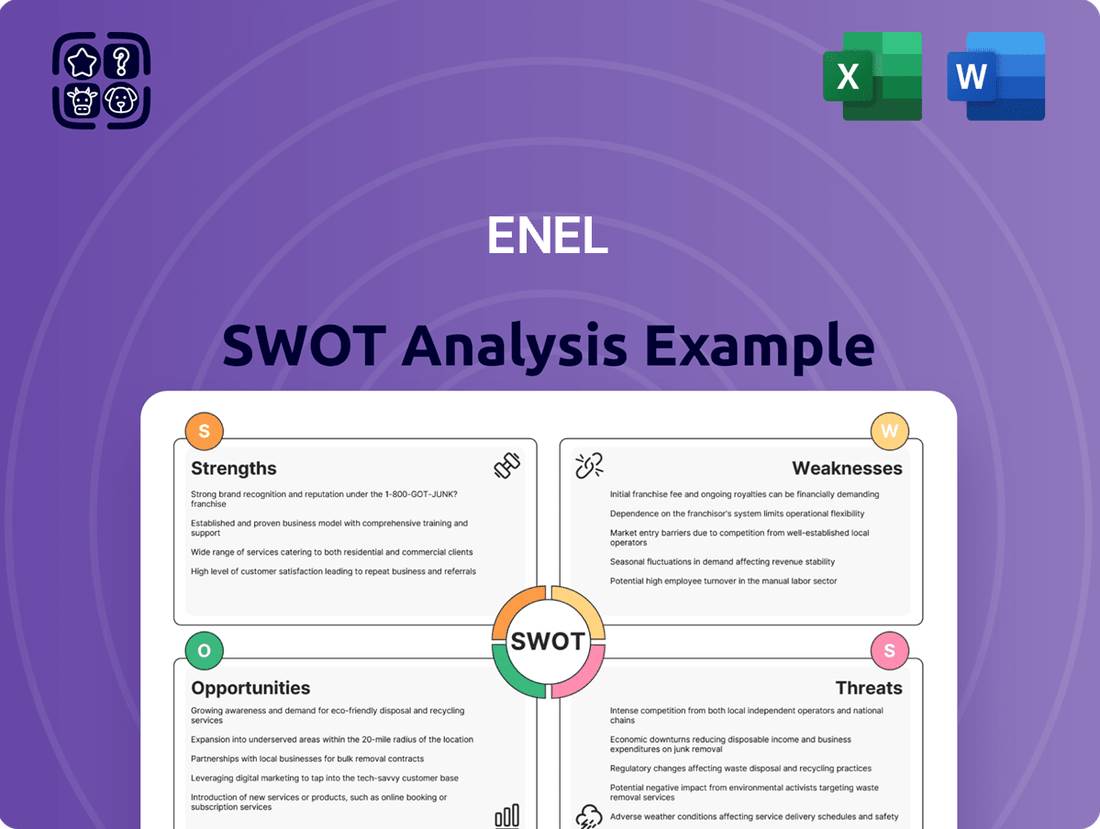

Enel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enel Bundle

Enel, a global energy giant, navigates a dynamic landscape with significant strengths in renewable energy and a vast operational footprint. However, it also faces challenges like regulatory shifts and intense competition.

Want the full story behind Enel’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enel boasts a leading global position in renewable energy, consistently expanding its installed capacity. The company is targeting approximately 76 GW of renewables by 2027, underscoring its dedication to clean energy growth.

Significant investment fuels this expansion, with Enel planning around €12 billion for renewables between 2025 and 2027. This capital will be directed towards key technologies such as onshore wind, hydro, and battery storage systems.

Renewables already represent a substantial portion of Enel's energy mix, accounting for nearly 70% of its total production. This strong foundation solidifies Enel's status as a frontrunner in the global transition towards sustainable energy sources.

Enel has showcased impressive financial resilience, successfully meeting its strategic targets and delivering robust results throughout 2024. The company's ordinary EBITDA reached €22.8 billion for the year, a testament to its operational efficiency and strategic execution. This strong financial footing is further evidenced by significant growth in net ordinary income, underscoring Enel's capacity to generate value and maintain a healthy balance sheet.

Enel's extensive global integrated presence is a significant strength, allowing it to operate across the entire energy value chain, from generation to retail. This integrated model, spanning regions like Europe, North America, and Latin America, provides a diversified revenue stream, making the company more resilient to localized market downturns. For instance, in 2023, Enel reported revenues of €90.9 billion, with a substantial portion coming from its diverse geographical operations.

Significant Grid Investments and Digitalization

Enel is making substantial investments in upgrading and digitizing its electricity grids, with a significant €26 billion earmarked for these initiatives between 2025 and 2027. This forward-looking strategy is primarily focused on enhancing grid quality and resilience, particularly in key markets like Italy and Spain. These modernization efforts are vital for accommodating the increasing integration of renewable energy sources and ensuring a more robust and efficient power distribution system.

The digitalization of Enel's grids is a critical component of its long-term vision, enabling better management and responsiveness. This includes deploying advanced technologies to monitor grid performance, predict potential issues, and optimize energy flow. Such investments are essential for building an energy infrastructure capable of withstanding the challenges posed by climate change and the evolving energy landscape.

Key aspects of these grid investments include:

- Enhanced Resilience: Strengthening infrastructure to better withstand extreme weather events, thereby reducing service disruptions.

- Renewable Integration: Facilitating the seamless connection and management of a growing volume of renewable energy sources.

- Digital Infrastructure: Deploying smart meters, advanced sensors, and data analytics for improved grid monitoring and control.

- Operational Efficiency: Optimizing energy distribution and reducing losses through advanced grid management technologies.

Ambitious Decarbonization Targets

Enel has set ambitious decarbonization targets, aiming for net-zero emissions by 2040. This commitment is a significant strength, positioning the company as a leader in the energy transition. By 2027, Enel plans to phase out coal power generation entirely, a crucial step towards its sustainability goals.

The company's strategy also includes exiting gas power generation by 2040, further solidifying its dedication to a low-carbon future. These targets are aligned with the Paris Agreement, demonstrating a proactive approach to climate change mitigation and enhancing Enel's reputation as a responsible corporate citizen.

- Net-Zero Emissions Target: 2040

- Coal Phase-Out: By 2027

- Gas Phase-Out: By 2040

- Alignment: Paris Agreement

Enel's leading global position in renewable energy, with a target of approximately 76 GW by 2027, is a core strength. The company is backing this expansion with significant investment, allocating around €12 billion to renewables between 2025 and 2027, focusing on wind, hydro, and battery storage.

The company's extensive global integrated presence, operating across the energy value chain in diverse regions, provides revenue diversification and resilience, as evidenced by €90.9 billion in revenues in 2023. Furthermore, Enel's commitment to decarbonization, aiming for net-zero emissions by 2040 and phasing out coal by 2027, aligns with global climate goals and enhances its corporate reputation.

Enel's substantial investments in grid modernization and digitalization, with €26 billion allocated between 2025 and 2027, are crucial for enhancing resilience and efficiently integrating renewable energy sources. This strategic focus on infrastructure upgrades, particularly in key markets like Italy and Spain, ensures operational efficiency and future-readiness.

| Metric | 2024 Target/Plan | 2025-2027 Plan |

|---|---|---|

| Renewable Capacity Target | ~76 GW by 2027 | |

| Renewable Investment | ~€12 billion | |

| Grid Investment | ~€26 billion | |

| Coal Phase-Out | By 2027 | |

| Net-Zero Emissions Target | By 2040 |

What is included in the product

Delivers a strategic overview of Enel’s internal and external business factors, highlighting its strengths in renewable energy and global presence, while also addressing weaknesses in debt and opportunities in emerging markets, alongside threats from regulatory changes and competition.

Identifies critical internal weaknesses and external threats to proactively mitigate risks and inform strategic adjustments.

Weaknesses

Enel's global operations expose it to a patchwork of evolving energy regulations and political shifts across its numerous markets. For instance, in 2024, significant policy changes in Italy concerning renewable energy incentives could directly affect Enel's project pipeline and revenue streams.

The company must navigate varying political landscapes, where decisions on energy infrastructure, carbon pricing, and market access can rapidly alter the financial viability of existing and planned investments. This complexity demands robust risk management strategies to mitigate the impact of unforeseen regulatory or political disruptions.

Despite Enel's strategic shift towards renewables and regulated markets, its financial results remain susceptible to swings in energy commodity prices. For instance, the decline in wholesale electricity prices observed throughout much of 2024 directly impacted the profitability of its remaining thermal generation assets and its retail energy supply segments.

This price volatility necessitates ongoing risk management, including sophisticated hedging strategies to mitigate potential revenue shortfalls. The company's exposure means that a sustained downturn in energy markets, as seen in early 2024, can put pressure on earnings and cash flow generation.

Enel continues to carry substantial net financial debt, even with recent efforts to reduce it through asset sales. As of the first quarter of 2024, the company reported a net financial debt of approximately €60.5 billion. While this represents a decrease from previous periods, the sheer volume of this debt necessitates careful financial management to maintain a healthy debt-to-EBITDA ratio, which stood at around 2.4x at the end of 2023.

This significant debt load can constrain Enel's financial flexibility, potentially limiting its capacity for substantial new investments or strategic acquisitions. Managing these obligations requires a consistent focus on operational efficiency and cash flow generation to service interest payments and principal repayments, which could divert resources from growth initiatives.

Operational Challenges from Infrastructure Vulnerabilities

Enel's vast electricity distribution networks, especially in areas like Brazil, grapple with significant operational hurdles stemming from infrastructure vulnerabilities. Cable theft, for instance, is a persistent problem, directly causing power outages that impact a large customer base and incur substantial financial losses. For example, in 2023, Enel reported significant impacts from non-technical losses, a category often including theft, which affected a portion of its energy distribution in Latin America.

These security weaknesses necessitate ongoing investment in enhanced security protocols and the regular replacement of stolen or damaged materials. The continuous need to mitigate these operational disruptions, such as those experienced in Brazil where infrastructure theft is a known issue, diverts resources that could otherwise be allocated to network modernization or expansion. This ongoing battle against theft and vandalism represents a consistent drain on financial resources and operational efficiency.

- Cable theft incidents lead to widespread power outages.

- Financial losses are substantial due to theft and repair costs.

- Continuous investment in security and material replacement is required.

Potential for Underinvestment in R&D

Enel's investment in research and development (R&D) may lag behind some competitors in the dynamic energy sector. This could impede its capacity to innovate at the same speed as peers and to seize opportunities in emerging technologies. Such a gap is particularly concerning for long-term competitiveness in areas like smart grids and sophisticated energy solutions.

For instance, while specific comparative R&D spending figures fluctuate annually, industry analyses often highlight a more concentrated investment in innovation among certain global energy giants. This strategic focus allows them to rapidly develop and deploy next-generation technologies.

- R&D Investment Gap: Enel's R&D expenditure may not consistently match the aggressive innovation budgets of some leading global energy firms.

- Innovation Pace: A lower R&D spend could translate to a slower adoption of cutting-edge technologies compared to more research-intensive competitors.

- Future Competitiveness: This potential underinvestment poses a risk to Enel's ability to lead in rapidly evolving fields such as advanced energy storage and digital grid management.

Enel's significant debt burden, reported at approximately €60.5 billion as of Q1 2024, can limit its financial flexibility for new investments. The company's debt-to-EBITDA ratio stood around 2.4x at the end of 2023, requiring careful management to service obligations and potentially diverting resources from growth initiatives.

Operational weaknesses, particularly in distribution networks like those in Brazil, are exacerbated by infrastructure vulnerabilities such as cable theft. These incidents cause power outages, leading to substantial financial losses and necessitating continuous investment in security and material replacement, impacting overall efficiency.

Enel's R&D investment may not consistently match that of some competitors, potentially slowing its adoption of cutting-edge technologies. This could hinder its long-term competitiveness in rapidly evolving areas like smart grids and advanced energy solutions.

Exposure to fluctuating energy commodity prices, as seen with wholesale electricity price declines in 2024, directly impacts profitability, particularly for its thermal generation and retail segments. This volatility necessitates robust hedging strategies to mitigate revenue shortfalls.

| Weakness | Description | Impact | Relevant Data (2023/2024) |

| High Debt Levels | Significant net financial debt | Constrained financial flexibility, potential impact on investment capacity | Net financial debt ~€60.5 billion (Q1 2024); Debt/EBITDA ~2.4x (End 2023) |

| Operational Vulnerabilities | Infrastructure issues like cable theft in distribution networks | Power outages, financial losses, diversion of resources to security | Reported impacts from non-technical losses affecting distribution in Latin America (2023) |

| R&D Investment Lag | Potentially lower R&D spending compared to some competitors | Slower innovation pace, risk to long-term competitiveness in new technologies | Industry analyses suggest some competitors have more concentrated innovation budgets. |

| Commodity Price Volatility | Sensitivity to swings in energy prices | Impacts profitability of thermal generation and retail segments | Wholesale electricity price declines observed through much of 2024 |

Preview Before You Purchase

Enel SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It offers a comprehensive overview of Enel's internal strengths and weaknesses, alongside external opportunities and threats. This detailed analysis is crucial for strategic planning.

Opportunities

Global electricity demand is on an upward trajectory, with projections indicating a significant increase in consumption through 2030. This surge is fueled by the widespread adoption of electric vehicles, the growing energy needs of data centers, and the ongoing electrification of industrial processes and household appliances.

Enel is well-positioned to capitalize on this trend. The company's substantial investments in renewable energy generation, particularly solar and wind power, align perfectly with the need for cleaner and more sustainable electricity sources to meet this escalating demand.

For instance, Enel's 2023 financial reports highlighted a robust pipeline of renewable projects, aiming to add gigawatts of new capacity. This expansion directly addresses the growing market need for electricity, offering Enel a clear path for revenue growth and market share expansion in the coming years.

Enel has a significant opportunity to grow its renewable energy business, focusing on established areas like onshore wind, hydropower, and battery storage. These sectors are ripe for expansion and are expected to boost the company's financial performance.

The company aims to add 12 gigawatts of new renewable capacity by 2027, with a strong emphasis on these particular technologies. This strategic push is designed to drive profitable growth within the rapidly expanding clean energy market.

Enel's strategic decision to concentrate its investments in core geographies such as Italy, Spain, Latin America, and North America presents a significant opportunity to refine its risk-return dynamics. This focus allows for a more efficient allocation of capital, targeting areas where the company has established operations and a deeper understanding of market conditions.

By prioritizing these key markets, Enel can leverage supportive and predictable regulatory environments, which are crucial for long-term infrastructure investments. For instance, in 2023, Enel continued its robust development in renewables across these regions, with a particular emphasis on expanding its solar and wind capacity in Latin America, a market known for its growing demand for clean energy solutions.

This concentration also enables Enel to capitalize on strong demand for energy transition solutions, including renewable energy generation and grid modernization. The company's 2024-2028 strategic plan, released in late 2023, outlines significant investment targets in these core areas, aiming to drive sustainable growth and enhance shareholder value by optimizing resource deployment and operational efficiency.

Development of Smart Grid and Energy Services

The ongoing digitalization of electricity grids, often referred to as smart grid development, presents a significant avenue for growth. This trend is particularly relevant for Enel, as it allows for enhanced grid efficiency and resilience through advanced monitoring and control systems. By 2024, global investment in smart grids was projected to reach hundreds of billions of dollars, highlighting the scale of this opportunity.

Furthermore, the expansion of integrated energy services offers substantial potential for Enel to create new revenue streams. Bundling core energy supply with additional products and services, such as energy efficiency solutions or electric vehicle charging infrastructure, can foster deeper customer relationships and increase loyalty. This strategy directly addresses evolving consumer demands for more comprehensive and convenient energy management.

- Smart Grid Investment: Global smart grid investments are expected to exceed $300 billion by 2025, creating a robust market for Enel's technological advancements.

- Integrated Services Growth: The market for integrated energy services is rapidly expanding, with projections indicating significant growth in demand for bundled energy solutions.

- Customer Engagement: Offering combined energy and service packages can boost customer retention by up to 15% for utility providers, according to industry analyses.

Asset Optimization and Portfolio Rationalization

Enel's ongoing strategy involves carefully selling off or shifting assets that don't align with its core business. This allows them to continuously refine their portfolio.

By shedding less important assets and reinvesting that money into projects with higher potential for profit, Enel gains more financial freedom. This move also helps reduce their debt burden.

This focus on core activities means Enel can concentrate on areas that are likely to yield better returns and support long-term, sustainable expansion. For instance, in 2023, Enel continued its asset rotation program, including the sale of its stake in the Eastern European business, aiming to simplify its geographic footprint and concentrate on core markets.

- Portfolio Optimization: Enel actively manages its asset base through selective disposals and rotations.

- Capital Reallocation: Proceeds from asset sales are strategically reinvested in higher-return projects.

- Financial Improvement: This strategy enhances financial flexibility and aids in debt reduction.

- Focus on Core Business: The company prioritizes investments in its most promising and strategic activities for sustainable growth.

Enel is poised to benefit from the increasing global demand for electricity, driven by factors like EV adoption and data center growth. The company's substantial investments in solar and wind power directly address the need for cleaner energy sources, with a target of adding 12 GW of new renewable capacity by 2027. This strategic focus on renewables, particularly in core markets like Italy, Spain, and Latin America, allows Enel to leverage supportive regulatory environments and capitalize on the strong demand for energy transition solutions.

The digitalization of electricity grids, or smart grid development, presents a significant growth avenue, with global investments projected to exceed $300 billion by 2025. Furthermore, expanding integrated energy services by bundling core supply with offerings like EV charging can foster deeper customer relationships and create new revenue streams. Enel's strategic asset rotation also enhances financial flexibility and allows for capital reallocation into higher-return projects, reinforcing its focus on core, profitable activities.

| Opportunity Area | Key Driver | Enel's Strategic Alignment | Market Data/Projection |

|---|---|---|---|

| Renewable Energy Expansion | Rising global electricity demand, energy transition | Significant investments in solar and wind, 12 GW new capacity target by 2027 | Global electricity demand projected to increase significantly through 2030 |

| Smart Grid Development | Grid modernization, efficiency, resilience | Leveraging digitalization for enhanced grid performance | Global smart grid investments expected to exceed $300 billion by 2025 |

| Integrated Energy Services | Evolving consumer demand for comprehensive solutions | Bundling energy supply with EV charging, energy efficiency | Market for integrated energy services is rapidly expanding |

| Portfolio Optimization | Focus on core business, financial flexibility | Selective asset disposals and reinvestment in higher-return projects | Proceeds reinvested in promising strategic activities |

Threats

The global energy sector is a battleground, with established players and agile newcomers constantly vying for dominance in generation, distribution, and customer engagement. This fierce rivalry puts considerable pressure on Enel's ability to set prices and maintain healthy profit margins. For instance, in 2023, the European electricity market saw significant price volatility due to geopolitical events and supply chain disruptions, impacting utility profitability across the board.

To stay ahead, Enel must continually invest in innovation and operational efficiency. The increasing demand for renewable energy sources, coupled with advancements in smart grid technology, means that companies failing to adapt risk losing market share. Enel's strategic focus on renewables, with a significant portion of its 2024-2028 investment plan dedicated to clean energy, aims to address this competitive threat by positioning itself as a leader in the energy transition.

Enel faces significant macroeconomic instability, with inflation and currency fluctuations posing ongoing challenges. For instance, in early 2024, persistent inflation in several key European markets continued to pressure operating costs, impacting margins. Rising interest rates, as seen with the European Central Bank's policy adjustments throughout 2023 and into 2024, also increase Enel's cost of borrowing, potentially affecting the profitability of its extensive capital expenditure plans.

Enel faces considerable risk from evolving government policies and energy regulations across its operating regions. For instance, changes to renewable energy subsidies or feed-in tariffs, common in many European markets where Enel has substantial investments, could directly impact the economic viability of its green energy projects. In 2023, for example, some countries saw adjustments to renewable support mechanisms, creating uncertainty for future project pipelines.

Physical Risks from Climate Change

The increasing frequency and intensity of extreme weather events, directly linked to climate change, pose a significant physical threat to Enel's vast energy infrastructure. These events, like severe storms and heatwaves, can lead to widespread power outages and damage assets, impacting service reliability and Enel's financial results. For instance, in 2023, extreme weather events across Europe caused considerable disruptions, with repair costs for grid damage amounting to hundreds of millions of euros for major utility providers.

These disruptions necessitate substantial investment in grid resilience and adaptation measures. Enel's extensive network, particularly in regions prone to flooding or high winds, faces heightened risks. The company's 2024-2025 capital expenditure plans include significant allocations towards hardening infrastructure against these physical impacts, aiming to mitigate potential losses and ensure operational continuity.

- Increased frequency of extreme weather events: Storms, heatwaves, and floods are becoming more common and severe.

- Direct physical damage to infrastructure: Enel's grid assets are vulnerable to damage, leading to outages.

- Significant repair and maintenance costs: Restoring damaged infrastructure incurs substantial financial outlays.

- Impact on service continuity and financial performance: Outages and repair costs directly affect Enel's revenue and profitability.

Operational Disruptions (e.g., Cable Theft)

Cable theft remains a significant operational threat for Enel, particularly in regions like Italy and Latin America. In 2023, incidents of electrical cable theft continued to cause widespread power outages, impacting thousands of customers and leading to substantial financial losses for the company, estimated in the tens of millions of euros annually due to replacement costs and lost revenue.

These disruptions not only affect service reliability but also necessitate increased spending on preventative measures and infrastructure reinforcement. Enel's ongoing efforts to combat this issue involve enhanced surveillance and the use of more robust materials, which add to operational expenses and can indirectly impact customer satisfaction through service interruptions and potential tariff adjustments.

- Persistent Cable Theft: Criminal activities targeting electrical cables continue to plague Enel's operations, causing significant service disruptions.

- Financial Impact: In 2023, cable theft resulted in millions of euros in losses for Enel due to infrastructure damage and revenue interruption.

- Operational Strain: The need for enhanced security and infrastructure hardening diverts resources and impacts overall operational efficiency.

Enel faces intense competition from both traditional utilities and new energy providers, pressuring its pricing power and profit margins, as evidenced by the price volatility in the European electricity market during 2023. Furthermore, macroeconomic instability, including persistent inflation and rising interest rates observed throughout 2023 and into 2024, directly increases Enel's operating costs and borrowing expenses. Evolving government policies and energy regulations, such as adjustments to renewable energy subsidies seen in various European markets in 2023, create uncertainty for project viability and future investment returns.

| Threat Category | Description | Impact on Enel | Example/Data Point (2023-2024) |

|---|---|---|---|

| Competition | Rivalry from established and new energy players. | Price pressure, reduced profit margins. | European electricity market price volatility in 2023. |

| Macroeconomic Instability | Inflation, currency fluctuations, rising interest rates. | Increased operating costs, higher borrowing costs. | Persistent inflation in Europe (early 2024); ECB rate hikes (2023-2024). |

| Regulatory & Policy Changes | Shifts in government energy policies and subsidies. | Uncertainty for renewable projects, impact on economic viability. | Adjustments to renewable support mechanisms in some European countries (2023). |

SWOT Analysis Data Sources

This Enel SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market intelligence, and expert industry analyses to provide a thorough and actionable strategic overview.